Global Policosanol Market By Source(Sugarcane, Wheat Germ, Besswax, Others), By Form(Tablets, Capsules, Powder, Liquid), By Grade(0.90 Policosanol, 0.95 Policosanol, 0.99 Policosanol), By Extraction Process(Solvent Extraction, Supercritical Carbon Dioxide Extraction), By Application(Dietary supplements, Pharmaceutical drugs, Personal care and Cosmetics, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132044

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

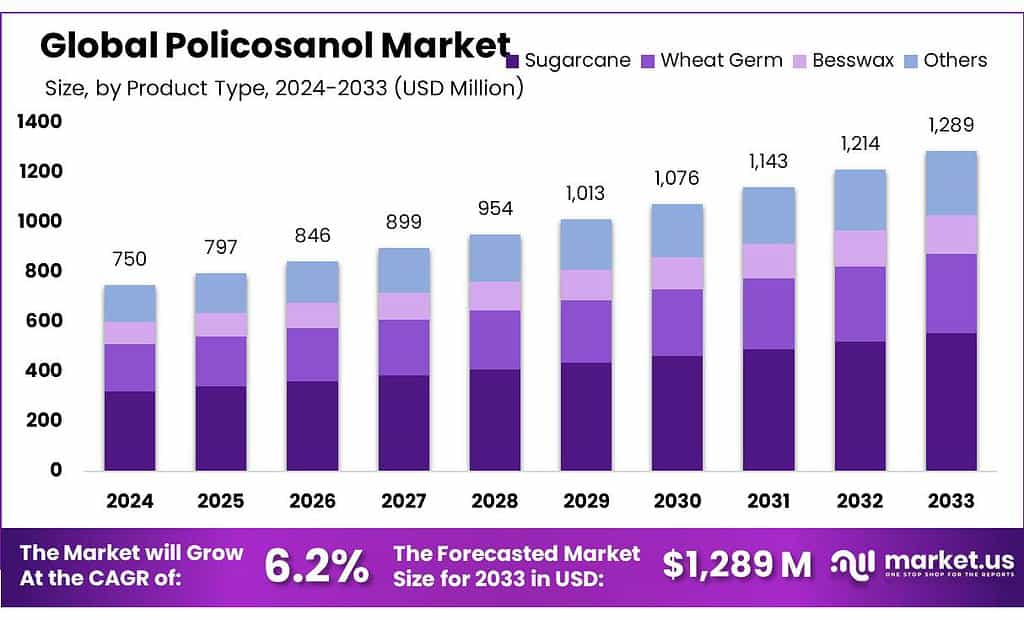

The Global Policosanol Market size is expected to be worth around USD 1289 Mn by 2033, from USD 750 Mn in 2023, growing at a CAGR of 6.2% during the forecast period from 2024 to 2033.

Policosanol, a natural supplement derived predominantly from sugarcane wax, also sourced from beeswax and wheat germ, is increasingly recognized for its health benefits, particularly in cholesterol management and cardiovascular health support. With cardiovascular diseases (CVDs) as a leading cause of death globally—claiming approximately 17.9 million lives annually according to the World Health Organization—the demand for effective, natural treatment alternatives like policosanol is on the rise.

In terms of market dynamics, the United States plays a critical role as a major exporter in the dietary supplement market, which saw international trade approximate $50 billion in 2021, with U.S. exports accounting for about $20 billion. This underscores the robust demand for dietary supplements containing natural ingredients like policosanol across various international markets.

Furthermore, the Government of India is proactively promoting the local production of active pharmaceutical ingredients (APIs) and key starting materials (KSMs) through Production Linked Incentive (PLI) schemes. These initiatives, with an allocation of ₹15,000 crore (approximately $2 billion), aim to enhance India’s manufacturing capabilities in the pharmaceutical sector, including supplements like policosanol. This strategic move is designed to position India as a global hub in pharmaceutical production, particularly focusing on biopharmaceuticals and complex generics.

