Global Fiberglass Pipe Market By Product Type (GRP Pipes, GRE Pipes and Other Product Types) By Fiber Type (T/ S/ R Glass, E-glass and Other Fiber Types) By End-Use (Oil & Gas, Chemicals, Sewage and Other End-Use) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jan 2024

- Report ID: 66521

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

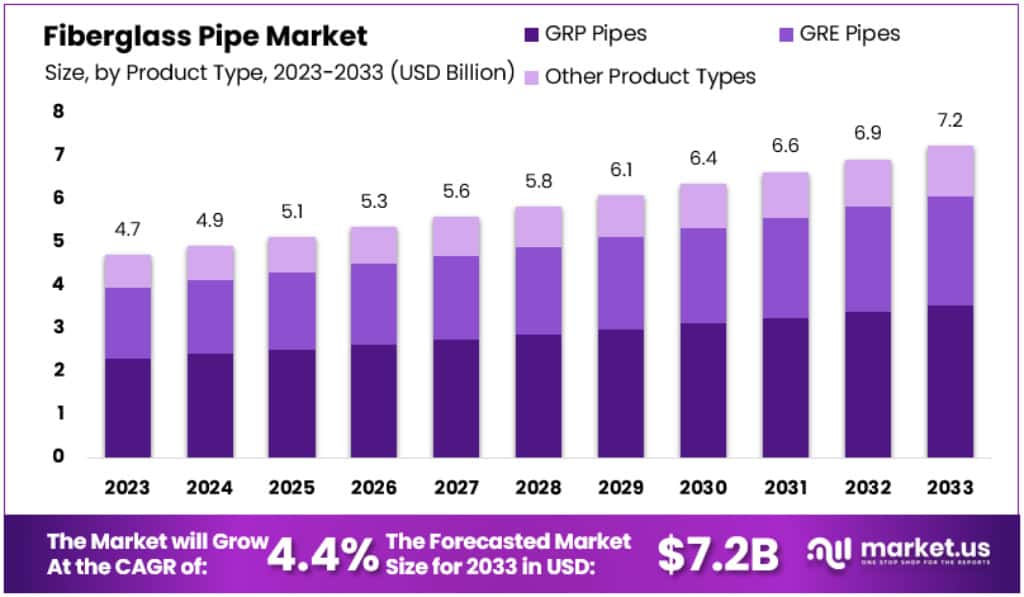

The Global Fiberglass Pipes Market size is expected to be worth around USD 7.2 Billion by 2033, from USD 4.7 Billion in 2023, growing at a CAGR of 4.4% during the forecast period from 2024 to 2033.

This growth can be attributed to the increasing demand for pipes that are light in weight, resistant to fire, highly durable against corrosion, and offer considerable stiffness.

Fiberglass pipes can be described as composite materials that combine the properties of several materials, such as resins and glass fibers. They are used in many end-use industries like chemicals and irrigation. Oil & Gas, Chemicals, sewage, and others are the key industries. GRE is the main product segment driving the industry. It is used in many offshore and onshore oil and gas exploration and production activities.

Globally, the demand for fiberglass pipes is rising. This is driven by their benefits such as ease of installation, low maintenance costs, and the ability to produce complex shapes. These pipes are also immune to corrosion, setting them apart from traditional materials like PVC, concrete, and steel. The market is increasingly embracing fiberglass pipes as a practical alternative to conventional materials, thanks to their longer lifespan, lighter weight, and compliance with strict regulations.

The Asia-Pacific region leads the market, largely due to increased government investment in water and waste management in developing countries. Furthermore, the oil & gas industry’s growing need for cost-effective and efficient gas transportation is boosting the demand for fiberglass pipes. However, the market’s growth is somewhat hindered by the high cost of raw materials.

Key Takeaways

- The Global Fiberglass Pipes Market is expected to reach approximately USD 7.2 Billion by the year 2033, up from USD 4.7 Billion in 2023.

- This growth is forecasted at a CAGR of 4.4% during the period from 2024 to 2033.

- In 2023, GRE pipes held a substantial market share of 47.9%, especially suitable for high-pressure and high-temperature applications.

