Global Feed Premixes Market Size, Share, And Business Benefits By Ingredient Type (Antibiotics, Vitamins, Antioxidants, Amino Acids, Minerals, Others), By Form (Dry, Liquid), By Animal Type (Pet, Poultry, Ruminant, Swine, Aquaculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155102

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

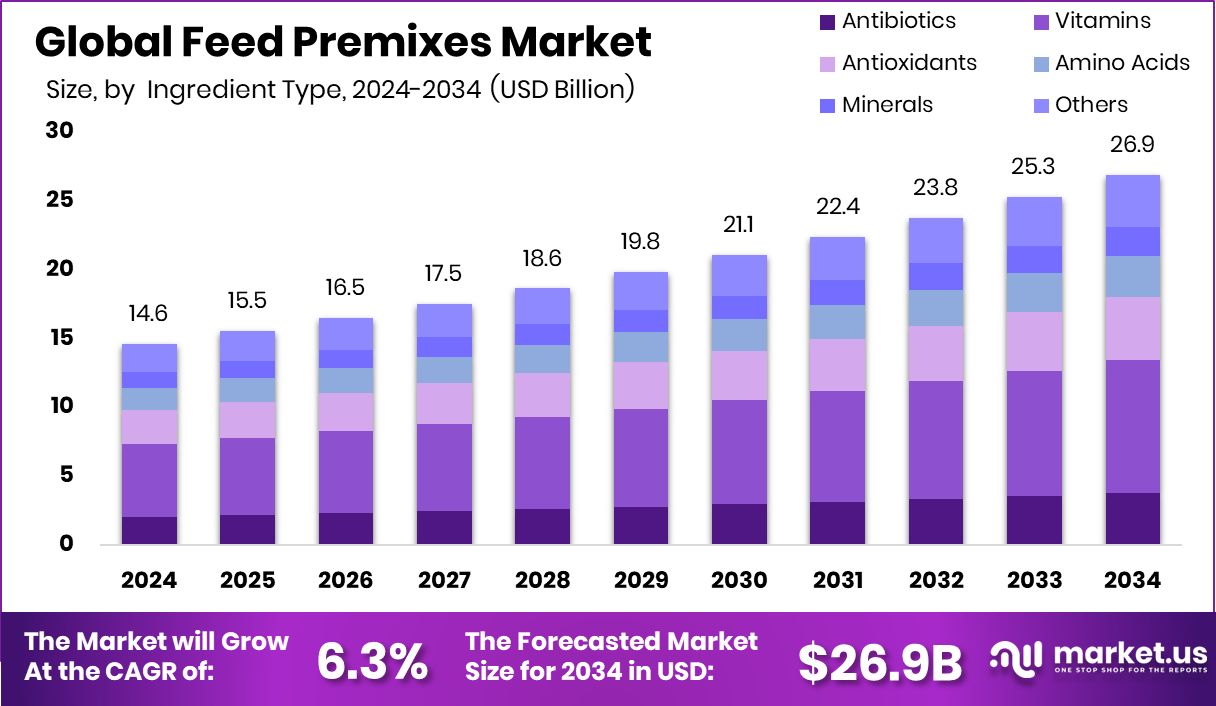

The Global Feed Premixes Market is expected to be worth around USD 26.9 billion by 2034, up from USD 14.6 billion in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034. Strong demand drives steady growth across livestock sectors in North America, 45.7%.

Feed Premixes are concentrated blends of vitamins, minerals, amino acids, and other essential nutrients that are mixed with animal feed to ensure balanced nutrition and optimal growth. They act as a vital component in livestock and poultry diets, enhancing feed quality, improving animal health, and supporting productivity. Premixes are carefully formulated to meet the specific dietary needs of different species and production stages.

The Feed Premixes Market refers to the global trade and production of these nutrient-rich additives used in animal feed manufacturing. The market is driven by the rising demand for high-quality meat, dairy, and poultry products, as well as the need to improve feed efficiency and animal health. This industry covers a variety of premix formulations tailored for livestock, poultry, aquaculture, and pets.

