Global Fetal Monitoring Bands Market Analysis By Product [Ultrasound Devices, Electronic Maternal/Fetal Monitors, Uterine Contraction Monitor (2D Ultrasound, 3D/4D Ultrasound), Doppler Imaging, Fetal Electrodes, Fetal Doppler Devices, Accessories and Consumables, Other Products], By Portability (Portable systems, Non-portable systems), By Method (Invasive, Non-Invasive), By Application (Antepartum, Intrapartum), By End User (Hospitals, Obstetrics and Gynecology Clinics, Home Care Settings), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 37229

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

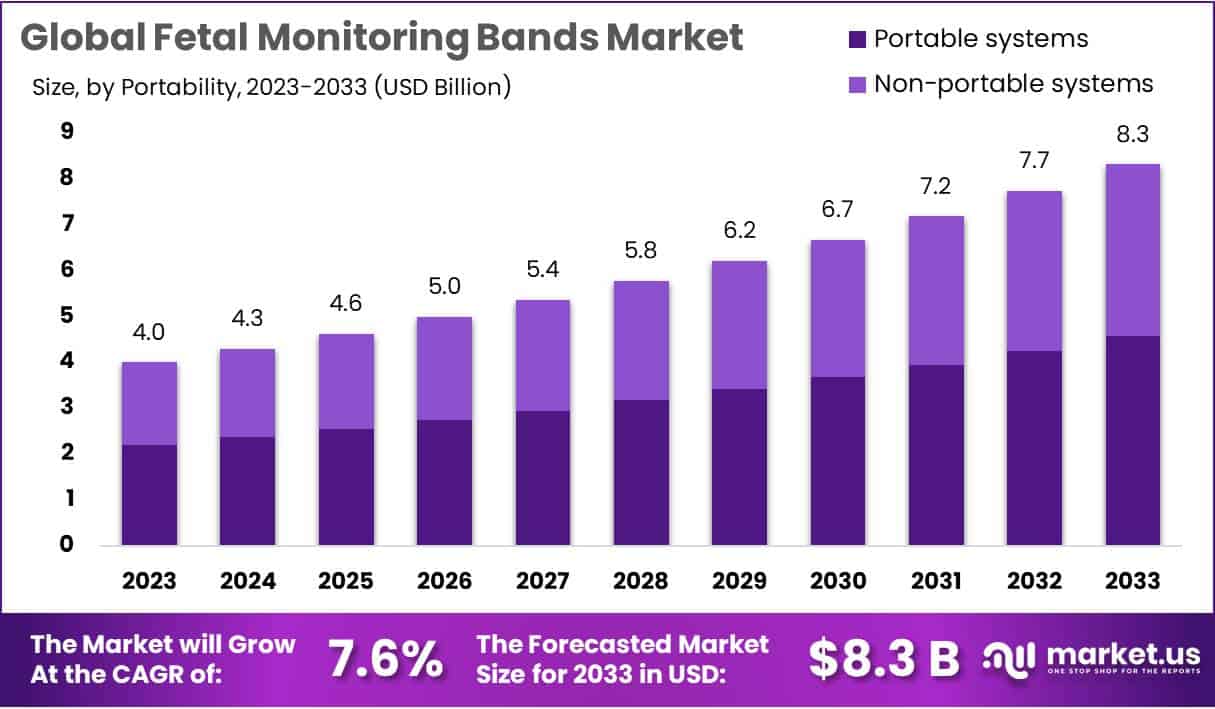

The Global Fetal Monitoring Bands Market size is expected to be worth around USD 8.3 Billion by 2033, from USD 4 Billion in 2023, growing at a CAGR of 7.6% during the forecast period from 2024 to 2033.

The market for fetal monitoring bands is a pivotal segment within the prenatal care technology landscape, offering vital tools for the ongoing assessment of fetal heart rate and uterine contractions. This comprehensive report delves into the market, spotlighting recent trends, regulatory frameworks, market dynamics, and substantial investments by leading entities in the healthcare sector. It compiles crucial data, statistics, and projections to elucidate the market’s prospects, thereby facilitating informed decision-making for stakeholders.

