Global Ferroalloys Market; By Product Type (Ferrochrome, and Ferro Silicon); By Application (Carbon & Low Alloy Steel, and Other Applications); As well as by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast: 2023-2033

- Published date: Nov 2023

- Report ID: 15886

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

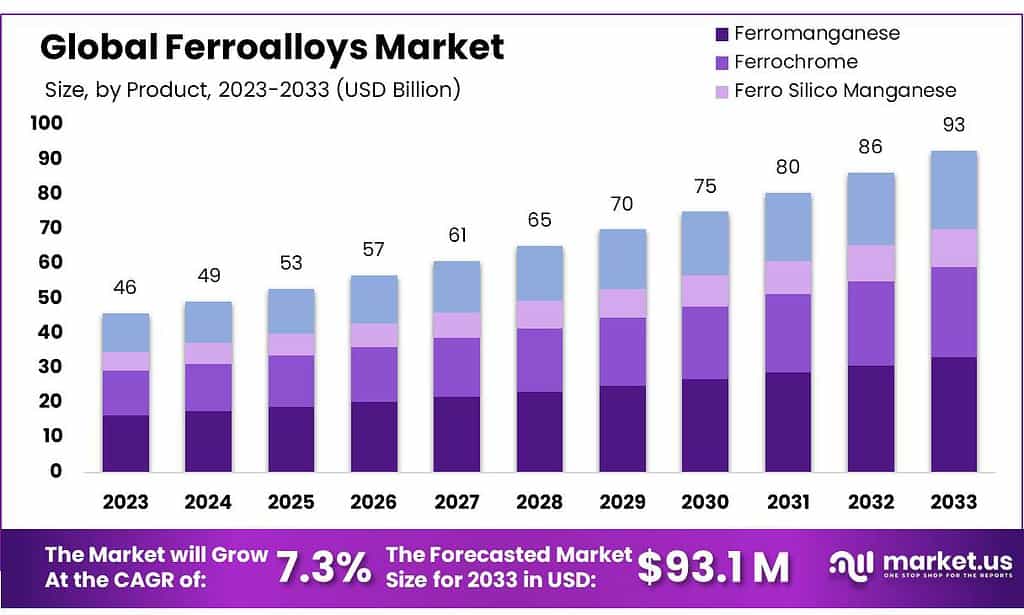

The global Ferroalloys Market size is expected to be worth around USD 92.7 billion by 2033, from USD 45.8 billion in 2023, growing at a CAGR of 7.3% during the forecast period from 2023 to 2033.

Market growth is expected to be aided by the continued production of steel in the world. Ferroalloys are a grouping of metals that are made up of iron and other alloying elements. They are used in the production of steel. Steelmaking uses ferroalloys to enhance the properties of its end products.

Ferroalloys can improve properties like ductility, fatigue strength, resistance, corrosion resistance, and tensile strength.

Product Type Analysis

In 2023, the Ferroalloys Market was led by Ferrochrome, Ferromanga nese, Ferro Silico Manganese, and Ferro Silicon, collectively holding over a 35% market share. Ferrochrome, known for enhancing corrosion resistance in stainless steel, was a significant contributor.

The Ferroalloys Market includes different types like Ferrochrome, Ferromanganese, Ferro Silico Manganese, and Ferro Silicon. These are special mixtures used in making steel and other materials stronger and better.

Ferrochrome, for example, helps steel resist corrosion. Ferromanganese and Ferro Silico Manganese make steel harder and more durable. Ferro Silicon is great at removing impurities from steel. Each of these plays a unique role in making different kinds of strong and reliable materials.

Ferromanganese, employed to improve the hardness and durability of steel, also played a key role. Ferro Silico Manganese, used to deoxidize and enhance steel strength, and Ferro Silicon, aiding in deoxidation and improving steel quality, further bolstered the market’s strength.

