Global eSports Betting Software Market Size, Share, Industry Analysis Report By Component (Software, Services), By Device Type (Desktop, Mobile), By End-User (Individual Bettors, Commercial Operators), By Game Type (First-Person Shooter, Multiplayer Online Battle Arena, Real-Time Strategy, Sports Games, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 166677

- Number of Pages: 393

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Revenue and Usage Statistics

- By Component

- By Device Type

- By End-User

- By Game Type

- Adoption Rate

- Business Benefits

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

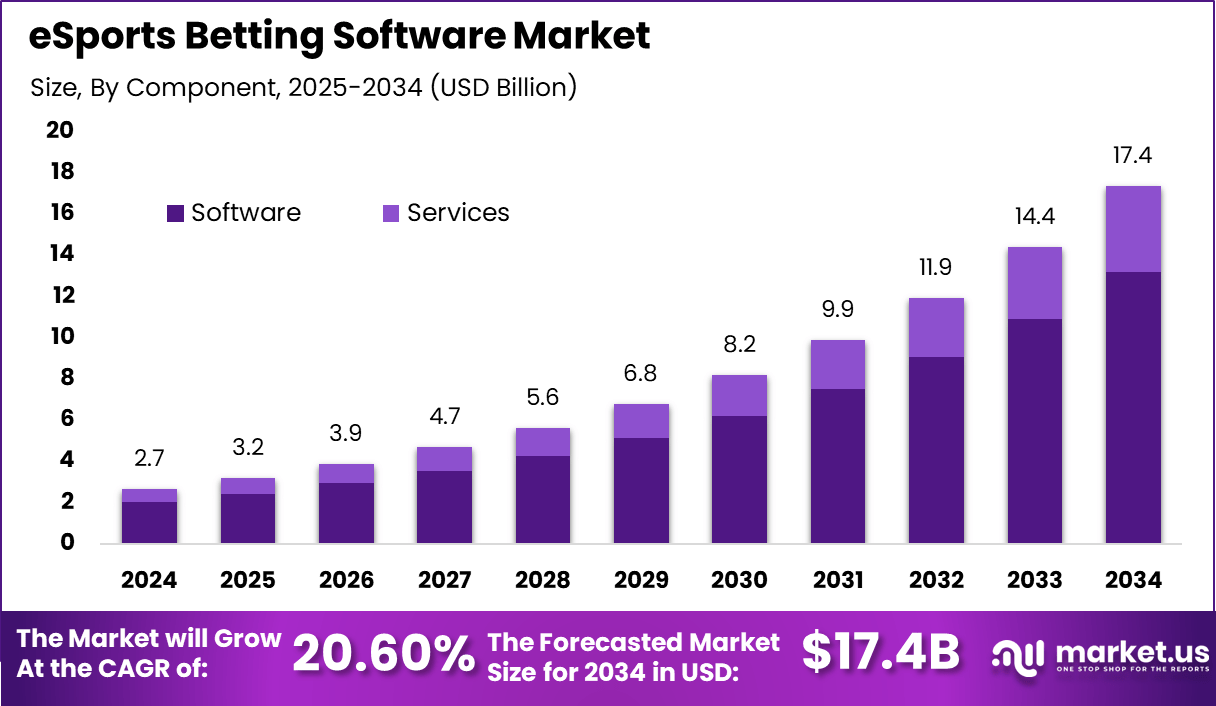

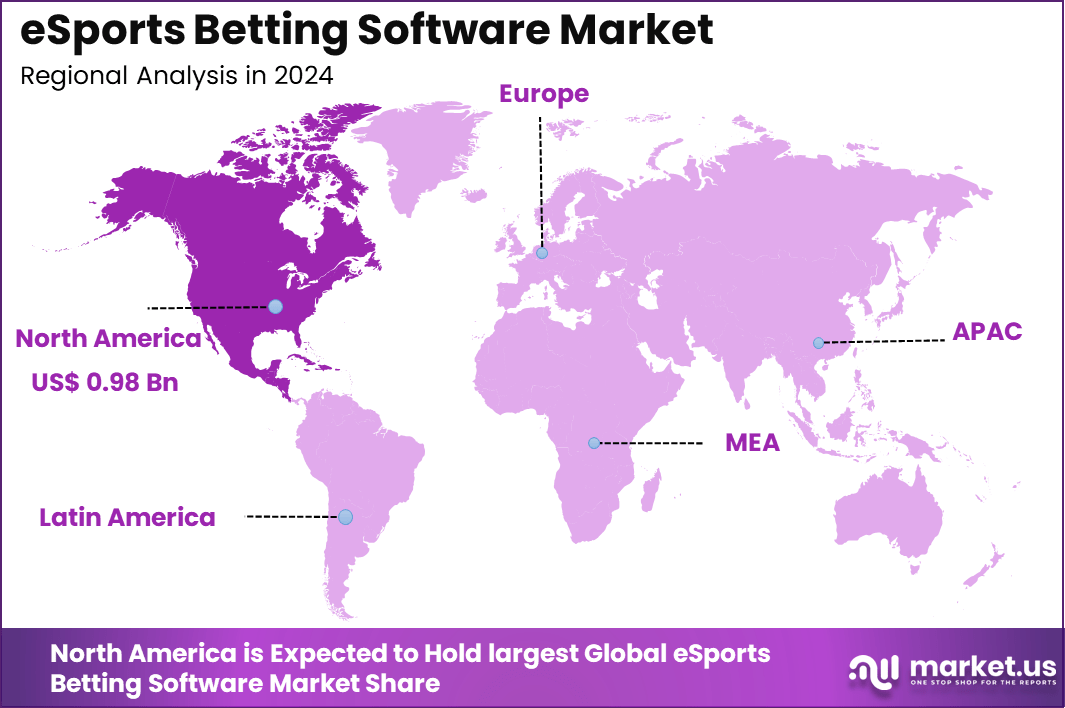

The Global eSports Betting Software Market generated USD 2.7 billion in 2024 and is predicted to register growth from USD 3.2 billion in 2025 to about USD 17.4 billion by 2034, recording a CAGR of 20.60% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 36.8% share, holding USD 0.98 Billion revenue.

The esports betting software market has expanded as global esports viewership grows and audiences seek digital platforms for interactive wagering. The market has shifted from niche online betting to full scale software ecosystems that support real time odds, live streaming integration and automated risk management. Growth reflects the rising professionalisation of esports and increased acceptance of regulated online betting platforms.

The growth of the market can be attributed to increasing esports tournaments, rising engagement among younger audiences and greater interest in real time wagering. Improved streaming quality, higher internet penetration and the global reach of competitive gaming support strong demand. Regulatory acceptance in several regions and the shift toward digital entertainment also encourage market growth.

According to Market.us, The broader global esports market is also expanding, expected to reach USD 16.7 billion by 2033, up from USD 2.3 billion in 2023 with a 21.9% CAGR. In 2023, North America again dominated with a 36.3% share and revenue of USD 0.83 billion, showing its strong influence across both mobile and traditional esports segments.

Demand is rising across online betting operators, gaming communities, fantasy sports platforms and digital entertainment networks. Users seek seamless betting experiences that combine live match viewing with dynamic odds and instant settlement. The popularity of major esports titles drives sustained interest, while casual viewers increasingly explore betting as part of the overall viewing experience.

Top Market Takeaways

- By component, software dominates the market with a 75.8% share. This includes platforms and applications offering comprehensive betting solutions with real-time analytics, odds management, and secure payment processing.