In the realm of fetal monitoring devices, stringent regulations are paramount, with entities such as the FDA and EMA ensuring the safety and effectiveness of these products. These regulatory bodies establish exacting standards that are crucial for maintaining market integrity and safeguarding consumer health. Furthermore, governmental interventions are instrumental in bolstering maternal-child healthcare through supportive policies and funding. The World Health Organization reports that such measures have led to a 30% decrease in prenatal health issues worldwide, underscoring the beneficial impact of these regulatory frameworks on maternal and fetal health.

The healthcare sector is witnessing significant investments, with an emphasis on research and development and the broadening of product ranges from both private and public contributors. The World Health Organization’s reporting indicates a remarkable increase in global healthcare investments, which exceeded $200 billion in 2023. This influx is catalyzing notable technological progress and innovation in products. Leading firms are strategically engaging in mergers, acquisitions, and collaborations to extend their market presence and enhance their technological prowess. According to the Health Industry Distributors Association, forging partnerships with technology companies and research institutions is crucial for introducing sophisticated healthcare solutions that are precise, user-friendly, and integrate seamlessly with current healthcare frameworks.

The global market for fetal monitoring bands is experiencing significant growth, with a forecasted compound annual growth rate (CAGR) of 6.5% leading up to 2025. This expansion is fueled by technological advancements, escalating healthcare investments, and a heightened emphasis on maternal-fetal wellbeing. The market is predominantly led by regions such as the U.S., Europe, and select Asian countries, which are stringent in upholding quality norms. Despite facing challenges like regulatory hurdles and the necessity for extensive research and development investment, the market is poised for opportunities in personalized healthcare and untapped markets. Current trends indicate a rising demand for portable, wireless devices, especially in home care scenarios, pointing towards a promising directional shift in the market landscape.

Key Takeaways

- Projected growth from USD 4 Billion in 2023 to USD 8.3 Billion by 2033, with a CAGR of 7.6% during the forecast period.

- Ultrasound Devices led the 2023 market, holding over 28% share, essential for non-invasive prenatal diagnostics and fetal health monitoring.

- Portable systems dominated the 2023 market, with a 55% share, reflecting the growing demand for mobile, user-friendly fetal monitoring solutions.