Application analysis

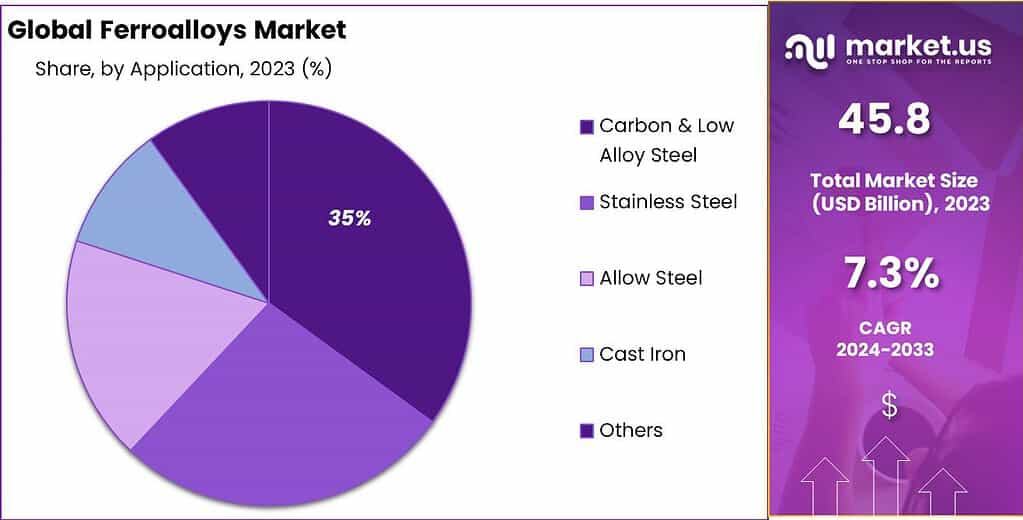

In 2023, the Ferroalloys Market dominated across various applications, securing over a 34% market share. Carbon & Low Alloy Steel applications led the market, relying on ferroalloys to enhance strength and durability.

Stainless Steel applications followed closely, leveraging ferroalloys for corrosion resistance and durability. Alloy Steel applications benefited from ferroalloys to achieve specific properties like toughness and heat resistance.

Additionally, ferroalloys played a crucial role in Cast Iron applications by improving its strength and wear resistance, showcasing their versatility across diverse applications within the market.

These areas showed how vital ferroalloys are in many industries, not just the main ones. They’re super versatile and crucial for lots of different industrial needs. Ferroalloys are a big deal in many sectors because they help make materials stronger, last longer, and resist damage from things like rust. This shows just how essential they are in the Ferroalloys Market—they’re basically irreplaceable!

Alloy Steel, too, witnessed notable growth, thanks to ferroalloys’ unique properties. Ferroalloys also played a pivotal role in fortifying Cast Iron, making it tougher. Beyond these main segments, ferroalloys showcased their adaptability in Other Applications, highlighting their indispensable role in meeting diverse industrial demands.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Ferrochrome

- Ferromanganese

- Ferro Silico Manganese

- Ferro Silicon

By Application

- Carbon & Low Alloy Steel

- Stainless Steel

- Allow Steel

- Cast Iron

- Other Applications

Drivers

Steel in Construction: More buildings mean more steel. In places like China and other developed countries, the government spends money on building things, which increases the need for steel. This is good for ferroalloys, which are important in making steel.

Deoxidizing Steel: Ferroalloys are like helpers in making steel better. They help remove impurities when making steel. Even though the sales of these helpers didn’t change much in 2023, the overall amount of steel made increased.

Steel in Cars: Cars need steel, and as more cars are being made, more steel and therefore more ferroalloys are used. In 2023, more cars were sold compared to 2020, bouncing back from the pandemic.

Making Iron: There’s a lot of demand for things made from iron, like steel, building materials, and machinery. Ferroalloys are used to make these things better. More of these products means more demand for ferroalloys.

