Global Feed Antioxidants Market Size, Share, And Industry Analysis Report Cargill, Archer Daniels Midland Company, Koninklijke DSM N.V., BASF SE, Nutreco, Kemin, Adisseo, Perstorp, Alltech, Caldic, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174913

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

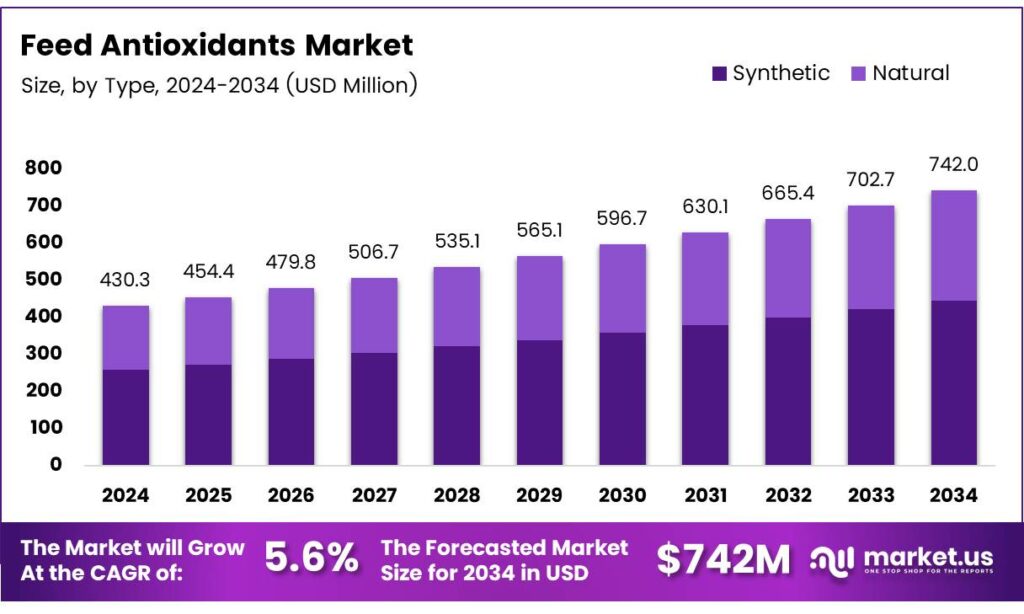

The Global Feed Antioxidants Market size is expected to be worth around USD 742.0 million by 2034, from USD 430.3 million in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

The Feed Antioxidants Market is a foundational part of modern animal nutrition systems. In simple terms, this market covers additives used in animal feed to slow oxidation, protect nutrients, and extend feed shelf life. Consequently, it directly supports feed efficiency, animal health, and predictable farm economics across poultry, swine, ruminants, and aquaculture.

Feed antioxidants work quietly but decisively inside formulations. By limiting oxidative stress, they help preserve fats, vitamins, and pigments during storage and transport. As a result, feed manufacturers gain better formulation stability, while farmers experience more consistent animal performance. This practical value keeps antioxidants embedded in routine feed procurement decisions.

- Scientific studies confirm the strong antioxidant performance of Ethoxyquin in feed preservation. In untreated feed, vitamin A activity declined from 150,325 I.U. to 77,800 I.U., representing a 48.2% loss during storage. By contrast, feed treated with 150 ppm Ethoxyquin limited vitamin A degradation, with levels decreasing modestly from 151,366 I.U. to 115,633 I.U., equal to only 23.6% loss, demonstrating improved nutrient retention.

Unstabilized fish meal delivered 7.0% extractable fat and 1,149 cal/lb metabolizable energy, while Ethoxyquin-stabilized meal improved fat to 9.4%, iodine value to 178, and energy to 1,461 cal/lb. In poultry trials, hatchability rose from 55.50% without antioxidants to 78.96% with 125 ppm Ethoxyquin, validating measurable performance benefits reported by leading animal nutrition studies.