Increasing global meat consumption, coupled with growing awareness of animal nutrition, is fueling market expansion. Advances in feed technology and precision nutrition are also driving demand for more specialized premix formulations. According to an industry report, Trouw Nutrition invests €2.33 million in a feed mill in Northern Ireland.

Rising livestock farming, population growth, and changing dietary preferences toward protein-rich foods are pushing the need for nutrient-rich animal feed. Improved income levels in emerging economies are further boosting demand.

Key Takeaways

- The Global Feed Premixes Market is expected to be worth around USD 26.9 billion by 2034, up from USD 14.6 billion in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034.

- Vitamins hold a 36.3% share, reflecting their essential role in animal health.

- Dry feed premixes dominate with 89.4%, favored for storage, stability, and ease of mixing.

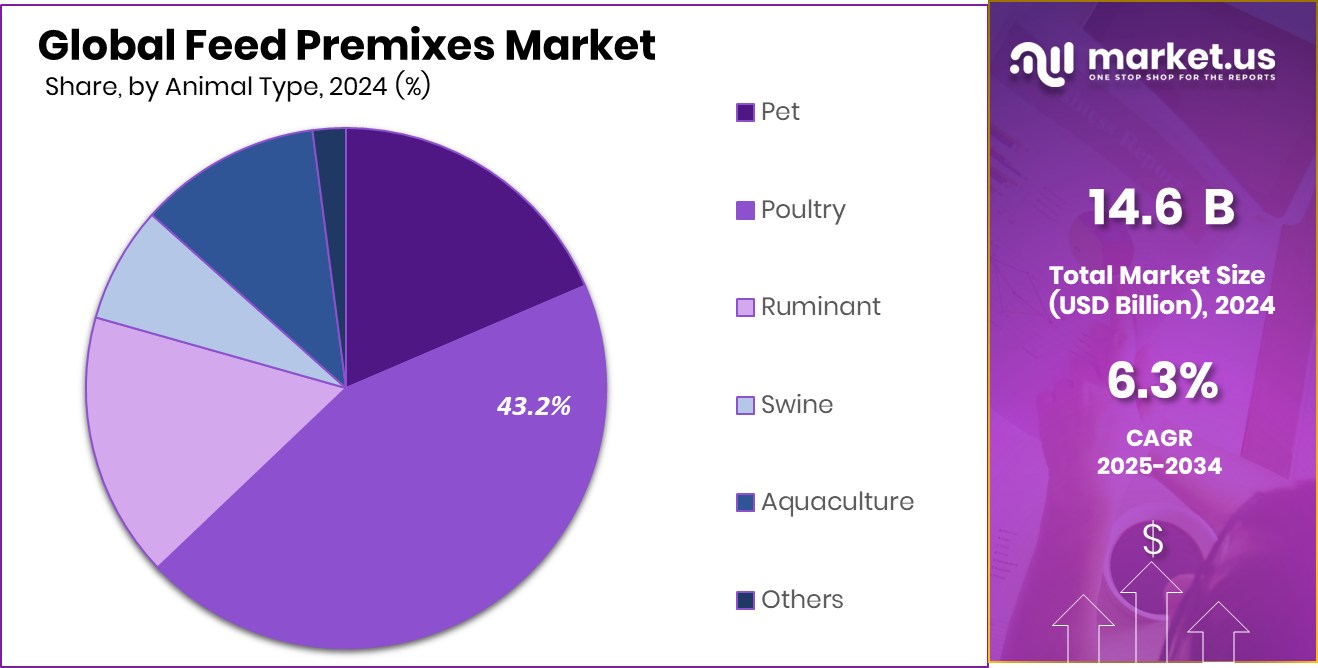

- Poultry leads at 43.2%, driven by rising global demand for quality poultry products.

- The market value in North America reached USD 6.6 Bn.

By Ingredient Type Analysis

Vitamins hold a 36.3% share in the feed premixes market.