Special Ferroalloys: Some special types of ferroalloys, called noble ferroalloys, have unique uses. They’re not just for steel, but also for special stuff like in the aerospace industry or electron microscopes. The production of these special types of ferroalloys increased too.So, in simple terms, more buildings, cars, and iron-based products mean a higher need for ferroalloys, these special helpers that make things stronger and better.

Restraint

In 2023, an important challenge for the ferroalloys market revolves around environmental worries linked to how these alloys are made. The production methods sometimes involve using stuff that’s not so good for the environment or our health. With more rules getting stricter and people caring more about the environment, companies making ferroalloys might have to find cleaner ways to produce them.

This could mean spending more money and making things slower, which might affect how much they can produce and grow. Also, changes in the prices of materials they use and tensions between countries might slow down how much the market can grow this year.

Opportunities

In 2023, there are big chances for the ferroalloys market. More steel is needed for buildings, cars, and stuff, so there’s more demand for ferroalloys, making things better for the companies that make them. Better technology means they can make even cooler ferroalloys. They can create new types that suit different industries, making the market grow bigger.

Clean energy like wind and solar power needs special stuff like ferroalloys for making things like wind turbines and solar panels. This lets ferroalloy makers find new markets.

Moreover, special alloys like ferrochrome aren’t just for steel anymore. Industries like aerospace and electronics want them too. So, ferroalloy companies can now be part of more industries.

Challenges

Government rules might affect the ferroalloys market because making these materials can involve harmful stuff like heavy metals and toxins.

To protect the environment and people’s health, governments are putting stricter rules on how these things are made, used, and thrown away. Also, there’s a growing interest in finding other materials instead of steel, which might affect how much ferroalloys are needed.

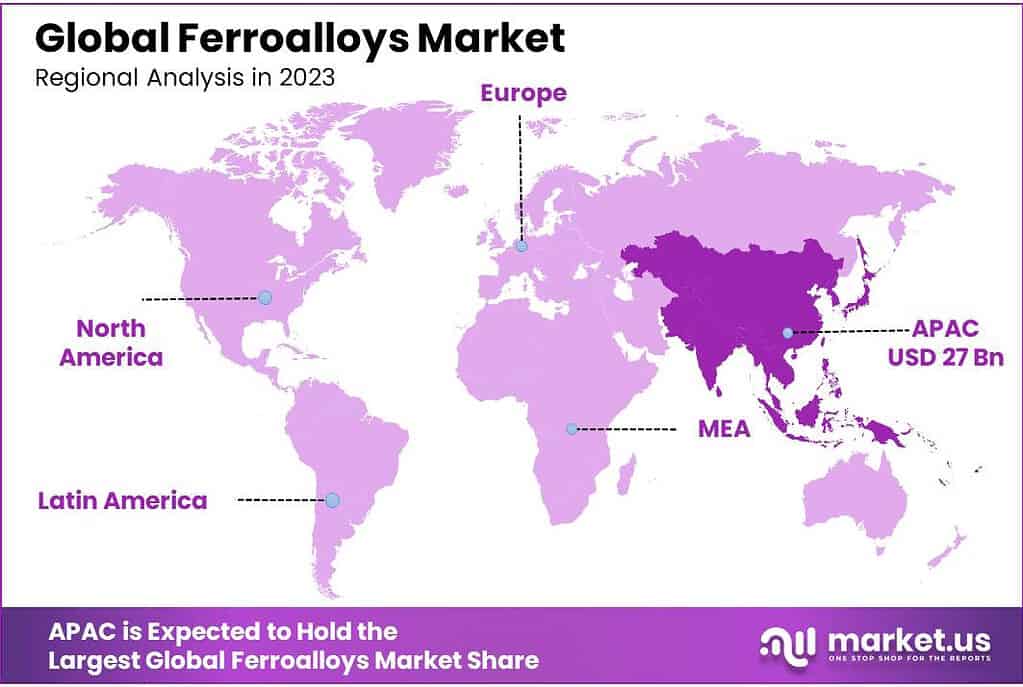

Regional Analysis

The Asia Pacific was the dominant regional market, accounting for over 59% of global revenues in 2023. China, a key consumer, and producer of ferroalloys in the Asia Pacific region is expected to continue its leadership role in the industry over the next few years. India, Indonesia, and Malaysia are emerging markets for ferroalloys within the Asia Pacific. China and the aforementioned emerging markets are expected to experience lucrative growth over the next few years.

