Global EtherCAT Market Size, Share, Industry Analysis Report By Component (Hardware, Software, Services), By Device Type (Master Controllers, Slave Controllers, I/O Modules, Gateways), By End Use (Automotive & Transportation, Electrical & Electronics, Aerospace & Defense, Energy & Power / Oil & Gas, Pharmaceutical & Medical Devices, Food & Beverages, Metal Forming & Assembly), By Region, Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158654

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

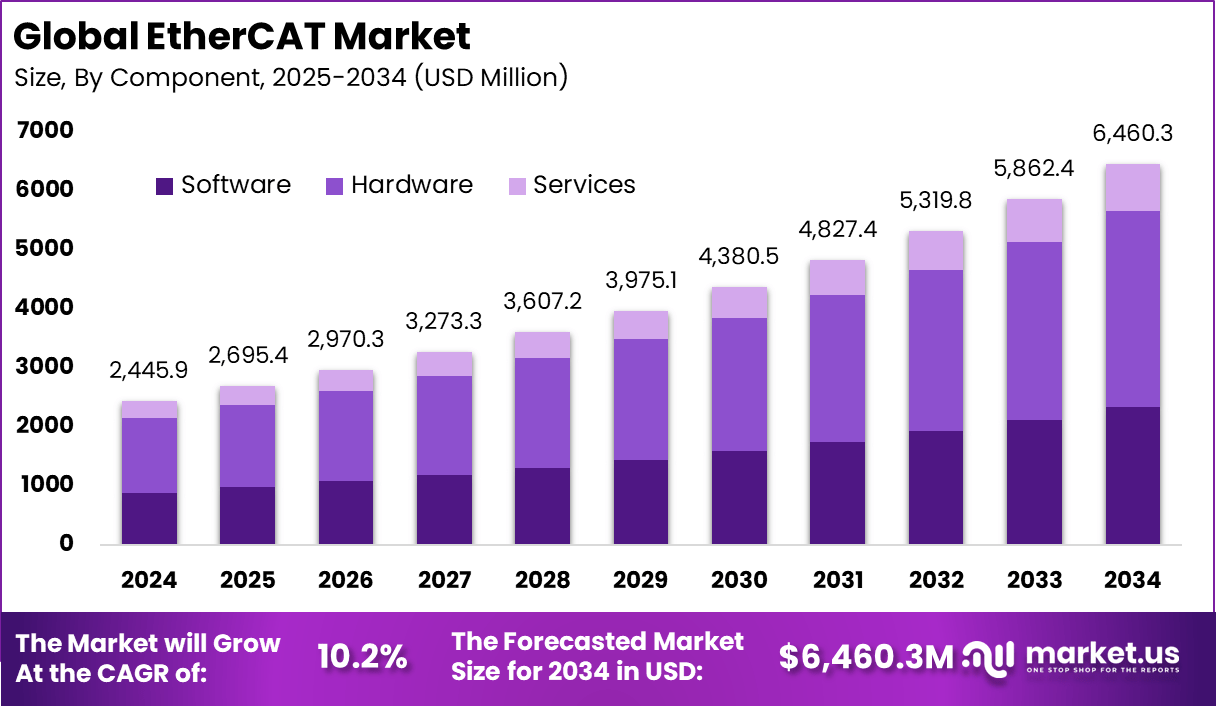

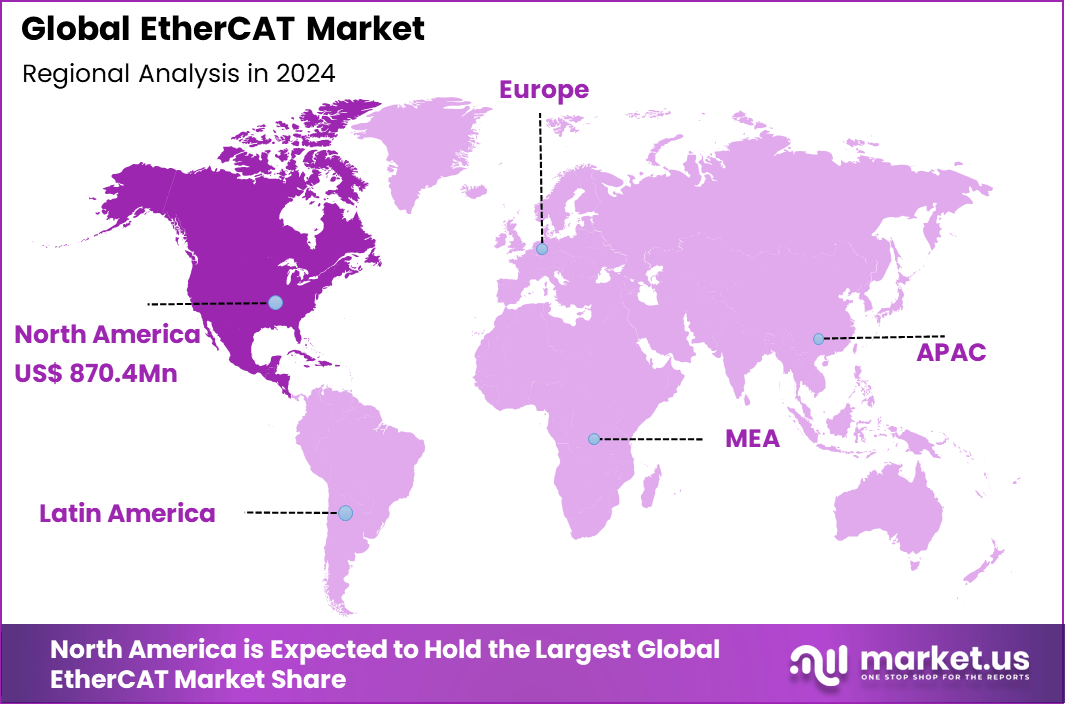

The Global EtherCAT Market size is expected to be worth around USD 6,460.3 Million By 2034, from USD 2,445.9 Million in 2024, growing at a CAGR of 10.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 35.6% share, holding USD 870.42 Billion revenue.

The EtherCAT Market refers to the industry surrounding the adoption of EtherCAT (Ethernet for Control Automation Technology), an Ethernet-based fieldbus system designed for real-time industrial automation. EtherCAT is valued for its high-speed communication, low latency, and efficient data handling, making it well-suited for applications in factory automation, robotics, semiconductors, energy systems, and automotive manufacturing.

According to Wiley Industry News, the EtherCAT Technology Group reported about 88 million EtherCAT nodes in use worldwide, with 11 million added in 2024 despite economic challenges and chip overstock. Around 10% of these are FPGA-based devices, confirming EtherCAT’s continued growth and leading role in industrial communication.

The market includes hardware such as controllers, I/O modules, and gateways, as well as supporting software and integration services. The market is driven by the rising need for fast and reliable communication in industrial automation. Manufacturers are increasingly relying on EtherCAT to meet the performance demands of robotics, motion control, and real-time monitoring.

The shift toward smart factories and Industry 4.0 is further accelerating adoption. EtherCAT’s ability to integrate seamlessly with existing Ethernet infrastructure and its scalability for large networks are additional drivers. The growth of robotics in automotive and electronics industries strongly contributes to demand.

Key Insight Summary

- By component, Hardware dominated the EtherCAT market with a 51.5% share.

