Global Flavored Syrups Market By Product (Fruits, Coffee, Chocolate, Vanilla, Mint, Nuts and Others) By Distribution Channel (Food Service and Food Retail) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2023

- Report ID: 37449

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

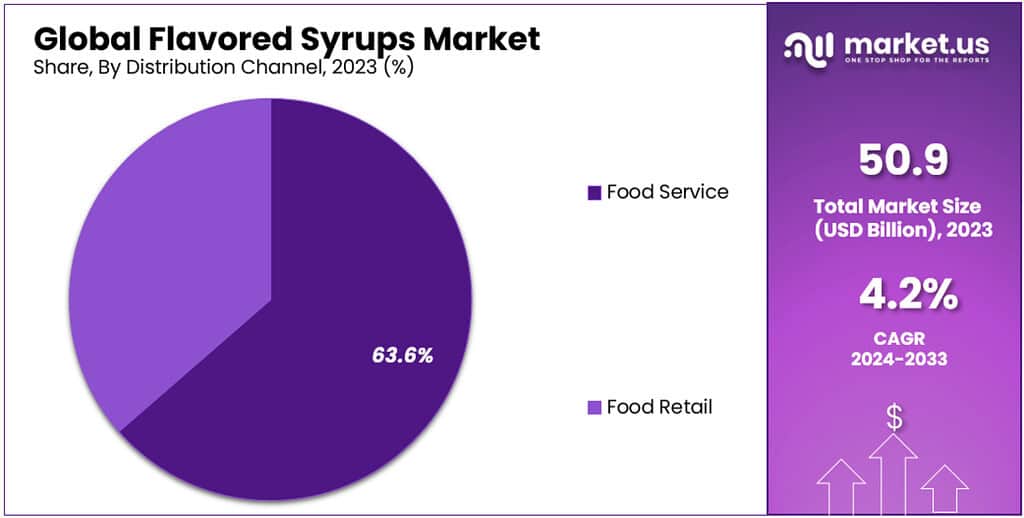

The Global Flavored Syrups Market size is expected to be worth around USD 76.8 Billion by 2033, from USD 50.9 Billion in 2023, growing at a CAGR of 4.2% during the forecast period from 2023 to 2033.

Flavored syrups are sweet, flavored liquids commonly used in a variety of food and drinks. They typically consist of a simple syrup (sugar fully mixed with water while heated) with naturally occurring or artificial flavorings dissolved in them. These syrups can be used in beverages such as coffee, tea, and cocktails, as well as in cooking to sweeten sauces, marinades, and desserts.

Key Takeaways

- The Global Flavored Syrups Market is projected to reach approximately USD 76.8 Billion by 2033.

- In 2023, the market was valued at USD 50.9 Billion.

- The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.2% from 2023 to 2033.

- Fruits accounted for a significant market share, capturing 35.6% in 2023.

- The chocolate segment is poised to experience the fastest growth with an expected rate of approximately 4.6% from 2023 to 2030.

- Food Service held a dominant market position in 2023, capturing over 63.6% share.

- The B2C segment is projected to have the fastest CAGR of ~4.5% from 2023 to 2033.

