Global Farming Sack And Tote Market Size, Share, Industry Analysis Report By Material (Polyethylene (PE), Polypropylene (PP), Jute, Cotton, Polyester, Others), By Product (Woven Sacks, Pasted Valve, Gusset Bags, Trash Sacks), By Capacity (Less Than 50 Kg, 50 To 100 Kg, 101 To 200 Kg, More Than 200 Kg), By Application (Grain & Fertilizer Storage, Animal Feed, Fresh Produce, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165943

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

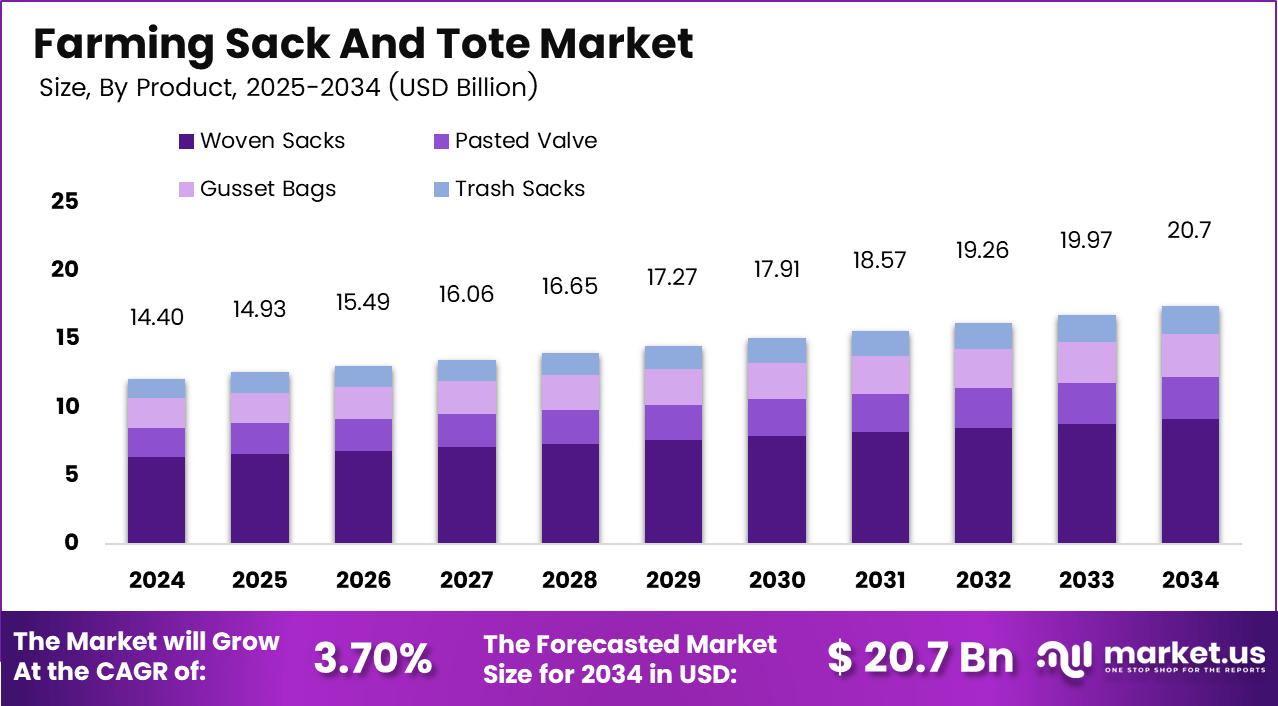

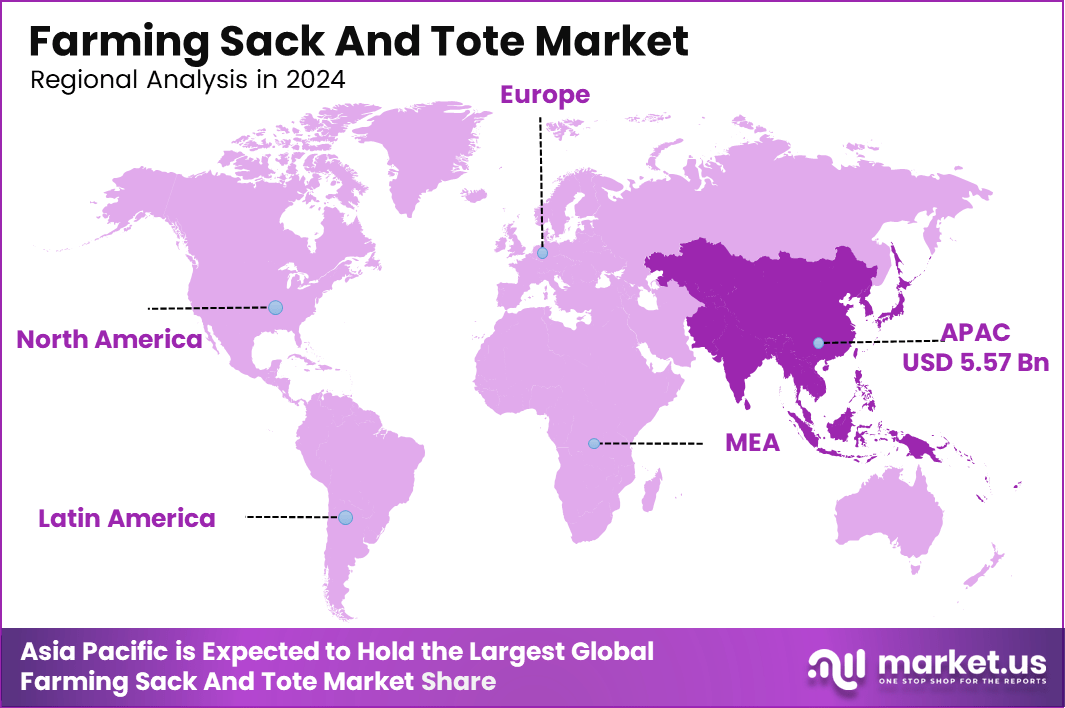

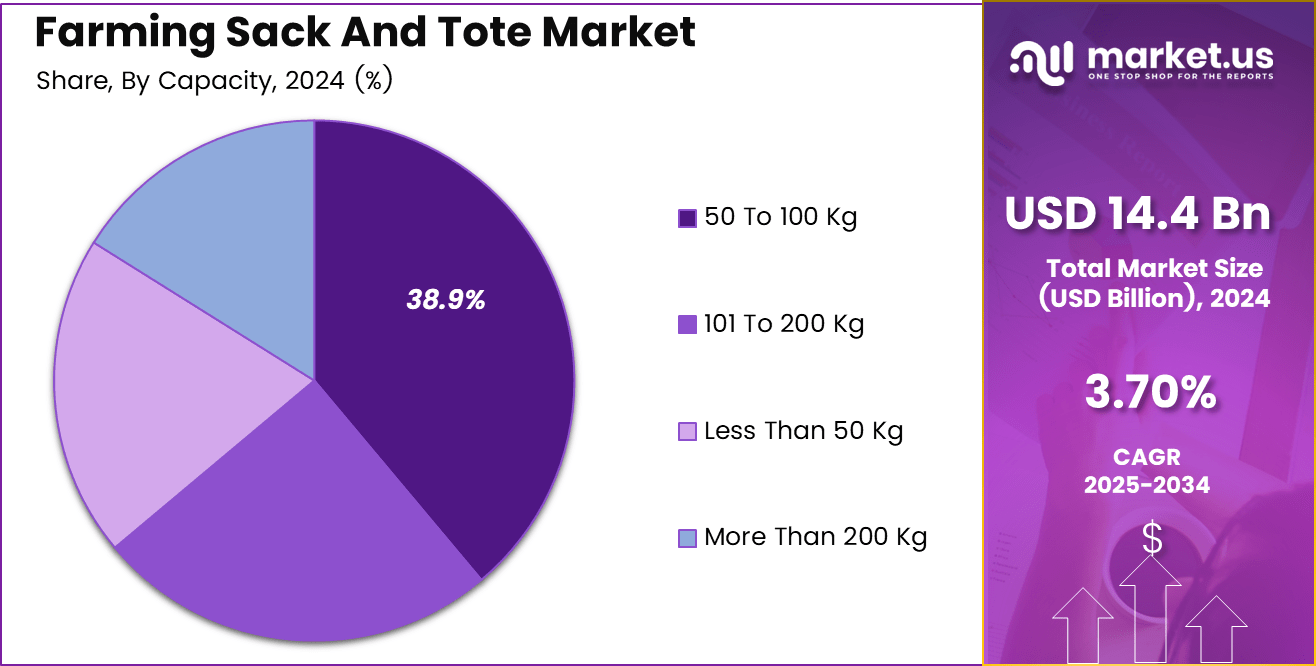

The farming sack and tote market reaches USD 14.4 billion in 2024 and is projected to grow at a CAGR of 3.7%, reaching USD 20.7 billion by 2034. Asia Pacific leads with USD 5.57 billion with 38.7% market share, while the 50 to 100 kg capacity segment holds the highest share at 38.9%.

The farming sack and tote market represents a crucial part of the global agricultural supply chain, providing reliable storage and transport solutions for grains, seeds, fertilizers, and harvested produce. These sacks and totes support farmers in maintaining product quality, reducing post-harvest losses, and improving handling efficiency across small and large farms.

