Global Flexible Packaging Market By Packaging Type (Bags, Pouches, Films and Wraps, Others), By Raw Material (Plastic, Paper, Aluminum, Bioplastics, Polyethylene, Polypropylene, Polyethylene Terephthalate, Others), By Printing Technology (Flexography, Digital Printing, others) By Application (Food & Beverages, Pharmaceutical, Cosmetics, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 16777

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

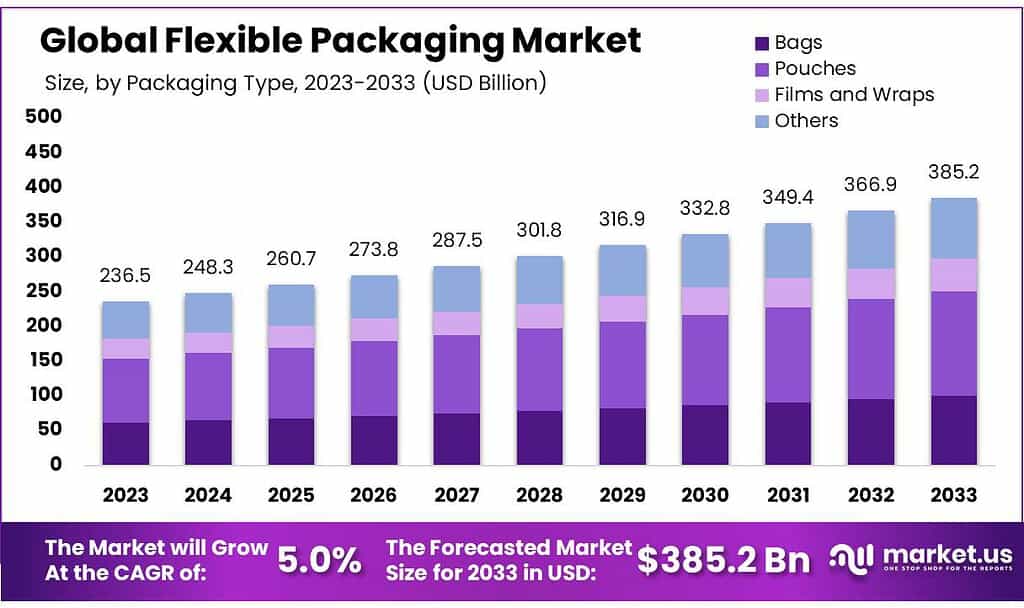

The worldwide flexible Packaging market size is predicted to reach USD 385.2 billion in 2033 and up or down from USD 236.5 billion by 2023 and growing by a CAGR of 5.0% over the period between 2023 and 2033.

Growth for this industry should continue due to an ever-increasing food demand in Asia Pacific region – specifically India and China.

Flexible packaging companies increasingly rely on bioplastics as key raw material components, with bio-based PLA film becoming an essential commodity in food, confectionery, bakery and snack packaging in the coming seven years due to its easy recycling capabilities and biodegradability properties.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth Projection: The flexible packaging market is projected to witness substantial growth, expected to reach around USD 385.2 billion by 2033 from USD 236.5 billion in 2023, representing a CAGR of 5.0%.

- Key Factors Driving Growth: Asia Pacific Demand: The ever-increasing demand for food in Asia Pacific, particularly in countries like India and China, is a significant growth driver for the industry Bioplastics Surge: Companies are increasingly relying on bioplastics due to their easy recycling capabilities and biodegradability, especially in segments like food, confectionery, bakery, and snacks. Packaging Preferences: In 2023, pouches led the market with over 39.2% share, valued for their versatility and convenience. Bags followed at 31.5%, favored for their flexibility across various industries.

- Raw Material Insights: Plastic Dominance: Plastic accounted for 64.9% of revenue share in 2023 due to its cost-effectiveness and versatility in various applications. Bioplastics Demand: The increasing demand for bioplastics is expected to surge further due to stricter regulations on plastic usage and the need for sustainable materials.

- Printing Technologies: Flexography: Widely used for high-speed, cost-effective printing in packaging industries, especially for materials like plastic, paper, and film. Digital Printing: Gaining traction for its versatility and customization abilities, ideal for shorter print runs and personalized packaging.