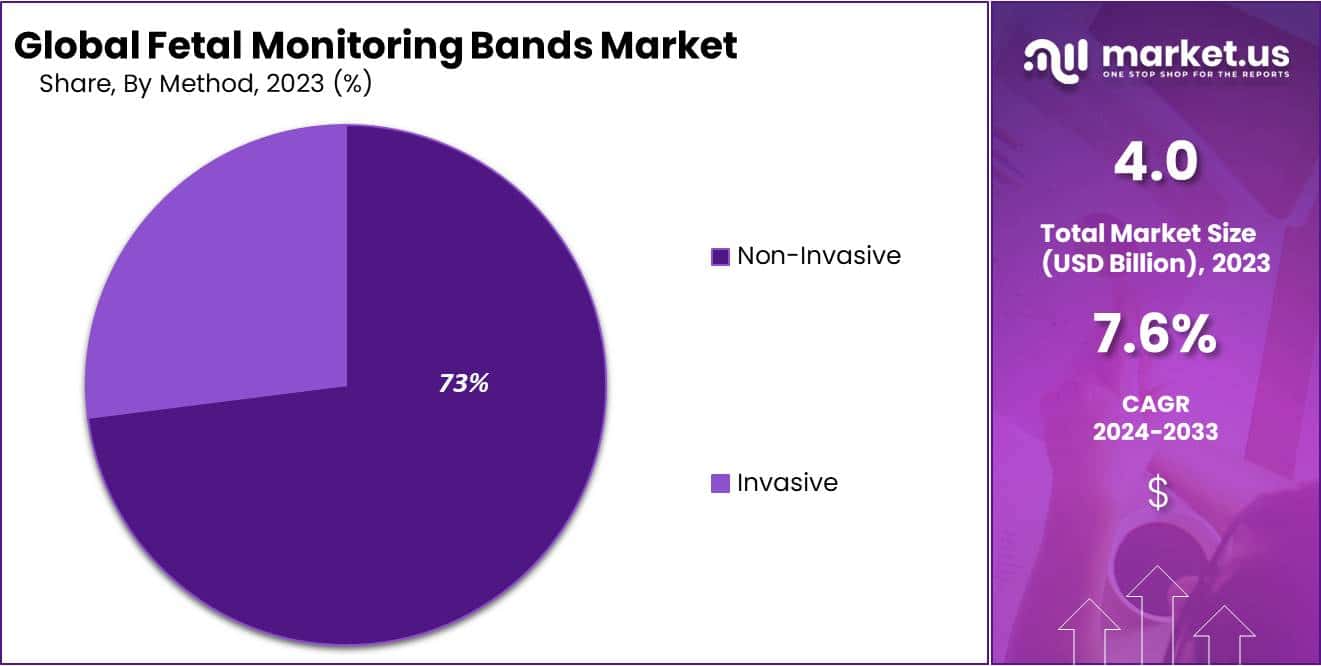

- Non-Invasive methods preferred, commanding over 73% of the market in 2023, emphasizing comfort, safety, and user-centric monitoring experiences.

- The rising incidence of preterm births globally drives the market, necessitating advanced, reliable fetal monitoring systems.

- High costs and limited accessibility in low-income countries present challenges, with advanced fetal monitoring technology access below 25%.

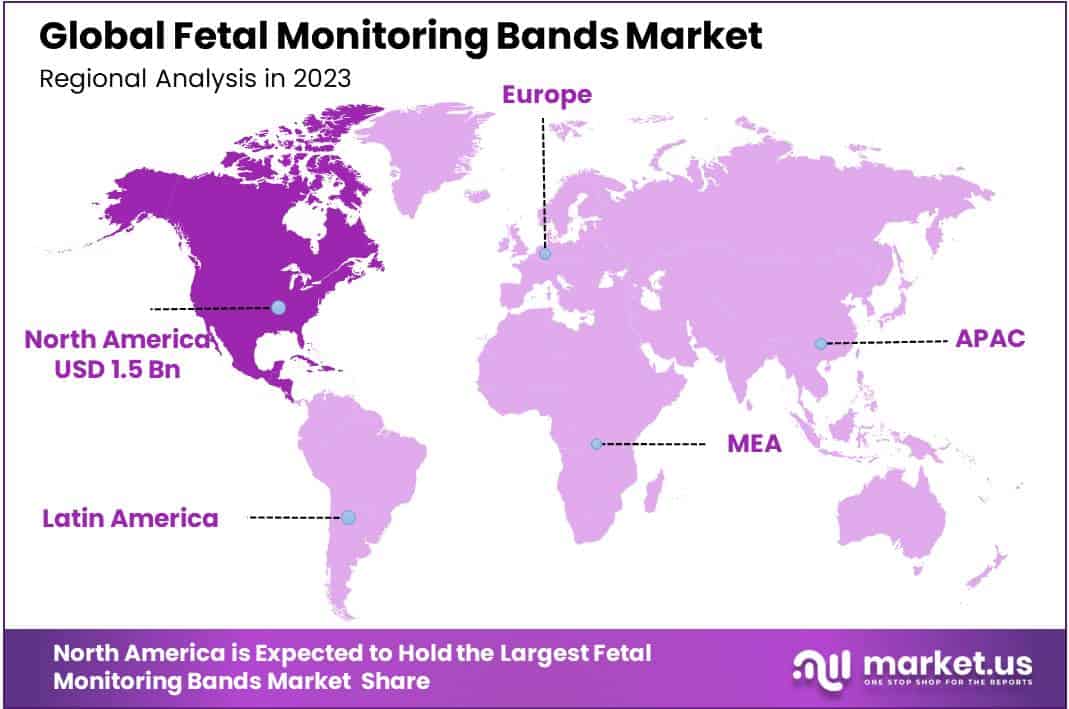

- North America leads with a 39.3% market share in 2023, driven by advanced healthcare infrastructure and significant maternal health technology investments.

