Factor Xa Inhibitors Market By Product Type (Oral Drugs and Injections), By Application (Atrial Fibrillation, Pulmonary Embolism, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152989

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

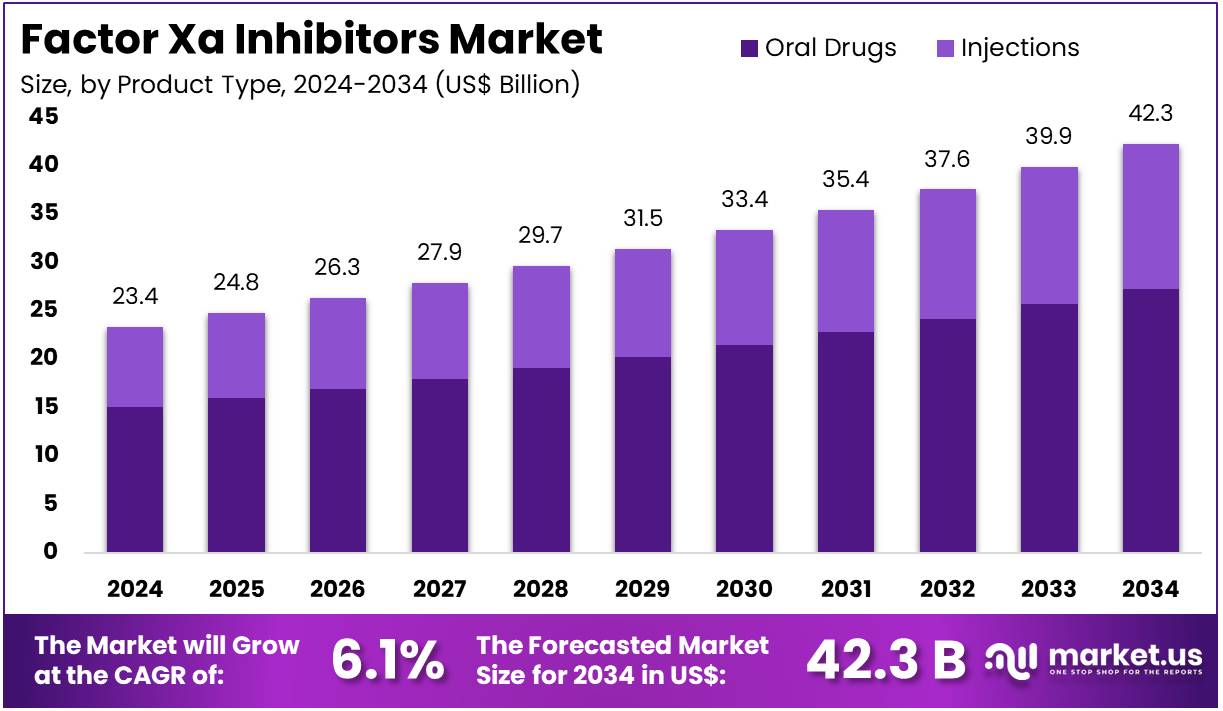

The Factor Xa Inhibitors Market size is expected to be worth around US$ 42.3 billion by 2034 from US$ 23.4 billion in 2024, growing at a CAGR of 6.1% during the forecast period 2025 to 2034.

Rising demand for more effective and targeted anticoagulant therapies is driving the growth of the factor Xa inhibitors market. Factor Xa inhibitors, such as rivaroxaban, apixaban, and edoxaban, have gained significant traction due to their ability to effectively prevent and treat thromboembolic disorders like deep vein thrombosis (DVT), pulmonary embolism (PE), and stroke prevention in patients with atrial fibrillation. These direct oral anticoagulants (DOACs) offer advantages over traditional therapies like warfarin, including fixed dosing, no routine monitoring, and fewer food and drug interactions, improving patient compliance and quality of life.

The market benefits from the growing prevalence of cardiovascular diseases and the increasing number of surgeries requiring anticoagulation therapy, which drives demand for safe and effective blood-thinning agents. In December 2023, Sirnaomics Ltd. and its subsidiaries announced the successful completion of Cohort 1 in their ongoing Phase I clinical trial for STP122G, a novel anticoagulant targeting Factor XI. This new development reflects the continued trend toward discovering and developing more specialized anticoagulants with better safety profiles and fewer side effects.