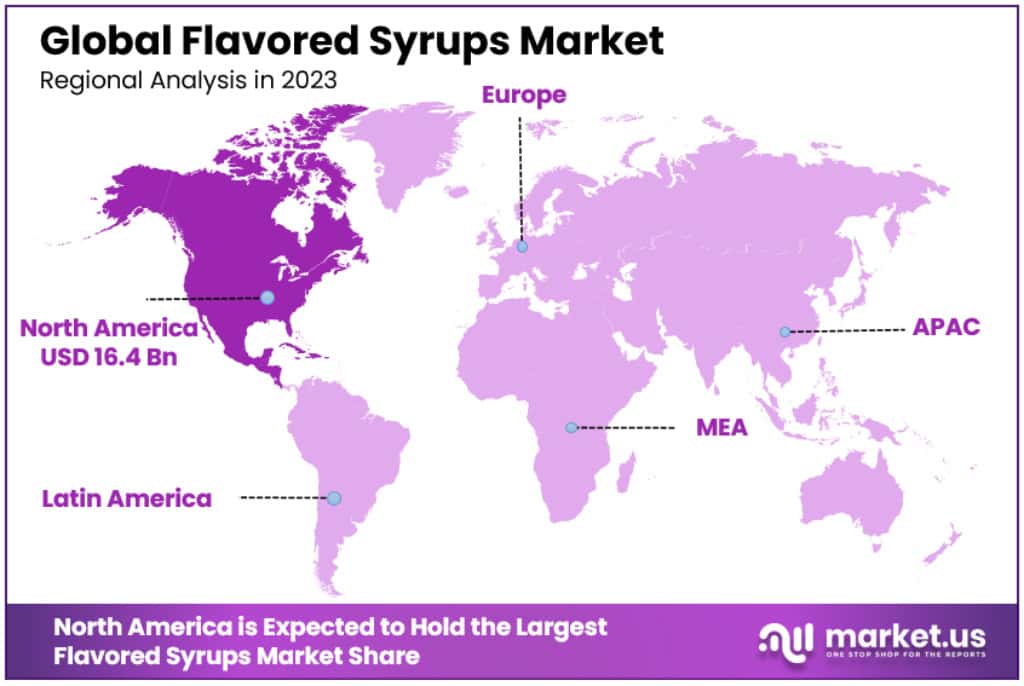

- North America dominated the market with a 32.3% share, valued at USD 16.4 billion in 2023.

- Asia Pacific is expected to grow at the highest CAGR of approximately 7% between 2023-2033.

Product Analysis

In 2023, the Flavored Syrups Market witnessed varied growth across its segments, with fruits, coffee, chocolate, vanilla, mint, nuts, and others, each contributing differently to the market dynamics.

Fruits Segment

Fruits maintained a dominant market position, capturing a significant 35.6% share. The surge in demand for fruit-infused flavored syrups, driven by consumer preferences for unique tastes, accelerated market growth. Producers focused on developing combined fruit syrups and launching innovative flavors, such as beetroot juice, apple, 100% natural sour cherry, and common sea buckthorn, to hold their position in the global industry. This trend towards pure, natural, and organic products significantly influenced the segment’s expansion.

Chocolate Segment

The chocolate segment is poised for the fastest growth, with an expected rate of ~4.6% from 2023 to 2030. This growth is fueled by the rising popularity of chocolate syrup in the food and beverage industry, particularly in cold and hot beverages such as coffee, milkshakes, and smoothies, as well as in baking and confectionery products like pastries, cakes, waffles, and pancakes. Developing economies like India and China, where there is a high preference for chocolate-based products, are emerging as key target markets for chocolate syrup manufacturers.

Coffee Segment

The coffee-flavored syrup segment also displayed substantial growth, with an increasing trend towards specialty coffee and personalized beverage experiences. This segment benefits from its widespread use in both home and commercial settings.

Vanilla Segment

Vanilla-flavored syrups continued to be essential in various culinary preparations. Their versatility and subtle sweetness cater to a broad consumer base, ensuring a steady market presence.

Mint Segment

Mint-flavored syrups, though holding a smaller market share, are gaining popularity for their refreshing taste in seasonal drinks and as a complement to certain desserts.

Nuts Segment

Nuts-flavored syrups, including flavors like almond and hazelnut, are witnessing gradual growth. Their application in gourmet foods and desserts is slowly expanding their market reach.

Other Flavors

The ‘Others’ category, encompassing unconventional and emerging flavors, is experiencing incremental growth due to continual innovation in the industry, catering to niche tastes and preferences.

Distribution Channel Analysis

In 2023, the Flavored Syrups Market, segmented by distribution channels such as Food Service and Food Retail, demonstrated significant differences in market share and growth potential.