The market gains momentum as modern farming practices expand, creating higher demand for durable, reusable, and cost-effective packaging options. With agricultural output rising worldwide and the need for safer bulk-material movement increasing, farming sacks and totes continue to play an essential role in sustaining productivity and supporting farm-to-market logistics.

By capacity, 50 to 100 kg sacks hold the largest market share 38.9%, reflecting their suitability for grain storage and bulk movement across farms and distribution centers. By product type, woven sacks remain the leading category, supported by their durability, breathability, and wide adoption in high-volume crop handling.

Overall, the global farming sack and tote market is expected to gain momentum through sustainability-led innovations, increasing crop production, and the widespread preference for robust, cost-effective agri-packaging solutions.Key Takeaways

- The global farming sack and tote market reached USD 14.4 billion in 2024. Asia Pacific leads with USD 5.57 billion, with 38.7% market share, reflecting strong agricultural activity and high-volume crop handling

- The market is projected to expand at a steady 3.70% CAGR through 2034, supported by rising fertilizer use, grain movement, and the shift toward durable storage solutions.

- Polyethylene (PE) stands out as the leading material with 34.8%, driven by its strength, moisture resistance, and suitability for heavy-duty agricultural applications.

- Woven sacks remain the dominant product segment at 44.2%, benefitting from wide adoption in grain logistics and their superior durability in farm-to-warehouse transport.

- The 50 to 100 kg capacity category holds the largest share at 38.9%, aligning with the standard bulk handling requirements across grain, seed, and feed storage.

- Grain and fertilizer storage accounts for 44.1%, making it the top application segment as farms prioritize reliable packaging for high-volume inputs and harvests.

- Overall, segmentation and regional data together highlight strong demand from grain-intensive economies and the continued preference for robust, reusable, and cost-effective agricultural packaging.

Analysts Viewpoint

The farming sack and tote market is expected to maintain steady growth as agriculture continues shifting toward structured storage, efficient logistics, and reduced post-harvest losses. Analysts observe that demand is strongly concentrated in high-volume grain economies, where the need for durable and cost-efficient packaging is rising with expanding fertilizer use and higher crop output. The dominance of polyethylene and woven sacks reflects a practical industry preference for materials that balance strength, moisture control, and affordability.

