Global Mobile Esports Market Size, Share Analysis Report By Game Type (Multiplayer Online Battle Arena (MOBA), First-Person Shooter (FPS), Real-Time Strategy (RTS), Others), By Revenue Source (Sponsorship, Advertising, Media Rights, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146824

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

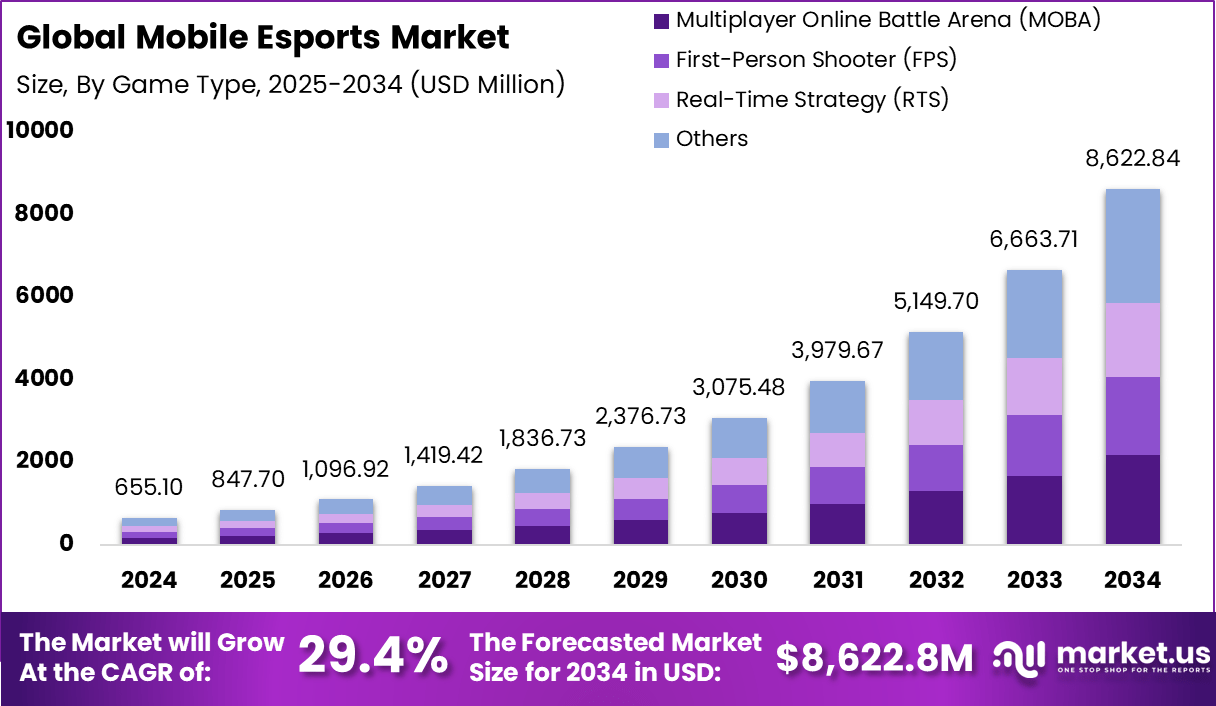

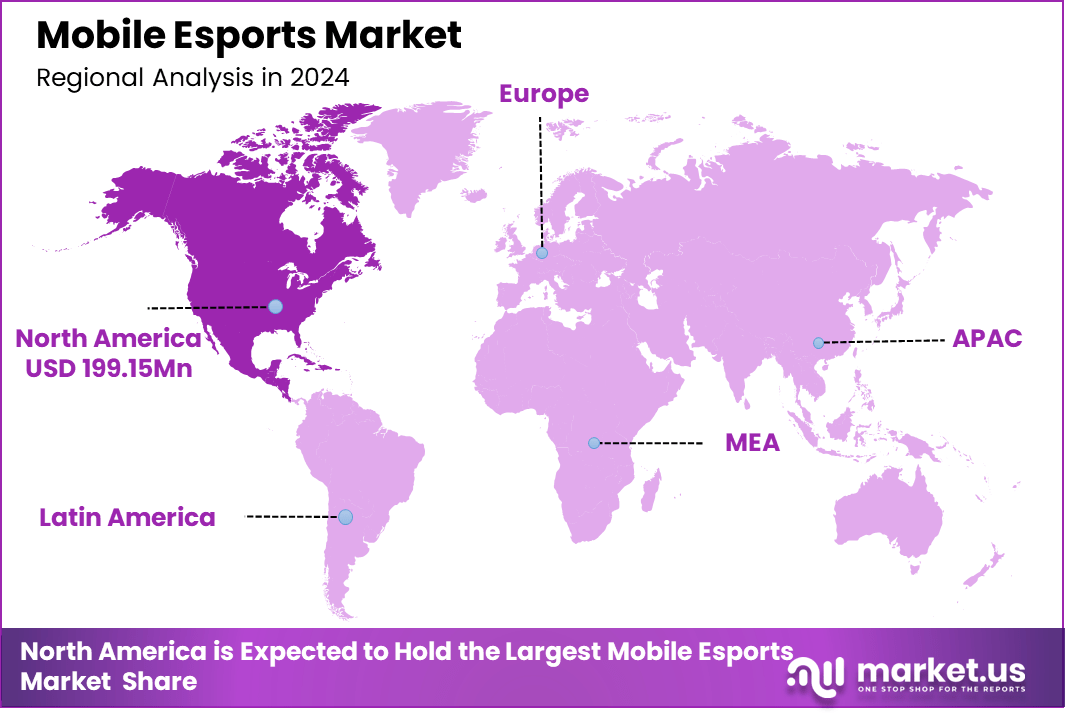

The Global Mobile Esports Market size is expected to be worth around USD 8,622.84 Million By 2034, from USD 655.1 Million in 2024, growing at a CAGR of 29.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 30.4% share, holding USD 199.15 Billion revenue.

Mobile esports refers to the competitive playing of video games on mobile devices where players participate in organized competitions. These events can range from large international tournaments to smaller, community-driven contests. Mobile esports has gained significant traction due to the accessibility and widespread adoption of smartphones, providing a platform where anyone can compete from virtually anywhere.

The mobile esports market has shown significant growth and is driven by several key factors. The development of mobile-specific esports titles that are optimized for handheld play has greatly contributed to the market’s expansion. Games like PUBG Mobile and Call of Duty Mobile offer sophisticated gaming experiences that were traditionally only available on PC or console formats.

The demand for mobile esports is primarily driven by the youth demographic, which is increasingly engaged in mobile gaming as a legitimate form of entertainment and competition. The convenience of mobile devices allows users to access games at any time, fostering a larger, more active user base.

