Global Expanded Polypropylene Foam Market, By Product (High Density, Low Density, and Medium Density), By Application (Bumpers, Roof Pillars, and Other Applications), By End-User(Automotive, Packaging, Consumer goods, Appliances, Oil & Gas), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Dec 2024

- Report ID: 57497

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

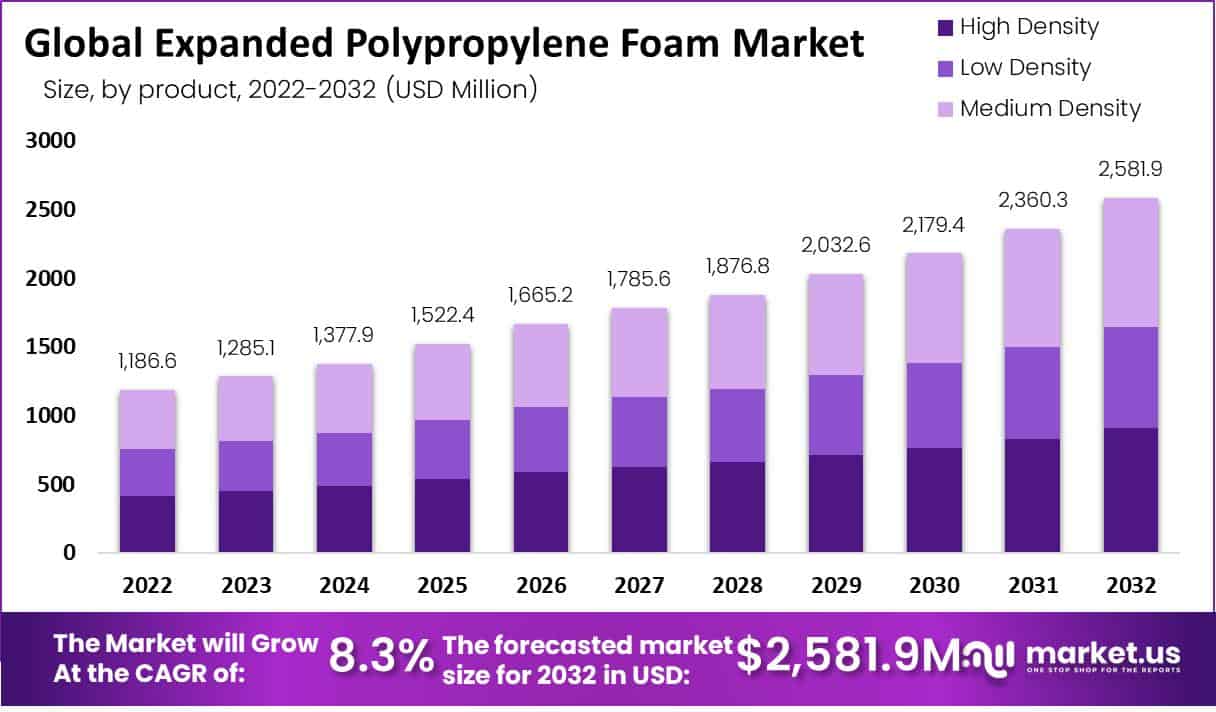

In 2022, the Global Expanded Polypropylene Foam Market was valued at USD 1,186.6 million and is expected to reach USD 2581.9 million in 2032. This market is estimated to register a CAGR of 8.3% between 2023 and 2032.

Products are used in numerous applications like consumer goods, packaging, building, and construction, and others have contributed to an expansion.

Expanded polypropylene (EPP) foam does have a strong preference to be utilized for high-impact resistance for sensitive materials like computer equipment and circuit boards.

It is anticipated that the more expanded polypropylene (EPP) foam will find its way into toys and sporting products as consumers become more vigilant about their physical health. These factors are expected to boost demand for expanded polypropylene foam globally.

Key Takeaways

- The global expanded polypropylene foam market is projected to experience steady expansion through 2032 with an expected compound annual growth rate (CAGR) of 8.3% from 2023-2032.

