Global Digital Breast Tomosynthesis Market By Product Type(2D/3D Combination Systems, Standalone 3D Systems) By End Use(Hospital, Diagnostics Centers, Others) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147606

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

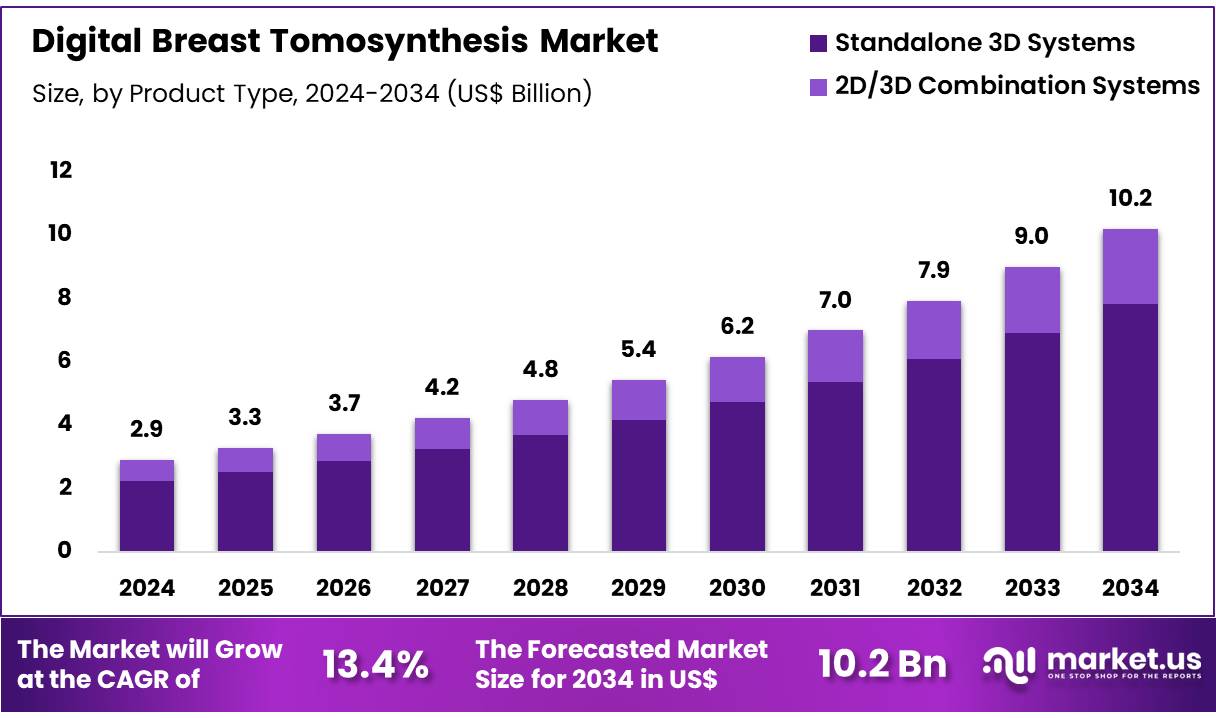

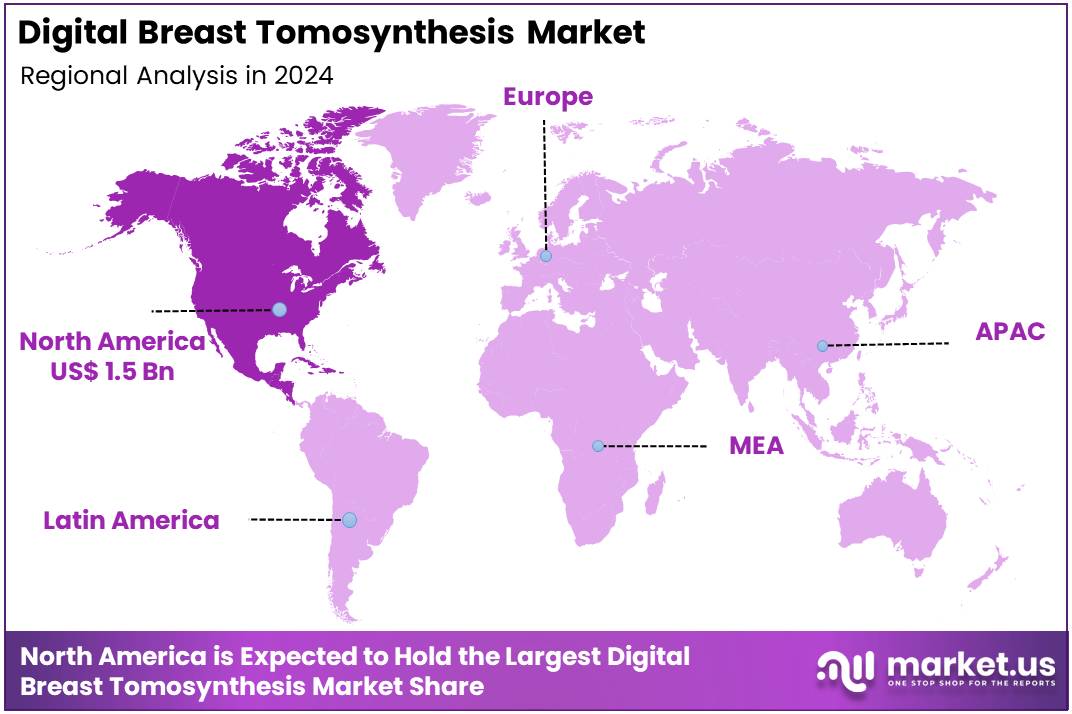

Global Digital Breast Tomosynthesis Market Nsize is expected to be worth around US$ 10.2 Billion by 2034 from US$ 2.9 Billion in 2024, growing at a CAGR of 13.4% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 54.6% share with a revenue of US$ 1.5 Billion.

The rising incidence of breast cancer is a primary factor contributing to the increased demand for digital breast tomosynthesis (DBT) systems. Lifestyle-related risk factors such as physical inactivity, obesity, unhealthy dietary patterns, and increased alcohol consumption have significantly influenced the global burden of breast cancer. As a result, the need for accurate and early-stage breast cancer detection has intensified, thereby driving adoption of advanced diagnostic imaging modalities like DBT.

In line with this, manufacturers are investing in the development of enhanced imaging solutions aimed at improving lesion detectability in early cancer stages. These innovations are supported by a broader set of growth enablers, including public awareness initiatives, government screening programs, and ongoing technological advancements in medical imaging systems.

According to the World Health Organization (WHO) report published in March 2024, approximately 2.3 million women were diagnosed with breast cancer globally in 2022, with 670,000 deaths reported in the same year. This rising disease prevalence is expected to fuel the demand for efficient and high-precision diagnostic tools such as digital breast tomosynthesis, which offers advantages over traditional 2D mammography through enhanced image clarity and reduced recall rates.