Additionally, the cultural shift towards accepting gaming as a viable career path in many regions also contributes to the market’s expansion. Mobile esports trends include the integration of advanced gaming technologies, the development of mobile-specific esports titles, and increased investment in mobile gaming tournaments.

As reported by Market.us, The global Esports market is expected to expand from USD 2.3 billion in 2023 to approximately USD 16.7 billion by 2033, registering a strong CAGR of 21.9% over the forecast period. In 2023, North America led the market, accounting for over 36.3% share, with revenue reaching USD 0.83 billion, driven by a mature digital infrastructure and high consumer engagement in competitive gaming.

Similarly, the Esports content creation market is forecasted to grow from USD 2.2 billion in 2024 to nearly USD 43.6 billion by 2034, driven by an exceptional CAGR of 34.8%. In 2024, North America again maintained dominance, capturing a 32.4% market share and generating USD 0.7 billion in revenue, supported by strong creator economies, streaming platforms, and monetization models tailored to gaming audiences.

The adoption of 5G technology is particularly noteworthy as it supports ultra-low latency gaming, a critical element for competitive esports. Developers are also creating games that are optimized for mobile play, which supports a better user experience and competitive play on mobile devices.

Key Takeaways

- The Global Mobile Esports Market is expected to witness significant expansion, growing from USD 655.1 million in 2024 to approximately USD 8,622.84 million by 2034. This growth reflects a robust CAGR of 29.4% during the forecast period from 2025 to 2034.

- North America secured a leading position in the global market in 2024, accounting for more than 30.4% of the market share with revenues reaching about USD 199.15 million. The dominance of the region is mainly attributed to strong infrastructure, widespread 5G adoption, and the presence of leading esports organizations.