- Expanded polypropylene foam has seen increasing popularity due to an emphasis on eco-friendly and lightweight materials, prompting rising market demands in various applications.

- The expanded polypropylene foam market can be divided into high density, low density, and medium density segments; among these categories, high-density was by far the market leader, accounting for 42.0% market share as of 2022.

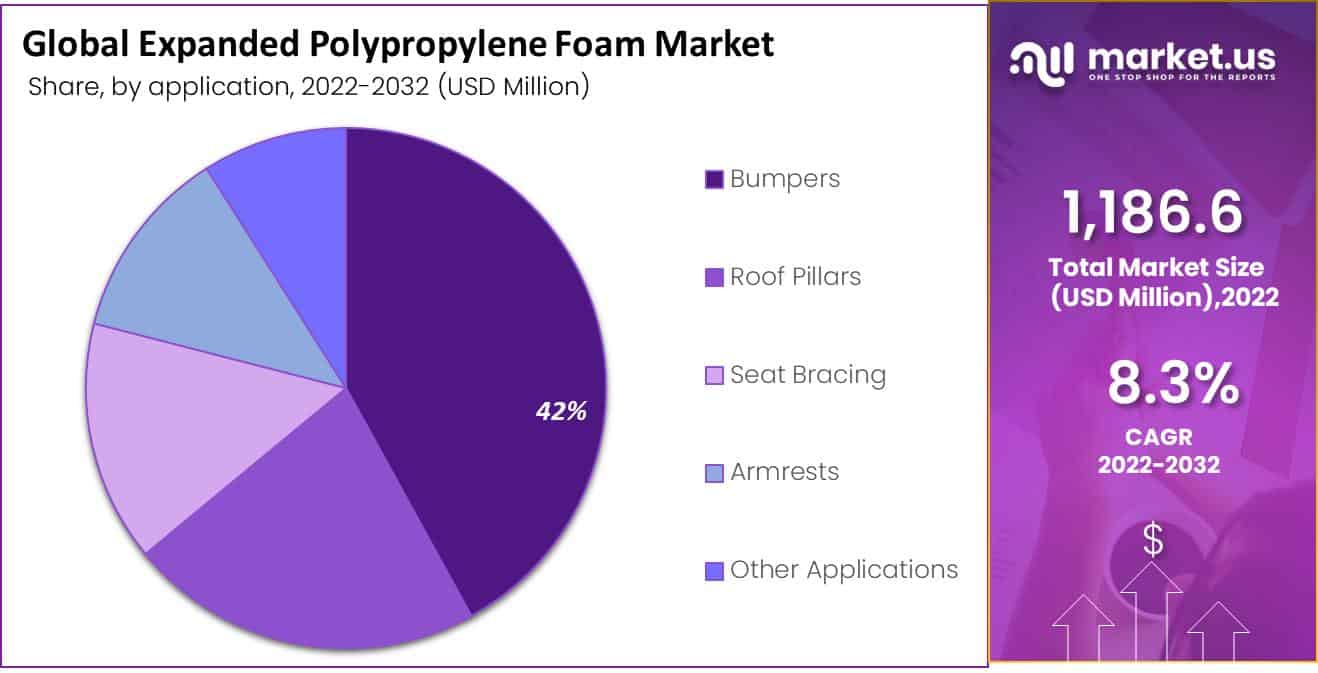

- Bumpers applications were the clear market leaders, accounting for 42% of market revenue in 2022 due to rising use in automotive applications of expanded polypropylene foam.

- EPP foam finds widespread application in automotive components due to its cost-effectiveness, impressive mechanical properties and malleability – properties which allow potential weight savings of 10% for up to 7% fuel savings! This leads to potential reduction of vehicle weight.

