Europe Breast and Prostate Cancer Diagnostics Market By Test (Liquid Biopsy, Tumor Biomarkers Tests, In Situ Hybridization, Immunohistochemistry, Imaging, and Biopsy), By Application (Breast Cancer and Prostate Cancer), By End-user (Cancer Research Institutes, Independent Diagnostic Laboratories, Hospital Associated Labs, Diagnostic Imaging Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165889

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

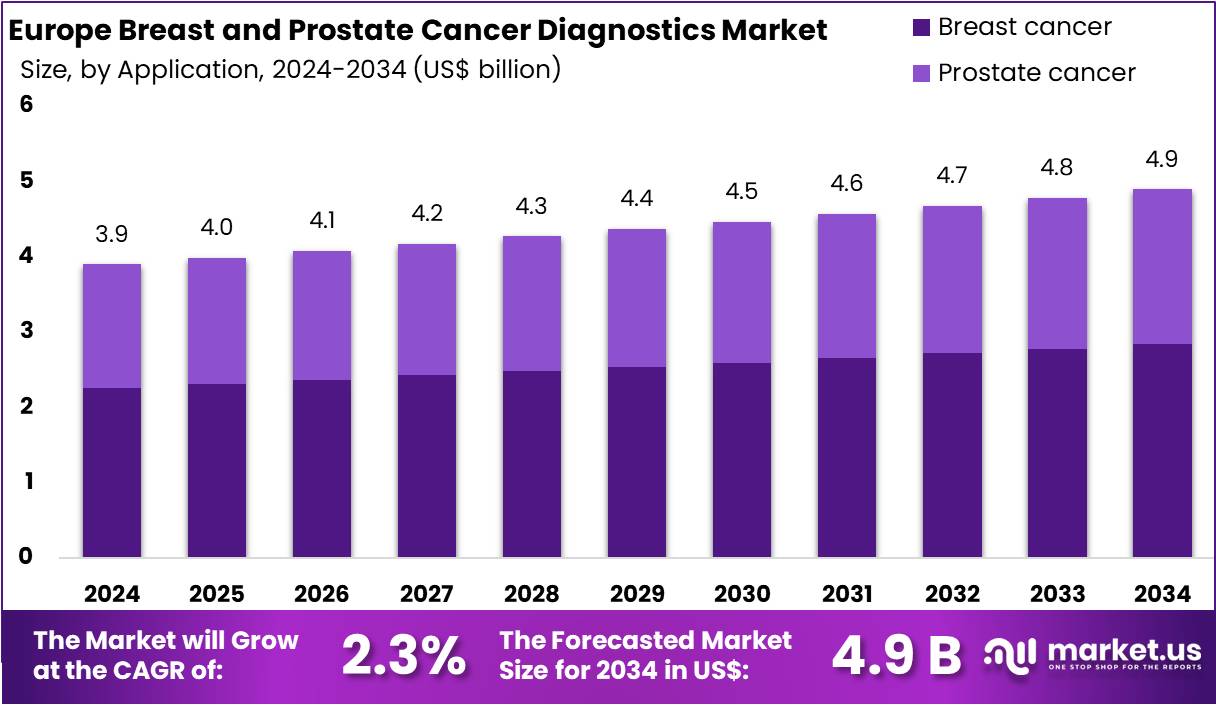

The Europe Breast and Prostate Cancer Diagnostics Market size is expected to be worth around US$ 4.9 billion by 2034 from US$ 3.9 billion in 2024, growing at a CAGR of 2.3% during the forecast period 2025 to 2034.

Increasing clinical reliance on precision oncology tools propels the Europe Breast and Prostate Cancer Diagnostics market, as oncologists integrate multimodal assays to refine risk assessment and therapeutic selection. Diagnostic laboratories deploy immunohistochemistry for hormone receptor status, liquid biopsies for minimal residual disease tracking, and gene-expression profiling for subtype classification in breast cancer management. These technologies also enable PSA velocity monitoring, multiparametric MRI fusion for targeted prostate biopsies, and genomic risk scores for active surveillance decisions.

