Global Erucic Acid Market Size, Share Analysis Report By Form (Liquid, Solid), By Source (Natural, Synthetic), By End Use (Automotive, Consumer Goods, Pharmaceuticals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162242

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

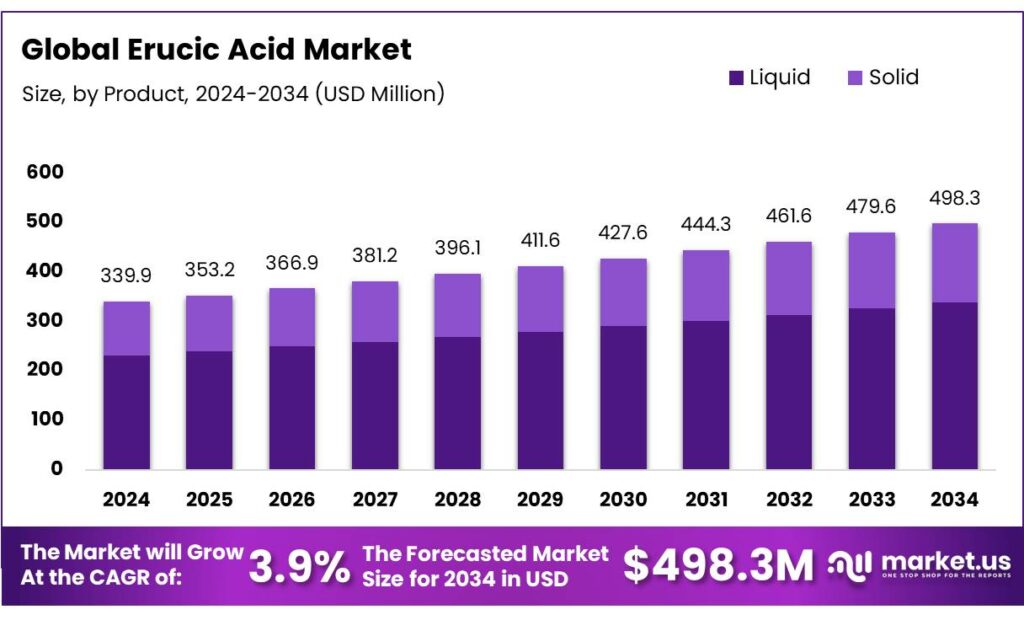

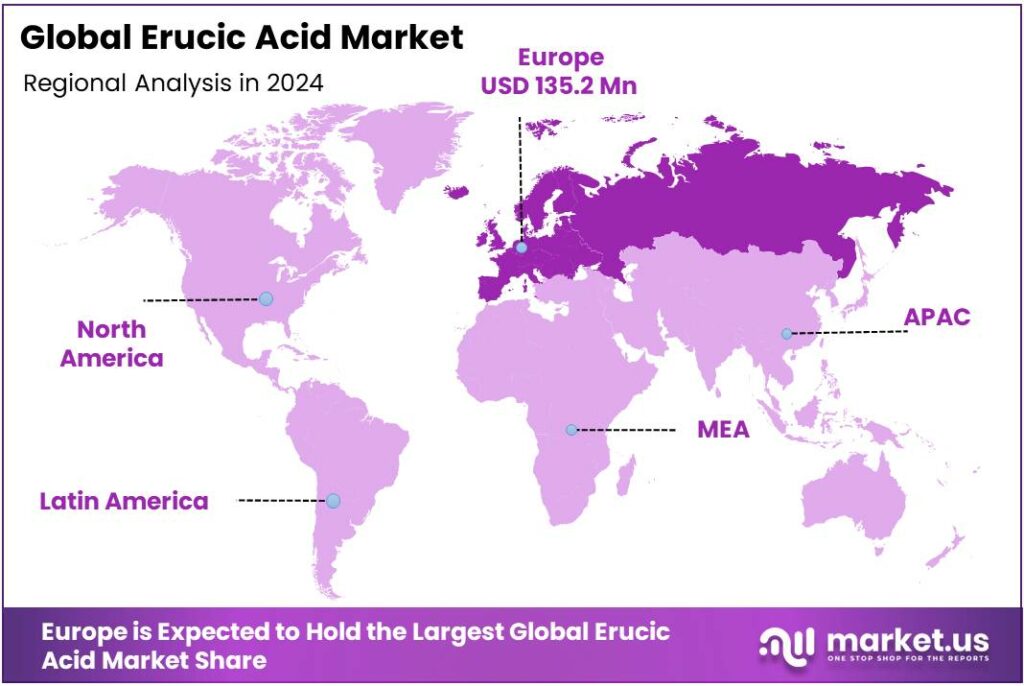

The Global Erucic Acid Market size is expected to be worth around USD 498.3 Million by 2034, from USD 339.9 Million in 2024, growing at a CAGR of 3.9% during the forecast period from 2025 to 2034. In 2024 European held a dominant market position, capturing more than a 39.80% share, holding USD 135.2 Million in revenue.