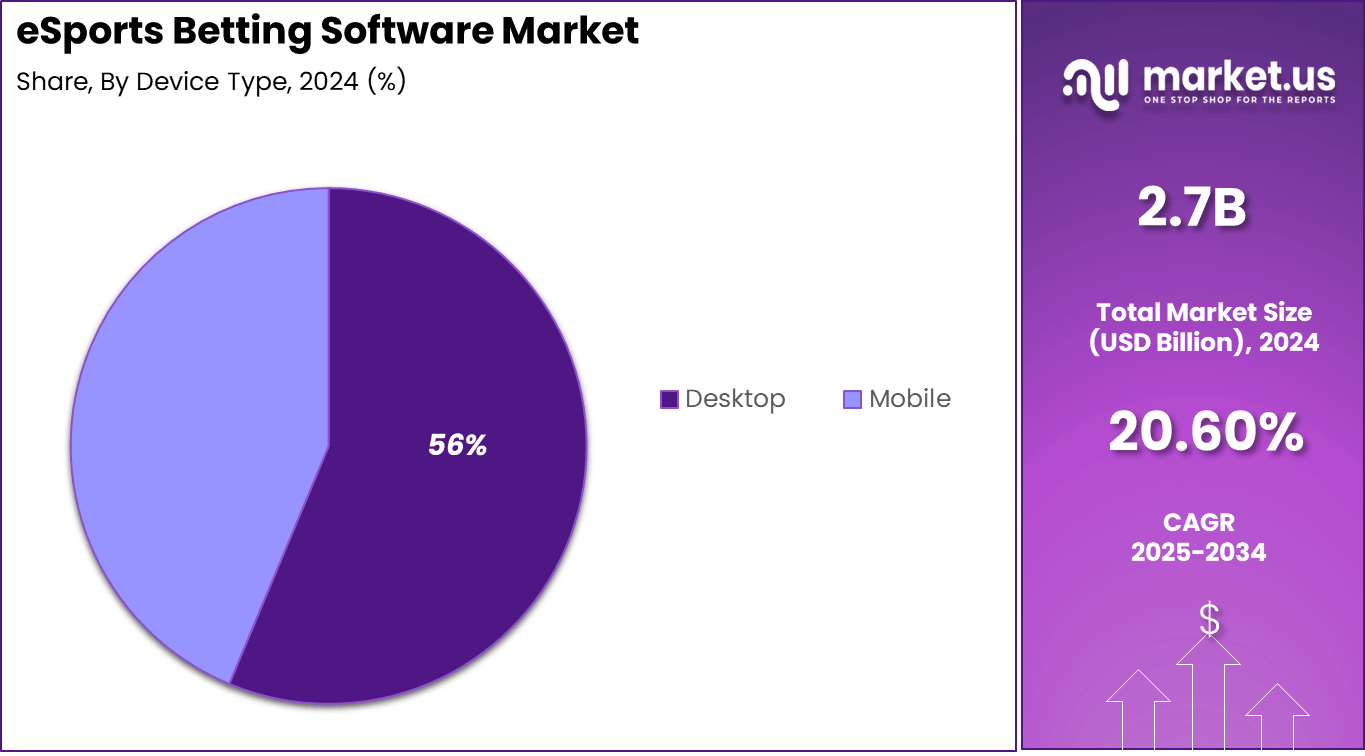

- By device type, desktop is the leading platform with 56.3% share, preferred by serious bettors for stable connections, better user interfaces, and advanced features. However, mobile platforms are growing rapidly as well.

- By end-user, commercial operators constitute 70.2% of the market, including sportsbooks, betting platforms, casinos, and enterprises leveraging eSports betting for monetization.

- By game type, first-person shooter (FPS) games lead with 45.6% market share, driven by the popularity of titles like Counter-Strike, Valorant, and Call of Duty that attract large betting audiences known for high engagement.

- Regionally, North America commands about 36.8% share of the global market.

