Global Fecal Calprotectin Testing Market Analysis By Assay Type (ELISA, Fluoro-/Chemiluminescence Immunoassay, Rapid/Point-of-Care Immune-Chromatography/Dipstick, Others), By Indication (Inflammatory Bowel Disease (IBD) (Crohn’s disease, Ulcerative colitis), Irritable Bowel Syndrome (IBS), Colorectal or Intestinal cancer), By Patient Type (Adult, Pediatric), By End-User (Hospitals, Diagnostic Laboratories, Homecare Settings, Academic & Research Institutes) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 163785

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

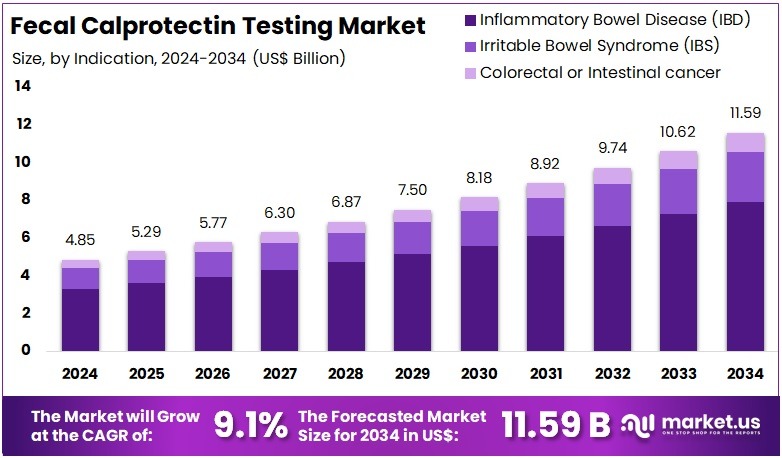

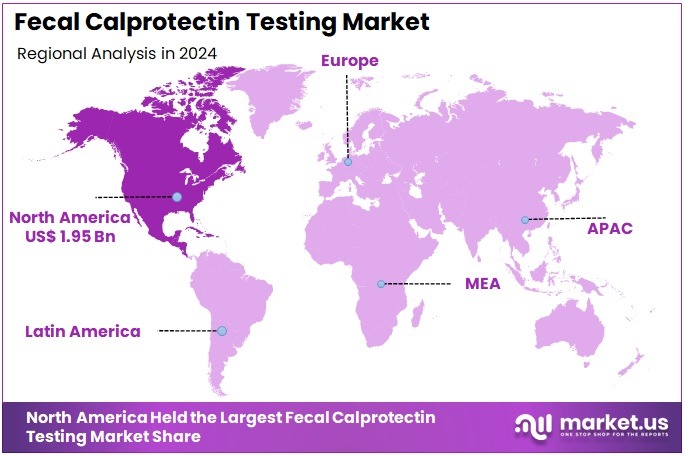

The Global Fecal Calprotectin Testing Market size is expected to be worth around US$ 11.59 Billion by 2034, from US$ 4.85 Billion in 2024, growing at a CAGR of 9.1% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 40.3% share and holds US$ 1.95 Billion market value for the year.

Fecal calprotectin testing is used to measure inflammation in the gastrointestinal tract through stool analysis. The protein calprotectin is released by neutrophils during intestinal inflammation, and levels in stool are known to be about six times higher than in plasma in healthy individuals. The test supports early identification of inflammatory bowel disease (IBD) and helps distinguish it from functional disorders. It is viewed as a non-invasive alternative to colonoscopy and reduces unnecessary invasive procedures.

Demand for testing has been rising due to clearer disease burden and clinical need. In the United States, an estimated 2.4–3.1 million people have IBD. According to national burden studies, global prevalence and years lived with disability continue to increase. In Australia, Medical Services Advisory Committee data estimated ~102,423 people with IBD in 2024, with ~60% eligible uptake in the first year for patients seeing a gastroenterologist. These figures support sustained test volumes across care settings.

