Global Estate Planning Service Market Size, Share, Growth Analysis By Service Type (Will Drafting, Trust Creation and Management, Probate Services, Power of Attorney Services, Estate Tax Planning, Wealth and Asset Protection, Business Succession Planning), By Client Type (Individuals, High-Net-Worth Individuals (HNWIs), Families, Business Owners), By Mode of Service (Online Estate Planning Services, Offline Estate Planning Services), By End User (Individuals and Families, Corporate and Business Entities), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142041

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

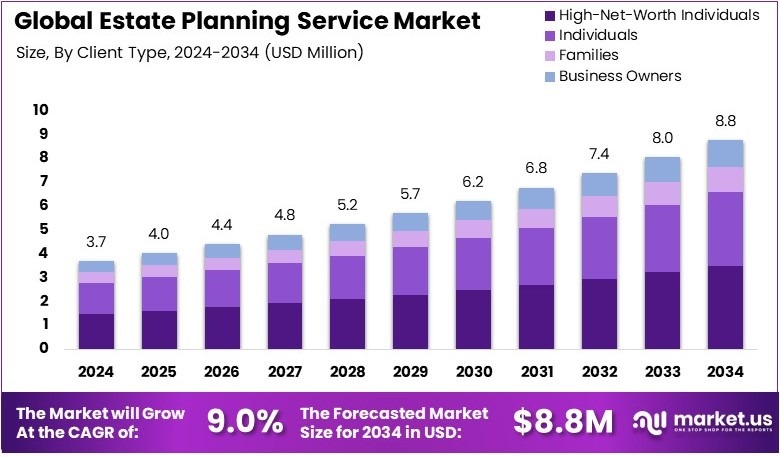

The Global Estate Planning Service Market size is expected to be worth around USD 8.8 Million by 2034, from USD 3.7 Million in 2024, growing at a CAGR of 9.0% during the forecast period from 2025 to 2034.

Estate planning service helps individuals manage and transfer their assets. It includes wills, trusts, and tax planning. The goal is to protect wealth and ensure smooth inheritance. Legal and financial experts guide individuals in making informed decisions. Proper estate planning prevents disputes and secures financial stability for future generations.

The estate planning service market includes law firms, financial advisors, and online platforms. It provides services for asset protection and inheritance planning. Demand comes from individuals, businesses, and high-net-worth clients. Regulations, tax laws, and wealth management trends shape the market. Digital solutions are expanding accessibility and efficiency in estate planning.

The estate planning market is growing as more people seek expert guidance. High-net-worth individuals and aging populations are key clients. Additionally, tax changes are influencing estate planning decisions. The $13.61 million federal estate tax exemption may decrease, increasing the number of taxable estates and driving demand for professional services.

Estate planning helps individuals protect their assets and ensure a smooth transfer of wealth. However, only 31% of Americans have an active will, while 55% lack any estate planning documents. This gap creates legal and financial risks. As life expectancy increases, more people are realizing the importance of planning ahead.

A major factor driving demand is the upcoming wealth transfer of $84 trillion from Baby Boomers to younger generations. Additionally, legal disputes over inheritances are rising, making estate planning more necessary. Financial advisors are expanding services, but only 22% of clients receive estate planning despite 93% expecting it. This presents a strong business opportunity.

Market saturation is low, as many individuals still lack proper planning. However, competition is increasing among law firms, financial advisors, and online platforms. Digital solutions are making real estate planning more accessible. As a result, firms that offer affordable and efficient services are gaining an advantage over traditional providers.

Government regulations play a crucial role in shaping the market. Changes in tax laws can increase or decrease demand. Additionally, financial education programs help individuals understand estate planning benefits. By adapting to new regulations and offering clear guidance, service providers can build trust and expand their client base.

Key Takeaways

- The Estate Planning Service Market was valued at USD 3.7 million in 2024 and is expected to reach USD 8.8 million by 2034, with a CAGR of 9.0%.

- In 2024, Trust Creation & Management dominates the service type segment with 34.5%, driven by growing demand for asset protection.

- In 2024, High-Net-Worth Individuals (HNWIs) lead the client type segment with 40.2%, due to their complex estate needs.

- In 2024, Online Estate Planning Services account for 58.6%, reflecting the shift toward digital solutions.