Persistent mortality challenges, such as the projected 2025 EU age-standardized rate of 13.3 breast cancer deaths per 100,000 women totaling around 90,100 fatalities, sustain investments in high-sensitivity detection platforms. Healthcare providers capitalize on opportunities to combine traditional screening with molecular insights for earlier intervention. This epidemiological pressure accelerates the shift toward comprehensive diagnostic workflows in oncology centers.

Growing evidence of mortality reductions through advanced screening accelerates the Europe Breast and Prostate Cancer Diagnostics market, as health authorities expand coverage for innovative assays that demonstrate outcome improvements. Pathology departments adopt multigene panels to predict recurrence in hormone-positive breast tumors, circulating tumor DNA for post-surgical surveillance, and AI algorithms to enhance mammographic specificity.

Applications extend to prostate-specific antigen isoform analysis for benign versus malignant differentiation, transperineal biopsy guidance under imaging fusion, and polygenic risk scoring in hereditary cancer syndromes. A notable 4% EU-wide and 6% UK-specific decline in breast cancer mortality from 2020 to 2025 underscores the impact of these technologies on survival rates. Reimbursement policies increasingly favor such precision tools, creating commercial pathways for broader implementation. This positive trend motivates diagnostic firms to innovate and scale production of validated assays.

Rising focus on prostate cancer lethality invigorates the Europe Breast and Prostate Cancer Diagnostics market, as urologists prioritize stratified testing to mitigate aggressive disease progression. Clinicians utilize elevated PSA thresholds with free-to-total ratios, high-resolution MRI for PI-RADS scoring, and biomarker panels like PHI or 4Kscore for biopsy decision-making. These approaches complement breast diagnostics through shared platforms for BRCA mutation testing in familial cases and sentinel node mapping with fluorescent tracers.

In the UK, prostate cancer’s 14% share of male cancer deaths from 2021 to 2023, averaging 12,200 annual losses, highlights the urgency for robust early detection strategies. National programs integrate genomic screening into routine practice, expanding market reach across public and private sectors. This mortality profile drives collaborative efforts to standardize and deploy cutting-edge diagnostic protocols.

Key Takeaways

- In 2024, the market generated a revenue of US$ 3.9 billion, with a CAGR of 2.3%, and is expected to reach US$ 4.9 billion by the year 2034.

- The test segment is divided into liquid biopsy, tumor biomarkers tests, in situ hybridization, immunohistochemistry, imaging, and biopsy, with liquid biopsy taking the lead in 2024 with a market share of 46.7%.

- Considering application, the market is divided into breast cancer and prostate cancer. Among these, breast cancer held a significant share of 58.1%.