Clinical guidance has strengthened adoption in primary care. UK guidance under NICE DG11 supports use of fecal calprotectin to differentiate IBD from irritable bowel syndrome. A UK pathway document from March 2024 states that <100 µg/g suggests low likelihood of IBD. In the United States, BlueShieldCA guidance effective 1 March 2024 adopts <50 µg/g as a low-likelihood threshold. A UK guideline reviewed 3 April 2024 and valid until 3 April 2026 confirms standardization of primary-care pathways. These recommendations anchor testing in early triage.

System pressures have reinforced the role of non-invasive diagnostics. NHS England documents, such as the June 2024 “Getting it Right” scenario for IBD, highlight referral pathways and endoscopy capacity strain. Stool-based testing is positioned to support community pathways and manage waiting lists. Regulatory clarity also accelerates availability. In the United States, fecal calprotectin immunological test systems are classified as Class II with special controls, and multiple assays hold 510(k) clearance, confirming defined indications for use.

Clinical utility extends beyond diagnosis. Tests are used to monitor mucosal inflammation and assess relapse risk. Study by Clin Chem in 2024 highlighted day-to-day variability with a coefficient of variation of ~40% at higher concentrations, which informs interpretation practices. A study in September 2025 involving 340 post-metabolic bariatric surgery patients demonstrated expanding application beyond classic IBD cases. For example, repeat testing supports treatment planning and remission monitoring, driving steady volume growth over time.

Industry expansion is supported by reimbursement and commissioning. UK commissioning materials and the York Primary Care Pathway emphasize reduced unnecessary secondary-care referrals. In the US, recognized procedure coding supports routine use. For instance, insurers include the test in fee schedules, enabling ordering in hospitals, diagnostic laboratories, and community clinics. According to a 2021 BMJ Open meta-analysis, diagnostic accuracy varies in primary care, yet system protocols continue to mature. Overall, strong guidelines, epidemiology, and operational needs point to continued growth across laboratory and point-of-care platforms.

Key Takeaways

- The global fecal calprotectin testing market is projected to reach approximately US$ 11.59 Billion by 2034, expanding from US$ 4.85 Billion in 2024 at a 9.1% CAGR.

- The ELISA assay type was reported as the leading segment in 2024, accounting for over 62% of the total market share globally.

- Inflammatory Bowel Disease applications dominated the indication category in 2024, representing more than 68.4% of overall demand for fecal calprotectin testing.

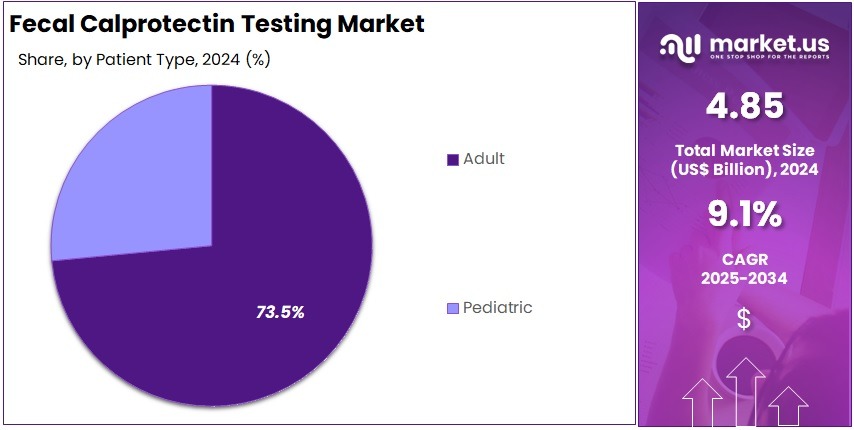

- Adult patients were observed to form the largest patient group in 2024, contributing over 73.5% to the market share for these diagnostic tests.