Technological innovation remains a key market driver. The integration of artificial intelligence (AI) and machine learning into DBT platforms is enabling enhanced image interpretation, reduction of false-positive results, and improved detection of small or overlapping lesions. These capabilities are vital for improving diagnostic accuracy and workflow efficiency in clinical settings. According to the Radiological Society of North America (RSNA), by March 2022, 82% of all breast imaging centers in the United States had adopted digital breast tomosynthesis, highlighting the rapid penetration of this technology.

Further supporting the market’s growth, a German study published in European Radiology in October 2021 found that combining DBT with synthesized 2D mammography significantly increased cancer detection rates while reducing the number of patient recalls. This combination uses DBT-acquired data to generate 2D images without exposing patients to additional radiation, maintaining diagnostic efficiency at lower radiation doses.

One notable technological advancement is Hologic’s direct conversion detector integrated into its Selenia Dimensions system. This design eliminates the need to convert x-rays into visible light, resulting in exceptionally sharp digital images. The system also offers a high Detective Quantum Efficiency (DQE), enabling low-dose imaging without compromising image quality, which is essential for both patient safety and early cancer detection.

Key Takeaways

- Market Size: Digital Breast Tomosynthesis Market size is expected to be worth around US$ 10.2 Billion by 2034 from US$ 2.9 Billion in 2024.