Erucic acid (C22:1 n-9) is a long-chain monounsaturated fatty acid occurring naturally in certain oilseeds, especially traditional rapeseed and mustard. Modern “low-erucic” canola varieties were bred to reduce erucic acid in edible oils for safety, while retaining industrial chemistry value via derivatives such as erucamide, behenyl alcohols, and specialty lubricants used in high-temperature or metal-working environments. Regulatory science anchors its risk management: the European Food Safety Authority (EFSA) established a tolerable daily intake of 7 mg/kg body weight/day for erucic acid in 2016.

Industrial availability is tied to rapeseed supply. USDA’s global balance shows 2023/24 rapeseed production at 89.9 MMT and a projected 85.1 MMT in 2024/25 as yields normalize; the 10-year average is 77.6 MMT. Canada—one of the largest producers—has hovered near 19.2–19.5 MMT in recent seasons with 2024/25 at 19.2 MMT on roughly 8.8 Mha sown. India’s rapeseed-mustard complex adds scale in Asia with ~11.9 MMT. Such upstream volumes underpin feedstock for erucic-bearing side streams and the derivative chemicals slate.

Policy sets decisive quality and safety thresholds that manufacturers must meet. In the EU, Regulation (EU) 2023/915 caps erucic acid at 20 g/kg in most vegetable oils and fats (2% of fat), 50 g/kg in camelina, mustard, and borage oils, and 0.020 g/kg in baby foods; stricter infant-specific limits also apply. In the United States, FDA recognizes “low erucic acid rapeseed oil” for food use, with erucic acid not exceeding 2% of component fatty acids.

Energy-transition dynamics are an indirect but important industrial driver. Rapeseed oil remains a leading biodiesel/HVO feedstock in Europe; in Germany, rapeseed-based biodiesel accounted for ~53.1% of output in 2024, supporting stable crush and co-product flows relevant to erucic-bearing fractions. More broadly, the International Energy Agency notes biofuels demand growth and policy breadth: over 80 countries now support biofuels through mandates or incentives, and global renewable-fuels scenarios require liquid biofuel use to nearly double by 2030 to align with targets—sustaining oilseed processing incentives.

Key Takeaways

- Erucic Acid Market size is expected to be worth around USD 498.3 Million by 2034, from USD 339.9 Million in 2024, growing at a CAGR of 3.9%.

- Liquid held a dominant market position, capturing more than a 67.3% share of the global erucic acid market.

- Natural held a dominant market position, capturing more than a 73.2% share of the global erucic acid market.

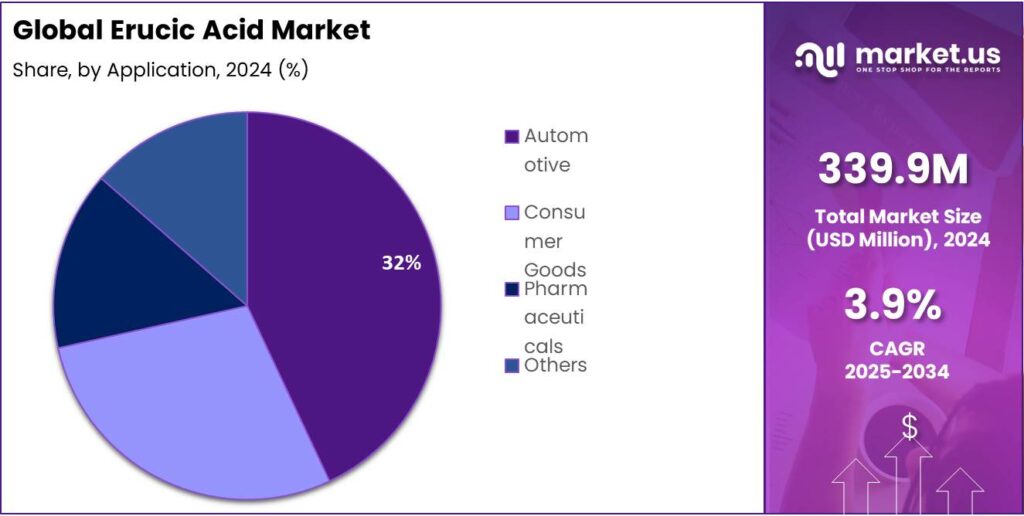

- Automotive held a dominant market position, capturing more than a 31.7% share of the global erucic acid market.