The market is also witnessing increasing research into the broader applications of factor Xa inhibitors in various conditions, including cancer-related thrombosis and post-surgical thrombosis prevention. Additionally, the ongoing exploration of combination therapies using factor Xa inhibitors with other treatments, such as antiplatelet drugs, presents significant opportunities for market growth. As the understanding of anticoagulation therapy continues to evolve, the factor Xa inhibitors market is poised for further expansion, driven by innovations in drug development and personalized medicine.

Key Takeaways

- In 2024, the market for factor Xa inhibitors generated a revenue of US$ 23.4 billion, with a CAGR of 6.1%, and is expected to reach US$ 42.3 billion by the year 2034.

- The product type segment is divided into oral drugs and injections, with oral drugs taking the lead in 2023 with a market share of 64.5%.

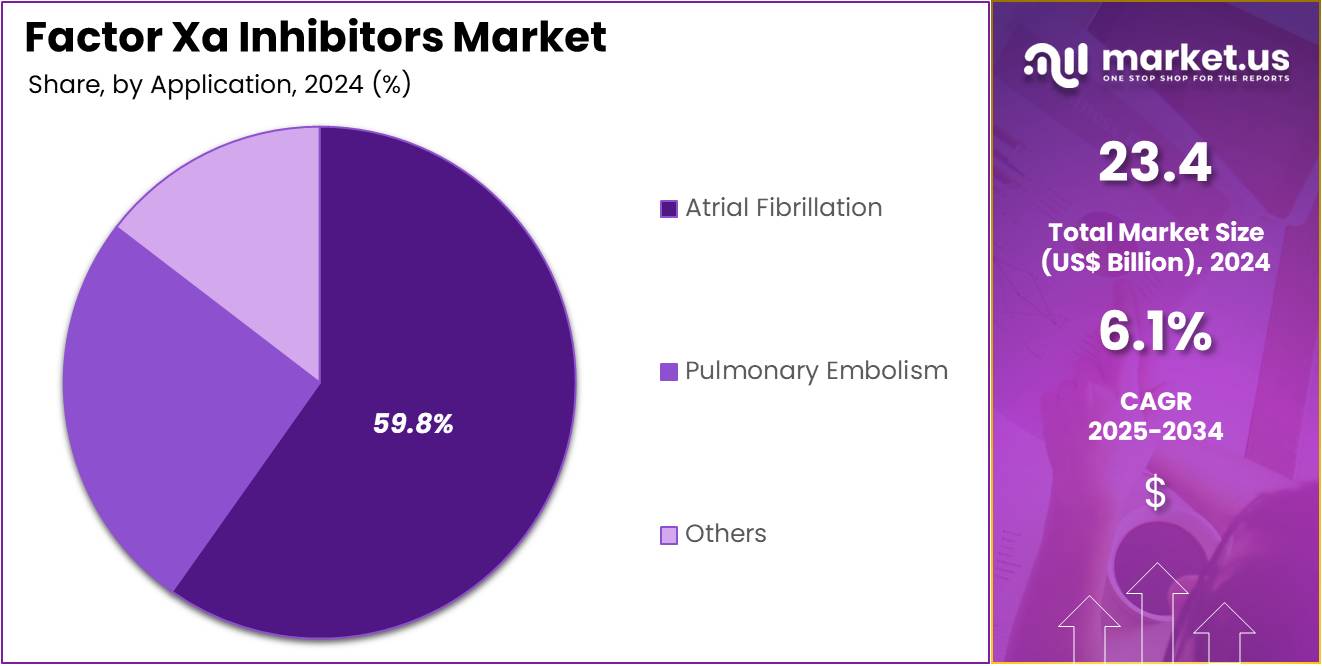

- Considering application, the market is divided into atrial fibrillation, pulmonary embolism, and others. Among these, atrial fibrillation held a significant share of 59.8%.