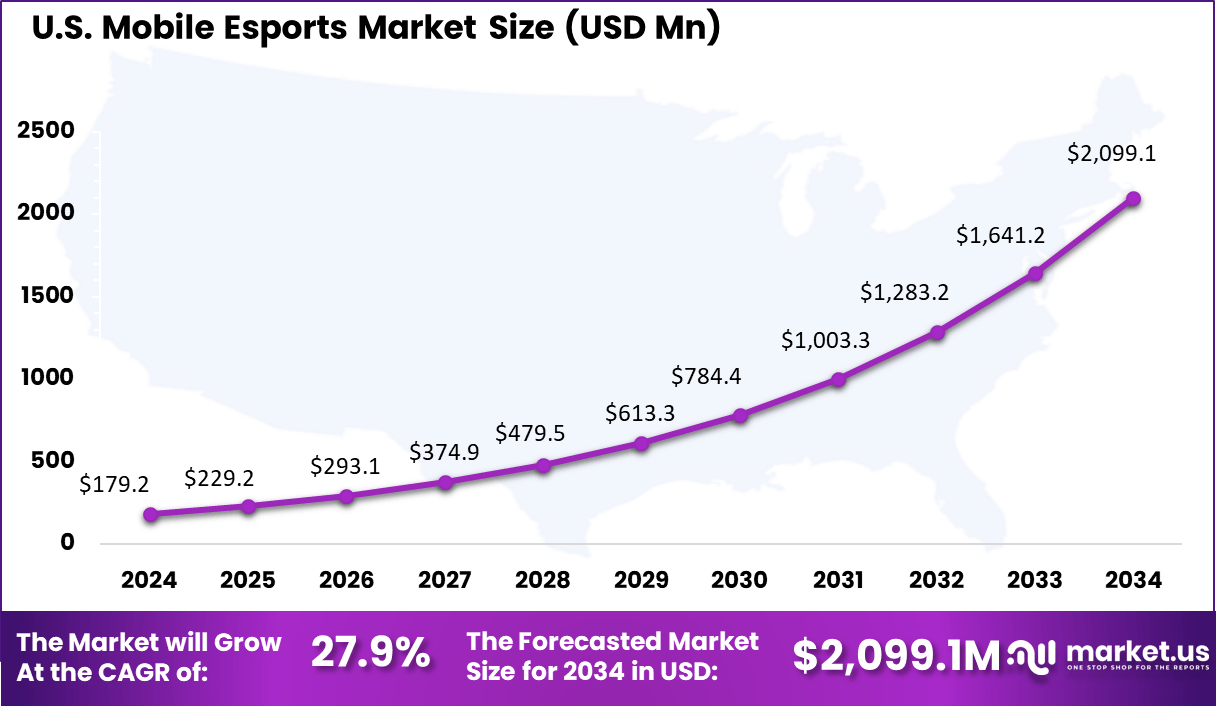

- The United States Mobile Esports Market demonstrated healthy growth momentum, valued at around USD 179.2 million in 2024. The market is forecasted to grow sharply, reaching approximately USD 2,099.1 million by 2034, achieving a CAGR of 27.9% during the period from 2025 to 2034.

- Within the game type segmentation, the Multiplayer Online Battle Arena (MOBA) segment held the largest share at 25.1% in 2024. The high engagement levels and strategic gameplay experience offered by MOBA games are key factors supporting this segment’s leadership position.