- E-glass fiber accounted for over 55% of the market share in 2023, known for its exceptional resistance to acidic corrosion.

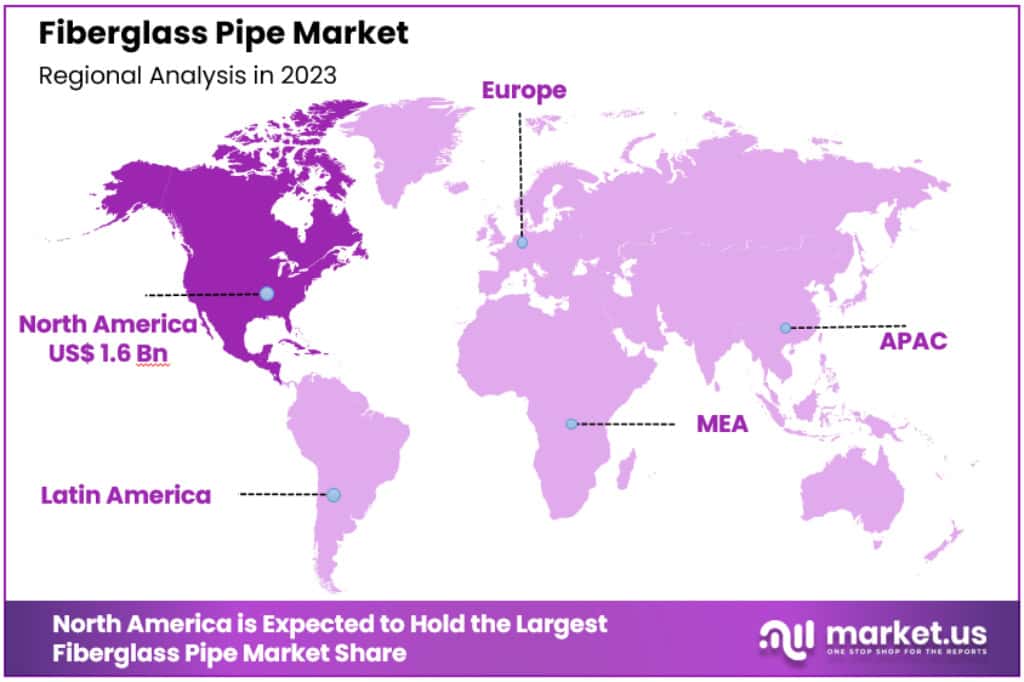

- North America dominated the Fiberglass Pipes Market in 2023 with a 36% Share and a market value of USD 1.6 billion.

- China’s shift from coal to natural gas creates opportunities for fiberglass pipes in energy transportation.

Product Type Analysis

In the fiberglass pipes market, the GRE Pipes segment commanded a prominent position in 2023, holding a substantial 47.9% market share. GRE pipes, reinforced with epoxy resins, are particularly suitable for high-pressure and high-temperature applications that demand exceptional corrosion resistance. These applications include industrial and offshore oil & gas sectors. The approval by the International Marine Organization (IMO) for their use in level 3 fire endurance marine applications further boosts their demand, anticipated to rise significantly.

The GRP Pipes segment, based on resin type, encompasses the Epoxy, Polyester, and Vinyl Ester categories. The Epoxy resin segment held a significant share, underpinned by its excellent resistance to a broad range of chemicals and hydrocarbons. This segment’s robustness is further evidenced by key market developments, such as the acquisition of Denali Incorporated. Denali, a leader in FRP solutions, significantly contributes to the market with its expertise in large underground FRP tanks. Additionally, the opening of a new Fiber Glass Systems manufacturing facility in Dammam, Saudi Arabia, marks a significant expansion. This facility, specializing in GRE pipe manufacturing, underscores the segment’s growth by addressing corrosion issues and enhancing resource transportation efficiency.