- Market Growth: The market growing at a CAGR of 13.4% during the forecast period from 2025 to 2034.

- Product Type Analysis: As of 2024, Standalone 3D Systems dominate the market, accounting for approximately 76.8% of the total market share.

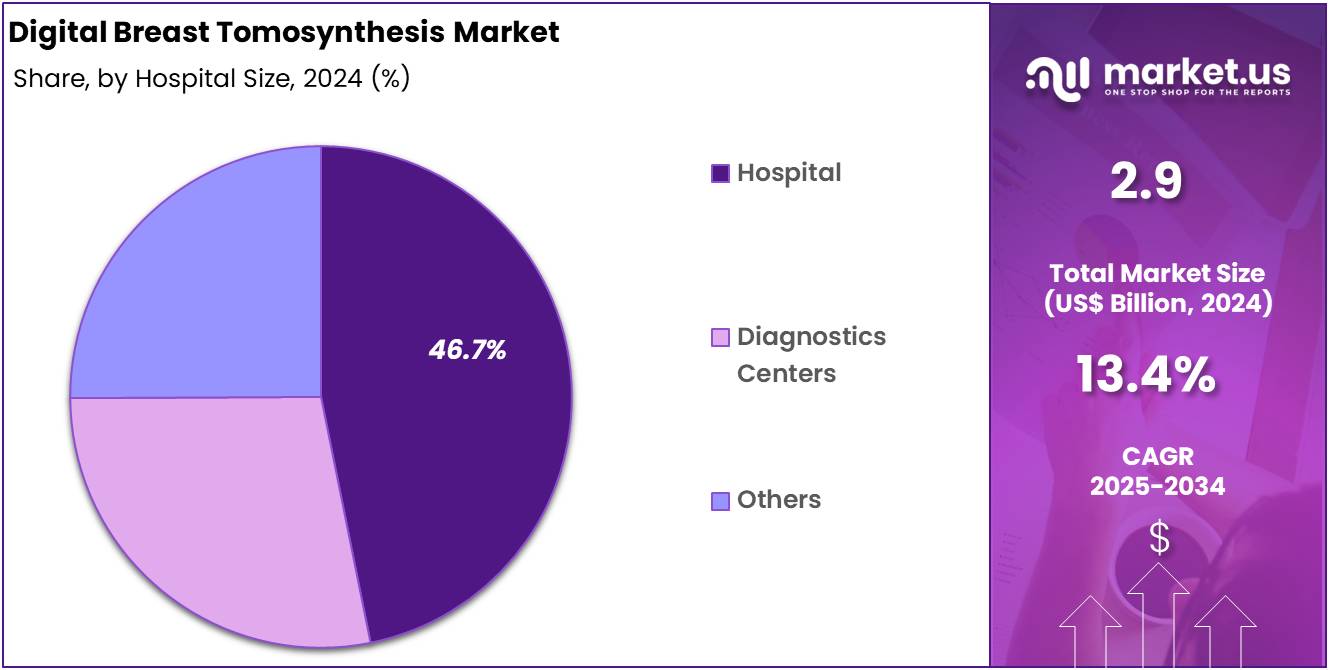

- End User Analysis: The Hospital segment dominates the market, accounting for approximately 46.7% of the total market share.

- Regional Analysis: In 2024, North America held a dominant market position, capturing more than a 54.6% share and holds US$ 1.5 Billion market value for the year.

Product Type Analysis

The global Digital Breast Tomosynthesis (DBT) market is segmented by product type into Standalone 3D Systems and 2D/3D Combination Systems. As of 2024, Standalone 3D Systems dominate the market, accounting for approximately 76.8% of the total market share. This dominance is attributed to their advanced imaging capabilities, which enhance lesion visualization and improve diagnostic accuracy, particularly in patients with dense breast tissue.

Conversely, the 2D/3D Combination Systems segment is projected to experience the highest growth rate during the forecast period. These systems offer the flexibility of performing both 2D and 3D imaging using a single device, leading to operational efficiency and reduced patient examination time. The ability to switch seamlessly between imaging modes enhances workflow efficiency and supports early and precise cancer detection.