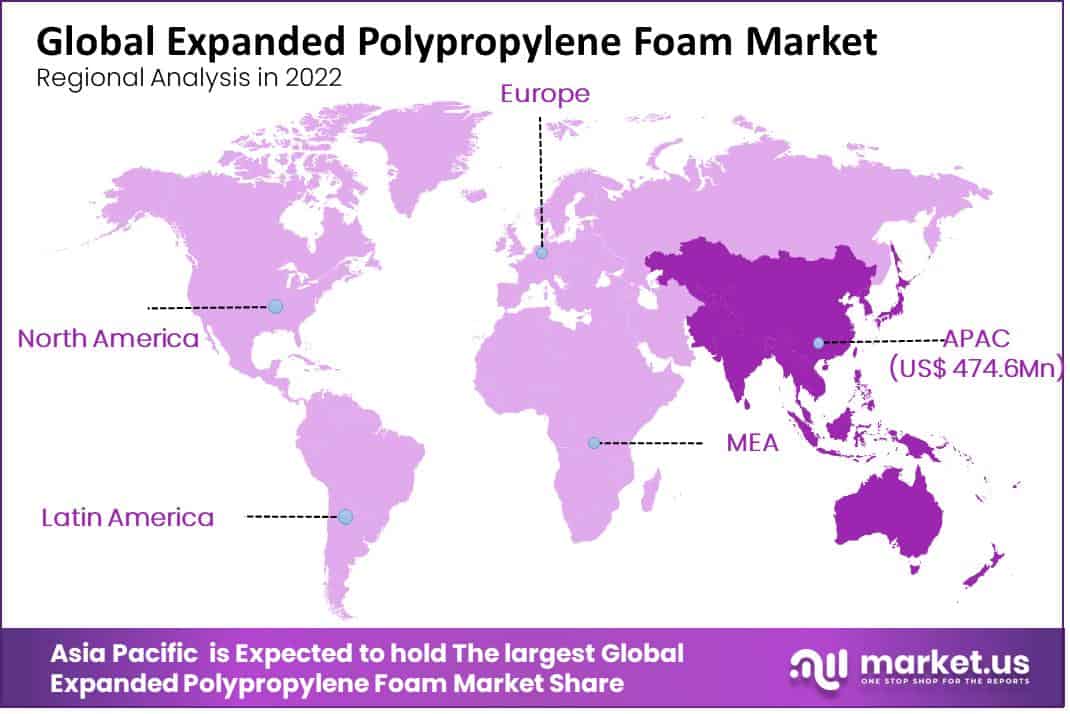

- Asia Pacific held the highest market share for expanded polypropylene foam sales – accounting for 40.0 % of revenue generated worldwide.

Driving Factors

Growing demand from the automotive industry:

Expanded polypropylene foam is widely used in the automotive industry for many different purposes, including bumpers, door panels, and instrument panels. The material is a great option for automakers looking to lighten vehicles and increase fuel efficiency due to its lightweight, toughness, and impact resistance.

The need for expanded polypropylene foam in the automotive industry is anticipated to increase worldwide.

Increased use in the packaging industry:

Expanded polypropylene foam is increasingly being used in the packaging sector, where it is used for protective packaging, insulation, and cushioning.

The demand for expanded polypropylene foam in the packaging sector is being driven by the growth of e-commerce and the rising demand for sustainable packaging solutions.

Restraining Factors

Polypropylene, one of the raw materials needed to make expanded polypropylene foam, can be expensive and subject to fluctuations in the global market. This may lower the makers’ profitability and raise the cost of the finished goods.

Expanded polypropylene foam faces competition from other lightweight materials, such as expanded polystyrene (EPS) foam, which is a cheaper alternative.

Furthermore, new materials and technologies are always being developed that could potentially replace the use of expanded polypropylene foam in certain applications. Even though EPP foam is frequently used in some areas, it may be less well-known or less readily available in other regions.

Its potential for adoption and expansion in those areas may be impacted by this. Expanded polypropylene foam can be recycled, but it requires specific tools and facilities and might be challenging. This may reduce the amount of recycled EPP foam and affect the material’s overall sustainability rating.

By Product Analysis

Based on the product, the market for expanded polypropylene foam is segmented into high density, low density, and medium density. The high-density segment dominated the market and held more than 42.0% of the overall market share in 2022.

High-density expanded polypropylene foams are used in energy management systems for automotive safety components like bumpers and side skirts.