The North American market indexed a positive increase in steel production in the U.S., while Canada and Mexico experienced a decrease in 2021. Due to its vast steel production, the U.S. is a much larger market for ferroalloys than Canada and Mexico. This region’s increased steel production is a major market growth factor. This regional ferroalloys market registered a sharp drop in 2021 as steel production fell by more than 18%.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

This market is highly competitive and will see new investments by established players in the future. Zimasco, a subsidiary of Sinosteel Corporation, announced a USD 35.0 million investment for the expansion of ferrochrome production.

The Kwekwe Ferrochrome Smelting Complex will likely start a new project with an additional 72 kilotons of annual capacity. This industry will register increased competition due to growing production capacities to meet steel demand.

Маrkеt Кеу Рlауеrѕ

- Glencore

- Samancore Chrome

- Shanghai Shenjia Ferroalloys Co. Ltd.

- Ferro Alloys Corporation Limited.

- C. Feral S.R.L

- Tata Steel Limited – Ferro Alloys & Minerals Division

- China Minmetals Corporation

- Jindal Group

- China Minmetals

- SAIL

- Other Key Players

Recent Development

In 2022, POSCO announced that it will invest USD 1.2 billion to expand its ferroalloys production capacity in South Korea.

In 2023, Tata Steel announced that it will invest USD 1.5 billion to expand its ferroalloys production capacity in India.

In 2023, Gerdau announced that it will invest USD 1 billion to expand its ferroalloys production capacity in Brazil.

In 2023, Shougang Group announced that it will invest USD 0.8 billion to expand its ferroalloys production capacity in China.

In 2023, JFE Steel announced that it will invest USD 0.7 billion to expand its ferroalloys production capacity in Japan.

Report Scope

Report Features Description Market Value (2023) USD 45.8 Billion Forecast Revenue (2033) USD 92.7 Billion CAGR (2023-2032) 7.3% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ferrochrome, and Ferro Silicon); By Application (Carbon & Low Alloy Steel, and Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Glencore, Samancore Chrome, Shanghai Shenjia Ferroalloys Co. Ltd., Ferro Alloys Corporation Limited., C. Feral S.R.L, Tata Steel Limited – Ferro Alloys & Minerals Division, China Minmetals Corporation, Jindal Group, China Minmetals, SAIL, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are Aroma Chemicals?Aroma chemicals are compounds used to create scents in various products like perfumes, soaps, and cosmetics. They provide distinctive fragrances and are derived from natural or synthetic sources.

How are Aroma Chemicals Used?They are extensively used in perfumery, personal care products, household cleaners, and air fresheners to impart specific scents or fragrances.

Are Aroma Chemicals Safe?Aroma chemicals, when used within regulated limits, are considered safe. However, some individuals may have sensitivities or allergies to certain chemicals, causing reactions.

What are the Sources of Aroma Chemicals?These chemicals can be derived from natural sources like plants, flowers, or fruits, or created synthetically in laboratories to mimic natural scents.

-

-

- Glencore

- Samancore Chrome

- Shanghai Shenjia Ferroalloys Co. Ltd.

- Ferro Alloys Corporation Limited.

- C. Feral S.R.L

- Tata Steel Limited - Ferro Alloys & Minerals Division

- China Minmetals Corporation

- Jindal Group

- China Minmetals

- SAIL

- Other Key Players