Global Esports Advertising Market Size, Share Analysis Report By Type (Static Ads, Dynamic Ads), By Device Type (PC/Laptop, Smartphone/Tablet), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146861

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

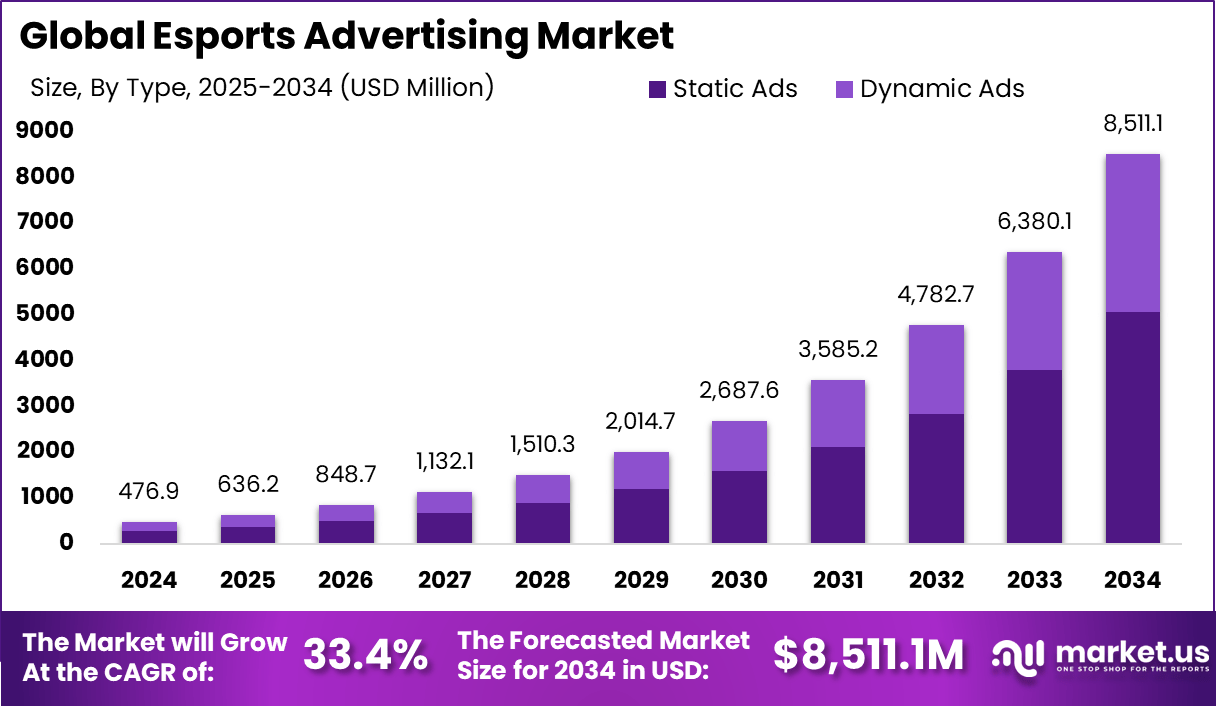

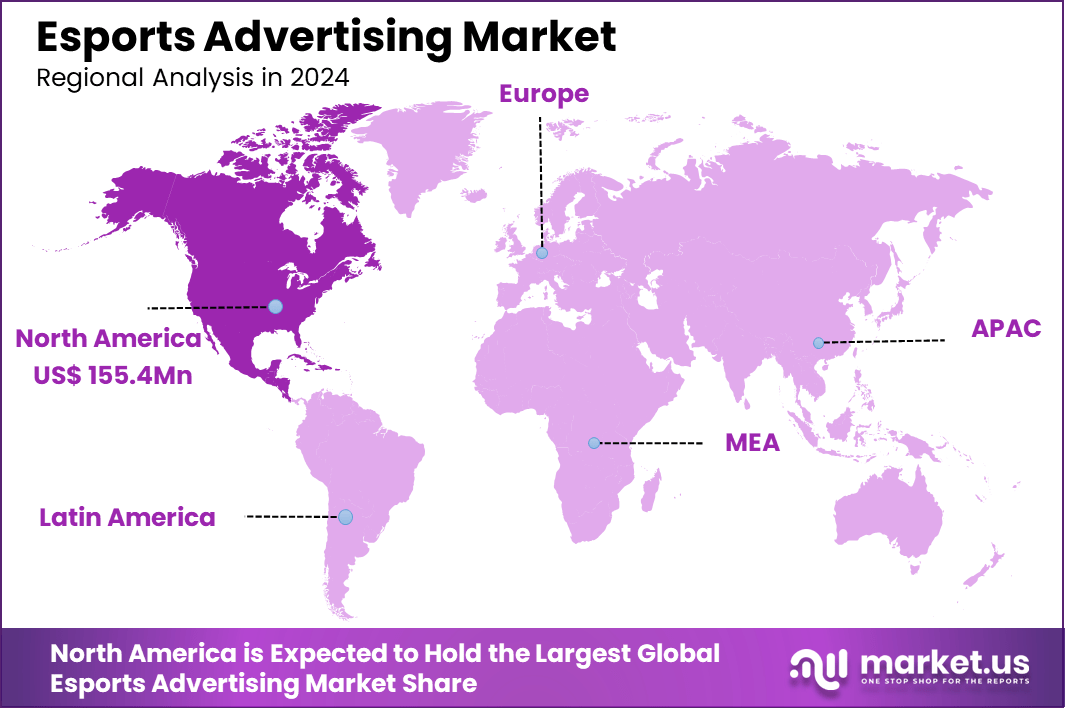

The Global Esports Advertising Market size is expected to be worth around USD 8,511.1 Million By 2034, from USD 476.9 Million in 2024, growing at a CAGR of 33.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 32.6% share, holding USD 155.4 Million revenue.

Esports advertising refers to marketing strategies focused on promoting products and services within the esports industry. This can include sponsorships, branded content, in-game advertising, and partnerships with esports leagues, teams, and players. The unique aspect of esports advertising lies in its ability to connect brands with a predominantly younger, tech-savvy audience through digital channels and live events, creating interactive and immersive brand experiences.

The esports advertising market has witnessed significant growth, driven by the expanding global esports audience and the increasing integration of advertising within gaming platforms. Brands are recognizing the value of connecting with the esports demographic, which predominantly comprises younger, tech-savvy individuals with substantial purchasing power.

The primary drivers of the esports advertising market include the expanding global reach of esports due to technological advancements in gaming and broadcasting, significant investments from major brands, and the rising number of esports enthusiasts who regularly follow tournaments and leagues.

Demand in the esports advertising market is boosted by the growing global viewership of esports competitions, which attracts substantial investments from mainstream brands seeking to tap into this engaged audience.

The professionalization of esports leagues and the technological advancements in gaming hardware and software also enhance viewer experience, making advertising more appealing. Technologies like virtual reality (VR) and AI are being increasingly adopted within the esports realm to create more engaging and interactive user experiences.