Demand rises steadily alongside intensifying livestock production and longer feed storage cycles. Moreover, expansion of commercial poultry and aquaculture operations increases reliance on stabilized, high-energy feeds. Transitioning toward value-based nutrition, buyers increasingly evaluate antioxidants not as costs, but as risk-management tools protecting nutrient investments.

Key Takeaways

- The Global Feed Antioxidants Market reached USD 430.3 million in 2024 and is projected to hit USD 742.0 million by 2034 at a 5.6% CAGR.

- Synthetic antioxidants dominated the Type segment with a 59.8% market share in 2025.

- Dry form led the Form segment with a 61.2% share due to better stability and handling benefits.

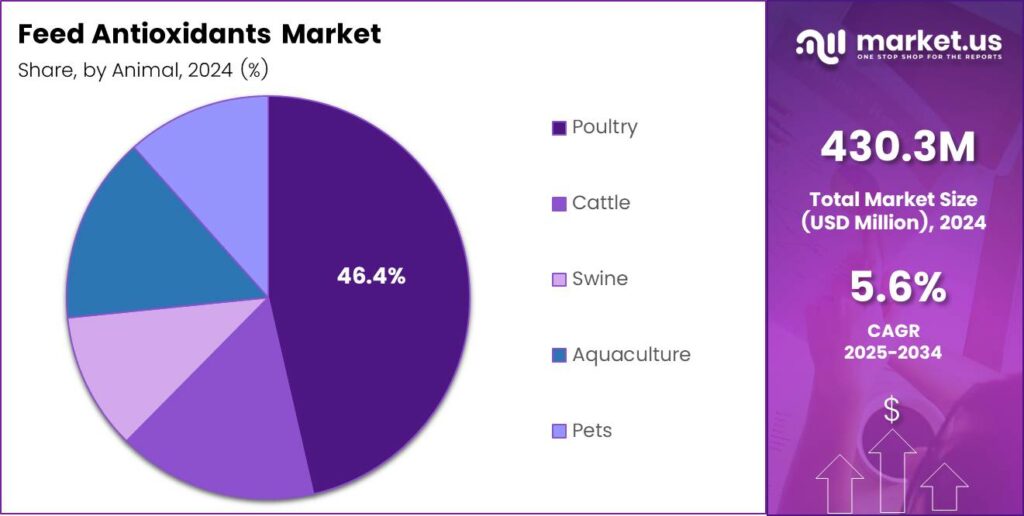

- Poultry remained the leading Animal segment, accounting for 46.4% of total consumption.