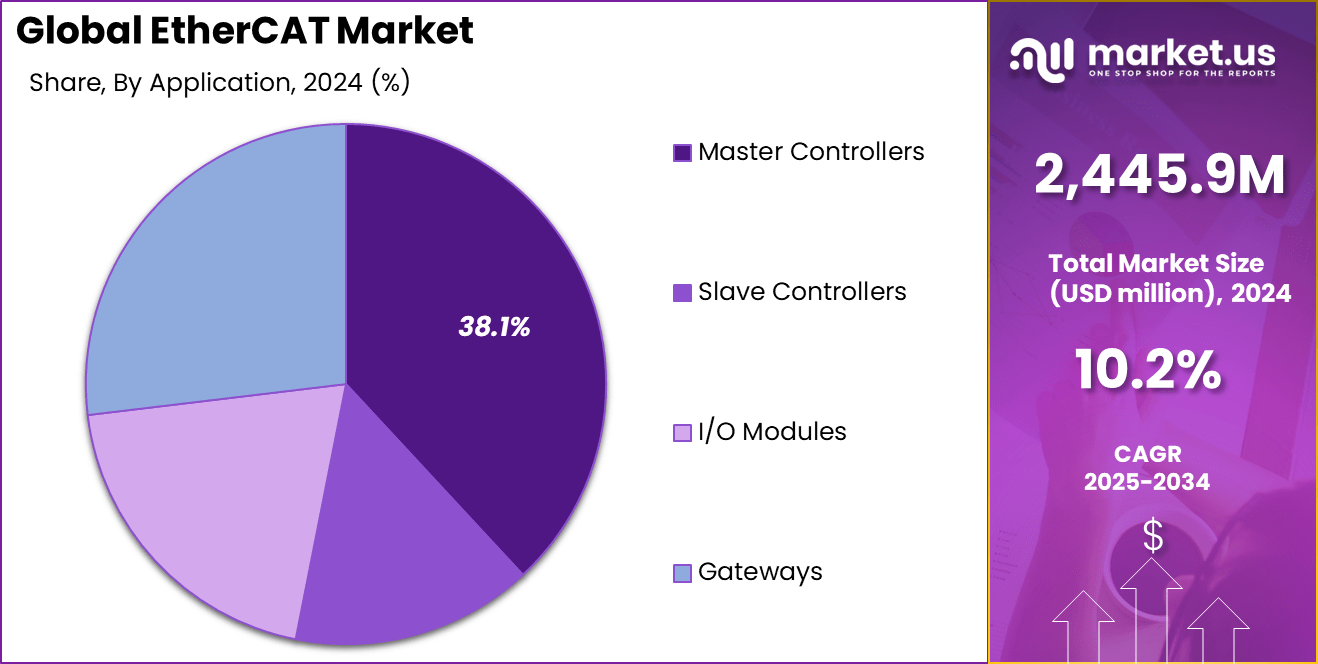

- By device type, Master Controllers led the segment, accounting for 38.1% share.

- By end use, the Automotive & Transportation sector emerged as the leading adopter of EtherCAT technology.

- Regionally, North America captured 35.6% share, reflecting strong adoption in industrial automation and automotive applications.

Analysts’ Viewpoint

Demand for EtherCAT solutions is strong in manufacturing sectors that require precision and speed. Automotive production lines use EtherCAT to coordinate robotics and assembly systems. The semiconductor industry depends on EtherCAT for cleanroom automation and testing equipment. In packaging and food processing, EtherCAT supports synchronized motion control, ensuring efficiency and accuracy.

Renewable energy projects, such as wind turbines and solar systems, are also adopting EtherCAT for condition monitoring and grid integration. Smaller enterprises are beginning to explore EtherCAT for cost-effective automation upgrades. Technological adoption is increasing in areas such as robotics, motion control, and factory automation, where high-speed synchronization and real-time data exchange are vital.

EtherCAT is often preferred over alternative protocols due to its deterministic communication and ability to support complex network topologies like line, tree, and ring. The rise of Industry 4.0 and the Industrial Internet of Things adds to the growing reliance on EtherCAT for orchestrating highly interconnected automated systems.

Investment and Business Benefits

Investment opportunities in the EtherCAT market are expanding as governments promote Industry 4.0 and digital transformation through grants and incentives. The manufacturing sector’s projected growth at an annual rate above 4% globally fuels demand for real-time automated control systems. The Asia-Pacific region and North America are hotspots for investments due to their industrial base and progressive automation infrastructure.

The business benefits of adopting EtherCAT lie in increased productivity, cost reduction, and enhanced precision in industrial applications. By enabling real-time synchronization and high-speed communication, EtherCAT reduces cycle times and improves machine accuracy, resulting in less waste and higher throughput. Additionally, its compatibility with multiple network topologies enhances scalability, allowing businesses to expand without significant overhauls.

The regulatory environment around EtherCAT is shaped by international standards and government initiatives encouraging automation and safety protocols. EtherCAT is standardized under IEC 61158 and IEC 61784, ensuring interoperability and reliability across devices. Regulatory bodies are increasingly pushing for functional safety and cybersecurity in industrial automation, which is reflected in the evolving features of EtherCAT controllers.

