Global Evaporated Milk Market By Type(Whole, Skimmed), By Packaging Type(Cans, Tetrapacks, Others), By Distribution Channel(Offline, Online), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 12436

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

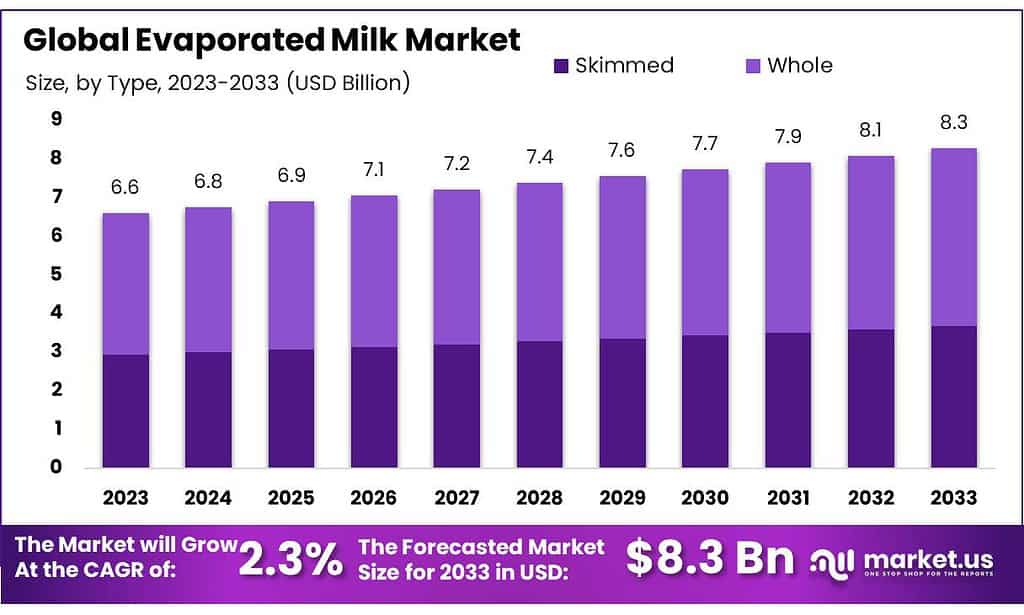

The global evaporated milk market size is expected to be worth around USD 8.3 billion by 2033, from USD 6.6 billion in 2023, growing at a CAGR of 2.3% during the forecast period from 2023 to 2033.

The market’s expansion can be ascribed to elements including the downstream application sector’s broad scope, good nutritional value, long shelf life, and moderate pricing. A surge in household applications for evaporated milk is also attributed to changing culinary trends.

Fresh milk has been compressed so that 60% of its water content is removed, known as evaporated milk. Consumers enjoy unsweetened condensed milk that is made from evaporated milk. Demand for evaporated milk is expanding in the Evaporated Milk market due to its general use in various end-uses, such as food and beverage products, including shakes, coffee, and others.

This made evaporated milk, particularly popular before refrigeration, a safe and dependable alternative for perishable fresh milk since it could be easily conveyed to regions lacking safe milk production or storage. Evaporated milk is mainly used in food processing and beverages based on milk in the food and beverage industry.

Key Takeaways

- Market Growth: The global evaporated milk market is set to reach USD 8.3 billion by 2033, growing at a 2.3% CAGR from its 2023 valuation of USD 6.6 billion.

- Dominant Type: In 2023, whole evaporated milk held a leading market position with over 55.6% share, valued for its rich taste and creaminess.

- Packaging Preference: Cans, known for durability, dominated the market in 2023, holding a robust share, while Tetra Packs gained ground for eco-friendly packaging.

