Europe Personal Protective Equipment (PPE) Market Size, Share, Growth Analysis By Product Type (Protective Clothing, Respiratory Protection, Fall Protection, Protective Footwear, Head, Eye & Face Protection, Hearing Protection, Hand Protection & Others), By Consumer Group (Men & Women), By End-Use (Manufacturing, Construction, Healthcare, Oil & Gas, Chemicals, Mining, Automotive & Transportation, Food & Beverage, Others) By Distribution Channel (Direct Sales (B2B), Distributors & Wholesalers, Retail & Online Retail/E-commerce), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2023

- Report ID: 158778

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Europe Personal Protective Equipment (PPE) Market, By Product Type, 2020-2024 (USD Mn)

- Consumer Group Analysis

- Europe Personal Protective Equipment (PPE) Market, By Consumer Group, 2020-2024 (USD Mn)

- End-Use Analysis

- Europe Personal Protective Equipment (PPE) Market, By End-Use, 2020-2024 (USD Mn)

- Distribution Channel Analysis

- Europe Personal Protective Equipment (PPE) Market, By Distribution Channel, 2020-2024 (USD Mn)

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Geopolitical Impact Analysis

- Key Countries Covered in this Report:

- Market Share & Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

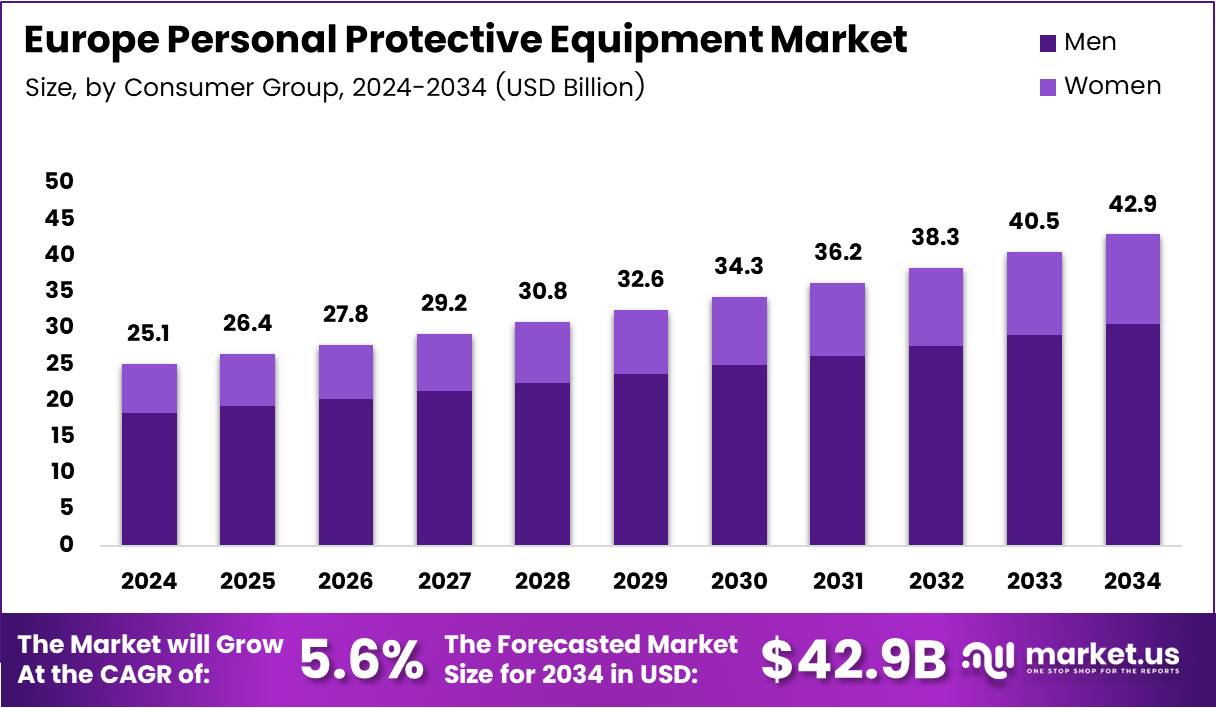

The Europe Personal Protective Equipment (PPE) Market size is expected to be worth around USD 42.9 Billion by 2034, from USD 25.1 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