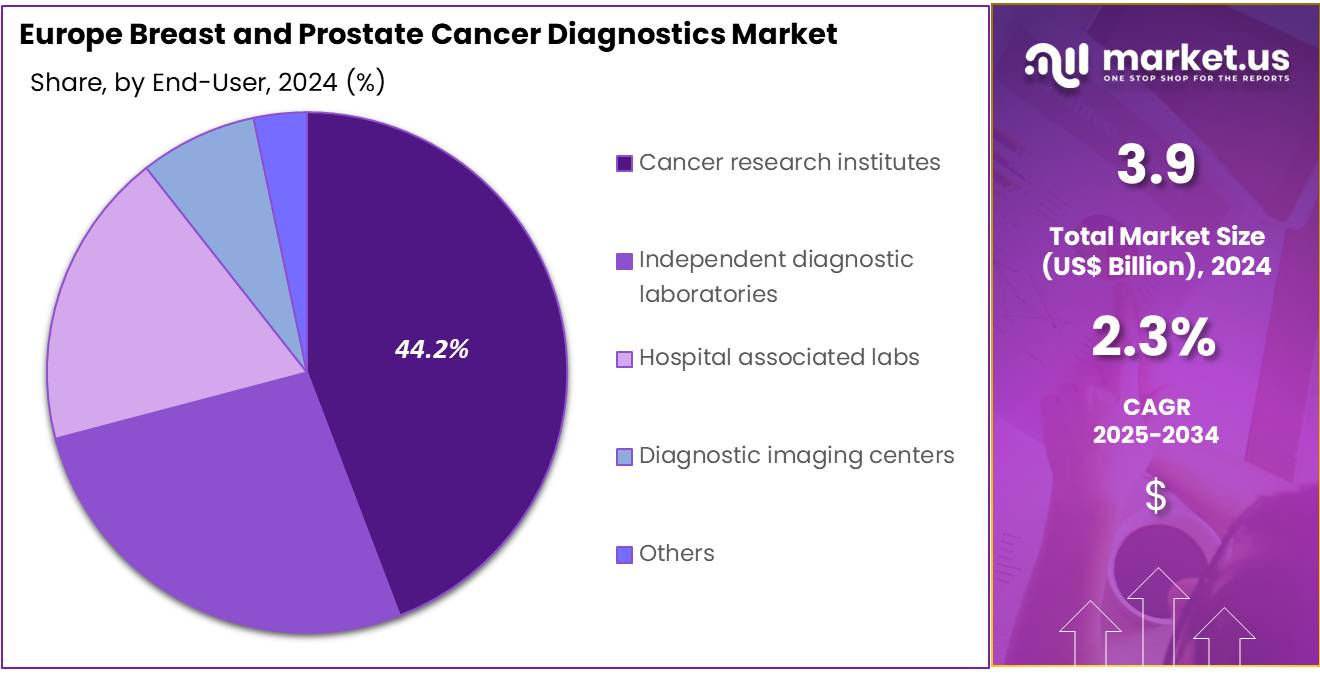

- Furthermore, concerning the end-user segment, the market is segregated into cancer research institutes, independent diagnostic laboratories, hospital associated labs, diagnostic imaging centers, and others. The cancer research institutes sector stands out as the dominant player, holding the largest revenue share of 44.2% in the market.

Test Analysis

Liquid biopsy holds 46.7% of the Europe Breast and Prostate Cancer Diagnostics market and is anticipated to dominate due to its minimally invasive nature and ability to detect circulating tumor DNA (ctDNA) and circulating tumor cells (CTCs) with high precision. The method enables early-stage cancer detection and real-time monitoring of disease progression and treatment response.

European oncology programs increasingly adopt liquid biopsy for therapy selection, especially in patients unfit for tissue biopsies. Advancements in next-generation sequencing (NGS) and droplet digital PCR technologies are improving sensitivity and quantification of rare mutations. Several European regulatory authorities are supporting companion diagnostic approvals linked to liquid biopsy assays for personalized oncology.

Pharmaceutical collaborations with diagnostic firms are accelerating clinical validation of novel biomarkers. Additionally, growing awareness among clinicians regarding non-invasive monitoring for therapy resistance is driving adoption. With continued innovation and integration into precision oncology workflows, liquid biopsy is expected to remain the leading diagnostic modality across Europe’s cancer landscape.

Application Analysis

Breast cancer represents 58.1% of the Europe Breast and Prostate Cancer Diagnostics market and is projected to dominate owing to its high prevalence and strong focus on early detection initiatives across the region. Public health screening programs and national cancer registries in countries such as Germany, France, and the UK are increasing test volumes for breast cancer diagnostics.

Continuous advancements in molecular and imaging-based testing are improving diagnostic accuracy and treatment personalization. European research institutes are expanding validation studies on biomarkers such as HER2, BRCA1/2, and PIK3CA mutations for targeted therapy guidance. The integration of AI-assisted mammography and 3D tomosynthesis further enhances detection sensitivity.