In 2024, Vitamins held a dominant market position in the By Ingredient Type segment of the Feed Premixes Market, with a 36.3% share. This leadership reflects the critical role vitamins play in enhancing animal health, immunity, and overall productivity. Vitamins are essential for metabolic functions, reproduction, and growth, making them a core component in livestock and poultry feed formulations. Their inclusion in feed premixes ensures balanced nutrition, prevents deficiencies, and supports optimal feed conversion rates, which directly impact production efficiency.

The demand for vitamin-based premixes is strongly supported by the rising focus on disease prevention and the reduction of antibiotic use in animal farming. Producers are increasingly relying on vitamin enrichment to naturally boost immunity and sustainably maintain herd health. Additionally, the growing trend toward high-quality meat, milk, and egg production has further elevated the importance of vitamin supplementation in feed.

Market growth for vitamin premixes is also driven by advancements in feed formulation technologies, enabling precise dosage and better nutrient stability. As global livestock populations expand and the focus on productivity intensifies, vitamin-based feed premixes are expected to maintain their strong market presence, meeting both commercial farming and animal welfare needs.

By Form Analysis

Dry form dominates with 89.4% in the feed premixes market.

In 2024, Dry held a dominant market position in the By Form segment of the Feed Premixes Market, with an 89.4% share. This strong position is primarily due to the extended shelf life, ease of storage, and cost-effectiveness of dry premixes, which make them the preferred choice for large-scale feed manufacturing. Dry formulations offer better stability for sensitive nutrients like vitamins and minerals, ensuring consistent nutritional quality throughout the feed production process.

Their compatibility with automated mixing systems and ability to blend uniformly with various feed types further contribute to their widespread adoption. Farmers and feed manufacturers value dry premixes for their precise nutrient composition, which supports improved feed efficiency and animal performance. Additionally, the lower risk of contamination and easier handling compared to liquid alternatives strengthen their market appeal.

The dominance of dry premixes is also supported by their adaptability across livestock, poultry, aquaculture, and pet nutrition sectors. As demand for high-quality animal protein grows globally, feed producers are increasingly focusing on formulations that deliver consistent results at scale. With their proven effectiveness, cost advantages, and practicality in diverse farming conditions, dry feed premixes are expected to retain their leading position in the market in the coming years.

By Animal Type Analysis

Poultry leads at 43.2% in the feed premixes market.

In 2024, Poultry held a dominant market position in the By Animal Type segment of the Feed Premixes Market, with a 43.2% share. This leadership is largely driven by the rapid expansion of the global poultry industry, which supplies a significant share of the world’s meat and eggs. Poultry production requires highly balanced nutrition to support fast growth rates, high feed conversion efficiency, and consistent product quality, making feed premixes an essential component of their diets.

Vitamin, mineral, and amino acid enrichment through premixes ensures better immunity, reproductive performance, and overall flock health, reducing mortality rates and improving output. The rising global demand for affordable and lean protein sources such as chicken and eggs has further intensified the use of premixes in commercial poultry farming.

The strong position of poultry in this segment is also supported by large-scale integrated farming systems, where consistent feed quality is crucial for maintaining productivity and profitability. Growing consumption in both developed and emerging markets, coupled with the trend toward antibiotic-free poultry production, has increased reliance on high-quality premixes for natural health enhancement.

Key Market Segments

By Ingredient Type

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Minerals

- Others

By Form

- Dry

- Liquid

By Animal Type

- Pet

- Poultry

- Ruminant

- Swine

- Aquaculture

- Others

Driving Factors

Rising Demand for High-Quality Animal Protein

One of the biggest driving factors for the Feed Premixes Market is the growing global demand for high-quality animal protein, such as meat, milk, and eggs. As the population increases and incomes rise, especially in developing countries, more people are including protein-rich foods in their diets. To meet this demand, livestock and poultry producers are focusing on improving animal health, productivity, and feed efficiency.

Feed premixes play a key role in ensuring balanced nutrition, which leads to better growth, higher yield, and improved product quality. With consumers becoming more aware of food quality and safety, farmers are turning to nutrient-rich feed premixes as a reliable way to meet production goals while maintaining healthy and sustainable livestock practices.