The Europe Personal Protective Equipment (PPE) market is a strategically vital and tightly regulated industry that underpins workplace safety across sectors such as manufacturing, construction, healthcare, oil & gas, and logistics. PPE includes gloves, respirators, safety glasses, footwear, coveralls, helmets, and smart wearables designed to protect workers from chemical, physical, electrical, and mechanical hazards.

The institutionalization of PPE began with the PPE at Work Regulations Act of 1992, evolving into today’s robust framework under Regulation (EU) 2016/425, which harmonizes quality, testing, and conformity assessment across the EU.

Recent amendments, including Commission Implementing Decision (EU) 2023/941, have strengthened standards for fall protection, respiratory devices, footwear, helmets, and facial protective gear, reflecting a growing focus on risk mitigation and compliance. This regulatory rigor, coupled with heightened awareness of occupational safety, has fueled consistent market growth.

Technological innovation is now reshaping the industry, with smart PPE—such as IoT-enabled helmets and AI-integrated wearables—monitoring health metrics and environmental conditions in real time. Advanced materials such as graphene and nanocomposites are enhancing durability and comfort, signaling a shift toward high-performance gear.

As industries embrace digitalization and sustainability, Europe’s PPE market is positioned for continued expansion, balancing regulatory compliance, innovation, and workforce protection.

Key Takeaways

- The Europe Personal Protective Equipment (PPE) Market was valued at US$ 25.1 billion in 2024.

- The Europe Personal Protective Equipment (PPE) Market is projected to reach US$ 42.9 billion by 2034.