Increasing funding for research in hormone receptor-positive and triple-negative breast cancers is driving biomarker test adoption. Moreover, growing emphasis on liquid biopsy and multi-analyte assays for recurrence monitoring is expanding diagnostic applications. As awareness campaigns and reimbursement frameworks strengthen, breast cancer diagnostics are anticipated to lead the market’s growth trajectory.

End-User Analysis

Cancer research institutes account for 44.2% of the Europe Breast and Prostate Cancer Diagnostics market and are projected to maintain dominance due to their central role in biomarker validation, clinical studies, and translational oncology research. These institutes are advancing genomic and proteomic platforms that accelerate diagnostic assay development and clinical integration.

Collaborations between academia and industry across the EU are fostering innovation in liquid biopsy, imaging biomarkers, and molecular profiling technologies. Research institutions are also leading pan-European cancer projects funded under Horizon Europe and EU4Health initiatives, driving adoption of next-generation diagnostics. Their extensive biobank networks and access to large patient cohorts enhance the accuracy of biomarker correlation studies.

Additionally, partnerships with pharmaceutical companies enable simultaneous development of companion diagnostics and targeted therapies. The emphasis on personalized medicine and early cancer detection aligns with institutional mandates, positioning research centers as pivotal contributors to Europe’s cancer diagnostics ecosystem. As precision oncology advances, cancer research institutes are expected to remain at the forefront of diagnostic innovation and adoption.

Key Market Segments

By Test

- Liquid Biopsy

- Tumor Biomarkers Tests

- In Situ Hybridization

- Immunohistochemistry

- Imaging

- Biopsy

By Application

- Breast Cancer

- Prostate Cancer

By End-user

- Cancer Research Institutes

- Independent Diagnostic Laboratories

- Hospital Associated Labs

- Diagnostic Imaging Centers

- Others

Drivers

Increasing Incidence of Breast and Prostate Cancer is Driving the Market

The upward trajectory in breast and prostate cancer diagnoses throughout Europe has established a compelling driver for the diagnostics market, as heightened caseloads necessitate expanded screening and confirmatory testing capacities. Demographic shifts, including aging populations and lifestyle factors, contribute to this escalation, placing unprecedented demands on healthcare infrastructures.

National health services are compelled to enhance mammography, ultrasound, and PSA testing protocols to accommodate surging volumes. Diagnostic equipment manufacturers are scaling production of high-resolution imaging systems tailored for European regulatory standards.

Collaborative European initiatives facilitate data sharing, enabling refined risk models that inform targeted screening campaigns. This incidence surge prompts investments in workforce training for radiologists and pathologists, ensuring proficient interpretation of diagnostic outputs. Reimbursement frameworks adapt to prioritize high-throughput assays, mitigating bottlenecks in referral pathways.

Public health messaging underscores the benefits of early detection, fostering greater patient engagement with diagnostic services. The resultant ecosystem stimulates innovation in hybrid imaging modalities, blending MRI with biopsy guidance for precision.

In the European Union, breast cancer accounted for an estimated 380,000 new cases and prostate cancer for 330,000 new cases in 2022. These figures, derived from the European Cancer Information System, illustrate the scale of diagnostic imperatives. Overall, this driver reinforces the market’s alignment with preventive oncology priorities across the continent.

Restraints

Declining Participation in Screening Programs is Restraining the Market

Persistent reductions in screening uptake for breast cancer across numerous European countries continue to impede the diagnostics market, limiting the volume of early-stage detections and downstream testing opportunities. Post-pandemic disruptions have eroded trust in organized programs, with logistical barriers exacerbating non-attendance in rural locales.

Disparities in program accessibility, particularly for migrant and low-income groups, compound these challenges, resulting in uneven diagnostic utilization. Health authorities grapple with fragmented outreach, as digital reminders fail to reach underserved demographics effectively. This restraint manifests in delayed diagnoses, elevating treatment complexities and associated costs for advanced cases.