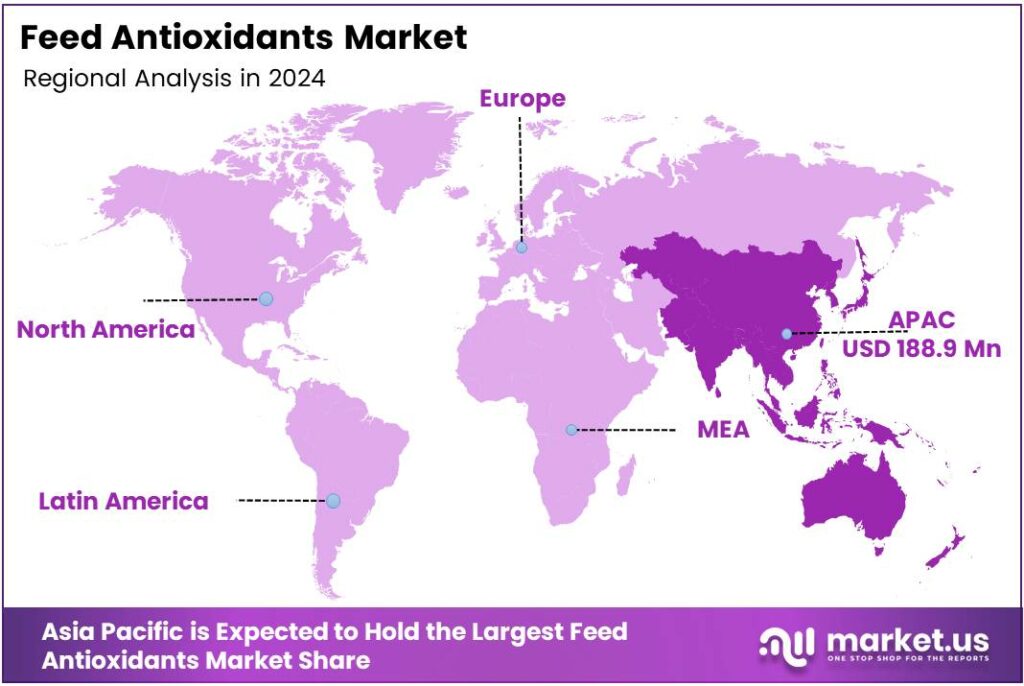

- Asia Pacific emerged as the largest regional market with a 43.9% share valued at USD 188.9 million.

By Type Analysis

Synthetic dominates with 59.8% due to its stability and extended feed protection.

In 2025, Synthetic held a dominant market position in the By Type segment of the Feed Antioxidants Market, with a 59.8% share. This segment leads because synthetic antioxidants offer strong oxidative stability, longer shelf life, and consistent performance, making them suitable for large-scale feed manufacturing where uniformity and cost-effectiveness matter.

The Natural segment continued to expand as producers sought cleaner and plant-derived ingredients. Growing awareness about residue-free feed and sustainable production encouraged a steady shift toward natural antioxidants. Although it did not surpass synthetic antioxidants, natural options gained importance as feed formulators experimented with botanical extracts and organic preservation solutions.

By Form Analysis

Dry form dominates with 61.2% because it offers easy handling and better shelf stability.

In 2025, Dry held a dominant market position in the By Form segment of the Feed Antioxidants Market, with a 61.2% share. Dry antioxidants are preferred in commercial feed mills because they blend uniformly with feed ingredients, reduce handling complexities, and provide longer storage life during transportation and bulk preparation.

The Liquid segment maintained a meaningful role as producers used it for targeted applications in premixes and oil-rich formulations. Liquid antioxidants offered rapid dispersion and quick absorption but were used selectively due to storage sensitivity. Their adoption improved gradually as specialized feed formulations demanded precise and fast-acting antioxidant solutions.

By Animal Analysis

Poultry dominates with 46.4% due to rising processed poultry meat demand and intensive farming.

In 2025, Poultry held a dominant market position in the By Animal segment of the Feed Antioxidants Market, with a 46.4% share. The poultry industry relies heavily on antioxidants to prevent feed spoilage, maintain nutrient quality, and support fast growth cycles, making it the highest-consuming livestock segment globally.

The Cattle segment used feed antioxidants to protect high-fat rations and boost feed efficiency. Demand increased as dairy and beef producers focused on maintaining feed freshness in warmer climates. Although smaller than poultry, cattle producers steadily adopted antioxidant solutions to safeguard feed nutrients and support herd productivity and long-term performance.

The Swine segment showed stable use of antioxidants, supported by the need to prevent lipid oxidation in energy-dense feed. Swine nutrition depends on consistent feed quality, and antioxidants help minimize nutrient breakdown. The segment maintained steady uptake as pork production systems improved feed formulations for better health and growth outcomes.

The Aquaculture and Pets segments adopted antioxidants to protect sensitive feed components such as fish oils and specialty ingredients. Aquaculture relied on controlled diets requiring strong oxidative resistance, while pet food manufacturers used antioxidants to preserve premium formulations. Both segments grew steadily as quality and product longevity became essential priorities.

Key Market Segments

By Type

- Synthetic

- BHT

- BHA

- Ethoxyquin

- Propyl gallate

- Others

- Natural

- Carotenoids

- Tocopherols

- Botanical extracts

- Vitamins

By Form

- Dry

- Powders

- Beadlets

- Granules

- Liquid

By Animal

- Poultry

- Cattle

- Swine

- Aquaculture

- Pets

Emerging Trends

Focus on Sustainability and Feed Efficiency Shapes Market Trends

One of the key trends in the feed antioxidants market is the growing focus on sustainability. Feed producers are working to reduce waste and improve feed efficiency, and antioxidants support this by extending feed shelf life. Less feed spoilage means lower losses and better resource use.