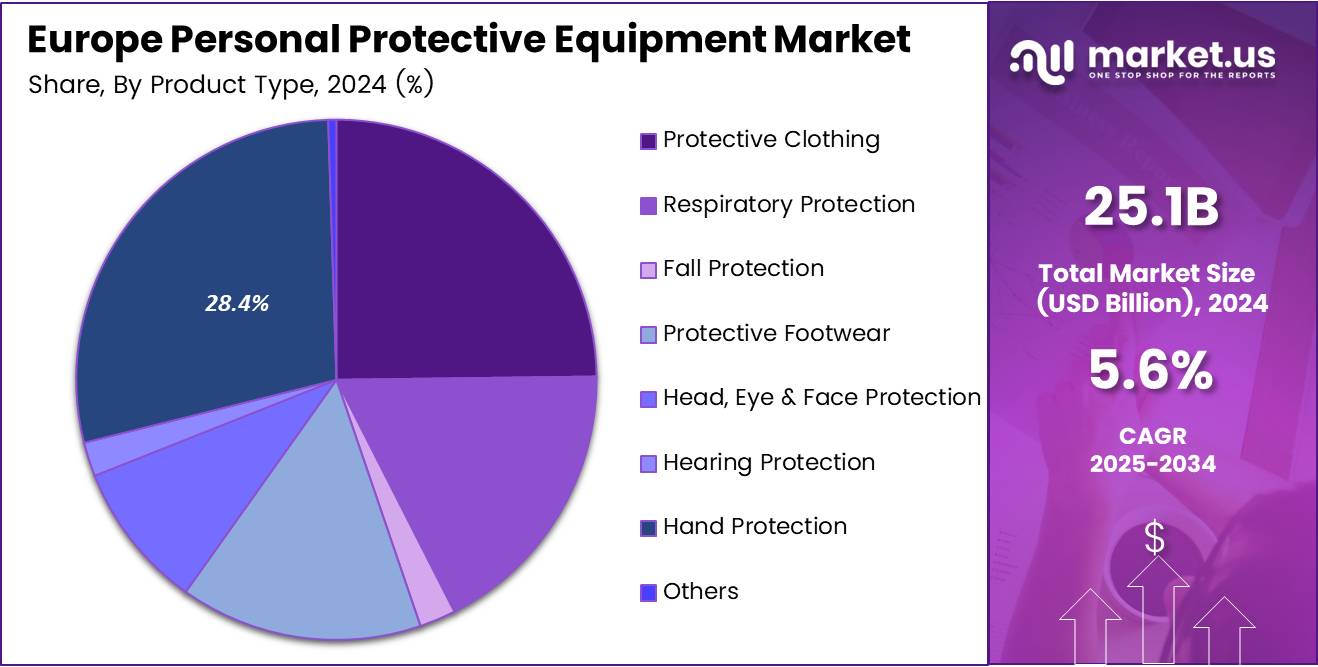

- Among product type, the hand protection held the majority of revenue share in 2024, with a market share of 28.4%.

- Based on consumer group, men segment accounted for the majority of the market share with 73.0%.

- Based on end-use, the manufacturing industry dominated the market with a share of 62.6%.

- Among distribution channels, Direct Sales (B2B) channels are more preffered by conusmers hence, they accounted for the majority of the personal protective equipment market share with 48.5%.

- In Europe Personal Protective Equipment (PPE) Market, Western European Countries Dominated by 83.9% of market share.

Product Type Analysis

Hand Protective Personal Protective Equipment Held The Major Share

The personal protective equipment market is segmented based on tomato type into protective clothing, respiratory protection, fall protection, protective footwear, head, eye & face protection, hearing protection, hand protection, & others. Among these, the hand protection type held the majority of revenue share in 2024, with a market share of 28.4% due to its universal use across industries and the critical role of hands in most workplace activities.

Gloves—ranging from disposable nitrile and latex to cut-resistant, chemical-resistant, and heat-resistant varieties—are indispensable in protecting workers from physical injuries, chemical burns, infections, and mechanical hazards. The segment’s dominance is driven by high demand in sectors such as healthcare, construction, manufacturing, food processing, and oil & gas, where strict compliance with safety regulations mandates routine glove use.

Europe Personal Protective Equipment (PPE) Market, By Product Type, 2020-2024 (USD Mn)

Product Type 2020 2021 2022 2023 2024 Protective Clothing 5,388.6 5,764.2 6,047.8 5,653.6 5,927.2 Heat & Flame Protection 2,039.4 1,602.6 1,706.8 1,943.9 2,046.4 Chemical Defending 707.2 833.8 864.1 776.0 808.0 Clean Room Clothing 115.2 134.9 140.5 127.0 133.0 Mechanical Protective Clothing 591.0 688.8 720.5 654.2 683.0 Workwear 1,665.9 2,185.2 2,286.0 1,857.0 1,951.3 Others 270.0 318.9 329.9 295.7 305.5 Respiratory Protection 3,648.3 4,136.1 4,314.5 4,021.3 4,219.7 Air-purifying Respirator 2,527.9 3,044.8 3,171.6 2,790.8 2,923.3 Supplied Air Respirators 1,120.3 1,091.3 1,142.9 1,230.5 1,296.4 Fall Protection 488.3 266.2 280.4 514.2 540.5 Soft Goods 198.4 109.5 113.0 204.7 212.6 Hard Goods 289.9 156.7 167.4 309.5 327.9 Protective Footwear 3,258.3 2,907.3 3,044.2 3,412.5 3,593.5 Safety Shoes 2,403.1 2,117.0 2,223.8 2,524.5 2,666.4 Rubber Boots 855.3 790.3 820.3 888.0 927.1 Head, Eye & Face Protection 2,103.0 2,143.8 2,236.4 2,082.0 2,182.4 Hard Hats 608.8 564.9 583.5 615.0 639.2 Bump Caps 167.5 147.3 154.3 146.0 153.6 Safety Glasses 372.5 326.7 342.4 325.4 343.0 Goggles 210.0 184.1 193.2 183.6 193.5 Face Shields 510.7 714.4 748.1 609.7 641.5 Welding Shields 233.5 206.3 214.8 202.3 211.6 Hearing Protection 468.2 267.5 279.1 488.4 511.0 Earplugs 261.4 146.3 154.0 275.0 289.4 Earmuffs 206.8 121.2 125.1 213.5 221.6 Hand Protection 5,870.3 6,660.9 6,948.0 6,470.6 6,779.9 Disposable Gloves 4,321.1 5,297.6 5,518.1 4,844.6 5,064.7 Reusable Gloves 1,305.5 1,122.2 1,181.7 1,375.2 1,457.2 Others 243.7 241.1 248.2 250.9 258.0 Others 116.3 67.1 68.9 119.4 122.6 Consumer Group Analysis