This market environment suggests a favorable growth trajectory for policosanol, driven by increased health consciousness and supportive government policies aimed at bolstering pharmaceutical manufacturing and exports. As research continues to validate policosanol’s health benefits, the market is expected to expand further, catering to a consumer base eager for natural health solutions.

Key Takeaways

- Policosanol Market size is expected to be worth around USD 1289 Mn by 2033, from USD 750 Mn in 2023, growing at a CAGR of 6.2%.

- In 2023, Sugarcane held a dominant market position, capturing more than a 56.3% share in the policosanol market.

- In 2023, Tablets held a dominant market position, capturing more than a 38.3% share of the policosanol market.

- 0.90 Policosanol held a dominant market position, capturing more than a 45.5% share.

- Solvent Extraction held a dominant market position, capturing more than a 64.4% share.

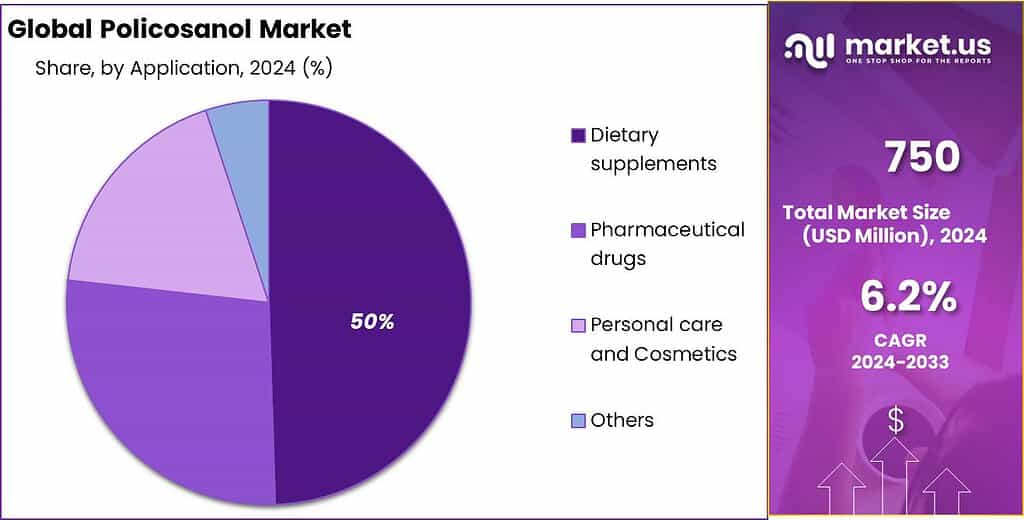

- Dietary Supplements held a dominant market position, capturing more than a 49.3% share.