In summary, while Standalone 3D Systems currently lead the DBT market due to their superior imaging performance, the 2D/3D Combination Systems are anticipated to gain significant traction, driven by their versatility and efficiency in clinical settings.

End User Analysis

The global Digital Breast Tomosynthesis (DBT) market is segmented by end-user into Hospitals, Diagnostic Centers, and Others. As of 2024, the Hospital segment dominates the market, accounting for approximately 46.7% of the total market share. This dominance is attributed to hospitals being the primary point of care for breast cancer diagnosis and treatment, equipped with advanced imaging technologies and comprehensive healthcare services.

The integration of DBT systems in hospitals enhances diagnostic accuracy and patient outcomes, particularly in large cancer centers and multi-specialty hospitals. Furthermore, the growing incidence of breast cancer and increasing government expenditure on hospital-based cancer screening programs are driving the demand for DBT systems in hospitals.

Diagnostic Centers represent the second-largest segment, offering specialized imaging services with dedicated equipment, thereby improving patient accessibility and diagnostic precision. These centers cater to a significant portion of the population seeking specialized diagnostic services outside hospital settings. The ‘Others’ category, encompassing research institutions and academic centers, contributes to the market through technological advancements and clinical research, albeit holding a smaller market share.

In summary, while hospitals currently lead the DBT market due to their comprehensive services and infrastructure, diagnostic centers are gaining traction by providing specialized and accessible imaging services. The combined efforts of these end-users are pivotal in advancing breast cancer detection and treatment.

Key Market Segments

By Product Type

- 2D/3D Combination Systems

- Standalone 3D Systems

By End Use

- Hospital

- Diagnostics Centers

- Others

Driver

Rising Prevalence of Breast Cancer and Demand for Early Detection

The increasing global incidence of breast cancer is a major driver of the digital breast tomosynthesis (DBT) market. According to the World Health Organization (2024), around 2.3 million women were diagnosed with breast cancer in 2022.

This rising disease burden has heightened the demand for early and accurate diagnostic methods. DBT offers enhanced imaging capabilities, allowing for the detection of small lesions often missed in conventional mammography. As a result, hospitals and diagnostic centers are rapidly adopting this technology to improve early detection outcomes, which in turn is propelling market growth.

Trend

Integration of AI in DBT for Enhanced Diagnostic Accuracy

A significant trend in the digital breast tomosynthesis market is the integration of artificial intelligence (AI) and machine learning tools. These technologies help radiologists interpret DBT images more accurately by reducing false positives and increasing diagnostic precision.

AI-enabled systems can analyze vast amounts of imaging data rapidly, providing predictive analytics and assisting in the early identification of abnormal tissues. This advancement enhances workflow efficiency in healthcare facilities and supports more personalized treatment planning. As AI algorithms become increasingly refined, their incorporation into DBT systems is expected to redefine breast cancer screening practices globally.

Restraint

High Equipment Costs and Limited Access in Low-Income Regions

Despite its advantages, the adoption of digital breast tomosynthesis is restricted by high equipment and maintenance costs. DBT systems require significant upfront investment and regular servicing, making them financially unfeasible for many small healthcare providers, especially in low- and middle-income countries.

Moreover, lack of skilled radiologists and insufficient infrastructure further limits accessibility. These economic and logistical barriers delay the integration of DBT in resource-constrained settings, thereby restraining the market’s full potential. Addressing affordability and access challenges remains essential for broader market penetration and equitable healthcare delivery.

Opportunity

Government Initiatives and Screening Program Expansion

The digital breast tomosynthesis market is poised for expansion due to increasing government support and breast cancer screening programs. Numerous national health agencies are implementing organized screening campaigns and funding the procurement of advanced diagnostic tools like DBT to reduce cancer-related mortality.For instance, many European and North American countries are updating public healthcare guidelines to include DBT as a preferred imaging method. These public health efforts are expected to increase awareness, improve screening rates, and foster infrastructure upgrades, thereby creating strong growth opportunities for DBT technology providers in the coming years.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 54.6% share and holds US$ 1.5 Billion market value for the year. This leadership is largely due to the increasing prevalence of breast cancer across the region. According to the Centers for Disease Control and Prevention (CDC), breast cancer remains one of the most diagnosed cancers among women in the United States. The rising disease burden has driven greater demand for accurate, early detection technologies such as digital breast tomosynthesis (DBT).