- The International Feed Industry Federation (IFIF) notes that world compound feed production is estimated at over one billion tonnes annually, and global commercial feed manufacturing generates an estimated annual turnover of over US $400 billion.

Digital farming and data-driven feed management are also influencing the market. Farmers now track feed quality and animal health more closely, increasing demand for reliable feed additives. As precision livestock farming grows, feed antioxidants will continue to play a supporting role in modern, efficient animal production systems.

Drivers

Rising Demand for Quality Animal Nutrition Drives Feed Antioxidants Market Growth

The feed antioxidants market is mainly driven by the growing focus on animal health and feed quality. Livestock producers are becoming more careful about what goes into animal feed, as good nutrition directly affects animal growth, immunity, and productivity. Feed antioxidants help prevent feed spoilage by stopping fat oxidation, which keeps nutrients stable for a longer time.

- The rising global demand for meat, dairy, eggs, and aquaculture products. To meet this demand, farmers are increasing livestock production and using compound feeds. Alltech’s global feed survey reported that world feed production increased in 2024 by 1.2% to 1.396 billion metric tons.

Feed antioxidants play a key role in protecting these feeds during storage and transportation. They also support better feed conversion, which helps farmers manage costs and improve output. Stricter food safety expectations from consumers and regulators are pushing feed manufacturers to use antioxidants.

Restraints

Concerns Over Synthetic Additives Restrain Feed Antioxidants Market Expansion

One major restraint in the feed antioxidants market is the growing concern about the use of synthetic additives. Some farmers and consumers worry about the long-term effects of chemical antioxidants on animal health and food safety. This concern has increased demand for clean-label and naturally produced animal products, making some producers hesitant to use certain antioxidants.

Regulatory challenges also limit market growth. Different countries have strict rules on which feed additives are allowed and in what quantity. Meeting these regulations can be complex and costly for manufacturers, especially small and medium-sized players. Any delay in approvals can slow down product launches and limit market penetration.

Price sensitivity is another restraint. Feed antioxidants add extra cost to animal feed, and small farmers often operate on thin margins. When raw material prices rise, antioxidant costs may increase, making them less affordable. In developing regions, limited awareness about the benefits of antioxidants further reduces adoption, slowing overall market expansion.

Growth Factors

Shift Toward Natural Feed Solutions Creates New Growth Opportunities

The growing preference for natural and plant-based feed additives is opening strong opportunities in the feed antioxidants market. Producers are increasingly looking for natural antioxidants derived from herbs, spices, and plant extracts. These options align well with organic farming trends and consumer demand for safer animal products.

- The need for stable and high-energy feed increases. Feed antioxidants help protect oils and fats used in aquafeed, improving shelf life and animal performance. The U.S. Department of Agriculture (USDA) states that in the United States, food waste is estimated at between 30–40% of the food supply, based on USDA estimates of food loss at retail and consumer levels.

Emerging markets also offer growth potential. Rising income levels and increasing awareness of animal nutrition are encouraging farmers to adopt better feed practices. As commercial farming expands in these regions, the use of feed antioxidants is expected to grow steadily, creating long-term market opportunities.

Regional Analysis

Asia Pacific Dominates the Feed Antioxidants Market with a Market Share of 43.9%, Valued at USD 188.9 Million

The Asia Pacific region leads the global Feed Antioxidants Market, securing a dominant 43.9% share worth USD 188.9 million. This leadership is driven by the region’s large livestock population, fast-growing feed manufacturing sector, and strong adoption of quality-enhancing additives. Rising demand for poultry and aquaculture products further boosts antioxidant usage to preserve feed freshness and nutritional value across expanding supply chains.