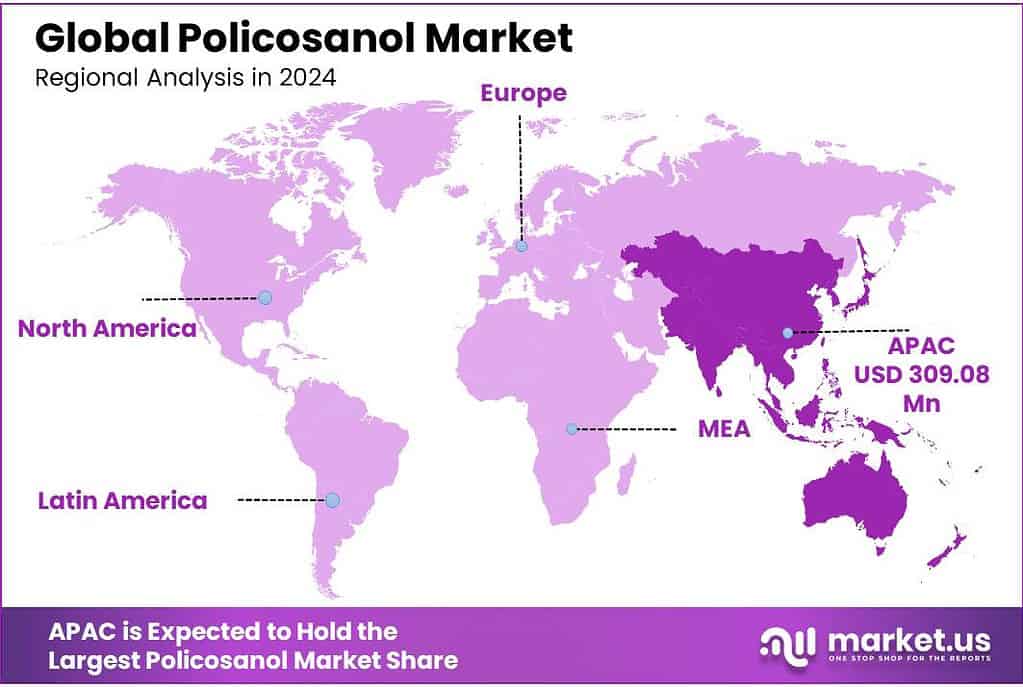

- Asia-Pacific (APAC) is the most dominant region in the policosanol market, holding a 41% market share valued at approximately USD 309.08 million.

By Source

In 2023, Sugarcane held a dominant market position, capturing more than a 56.3% share in the policosanol market. This is largely due to its widespread availability and cost-effectiveness in producing policosanol, which is highly valued for its cholesterol-lowering properties. Sugarcane-derived policosanol is a preferred choice in dietary supplements aimed at improving heart health.

Wheat Germ is another significant source for policosanol, known for its rich nutritional profile including vitamins, minerals, and antioxidants. Though it holds a smaller market share compared to sugarcane, wheat germ-derived policosanol is gaining traction for its health benefits beyond cholesterol management, such as improving skin health and boosting energy.

Beeswax, a less common source of policosanol, caters to niche segments within the market. Its natural origin and sustainable extraction process make it appealing, particularly within the organic and natural product markets. Beeswax-derived policosanol is also noted for its environmentally friendly production processes.

By Form

In 2023, Tablets held a dominant market position, capturing more than a 38.3% share of the policosanol market. This format’s popularity is primarily due to its convenience for dosage control and consumer preference for traditional oral delivery methods.

Capsules are also favored for their ease of ingestion and ability to mask the taste of policosanol, making them a preferred choice for those who are sensitive to taste. While capsules share many benefits with tablets, they often cater to consumers looking for rapid absorption or who avoid gelatin-based products.

Powder form of policosanol offers versatility, as it can be easily incorporated into foods and beverages. This form is appealing for its dosing flexibility and is often chosen by health enthusiasts looking to blend dietary supplements into their regular meals.

Liquid policosanol is valued for its fast absorption rate and ease of use, particularly among individuals who have difficulty swallowing pills. This form is suitable for a wide range of age groups, from children to the elderly, who may require alternative dosing options.

By Grade

In 2023, 0.90 Policosanol held a dominant market position, capturing more than a 45.5% share. This grade is widely utilized due to its effective balance of efficacy and cost, making it accessible for broad consumer use in supplements aimed at cholesterol management.

The 0.95 Policosanol grade, known for its higher purity, targets a more niche segment of the market. This grade appeals to consumers seeking premium products with potentially enhanced health benefits, reflecting a growing consumer trend towards high-quality supplement ingredients.

Meanwhile, 0.99 Policosanol represents the highest purity available, commanding a premium price and catering to the top tier of the market. This grade is favored in formulations where the utmost efficacy is desired, often used by brands that emphasize superior product quality.

By Extraction Process

In 2023, Solvent Extraction held a dominant market position, capturing more than a 64.4% share. This method is favored for its efficiency and cost-effectiveness, making it widely adopted across the industry for producing policosanol. It allows for the extraction of high yields of policosanol from various sources like sugarcane and beeswax, supporting large-scale production demands.

Supercritical Carbon Dioxide Extraction, on the other hand, is known for its environmental benefits and high purity output. Although it covers a smaller segment of the market, this method is gaining traction due to its ability to avoid solvent residues and lower energy consumption. It appeals particularly to manufacturers aiming for premium-quality policosanol products that meet stringent health and safety standards.