Role of Generative AI

Generative AI is playing an increasingly important role in enhancing EtherCAT-based automation systems. It helps optimize real-time motion control and robotic operations by improving decision-making processes on the fly.

Recent deployment of dual EtherCAT master AI robot controllers empowered by advanced AI chips shows how generative AI supports fast synchronization and precision control in industrial robots. This integration is raising the bar for reliability and performance, especially in complex manufacturing and factory automation environments.

The growing presence of generative AI models in EtherCAT systems is enabling smarter diagnostics, predictive maintenance, and autonomous operation, contributing to higher operational efficiency. By 2025, adoption of AI within EtherCAT-controlled systems is accelerating, helping them move from experimental phases to production-scale use with improved scalability and responsiveness.

By Component

In 2024, Hardware forms the backbone of the EtherCAT market, holding a 51.5% share. This includes interface cards, gateways, and modules that enable high-speed and real-time data communication. Hardware adoption remains strong as industries seek reliable physical infrastructure to maintain seamless network performance.

The demand for EtherCAT-compatible hardware is also linked to its ability to integrate with both legacy systems and advanced automation setups. Manufacturers prefer solutions that support scalability and low latency, making hardware a consistently prioritized investment within industrial automation networks.

By Device Type

In 2024, Master controllers hold a significant 38.1% share of the market. These devices function as the central command units in EtherCAT networks, ensuring precise synchronization of connected nodes and smooth control over industrial processes. Their role is critical in maintaining consistency when multiple devices operate simultaneously.

A major reason behind the share of master controllers is their adoption in applications requiring high reliability, such as robotics and automated production lines. As factories move towards digitalized environments, the role of EtherCAT master controllers grows in value for managing large-scale machine-to-machine communication.

By End Use

In 2024, the automotive and transportation sector is the leading end-use industry for EtherCAT. Automakers rely on EtherCAT networks to ensure real-time efficiency in assembly lines, automated testing, and advanced driver-assistance system development. The ability to handle high data volumes at low latency makes EtherCAT highly suitable for these environments.

Beyond manufacturing, transport applications such as rail systems and intelligent traffic management also adopt EtherCAT technologies to achieve faster processing and reliable signaling. This broad scope of use keeps the sector in the leading position for end-use.

By Region

North America Market Trends

North America accounts for 35.6% of the EtherCAT market. The region benefits from strong adoption of industrial automation technologies across automotive, aerospace, and electronics industries, where real-time communication networks are essential. Investments in smart manufacturing and Industry 4.0 also drive the expansion of EtherCAT adoption.

Local innovation and early deployment of advanced control systems give North American firms a competitive advantage in automation efficiency. Widespread implementation across medium and large-scale enterprises further strengthens the region’s position in the global EtherCAT market.

Europe Market Trends

Europe’s EtherCAT market is marked by strong growth driven by its well-established manufacturing and automotive industry clusters. Countries such as Germany and France are pioneers in implementing smart factory initiatives that rely on EtherCAT networks to ensure precision and synchronization across production lines.

The region’s focus on regulatory standards for safety and efficiency further supports EtherCAT adoption. European manufacturers prioritize reliability and low latency in industrial communication, making EtherCAT an attractive protocol choice. Investments in connected manufacturing and automation tools contribute to the expanding market.

Asia Pacific Market Trends

Asia Pacific is recognized as the fastest-growing market for EtherCAT technology. Countries like China, Japan, and South Korea are aggressively adopting EtherCAT in sectors such as automotive, electronics, and robotics to drive automation.

The region’s expanding industrial base, coupled with government initiatives promoting smart factories and Industry 4.0, fuels this rapid growth. Local manufacturers and international technology players collaborate to introduce advanced EtherCAT solutions tailored to the market’s needs.

The scalability and high performance of EtherCAT networks align well with the region’s push toward smart manufacturing, further accelerating adoption. Asia Pacific’s growth reflects a strong appetite for real-time industrial communication to boost productivity.