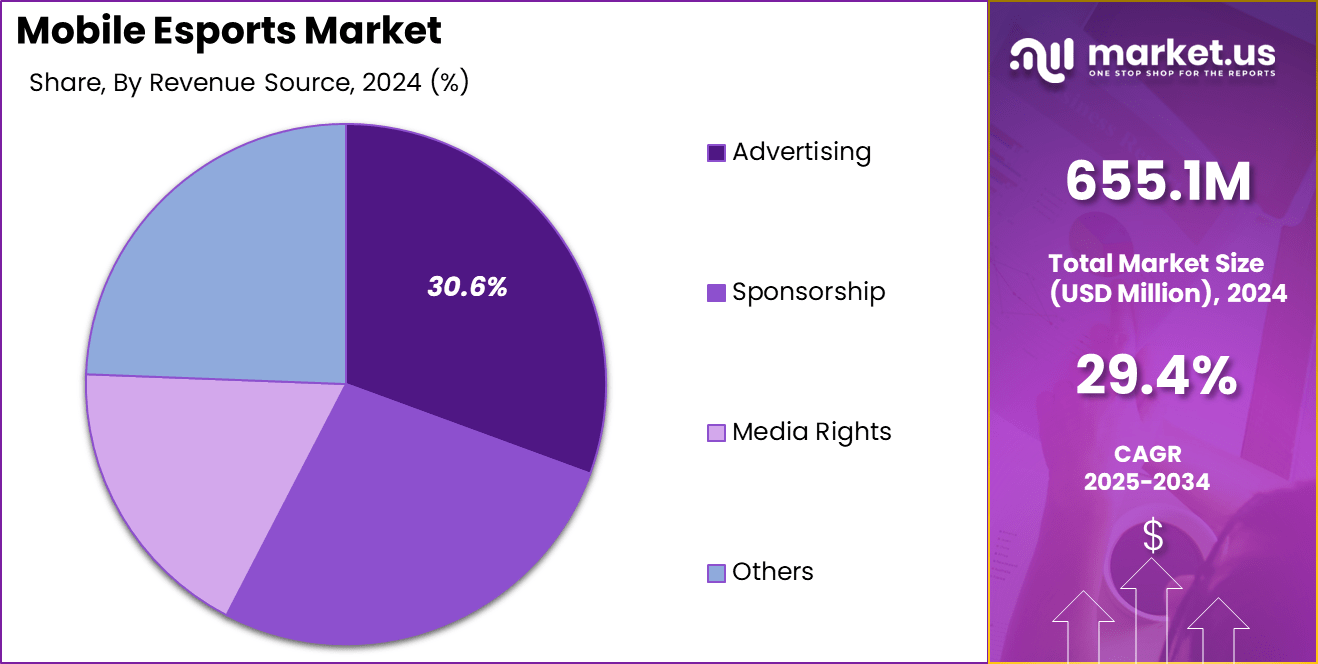

- Based on revenue streams, the Advertising segment emerged as the top contributor, capturing more than 30.6% of the market share in 2024.

Analysts’ Viewpoint

The mobile esports sector offers substantial investment opportunities due to its rapid growth and the expanding base of engaged users. Businesses benefit from various revenue streams including in-game purchases, advertising, sponsorships, and tournament winnings. The sector’s growth also encourages investments in related areas such as game development, streaming platforms, and mobile gaming hardware.

Regulatory environments vary by region but generally focus on digital consumer protection, fair play in gaming, and the regulation of in-game purchases and data privacy. The main factors impacting the mobile esports market include the standardization of competition formats, ensuring fairness and integrity in competitions, and adapting regulations to keep pace with technological advancements.

For businesses, mobile esports presents a dynamic segment ripe for investment, with diverse revenue streams including advertising, sponsorships, in-game purchases, and media rights. The expanding audience base also provides a lucrative platform for brand promotions and digital marketing campaigns aimed at a predominantly younger demographic that is hard to reach through traditional media channels.

US Market Growth

The US Mobile Esports Market is valued at approximately USD 179.2 Million in 2024 and is predicted to increase from USD 229.2 Million in 2025 to approximately USD 2,099.1 Million by 2034, projected at a CAGR of 27.9% from 2025 to 2034.

In 2024, North America held a dominant market position in the Mobile Esports market, capturing more than a 30.4% share, with revenues amounting to USD 199.15 Million. This leadership can be primarily attributed to the region’s advanced technological infrastructure and the widespread acceptance of mobile gaming.

The prevalence of high-speed internet and the widespread ownership of smartphones have provided an ideal environment for mobile esports to thrive. Furthermore, North America benefits from the presence of several key players in the esports industry, which promote and organize numerous tournaments and events, drawing significant viewer participation and sponsorship.

Moreover, the cultural acceptance of esports as a legitimate form of entertainment and competition continues to grow within the region. Educational institutions and sports organizations are increasingly recognizing mobile esports, with some universities even offering scholarships for esports, thus nurturing a new generation of professional players.

Game Type Analysis

In 2024, the Multiplayer Online Battle Arena (MOBA) segment held a dominant market position in the Mobile Esports industry, capturing more than a 25.1% share. This leading stance can be largely ascribed to the genre’s deep strategic gameplay and the robust community engagement it fosters.

MOBAs have successfully translated the complex, team-based competition from desktop to mobile, making them highly appealing to both casual and competitive gamers. The format of MOBAs promotes team collaboration and competition, essential elements that resonate well with the esports ethos.

Additionally, MOBAs benefit from high-profile game titles that carry strong brand recognition and loyal player bases. These games often feature extensive support for esports tournaments, including sponsorships and well-funded prize pools that attract top players from around the world.

The spectator experience in MOBA games is also highly optimized for live streaming, making it easier for fans to watch tournaments on various platforms, thus increasing viewer engagement and driving the segment’s growth.