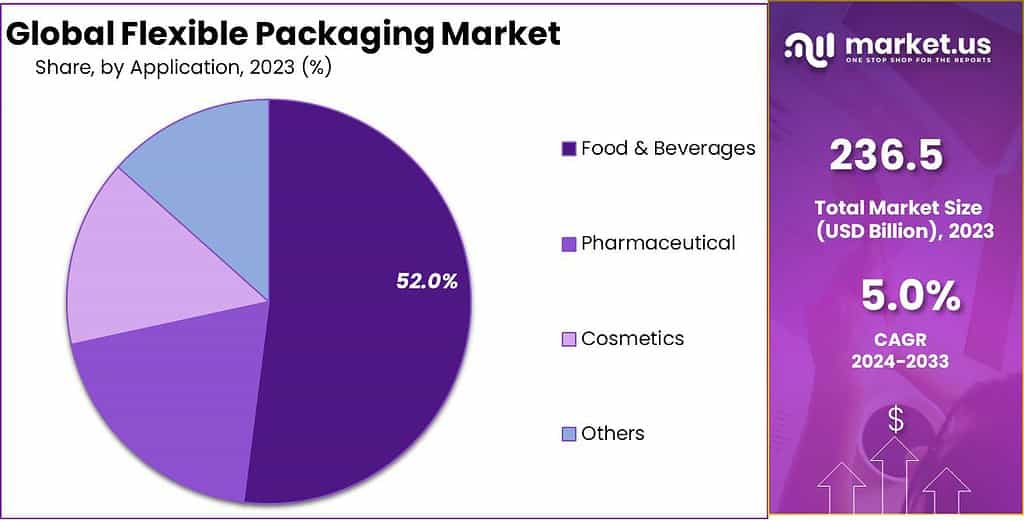

- Application Areas: Food & Beverage Dominance: Accounting for 52% of global revenue share in 2023, the segment is expected to drive demand, especially for packaged and ready-to-eat meals. Pharmaceutical Growth: Due to technological advancements and rising awareness, pharmaceutical industries have been a significant market share holder.