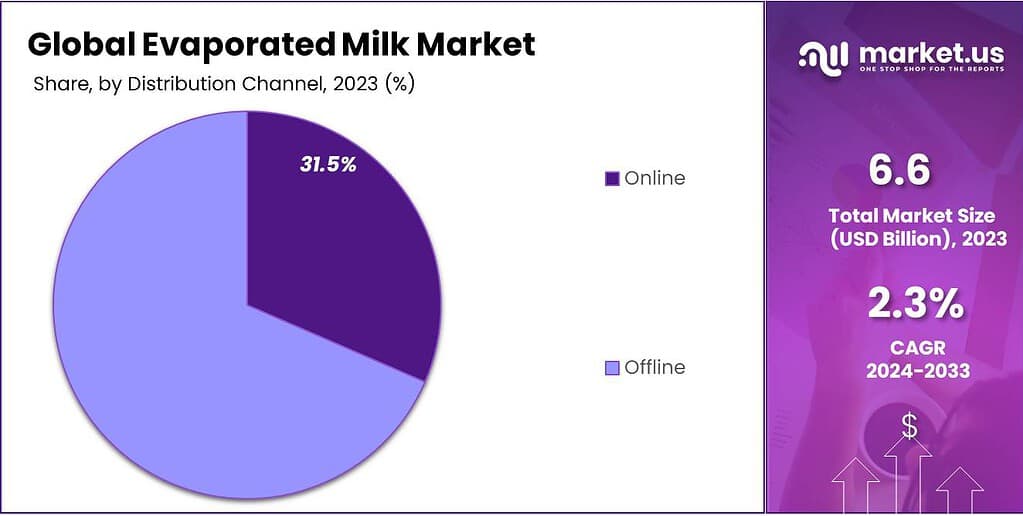

- Sales Channels: In 2023, offline sales dominated with over 68.5% share, but the rising influence of online platforms signals a changing distribution landscape.

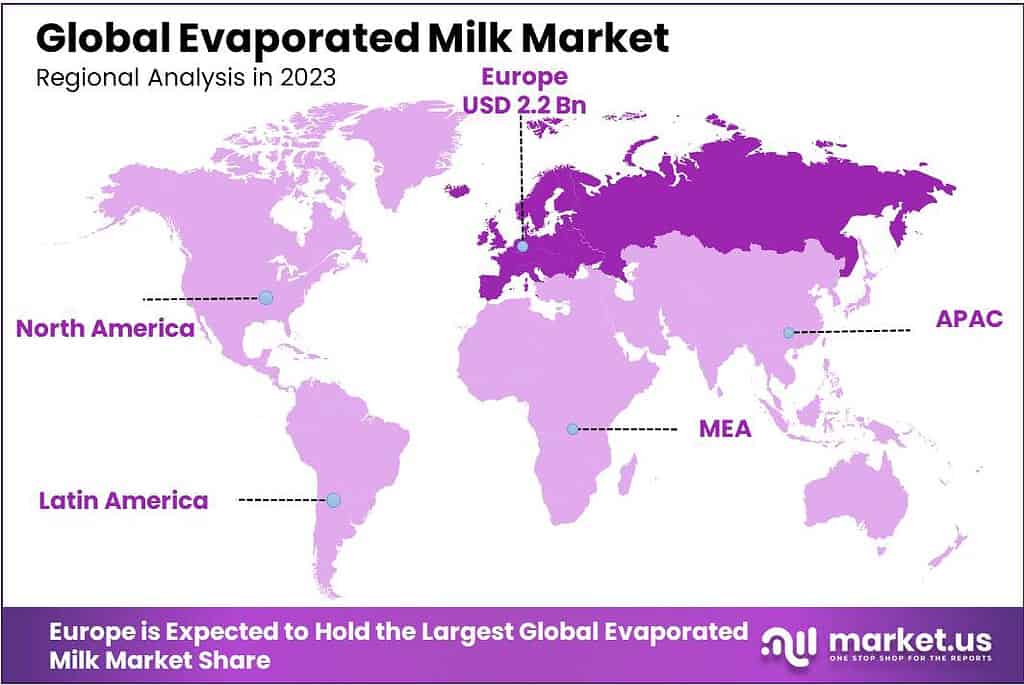

- Regional Dynamics: Europe led with over 33.5% revenue share in 2023, driven by regulatory restrictions on unhealthy foods and growing concerns about sugar content.

- Asia Pacific Growth: Anticipated to be the fastest-growing region with a 2.4% CAGR, driven by high demand for milk substitutes in developing nations like Thailand and Malaysia.

By Type

In 2023, the Whole evaporated milk type had the leading market position, holding over 55.6% share. Whole evaporated milk retains all its natural fat content, providing a richer taste and creamier texture compared to skimmed varieties.

Whole Evaporated Milk: This type contains the full-fat content of milk, preserving the natural richness and creaminess. It’s commonly used in various recipes, desserts, and coffee due to its fuller flavor.

Skimmed Evaporated Milk: Skimmed evaporated milk has had most of its fat content removed, making it lower in calories and fat compared to Whole. It’s favored by those seeking a lighter option without compromising on the milk’s texture.

These different types offer consumers choices based on their dietary preferences, taste preferences, and specific culinary requirements, catering to various cooking and baking needs.

By Packaging Type

In 2023, cans held a dominant market share in the evaporated milk market, a trend largely driven by their durability and convenience. Cans, traditionally made of tin-coated steel or aluminum, are renowned for their robustness, effectively preserving the product’s quality and extending its shelf life.

The popularity of cans can be attributed to their ease of storage and transportation, making them a preferred choice for both consumers and retailers. Additionally, the recyclability of metal cans aligns with increasing consumer demand for sustainable packaging solutions.