As a result of their resilience to impacts, they are frequently utilized in manufacturing packaging applications.

Throughout the course of the projection period, there would probably have been a rise in the requirement for high-density expanded polypropylene (EPP) foam due to the rising popularity of lightweight and premium products.

By Application Analysis

Based on application, the market for expanded polypropylene foam is segmented into Bumpers, Roof Pillars, Seat Bracing, Armrests, and Other Applications.

Due to the increasing use of expanded polypropylene foam in automotive, the bumpers application segment dominated the market and held more than 42.0% of the overall market share in 2022.

The rising demand for high-impact resistant packaging options for vehicle interior and exterior components is expected to grow the market. EPP foam bumpers are used in car interiors in the automotive industry to protect the consumer from accidents.

Moreover, they serve as crash absorbers and bumper reinforcements on the exterior of cars. Due to their capacity to absorb significant impact energy without distorting or shattering, expanded polypropylene foam bumpers are chosen over other materials.

By End-Users Analysis

Based on end-users, the market for expanded polypropylene foam is segmented into Automotive, Packaging, Consumer goods, Appliances, Oil & Gas, and Other End-Users. The automotive segment dominated the market.

EPP foam is frequently used in automotive parts due to its inexpensive cost, exceptional mechanical capabilities, and moldability. It helps in reducing vehicle weight by up to 10% allowing up to 7% fuel savings.

Also, it helps decrease the emission of VOCs from automotive interior components. A greater quantity of energy can be absorbed and dispersed when metals are added to EPP foam. These elements are encouraging the development of eco-friendly vehicles.

Key Market Segments

Based on Product

- High Density

- Low Density

- Medium Density

Based on Application

- Bumpers

- Roof Pillars

- Seat Bracing

- Armrests

- Other Applications

Based on End-User

- Automotive

- Packaging

- Consumer goods

- Appliances

- Oil & Gas

- Other End-Users

Growing Opportunities

The expanding packaging and automotive sectors in nations are expected to drive the need for expanded polypropylene foam. There is a great deal of opportunity for the development of new uses for expanded polypropylene foam, including in the building sector for applications like insulation and cushioning.

Expanded polypropylene foam can be utilized to make toys and sports equipment, which offers enormous growth potential.

Technology and manufacturing process improvements should lower production costs and boost the effectiveness of expanded polypropylene foam manufacturing. As a result, expanded polypropylene foam might become more affordable and be used in more applications.

Expanded polypropylene foam is well-positioned to gain a larger share of the market because of the rising need for lightweight, sustainable materials across a variety of sectors.

Manufacturers seeking to reduce weight and increase sustainability will find it an appealing alternative due to its distinctive qualities, including durability, flexibility, and impact resistance.

Expanded polypropylene foam is widely utilized in the manufacture of electric vehicle batteries, hence it is anticipated that the market for electric vehicles would expand and drive demand for the material. The need for expanded polypropylene foam will increase along with the electric vehicle sector.

Latest Trends

Expanded polypropylene foam is being used more frequently in the medical sector for packaging and cushioning purposes. The material is a desirable choice for medical device producers looking to safeguard sensitive instruments during transit due to its lightweight and impact resistance.

Companies looking to lessen their environmental impact and satisfy consumer demand for environmentally friendly goods are driving up demand for sustainable packaging solutions.

EPP foam is a desirable solution for sustainable packaging because of its lightweight and recyclable qualities. For interior parts like seating and overhead compartments, EPP foam is being used more and more in the aerospace sector.

Manufacturers of aerospace products are particularly drawn to the material’s lightweight qualities due to their desire to lighten their products and increase their fuel efficiency.

Regional Analysis

In 2022, Asia Pacific dominated the expanded polypropylene foam market, accounting for 40.0% of the total revenue share. The manufacture of electronics and consumer goods is expanding rapidly in Japan, India, and China as a result of these countries’ quick industrialization, accessibility to raw resources, and ease of access to labor.

Throughout the projection period, these elements are anticipated to fuel demand for expanded polypropylene foam.