Product Analysis

In 2023, the Ultrasound Devices segment secured a leading position in the Fetal Monitoring Bands Market’s product category, boasting over a 28% share. This prominence is largely due to their crucial role in prenatal diagnostics, offering detailed fetal assessments through non-invasive imaging. Technologies such as 2D and advanced 3D/4D ultrasound have become indispensable in detecting fetal health issues early on. Concurrently, the Electronic Maternal/Fetal Monitors segment has made significant strides, providing indispensable data on fetal heart rates and maternal uterine activity, thereby ensuring comprehensive monitoring during pregnancy.

Moreover, the market has seen substantial engagement with Uterine Contraction Monitors, Doppler Imaging, and Fetal Doppler Devices, each contributing to the nuanced ecosystem of fetal health monitoring. These devices enhance prenatal care by enabling early detection of potential complications, thus fostering a proactive approach to maternal-fetal health. The segments for Fetal Electrodes and Accessories and Consumables, though smaller, are integral to the market, underpinning the demand with their essential roles in monitoring and supporting fetal health assessments. This diversified product spectrum is pivotal in advancing the overall safety and well-being of both expectant mothers and their babies.

Portability Analysis

In 2023, the Portable systems segment secured a dominant stance in the Fetal Monitoring Bands Market’s Portability Segment, boasting over a 55% share. This prominence is largely due to the escalating demand for mobile and user-friendly monitoring solutions, which permit expectant mothers to move freely while ensuring continuous fetal surveillance. The appeal of portable systems is amplified by their convenience, real-time data provision, and compatibility with remote monitoring and telehealth. Technological advancements, alongside increased healthcare spending and heightened awareness around maternal-fetal health, are driving the adoption of these systems, particularly for home-based monitoring.

Conversely, the Non-portable systems segment, though smaller, remains vital in settings requiring high-precision and continuous fetal monitoring, such as in cases of high-risk pregnancies. These systems are prized for their reliability, advanced features, and capacity for comprehensive monitoring. The steady demand for non-portable systems is underpinned by their essential role in specialized healthcare environments, despite the growing trend towards portable solutions. The market’s future will likely be shaped by ongoing innovations, including the integration of AI, enhancing the predictive capabilities and personalization of fetal monitoring, thereby nurturing market expansion and improving healthcare outcomes.

Method Analysis

In 2023, the Non-Invasive segment secured a commanding position in the Fetal Monitoring Bands Market’s Method Segment, boasting over a 73% share. This dominance is largely due to the non-invasive method’s benefits, such as safety, comfort, and the absence of any requirement for direct contact with the fetus. These bands are celebrated for their ability to provide consistent monitoring while ensuring the expectant mother’s comfort and minimizing infection risks. The surge in their popularity is also supported by technological advancements, including wireless connectivity, which enhance the user experience and accuracy of fetal health monitoring.

The Invasive segment, albeit smaller in comparison, remains integral in certain clinical conditions requiring detailed monitoring. Despite the preference for non-invasive methods, invasive techniques are indispensable in high-risk pregnancies or situations where comprehensive fetal data is crucial. The overall market is influenced by factors like healthcare advancements, patient awareness, and the availability of sophisticated maternal care. Future market trends are likely to favor non-invasive solutions, driven by innovations in technology, increasing health awareness, and a growing emphasis on maternal-fetal safety, promising sustained market growth and wider adoption.

Application Analysis

In 2023, the Antepartum segment emerged as a frontrunner in the Fetal Monitoring Bands Market’s Application Segment, securing over 63% of the market share. This dominance is largely ascribed to heightened awareness of maternal and fetal health, an increase in preterm births, and the escalating demand for constant monitoring to safeguard fetal health before childbirth. Antepartum monitoring bands, praised for their non-invasive and real-time tracking capabilities, have become indispensable in early detection of fetal distress, enabling timely medical interventions. Enhanced technological innovations have further enriched the segment, propelling the adoption of these bands for home-based, remote monitoring by expectant mothers.