GRE pipes, excelling in dimensional stability, lightness, ease of installation, and corrosion resistance, outperform traditional metallic and concrete pipes. Consequently, their use in industries such as oil & gas, sewage, and chemicals is expanding. The water treatment sector, undergoing a significant transition due to population growth and increasing demand for potable water, especially in developing regions, emerges as a primary market for GRE pipes. This shift, driven by advancements in water treatment technology, underscores the growing preference for GRE pipes in water treatment applications.

Fiber Type Analysis

In 2023, the E-glass fiber segment in the fiberglass pipes market maintained a dominant position, capturing over 55% of the market share. E-glass fiber, known for its role as a reinforcement agent in various composites, enhances the performance of resins by providing strength. The market for E-glass fiber, characterized by a partially consolidated landscape, features key players like PPG Industries, Saint-Gobain Vertotex, and Nippon Electric Glass Co., Ltd. E-glass fiber finds extensive use in applications such as drainage in construction and marine cooling.

E-Glass, an alumino-borosilicate glass, is notable for its exceptional resistance to acidic corrosion, making it ideal for manufacturing high-end pipes. These pipes are not only resistant to oils, solvents, and most chemical agents, but also boast high strength, lightweight, and smooth surfaces, both inside and out. This makes them perfectly suited for trenchless applications like micro-tunneling and relining, as well as for use in sewer systems, potable water lines, storage tanks, drainage pipes, hydropower penstocks, and industrial pipeline systems.

The chemical sector emerges as the primary market for the E-Glass segment. With the significant increase in chemical production from petroleum, coal, and biomass, technological advancements and the development of large production sites worldwide have surged. This trend has catalyzed the demand for E-Glass in these production plants, which is expected to drive market growth in the forecast period.

End-Use Analysis

In 2023, the oil and gas sector in the fiberglass pipes market held a dominant position, capturing more than 40.8% of the market share. The significant growth in this sector is largely attributed to the robust development in emerging countries across Asia Pacific, South and Central America, and the Middle East and Africa. These regions are undergoing rapid growth and energy infrastructure reforms to meet increasing energy demands and to upgrade aging infrastructures.

A primary reason for the increased use of fiberglass pipes in the oil and gas industry is their exceptional corrosion resistance, which is crucial for safe and efficient chemical transportation. Unlike traditional metallic pipes, which are prone to corrosion, leading to maintenance challenges and safety hazards, fiberglass pipes offer a more durable and reliable solution. Additionally, their light weight makes them easier to transport and install, especially in remote or offshore locations.

The chemical industry also represents a key market, particularly in Europe and North America. Here, the growth of fiberglass pipes is bolstered by lower natural gas prices, with natural gas being a critical feedstock in various chemical processing industries. Moreover, the construction sector, especially in rapidly developing countries like China, India, and Saudi Arabia, is expected to see robust growth, further driving demand for fiberglass pipes.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- GRP Pipes

- GRE Pipes

- Other Product Types

By Fiber Type

- T/ S/ R Glass

- E-glass

- Other Fiber Types

By End-Use

- Oil & Gas

- Chemicals

- Sewage

- Other End-Uses

Drivers

- Superior Flow Properties and Pressure Performance: In 2023, the fiberglass pipes market is driven by the superior qualities of fiberglass pipes, such as excellent flow properties and high-pressure performance. Technological advancements have made the production of dual helical four-axis fiberglass pipes more efficient, contributing to market expansion. The oil and gas sector, in particular, favors fiberglass pipes for extraction, processing, and distribution due to their high-capacity load handling.

- Increased Use in Sewage Applications: The rise in the application of fiberglass pipes in sewage systems is a significant driver. These pipes offer less frictional loss, ensuring good hydraulic efficiency. Their use in water treatment plants and wastewater management is driven by efforts to improve sanitary conditions, especially in Asia-Pacific countries.

- Revival in Oil Exploration: With a global increase in demand for crude oil, LPG, and natural gas, the revival in oil exploration is expected to drive the demand for fiberglass pipes. Their chemical resistance and cost-effectiveness make them ideal for oil field pipelines.

Restraints

- High Initial Cost and Limited Installation Expertise: Fiberglass pipes often have higher upfront costs compared to conventional materials. Additionally, their installation requires specific training and knowledge, posing a challenge due to a lack of trained installers.