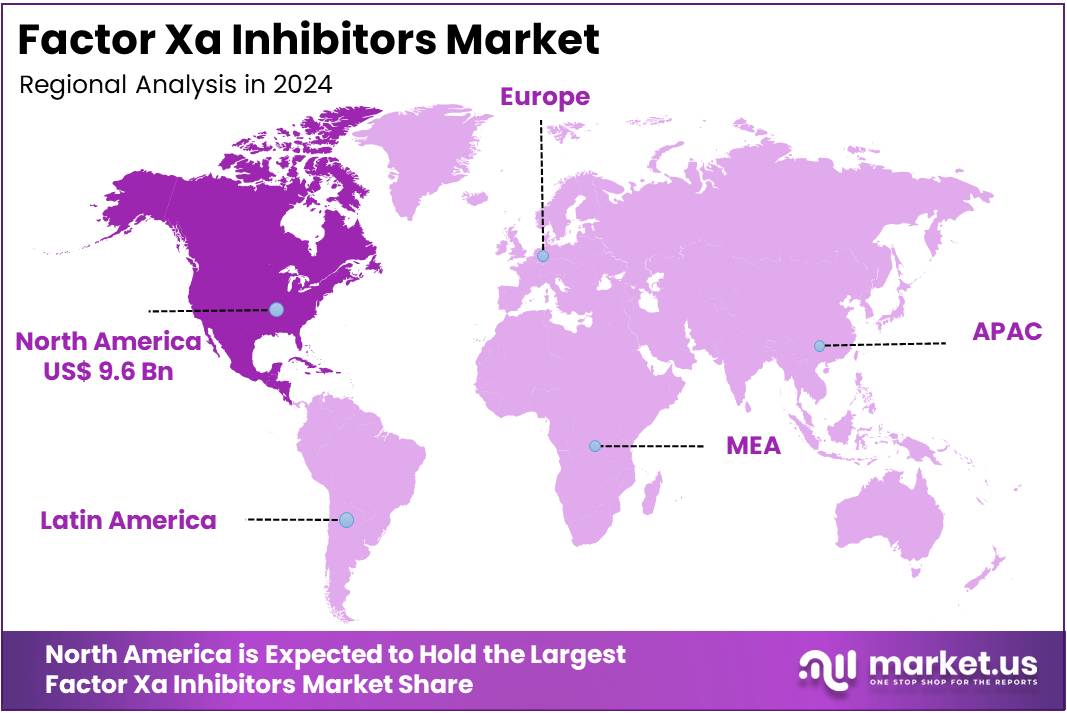

- North America led the market by securing a market share of 41.2% in 2023.

Product Type Analysis

Oral drugs dominate the Factor Xa inhibitors market with a significant share of 64.5%. This segment’s growth is expected to continue as oral drugs offer significant advantages in terms of patient convenience and ease of administration compared to injections. Oral Factor Xa inhibitors, such as rivaroxaban and apixaban, are increasingly preferred due to their ability to be taken in tablet form without the need for frequent monitoring, unlike traditional anticoagulants like warfarin. The increasing prevalence of conditions such as atrial fibrillation and deep vein thrombosis, which require long-term anticoagulation therapy, is projected to fuel the demand for oral drugs.

Furthermore, oral Factor Xa inhibitors are anticipated to gain more market share as new formulations and combinations of these drugs are developed, making treatment regimens more effective and patient-friendly. The growing number of patients seeking alternatives to injectable anticoagulants is likely to drive further demand for oral Factor Xa inhibitors. The simplicity of once-daily or twice-daily dosing regimens, along with better safety profiles and fewer dietary restrictions, are expected to enhance the segment’s growth in the coming years.

Application Analysis

Atrial fibrillation (AF) is the leading application segment in the Factor Xa inhibitors market, with a share of 59.8%. This growth is driven by the high incidence of AF globally, particularly in aging populations who are at an increased risk of developing the condition. AF is one of the most common causes of stroke, and the growing awareness of the importance of anticoagulation therapy in managing stroke risk in these patients is expected to increase demand for Factor Xa inhibitors. The increasing number of patients diagnosed with AF, along with advancements in diagnosis and treatment protocols, is anticipated to drive market growth.

Additionally, the approval of new Factor Xa inhibitors specifically targeted for AF patients, combined with improved patient outcomes and reduced risks of bleeding, will likely contribute to the market’s expansion. The shift toward more patient-friendly anticoagulation options, such as oral Factor Xa inhibitors, is expected to further enhance the demand within this segment. With a growing focus on personalized medicine and optimized treatment plans for AF patients, the atrial fibrillation application segment is projected to maintain its dominant position in the Factor Xa inhibitors market for the foreseeable future.