Government-backed screening programs have further supported the adoption of DBT systems. Initiatives by organizations like the U.S. Preventive Services Task Force and Medicare reimbursement policies have expanded access to advanced breast imaging. These programs encourage routine screening, thereby boosting the installation rate of 3D mammography systems in hospitals and diagnostic centers across the region.

In addition, North America’s advanced healthcare infrastructure, combined with high awareness among women regarding breast health, supports strong market uptake. The region also benefits from rapid adoption of AI-integrated imaging tools, enhancing diagnostic precision. The presence of leading medical device manufacturers in the U.S. has further contributed to North America’s continued dominance in the digital breast tomosynthesis market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The targeted therapeutics market is highly competitive and driven by continuous innovation in precision medicine. Key players in the industry focus on the development of biologics, small molecule inhibitors, and antibody-drug conjugates that offer high specificity for disease-related targets. These organizations invest heavily in clinical research, often collaborating with academic institutions and government bodies to accelerate drug discovery.

Expansion into oncology and rare disease segments is a primary strategy, with an emphasis on personalized treatment approaches supported by companion diagnostics. Companies are also increasing their presence in emerging markets through partnerships and regional manufacturing.

Additionally, there is a growing trend of acquiring biotech startups with novel pipeline assets. These strategic moves aim to strengthen therapeutic portfolios and improve treatment efficacy, ultimately contributing to sustained leadership in the targeted therapeutics landscape.

Market Key Players

- Hologic, Inc.

- GE Healthcare

- Siemens Healthineers

- FUJIFILM Corporation

- PerkinElmer

- Canon Medical Systems Corporation

- Analogic Corporation

- Trivitron Healthcare

- Thermo Fisher Scientific Inc.

- Koninklijke Philips N.V.

- Shimadzu Medical (India) pvt. Ltd

Recent Developments

- Fujifilm Introduces Amulet Sophinity: At ECR 2024, Fujifilm unveiled the Amulet Sophinity, a digital mammography system featuring dual-angle tomosynthesis and AI-driven image reconstruction. The system offers enhanced image quality with a low radiation dose, aiming to improve lesion detection in dense breast tissues.

- GE Healthcare Launches MyBreastAI Suite: In 2023, GE Healthcare introduced the MyBreastAI Suite, an AI-powered platform designed to assist radiologists in interpreting DBT images. The suite aims to enhance diagnostic accuracy and streamline workflow in breast cancer detection.

- Izotropic Plans Launch of IzoView: Izotropic announced plans to launch IzoView, a dedicated breast CT imaging system, targeting patients with dense breast tissue. The company is pursuing regulatory approvals in the U.S. and EU, positioning IzoView as an adjunctive tool to DBT for improved diagnostic accuracy.

Report Scope

Report Features Description Market Value (2024) US$ 2.9 Billion Forecast Revenue (2034) US$ 10.2 Billion CAGR (2025-2034) 13.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type, 2D/3D Combination Systems, Standalone 3D Systems, By End Use, Hospital, Diagnostics Centers, Others Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Hologic, Inc., GE Healthcare, Siemens Healthineers, FUJIFILM Corporation, PerkinElmer, Canon Medical Systems Corporation, Analogic Corporation, Trivitron Healthcare, Thermo Fisher Scientific Inc., Koninklijke Philips N.V., Shimadzu Medical (India) pvt. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Breast Tomosynthesis MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Breast Tomosynthesis MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Hologic, Inc.

- GE Healthcare

- Siemens Healthineers

- FUJIFILM Corporation

- PerkinElmer

- Canon Medical Systems Corporation

- Analogic Corporation

- Trivitron Healthcare

- Thermo Fisher Scientific Inc.

- Koninklijke Philips N.V.

- Shimadzu Medical (India) pvt. Ltd