Food Service Segment

Food Service held a dominant market position in 2023, capturing more than a significant 63.6% share. This segment includes industries like bakery & confectionery, beverages, and dairy & frozen desserts, which are expected to accelerate the market growth. Beverages, in particular, are a key area where flavored syrups are extensively used as taste and sweetness enhancers.

For example, Starbucks utilizes a range of naturally flavored syrups, including caramel, hazelnut, and vanilla, in their coffee offerings. The widespread use of flavored syrups in these industries underlines the segment’s robust market presence.

Food Retail Segment (B2C)

The B2C segment in the Flavored Syrups Market is projected to register the fastest Compound Annual Growth Rate (CAGR) of ~4.5% from 2023 to 2033. This growth trajectory can be attributed to the rising global popularity and demand for flavored syrups. The increase in sales of flavored syrups, primarily through company-owned websites and other e-commerce platforms, is expected to further fuel the growth of this segment. The introduction of novel flavors and the increasing indulgence factor among consumers, particularly in Asia-Pacific countries, is poised to drive the demand in the global market in the coming years.

In 2022, the Food Service (B2B) distribution channel held a large share. This is evident in the extensive use of flavored syrups in various industries, including beverages, dairy products, bakery items, and confectionery. The introduction of new flavors and the trend toward natural ingredients in establishments like Starbucks are reflective of the segment’s strong market position.

The B2C sector’s anticipated growth rate is indicative of evolving consumer purchasing patterns, with a shift towards online shopping and a growing preference for experimenting with different flavors at home. This trend is particularly pronounced in developing regions, where there is an increasing affinity for Western-style food and beverage products, including those with flavored syrups.

Key Market Segments

By Product

- Fruits

- Coffee

- Chocolate

- Vanilla

- Mint

- Nuts

- Others

By Distribution Channel

- Food Service

- Food Retail

Drivers

- Demand for Customized Flavors: There’s a growing interest in unique, tailored flavors in the food and beverage industry, boosting syrup sales.

- Convenience Foods: With more people choosing ready-to-eat foods, flavored syrups are increasingly used to enhance these products’ taste.

- Pandemic Influence: While COVID-19 slowed sales in the hospitality sector, home cooking trends maintained steady syrup demand, helping the market stay afloat.

- Fruit Flavors Leading the Way: Fruit-flavored syrups, especially raspberry and orange, are in high demand. This encourages manufacturers to innovate with flavors like Lime-Mint and Raspberry-Ginger, appealing to adventurous palates.

- Western Market Growth: Countries like the U.S., Germany, and Canada are seeing increased syrup use as toppings in a variety of foods, contributing significantly to market growth.

Restraints

- Health Concerns: High sugar content in syrups raises health concerns like diabetes and obesity, potentially slowing market growth.

- Competition from Alternatives: Domestic products like maize syrup offer competition to traditional flavored syrups.

Opportunities

- Innovative Flavors: There’s a surge in demand for unique flavors, pushing companies to invest in R&D and introduce new syrup varieties.

- Organic and Natural Syrups: As health consciousness rises, the market for organic and natural syrups grows, offering new opportunities for manufacturers.

Challenges

- Sugar Content: The high sugar content in syrups can be a barrier, especially as consumers shift towards healthier, sugar-free diets.

Trends

- Shift Toward Organic/Natural Syrups: There’s a notable trend towards organic and natural syrups, driven by increasing health awareness and the demand for clean-label ingredients.

- Functional Benefits: Consumers are looking for syrups that offer more than just taste, favoring those with health benefits.

- New Product Launches: For instance, Singing Dog Vanilla’s launch of organic vanilla syrup in the U.S. caters to the growing demand for flavored organic syrups.