Men Segment Accounted for a Largest Share in the Europe Personal Protective Equipment Market

Based on categories, the market is segmented into men and women. Among these consumer group, men accounted for the majority of the market share with 73.0%. Sectors such as construction, manufacturing, mining, oil & gas, and heavy engineering remain male-dominated in Europe, and these industries are the largest consumers of personal protective equipment. Tasks in these sectors often involve exposure to physical, chemical, and mechanical risks, necessitating extensive use of PPE, including hand protection, helmets, safety footwear, respirators, and full-body suits.

In contrast, while female participation in the workforce is steadily rising, women are more represented in sectors such as healthcare, education, and services, where PPE requirements are less intensive or are concentrated around specific categories like gloves, gowns, and masks. However, with growing female representation in industries like logistics, defense, and construction, demand for ergonomically designed, women-specific PPE is expected to rise, gradually balancing the market share in future years.

Europe Personal Protective Equipment (PPE) Market, By Consumer Group, 2020-2024 (USD Mn)

Consumer Group 2020 2021 2022 2023 2024 Men 15,395.8 16,037.1 16,801.0 16,583.2 17,416.9 Women 5,945.5 6,176.0 6,418.2 6,178.9 6,459.9 End-Use Analysis

By end-use, the market was divided into manufacturing, construction, healthcare, oil & gas, chemicals, mining, automotive & transportation, food & beverage & others. In the previous year, the manufacturing emerged as the major end-use sector of personal protective equipment, holding a 62.6% market share. It is driven by the industry’s high-risk environment and strict regulatory compliance requirements.

Workers in manufacturing are exposed to a wide range of hazards—mechanical injuries from machinery, chemical exposure from solvents and coatings, noise pollution, heat, and airborne particulates—all of which necessitate comprehensive protective solutions such as gloves, safety footwear, helmets, goggles, respirators, and protective clothing. The scale and diversity of Europe’s manufacturing base, which spans heavy engineering, electronics, automotive, metalworking, and textiles, further amplify PPE demand.

Europe Personal Protective Equipment (PPE) Market, By End-Use, 2020-2024 (USD Mn)

End-Use 2020 2021 2022 2023 2024 Manufacturing 4,140.9 4,058.2 4,137.1 4,714.5 4,901.6 Construction 3,333.1 3,190.9 3,296.6 3,443.4 3,578.8 Healthcare 4,326.9 5,927.1 6,325.6 4,617.4 4,918.1 Oil & Gas 2,747.5 2,599.6 2,722.2 2,877.0 3,021.6 Chemicals 2,126.0 2,013.2 2,108.2 2,226.3 2,339.1 Mining 1,383.6 1,315.9 1,377.9 1,448.7 1,507.5 Automotive & Transportation 1,695.0 1,603.9 1,679.5 1,775.0 1,867.6 Food & Beverage 1,251.2 1,181.9 1,237.6 1,310.1 1,380.0 Others 337.2 322.5 334.5 349.7 362.3 Distribution Channel Analysis

The personal protective equipment market was further categorized based on distribution channels such as direct sales (B2B), distributors & wholesalers, retail & online retail/e-commerce. In 2024, the Direct Sales (B2B) segment dominated the Personal Protective Equipment market, accounting for a 48.5% market share.