Tetra packs, another significant segment in the evaporated milk market, have also seen substantial growth. These packages are appreciated for their lightweight nature and compact design, which contribute to reduced transportation costs and storage space.

Tetra packs are predominantly made from renewable resources, thereby offering an eco-friendly packaging alternative. Their multi-layer construction ensures the long-term preservation of the milk without the need for refrigeration, catering to the needs of consumers seeking convenience and sustainability.

Distribution Channel Analysis

In 2023, Offline sales were the dominant force in the Evaporated Milk market, making up more than 68.5% of total sales. Offline distribution channels include supermarkets, grocery stores, and specialty food stores where consumers physically visit to purchase goods. These channels offer immediate access to products and the chance to inspect and choose from a variety of options. However, with the rising influence of online shopping, the convenience and accessibility of Evaporated Milk through e-commerce platforms are also growing steadily.

Skimmed Evaporated Milk: Skimmed evaporated milk has a lower fat content compared to whole milk. It’s prepared by removing most of the water content from fresh milk, resulting in a concentrated, slightly thinner product. Skimmed milk offers consumers looking to reduce their fat consumption and reap its healthful benefits an ideal beverage option.

Whole Evaporated Milk: Whole evaporated milk is known for its higher fat content compared to its skimmed equivalent, made by evaporating approximately 60% of fresh milk’s water content for a thicker texture and richer taste. Common uses for whole evaporated milk include culinary applications that require its creamy texture and unique flavors, like desserts.

Key Market Segments

By Type

- Whole

- Skimmed

By Packaging Type

- Cans

- Tetrapacks

- Others

By Distribution Channel

- Offline

- Online

Drivers

Versatile Use in Cooking: Evaporated milk is highly appreciated in cooking and baking due to its creamy texture and ability to enhance flavors. Its versatility in preparing various recipes, from savory dishes to desserts, drives its demand.

Extended Shelf Life: The extended shelf life of evaporated milk compared to fresh milk makes it a convenient option for consumers, reducing food wastage and ensuring a longer storage period without refrigeration.

Nutritional Value: It contains essential nutrients like calcium, protein, and vitamins, appealing to health-conscious consumers seeking nutritious dairy alternatives.

Affordable Option: Often offered at a lower price than fresh milk, evaporated milk is an affordable dairy option for consumers, catering to budget-conscious households.

Ease of Availability: Being readily available in both online and offline stores ensures its accessibility to a wide consumer base, contributing to its market demand.

Restraints

Perception of Freshness: Some consumers perceive evaporated milk as less fresh compared to regular milk, impacting its preference among certain demographics.

Competition from Alternatives: Evaporated milk faces stiff competition from a range of substitutes such as fresh milk, powdered milk, condensed milk, and plant-based alternatives like almond or soy milk, affecting its market growth.

Allergen Concerns: Individuals with lactose intolerance or milk allergies might avoid evaporated milk due to its lactose content, limiting its consumption among certain consumer groups.

Changing Dietary Preferences: Shifting consumer dietary preferences towards vegan or dairy-free options influences the market, prompting consumers to opt for non-dairy alternatives over evaporated milk.

Storage and Convenience Issues: Evaporated milk, though convenient for longer shelf life, might require refrigeration once opened, limiting its convenience for some consumers seeking non-refrigerated storage options.

Opportunities

Growing Health Awareness: Consumer trends toward healthier choices could open avenues for low-fat or fortified evaporated milk variants, tapping into health-conscious markets seeking nutritious dairy options.

Product Diversification: Innovations in flavor profiles or packaging designs can attract new consumer segments. Offering flavored or organic variants may appeal to a wider audience seeking diverse taste experiences or natural ingredients.

Market Expansion: Expanding into emerging markets or regions with lower market penetration presents a substantial growth opportunity. Targeting regions where evaporated milk is not yet widely available can significantly expand its consumer base.

Functional Ingredients: Incorporating functional additives like vitamins, probiotics, or minerals into evaporated milk formulations can create functional or fortified products, aligning with the growing demand for health-enhancing foods.

Rising Culinary Applications: Evaporated milk’s versatility in cooking and baking applications can be leveraged by promoting recipes and cooking tutorials, appealing to consumers looking for culinary inspiration and convenience.

Challenges

Competitive Market: The market faces tough competition from a wide range of dairy and non-dairy substitutes like condensed milk, powdered milk, and plant-based milk alternatives. Standing out and maintaining market share in a competitive landscape poses a challenge.

Changing Consumer Preferences: Evolving consumer preferences and dietary habits, including lactose intolerance or a shift toward vegan or plant-based diets, present challenges for traditional dairy products like evaporated milk.