- European region emerged as the dominant market for erucic acid, commanding approximately 39.80% share and accounting for revenue of around USD 135.2 million.

By Form Analysis

Liquid Form Leads the Erucic Acid Market with 67.3% Share in 2024

In 2024, Liquid held a dominant market position, capturing more than a 67.3% share of the global erucic acid market. The dominance of the liquid form is largely due to its high solubility, ease of blending, and better compatibility with industrial processing systems. Liquid erucic acid is widely utilized in the production of lubricants, surfactants, slip agents, and polymer additives, where consistent viscosity and homogenous mixing are crucial. The form’s efficient transportability and lower processing costs compared to solid forms have further encouraged manufacturers to prefer liquid-grade erucic acid for continuous industrial operations.

In 2024, increasing demand from end-use sectors such as plastics, cosmetics, and specialty chemicals contributed significantly to the growing consumption of liquid erucic acid. Industries focused on bio-based lubricants and plastic additives have also expanded their use of liquid erucic acid owing to its renewable origin and chemical versatility. In 2025, the segment is expected to witness stable demand growth, supported by steady expansion in downstream polymer and lubricant manufacturing capacities across North America, Europe, and Asia-Pacific.

By Source Analysis

Natural Source Dominates the Erucic Acid Market with 73.2% Share in 2024

In 2024, Natural held a dominant market position, capturing more than a 73.2% share of the global erucic acid market. The strong position of the natural source segment is attributed to the widespread use of renewable oilseeds such as rapeseed, mustard, and crambe as key feedstocks for erucic acid extraction. Industries are increasingly preferring naturally derived erucic acid due to its biodegradability, environmental compatibility, and consistent quality for use in lubricants, plastic additives, and surfactants. The shift toward bio-based chemicals, supported by global sustainability targets and green production policies, has reinforced the growth of the natural segment during 2024.

Demand for naturally sourced erucic acid is projected to continue rising, supported by growing industrial focus on renewable raw materials and the expansion of high-erucic oilseed cultivation in Europe, Canada, and parts of Asia. The segment also benefits from reduced regulatory constraints compared to synthetic variants, making it more suitable for applications in food-safe coatings, cosmetics, and bio-lubricants. The increasing adoption of circular economy practices and cleaner production technologies further enhances the preference for naturally derived erucic acid.

By End Use Analysis

Automotive Sector Leads the Erucic Acid Market with 31.7% Share in 2024

In 2024, Automotive held a dominant market position, capturing more than a 31.7% share of the global erucic acid market. The segment’s leadership is driven by the increasing use of erucic acid derivatives in the formulation of high-performance lubricants, plasticizers, and corrosion inhibitors essential for modern automotive manufacturing. Erucic acid–based lubricants provide superior thermal stability, oxidation resistance, and eco-friendly characteristics, which align with the automotive industry’s growing focus on sustainability and energy efficiency.

The rise in electric vehicle production and the shift toward lightweight, durable materials boosted demand for erucic acid in automotive polymers and coatings. The segment also benefited from advancements in biobased lubricant technologies, as manufacturers sought renewable alternatives to petroleum-based chemicals. In 2025, demand is expected to grow further, supported by expansion in global vehicle production and tightening emission regulations that encourage the use of cleaner, bio-based chemical inputs.

Key Market Segments

By Form

- Liquid

- Solid

By Source

- Natural

- Synthetic

By End Use

- Automotive

- Consumer Goods

- Pharmaceuticals

- Others

Emerging Trends

Closer surveillance steering erucic acid to industrial lanes

A clear, recent trend around erucic acid is the consolidation of strict food rules and intensified surveillance, which is pushing the market into a “dual-track” model: very low-erucic channels for food and dedicated higher-erucic streams for industrial chemistry. The scientific anchor is unchanged but decisive: the European Food Safety Authority set a tolerable daily intake at 7 mg/kg body weight/day in its risk assessment, noting higher exposure in infants and young children.