Most PPE purchases in Europe are driven by institutional and industrial demand, where companies in manufacturing, construction, healthcare, oil & gas, and mining procure in bulk through direct sales (B2B), distributors, and wholesalers to ensure continuous supply for their workforce.

Employers prefer offline channels due to the need for certified, standardized, and customized PPE, which often requires technical consultation, product trials, and compliance verification. Large tenders and long-term contracts with distributors and manufacturers also strengthen the dominance of this channel, as they guarantee cost efficiency, supply reliability, and after-sales services such as fit testing and training.

Europe Personal Protective Equipment (PPE) Market, By Distribution Channel, 2020-2024 (USD Mn)

Distribution Channel 2020 2021 2022 2023 2024 Direct Sales (B2B) 10,225.2 10,776.9 11,196.4 11,075.1 11,574.4 Distributors & Wholesalers 6,569.8 6,745.2 7,116.4 6,931.6 7,299.4 Retail 1,484.4 1,543.4 1,603.7 1,542.5 1,611.6 Online Retail/E-commerce 3,061.8 3,147.6 3,302.8 3,212.9 3,391.4 Key Market Segments

By Product Type

- Protective Clothing

- Heat & flame Protection

- Chemical Defending

- Clean Room Clothing

- Mechanical Protective Clothing

- Workwear

- Others

- Respiratory Protection

- Air-purifying Respirator

- Supplied Air Respirators

- Fall Protection

- Soft Goods

- Hard Goods

- Protective Footwear

- Safety Shoes

- Rubber Boots

- Head, Eye & Face Protection

- Hard Hats

- Bump Caps

- Safety Glasses

- Goggles

- Face Shields

- Welding Shields

- Hearing Protection

- Earplugs

- Earmuffs

- Hand Protection

- Disposable Gloves

- Reusable Gloves

- Others

- Others

By Consumer Group

- Men

- Women

By End-Use

- Manufacturing

- Construction

- Healthcare

- Oil & Gas

- Chemicals

- Mining

- Automotive & Transportation

- Food & Beverage

- Others

By Distribution Channel

- Direct Sales (B2B)

- Distributors & Wholesalers

- Retail

- Online Retail/E-commerce

Drivers

Growing Occupational Risk Awareness and Employer Liability

The demand for personal protective equipment (PPE) in Europe is strongly influenced by the intensity of workplace risk factors and, equally, by the level of awareness among company managers and employees. Sectors with the highest exposure to occupational hazards—such as construction, chemical processing, mining, and heavy machinery—consistently generate the greatest demand for certified PPE, reflecting the correlation between accident risk and safety investment.

The rising focus on occupational risk awareness and employer accountability continues to reshape PPE procurement practices across the region. As industrial operations become more sophisticated and mechanized, the spectrum and severity of on-the-job hazards have expanded significantly.

This has prompted both regulatory authorities and employers to reassess whether current safety measures are adequate for increasingly complex operational environments. Intensified scrutiny around safety protocols—particularly following injury spikes or high-profile incidents—has reinforced the adoption of standardized protective equipment across high-risk sectors.

- For instance, as per European Commission in 2022, the European Union recorded approximately 2.97 million non-fatal accidents at work that led to absences of at least four calendar days. This marked a continuation of an upward trend observed between 2012 and 2019, during which time the EU saw an increase of about 203,000 such incidents—an overall rise of 6.9%.

Restraints

Fluctuating Raw Material Costs Impact the Market

Fluctuating raw material costs present a persistent restraint on the Europe personal protective equipment (PPE) market, placing considerable strain on manufacturers’ profit margins and complicating procurement strategies throughout the supply chain.