Manufacturers encounter subdued demand for routine screening kits, constraining economies of scale in production. Policy evaluations reveal implementation gaps in national strategies, hindering standardized diagnostic pathways. Addressing socioeconomic determinants requires multifaceted interventions, yet progress remains incremental amid fiscal constraints. The overall effect curtails market predictability, as variable participation rates disrupt supply planning.

Breast cancer screening participation averaged 56% across 24 European Union countries in 2022, with one in two countries experiencing a decline over the preceding decade. Such trends, documented in the European Union Country Cancer Profiles, underscore systemic barriers to sustained engagement. Resolving these issues demands coordinated enhancements in program design and equity-focused promotions.

Opportunities

Investments under Europe’s Beating Cancer Plan are Creating Growth Opportunities

Strategic allocations within Europe’s Beating Cancer Plan are cultivating expansive prospects for the breast and prostate cancer diagnostics market, channeling resources toward innovative screening and precision tools. This comprehensive framework prioritizes equitable access, funding pilot programs that integrate advanced biomarkers into routine assessments.

Opportunities abound in cross-border consortia, where shared expertise accelerates validation of next-generation sequencing for hereditary risks. Diagnostic innovators benefit from streamlined procurement tenders, enabling rapid deployment of AI-augmented mammography suites. The plan’s emphasis on digital health interoperability fosters platforms for centralized result repositories, enhancing collaborative research.

Regional disparities are targeted through subsidized equipment upgrades in under-resourced facilities, broadening market penetration. These investments spur private-sector collaborations, blending public grants with commercial R&D for hybrid diagnostic solutions. Long-term, they position Europe as a hub for exporting validated technologies to global partners. The resultant momentum diversifies revenue streams, from consumables to service contracts.

Europe’s Beating Cancer Plan has committed €4 billion in European Union funding from 2021 to 2027 to bolster early detection and diagnostics for cancers, including breast and prostate varieties. This substantial endowment, outlined in the official plan document, signals robust support for market maturation. Consequently, stakeholders anticipate accelerated adoption of cutting-edge diagnostic paradigms.

Impact of Macroeconomic / Geopolitical Factors

Sustained inflation and fiscal tightening across Europe compel national health services to trim diagnostic budgets, delaying upgrades to advanced breast and prostate cancer screening tools in peripheral regions. Robust EU funding for oncology research and demographic shifts toward older populations, however, spur clinics to prioritize high-throughput assays, elevating detection rates through subsidized programs.

Ongoing geopolitical strains from the Ukraine conflict drive energy price spikes that inflate operational costs for imaging centers, straining procurement of essential radiology consumables. These tensions, nevertheless, galvanize pan-European consortia to develop energy-efficient diagnostic protocols, fostering cross-border data sharing that refines accuracy standards.

The recent EU-US trade agreement, stripping pharma of tariff exemptions since August 2025, escalates import duties on U.S.-sourced biopsy reagents by up to 10%, complicating cost structures for European labs reliant on transatlantic components. Manufacturers adapt by accelerating local API production and tapping intra-EU supplier networks, which stabilizes pricing and shortens delivery cycles.

Latest Trends

Launch of AI-Integrated Data Platforms for Screening is a Recent Trend

The initiation of artificial intelligence-enhanced data integration platforms for breast and prostate cancer screening has emerged as a salient trend in 2025, revolutionizing image analysis and risk assessment workflows. These platforms aggregate multimodal datasets from diverse European centers, employing machine learning to standardize interpretations and predict lesion malignancy.

Regulatory alignments under the European Health Data Space expedite secure data flows, mitigating privacy concerns while enabling federated learning models. This trend facilitates personalized screening intervals, optimizing resource allocation in overburdened systems. Manufacturers are embedding AI modules into existing hardware, retrofitting legacy systems for enhanced sensitivity. Clinical trials validate these tools against traditional methods, demonstrating superior detection rates for dense breast tissue and subtle prostate anomalies.

The approach extends to patient-facing applications, empowering informed consent through visualized risk profiles. Broader implications include reduced inter-observer variability, elevating diagnostic confidence across multidisciplinary teams.