Comparatively, other game types like First-Person Shooters (FPS) and Real-Time Strategy (RTS) also contribute significantly to the mobile esports market. FPS games, known for their immersive gameplay and graphics, appeal to players looking for intense, fast-paced action, whereas RTS games attract those who enjoy deep, tactical planning and real-time decision-making.

Revenue Source Analysis

In 2024, the Advertising segment held a dominant market position in the Mobile Esports sector, capturing more than a 30.6% share. This prominence is primarily due to the increasing integration of advertisements into mobile gaming platforms, which has proven to be a highly effective method for reaching engaged and tech-savvy audiences.

Mobile games offer advertisers unique interactive and targeted advertising opportunities that are not as prevalent in other media landscapes. As a result, brands are keen to leverage these opportunities to promote their products and services in a dynamic and attention-grabbing manner.

Moreover, the growth of the Advertising segment is fueled by the development of sophisticated ad formats such as rewarded videos, playable ads, and in-app banners, which enhance user engagement without detracting from the gaming experience.

These formats are particularly effective in mobile esports environments, where they can be seamlessly integrated into the game flow, thus ensuring high visibility and engagement rates. The effectiveness of these advertising strategies is further enhanced by advanced analytics and targeting capabilities, enabling advertisers to reach the right audience with the right message at the right time.

Key Market Segments

By Game Type

- Multiplayer Online Battle Arena (MOBA)

- First-Person Shooter (FPS)

- Real-Time Strategy (RTS)

- Others

By Revenue Source

- Sponsorship

- Advertising

- Media Rights

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Technological Advancements and Accessibility

One of the primary drivers of the mobile esports market is the rapid advancement in smartphone technology combined with the increasing accessibility of mobile gaming. Modern smartphones are equipped with high-performance processors, advanced graphics, and high-refresh-rate screens, which enhance the gaming experience and make them suitable for competitive esports.

The global proliferation of high-speed internet, especially 5G networks, has significantly reduced latency, enabling real-time, competitive gaming without the need for expensive gaming rigs. This accessibility invites a diverse demographic of players from various geographic and socio-economic backgrounds, expanding the potential audience and participant base for mobile esports.

Restraint

Fragmentation of Mobile Devices

A significant restraint in the mobile esports market is the fragmentation of mobile devices in terms of hardware capabilities, operating systems, and screen sizes. This diversity can lead to inconsistent gaming experiences, where players with higher-end devices may have a competitive advantage over those with less capable hardware. Additionally, developers face challenges in creating games that offer fair and balanced competition across such a varied spectrum of devices, which can inhibit the growth of a universally competitive environment.

Opportunity

Expansion into Emerging Markets

The mobile esports market has substantial growth opportunities in emerging markets, where there is a rapid increase in smartphone penetration and internet connectivity. Regions like Southeast Asia, India, and parts of Africa are witnessing a surge in mobile device adoption, supported by affordable data plans and a growing young population interested in mobile gaming. These markets present a fertile ground for mobile esports to expand, driven by an untapped audience eager to engage in digital entertainment and competitive gaming.

Challenge

Maintaining Competitive Integrity

One of the primary challenges in mobile esports is maintaining competitive integrity, especially against the backdrop of easy accessibility. The risk of cheating and the use of unauthorized third-party applications pose a significant threat to fair play.

Ensuring a level playing field is crucial, as the spirit of competition is fundamental to esports. Tournament organizers and game developers need to invest in robust anti-cheat technologies and enforce strict regulations to mitigate these risks and uphold the credibility of competitions.

Growth Factors

The expansion of mobile esports is driven by several key factors that are enhancing both the accessibility and appeal of this gaming sector. Technological advancements in mobile devices, which include superior graphics, faster processors, and longer battery life, have significantly enhanced the gaming experience on mobile platforms. These improvements make mobile games more engaging and viable for professional-level competition.

The widespread adoption of 5G technology has been pivotal, offering low-latency and high-speed internet connections that are essential for competitive gaming. This technological shift has enabled real-time gaming without lag, which is crucial for esports where milliseconds can determine the outcome of competitions.

Additionally, mobile esports benefits from an expansive and inclusive gaming ecosystem that attracts a diverse global audience. This inclusivity is facilitated by the affordability and accessibility of smartphones compared to traditional PC and console setups, allowing more people from various backgrounds to participate in gaming.