AI, for instance, is used for analyzing player performance and enhancing game design, which in turn can attract more viewers and potential ad placements. The adoption of these technologies is driven by the need to enhance the spectator experience, provide deeper analytics for strategy development, and maintain the competitiveness of esports as a modern, technology-driven sport.

Based on insights provided by demandsage, By 2025, the global esports audience is projected to grow to 640.8 million, signaling strong worldwide engagement. Within this, 322.7 million will be casual or occasional viewers, while 318.1 million are expected to be committed fans who follow the scene regularly.

The Asia-Pacific region alone is responsible for more than 57% of the global esports viewership, underscoring its dominance in shaping esports culture and trends. Remarkably, China and the Philippines together represent 40% of the entire global fanbase, highlighting the region’s deep-rooted interest and investment in competitive gaming.

In contrast, the United States, though smaller in fan share, commands significant economic value with its esports market estimated at USD 1.07 billion, driven by high sponsorship demand, media rights, and active participation from approximately 3,530 professional players.

For businesses, investing in esports advertising can lead to increased brand visibility, engagement with a younger demographic, and alignment with innovation and technology. Additionally, esports offers a global platform for brands to reach an international audience, maximizing the impact of their marketing efforts.

Key Takeaways

- The global esports advertising market is set for robust growth, expected to reach USD 8.51 billion by 2034, driven by the rising popularity of online gaming and digital engagement.

- North America remains the leading region, accounting for over 32.6% of the global market share in 2024, supported by a strong esports culture and high advertiser spending.

- The static ads segment dominated the market landscape in 2024, contributing more than 59.4% share, as brands increasingly prefer non-intrusive, banner-style promotions within gaming environments.