The legal framework has been tightened and unified. The EU’s contaminants regulation now codifies a maximum level of 20 g/kg (2%) erucic acid for vegetable oils and fats sold to consumers or used as ingredients, with stricter infant-specific rules applied elsewhere. This consolidation under Regulation (EU) 2023/915 replaced and updated earlier provisions to close gaps and harmonize enforcement.

Codex keeps the global baseline aligned: its standard for named vegetable oils requires that “low-erucic acid rapeseed oil” must not exceed 2% erucic acid, which influences trade specs and import checks worldwide. In the United States, FDA’s regulation on rapeseed oil similarly limits “low-erucic acid” oils to ≤ 2% of component fatty acids and excludes their use in infant formula, so the safety buffer carries through to product design.

Monitoring data and national opinions translate these rules into day-to-day practice. Germany’s Federal Institute for Risk Assessment (BfR) highlights that if infant formula were produced right at the legal ceiling (0.4% of total fat), modeled intakes could exceed the 7 mg/kg bw/day TDI; hence manufacturers set much lower internal targets. Measured market products in Germany typically use 33–47% of the TDI for exclusively formula-fed infants—well below the limit, but close enough to keep vigilance high.

Drivers

Growing Demand from the Bio-fuel and Bio-based Feedstock Sector

One of the key driving factors behind the rising interest in erucic acid is the expanding demand for bio-based feedstocks and industrial oils derived from rapeseed and similar crops. What makes this so compelling is not just the raw numbers, but how policy, agriculture and downstream chemistry are aligning to elevate the role of long-chain fatty acids such as erucic acid in non-food streams.

To begin, the global production of rapeseed — the primary source of erucic acid–bearing fractions — stands at approximately 85.1 million metric tons for the 2024/25 marketing year. That is down slightly from 89.9 million MT in 2023/24. These are substantial volumes of oilseed crops that feed both edible oil chains and industrial-side derivative flows. The more plentiful and stable the base of rapeseed production, the more opportunity there is for streams rich in erucic and other non-food fatty acids to be harvested and directed into industrial uses.

Secondly, and more pointedly, the bio-fuel sector has become a significant outlet driving demand for vegetable oils — including rapeseed oil. In the European Biodiesel Board (EBB) 2023 statistical report, it was noted that in 2022 global biodiesel production was nearly 52 million tonnes, and the EU-27 alone accounted for approximately 13.7 million tonnes of this output.

Rapeseed oil is the primary feedstock in the crop-based segment: vegetable oils grown from agricultural crops make up 76% of the biodiesel feedstocks in Europe, and rapeseed oil is the largest single contributor. A further study found that around 46% of the EU’s vegetable-oil supply is used in the biodiesel industry. In one striking benchmark, it’s reported that as much as 58% of all rapeseed oil in Europe was being diverted into transport fuel in recent years.

Restraints

Regulatory exposure limits that narrow food-adjacent demand

A major restraint on erucic acid is the tight safety cap set by public health authorities, which limits how much erucic acid can appear in edible oils and infants’ foods. The European Food Safety Authority established a tolerable daily intake of 7 mg/kg body-weight/day in 2016 after reviewing cardiotoxicity evidence; EFSA also flagged infants and young children as the highest-exposed groups. In response, the EU reduced legal limits. Commission Regulation (EU) 2019/1870 set maximum levels of 20 g/kg erucic acid in vegetable oils and fats, 4 g/kg in infant and follow-on formula, and 30 g/kg in mustard, replacing looser historical thresholds.

These numbers translate into practical constraints across supply chains. Germany’s federal risk institute (BfR) calculated that, if infant formula were produced right at the legal maximum of 0.4% of fat, intake could exceed the 7 mg/kg bw/day TDI; real-world monitoring shows products are usually well below that, but typical exclusive-formula diets still use up 33–47% of the TDI in early months—leaving little headroom. The UK Food Standards Agency likewise notes that legislative specifications for rapeseed oil and infant formula limit potential exposure by law—constraining how formulations can be designed.