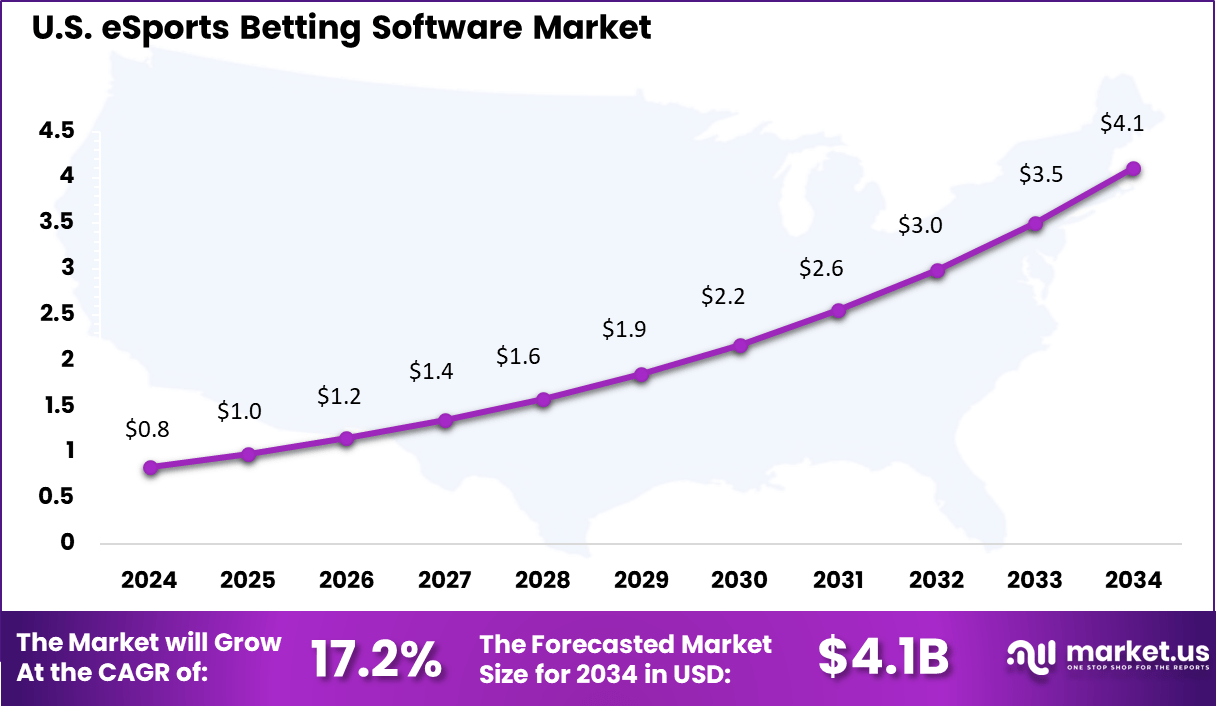

- The U.S. market size is approximately USD 0.84 billion in 2025.

- The market is growing at a CAGR of 17.2%, fueled by the legalization of eSports betting in several states, technological advances in betting software, and increased viewership of eSports events.

- Growth drivers include partnerships between betting operators and eSports leagues, adoption of AI and blockchain for secure betting and fair play, and expanding user bases shifting from traditional sports betting to eSports.

Revenue and Usage Statistics

- Active Bettors: The global online eSports betting audience increased from 21.9 million users in 2017 to more than 74.3 million in 2024, showing rapid expansion.

- ARPU Levels: Average revenue per user reached USD 33.59 in 2024 and is projected to rise to USD 34.90 in 2025, indicating steady monetization growth.

- Wager Size: The typical eSports wager averaged EUR 29, significantly higher than the EUR 5 average for football bets in late 2024.

- Usage Frequency: About 32% of global online bettors participate in eSports tournaments at least once each month.

- Mobile Usage: Close to 58% of eSports wagers in 2024 were placed through mobile applications, highlighting the strong shift toward mobile-centric platforms.

- Engagement Growth: For DATA.BET, the third quarter of 2025 recorded a 126% increase in active players and a 33% rise in the number of placed bets, reflecting strong market engagement.

By Component

In 2024, the software segment leads the eSports betting software market with a dominant 75.8% share. These platforms serve as the backbone for all betting operations, hosting functionalities such as live betting, real-time odds updates, player account management, and transaction processing.