Restraining Factors

High Cost of Quality Ingredients and Production

A key restraining factor for the Feed Premixes Market is the high cost of sourcing quality ingredients and producing nutrient-rich blends. Vitamins, minerals, amino acids, and other essential additives often require advanced processing and strict quality control, which increases production expenses. Fluctuations in raw material prices, driven by factors such as supply shortages, currency changes, and climatic conditions, can further raise costs for manufacturers.

For small-scale farmers or feed producers, these higher prices can make premium premixes less affordable, leading them to opt for cheaper, less effective alternatives. This cost challenge can slow market growth, especially in price-sensitive regions, where balancing affordability with quality remains a significant concern for sustaining long-term adoption.

Growth Opportunity

Expansion of Sustainable and Antibiotic-Free Farming

A major growth opportunity in the Feed Premixes Market comes from the global shift toward sustainable and antibiotic-free farming practices. Consumers are increasingly concerned about food safety, animal welfare, and environmental impact, which is pushing producers to reduce or eliminate the use of growth-promoting antibiotics. Feed premixes enriched with natural vitamins, minerals, probiotics, and plant-based additives can support animal health and growth without relying on antibiotics.

This opens the door for innovative, eco-friendly formulations that meet both regulatory standards and consumer expectations. With governments promoting sustainable agriculture and retailers demanding cleaner supply chains, the adoption of high-quality, natural feed premixes is expected to grow rapidly, creating significant opportunities for producers to expand into premium and specialty product segments.

Latest Trends

Rising Use of Customized Nutritional Formulations

One of the latest trends in the Feed Premixes Market is the growing demand for customized nutritional formulations tailored to specific animal species, production stages, and farming conditions. Farmers and feed producers are increasingly seeking premixes that address unique needs, such as improving feed efficiency, enhancing immunity, or supporting faster growth rates.

Advanced formulation technologies now allow precise blending of vitamins, minerals, amino acids, and functional additives to achieve targeted results. This trend is also driven by the rise of precision farming, where data on animal health and performance is used to design optimal feed solutions.

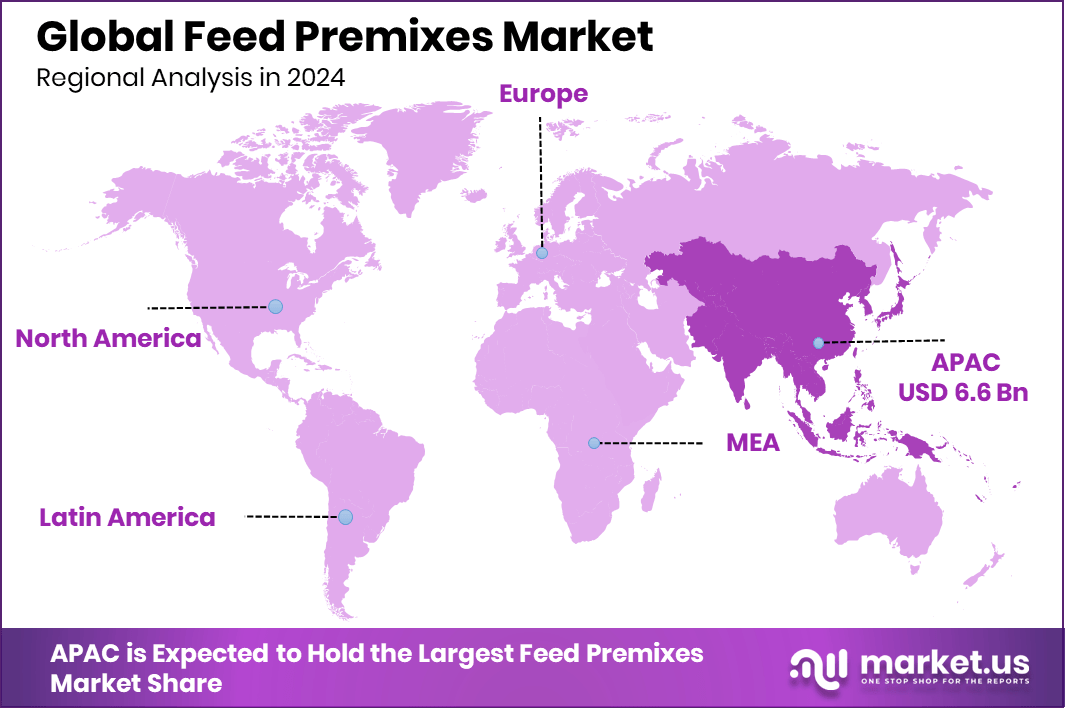

Regional Analysis

North America holds a 45.7% share in the Feed Premixes Market.