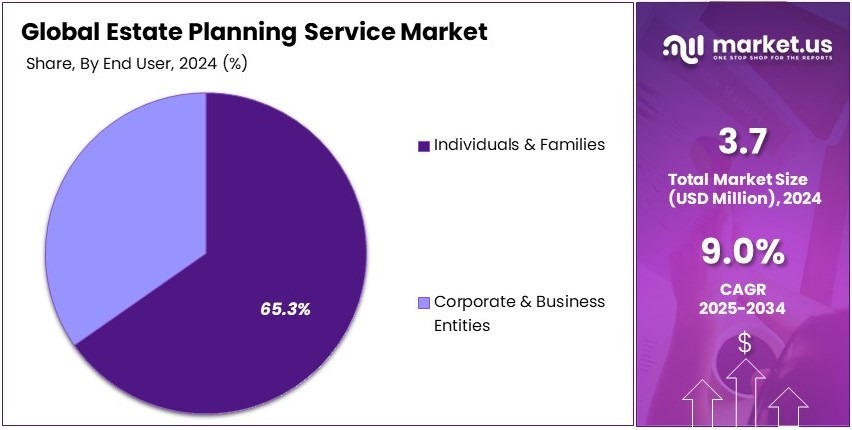

- In 2024, Individuals & Families dominate the end-user segment with 65.3%, as estate planning gains traction among personal clients.

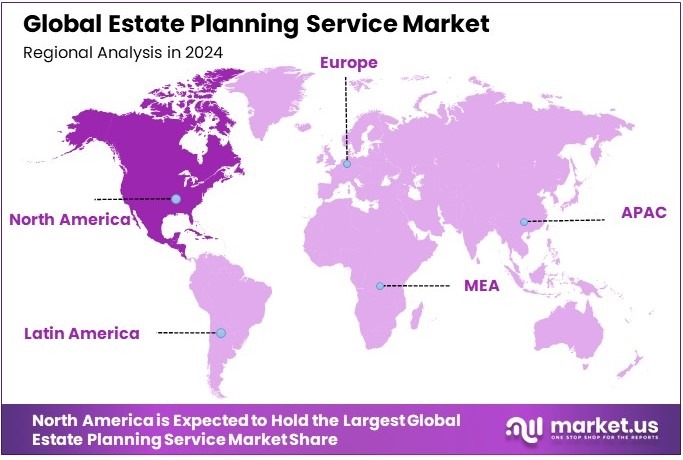

- In 2024, North America holds the largest market share, driven by high awareness and advanced financial services.

Service Type Analysis

Trust Creation & Management dominates with 34.5% due to its critical role in long-term asset management.

Trust Creation & Management has established itself as the leading sub-segment in the Estate Planning Service Market, holding a 34.5% share. This prominence stems from the increasing awareness among individuals about the importance of safeguarding their assets for future generations and managing them effectively to minimize estate taxes. Trust services are not only about preserving wealth but also ensuring that it is distributed according to the grantor’s wishes without legal complications.

Will Drafting remains a fundamental service, providing individuals the peace of mind that their assets will be distributed as intended. Probate Services play an essential role in the legal process after death, ensuring that a deceased’s affairs are settled according to the will.

Power of Attorney Services and Estate Tax Planning are critical for comprehensive estate management, helping individuals maintain control over their financial and health-related decisions and minimize the tax burden on inheritances.

Client Type Analysis

High-Net-Worth Individuals (HNWIs) lead with 40.2% due to their complex asset portfolios.

High-Net-Worth Individuals (HNWIs) dominate the client segment of the Estate Planning Service Market, accounting for 40.2% of the market. This group often possesses diverse and extensive asset portfolios that require sophisticated management strategies to preserve wealth and minimize taxes. The complex nature of HNWIs’ financial affairs makes them prime candidates for comprehensive estate planning services.

Individuals and Families also form significant segments, seeking to secure their financial future and ensure their assets are protected and passed on efficiently. Business Owners focus on integrating personal financial goals with the continuity of their business interests, highlighting the need for specialized business succession planning within the estate planning framework.

Mode of Service Analysis

Online Estate Planning Services dominate with 58.6% due to their convenience and scalability.

Online Estate Planning Services have taken a significant lead in the market, capturing a 58.6% share. The growth of digital solutions in estate planning has revolutionized how services are delivered, offering greater accessibility and convenience to users. Online platforms enable efficient document management, updates, and consultations, making it easier for clients to engage with estate planning processes from anywhere.

Offline Estate Planning Services, though not as dominant, still play a crucial role, particularly for clients who prefer face-to-face interactions and more personalized service. This mode is particularly valued by older clients or those with more complex estate planning needs who seek direct engagement with professionals.

End User Analysis

Individuals & Families dominate with 65.3% due to the universal need for estate planning.

The segment of Individuals & Families leads the End User category in the Estate Planning Service Market with a share of 65.3%. This dominance is driven by the general need among people to manage and secure their assets and ensure proper care for their families after they are gone. Estate planning is seen as a necessary step for anyone wanting to establish a clear and legally sound plan for their assets, regardless of wealth level.

Corporate & Business Entities also utilize estate planning services, particularly in the context of succession planning and protecting business assets. These services are crucial for ensuring the smooth transition of ownership and operational control in businesses, which is vital for long-term corporate health and stability.