Software providers invest heavily in incorporating AI and machine learning to offer personalized experiences, fraud detection, and risk management. The evolving landscape emphasizes mobile compatibility and seamless integration with streaming services to keep users engaged.

The continual innovation in software features – ranging from virtual reality environments to blockchain-based security – is designed to enhance user trust and enjoyment. Software reliability and scalability have become pivotal as betting volume increases, making software the strategic focus for market players aiming to capture and retain users.

By Device Type

In 2024, Desktop devices hold 56% of usage share in eSports betting software, favored for their powerful processing and large display sizes. Serious bettors and professional players prefer desktop platforms for in-depth analysis, multi-window setups, and real-time interaction with game streams and betting interfaces. Desktops provide complex visualization tools that help users monitor multiple games or bets simultaneously, which is critical in high-volume wagering contexts.

Despite the rise of mobile betting driven by convenience and portability, desktops remain preferred among users who demand precision and comprehensive engagement. The desktop platform sustains its relevance through continuous improvements in user interface and interactive features tailored for committed bettors.

By End-User

In 2024, Commercial operators are the major end users with a 70.2% market share, including regulated sportsbooks, online betting companies, and casino operators offering eSports wagering. These entities drive market innovation by adopting sophisticated software solutions that emphasize security, compliance with regulatory frameworks, and user retention through gamification and loyalty programs.

Commercial operators benefit from partnerships with eSports leagues and gaming platforms, broadening their market reach and driving revenue growth. They face competitive pressure to continuously enhance their offerings with features like AI-powered odds adjustment, live data analytics, and immersive betting experiences, integrating augmented and virtual reality to attract younger demographics.

By Game Type

In 2024, First-person shooter (FPS) games account for 45.6% of eSports betting volumes, reflecting the genre’s massive popularity and dynamic gameplay that appeals to viewers and bettors. Titles like Counter-Strike and Call of Duty attract large, passionate audiences and frequent tournaments, creating regular betting opportunities with diverse markets for in-play and futures bets.

The intense, skill-based nature of FPS games creates engaging betting scenarios ideal for live streaming and dynamic odds systems. FPS betting’s growth is reinforced by strong community support, game developer collaborations, and the constant introduction of new competitions and leagues. This genre’s ability to drive betting liquidity and user engagement positions it as a critical pillar of the eSports betting ecosystem.

Adoption Rate

The adoption rate of eSports betting software is estimated to be around 35% globally, with North America leading this figure due to high engagement in online gaming and well-established betting frameworks. The Asia-Pacific region is also rapidly expanding in adoption, driven by increasing internet penetration and a vibrant gaming culture.

Europe follows with a significant share, reflecting growing interest and regulatory acceptance in the region. Mobile platforms and live betting features are key drivers behind this increasing adoption, especially popular among younger audiences aged 18-30 who prefer quick, interactive betting experiences.

This adoption rate highlights the growing acceptance and integration of eSports betting in the broader digital entertainment landscape, reflecting technological advancements and changing consumer behaviors favoring online and mobile gambling formats.

Business Benefits

The business benefits of implementing eSports betting software are significant. Operators can expand their market reach by catering to a younger, tech-savvy demographic that favors mobile and online gaming. The software provides advanced analytics and real-time data feeds, enabling more accurate odds setting and risk management, which helps maximize profitability.

Additionally, features like targeted promotions, multi-language support, and cross-selling opportunities with traditional sports betting increase player retention and lifetime value. Enhanced security protocols and fraud prevention measures also build player confidence, aiding in sustainable growth. Altogether, these benefits help operators increase turnover while maintaining operational efficiency and compliance.