In 2024, North America emerged as the leading region in the global Feed Premixes Market, capturing a dominant 45.7% share and generating revenues of USD 6.6 billion. This strong position is supported by the region’s advanced livestock production systems, high adoption of precision nutrition, and stringent quality standards in animal feed.

The U.S. and Canada have well-established poultry, swine, and dairy industries, where the use of nutrient-rich premixes is integral to maintaining productivity, animal health, and product quality. Europe follows closely, driven by regulatory emphasis on sustainable farming and the reduction of antibiotic use in feed.

The Asia Pacific region continues to witness rapid growth, supported by rising meat consumption, expanding poultry production, and increasing awareness of animal nutrition. Meanwhile, the Middle East & Africa and Latin America are experiencing gradual adoption, driven by modernizing livestock sectors and growing demand for protein-rich diets.

While multiple regions contribute to market expansion, North America’s strong infrastructure, research-led innovations, and established supply chains ensure its leadership position, making it the benchmark for quality and performance in the global feed premixes landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cargill, Inc. maintained a strong presence through its extensive global supply chain, advanced formulation capabilities, and focus on innovative nutrient blends designed to support sustainable livestock production. Its ability to integrate precision nutrition solutions allowed it to cater effectively to diverse livestock and poultry needs.

ADM demonstrated its competitive edge by utilizing its deep expertise in agricultural processing and ingredient innovation. The company focused on enhancing feed premix efficiency, stability, and quality, aligning with global trends toward antibiotic-free and nutrient-optimized feeds. ADM’s extensive sourcing network ensured consistent ingredient availability despite raw material price fluctuations.

DLG, with its cooperative-based structure, strengthened its position in Europe by delivering tailored feed solutions that align with regional farming practices and sustainability goals. The company’s emphasis on farmer-focused innovations and localized production made it a trusted partner for livestock producers seeking quality and cost-effective premix options.

ForFarmers advanced its role as a leading feed solutions provider by integrating feed premixes into broader nutritional programs aimed at improving herd and flock performance. Its focus on data-driven feeding strategies and close customer engagement enhanced its ability to deliver measurable results.

Top Key Players in the Market

- Cargill, Inc.

- ADM

- DLG

- ForFramers

- Danish Agro

- BASF SE

- Land O’Lakes Inc.

- Godrej Agrovet Limited

- dsm-firmenich

- InVivo Group

Recent Developments

- In September 2024, Cargill acquired two feed mills—one in Denver and another in Kansas City, Kansas—from Compana Pet Brands. This strengthened its production and distribution capabilities under Animal Nutrition & Health, serving farmers and ranchers along with retailers selling premixes and pet foods.

- In June 2024, ADM’s Animal Nutrition division expanded its recall list to include additional feed premix products due to elevated levels of minerals like magnesium, sodium, calcium, chloride, and phosphorus. This action underscores the company’s commitment to feed safety and quality control.

Report Scope

Report Features Description Market Value (2024) USD 14.6 Billion Forecast Revenue (2034) USD 26.9 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Ingredient Type (Antibiotics, Vitamins, Antioxidants, Amino Acids, Minerals, Others), By Form (Dry, Liquid), By Animal Type (Pet, Poultry, Ruminant, Swine, Aquaculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill, Inc., ADM, DLG, ForFramers, Danish Agro, BASF SE, Land O’Lakes Inc., Godrej Agrovet Limited, DSM-Firmenich, InVivo Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cargill, Inc.

- ADM

- DLG

- ForFramers

- Danish Agro

- BASF SE

- Land O'Lakes Inc.

- Godrej Agrovet Limited

- dsm-firmenich

- InVivo Group