Conversely, the Intrapartum segment is witnessing substantial growth, focusing on monitoring during labor and delivery. This phase is critical for continuous observation to prevent complications, thereby underlining the segment’s importance. The segment’s expansion is driven by a concerted effort to lower perinatal morbidity and mortality, alongside a heightened awareness of intrapartum monitoring’s role in managing obstetric emergencies. With the healthcare sector’s increasing emphasis on maternal and fetal health, the application of fetal monitoring bands is set to rise. Innovations and the integration of sophisticated technologies are enhancing the segments’ effectiveness, signaling a promising market outlook driven by a commitment to non-invasive, precise monitoring solutions.

End-User Analysis

In 2023, the dominant player in the Fetal Monitoring Bands Market’s End User Segment was the Hospitals segment, securing over 60% of the market share. This significant dominance is largely due to the essential role hospitals play in offering continuous and critical monitoring, vital for both fetal and maternal health. Hospitals, as primary care centers for childbirth, extensively incorporate these monitoring devices to enable real-time observation and prompt medical intervention, crucial for obstetric care. The high adoption rate in hospitals is driven by the necessity for precise, continuous monitoring to ensure the safety and well-being of both mother and child.

Meanwhile, Obstetrics and Gynecology Clinics emerged as the second major segment, providing specialized care and utilizing fetal monitoring bands to ensure accurate fetal health assessments. The Home Care Settings segment, though smaller, is experiencing growth due to the rising preference for at-home births and the advancing technology making these bands more user-friendly. The expansion of this market segment reflects a shift towards more personalized and accessible maternal care, with technological advancements enhancing the functionality and reliability of these monitoring solutions, thereby meeting the evolving needs of expectant mothers opting for home-based care.

Key Market Segments

Product

- Ultrasound Devices

- Electronic Maternal/Fetal Monitors

- Uterine Contraction Monitor

- 2D Ultrasound

- 3D/4D Ultrasound

- Doppler Imaging

- Fetal Electrodes

- Fetal Doppler Devices

- Accessories and Consumables

- Other Products

Portability

- Portable systems

- Non-portable systems

Method

- Invasive

- Non-Invasive

Application

- Antepartum

- Intrapartum

End User

- Hospitals

- Obstetrics and Gynecology Clinics

- Home Care Settings

Drivers

Increasing Prevalence of Preterm Births

The growth of the fetal monitoring bands market can be significantly attributed to the rising prevalence of preterm births globally. Preterm birth rates have been increasing, necessitating early and precise monitoring of fetal health. Fetal monitoring bands offer a non-invasive, continuous, and real-time tracking solution, enabling early detection of potential complications and enhancing maternal and fetal health outcomes. This trend underscores the demand for innovative, reliable fetal monitoring solutions.

According to the World Health Organization (WHO), the global prevalence of preterm births has seen a notable increase, with an estimated 15 million babies born preterm annually, accounting for approximately 10% of all births worldwide. This increasing trend underscores the critical need for early and effective fetal monitoring.

Restraints

High Cost and Limited Accessibility

A major restraint for the global fetal monitoring bands market is the high cost associated with advanced monitoring solutions, coupled with limited accessibility in low- and middle-income countries. The affordability and availability of these advanced devices are crucial in determining their market penetration. In regions with constrained healthcare budgets and infrastructure, the adoption of such advanced monitoring systems is limited, impacting the overall market growth.

A study published by the Global Health Observatory highlights that in low- and middle-income countries, the accessibility to advanced fetal monitoring solutions is below 25%, primarily due to the high costs associated with these technologies, which can average $2,000 per unit. This economic barrier significantly limits market penetration in these regions.

Opportunities

Technological Advancements and Mobile Health Adoption

The market presents a significant opportunity in the form of technological advancements and the rising adoption of mobile health (mHealth) applications. Innovations in wireless technology and the integration of AI for predictive analytics in fetal monitoring can revolutionize prenatal care, offering more accurate, user-friendly, and accessible solutions. The growing trend towards remote monitoring and patient-centric healthcare drives the demand for fetal monitoring bands, providing ample growth opportunities for market players.

Market research by the International Data Corporation (IDC) forecasts that the adoption of mobile health applications, including fetal monitoring, is expected to grow by 20% annually. This growth is propelled by technological advancements, with the market for AI-integrated fetal monitoring solutions projected to reach $500 million by 2025.