Emerging Trends

Key Trend Description Integration of AI and predictive analytics AI-powered algorithms improving odds accuracy, real-time betting insights, and fraud detection. Growth of live and in-play betting Sustained surge in dynamic betting options during live eSports events driving higher user engagement. Blockchain adoption Increasing use of blockchain for secure, transparent, and decentralized betting transactions. Mobile-first platform development Rising demand for convenient and accessible mobile betting apps improving user experience. Strategic partnerships with eSports entities Collaborations between platforms, teams, and tournament organizers expanding reach and market offerings. Growth Factors

Key Factor Description Rising eSports viewership and participation Growing global audience and increasing player base fueling demand for betting platforms. Advancements in betting software technology Continuous improvements in UX/UI, security, and data analytics strengthening platform performance. Increasing legalization and regulation Regulatory clarity in major markets supporting safer and broader adoption of eSports betting. Expanding smartphone and internet penetration Greater connectivity and mobile access, especially in emerging markets, boosting market expansion. Strategic investments and partnerships Investments by gaming and betting companies helping innovate and expand product portfolios and geographic reach. Key Market Segments

By Component

- Software

- Services

By Device Type

- Desktop

- Mobile

By End-User

- Individual Bettors

- Commercial Operators

By Game Type

- First-Person Shooter

- Multiplayer Online Battle Arena

- Real-Time Strategy

- Sports Games

- Others

Regional Analysis

North America held a dominant position in the eSports betting software market, capturing approximately 36.8% of the global share. The region’s growth is fueled by widespread internet penetration, growing popularity of eSports, and the increasing legalization of online betting across various states.

Advancements in technology, including mobile platforms, real-time betting analytics, and secure payment solutions, have significantly enhanced user experience and market reach. North America boasts a mature digital ecosystem backed by leading software providers continuously innovating with AI-driven personalization and gamification features that resonate well with younger demographics, driving sustained market expansion.

The U.S. emerges as the largest market within North America, with a valuation near USD 0.84 billion in 2024 and a robust CAGR of 17.2%. This high growth can be attributed to the increasing number of licensed online sports betting operators, expanding eSports viewership, and strategic partnerships between betting firms and eSports organizations.

Legal reforms in multiple states facilitate safer and more regulated betting environments, attracting more users. Furthermore, the integration of immersive technologies such as augmented reality (AR) and virtual reality (VR) in betting platforms is gaining traction in the U.S., further boosting engagement and revenue generation.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rapid Growth of eSports Viewership and Engagement

The eSports betting software market is driven by the explosive growth in eSports viewership, with over 532 million fans watching competitive gaming worldwide. This growing audience fuels demand for immersive and interactive betting platforms that allow fans to wager on live events in real time.

Integration of live streaming with in-play betting options enhances user engagement, making the betting experience more dynamic and entertaining. Traditional gambling companies’ investments in eSports platforms signal increasing mainstream acceptance, attracting younger, tech-savvy demographics familiar with online gaming.

Restraint

Regulatory Uncertainties and Fragmented Legal Frameworks

The market faces significant restraints from fragmented and evolving regulatory environments. Many countries have unclear or restrictive laws on eSports betting, forcing operators to navigate complex licensing and compliance processes. For example, only a limited number of U.S. states allow eSports-specific betting, while many regions worldwide have partial bans or no specific policies.

These regulatory uncertainties increase operational costs and hinder market expansion, especially for international operators seeking to scale uniformly. Concerns about underage gambling and match-fixing urge regulators to impose stringent controls, adding challenges for platform operators.

Opportunity

Blockchain Integration and AI-Powered Personalization

Emerging technologies like blockchain and AI offer exciting opportunities to reshape eSports betting platforms. Blockchain facilitates transparent, secure, and instant transactions with smart contracts reducing fraud risks and boosting user trust. The rise of decentralized betting ecosystems is attracting investments and growing user adoption.

AI-driven algorithms enable personalized betting recommendations, dynamic odds calculation, and enhanced fraud detection, improving user experience and platform reliability. Expansion into virtual reality and augmented reality betting also promises immersive and innovative engagement models that could further catalyze market growth.

Challenge

High Operational Costs and Licensing Fees

One of the major challenges in the eSports betting software market is managing high operational costs, including complex server infrastructure, cybersecurity, and real-time data processing capabilities. Maintaining fast, uninterrupted services demands substantial technology investment, often exceeding $2.5 million yearly for mid-sized operators.