Due to expanding end-user sectors in the United States and Canada, North America’s revenue share was 29.0% in 2022. The U.S. automotive industry’s shift in emphasis towards electricity-powered and fuel-efficient vehicles has resulted in a number of breakthroughs and technological developments, which have raised consumer demand for high-end electric automobiles.

Because of the increased demand for fuel-efficient automobiles and the increasing use of high-performance materials for auto parts, chemically stable EPP foam is preferred over the current options.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

key players are focused working on developing polymers for the production of EPP foam due to the rising demand for EPP components from the appliances and automotive industry. This product is ideal for non-technical uses including furniture, leisure, and packaging because it has the lowest carbon footprint.

A majority of the global companies are expected to increase their polymer offer to the Asia Pacific, Central & South America, and the Middle East & Africa owing to high market growth potential in these regions given the growth of the EPP foam market.

Key Players

- JSP

- BASF SE

- Kaneka Corporation

- DS Smith

- Furukawa Electric Co., Ltd.

- Hanwha Group

- Sonoco Products

- Knauf Industries

- Izoblok

- Dongshin Industry Incorporated

- Clark Foam Products Corporation

- Paracoat Products Ltd.

- Molan-Pino South Africa

- Signode Industrial Group LLC

- Armacel

- Furukawa Electric Co., Ltd.

- Other Market Players

Recent Developments

- In April 2023, JSP Corporation said it expanded its EPP foam production in Japan. It will be done in 2024 and will increase their production by 50%.

- In May 2023, Kaneka Corporation created a new kind of EPP foam that is better for the environment. The new EPP foam is made with recycled materials and can be recycled.

- In June 2023, BASF SE made a deal with a big car maker to supply EPP foam for a long time. It will start in 2024.

Report Scope

Report Features Description Market Value (2022) USD 1,186.6 Mn Forecast Revenue (2032) USD 2,581.9 Mn CAGR (2023-2032) 8.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (High Density, Low Density, Medium Density) By Application (Bumpers, Roof Pillars, Seat Bracing, Armrests, Other Applications) By End-User (Automotive, Packaging, Consumer goods, Appliances, Oil & Gas and Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape JSP, BASF SE, Kaneka Corporation, DS Smith, Furukawa Electric Co., Ltd., Hanwha Group, Sonoco Products, Knauf Industries, Izoblok, Dongshin Industry Incorporated, Clark Foam Products Corporation, Paracoat Products Ltd., Molan-Pino South Africa, Signode Industrial Group LLC, Armacel, Furukawa Electric Co., Ltd., Other Market Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

List the segments encompassed in this report on the Expanded Polypropylene Foam Market?Market.US has segmented the Expanded Polypropylene Foam Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Product, market has been segmented into High Density, Low Density and Medium Density. By Application, the market has been further divided into, Bumpers, Roof Pillars, Seat Bracing, Armrests and Other Applications.

Name the major industry players in the Expanded Polypropylene Foam Market.JSP, BASF SE, Kaneka Corporation, DS Smith, Furukawa Electric Co., Ltd., Hanwha Group, Sonoco Products, Knauf Industries, Izoblok and Other Key Players are the main vendors in this market.

What will be the market size for Expanded Polypropylene Foam Market in 2032?In 2032, the Expanded Polypropylene Foam Market will reach USD 1186.6 million.

What will be the market size for Expanded Polypropylene Foam Market in 2032?In 2032, the Expanded Polypropylene Foam Market will reach USD 2581.9 million.

Expanded Polypropylene Foam MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Expanded Polypropylene Foam MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- JSP

- BASF SE

- Kaneka Corporation

- DS Smith

- Furukawa Electric Co., Ltd.

- Hanwha Group

- Sonoco Products

- Knauf Industries

- Izoblok

- Dongshin Industry Incorporated

- Clark Foam Products Corporation

- Paracoat Products Ltd.

- Molan-Pino South Africa

- Signode Industrial Group LLC

- Armacel

- Furukawa Electric Co., Ltd.

- Other Market Players