- Hospitals were identified as the primary end-use setting in 2024, capturing above 52.1% of the total market due to higher testing volumes and clinical adoption.

- North America maintained its position as the leading regional market in 2024, securing over 40.3% share, valued at approximately US$ 1.95 Billion.

Assay Type Analysis

In 2024, the ELISA Section held a dominant market position in the Assay Type Segment of Fecal Calprotectin Testing Market, and captured more than a 62.0% share. This leading position was driven by high accuracy and reliable detection capability. Broad acceptance in clinical environments strengthened demand. Laboratories favored this assay for its repeatability and validated protocols. Its use was common in hospital settings and reference laboratories. Strong diagnostic confidence encouraged continued adoption.

Fluoro- and chemiluminescence immunoassays were viewed as a rising category. Analysts observed consistent adoption in automated diagnostic workflows. Faster turnaround time supported higher sample throughput. Precision and improved sensitivity enhanced appeal among high-volume facilities. These assay systems helped streamline clinical decision-making. Expanded use in specialized testing centers was anticipated. Their technical efficiency positioned them for steady growth. This category benefited from investments in automated diagnostic instruments.

Rapid and point-of-care immune-chromatography tests gained traction in decentralized settings. These kits allowed quicker results and convenient screening. Their ease of use supported wider access to gastrointestinal diagnostics. Primary care providers and outpatient facilities preferred them for preliminary evaluation. Sensitivity remained lower compared with laboratory-based methods. However, adoption increased as near-patient testing expanded. Other evolving assay formats remained niche but advanced steadily. Innovation in digital and automated laboratory platforms supported their gradual entry into clinical practice.

Indication Analysis

In 2024, the Inflammatory Bowel Disease (IBD) Section held a dominant market position in the Indication Segment of the Fecal Calprotectin Testing Market, and captured more than a 68.4% share. This strong lead was driven by the rising clinical focus on Crohn’s disease and Ulcerative colitis. The growing burden of chronic gastrointestinal inflammation supported consistent test demand. Increased recommendations for fecal calprotectin screening in IBD management further strengthened adoption. The growth of the market can be attributed to early-diagnosis initiatives, ongoing disease monitoring, and the shift toward non-invasive diagnostic tools.

The Irritable Bowel Syndrome (IBS) segment accounted for a significant portion of test usage. Although IBS is a functional disorder, fecal calprotectin testing is increasingly used to differentiate IBS from inflammatory conditions. The need to reduce invasive procedures and improve diagnostic confidence contributed to rising test volume. Growing awareness among primary care providers and improved access to stool-based diagnostics supported segment expansion.

The Colorectal or Intestinal Cancer segment demonstrated steady demand. The application remained focused on distinguishing inflammatory symptoms from malignancy-related conditions. Increasing cases of colorectal cancer and heightened screening programs contributed to adoption. The use of fecal calprotectin as a supporting biomarker in risk assessment and patient triage enhanced its role in oncology pathways. Gradual integration into cancer-screening protocols and clinical workflows is likely to encourage sustained market growth.

Patient Type Analysis

In 2024, the Adult Section held a dominant market position in the Patient Type Segment of Fecal Calprotectin Testing Market, and captured more than a 73.5% share. This lead position was supported by a higher rate of inflammatory bowel diseases in adults. Many adults are diagnosed with Crohn’s disease and ulcerative colitis. Increased clinical screening and frequent diagnostic follow-ups strengthened test adoption. Access to advanced laboratories and reimbursement support also helped. A shift toward non-invasive testing methods continued to favor adult patients.

Industry data indicated that adult testing volumes remained strong due to routine disease monitoring. Adults with chronic gastrointestinal disorders undergo repeated fecal calprotectin evaluations to assess disease activity. Medical professionals prefer this method because it is reliable and non-invasive. Higher awareness among physicians and patients also played a vital role. Growing emphasis on early diagnosis improved testing uptake in symptomatic adults. This trend is expected to continue as gastrointestinal cases rise globally.