- Material Compatibility and Regulatory Compliance: While fiberglass pipes are resistant to corrosion and chemicals, they may not be suitable for extremely reactive substances. Ensuring regulatory compliance also adds to the complexity and cost of manufacturing.

- High Price of Raw Materials: The cost of manufacturing fiberglass pipes is impacted by the high price of raw materials like resins, fiberglass, catalysts, and accelerators. This is a significant challenge affecting market prices.

Opportunities

- Reducing Dependence on Coal in China: The shift from coal to natural gas in countries like China creates opportunities for fiberglass pipes in energy transportation. This is due to the cost-effectiveness of pipeline transportation over LNG ships.

- Chemical Industry Growth in China: As China accounts for over 43% of global chemical sales, the growth of chemical industries in the region presents opportunities for the fiberglass pipes market.

Challenges

- Fluctuations in Raw Material Prices: The demand from the automotive and aerospace industries for carbon fiber puts pressure on raw material suppliers, leading to price fluctuations and demand-supply mismatches.

- Vulnerability to Mechanical Damage: The susceptibility of fiberglass pipes to mechanical damage and the lack of standardized pipe jointing systems pose challenges to market growth.

Trends

- Growth in the Oil and Gas Industry: Significant growth in the oil and gas industry drives the market, with fiberglass pipes being essential in various processes due to their durability and performance under extreme conditions.

- Advancements in Production Technology: The integration of CAD technology and new production processes like dual helical filament binding enhances the market growth by improving production efficiency and accuracy.

- Increased Demand in Construction Activities: Rising construction activities have facilitated the demand for durable pipelines in commercial and residential complexes, creating a positive outlook for the market.

- Government Investments in Water and Waste Management: Investments by governments in water and waste management systems and infrastructural development activities are anticipated to drive the market.

- Rapid Urbanization and Industrial Growth: Rapid urbanization and associated industrial growth in sectors like oil and gas are major market drivers, with fiberglass pipes increasingly used due to their corrosion resistance and suitability for high-pressure conditions.

Regional Analysis

In 2023, North America dominates the Fiberglass Pipes Market, holding a commanding 36% share with a market value of USD 1.6 billion. This leadership is driven by a growing emphasis on renewable energy, necessitating the use of corrosion-resistant fiberglass pipes. The United States, in particular, shows promising prospects for manufacturers due to the Water Resources Development Act of 2016, which encourages investments in water infrastructure and prioritizes corrosion-resistant installations. Furthermore, stringent environmental regulations in North America demand materials that minimize environmental impact, aligning well with the corrosion-resistant and eco-friendly nature of fiberglass pipes.

China, as a significant importer of oil and gas and a major global chemical producer, contributes largely to this growth. The country’s policies to increase natural gas use and reduce coal reliance, mainly for environmental reasons, predict a rising demand for fiberglass pipes. Additionally, China’s chemical industry, accounting for over 43% of global chemical sales, further amplifies this demand.

In India, the chemical processing industry is highly diversified, producing around 70,000 products. Being the 3rd largest chemical producer in Asia and 7th globally, the Indian chemical sector is expected to reach about USD 300 billion by 2025, according to the India Brand Equity Foundation (IBEF). This growth in the chemical sector is anticipated to fuel the demand for fiberglass pipes in the region.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

National Oilwell Varco Inc., Graphite India Limited, and Saudi Arabian AMIANTIT Company are the key players in this global market. PPG Fiberglass Industries, HOBAS International GmbH, Fibrex Corporation, and Domestic companies place great emphasis on quality products at affordable prices that meet international standards. Key players in the global market include National Oilwell Varco, Inc., Graphite India Limited, and Saudi Arabian AMIANTIT Company.

Маrkеt Кеу Рlауеrѕ

- National Oilwell Varco Inc.