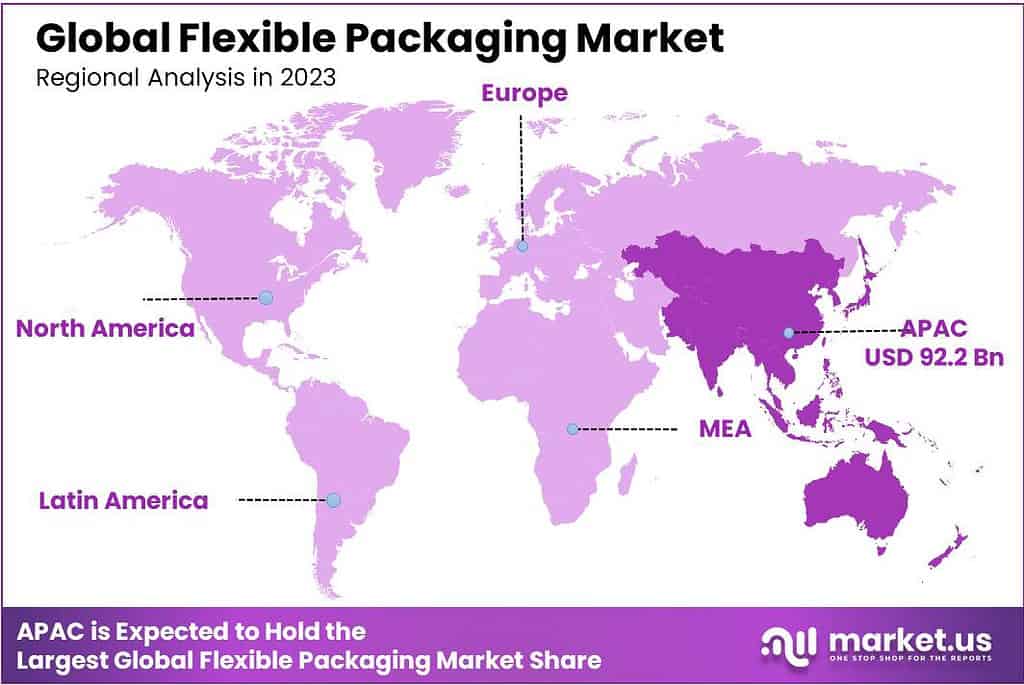

- Regional Dynamics: Asia Pacific Lead: Accounted for 38.9% of revenue share in 2023, with India and China’s thriving food and beverage sectors driving the market. Europe and North America Trends: Europe shows increased R&D spending in pharmaceuticals, while North America benefits from eliminating regulatory barriers for manufacturing units.

- Challenges and Opportunities: Challenges: High costs of raw materials and limited efficient recycling infrastructure pose hurdles. Opportunities: Meeting consumer demand for sustainable packaging solutions presents an opportunity for manufacturers to evolve and attract customers.

- Key Players and Recent Developments: Major players like Mondi, Amcor, Bemis Company Inc., Huhtamaki Group, and BASF SE are actively involved in the market, focusing on sustainability and technological advancements.

By Packaging Type

In 2023, Pouches were the top choice, grabbing over 39.2% of the flexible packaging market. They’re popular for their versatility, offering convenience with features like zippers or spouts for various products.

Bags came in next, holding a significant share at 31.5%. They’re flexible and suit different items, from food to industrial stuff, offering ease of storage and handling.

Films accounted for about 20.1% of the market. These thin, protective layers are used for wrapping and sealing, maintaining product freshness and protection.

Wraps secured the remaining 9.2%. They’re great for safeguarding individual items during storage or transit, providing an extra layer of security.

Overall, pouches took the lead, but each type of flexible packaging serves specific needs across industries, ensuring products are stored, transported, and presented effectively.

Raw Material Analysis

Flexible packaging dominated revenue share for 2023 at 64.9% due to plastic’s dominance. With their low shipping costs and storage needs, flexible packages have proven highly attractive due to their widespread application within food and beverage manufacturing businesses – their variety in form and function being key advantages of flexible packaging technology.

With more stringent regulations surrounding plastic usage, demand for bioplastics will likely surge over the coming years. Thanks to biocompatible materials’ increased use in end-use industries such as food and beverage production, cosmetics production, and more products like shoes – bioplastic usage will only become more prominent due to reducing plastic packaging waste. The segment should continue its rise due to this need.

The growing demand for bio-based PLA film in food, confectionery, bakery, and snack packaging will drive up demand. Due to strict policies, flexible plastic packaging is widely used in the food and beverage and pharmaceutical industries, especially in North America and Europe.

The forecast period will see significant demand for aluminum materials. The segment is expected to grow due to the increasing use of aluminum foil for household and food & drink applications. The Flexible Packaging market also benefits from the acceptance of international standards that allow for product certification and testing.

By Printing Technology

Flexography: Flexographic printing is a widely used technique in flexible packaging. It involves a flexible relief plate that transfers ink onto substrates, commonly used for printing on materials like plastic, paper, and film. Flexography allows for high-speed, cost-effective printing suitable for large production runs, making it popular in packaging industries.

Digital Printing: This technology has gained traction in flexible packaging due to its versatility and customization capabilities. Digital printing enables on-demand printing with variable data, precise color matching, and shorter production runs without the need for plates. It’s ideal for shorter print jobs, personalized packaging, and quick turnaround times.

Application Analysis

Food & beverage was the largest segment accounting for 52% of global revenue share in 2023. The forecast period will increase demand for packaged food, including ready-to-eat meals, frozen meals, and cake mixes.

Industry demand is expected to rise due to the rising popularity of nutrient enrichment and the European Commission’s support for regulating flexible packaging in food applications at the domestic level. Demand will rise shortly due to increased R&D spending in Europe and the presence of key manufacturers.

Pharmaceutical industries dominated the flexible packaging market share in 2023, due to technological advancements and rising consumer awareness in emerging countries like Brazil, China, India and China.