Essential materials such as nitrile, latex, neoprene, polyethylene, polypropylene, and a range of synthetic rubbers constitute the primary inputs in PPE manufacturing, particularly for gloves, masks, and protective apparel. These materials are highly vulnerable to price instability driven by global supply-demand mismatches, geopolitical tensions, energy price volatility, and evolving environmental policies.

Over the past few years, the fragility of international supply chains has intensified, disrupted by factors such as the COVID-19 pandemic, the Russia-Ukraine conflict, and increasingly stringent energy regulations. Europe’s dependence on imported raw materials renders the region especially susceptible to such external shocks.

A prime example lies in the direct correlation between crude oil prices and the cost of synthetic resins and polymers integral to items like respirators and protective clothing. The volatility in energy markets is thus mirrored in the pricing of PPE components, amplifying uncertainty in production budgeting and inventory management.

Growth Factors

Rapid Growth in Food & Beverage Industry Creates Lucrative Opportunities In the Market

The rapid expansion of the food and beverage (F&B) industry across Europe is creating notable growth prospects for the personal protective equipment (PPE) market, as the sector increasingly aligns with evolving health, safety, and hygiene mandates. Recognized as the European Union’s largest manufacturing sector by both employment and value addition, the F&B industry also plays a strategic role in the region’s trade dynamics.

- Over the past decade, exports from the EU food and drink sector have doubled, surpassing €182 billion and generating a trade surplus of nearly €30 billion. The industry’s success is further bolstered by the advantages of the EU Single Market, which accounts for approximately 60% of the total €513 billion in EU exports.

As global and domestic consumers become more discerning regarding food safety standards, regulatory bodies have responded by intensifying oversight under the EU food safety framework. This shift has compelled F&B producers to strengthen compliance through enhanced safety protocols, which prominently include investments in PPE. The rising demand for sector-specific protective gear—such as hygienic gloves, protective gowns, safety shoes, face masks, and hairnets—mirrors the scale and complexity of the industry’s expansion.

Emerging Trends

Increasing Adoption of Smart PPE

The adoption of smart personal protective equipment (PPE), particularly through the integration of smart fabrics and wearable technology, is redefining safety protocols across Europe’s industrial landscape. These innovative materials are designed to enhance both the functionality and intelligence of traditional protective gear by embedding advanced sensors and connectivity components.

Smart fabrics are capable of monitoring physiological indicators such as heart rate, body temperature, and fatigue levels in real time, delivering critical data that contributes to proactive risk management, especially in high-risk operational environments. This technological evolution allows workers to remain not only protected but also connected to centralized health and safety monitoring systems. In sectors such as healthcare, emergency response, and heavy industry, smart textiles are becoming instrumental.

Geopolitical Impact Analysis

Geopolitical Tensions Significantly Impacted the Growth of the Personal Protective Equipment Market IN Europe

The geopolitical impact of Russia’s invasion of Ukraine has significantly reshaped the European Personal Protective Equipment (PPE) market, exposing vulnerabilities in supply chains, energy security, and material sourcing.

The conflict triggered an energy crisis, as reduced Russian gas exports drove up electricity and fuel costs, increasing production expenses for energy-intensive PPE manufacturing processes such as melt-blown fabric for masks and synthetic rubber for gloves. Inflationary pressures in 2023–2024 further reduced the price competitiveness of European manufacturers against Asian suppliers.

At the same time, supply chain disruptions caused by sanctions and restricted trade corridors through Russia, Ukraine, and Belarus cut off access to critical raw materials, leading to longer lead times, procurement challenges, and volatile prices for nitrile gloves, masks, and protective suits. Logistics constraints worsened as air routes over Russia were restricted and freight congestion intensified in border states such as Poland and Romania due to military and humanitarian shipments, delaying civilian PPE deliveries.