By Application

In 2023, Dietary Supplements held a dominant market position, capturing more than a 49.3% share. This segment benefits from growing consumer awareness about health and wellness, particularly in the management of cholesterol levels and cardiovascular health, making policosanol a popular ingredient in these products.

Pharmaceutical Drugs also make significant use of policosanol, especially in regions where it is approved for use in cholesterol-lowering medications. While this application does not share the same volume as dietary supplements, its importance grows with increasing clinical validation of policosanol’s benefits.

Personal Care and Cosmetics is another relevant application, utilizing policosanol’s beneficial properties such as emollient and skin-conditioning agent. This segment leverages the natural and wellness trend that has been expanding within the beauty industry.

Key Market Segments

By Source

- Sugarcane

- Wheat Germ

- Besswax

- Others

By Form

- Tablets

- Capsules

- Powder

- Liquid

By Grade

- 0.90 Policosanol

- 0.95 Policosanol

- 0.99 Policosanol

By Extraction Process

- Solvent Extraction

- Supercritical Carbon Dioxide Extraction

By Application

- Dietary supplements

- Pharmaceutical drugs

- Personal care and Cosmetics

- Others

Driving Factors

Growing Health Consciousness

One major driver of the policosanol market is the increasing global health consciousness, especially concerning cardiovascular health. Policosanol is acclaimed for its efficacy in reducing bad cholesterol (LDL) and increasing good cholesterol (HDL), which directly supports heart health. As awareness of its benefits spreads, demand escalates, particularly in regions burdened with high rates of heart-related ailments.

Government Initiatives Boosting Natural Product Markets

Government policies worldwide are increasingly favoring the production and distribution of natural health products, including policosanol. For instance, various government initiatives aiming to boost the pharmaceutical sector’s capabilities directly benefit the production and innovation in natural supplements. Such policies not only support local economies but also encourage research and development in natural health products, providing a stable environment for the policosanol market to thrive.

Impact of Global Health Policies and Economic Development

Global health policies focusing on reducing the prevalence of chronic diseases such as cardiovascular conditions also drive the policosanol market. Economic development in emerging markets increases disposable incomes, enabling more individuals to invest in health-promoting supplements, thus expanding the consumer base for policosanol products. These trends are complemented by global movements toward preventive healthcare, further bolstering the market.

Restraining Factors

High Competition from Prescription Medications

One of the significant restraining factors for the growth of the policosanol market is the stiff competition it faces from well-established prescription medications used for lowering cholesterol. These pharmaceutical options often demonstrate high efficacy with proven results, which can discourage consumers from opting for alternative solutions like policosanol, especially in markets where such medications are readily available and commonly prescribed by healthcare providers.

Economic Barriers in Low-Income Markets

Another considerable challenge is the economic aspect affecting policosanol’s adoption, particularly in low-income regions. Despite its natural appeal, the high cost of policosanol supplements can be a barrier for widespread adoption in markets with limited healthcare funding or lower consumer purchasing power. This economic factor can significantly limit the market growth, as consumers in these regions might opt for more affordable treatment options.

Regulatory and Market Access Challenges

Lastly, the policosanol market also encounters challenges related to regulatory approvals and market access. Navigating the complex landscape of health regulations and gaining market entry can be particularly challenging for natural supplements. These hurdles include demonstrating the efficacy and safety of policosanol to regulatory bodies, which can be both time-consuming and costly, potentially delaying market access and affecting growth prospects.

Growth Opportunity

Increasing Demand in Cardiovascular Health Management

Policosanol presents a significant growth opportunity in the global health supplement market, particularly as an effective natural treatment for cardiovascular diseases (CVD). With CVDs remaining a leading cause of death worldwide, policosanol’s cholesterol-modulating properties make it a valuable product. The World Health Organization estimates that 17.9 million people die annually from CVDs, highlighting the critical need for effective management strategies. Policosanol’s ability to improve cholesterol profiles could drive its adoption in preventive healthcare regimes across various demographics.