Latin America Market Trends

Latin America is an emerging market for EtherCAT, showing steady growth driven by increasing investments in industrial automation within manufacturing hubs in Brazil and Mexico. The adoption of EtherCAT is gradually increasing as companies modernize their production systems to improve efficiency and reliability.

Challenges such as limited infrastructure availability and the requirement for skilled labor slow market growth, but ongoing economic development and regional industrial expansion provide optimism. The growing awareness of EtherCAT’s benefits in cost savings and production optimization is expected to sustain interest and adoption in Latin America.

Emerging Trends

Several clear trends are shaping the EtherCAT landscape in 2025. The expansion of industrial communication with the support of 5G technology is helping EtherCAT networks overcome traditional latency and wiring constraints. 5G enables wireless, ultra-low latency control that complements EtherCAT’s real-time deterministic communication.

Additionally, the market is witnessing increased integration of EtherCAT with Internet of Things (IoT) technologies and digital transformation initiatives in manufacturing, pushing for smarter factories. The modularization and standardization of EtherCAT components make it easier for diverse industries, including automotive and pharmaceuticals, to adopt it.

EtherCAT is also moving toward higher bandwidth solutions with enhancements such as EtherCAT G and EtherCAT P, supporting the demand for faster and more complex data exchange. Increasing node counts highlight strong infrastructure growth, with over 88 million EtherCAT nodes recorded in 2024, showing robust adoption despite economic challenges.

Growth Factors

Growth in the EtherCAT market is primarily driven by industrial automation demands that require precise, real-time communication protocols. EtherCAT’s high-speed data transfer, adaptability, and low latency suit applications requiring exact machine control and synchronization.

Industry 4.0 transformation plays a key role, as factories seek to implement scalable automation with interoperable networks. The use of EtherCAT spans across automotive production lines, robotics, electronics assembly, and food processing, each contributing to steady demand growth.

Government initiatives to modernize manufacturing infrastructure and increase digital adoption also serve as important growth catalysts. Furthermore, advances in hardware supporting EtherCAT, including dual-master controllers and edge AI integration, are expanding the range of possible applications and enabling higher control precision and reliability.

Key Market Segments

EtherCAT By Component

- Hardware

- Software

- Services

EtherCAT By Device Type

- Master Controllers

- Slave Controllers

- I/O Modules

- Gateways

EtherCAT By End Use

- Automotive & Transportation

- Electrical & Electronics

- Aerospace & Defense

- Energy & Power / Oil & Gas

- Pharmaceutical & Medical Devices

- Food & Beverages

- Metal Forming & Assembly

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Demand for Real-Time Automation Control

One of the key drivers for EtherCAT adoption is the increasing demand for high-speed, real-time automation control across industries like automotive manufacturing, electronics, and robotics. EtherCAT offers superior real-time communication capabilities that allow precise synchronization and deterministic data exchange.

This makes it ideal for applications that require fast and reliable motion control, such as semiconductor manufacturing and factory automation, where timing and accuracy directly impact productivity and quality. For instance, industries embracing Industry 4.0 have prioritized EtherCAT because it supports efficient integration of connected machines and smart devices.

The ability to control multiple motors simultaneously with high-speed synchronization helps manufacturers improve machine efficiency and reduce downtime. This real-time performance advantage is pushing more companies to adopt EtherCAT in their automation networks to stay competitive in increasingly complex production environments.

Restraint

High Initial Implementation Costs

One major restraint slowing EtherCAT adoption is the significant initial investment required for infrastructure setup, including controllers and compatible devices. Small and medium enterprises often find the upfront costs prohibitive, especially when compared to traditional industrial communication protocols that may seem cheaper or more familiar.

Additionally, the specialized expertise needed to install and program EtherCAT systems adds to the financial and operational burden. For example, many companies hesitate to replace existing legacy automation systems due to the complexity and cost of integration with EtherCAT.

The need for trained engineers or consultants to support implementation can be a barrier, especially in regions or industries where skilled labor is scarce. This cost factor limits the reach of EtherCAT, especially among smaller manufacturers who might benefit from its advanced capabilities but lack the resources to invest initially.