The Pediatric Section represented the remaining market share. It showed a stable growth trajectory due to rising childhood gastrointestinal disorders. Pediatric inflammatory bowel disease cases were noted to be increasing worldwide. Healthcare providers actively promoted early screening in children. Parents also showed growing acceptance of non-invasive stool biomarker tests for their children. Efforts to avoid invasive diagnostic methods in pediatric care supported demand. Continued investment in pediatric gastrointestinal health programs is expected to enhance testing usage in younger age groups.

End-User Analysis

In 2024, the Hospitals Section held a dominant market position in the End-User Segment of Fecal Calprotectin Testing Market, and captured more than a 52.1% share. Hospitals were observed to lead due to strong clinical infrastructure and advanced diagnostic capacity. Higher patient admissions for gastrointestinal issues supported test volumes. The need for precise inflammation assessment promoted the use of calprotectin testing. Skilled medical professionals and structured diagnostic workflows further strengthened usage. Early disease detection efforts also enhanced adoption.

Diagnostic laboratories were identified as the next major contributors. This segment benefited from high referral rates from clinics and specialty practices. Centralized laboratory operations enabled fast and reliable processing. High testing throughput improved cost efficiency. Growing focus on standardized diagnostic accuracy encouraged lab involvement. Screening programs, especially for inflammatory bowel conditions, supported test demand. The segment is anticipated to achieve consistent expansion due to reliance on professional laboratory services and structured diagnostic networks.

Homecare settings showed gradual growth in adoption. Patients increasingly sought convenient monitoring for chronic gastrointestinal disorders. Point-of-care kits allowed basic testing at home. However, accuracy limitations were observed when compared to laboratory systems. Ease of access and comfort encouraged usage. Academic and research institutes also contributed as niche users. Research efforts in biomarker development supported testing levels. These institutions focused on innovation in diagnostic methods. Continued research funding and collaboration with healthcare bodies indicated steady long-term potential.

Key Market Segments

By Assay Type

- ELISA

- Fluoro-/Chemiluminescence Immunoassay

- Rapid/Point-of-Care Immune-Chromatography/Dipstick

- Others

By Indication

- Inflammatory Bowel Disease (IBD)

- Crohn’s disease

- Ulcerative colitis

- Irritable Bowel Syndrome (IBS)

- Colorectal or Intestinal cancer

By Patient Type

- Adult

- Pediatric

By End-User

- Hospitals

- Diagnostic Laboratories

- Homecare Settings

- Academic & Research Institutes

Drivers

Rising Incidence of Inflammatory Bowel Diseases and Growing Preference for Non-Invasive Diagnostics

The growth of fecal calprotectin testing is being driven by the rising prevalence of inflammatory bowel diseases, including Crohn’s disease and ulcerative colitis. These chronic disorders affect millions and require continuous monitoring. As global disease incidence increases, demand for reliable biomarkers has intensified. Fecal calprotectin has gained clinical importance due to its accuracy in detecting intestinal inflammation. As a result, healthcare providers are adopting this test to support timely diagnosis and disease management.

The adoption of fecal calprotectin testing has been supported by the shift toward non-invasive diagnostic approaches in gastroenterology. Traditional diagnostic methods, such as endoscopy, can be invasive, time-consuming, and costly. In comparison, fecal calprotectin testing offers a simple stool-based alternative that delivers rapid and reliable inflammatory markers. Clinicians are increasingly preferring this method to differentiate between inflammatory bowel diseases and functional gastrointestinal disorders, improving patient comfort and reducing reliance on invasive procedures.

Growing awareness among healthcare professionals regarding early disease detection is boosting test utilization across hospitals and specialty clinics. Regular monitoring of inflammatory bowel disease patients is critical to prevent flare-ups and complications. Fecal calprotectin testing plays a vital role in tracking disease activity and guiding treatment decisions. Adoption is further supported by evidence-based clinical guidelines recommending biomarker testing. As healthcare systems prioritize early diagnosis and efficient disease management, fecal calprotectin testing continues to gain prominence in routine gastrointestinal care pathways.