Support from Government Health Initiatives

Government initiatives aimed at improving public health outcomes present another growth avenue for policosanol. For example, many governments are promoting the use of natural supplements to combat the high incidence of non-communicable diseases. In India, the government’s Production Linked Incentive (PLI) schemes encourage local manufacturing of pharmaceuticals, including natural supplements like policosanol. These initiatives not only promote domestic production but also support market growth by making these health solutions more accessible and affordable to the public.

Rise in Health and Wellness Trends

The increasing consumer interest in health and wellness is a significant driver for the policosanol market. The global wellness industry, valued at trillions of dollars, continues to expand as individuals seek out natural and safer alternatives to synthetic drugs. Policosanol, derived from sources like sugarcane and beeswax, appeals to the growing segment of consumers who prefer organic and non-chemical products. This trend is supported by rising health consciousness and a shift towards preventive healthcare, which is particularly strong in regions with growing middle-class populations and increasing disposable incomes.

Latest Trends

Rising Popularity in Cardiovascular Health Management

A prominent trend in the policosanol market is its growing use in managing cardiovascular diseases, leveraging its cholesterol-lowering properties. This natural supplement is being increasingly recognized for its potential to improve cardiovascular health, especially in areas with high prevalence of heart-related illnesses. This rising awareness and subsequent demand are driving significant market growth, particularly in regions like Asia-Pacific where health and wellness consciousness is on the rise.

Expansion in Emerging Markets

Emerging markets are presenting substantial growth opportunities for policosanol due to increasing healthcare expenditures and supportive government initiatives. In countries like India and Japan, the growth of the pharmaceutical sector, driven by both government support and rising consumer health awareness, is particularly beneficial for the expansion of the policosanol market. These markets are capitalizing on policosanol’s health benefits, positioning it as a favorable option in preventative healthcare.

Growth in Product Development and Innovation

The policosanol market is also experiencing a trend towards innovation and diversification of source materials beyond traditional ones like sugarcane and beeswax. New extraction methods and the exploration of different source materials such as rice bran and various grasses are enhancing product offerings and market reach. These innovations are not only improving the efficiency and sustainability of policosanol production but also catering to a broader range of consumer preferences and needs.

Regional Analysis

Asia-Pacific (APAC) is the most dominant region in the policosanol market, holding a 41% market share valued at approximately USD 309.08 million. This dominance is driven by significant consumer interest in natural health products and robust growth in pharmaceutical sectors within countries like India and China. The region benefits from increasing healthcare expenditure and supportive government policies aimed at bolstering local manufacturing capabilities.

North America follows, with a strong emphasis on heart health and preventive care driving demand for policosanol. The market here is supported by a well-established dietary supplement industry and heightened consumer awareness regarding the benefits of natural cholesterol management solutions. Regulatory support for natural health products further underpins market growth.

Europe presents a mature market with increasing demand for policosanol in Western European countries, driven by an aging population and rising preference for natural supplements over synthetic therapeutic options. The European market is also seeing a shift towards more stringent regulations which could affect market dynamics by reinforcing quality and safety standards.

Latin America has shown promising growth, particularly in countries like Brazil, where there is a rich tradition of using natural products for health and wellness. The region’s market is expanding due to growing urbanization and health awareness, coupled with increasing economic stability, which is enhancing consumer spending power on health products.

Middle East & Africa (MEA), although smaller in comparison to other regions, is experiencing gradual growth in the demand for policosanol. This is due to rising awareness of non-communicable diseases and improving healthcare infrastructure which is fostering wider availability and acceptance of new supplement products like policosanol.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The policosanol market features a diverse array of key players, each contributing to the global supply with unique product offerings and strategic market approaches. Ambe Phytoextracts Pvt. Ltd and Bioriginal Food & Science Corp are notable for their extensive range of natural extracts and dietary supplements, leveraging robust R&D capabilities to innovate within the space. BOC Sciences and Botanic Healthcare stand out for their focus on scientific rigor and comprehensive product portfolios that address both consumer health and industrial needs.

Companies like Douglas Laboratories and Garuda International Inc. maintain a strong presence in North America, known for their high-quality standards and commitment to natural product purity. Similarly, Hainan Zhongxin Chemical and Herblink Biotech Corporation are key players in the Asia-Pacific market, capitalizing on regional growth opportunities by expanding their reach in local and international markets. HUZHOU SHENGTAO BIOTECH LLC and India Glycols Ltd emphasize sustainable practices and vertical integration to control quality and cost.