Emerging Trends

Emerging trends within mobile esports indicate a dynamic evolution influenced by both technological innovations and changing consumer preferences. The integration of augmented reality (AR) and virtual reality (VR) technologies is set to transform the spectator experience, making it more immersive. These technologies allow fans to feel as if they are part of the live action, enhancing engagement and deepening their connection to the games.

Another significant trend is the diversification of game titles and genres within the mobile esports domain. As developers continue to innovate, new genres are becoming part of the esports landscape, attracting broader audiences and keeping the market vibrant and competitive.

Business Benefits

The business realm of mobile esports offers numerous benefits due to its robust growth and expanding audience base. One of the primary advantages is the significant revenue generation from diverse streams such as sponsorships, advertising, in-game purchases, and tournament winnings. These revenue streams are bolstered by the global reach and high engagement levels of mobile esports, attracting major brands and investments into the sector.

Mobile esports also provides opportunities for game developers and related businesses to tap into emerging markets where mobile penetration is increasing rapidly. These markets present new user bases and have the potential to drive further growth in the esports ecosystem.

The continuous development of mobile-specific esports titles tailored to the unique features of mobile devices (such as touch interfaces) not only enhances player experience but also supports the growth of a dedicated community of players and fans. This community engagement is crucial for sustaining and expanding the mobile esports market.

Key Player Analysis

In 2024, significant activities in the mobile esports market highlight the strategic moves of top companies through acquisitions, new product launches, and mergers. Here’s an analysis of three key players that made notable strides:

In July 2024, Keywords Studios, a leader in video game services, was acquired by EQT along with CPP Investments and Temasek for £2.2 billion. This acquisition is a clear demonstration of the increasing value seen in companies that provide essential services to the gaming industry, such as game development outsourcing.

NODWIN Gaming’s Purchase of StarLadder: Another significant transaction was NODWIN Gaming’s acquisition of the esports tournament organizer StarLadder for $5.5 million. This move is part of NODWIN Gaming’s strategy to expand its global footprint in the esports tournament landscape, enhancing its capabilities and reach in hosting international competitive gaming events

While not a corporate acquisition, T1’s ongoing success in the esports arena, particularly in League of Legends, underlines its strategic focus on maintaining a high-performing team. The team’s victory at the Worlds 2024 event, despite stiff competition, not only cements its reputation in esports but also demonstrates the effectiveness of its player development and team management strategies, which are critical to maintaining a lead in the highly competitive esports market

Top Key Players in the Market

- Gameloft SE

- Modern Times Group (MTG)

- Gfinity plc

- Allied Esports

- Tencent Holding Limited

- Nintendo of America Inc.

- Valve Corporation

- Activision Blizzard, Inc.

- Electronic Arts Inc.

- Take-Two Interactive

- Huya

- Fragbite Group

- Others

Recent Developments

- In April 2025, Riot Games announced the launch of Valorant Mobile in China. The development is led by LightSpeed Studios, known for mobile adaptations of PUBG and Apex Legends. Pre-registration for playtesting began in April 2025. A global release is anticipated based on the game’s performance in China.

- In February 2025, Siyata Mobile merged with Core Gaming, a Miami-based mobile game developer, in a deal valued at $160 million. Core Gaming has 43 million monthly active users and 2,100+ games. This merger aims to boost Siyata’s presence in the mobile gaming and esports market.

- In January 2024, OverActive Media announced plans to acquire Spanish esports organizations KOI and Movistar Riders. The merger aims to consolidate their esports assets under a single brand, Movistar KOI, by the end of 2024. The combined entity will participate in games like League of Legends, Valorant, and Free Fire.

Report Scope

Report Features Description Market Value (2024) USD 655.1 Mn Forecast Revenue (2034) USD 8,622.84 Mn CAGR (2025-2034) 29.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Game Type (Multiplayer Online Battle Arena (MOBA), First-Person Shooter (FPS), Real-Time Strategy (RTS), Others), By Revenue Source (Sponsorship, Advertising, Media Rights, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Gameloft SE, Modern Times Group (MTG), Gfinity plc, Allied Esports, Tencent Holding Limited, Nintendo of America Inc., Valve Corporation, Activision Blizzard, Inc., Electronic Arts Inc., Take-Two Interactive, Huya, Fragbite Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Gameloft SE

- Modern Times Group (MTG)

- Gfinity plc

- Allied Esports

- Tencent Holding Limited

- Nintendo of America Inc.

- Valve Corporation

- Activision Blizzard, Inc.

- Electronic Arts Inc.

- Take-Two Interactive

- Huya

- Fragbite Group

- Others