- Graphite India Limited

- PPG Fiberglass Industries

- HOBAS International GmbH

- Fibrex Corporation

- Andronaco Industries

- Future Pipe Industries

- Sarplast SA

- FCX Performance

- Amiblu Holding GmbH

- Chemical Process Piping Pvt. Ltd. (CPP)

- Saudi Arabian AMIANTIT Company

- Other Key Players

Recent Developments

Acquisitions

- Fiber Glass System’s High-Pressure Vessel Initiative: Fiber Glass Systems (FGS) launched a new initiative to expand its product range. This includes the introduction of high-pressure fiber-reinforced epoxy vessels, with diameters reaching up to 60 inches (1.5 meters). The initiative involved collaboration between FGS Plymouth and FGS Malaysia to certify both UK and Malaysian facilities for the production of Class I ASME Boiler and Pressure Vessel Code-certified pressure vessels.

- JICA and Vietnam’s Government Collaboration: A significant grant agreement was established between the Japan International Cooperation Agency (JICA) and the government of Vietnam. This agreement, worth US$ 17.4 billion, is aimed at supporting the Trenchless Sewerage Pipe Rehabilitation Project in Ho Chi Minh City.

- Acquisition of Denali Incorporated by an Unnamed Company: Denali Incorporated, a leader in fiberglass-reinforced plastic (FRP) products, was acquired in October 2019. With over 50 years of experience, Denali is known for its innovative FRP solutions in industries like petroleum, chemical, power generation, and water. Its largest business, Containment Solutions, Inc., specializes in manufacturing large underground FRP tanks for fuel storage at gasoline stations in North America.

New Trends

- Focus on Sustainable Fiberglass: There is a growing trend towards the use of recycled and bio-based materials in fiberglass production, driven by environmental concerns and regulations. Companies like Owens Corning and Saint-Gobain are making significant investments in developing sustainable fiberglass technologies.

- Adoption of Smart Pipe Technologies: The integration of sensors and monitoring systems into fiberglass pipes is gaining traction, particularly in water distribution and infrastructure applications. These smart pipes can help detect leaks, optimize flow, and improve overall management of critical infrastructure.

- Rise of Non-Woven Reinforcements: Non-woven fiberglass fabrics are increasingly being used as an alternative to traditional woven fabrics in pipe production. This offers advantages such as improved strength, lower weight, and reduced manufacturing costs.

Report Scope

Report Features Description Market Value (2023) USD 4.7 Billion Forecast Revenue (2033) USD 7.2 Billion CAGR (2024-2033) 4.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (GRP Pipes, GRE Pipes and Other Product Types) By Fiber Type (T/ S/ R Glass, E-glass and Other Fiber Types) By End-Use (Oil & Gas, Chemicals, Sewage and Other End-Use) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape National Oilwell Varco Inc., Graphite India Limited, PPG Fiberglass Industries, HOBAS International GmbH, Fibrex Corporation, Andronaco Industries, Future Pipe Industries, Sarplast SA, FCX Performance, Amiblu Holding GmbH, Chemical Process Piping Pvt. Ltd. (CPP), Saudi Arabian AMIANTIT Company and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: What is the size of the fiberglass pipes market in 2023?The Fiberglass pipe market size is estimated to be USD 4.7 Billion in 2023.

Q: What is the projected CAGR at which the fiberglass pipes market is expected to grow at?The Fiberglass pipe market is expected to grow at a CAGR of 4.4% (2024-2033).

Q: List the key industry players of the Fiberglass pipe market?National Oilwell Varco Inc., Graphite India Limited, PPG Fiberglass Industries, HOBAS International GmbH, Fibrex Corporation, Andronaco Industries, Future Pipe Industries, Sarplast SA, FCX Performance, Amiblu Holding GmbH, Chemical Process Piping Pvt. Ltd. (CPP), Saudi Arabian AMIANTIT Company, Other Key Players. are the key vendors in the Fiberglass Pipe market

-

-

- National Oilwell Varco Inc.

- Graphite India Limited

- PPG Fiberglass Industries

- HOBAS International GmbH

- Fibrex Corporation

- Andronaco Industries

- Future Pipe Industries

- Sarplast SA

- FCX Performance

- Amiblu Holding GmbH

- Chemical Process Piping Pvt. Ltd. (CPP)

- Saudi Arabian AMIANTIT Company

- Other Key Players