European firms such as Laboratories Dalmer S.A. are recognized for their pioneering work in clinical research and policosanol’s therapeutic applications, which complement efforts by companies like MANUS AKTTEVA BIOPHARMA LLP and Marcor in broadening the scientific understanding and consumer base for policosanol. Now Foods, Risun Bio Tech Inc., and Sabinsa continue to enhance their global footprint through a combination of organic growth and strategic partnerships, focusing on accessibility and consumer health trends.

Sami Labs Ltd., SHREEJI PHARMA INTERNATIONAL, Sunpure Extracts Pvt Ltd., and ZXCHEM Group each play crucial roles in their respective markets, driving forward the policosanol industry with innovative products and a strong focus on market demands. These companies’ efforts are essential in promoting policosanol as a valuable component of health supplements worldwide.

Top Key Players in the Market

- Ambe Phytoextracts Pvt. Ltd

- Bioriginal Food & Science Corp

- BOC Sciences

- Botanic Healthcare

- Douglas Laboratories

- Garuda International Inc.

- Hainan Zhongxin Chemical

- Herblink Biotech Corporation

- HUZHOU SHENGTAO BIOTECH LLC

- India Glycols Ltd

- Laboratories Dalmer S.A.

- MANUS AKTTEVA BIOPHARMA LLP

- Marcor

- Now Foods

- Risun Bio Tech Inc.

- Sabinsa

- Sami Labs Ltd.

- SHREEJI PHARMA INTERNATIONAL

- Sunpure Extracts Pvt Ltd.

- ZXCHEM Group

Recent Developments

- In 2023 Ambe Phytoextracts Pvt. Ltd is recognized in the policosanol market for its manufacturing and export of clinically tested branded ingredients, standardized botanical extracts, and Active Pharmaceutical Ingredients (APIs).

- In 2023 Bioriginal leverages its 30 years of global experience to ensure that their products meet the highest standards of quality and efficacy.

Report Scope

Report Features Description Market Value (2023) USD 750 Mn Forecast Revenue (2033) USD 1289 Mn CAGR (2024-2033) 6.2% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source(Sugarcane, Wheat Germ, Besswax, Others), By Form(Tablets, Capsules, Powder, Liquid), By Grade(0.90 Policosanol, 0.95 Policosanol, 0.99 Policosanol), By Extraction Process(Solvent Extraction, Supercritical Carbon Dioxide Extraction), By Application(Dietary supplements, Pharmaceutical drugs, Personal care and Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ambe Phytoextracts Pvt. Ltd, Bioriginal Food & Science Corp, BOC Sciences, Botanic Healthcare, Douglas Laboratories, Garuda International Inc., Hainan Zhongxin Chemical, Herblink Biotech Corporation, HUZHOU SHENGTAO BIOTECH LLC, India Glycols Ltd, Laboratories Dalmer S.A., MANUS AKTTEVA BIOPHARMA LLP, Marcor, Now Foods, Risun Bio Tech Inc., Sabinsa, Sami Labs Ltd., SHREEJI PHARMA INTERNATIONAL, Sunpure Extracts Pvt Ltd., ZXCHEM Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ambe Phytoextracts Pvt. Ltd

- Bioriginal Food & Science Corp

- BOC Sciences

- Botanic Healthcare

- Douglas Laboratories

- Garuda International Inc.

- Hainan Zhongxin Chemical

- Herblink Biotech Corporation

- HUZHOU SHENGTAO BIOTECH LLC

- India Glycols Ltd

- Laboratories Dalmer S.A.

- MANUS AKTTEVA BIOPHARMA LLP

- Marcor

- Now Foods

- Risun Bio Tech Inc.

- Sabinsa

- Sami Labs Ltd.

- SHREEJI PHARMA INTERNATIONAL

- Sunpure Extracts Pvt Ltd.

- ZXCHEM Group