Over the next six years, cosmetics is expected to experience rapid expansion driven by busy consumers’ lives and an increasing awareness of hygiene and health in emerging markets like China and India. Flexible packaging used in cosmetic production helps prevent moisture entry.

*Actual Numbers Might Vary In The Final Report

Маrkеt Ѕеgmеntѕ

By Packaging Type

- Bags

- Pouches

- Films and Wraps

- Others

By Raw Material

- Plastic

- Paper

- Aluminum

- Bioplastics

- Polyethylene

- Polypropylene

- Polyethylene Terephthalate

- Others

By Printing Technology

- Flexography

- Digital Printing

- Others

By Application

- Food & Beverages

- Pharmaceutical

- Cosmetics

- Other Applications

Driver

cost-effectiveness and increased product shelf will drive the market.

Flexible plastic packaging stands out for its cost-efficiency. It’s light and uses inexpensive materials, making it a budget-friendly choice for manufacturers. Compared to materials like glass, metal, or paper, producing flexible plastic packaging requires less energy and fewer resources. This not only cuts down on manufacturing costs but also reduces expenses for transportation and storage, benefiting both manufacturers and consumers. Many industries lean towards flexible plastic packaging due to this cost advantage.

Moreover, flexible plastic packaging plays a vital role in prolonging product shelf life. Barrier films, a key feature, act as shields, blocking out moisture, air, and external contaminants. This protection extends the shelf life of products, especially crucial for perishable items like food and beverages. It allows these products to be stored and transported for longer periods without compromising their quality or freshness. This feature is especially valuable for items with short shelf lives, ensuring they remain in top condition for an extended period.

Restraint

High cost of flexible plastic packaging raw material and unavailability of good recycling infrastructure

Rising raw material prices present the flexible plastic packaging industry with an enormous challenge. Products made of this kind typically utilize different kinds of materials like plastic, paper, and metal – cost for materials like polyethylene and polypropylene often fluctuates based on market forces such as supply and demand and their impactful effect on overall production costs of flexible plastic packaging products.

Limited efficient recycling is another significant obstacle. Inadequate recycling activities restrict the amount of plastic that can be properly recycled. This leads to a buildup of plastic waste in landfills, oceans, and natural habitats, causing environmental pollution and harm to wildlife. Effective recycling of plastic packaging demands advanced infrastructure and expertise, but many parts of the world lack such facilities, making recycling efforts challenging and time-consuming.

Opportunities

Implementing sustainable packaging solutions to meet growing consumer demand and preferences

Consumers favor brands committed to sustainability and avoid those harming the environment. Consequently, several flexible plastic packaging companies are investing in research for eco-friendly materials. They’re also launching recycling initiatives and creating packaging that’s simpler to recycle.

With consumers increasingly seeking sustainable choices, the industry is evolving. This gives flexible plastic packaging manufacturers a chance to attract customers by offering sustainable packaging solutions.

Challenges

Recyclability of plastics

The recyclability of flexible plastic packaging poses a significant challenge for the packaging industry, impacting both the environment and society. Recycling multi-layer flexible plastic packaging is particularly complex compared to single-layer packaging. These multi-layer packages consist of various polymer types and inks, complicating their sorting from bulk waste.

In the recycling process, polypropylene (PP) films, due to their lower melting point compared to other plastics, can create problems. They tend to stick to recycling machinery, causing disruptions and blockages. This issue arises especially when PP films are mixed with other plastic packaging materials, making the recycling process more challenging.

Regional Analysis

The Asia Pacific accounted for 38.9% of revenue share in 2023, making it the largest regional Flexible Packaging market. The growing regional market can be attributed to India and China’s thriving food, beverage, and food retail sectors. Flexible packaging will be in demand due to rising disposable income and increasing demand for packaged foods.

Europe accounted for 29.8% of the total revenue share with a 3.1% CAGR in 2023. Over the next six years, flexible packaging demand will be fueled indirectly by increased R&D spending in Europe’s pharmaceutical industry. Over the forecast period, there will be a positive effect from rising personal care product demand in Germany and France.