Key Market Segments

By Product Type

- Oral Drugs

- Injections

By Application

- Atrial Fibrillation

- Pulmonary Embolism

- Others

Drivers

Increasing Incidence of Atrial Fibrillation and Venous Thromboembolism is Driving the Market

The increasing global incidence of atrial fibrillation (AF) and venous thromboembolism (VTE), including deep vein thrombosis (DVT) and pulmonary embolism (PE), serves as a primary driver propelling the factor Xa inhibitors market. These conditions significantly elevate the risk of blood clot formation, necessitating effective anticoagulant therapies to prevent serious complications like stroke and recurrent VTE events. Factor Xa inhibitors offer a significant advantage over traditional anticoagulants due to their predictable pharmacokinetics, fewer drug-food interactions, and no requirement for routine coagulation monitoring, making them a preferred choice for long-term management.

The US Centers for Disease Control and Prevention (CDC) continuously monitors cardiovascular health. As of their most recent updates in 2024, AF affects approximately 2.7 to 6.1 million people in the United States, with projections indicating a substantial increase in prevalence over the coming decades due to an aging population. Similarly, the CDC notes that VTE affects an estimated 350,000 to 600,000 people in the US annually. This growing patient population with a high risk of thromboembolic events creates a sustained and expanding demand for effective, safe, and convenient anticoagulant options, directly driving the adoption and growth of factor Xa inhibitors.

Restraints

Risk of Bleeding and Challenges in Reversal are Restraining the Market

The inherent risk of bleeding associated with all anticoagulants, including factor Xa inhibitors, coupled with existing challenges in their rapid reversal during critical situations, notably restrains the market. While factor Xa inhibitors generally demonstrate a favorable safety profile compared to older anticoagulants, major bleeding events, including gastrointestinal and intracranial hemorrhages, remain a serious concern for patients and healthcare providers.

Managing these bleeding complications effectively requires specialized reversal agents, and the immediate availability and cost of such antidotes can be limiting factors, particularly in emergency settings. A September 2024 review in PubMed Central examining bleeding in oral anticoagulant users across a nationwide cohort reported that the incidence rate of major bleeding was estimated to be 27.9 per 1000 patient-years. This figure, encompassing various oral anticoagulants, underscores the persistent challenge of bleeding events.

Furthermore, the need for careful patient selection, meticulous dosing, and awareness of potential drug-drug interactions to mitigate bleeding risk adds complexity to the clinical management of patients on these medications. These safety concerns and the complexities surrounding emergency reversal contribute to hesitancy among some prescribers and patients, thereby restraining the full market potential of these powerful anticoagulant drugs.

Opportunities

Development of Specific Reversal Agents and Broader Clinical Applications is Creating Growth Opportunities

The ongoing development and increasing availability of specific reversal agents for factor Xa inhibitors, coupled with the exploration of their use in broader clinical applications, are creating significant growth opportunities in the market. The availability of targeted antidotes like andexanet alfa for rapid reversal of factor Xa inhibitor activity in cases of life-threatening bleeding or urgent surgery addresses a critical safety concern, increasing physician confidence in prescribing these anticoagulants. This innovation mitigates one of the primary restraints on the market.

Furthermore, research into new indications beyond AF and VTE prophylaxis, such as use in specific oncological settings or in patients with renal impairment, promises to expand the patient pool eligible for these therapies. For example, in February 2025, Portola Pharmaceuticals (a subsidiary of Alexion, AstraZeneca Rare Disease) announced the initiation of a new Phase 3b/4 study for Andexxa (andexanet alfa) to further evaluate its use in patients experiencing major bleeding while on Factor Xa inhibitors, highlighting continued investment in safety and efficacy. This combination of enhanced safety through targeted reversal agents and the expansion into new therapeutic areas broadens the utility and adoption of factor Xa inhibitors, driving substantial market growth.