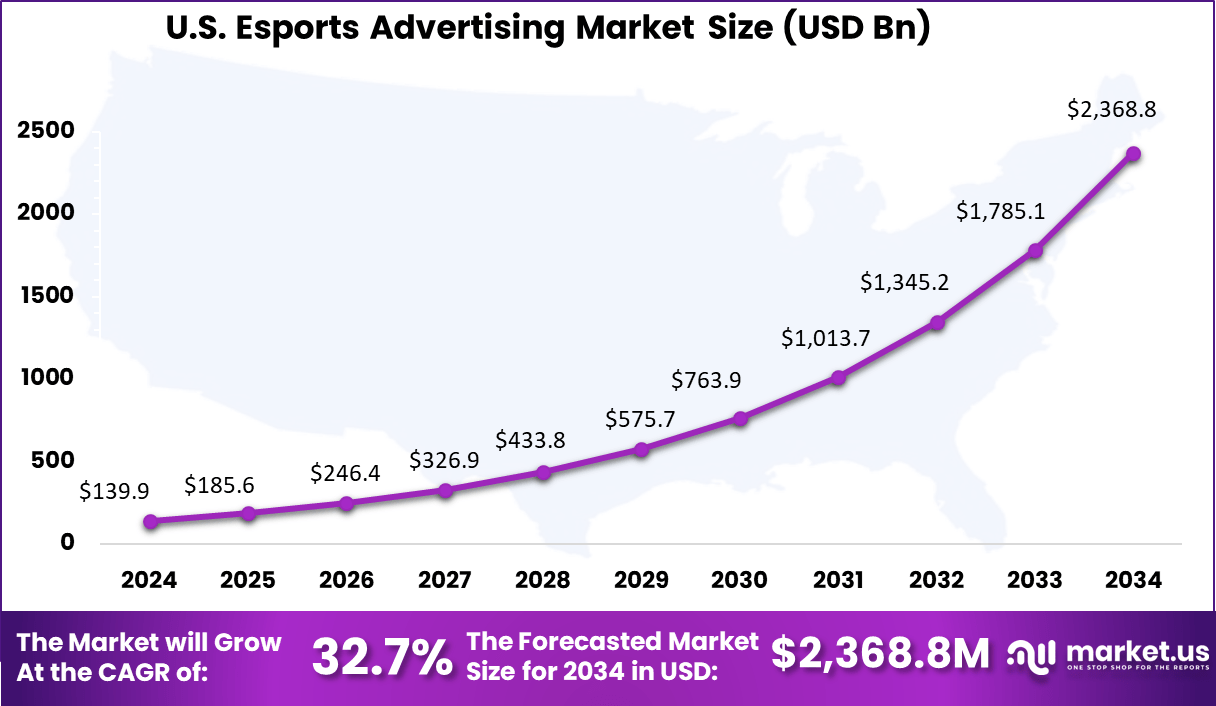

- The U.S. esports advertising market alone is forecasted to expand significantly, from approximately USD 139.9 million in 2024 to USD 2.36 billion by 2034, highlighting growing investments in game-based digital marketing.