North America has seen the elimination of Mexican regulations restricting the establishment of new manufacturing units. This has led to the construction of new facilities such as Daiichi Ranbaxy, Takeda, and Astellas. This government strategy has been a key driver of the domestic pharmaceutical industry. It is expected to drive product demand during the forecast period.

Over the forecast period, Middle East & Africa will grow significantly. The projected growth factor of the flexible packaging solution industry will be influenced by the Middle East’s rising health spending and government support.

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Mondi, Bemis Company Inc., Amcor Limited, Huhtamaki Group, and BASF SE are some key players involved in the production. Due to low production and labor costs, most major companies will shift their manufacturing base to developing nations like India and China.

To gain a competitive edge, key manufacturers engage in R&D. Forward integration is key to the market’s success. This includes flexible packaging products and raw material manufacturing. Distribution to different industries is also a major part of the Flexible Packaging market.

Farnell Packaging Limited, LPS Industries, and LPS Industries are integrated players offering plastic and paper packaging materials within their product portfolio. The following are some of the major players in global ANPR systems Markets:

Маrkеt Кеу Рlауеrѕ

- Amcor plc

- Mondi Group

- Berry Global Inc

- Huhtamaki Flexible Packaging

- Sonoco Products Company

- SEE (Sealed Air Corporation)

- Constantia Flexibles

- ProAmpac

- Transcontinental Inc.

- Graphic Packaging International, LLC

- Bemis Manufacturing Company

- Novolex

- Wipak Group

- DS Smith

- Sigma Plastics Group

- Other Key Players

Recent Developments

October 2022: Mondi Group collaborated with renowned Norwegian pet food company Felleskjopet to transition to recyclable high-barrier packaging for the relaunch of its premium Appetitt brand.

September 2022: Huhtamaki Oy invested in Emerald Technology Ventures AG’s sustainable packaging fund, which focuses on cutting-edge sustainable packaging technologies.

June 2022: Constantia Flexibles and Plasthill Technical Films, a company of the Dutch Oerlemans Packaging Group, have partnered to bring Constantia Flexibles’ proprietary technology, CompresSeal, to the market in Europe as part of Expansion.

Report Scope

Report Features Description Market Value (2023) USD 236.5 Bn Forecast Revenue (2033) USD 385.2 Bn CAGR (2024-2033) 5.0% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Packaging Type (Bags, Pouches, Films and Wraps, Others), By Raw Material (Plastic, Paper, Aluminum, Bioplastics, Polyethylene, Polypropylene, Polyethylene Terephthalate, Others), By Printing Technology (Flexography, Digital Printing, others) By Application (Food & Beverages, Pharmaceutical, Cosmetics, and Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Amcor plc, Mondi Group, Berry Global Inc, Huhtamaki Flexible Packaging, Sonoco Products Company, SEE (Sealed Air Corporation), Constantia Flexibles, ProAmpac, Transcontinental Inc., Graphic Packaging International, LLC, Bemis Manufacturing Company, Novolex, Wipak Group, DS Smith, Sigma Plastics Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of Flexible Packaging Market?Flexible Packaging Market size is expected to be worth around USD 385.2 billion by 2033, from USD 236.5 billion in 2023.

What is the CAGR of Flexible Packaging Market?The global Flexible Packaging Market is growing at a CAGR of 5% during the forecast period 2022 to 2033.Who are the major players operating in the Flexible Packaging Market?Amcor plc, Mondi Group, Berry Global Inc, Huhtamaki Flexible Packaging, Sonoco Products Company, SEE (Sealed Air Corporation), Constantia Flexibles, ProAmpac, Transcontinental Inc., Graphic Packaging International, LLC, Bemis Manufacturing Company, Novolex, Wipak Group, DS Smith, Sigma Plastics Group, Other Key Players.

-

-

- Amcor plc

- Mondi Group

- Berry Global Inc

- Huhtamaki Flexible Packaging

- Sonoco Products Company

- SEE (Sealed Air Corporation)

- Constantia Flexibles

- ProAmpac

- Transcontinental Inc.

- Graphic Packaging International, LLC

- Bemis Manufacturing Company

- Novolex

- Wipak Group

- DS Smith

- Sigma Plastics Group

- Other Key Players