Opportunity

Expansion in High-Precision Industrial Applications

EtherCAT holds substantial opportunity in expanding its presence in high-precision and high-speed industrial applications like semiconductor manufacturing, robotics, and electronic inspection equipment. These sectors require exact and fast control, which EtherCAT’s superior performance supports well.

There is growing demand for integrated control solutions that can handle complex multi-axis systems while maintaining low latency communication. For instance, new EtherCAT-compatible drivers and motor control products scheduled for release are designed to increase precision and operational efficiency in cutting-edge industries.

Advances such as integrating EtherCAT with AI-driven robotics controllers open further growth avenues by enabling smarter, real-time motion control solutions. This trend positions EtherCAT as a vital technology in next-generation manufacturing and industrial automation.

Challenge

Security Vulnerabilities in Networked Systems

A significant challenge for EtherCAT is vulnerability to cybersecurity threats as its networks become more interconnected across industrial environments. The increasing reliance on Ethernet-based communication and integration with broader IT systems exposes EtherCAT networks to risks such as malware, ransomware, and unauthorized access.

This raises concerns about the integrity and availability of critical data and system functions. For example, attacks targeting industrial protocols have grown, requiring more robust security measures in EtherCAT infrastructures.

Protecting networked devices from cyberattacks adds complexity and cost, and failure to address these risks can lead to operational disruption or safety hazards. As industries adopt web-based and off-the-shelf IT solutions, ensuring secure EtherCAT communications remains a pressing priority for vendors and users alike.

Competitive Analysis

In the EtherCAT market, Beckhoff Automation holds a central position as the original developer of the technology. The company continues to lead with strong innovation and widespread adoption of its EtherCAT-based solutions across industries. Its offerings support high-speed communication, real-time control, and scalable integration, making it a preferred choice in automation and robotics.

Other automation leaders such as Siemens, Schneider Electric, Bosch Rexroth, Omron, and Yaskawa Electric strengthen the market with extensive product portfolios. Their expertise in industrial control, robotics, and motion systems allows them to integrate EtherCAT seamlessly into existing platforms.

Specialized firms including Acontis Technologies, KEB Automation, Phoenix Contact, and WAGO add value with niche solutions and software support. They focus on EtherCAT masters, development tools, and connectivity components that ensure compatibility and ease of deployment.

Top Key Players in the Market

- Acontis Technologies GmbH

- Beckhoff Automation

- Bosch Rexroth AG

- KEB Automation KG

- Omron Corporation

- Phoenix Contact

- Siemens

- Schneider Electric

- WAGO

- Yaskawa Electric Corporation

Recent Developments

- In February 2025, Phoenix Contact revealed more than 100 new innovations in connection technology and automation technology, reflecting ongoing product expansion in EtherCAT-compatible devices.

- In February 2024, Acontis Technologies partnered with Delta Motion to integrate EtherCAT MainDevice functionality into the high-performance RMC200 motion controller, improving flexibility for industrial motion control applications. This collaboration leveraged Acontis’ well-established software expertise to meet high standards of performance and usability.

- In September 2024, Acontis Technologies announced full compatibility and support for their flagship EC-Master EtherCAT MainDevice software, enhancing robustness for embedded EtherCAT solutions.

Report Scope

Report Features Description Market Value (2024) USD 2,445.9 Mn Forecast Revenue (2034) USD 6,460.3 Mn CAGR(2025-2034) 10.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Device Type (Master Controllers, Slave Controllers, I/O Modules, Gateways), By End Use (Automotive & Transportation, Electrical & Electronics, Aerospace & Defense, Energy & Power / Oil & Gas, Pharmaceutical & Medical Devices, Food & Beverages, Metal Forming & Assembly) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Acontis Technologies GmbH, Beckhoff Automation, Bosch Rexroth AG, KEB Automation KG, Omron Corporation, Phoenix Contact, Siemens, Schneider Electric, WAGO, Yaskawa Electric Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Acontis Technologies GmbH

- Beckhoff Automation

- Bosch Rexroth AG

- KEB Automation KG

- Omron Corporation

- Phoenix Contact

- Siemens

- Schneider Electric

- WAGO

- Yaskawa Electric Corporation