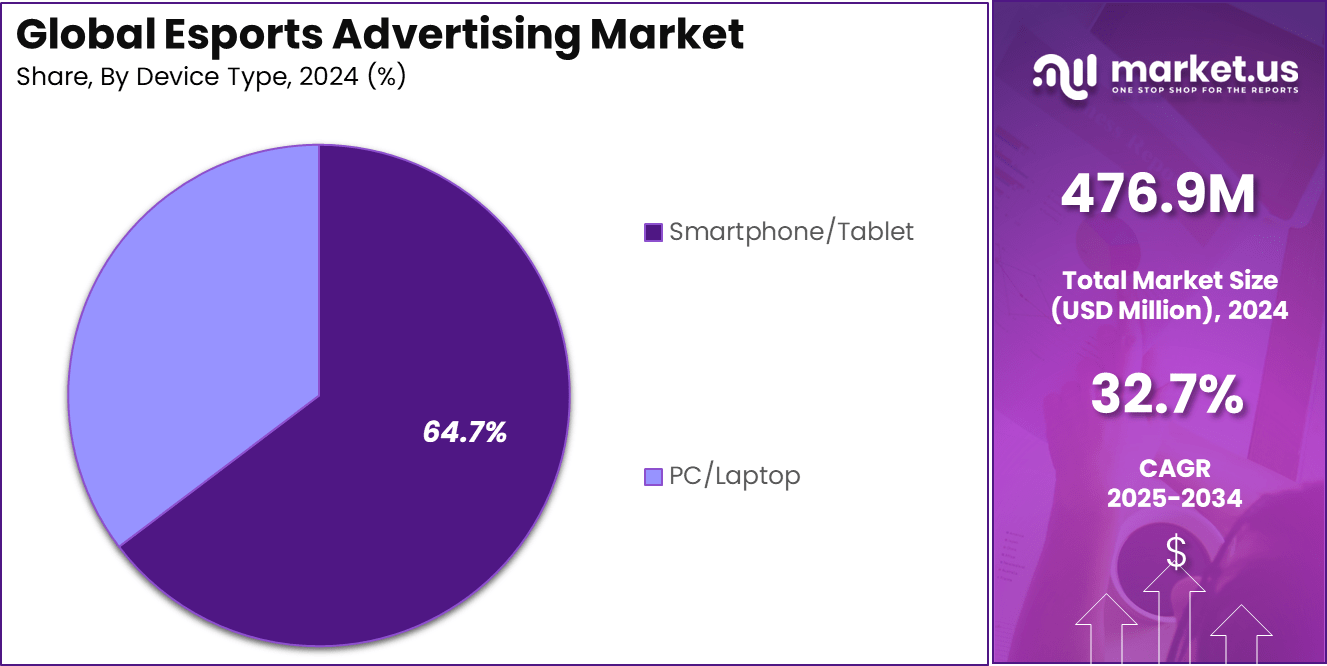

- Smartphones and tablets continue to be the primary platform for esports advertising, capturing over 64.7% share in 2024, reflecting the shift toward mobile-first gaming experiences.

Analysts’ Viewpoint

The esports advertising market offers numerous investment opportunities, from direct sponsorships of teams and events to investments in esports-related startups focusing on advertising technologies and platforms. As the market matures, more structured investment opportunities with clearer ROI are becoming available.

The regulatory environment for esports is gradually becoming more structured, with increased oversight and standardization. However, challenges like data privacy, online security, and advertising standards continue to evolve, requiring ongoing attention and adaptation by stakeholders in the esports advertising market.

Factors that significantly impact the esports advertising market include technological innovations, changes in consumer media consumption habits, regulatory developments, and the economic shifts that influence advertising budgets.

US Market Growth

The US Esports Advertising Market is valued at approximately USD 139.9 Million in 2024 and is predicted to increase from USD 185.6 Million in 2025 to approximately USD 2,368.8 Million by 2034, projected at a CAGR of 32.7% from 2025 to 2034.

The prominent growth of the US Esports Advertising market can be attributed to several compelling factors. Firstly, the increasing popularity of esports among the youth and millennials creates a robust audience base, making the US a fertile ground for advertisers.

The integration of streaming platforms like Twitch and YouTube, which are widely popular in the US, facilitates the direct engagement of brands with potential consumers, enhancing the effectiveness of advertising strategies.

Secondly, the strategic partnerships between leading esports teams and major global brands have elevated the visibility of esports advertising. These collaborations not only bring financial backing to the teams but also offer advertisers premium access to a dedicated and engaged audience.

In 2024, North America held a dominant market position in the Esports advertising market, capturing more than a 32.6% share, with revenues amounting to USD 155.4 million. This preeminence can be attributed to several pivotal factors.

Foremost, the region boasts a robust infrastructure that supports high-speed internet and advanced gaming technologies, which are crucial for the seamless streaming of esports events. Additionally, the cultural acceptance and popularity of esports among the North American youth provide a fertile ground for advertisers to target a tech-savvy and engaged audience.

Moreover, North America is home to many leading esports teams and leagues, which attract significant viewer attention globally. This presence not only enhances the visibility of advertising campaigns but also ensures a higher engagement rate.

The proactive involvement of these teams in global tournaments, coupled with the strategic partnerships between esports entities and major brands, further amplifies the region’s dominance in the Esports advertising landscape.

Type Analysis

In 2024, the Static Ads segment held a dominant market position in the Esports advertising market, capturing more than a 59.4% share. The substantial share of Static Ads can be largely attributed to their simplicity and cost-effectiveness, making them an accessible option for a wide range of advertisers.