Key Market Segments

By Service Type

- Will Drafting

- Trust Creation & Management

- Probate Services

- Power of Attorney Services

- Estate Tax Planning

- Wealth & Asset Protection

- Business Succession Planning

By Client Type

- Individuals

- High-Net-Worth Individuals (HNWIs)

- Families

- Business Owners

By Mode of Service

- Online Estate Planning Services

- Offline Estate Planning Services

By End User

- Individuals & Families

- Corporate & Business Entities

Driving Factors

Financial Insight Drives Market Growth

Growing awareness about asset protection and wealth transfer planning has driven significant demand in the estate planning service market. Initially, more individuals and families are recognizing the need to safeguard assets and secure a legacy for future generations.

Furthermore, the rising incidence of legal disputes has encouraged clients to seek structured estate planning to avoid conflicts and ensure clarity. Additionally, digital estate planning tools and online will services are becoming widely adopted, as these platforms simplify the process and reduce administrative burdens.

Moreover, financial advisory firms are expanding their service portfolios to include comprehensive estate planning solutions, which adds professional guidance to the planning process. Consequently, this multi-faceted approach offers enhanced security and convenience for clients.

For instance, customers now benefit from integrated digital services that streamline legal documentation while receiving expert advice. As a result, the market is experiencing rapid growth driven by technological innovation and increased financial awareness.

Restraining Factors

Legal and Cost Complexities Restrain Market Growth

Complex estate laws and regulations often create uncertainty for potential clients in the estate planning service market. Initially, many individuals feel overwhelmed by the legal complexities and hesitate to engage professional services.

Furthermore, high legal and consultancy fees restrict access for many families and small business owners, limiting the market reach significantly. Additionally, younger generations show limited awareness about the importance of estate planning, as they prioritize immediate financial concerns over long-term asset management.

Moreover, privacy and security concerns related to digital estate planning platforms contribute to market hesitancy. For example, some potential clients worry about the safety of their sensitive information when using online tools.

Consequently, these apprehensions slow down the adoption of innovative digital services. In contrast, traditional methods remain preferred by those who are skeptical of modern technology.

Furthermore, the combination of high costs, legal complexity, and limited digital trust creates a challenging environment for growth. Notably, many prospective clients delay planning due to fear of hidden charges and unclear legal obligations. As a result, market penetration remains lower than expected. Overall, these factors significantly restrain the broader adoption of estate planning services, creating barriers that both providers and clients must overcome for future market expansion effectively.

Growth Opportunities

Digital Advancements Create Growth Opportunities

Technological advancements have paved the way for significant growth opportunities in the estate planning service market. Initially, the development of AI-powered estate planning tools has automated legal documentation, making the process faster and more accurate.

Furthermore, these tools reduce human error and enhance overall efficiency. Additionally, the expansion of estate planning services targeting the gig economy and freelancers is underway, as non-traditional workers seek flexible and affordable solutions for asset protection.

Moreover, the rise of cryptocurrency and digital assets has led to a demand for specialized estate planning solutions that secure digital wealth. Consequently, providers are innovating to include digital asset management in their service portfolios. For example, automated platforms now offer clear guidance on transferring digital assets securely.

In addition, there is increasing demand for ethical will services, where individuals can pass down personal values and life lessons along with their financial assets. Such services provide a more holistic approach to legacy planning.

Emerging Trends

Digital Trends Redefine Market Dynamics

Recent trends have transformed the estate planning service market into a dynamic field. Initially, there has been a surge in the popularity of subscription-based estate planning models, which offer regular updates and affordable access to essential services.

Additionally, they provide flexibility and ongoing support for clients, which makes estate planning more approachable. Furthermore, there is notable growth in green and sustainable estate planning preferences. For example, environmentally conscious clients now seek planning services that reflect their values by incorporating eco-friendly strategies.

Moreover, the rising demand for estate planning services tailored to blended families is reshaping the market. These specialized solutions address the unique needs of families with complex structures, ensuring fair asset distribution and conflict avoidance. Consequently, providers are developing customized plans that reflect modern family dynamics.

In addition, the integration of blockchain technology is emerging as a key trend. Blockchain offers secure and tamper-proof documentation, which enhances trust and reduces fraud risks. For example, digital records maintained on a blockchain are nearly impossible to alter, ensuring reliability and transparency.

Regional Analysis

North America Dominates with Market Share in the Estate Planning Service Market

North America leads the Estate Planning Service Market with a share. This dominance is due to the region’s advanced legal frameworks, high awareness about estate planning, and significant wealth accumulation. The presence of numerous estate planning professionals and firms that offer a wide range of tailored services also contributes to this high market share.

The market dynamics in North America are influenced by an aging population and the transfer of wealth from older generations to younger ones, which drives the demand for comprehensive estate planning. The region’s strong economic environment and high priority on legal preparations for wealth management and succession planning further enhance its market performance.