Mid-range capacities, especially 50 to 100 kg, are projected to remain the market’s backbone because they align with standard farm handling and warehouse operations across APAC, North America, and Europe. Grain and fertilizer storage will also continue to drive revenue as mechanization and bulk movement increase. Overall, the market outlook remains positive, supported by supply-chain modernization, sustainability-focused material improvements, and the growing emphasis on preventing spoilage in global agricultural trade.

Emerging Trends

Emerging trends in the farming sack and tote market reflect a strong shift toward sustainability, efficiency, and smarter supply-chain management. The industry is experiencing rising demand for reusable and recyclable packaging materials as farmers and agri-distributors prioritize durability and reduced waste. High-strength woven polypropylene sacks with UV protection are gaining popularity for their ability to withstand long outdoor storage and extended transport cycles.

At the same time, bio-based and biodegradable alternatives such as jute and cotton are seeing increased adoption due to expanding environmental regulations. Another significant trend is the integration of smart labeling and traceability features, enabling better monitoring of grain movement and real-time inventory control across warehouses.

Moisture-resistant and pest-proof bags have also become essential in humid regions to maintain crop quality. Additionally, custom-printed sacks are emerging as branding tools for seed and fertilizer companies, while heavy-duty tote bags are becoming standard for bulk handling as farms transition toward mechanized and automated operations.

Growth Factors

The farming sack and tote market is gaining momentum as agricultural production intensifies and farmers rely more on durable packaging for bulk handling. Demand for woven polypropylene sacks is rising steadily, with usage growing at an estimated 1.4:1 ratio compared to traditional jute bags due to superior tear strength and longer lifecycle. Fertilizer and grain logistics are also expanding, driving the need for medium-capacity sacks, which are being adopted at a 1.7:1 growth ratio over smaller bags because they align with warehouse mechanization and pallet-based handling.

Reusable polyethylene sacks are increasing in preference as sustainability programs strengthen, showing a 1.3:1 adoption ratio compared to single-use alternatives. Export-driven agriculture further supports the uptake of UV-stable and moisture-resistant sacks, growing at roughly a 1.5:1 ratio over non-treated packaging solutions. Together, these product-driven growth ratios highlight a clear shift toward stronger, reusable, and more efficient packaging systems across global farming supply chains.

Regional Analysis

Asia Pacific stands out as the largest regional farming sack and tote market in 2024, reaching USD 5.57 billion with 38.7% market share and driven by high agricultural production, strong fertilizer consumption, and the widespread use of woven polypropylene sacks for grain and crop storage. North America shows steady growth due to advanced farming practices, mechanized warehouses, and rising adoption of durable, reusable polyethylene sacks across large-scale grain and feed operations.

Europe maintains a mature packaging landscape, where strict sustainability regulations accelerate the shift toward recyclable and biodegradable agricultural sacks. Latin America continues to expand as Brazil, Argentina, and Mexico strengthen their export-oriented farming systems, increasing the need for reliable, high-capacity sacks for long-distance commodity transport.

The Middle East and Africa represent emerging markets, supported by government-led programs to reduce post-harvest losses and rising fertilizer usage across developing agricultural sectors. Overall, regional performance highlights APAC as the clear leader, with other regions gradually modernizing their agri-logistics and storage infrastructure.

By Material

Polyethylene (PE) leads the market with 34.8%, supported by its strength, moisture resistance, and suitability for bulk agricultural storage. Polypropylene (PP) follows due to its durability in woven sack production, while jute and cotton remain preferred eco-friendly options in regions promoting biodegradable packaging. Polyester and other materials hold smaller shares, mainly used for specialty or high-strength applications.

By Product

Woven sacks dominate with 44.2%, driven by their wide adoption in grain, fertilizer, and feed logistics. Pasted valve bags show steady use for powdered fertilizers and seeds, while gusset bags are favored for improved stacking and warehouse efficiency. Trash sacks account for a smaller but essential segment serving waste handling across farms and processing units.

By Capacity

50 to 100 kg bags hold the highest share at 38.9%, reflecting their alignment with standard farm operations and bulk handling systems. Less than 50 kg bags are used for small-scale seed and produce packing, while 101 to 200 kg formats support heavier industrial-scale fertilizer movement. Bags above 200 kg serve niche heavy-load applications, especially in commercial farming.