Static ads, including banners and overlays, do not require sophisticated software or high-bandwidth conditions to display effectively, ensuring their visibility remains consistent across various streaming qualities and devices. Furthermore, Static Ads offer advertisers predictability in terms of placement and exposure time, making it easier for them to measure the effectiveness of their campaigns.

These ads are often integrated into the streaming environment in a non-intrusive manner, which can be less disruptive to the viewer experience compared to more dynamic advertising forms. This characteristic is particularly valued in the esports community, where audience engagement and viewing experience are paramount.

Additionally, the ability to integrate these advertisements seamlessly into broadcasts without necessitating extensive production changes or updates allows organizers and advertisers to establish long-term partnerships, thereby fostering stability in the advertising revenue streams. This reliability and the established nature of Static Ads contribute significantly to their leading position in the Esports advertising market.

Device Type Analysis

In 2024, the Smartphone/Tablet segment held a dominant market position in the Esports advertising market, capturing more than a 64.7% share. This leadership can be primarily attributed to the pervasive adoption of mobile devices globally, coupled with the increasing prevalence of mobile gaming.

Smartphones and tablets offer the convenience of portability, allowing users to access gaming content and live streams of esports events from virtually anywhere, which significantly broadens the audience base for advertisers.

Moreover, the integration of advanced mobile technology and faster internet connectivity, such as 5G, has enhanced the quality and stability of live streaming on mobile devices, making it more appealing for viewers. This technological enhancement ensures that advertisements delivered on these devices are likely to engage a more extensive viewer base, given the high usage rates during live events and gameplay.

The targeted advertising capabilities on mobile platforms also play a crucial role in this segment’s dominance. Mobile devices provide advertisers with valuable user data, such as location, browsing habits, and app usage, which can be leveraged to tailor advertisements more effectively to individual preferences and behaviors.

This targeted approach not only increases the relevance of ads to viewers but also boosts the overall efficacy of advertising campaigns, further cementing the Smartphone/Tablet segment’s lead in the Esports advertising market.

Key Market Segments

By Type

- Static Ads

- Dynamic Ads

By Device Type

- PC/Laptop

- Smartphone/Tablet

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Technological Advancements and Global Connectivity

The rapid advancement of technology, particularly in internet infrastructure, is a primary driver for the esports advertising market. Enhanced global connectivity has made esports more accessible, allowing for real-time, competitive gaming across different continents, which significantly expands the audience base.

With the rise of 5G technology, the gaming experience has become more seamless, contributing to a surge in the number of esports viewers and participants. These technological improvements not only facilitate a larger, more engaged audience but also create a rich ground for advertisers to target a digitally-savvy demographic, thus driving substantial revenue through sponsorships and ads.

Restraint

Regulatory Variations and Privacy Concerns

One of the main restraints in the esports advertising market stems from the lack of a unified regulatory framework across different regions. In some areas, esports is regulated under general sports laws, while in others, it falls under entertainment or digital media statutes. This variation complicates the execution of global advertising campaigns and affects the consistency of market operations.

Additionally, concerns over data privacy and the ethical use of player information for advertising purposes pose significant challenges. The commercial use of personal data, such as player performance and preferences, raises privacy issues, potentially limiting aggressive marketing strategies unless addressed with clear regulations.

Opportunity

Integration of AR and VR Technologies

Augmented Reality (AR) and Virtual Reality (VR) technologies present significant opportunities in the esports advertising market. These technologies offer immersive experiences that are not possible through traditional media channels. By integrating AR and VR, advertisers can create engaging and interactive campaigns that significantly enhance brand visibility and consumer interaction.

For example, AR can be used to bring digital elements into the physical world during esports events, enhancing the spectator experience and creating unique advertising opportunities that can captivate the attention of viewers much more effectively than traditional ads.

Challenge

Cybersecurity Threats

As the esports industry continues to grow, it increasingly becomes a target for cybersecurity threats. These include data breaches and hacking incidents that can compromise both organizational and user data. Such security challenges not only threaten the integrity of esports competitions but also pose significant risks for advertisers, who might suffer from associated brand damage if their advertisements are linked to a cybersecurity incident.

Ensuring robust cybersecurity measures is crucial but also presents a substantial challenge as threat actors become more sophisticated and the attack surface expands with the increasing digitization of esports platforms.

Growth Factors

The growth of esports advertising is primarily fueled by the increasing popularity of video games and esports across a diverse global audience. The continuous development of professional leagues and sophisticated tournament infrastructure supports this growth by providing a structured platform for advertisers to engage with fans.