Impact of Macroeconomic / Geopolitical Factors

Global economic conditions, characterized by inflation and varying economic growth rates across regions, influence the factor Xa inhibitors market by impacting manufacturing costs and healthcare expenditure. The production of these advanced anticoagulant drugs involves intricate chemical synthesis and relies on a global supply chain for active pharmaceutical ingredients (APIs) and excipients. Rising energy costs and inflation for raw materials can directly increase manufacturing expenses for pharmaceutical companies.

For instance, the International Monetary Fund’s (IMF) World Economic Outlook Update in April 2024 noted that global inflation was projected to decline, but remained above pre-pandemic levels in many countries, impacting industries relying on complex manufacturing. Furthermore, geopolitical instability, such as regional conflicts or trade disputes, can disrupt these intricate supply chains, leading to delays in production or distribution.

This can result in localized shortages or increased costs due to logistical challenges and rerouting. However, these challenges also spur pharmaceutical companies to diversify their manufacturing footprints and build more resilient, geographically dispersed supply networks. This helps ensure a stable supply of these critical medications, ultimately fostering market stability and continuous patient access to factor Xa inhibitors even amidst global economic and geopolitical uncertainties.

Evolving US tariff policies are directly shaping the factor Xa inhibitors market by impacting the cost of imported inputs and influencing strategic decisions regarding domestic pharmaceutical production. While finished pharmaceutical products like factor Xa inhibitors are often deemed essential and may be exempt from broad tariffs, duties on crucial imported raw materials, specialized chemical intermediates, or advanced manufacturing equipment can significantly increase the cost of producing these drugs within the United States.

According to the US Census Bureau, the total value of imported medicinal and pharmaceutical products into the US reached US$90.2 billion in 2023, reflecting a substantial international supply chain where tariffs on various inputs can accumulate. This rise in input costs directly affects the profitability of factor Xa inhibitor manufacturers, potentially impacting their capacity for research and development or compelling them to adjust product pricing, which can burden patients and healthcare providers.

Conversely, these tariff measures, often coupled with government incentives like those highlighted by the US Department of Commerce’s investments in advanced pharmaceutical manufacturing through programs like the American Rescue Plan, increasingly encourage pharmaceutical companies to reshore or expand their manufacturing operations within the US. This strategic shift aims to reduce reliance on foreign supply chains for essential medications, enhancing national security in drug supply and fostering a more robust domestic manufacturing base for critical therapies like factor Xa inhibitors.

Latest Trends

Increased Adoption of Digital Health Solutions for Anticoagulation Management is a Recent Trend

A prominent recent trend significantly impacting the factor Xa inhibitors market in 2024 and continuing into 2025 is the increased adoption of digital health solutions, including mobile applications and telemedicine platforms, for anticoagulation management. These technologies are enhancing patient adherence, facilitating remote monitoring, and improving communication between patients and healthcare providers.

For individuals on long-term factor Xa inhibitor therapy, digital tools can provide reminders for medication intake, track symptoms, log bleeding events, and offer educational resources, empowering patients to manage their condition more effectively. Telemedicine consultations allow for virtual follow-ups, reducing the need for in-person clinic visits and making care more accessible, especially for patients in remote areas or those with mobility challenges.

While specific government-issued statistics on the widespread adoption rates for TPO-RA digital management for 2024 are not consolidated, a May 2025 report from the US Department of Health and Human Services (HHS) highlighted the continued expansion of telehealth services post-pandemic, noting a 3,800% increase in Medicare telehealth utilization from 2019 to 2021, a trend that persists for chronic disease management. This shift towards digitally-enabled care models optimizes patient management, improves safety by enabling timely interventions, and ultimately supports the sustained growth and wider utilization of factor Xa inhibitors.

Regional Analysis

North America is leading the Factor Xa Inhibitors Market

North America dominated the market with the highest revenue share of 41.2% owing to the increasing prevalence of cardiovascular conditions requiring anticoagulation, a preference for oral anticoagulant therapies over traditional alternatives, and expanded indications for these drugs. Atrial fibrillation (AF), a major indication for these therapies, affects a significant portion of the US adult population, with new estimates suggesting approximately 10.5 million adults, or 5% of the population, had the condition as of September 2024, a figure three times higher than previous projections. This rising patient pool directly translates to increased demand for effective anticoagulants.