Restraints

Limited Awareness and Established Alternatives

Market expansion for fecal calprotectin testing has been hindered by limited awareness in low- and middle-income economies. Demand remains lower in these regions because healthcare providers and patients are less familiar with this diagnostic method. Adoption has moved slowly due to restricted medical education and limited diagnostic infrastructure. As a result, testing volumes remain concentrated in developed markets. This has constrained broader market penetration and delayed the development of testing capacity in emerging healthcare systems. Awareness campaigns and training programs remain insufficient.

Preference for established diagnostic techniques has also restricted adoption. Many clinical settings continue to select endoscopy and serological testing as primary diagnostic tools. These methods remain dominant because they are integrated into long-standing diagnostic pathways and are trusted by clinicians. Hospitals and laboratories rely on familiar workflows, leading to slow acceptance of new testing solutions. Even where fecal calprotectin testing provides non-invasive benefits, traditional options often take priority in clinical decisions and reimbursement policies.

In addition, healthcare systems in resource-constrained environments face budget limitations. Investment in advanced stool-based diagnostic tools is often deprioritized. Infrastructure gaps and procurement barriers increase reliance on conventional procedures. These challenges extend diagnostic timelines and delay the shift toward non-invasive testing. Training needs and limited laboratory capacity further reinforce dependence on existing methods. As a result, growth potential remains unfulfilled in regions with emerging healthcare systems, even though clinical advantages for inflammatory bowel disease detection are recognized in advanced markets.

Opportunities

Opportunity in Rapid Point-of-Care Fecal Calprotectin Testing

Rapid point-of-care fecal calprotectin tests are creating a promising growth avenue. The demand is increasing as healthcare providers prioritize quick diagnostics to manage inflammatory bowel disease and related disorders. Convenience and speed are becoming critical factors in test adoption. This shift supports development of portable assays that deliver accurate results without centralized laboratory support. Time-efficient diagnosis can improve patient management and reduce healthcare burden. The trend is expected to support manufacturers that invest in validated, fast, and accessible point-of-care solutions.

Decentralized testing is gaining acceptance due to rising pressure on laboratory infrastructure and increased focus on early disease detection. Adoption of home-based and community-level testing tools is expanding steadily. These solutions enable routine monitoring and faster clinical decisions. In addition, patient preference for simple sample collection methods is increasing. High accuracy and ease of use are becoming essential product attributes. This movement strengthens opportunities for companies that design user-friendly fecal calprotectin point-of-care platforms with robust clinical reliability.

Growing emphasis on cost-effective and efficient healthcare delivery supports innovation in rapid fecal calprotectin assays. Healthcare systems are aiming to reduce unnecessary invasive procedures and hospital visits. Portable and rapid tests have the potential to support better triaging and disease tracking. They can also assist in therapy optimization and reduce diagnostic delays. Technology advancements in biosensors and digital diagnostics are expected to accelerate adoption. Companies that develop scalable, automated, and connected testing formats are likely to benefit from rising demand for outpatient and home-based gastrointestinal diagnostics.

Trends

Integration of Automated Platforms and Personalized Diagnostics in Fecal Calprotectin Testing

Automated systems have been adopted in fecal calprotectin testing to enhance accuracy and streamline clinical workflows. Digital interpretation tools have been incorporated to minimize manual errors and ensure consistent results. This transition has enabled laboratories to handle higher test volumes efficiently. The approach has also supported stable test quality across diverse healthcare settings. As reliance on automation continues to rise, consistent performance and faster turnaround times are expected to strengthen clinical confidence and expand diagnostic use.