Significant technological advancements, such as improved internet speeds and high-quality streaming services, further boost the esports advertising market by enhancing the viewing experience and increasing accessibility. These factors combine to create a lucrative environment for marketers aiming to tap into a young, tech-savvy demographic that is traditionally difficult to reach through conventional advertising channels.

Emerging Trends

One of the key trends in the esports advertising space is the integration of immersive technologies like virtual reality (VR) and augmented reality (AR). These technologies offer advertisers unique opportunities to create engaging and interactive campaigns that enhance the fan experience by blending digital and real-world elements.

Another emerging trend is the utilization of advanced data analytics and customer relationship management (CRM) systems to tailor advertising efforts to individual preferences, thereby increasing the effectiveness of marketing campaigns. Additionally, the rise of mobile esports has opened new avenues for advertisers, as mobile games are accessible to a broader audience and allow for on-the-go engagement.

Business Benefits

Esports advertising offers numerous business benefits, including access to a global audience that is highly engaged and predominantly comprises younger demographics. This engagement is not only deep but also allows for precise targeting thanks to digital analytics that track user behavior and preferences. Advertisers in the esports realm can achieve high levels of brand loyalty and recognition, given the passionate nature of esports fans.

Moreover, the dynamic and interactive nature of esports provides brands with the ability to be seen as cutting-edge and relevant to modern consumers. Finally, the global reach and digital nature of esports enable advertisers to achieve substantial scalability in their marketing efforts, optimizing the return on investment in ways that traditional sports and entertainment sectors might not offer.

Key Player Analysis

The Esports Advertising Market is characterized by a dynamic competitive landscape where key players leverage their strategic initiatives to gain a significant share. Here, we delve into the activities of three major companies:

Activision Blizzard Media stands out for its innovative approach to integrating advertisements directly into gameplay. By doing this, they offer advertisers seamless exposure while maintaining an engaging player experience. Their strategy focuses on creating immersive ads that resonate with the gaming community, enhancing both recall and impact.

Electronic Arts Inc. (EA) is renowned for its broad portfolio of popular esports titles, which it uses as platforms for targeted advertising campaigns. EA excels in creating partnerships with brands that align with their game themes, thereby ensuring that advertisements are relevant and appealing to their audience. Their adeptness in campaign integration helps maintain user engagement without disrupting the gaming experience.

Adverty AB specializes in in-game advertising, providing a technology that allows ads to be dynamically inserted into the game environment. Their platform ensures that advertisements are not only unobtrusive but are also placed contextually within the game, enhancing realism and engagement. Adverty’s innovative technology adapts ads to fit the game’s design, making them a natural part of the virtual world.

Top Key Players in the Market

- Activision Blizzard Media Ltd.

- AdInMo Ltd.

- Adverty AB

- Anzu Virtual Reality Ltd

- Bidstack Limited

- Electronic Arts Inc.

- HotPlay

- IronSource Ltd.

- Playwire

- RapidFire, Inc.

- Other Major Players

Recent Developments

- In October 2024, Adverty, in collaboration with Frameplay and AdInMo, unveiled a groundbreaking in-game advertising partnership aimed at enhancing immersive ad experiences.

- In June 2024, Anzu announced a strategic partnership with Stagwell to innovate new formats for bespoke in-game experiences for brands, aiming to transform the in-game advertising landscape.

- In January 2024, AdInMo launched the beta version of its InGamePlay SDK 3.0, introducing clickable ad units to enhance in-game advertising engagement.

Report Scope

Report Features Description Market Value (2024) USD 476.9 Mn Forecast Revenue (2034) USD 8,511.1 Mn CAGR (2025-2034) 33.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Static Ads, Dynamic Ads), By Device Type (PC/Laptop, Smartphone/Tablet) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Activision Blizzard Media Ltd., AdInMo Ltd., Adverty AB, Anzu Virtual Reality Ltd, Bidstack Limited, Electronic Arts Inc., HotPlay, IronSource Ltd., Playwire, RapidFire, Inc., Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Esports Advertising MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Esports Advertising MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Activision Blizzard Media Ltd.

- AdInMo Ltd.

- Adverty AB

- Anzu Virtual Reality Ltd

- Bidstack Limited

- Electronic Arts Inc.

- HotPlay

- IronSource Ltd.

- Playwire

- RapidFire, Inc.

- Other Major Players