The future influence of North America on the global Estate Planning Service Market is expected to remain strong. With ongoing economic growth and an increase in the population needing estate planning, especially among high-net-worth individuals, the demand for these services is likely to continue rising. This will not only retain but could potentially increase the region’s market share.

Regional Mentions:

- Europe: Europe has a robust Estate Planning Service Market, driven by its complex inheritance laws and high levels of wealth. The region emphasizes legal services that cater to diverse international laws, aiding its steady growth in this market.

- Asia Pacific: Asia Pacific is rapidly growing in the Estate Planning Service Market due to increasing wealth and the complexity of assets. Countries like Japan and China are seeing more demand for estate planning services as wealth generation shifts to younger, more globally integrated generations.

- Middle East & Africa: The Middle East and Africa are developing their estate planning services, focusing on securing wealth within families and businesses. The growing number of high-net-worth individuals in regions like the UAE is driving the demand for sophisticated estate planning solutions.

- Latin America: Latin America’s Estate Planning Service Market is expanding with rising economic stability and wealth accumulation. The need for estate planning is becoming more pronounced, especially among the growing middle and upper classes in countries like Brazil and Mexico.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Estate Planning Service Market, Charles Schwab, Fidelity Investments, Edward Jones, and Merrill Lynch (Bank of America) dominate due to their comprehensive service offerings that cater to diverse needs, from basic estate management to complex wealth preservation strategies.

Charles Schwab and Fidelity Investments are standout performers particularly for their user-friendly online tools that demystify estate planning for the average person. Their digital platforms provide educational resources and interactive tools that empower clients to manage their estate plans effectively, fostering a greater understanding of estate management essentials.

Edward Jones offers personalized estate planning through a network of dedicated financial advisors who assist clients in developing tailored strategies that address their specific financial and familial circumstances. Their approach emphasizes close client relationships and long-term planning, ensuring that each client’s estate is handled according to their individual preferences and goals.

Merrill Lynch (Bank of America) provides high-end estate planning services, focusing on high-net-worth individuals who require sophisticated solutions for asset distribution and tax planning. Their services are designed to seamlessly integrate with the broader financial planning services offered by Bank of America, providing a holistic approach to wealth management and succession planning.

These firms play crucial roles in the estate planning market, driving innovation and setting standards for quality and comprehensive care. Their efforts ensure the continuous evolution of the market, meeting the changing needs of clients across various demographics.

Major Companies in the Market

- Charles Schwab

- Fidelity Investments

- Edward Jones

- Merrill Lynch (Bank of America)

- Morgan Stanley

- Northern Trust

- Wells Fargo

- Vanguard Personal Advisor Services

- U.S. Trust (Bank of America Private Wealth Management)

- LPL Financial

Recent Developments

- Wealth.com and Merit Financial Advisors: On November 2024, Wealth.com, an estate planning platform, announced a strategic partnership with Merit Financial Advisors, a Georgia-based firm specializing in financial planning and wealth management. This collaboration provides Merit’s advisors with access to Wealth.com’s digital estate planning tools, enhancing their ability to serve clients more comprehensively. Merit Financial Advisors manages nearly $12 billion in assets and serves over 26,000 clients nationwide.

- Downing & Co.: On December 2024, Downing & Co., a Portland-based CPA firm, announced the enhancement of its estate planning services to help clients protect their wealth and ensure seamless asset transfer to future generations. With over five decades of experience, the firm focuses on minimizing estate taxes, facilitating efficient wealth transfer, and preserving family legacies.

Report Scope

Report Features Description Market Value (2024) USD 3.7 Million Forecast Revenue (2034) USD 8.8 Million CAGR (2025-2034) 9.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Will Drafting, Trust Creation and Management, Probate Services, Power of Attorney Services, Estate Tax Planning, Wealth and Asset Protection, Business Succession Planning), By Client Type (Individuals, High-Net-Worth Individuals (HNWIs), Families, Business Owners), By Mode of Service (Online Estate Planning Services, Offline Estate Planning Services), By End User (Individuals and Families, Corporate and Business Entities) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Charles Schwab, Fidelity Investments, Edward Jones, Merrill Lynch (Bank of America), Morgan Stanley, Northern Trust, Wells Fargo, Vanguard Personal Advisor Services, U.S. Trust (Bank of America Private Wealth Management), LPL Financial Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Estate Planning Service MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Estate Planning Service MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Charles Schwab

- Fidelity Investments

- Edward Jones

- Merrill Lynch (Bank of America)

- Morgan Stanley

- Northern Trust

- Wells Fargo

- Vanguard Personal Advisor Services

- U.S. Trust (Bank of America Private Wealth Management)

- LPL Financial