Advanced digital platforms have been integrated to assist clinicians in interpreting fecal calprotectin results with greater precision. These systems have supported data standardization and improved clinical decision-making. Enhanced analytics have enabled reliable evaluation of inflammatory bowel disease activity. The adoption of such tools has helped healthcare providers detect disease progression and treatment response more effectively. As technology advances, increased accessibility of digital solutions is anticipated to strengthen test utility in routine practice.

Personalized gastrointestinal disease monitoring has been emphasized, driving innovation in fecal calprotectin testing. Biomarker-based evaluation has become essential for individualized patient management. This approach has enabled tailored treatment pathways and optimized care for inflammatory bowel conditions. Continuous refinement of biomarker sensitivity has supported early detection and monitoring of disease flares. As demand for personalized healthcare increases, testing platforms are expected to evolve to support precise monitoring and improve long-term patient outcomes.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 40.3% share and holds US$ 1.95 Billion market value for the year. Strong healthcare infrastructure has been viewed as a key factor behind this lead. Higher awareness of inflammatory bowel disease and gastrointestinal disorders has supported early diagnosis. A steady increase in Crohn’s disease and ulcerative colitis cases has encouraged non-invasive testing. Fecal calprotectin testing has been preferred for accurate disease evaluation and monitoring.

Growth in testing has been supported by advanced reimbursement systems across the United States and Canada. Access to specialized laboratories and point-of-care solutions has improved testing penetration. A trained clinical workforce has helped ensure correct biomarker interpretation. Regional health policies and clinical practice guidelines have encouraged routine use of fecal biomarkers. These factors have worked together to strengthen adoption in both primary and specialty care facilities, ensuring reliable diagnostic pathways.

Research activity in biomarker-based diagnostics has remained strong. Continuous clinical validation studies have enhanced trust in fecal calprotectin testing. Investments in laboratory automation have increased accuracy and reduced processing time. Improvements in immunoassay platforms and testing kits have supported efficient workflows. These advancements have been seen as beneficial for patient monitoring and treatment planning. Better diagnostic precision has resulted in improved disease management outcomes across healthcare settings.

Demand has been influenced by rising preventive healthcare practices and patient preference for non-invasive procedures. Hospital labs, diagnostic centers, and gastroenterology clinics have reported increased testing volume. Digital health services and telemedicine adoption have allowed wider access to remote ordering and consultation for gastrointestinal screening. Aging population trends and higher chronic disease prevalence have contributed to future growth prospects. The region is expected to maintain its lead through continued innovation, clinical integration, and patient-centered diagnostic programs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

A strong competitive landscape has been observed in the fecal calprotectin testing market. Major participation has been recorded from manufacturers offering automated immunoassays, turbidimetric solutions, and ELISA kits. Established leaders such as BÜHLMANN Laboratories AG and DiaSorin S.p.A. hold significant positions due to their advanced platforms and regulatory approvals. These companies have invested in high-throughput systems and global distribution. Growth has been driven by the rising need for reliable inflammatory bowel disease diagnostics. Consistent quality and proven analytical performance have strengthened their competitive advantage.

The market has also seen robust participation from mid-volume diagnostic suppliers and specialized assay providers. Diazyme Laboratories Inc. and Epitope Diagnostics Inc. support widespread adoption through flexible immunoturbidimetric and ELISA-based offerings. Their solutions assist laboratories without large immunoassay platforms. Hycult Biotech and BioVendor have expanded access through research and clinical-grade kits. Strong product accessibility and technical support boost market presence. Increased stool biomarker testing volumes have supported these companies. Portfolio expansion and cost-efficient products remain key growth drivers.

A shift toward decentralized and point-of-care testing has created opportunities for rapid diagnostic developers. Companies including Svar Life Science AB and BÜHLMANN Laboratories AG have invested in home and near-patient systems. Rapid kits from Actim, Operon S.A., and AccuBioTech Co. Ltd. serve primary care and urgent care environments. Demand has been driven by faster triage needs and patient monitoring programs. Adoption has accelerated through self-testing initiatives and telemedicine support. Ease of use and shorter turnaround times remain strategic advantages.