Additionally, negotiating streaming rights and licensing with game publishers can be expensive, with fees reaching hundreds of thousands of dollars per region per title. These rising costs have driven some smaller platforms out of business. Balancing cost management with innovation and scalability remains critical for long-term success.

Competitive Analysis

Bet365, Betway, Pinnacle, and Unikrn lead the eSports betting software market with advanced platforms that support real-time odds, automated risk management, and seamless wagering experiences. Their systems integrate live match data, predictive analytics, and secure payment frameworks to enhance user engagement. These companies benefit from strong brand reach and high-volume betting activity across major eSports titles.

Rivalry, GG.BET, Buff.bet, Loot.bet, Betfair, William Hill, and 888sport strengthen the competitive landscape with specialized eSports-focused betting interfaces. Their platforms offer in-play betting, match statistics, and dynamic odds adjustments tailored for fast-paced gaming events. These providers invest in player behavior monitoring and anti-fraud tools to maintain platform integrity.

Betsson, Parimatch, Betfred, BetVictor, Sky Bet, LeoVegas, Mr Green, 10Bet, Intertops, and other players expand the market with localized betting solutions and mobile-first platforms. Their systems emphasize user-friendly dashboards, responsible gaming tools, and multi-currency support. These companies help diversify the betting ecosystem through niche markets and region-specific offerings.

Top Key Players in the Market

- Bet365

- Betway

- Pinnacle

- Unikrn

- Rivalry

- GG.BET

- Buff.bet

- Loot.bet

- Betfair

- William Hill

- 888sport

- Betsson

- Parimatch

- Betfred

- BetVictor

- Sky Bet

- LeoVegas

- Mr Green

- 10Bet

- Intertops

- Other Major Players

Future Outlook

The future outlook for the eSports betting software market is very positive, marked by strong growth driven by advancements in technology and wider market acceptance. Innovations like AI, blockchain, and mobile platforms will enhance user experience and security, while regulatory clarity across key regions will encourage market expansion. The increasing popularity of esports and mobile accessibility will further boost demand, making the market more diverse and dynamic in the coming years.

Recent Developments

- October, 2025, Bet365 announced the launch of a dedicated eSports betting platform in partnership with major game publishers, offering live betting, in-play options, and esports-specific features. They also expanded their market reach into Asia-Pacific, with localized platforms going live in November 2025.

- September, 2025, Betway introduced a suite of AI-driven personalized betting experiences for esports fans, including live odds customization and real-time betting suggestions based on gameplay analytics. The company also secured new sponsorship deals with leading esports teams in North America and Europe.

Report Scope

Report Features Description Market Value (2024) USD 2.7 Bn Forecast Revenue (2034) USD 17.4 Bn CAGR(2025-2034) 20.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component(Hardware, Software, Services), By Technology(Ultrasound, Structured Light, Time-of-Flight, Stereoscopic Vision, Other), By Sensor Type(Position Sensors, Image Sensors, Temperature Sensors,Others), By Connectivity(Wired Network Connectivity, Wireless Network Connectivity), By End-user Industry(Consumer Electronics, Automotive, Healthcare, Aerospace and Defense, Security and Surveillance, Media and Entertainment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bet365, Betway, Pinnacle, Unikrn, Rivalry, GG.BET, Buff.bet, Loot.bet, Betfair, William Hill, 888sport, Betsson, Parimatch, Betfred, BetVictor, Sky Bet, LeoVegas, Mr Green, 10Bet, Intertops, and other Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  eSports Betting Software MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

eSports Betting Software MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bet365

- Betway

- Pinnacle

- Unikrn

- Rivalry

- GG.BET

- Buff.bet

- Loot.bet

- Betfair

- William Hill

- 888sport

- Betsson

- Parimatch

- Betfred

- BetVictor

- Sky Bet

- LeoVegas

- Mr Green

- 10Bet

- Intertops

- Other Major Players