North America shows steady growth due to advanced animal husbandry practices and high emphasis on feed safety regulations. The region benefits from strong consumption of meat and dairy products, encouraging feed producers to adopt antioxidants for longer shelf life and improved feed stability. Increasing consumer interest in high-quality protein also supports sustained demand.

Europe remains a mature and well-regulated market where stringent quality norms drive the consistent use of antioxidants in feed formulations. The region’s focus on sustainable farming and strict limits on synthetic additives influences the growing preference for natural antioxidants. Expansion of the livestock and pet food sectors continues to support stable market growth.

Asia Pacific, beyond its leading role, continues to show strong momentum due to the rapid industrialization of farming systems. Growing awareness among farmers about oxidative damage in feed and its impact on productivity stimulates demand for effective antioxidant solutions. Urbanization-led dietary shifts toward poultry, pork, and fish further reinforce market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cargill remains a practical, scale-driven player in feed antioxidants in 2025, linking ingredient sourcing with premix and nutrition know-how. Its strength is helping integrators and large farms protect fat stability and vitamin potency across storage, transport, and pelleting. Expect continued focus on consistent quality, cost control, and solutions that work across species and climates.

Archer Daniels Midland Company brings a strong raw-material and processing backbone, which matters when lipid oxidation risk rises with higher-energy diets and variable oil quality. In 2025, ADM’s advantage is bundling antioxidants with broader feed solutions—nutrition, enzymes, and formulation support—so customers can manage shelf-life without disrupting performance targets. The company typically competes on reliability and supply continuity.

Koninklijke DSM N.V. is positioned around science-led nutrition and measurable outcomes, which fits the market shift toward efficiency and documentation in feed mills. In 2025, DSM’s antioxidant approach is likely to emphasize precision dosing, protection of sensitive nutrients, and alignment with sustainability goals (less waste, fewer quality losses). Its value proposition resonates where producers need both performance and compliance confidence.

BASF SE continues to benefit from deep chemical expertise and a global footprint that supports stable supply and technical service. In 2025, BASF’s role in feed antioxidants is closely tied to protecting fats, fat-soluble vitamins, and finished feed quality under demanding conditions. The company is well placed to support large-scale customers seeking robust, standardized solutions with strong quality assurance.

Top Key Players in the Market

- Cargill

- Archer Daniels Midland Company

- Koninklijke DSM N.V.

- BASF SE

- Nutreco

- Kemin

- Adisseo

- Perstorp

- Alltech

- Caldic

Recent Developments

- In 2025, Cargill won a Bronze Edison Award for its Cargill Natural Flavors, a proprietary blend of natural antioxidants that extends the shelf life of ground beef by up to five days, helping reduce food waste while maintaining freshness. This aligns with broader efforts to develop antioxidant solutions for beef shelf life extension.

- In 2025, ADM announced a joint venture with Alltech for North American animal feed. This combines expertise in production, innovation, and feed additives, potentially enhancing antioxidant-inclusive formulations for livestock health. ADM’s recent activities emphasize partnerships and trends in animal feed, with some relevance to antioxidants through broader nutrition solutions.

Report Scope

Report Features Description Market Value (2024) USD 430.3 Million Forecast Revenue (2034) USD 742.0 Million CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Synthetic – BHT, BHA, Ethoxyquin, Propyl gallate, Others; Natural – Carotenoids, Tocopherols, Botanical extracts, Vitamins), By Form (Dry – Powders, Beadlets, Granules; Liquid), By Animal (Poultry, Cattle, Swine, Aquaculture, Pets) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Cargill, Archer Daniels Midland Company, Koninklijke DSM N.V., BASF SE, Nutreco, Kemin, Adisseo, Perstorp, Alltech, Caldic Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Feed Antioxidants MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Feed Antioxidants MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Cargill

- Archer Daniels Midland Company

- Koninklijke DSM N.V.

- BASF SE

- Nutreco

- Kemin

- Adisseo

- Perstorp

- Alltech

- Caldic