Regional Analysis

North America is dominating the Flavored Syrups Market Market with a 32.3% share, with USD 16.4 Billion in 2023. This is largely due to consumers’ preference to use flavored syrups in their daily meals, such as snacks, desserts, and cereals. Due to the abundance of quality ingredients, such as toppings, fillings, frostings, and flavors, the bakery industry will experience significant growth. This encourages the use of flavor syrups throughout the food- and beverage industry.

Asia Pacific will grow at the highest CAGR, ~7%, between 2023-2033. Due to their low price, bakery products can be considered a product for mass consumption. In addition, sweet food lovers have encouraged manufacturers to develop innovative products that are flavored with syrups. Foreign companies have made rapid inroads into the Asian market. Hershey, for example, accounted in India for approximately 94% of all chocolate syrups sales in 2019.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

In the Flavored Syrups Market, a mix of both large and small companies are making significant strides. Major players like The Hershey Company, The Kraft Heinz Company, and Kerry Group are continually innovating and expanding their product lines to attract consumers. For instance, Starbucks stands out with its diverse flavored syrups, including toffee nut, peppermint mocha, cinnamon dolce, and peach, appealing to a broad consumer base.

A notable trend among these companies is the focus on health-conscious consumers. Monin Inc., for instance, offers an array of sugar-free syrups in fruit flavors such as raspberry, pomegranate, and peach, as well as other varieties like Irish cream, almond, and hazelnut. This approach caters to the growing demand for healthier alternatives in the market.

Other key players like Tate & Lyle, Toschi Vignola s.r.l., Fuerst Day Lawson, and Torani are also contributing significantly to the market’s growth. They are engaging in new market initiatives, expanding their global presence, and investing in research and development to enhance their product offerings.

Key Market Players

- The Hershey Company

- The Kraft Heinz Company

- Kerry Group

- Tate & Lyle

- Toschi Vignola s.r.l.

- Monin Inc.

- Fuerst Day Lawson

- Torani

- The J.M. Smucker Company

- Panos Brands

- Amoretti

- Skinny Mixes

- Nature’s Flavors, Inc.

- Sonoma Syrup Co

- Starbucks Coffee Company

- Archer Daniels Midland Company

- Other Key Players

Recent Developments

- October 2023: Mondelez International acquires a majority stake in BirchBenders, a leading US manufacturer of natural and organic syrups. This move expands Mondelez’s presence in the growing health-conscious segment of the market.

- November 2023: French flavor house Symrise acquires US-based Capol, a specialist in fruit flavors and extracts. This acquisition strengthens Symrise’s position in the North American market and expands its flavor portfolio.

- October 2023: Monin, a leading syrup manufacturer, launched a line of plant-based syrups made with monk fruit sweetener.

- September 2023: Torani, another major player, introduced a new line of functional syrups infused with adaptogens and probiotics.

- August 2023: Small-batch syrup producers are gaining traction, offering unique flavor combinations and locally sourced ingredients.

Report Scope

Report Features Description Market Value (2023) USD 50.9 Billion Forecast Revenue (2033) USD 76.8 Billion CAGR (2023-2032) 4.2% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Fruits, Coffee, Chocolate, Vanilla, Mint, Nuts and Others) By Distribution Channel (Food Service and Food Retail) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape The Hershey Company, The Kraft Heinz Company, Kerry Group, Tate & Lyle, Toschi Vignola s.r.l., Monin Inc., Fuerst Day Lawson, Torani, The J.M. Smucker Company, Panos Brands, Amoretti, Skinny Mixes, Nature’s Flavors, Inc., Sonoma Syrup Co, Starbucks Coffee Company, Archer Daniels Midland Company, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- The Hershey Company

- The Kraft Heinz Company

- Kerry Group

- Tate & Lyle

- Toschi Vignola s.r.l.

- Monin Inc.

- Fuerst Day Lawson

- Torani

- The J.M. Smucker Company

- Panos Brands

- Amoretti

- Skinny Mixes

- Nature's Flavors, Inc.

- Sonoma Syrup Co

- Starbucks Coffee Company

- Archer Daniels Midland Company

- Other Key Players