In 2025, three European Union for Health projects—CHOICE, BreastSCan, and UNICA—were launched to integrate breast and prostate cancer screening imaging data into the Cancer Image Europe platform, utilizing advanced AI models for analysis and risk stratification. These initiatives, detailed in the European Health and Digital Executive Agency announcement, exemplify the trend’s operationalization. This evolution promises enduring enhancements in diagnostic equity and efficacy continent-wide.

Key Players Analysis

Leading firms in the European oncology diagnostics arena propel growth by embedding AI-enhanced imaging algorithms into mammography and PSA reflex protocols, slashing false positives and anchoring placements in national screening frameworks. They consolidate genomics specialists to integrate liquid biopsy panels for endocrine therapy guidance, while forging radiology society partnerships to standardize hybrid PET-MRI workflows in premier cancer centers.

Executives prioritize EHDS-compliant data platforms that streamline tumor board decisions and expand into portable ultrasound for community outreach. Koninklijke Philips N.V., founded in Amsterdam in 1891, dominates via its Image-Guided Therapy suite, delivering Azurion angiography and Affiniti ultrasound systems that fuse spectral CT with real-time AI for precise breast and prostate interventions across Europe’s diverse healthcare systems.

Top Key Players in the Europe Breast and Prostate Cancer Diagnostics Market

- Siemens Healthcare GmbH

- QIAGEN N.V.

- Koninklijke Philips N.V

- General Electric (GE HealthCare)

- Hoffmann-La Roche Ltd.

- Danaher (Cepheid)

- Cook Group Inc.

- Bio Rad Laboratories Inc.

- Becton, Dickinson and Company

- Agilent Technologies, Inc.

Recent Developments

- In October 2025: Roche Diagnostics’ European expansion of the FoundationOne Liquid CDx assay for multi-gene cancer profiling strengthened its role in precision oncology. By enabling broader companion diagnostic applications, the platform allows clinicians to identify actionable mutations from liquid biopsies with high specificity. This development accelerates adoption of non-invasive, multi-cancer profiling solutions, significantly advancing Europe’s breast and prostate cancer diagnostics landscape through integration into routine clinical workflows.

- In October 2024: QIAGEN broadened its automated liquid biopsy portfolio with new EZ1 and QIAsymphony extraction kits, enhancing workflow efficiency for circulating cell-free DNA (ccfDNA) analysis. The improved automation and recovery performance directly benefit oncology diagnostics by enabling reliable liquid biopsy testing for minimal residual disease and tumor monitoring. These innovations support the growing trend toward minimally invasive diagnostics in Europe, thereby stimulating the overall breast and prostate cancer diagnostics market.

Report Scope

Report Features Description Report Features Description Market Value (2024) US$ 3.9 billion Forecast Revenue (2034) US$ 4.9 billion CAGR (2025-2034) 2.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Test (Liquid Biopsy, Tumor Biomarkers Tests, In Situ Hybridization, Immunohistochemistry, Imaging, and Biopsy), By Application (Breast Cancer and Prostate Cancer), By End-user (Cancer Research Institutes, Independent Diagnostic Laboratories, Hospital Associated Labs, Diagnostic Imaging Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens Healthcare GmbH, QIAGEN N.V., Koninklijke Philips N.V, General Electric (GE HealthCare), F.Hoffmann-La Roche Ltd., Danaher (Cepheid), Cook Group Inc., Bio Rad Laboratories Inc., Becton, Dickinson and Company, Agilent Technologies, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Europe Breast and Prostate Cancer Diagnostics MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Europe Breast and Prostate Cancer Diagnostics MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens Healthcare GmbH

- QIAGEN N.V.

- Koninklijke Philips N.V

- General Electric (GE HealthCare)

- Hoffmann-La Roche Ltd.

- Danaher (Cepheid)

- Cook Group Inc.

- Bio Rad Laboratories Inc.

- Becton, Dickinson and Company

- Agilent Technologies, Inc.