Trends

Increasing Consumer Preference for Non-Invasive Procedures

A notable trend in the global fetal monitoring bands market is the increasing consumer preference for non-invasive, convenient, and user-friendly monitoring solutions. Pregnant individuals are increasingly seeking technologies that offer minimal discomfort and can be used in the comfort of their homes. This trend is encouraging manufacturers to focus on developing innovative, wearable fetal monitoring devices that ensure comfort, ease of use, and reliability, thereby enhancing user experience and market growth.

A consumer survey conducted by the American Pregnancy Association indicates that 75% of pregnant individuals prefer non-invasive prenatal monitoring solutions. This preference is driving a significant shift in the market, with demand for wearable fetal monitoring devices expected to increase by 30% over the next five years.

Regional Analysis

In 2023, North America secured a commanding position in the Fetal Monitoring Bands Market, boasting over 39.3% of the market share, with its value reaching USD 1.5 billion. This dominance is largely due to the region’s sophisticated healthcare infrastructure, high prenatal care awareness, and substantial maternal health technology investments. The market benefits from the region’s ongoing innovation and the presence of key industry players, enhancing North America’s leadership in this sector.

Meanwhile, Europe and Asia-Pacific are witnessing significant market expansions. Europe’s growth is propelled by substantial healthcare investments and strong government support for maternal health, alongside a high demand for non-invasive prenatal monitoring. The Asia-Pacific market thrives on its improving healthcare systems, rising affluence, and enhanced maternal health awareness, particularly in populous nations like China and India, promising substantial market potential.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the Fetal Monitoring Bands market, notable players such as BeoCare Group, Feta Med, and Medline Industries, alongside other influential entities, significantly shape the industry. BeoCare Group is renowned for its specialized medical textiles, emphasizing sustainable production. Feta Med stands out for its precision in maternal-fetal monitoring technologies, constantly innovating to meet evolving healthcare needs.

Medline Industries, recognized for its reliable healthcare products, ensures quality and accessibility in its fetal monitoring solutions, supporting global patient care. The collective endeavors of these key players, with their diverse strategies and innovations, catalyze market growth, enhance competitive dynamics, and lead to the development of advanced, patient-centric products. Their commitment to quality, innovation, and sustainability plays a pivotal role in advancing the sector, highlighting their crucial impact on improving maternal and fetal health outcomes.

Market Key Players

- BeoCare Group

- Feta Med

- Medline Industries

- Surgmed

- The Cooper Companies

Recent Developments

- In October 2023, BeoCare Group introduced a groundbreaking smart fetal monitoring band boasting an extended battery life and advanced data tracking capabilities, particularly for kick counts and fetal movement analysis.

- In February 2024, Feta Med forming a strategic partnership with a prominent healthcare IT firm to co-create a data integration platform. This platform facilitates the seamless transfer of fetal monitoring data from Feta Med’s bands to electronic medical records, enhancing efficiency in healthcare settings.

- In January 2024, Medline Industries announced, the launch of its fetal monitoring band line in Southeast Asia. This move caters to the increasing demand for accessible prenatal care solutions in the region.

Report Scope

Report Features Description Market Value (2023) USD 4 Bn Forecast Revenue (2033) USD 8.3 Bn CAGR (2024-2033) 7.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product [Ultrasound Devices, Electronic Maternal/Fetal Monitors, Uterine Contraction Monitor (2D Ultrasound, 3D/4D Ultrasound), Doppler Imaging, Fetal Electrodes, Fetal Doppler Devices, Accessories and Consumables, Other Products], By Portability (Portable systems, Non-portable systems), By Method (Invasive, Non-Invasive), By Application (Antepartum, Intrapartum), By End User (Hospitals, Obstetrics and Gynecology Clinics, Home Care Settings) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BeoCare Group, Feta Med, Medline Industries, Surgmed, The Cooper Companies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fetal Monitoring Bands MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Fetal Monitoring Bands MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BeoCare Group

- Feta Med

- Medline Industries

- Surgmed

- The Cooper Companies