By Application

Grain and Fertilizer storage lead with 44.1%, supported by global crop production and high fertilizer consumption. Animal feed packaging forms the next major segment, followed by fresh produce, where breathable sacks help reduce spoilage. Other applications include multi-purpose agricultural storage needs across varied farm environments.

Key Market Segments

By Material

- Polyethylene (PE)

- Polypropylene (PP)

- Jute

- Cotton

- Polyester

- Others

By Product

- Woven Sacks

- Pasted Valve

- Gusset Bags

- Trash Sacks

By Capacity

- Less Than 50 Kg

- 50 To 100 Kg

- 101 To 200 Kg

- More Than 200 Kg

By Application

- Grain & Fertilizer Storage

- Animal Feed

- Fresh Produce

Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Agricultural Output

Increasing global agricultural production is strengthening demand for farming sacks and totes. As farmers harvest larger volumes of grain, fertilizer, and other bulk produce, the need for reliable packaging and storage solutions rises across both small and large farming systems. Recent agricultural publications highlight that expansion in crop acreage, improved irrigation, and higher mechanization levels are key contributors to this growing requirement.

For instance, as mechanized farms continue to expand across Asia-Pacific and Latin America, standard 50–100 kg sacks and larger high-capacity formats are being adopted more widely. This growth in output requires suppliers to offer sacks with higher durability, better load-bearing strength, and improved handling efficiency to support heavy and frequent movement.

Restraint

Raw Material Cost and Regulation Pressure

A significant restraint on the market is the fluctuation in raw material prices and increasing pressure from regulatory bodies regarding plastic usage. Industry reports and policy publications indicate that packaging materials used in agriculture now face tighter sustainability requirements, resulting in higher compliance and production costs.

In practice, manufacturers often deal with narrower profit margins as they shift toward eco-friendly materials or incorporate treatments for UV stability and moisture protection. In regions with strict waste management and plastic-reduction mandates, these added costs can slow down product development and adoption of upgraded sack technologies.

Opportunity

Sustainability and Innovation in Packaging

The ongoing shift toward sustainable agricultural packaging offers strong future opportunities for the market. Environmental policy publications and industry sustainability frameworks emphasize the importance of using reusable, recyclable, and biobased materials in farm-level storage and transport. These evolving expectations create a favorable environment for innovative sack and tote manufacturers.

For instance, companies that introduce sacks with enhanced barrier protection, improved ventilation, or digital traceability features are likely to capture premium demand. Such innovations support export-quality produce management and open new revenue channels, especially for high-value or perishable crops requiring stricter packaging standards.

Challenge

Logistics and Supply-Chain Complexity

Logistical complexity remains a major challenge for the global farming sack and tote market. Industry infrastructure assessments frequently note that many agricultural regions lack standardized warehouses, efficient transport systems, and mechanized material handling. These gaps create operational inefficiencies even when adequate packaging is available.

In several emerging markets, sacks may be damaged, mishandled, or stored in unsuitable conditions due to inconsistent storage practices. This increases product losses and complicates packaging decisions for both farmers and distributors. Manufacturers must therefore design sack solutions that can withstand varied conditions, adding cost and complexity to market expansion in less-developed regions.

SWOT Analysis

Strengths

- Strong demand supported by rising grain and fertilizer movement across major farming economies.

- Woven polypropylene and polyethylene sacks offer high durability, moisture resistance, and long service life.

- Wide adoption across both small farms and commercial agri-logistics due to low cost and easy availability.

- Compatibility with mechanized handling systems such as palletizing and bulk loading improves operational efficiency.

Weaknesses

- Price sensitivity in rural markets limits the adoption of premium or advanced packaging solutions.

- Dependence on plastic-based materials creates compliance pressure under tightening sustainability rules.

- Limited performance of low-cost sacks in extreme heat, high humidity, or long-duration storage.