Supply Chain Disruptions: The dairy industry often encounters supply chain challenges due to factors like seasonality, transportation issues, or fluctuations in milk supply, which can affect the consistent production of evaporated milk.

Health Concerns: Despite being a staple, health concerns related to saturated fats and caloric content in dairy products can hinder the market, especially amid increasing health-conscious consumer behavior.

Packaging and Sustainability: Environmental concerns related to packaging materials and sustainability can influence consumer choices. Brands need to consider eco-friendly packaging solutions to align with evolving consumer preferences.

Regional Analysis

Europe had the largest revenue share at over 33.5% in 2023. This is due to restrictions imposed by the British Retail Consortium (BRC) on unhealthy foods. The U.K. accounted for over 11.8% of the market in 2022 and is the largest and fastest-growing in the area.

Growing consumer concerns regarding sugar content in food and beverages, supported by the government’s policy to tax high-sugar foods, have compelled confectionery as well as dairy dessert manufacturers to reduce the amount of sugar in their product offerings, paving the way for the region’s market to grow over the forecast period.

With a CAGR of 2.4%, Asia Pacific is anticipated to be the fastest-growing leading region. This is due to the high demand for milk substitutes in developing nations such as Thailand and Malaysia. The utilization of evaporated milk as a substitute for regular milk in tea and coffee is a major driver of demand growth.

Aside from these, factors such as changing eating patterns, economic expansion, a thriving confectionery industry, and favorable government regulations are expected to drive regional growth through 2032.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Europe

- Germany

- The UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

New product launches and developing a solid supply chain through smart collaborations with distributors are predicted to be critical success factors in the future. Rising concerns about milk prices due to changing weather patterns and decreased livestock production are expected to pose a significant challenge to evaporated milk producers in the coming years.

Eagle Foods, the makers of Eagle Brand Sweetened Evaporated Milk, will launch its second annual “UnCookie Exchange” in November 2017. This exchange is designed to make holidays simple, but unique

Friesche Vlag, a subsidiary of FrieslandCampina, debuted a new product, Barista Oat, in May 2022, the company’s first plant-based beverage that may be substituted for dairy-based beverages. This is because of the increased customer demand for plant-based alternatives.

Arla Foods, a multinational dairy firm, will inaugurate a new plant at Pronsfeld Dairy in Germany in May 2022. This investment was made to address the international demand for dairy and bakery products that are accessible, sustainable, and healthy.

Market Key Players

- Nestle

- Arla

- Fraser and Neave

- Friesland Campina

- Marigold

- DMK GROUP

- Eagle Family Foods

- O-AT-KA Milk Products

- Holland Dairy Foods

- GLORIA

- Alokozay Group

- DANA Dairy

- Delta Food Industries FZC

- Yotsuba Milk Products

- Nutricima

- Other Key Players

Recent Development

In 2022, Nestle acquired the dairy business of Grupo Gloria in Latin America, including its evaporated milk brands.

Report Scope

Report Features Description Market Value (2022) USD 6.6 Bn Forecast Revenue (2032) USD 8.3 Bn CAGR (2023-2032) 2.3% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Company Profiles, Recent Developments Segments Covered By Type(Whole, Skimmed), By Packaging Type(Cans, Tetrapacks, Others), By Distribution Channel(Offline, Online) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Nestle, Arla, Fraser and Neave, Friesland Campina, Marigold, DMK GROUP, Eagle Family Foods, O-AT-KA Milk Products, Holland Dairy Foods, GLORIA, Alokozay Group, DANA Dairy, Delta Food Industries FZC, Yotsuba Milk Products, Nutricima, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). Frequently Asked Questions (FAQ)

What is the size of evaporated milk market?evaporated milk market size is expected to be worth around USD 8.3 billion by 2033, from USD 6.6 billion in 2023

What is the projected CAGR at which the Evaporated Milk Market is expected to grow at?Evaporated Milk Market is growing at CAGR of 2.3% during forecast periode 2024-2033List the key industry players of the Evaporated Milk Market?Nestle, Arla, Fraser and Neave, Friesland Campina, Marigold, DMK GROUP, Eagle Family Foods, O-AT-KA Milk Products, Holland Dairy Foods, GLORIA, Alokozay Group, DANA Dairy, Delta Food Industries FZC, Yotsuba Milk Products, Nutricima, Other Key Players

-

-

- Nestle

- Arla

- Fraser and Neave

- Friesland Campina

- Marigold

- DMK GROUP

- Eagle Family Foods

- O-AT-KA Milk Products

- Holland Dairy Foods

- GLORIA

- Alokozay Group

- DANA Dairy

- Delta Food Industries FZC

- Yotsuba Milk Products

- Nutricima

- Other Key Players