Key Countries Covered in this Report:

- Europe

- Western Europe

- Germany

- The U.K.

- France

- Spain

- Italy

- Netherlands

- Rest of Western Europe

- Eastern Europe

- Russia

- Czech Republic

- Poland

- Hungary

- Slovakia

- Austria

- Romania

- Rest of Eastern Europe

Market Players In The Personal Protective Equipment Industry Are Developing Through Various Strategies

Market players in the personal protective equipment industry are developing through various strategic approaches, including technological advancements, sustainable farming practices, and market expansion initiatives. Many companies are investing in controlled environment agriculture (CEA), such as greenhouses and vertical farming, to enhance yield, reduce water consumption, and ensure year-round production. The adoption of hydroponic and aeroponic farming techniques has further improved productivity while minimizing resource usage.

Top Key Players in the Market

- 3M Company

- Honeywell International

- DuPont de Nemours

- Ansell Ltd.

- Uvex Safety Group

- Lakeland Industries

- Bullard

- MSA Safety Incorporated

- Avon Rubber plc

- Delta Plus Group

- Maskpol S.A.

- Mercator Medical S.A.

- Haberkorn s.r.o.

- LANEX a.s.

- SpecZaschita

- Other Key Players

Recent Developments

- 8 April 2024 : Ansell agreed in April 2024 to acquire Kimberly-Clark’s Personal Protective Equipment business (KCPPE), which includes the Kimtech and KleenGuard brands, for approximately US$640 million. This strategic move strengthens Ansell’s position in healthcare, cleanroom, and industrial PPE and is set to expand its global portfolio and service capabilities.

- October 2024 : 3M has continued rolling out updates to its PPE catalog in Europe: The 3M EU-price catalog 2024 lists expanded offerings in respiratory protection (disposable, reusable, powered/supplied air respirators), protective apparel, fall protection, etc.

- Recently, 3M has launched new safety eyewear products featuring advanced coatings such as the 3M Scotchgard Protector Anti-Fog Coating. This coating uses a hydrophilic layer that prevents lens fogging by allowing condensation to form a continuous film rather than droplets.

Report Scope

Report Features Description Market Value (2024) USD 25.1 Billion Forecast Revenue (2034) USD 42.9 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Protective Clothing, Respiratory Protection, Fall Protection, Protective Footwear, Head, Eye & Face Protection, Hearing Protection, Hand Protection & Others), By Consumer Group (Men & Women), By End-Use (Manufacturing, Construction, Healthcare, Oil & Gas, Chemicals, Mining, Automotive & Transportation, Food & Beverage, Others) By Distribution Channel (Direct Sales (B2B), Distributors & Wholesalers, Retail & Online Retail/E-commerce) Regional Analysis Western Europe (Germany, The U.K., France, Spain, Italy, Netherlands, Rest of Western Europe)

Eastern Europe (Russia, Czech Republic, Poland, Hungary, Slovakia, Austria, Romania, Rest of Eastern Europe)Competitive Landscape 3M Company, Honeywell International, DuPont de Nemours, Ansell Ltd., Uvex Safety Group, Lakeland Industries, Bullard, MSA Safety Incorporated, Avon Rubber plc, Delta Plus Group, Maskpol S.A., Mercator Medical S.A., Haberkorn s.r.o., LANEX a.s., SpecZaschita & Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Europe Personal Protective Equipment (PPE) MarketPublished date: Jun 2023add_shopping_cartBuy Now get_appDownload Sample

Europe Personal Protective Equipment (PPE) MarketPublished date: Jun 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company

- Honeywell International

- DuPont de Nemours

- Ansell Ltd.

- Uvex Safety Group

- Lakeland Industries

- Bullard

- MSA Safety Incorporated

- Avon Rubber plc

- Delta Plus Group

- Maskpol S.A.

- Mercator Medical S.A.

- Haberkorn s.r.o.

- LANEX a.s.

- SpecZaschita

- Other Key Players