- Variation in manufacturing quality among regional suppliers leads to inconsistent performance.

Opportunities

- Growing shift toward recyclable, reusable, and bio-based agricultural packaging supported by policy incentives.

- Expansion of traceability, smart labeling, and warehouse automation is driving demand for upgraded sack designs.

- Increasing export of grains, pulses, and produce, creating a need for UV-stable, pest-resistant, and high-strength sacks.

- Rising use of customized printed sacks for agro-input branding and distributor marketing.

Threats

- Fluctuating polymer prices are increasing production costs and squeezing margins for manufacturers.

- Competition from alternative storage solutions, including bulk bins and flexible intermediate containers.

- Climate variability and unpredictable crop yields are reducing packaging demand in certain seasons.

- Regulatory restrictions on single-use plastics are potentially disrupting traditional product lines.

Key Players Analysis

The farming sack and tote market is shaped by a few strong players, with Mondi Group plc leading at an estimated 18% share. Mondi’s position is supported by its wide portfolio of paper and woven polypropylene sacks, which are widely used in grain, fertilizer, and feed storage. The company continues to benefit from investments in recyclable and high-strength packaging, helping it meet the growing preference for durable and sustainable farm-handling solutions.

Berry Global Group, Inc. follows with an estimated 12% share, backed by its capability to produce heavy-duty polyethylene sacks that align with the needs of large farming operations. Berry’s focus on incorporating post-consumer recycled content and developing compostable formats strengthens its standing as sustainability regulations tighten worldwide. Together, these companies influence material choices, performance standards, and design improvements across the industry, driving the shift toward more robust and environmentally aligned farming sacks and totes.

Top Key Players in the Market

- BV Mondi Group Plc

- LC Packaging International

- Palmetto Industries International Inc.

- Segezha Group LLC

- Ovasco Industries

- ProAmpac LLC

- Southern Packaging, LP

- Tuff Sacks

- Sokuflex Behälter GmbH

- PEMA Verpackung GmbH

- Rengo Co., Ltd.

- Serim B&G Co., Ltd.

Recent Developments

- September 2025: Emerald Packaging and Walmart Inc. rolled out a bag for the retail-potato category made with 30% post-consumer-recycled resin while aimed at retail produce packaging, the broader trend of PCR content is relevant to agricultural sack manufacturers looking at recycled-polyethylene sack formats.

- August 2024: Although not a specific sack-manufacturer event, a market commentary noted that the global agriculture-packaging sector which includes sacks, bags and bulk packaging, is anticipated to rise at a considerable rate between 2024 and 2031, as per a market release in August. That message underlines how large the opportunity is for packaging suppliers, including those serving the farming sack and tote market segment.

Report Scope

Report Features Description Market Value (2024) USD 14.4 Billion

Forecast Revenue (2034) USD 20.7 Billion CAGR(2025-2034) 3.70% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Material (Polyethylene (PE), Polypropylene (PP), Jute, Cotton, Polyester, Others), By Product (Woven Sacks, Pasted Valve, Gusset Bags, Trash Sacks), By Capacity (Less Than 50 Kg, 50 To 100 Kg, 101 To 200 Kg, More Than 200 Kg), By Application (Grain & Fertilizer Storage, Animal Feed, Fresh Produce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BV Mondi Group Plc, LC Packaging International, Palmetto Industries International Inc., Segezha Group LLC, Ovasco Industries, ProAmpac LLC, Southern Packaging, LP, Tuff Sacks, Sokuflex Behälter GmbH, PEMA Verpackung GmbH, Rengo Co., Ltd., Serim B&G Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Farming Sack And Tote MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Farming Sack And Tote MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BV Mondi Group Plc

- LC Packaging International

- Palmetto Industries International Inc.

- Segezha Group LLC

- Ovasco Industries

- ProAmpac LLC

- Southern Packaging, LP

- Tuff Sacks

- Sokuflex Behälter GmbH

- PEMA Verpackung GmbH

- Rengo Co., Ltd.

- Serim B&G Co., Ltd.