Furthermore, the incidence of venous thromboembolism (VTE), which includes deep vein thrombosis (DVT) and pulmonary embolism (PE), continues to be substantial, with an estimated 60,000–100,000 Americans dying of VTE each year, as reported by the CDC. Major pharmaceutical companies have significantly contributed to this market expansion. For instance, Bristol Myers Squibb reported that Eliquis (apixaban) sales, a leading factor Xa inhibitor, were US$3,195 million for the fourth quarter of 2024 (including alliance revenues), demonstrating an 11% increase compared to the same period in 2023. This growth highlights the continued adoption and strong performance of these therapies in the North American healthcare landscape, supported by their favorable efficacy and safety profiles in preventing and treating thrombotic events.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the rising incidence of cardiovascular diseases, an aging population, improving diagnostic capabilities, and increasing patient access to advanced medical treatments across the region. Countries like China and Japan are experiencing a growing burden of conditions such as atrial fibrillation and venous thromboembolism, which necessitate effective anticoagulation.

For example, a 2025 study highlighted that while Asian populations with atrial fibrillation have a lower incidence risk of death compared to Caucasian populations, the number of people affected by atrial fibrillation in Asia-Pacific is expected to increase significantly by 2050. Governments and healthcare organizations across Asia Pacific are actively working to enhance public health awareness and improve the management of cardiovascular diseases. Leading pharmaceutical companies are significantly investing in the region to meet this growing demand.

Bristol Myers Squibb, a co-developer of Eliquis, maintains a strong presence in key Asia Pacific markets such as Australia, China, India, and Japan, indicating its strategic focus on the region. Pfizer, another co-developer of Eliquis, also has a robust investor relations presence in Asia, reflecting its commitment to these markets. These factors collectively suggest that the adoption and utilization of these advanced anticoagulant therapies will accelerate significantly across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the factor Xa inhibitors market adopt several strategies to drive growth. They focus on expanding their product portfolios by developing novel, more effective anticoagulants with improved safety profiles and convenience. Companies also invest in extensive clinical trials to explore new therapeutic indications, enhancing the range of conditions treated.

Strategic partnerships with research institutions and healthcare providers facilitate accelerated product development and regulatory approvals. Geographical expansion, especially in emerging markets, plays a crucial role in capturing untapped patient populations. Additionally, companies work on improving patient adherence through innovative drug delivery systems and patient support programs.

One key player, Bristol Myers Squibb, is a global leader in the pharmaceutical industry, with a strong focus on cardiovascular treatments. The company’s factor Xa inhibitor, Eliquis, has become a key product in the anticoagulant market, targeting conditions like atrial fibrillation and venous thromboembolism. Bristol Myers Squibb continues to expand its portfolio through ongoing research and clinical trials, aiming to improve treatment outcomes and broaden patient access. The company’s commitment to innovation and global reach strengthens its position as a leader in the market.

Top Key Players in the Factor Xa Inhibitors Market

- Viatris

- Shanghai Huilun Pharmaceutical

- Roche

- Pfizer

- Hansoh Pharma

- Daiichi Sankyo

- Bayer

- AstraZeneca Pharma India Ltd

Recent Developments

- In February 2024: Roche announced the launch of three new coagulation tests in markets accepting the CE mark, specifically designed for the oral Factor Xa inhibitors rivaroxaban, edoxaban, and apixaban.

- In January 2024: AstraZeneca Pharma India Ltd., a biopharmaceutical company focused on scientific innovation, revealed that the Central Drugs Standard Control Organization (CDSCO) in India had granted approval for the import and sale of Andexanet Alfa. This groundbreaking treatment addresses life-threatening bleeding caused by Factor Xa (FXa) inhibitors.

Report Scope

Report Features Description Market Value (2024) US$ 23.4 billion Forecast Revenue (2034) US$ 42.3 billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Oral Drugs and Injections), By Application (Atrial Fibrillation, Pulmonary Embolism, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Viatris, Shanghai Huilun Pharmaceutical, Roche , Pfizer, Hansoh Pharma, Daiichi Sankyo, Bayer, AstraZeneca Pharma India Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Factor Xa Inhibitors MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Factor Xa Inhibitors MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Viatris

- Shanghai Huilun Pharmaceutical

- Roche

- Pfizer

- Hansoh Pharma

- Daiichi Sankyo

- Bayer

- AstraZeneca Pharma India Ltd