Additional competition has emerged from global specialty diagnostic distributors and niche suppliers. Creative Diagnostics, Eagle Biosciences Inc., DRG International Inc., and ALPCO continue to provide immunoassay kits to independent labs and regional testing facilities. Their presence strengthens supply availability across multiple geographies. Commercial expansion has been supported by partnerships and licensing agreements. The market has benefited from increased disease awareness and improved reimbursement frameworks. Continued innovation in assay automation, sample preparation, and sensitivity enhancement is expected to sustain competitive intensity.

Market Key Players

- BÜHLMANN Laboratories AG

- Diasorin S.p.A.

- Diazyme Laboratories Inc.

- Epitope Diagnostics Inc.

- Hycult Biotech

- Operon S.A.

- AccuBioTech Co. Ltd.

- Svar Life Science AB

- Creative Diagnostics

- BioVendor Research and Diagnostic Products

- Actim

- Eagle Biosciences Inc.

- DRG International Inc.

- ALPCO

Recent Developments

- In February 2024: On 6 Feb 2024, BÜHLMANN’s fCAL® turbo immunoturbidimetric fecal calprotectin assay plus the CALEX® Cap extraction device obtained U.S. FDA clearance (510(k): K232057) for quantitative measurement of fecal calprotectin aiding in the diagnosis of IBD (Crohn’s/UC) and differentiation from IBS.

- In Feb 2024: AccuBioTech exhibited at Medlab Middle East 2024 (Dubai) and highlighted a portfolio of new rapid tests, including its Rapid Calprotectin Test for fecal calprotectin detection.

- In December 2023: ALPCO commercially launched its Calprotectin Immunoturbidimetric Assay (for fecal calprotectin) in the U.S., noting that the assay “was developed in collaboration with Diazyme Laboratories”. The launch follows FDA 510(k) clearance for ALPCO’s assay in June 2023. This indicates an important product-extension/partnered development for Diazyme in the fecal calprotectin field.

- In February 2023: Fully automated chemiluminescent immunoassay analyzers (ECL25, ECL100) were launched; Epitope Diagnostics also provides a Fecal Human Calprotectin CLIA kit (CL0849), enabling automated fecal calprotectin testing on these platforms.

Report Scope

Report Features Description Market Value (2024) US$ 4.85 Billion Forecast Revenue (2034) US$ 11.59 Billion CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Assay Type (ELISA, Fluoro-/Chemiluminescence Immunoassay, Rapid/Point-of-Care Immune-Chromatography/Dipstick, Others), By Indication (Inflammatory Bowel Disease (IBD) (Crohn’s disease, Ulcerative colitis), Irritable Bowel Syndrome (IBS), Colorectal or Intestinal cancer), By Patient Type (Adult, Pediatric), By End-User (Hospitals, Diagnostic Laboratories, Homecare Settings, Academic & Research Institutes) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BÜHLMANN Laboratories AG, Diasorin S.p.A., Diazyme Laboratories Inc., Epitope Diagnostics Inc., Hycult Biotech, Operon S.A., AccuBioTech Co. Ltd., Svar Life Science AB, Creative Diagnostics, BioVendor Research and Diagnostic Products, Actim, Eagle Biosciences Inc., DRG International Inc., ALPCO Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fecal Calprotectin Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Fecal Calprotectin Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BÜHLMANN Laboratories AG

- Diasorin S.p.A.

- Diazyme Laboratories Inc.

- Epitope Diagnostics Inc.

- Hycult Biotech

- Operon S.A.

- AccuBioTech Co. Ltd.

- Svar Life Science AB

- Creative Diagnostics

- BioVendor Research and Diagnostic Products

- Actim

- Eagle Biosciences Inc.

- DRG International Inc.

- ALPCO