Global standards add more friction. Codex CXS 210 requires “low-erucic acid rapeseed oil” to contain ≤ 2% erucic acid (percentage of total fatty acids), aligning with many national rules and shaping international trade specs. In the United States, FDA’s 21 CFR 184.1555 allows “low erucic acid rapeseed oil” in foods only if erucic acid ≤ 2% of component fatty acids, and excludes use in infant formula—further narrowing edible applications and pushing higher-erucic streams toward non-food uses or requiring costly purification.

Opportunity

Biofuel-driven crush creating reliable feedstock for high-value erucic chemistry

A major growth opportunity for erucic acid sits where biofuel policy meets oilseed processing. When governments expand renewable fuel targets, crushers run harder, and that larger, steadier flow of rapeseed oil generates the fatty-acid streams from which erucic acid and its derivatives can be isolated and scaled. The foundation is already large: the USDA reports world rapeseed production at ~85.7 million metric tons in 2024/25, while rapeseed-oil output reached 34.33 MMT in 2023/24 against a 10-year average of ~30.0 MMT—ample throughput to support industrial fatty-acid valorization.

Policy keeps that throughput resilient. The European Union’s revised Renewable Energy Directive (RED III) sets an overall binding target of at least 42.5% renewables in the energy mix by 2030, with specific transport requirements adopted in October 2023. These targets sustain biodiesel/HVO demand, anchoring rapeseed crush and its co-products that feed erucic-acid chains.

Industry data confirm rapeseed oil’s central role in Europe’s biodiesel pool. The European Biodiesel Board’s statistical report shows agricultural crops supply 76% of EU biodiesel feedstocks, with rapeseed oil the single largest contributor (≈40%). In Germany specifically, biodiesel from rapeseed oil accounted for ≈53.1% in 2024, illustrating how national markets translate EU policy into sustained oilseed processing. This intensity of rapeseed-oil use stabilizes fatty-acid availability, a prerequisite for consistent erucic-acid supply.

Global energy trajectories amplify the opportunity. The International Energy Agency notes biofuels were just over 3.5% of global transport energy in 2022, and in its Net-Zero pathway, biofuels’ contribution more than doubles to 9% by 2030—an expansion that requires more feedstock and keeps crushers running. In parallel, the IEA expects massive renewables growth by 2030, reinforcing the policy environment that favors low-carbon liquids alongside electrification.

Regional Insights

In 2024, the European region emerged as the dominant market for erucic acid, commanding approximately 39.80% share and accounting for revenue of around USD 135.2 million. This leadership can be attributed to several structural factors: Europe’s well-established oilseed cultivation, robust chemical manufacturing infrastructure, and strong regulatory support for bio-based and sustainable raw materials. The presence of mature downstream industries—including specialty lubricants, polymer additives, and higher-value oleochemicals—enabled Europe to convert feedstock advantages into significant market share.

Europe’s dominance is further supported by the region’s strategic focus on renewable chemical intermediates and oleochemicals. For example, reports indicate Europe held around 40% of global erucic acid consumption in earlier years. This indicates consistency in the regional share and underlines the maturity of the market in Europe. Supply-side factors such as location of major processing plants and proximity to key oilseed cultivation areas have reduced logistics costs and strengthened competitiveness for European producers.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

PMC Biogenix is a specialist in renewable oleochemicals and fatty acid derivatives with over fifty years of experience in the market. The company produces erucic acid under brand lines such as Hystrene® 2290 for use in polymer additives and lubricants. In 2017, their Memphis facility expansion increased erucic and behenic acid production capacity by approximately 50%.

Cargill, a major agribusiness and oilseed processor, maintains a strong foothold in erucic acid derivatives via advanced refining and partnerships with rapeseed growers in Canada and Europe. The company reportedly operates plants producing erucic acid derivatives above 12,000 metric tons annually, tailored for lubricants and polymer industries.

Vantage is a U.S.-based specialty chemicals firm operating a business unit in oleochemicals which supplies high-quality fatty acids, esters and bio-based intermediates for personal care, food and industrial use. While specific erucic acid figures are not widely published, Vantage’s deep involvement in oleochemical feedstocks and formulations positions them as a relevant player in erucic acid derivatives.

Top Key Players Outlook

- PMC Biogenix

- Vantage Oleochemicals

- BASF

- Cargill

- Emery Oleochemicals

- AkzoNobel

- Others

Recent Industry Developments

In 2024, PMC Biogenix maintained a strong position in the erucic-acid sector by offering its flagship product grade Hystrene® 2290 (≈ 90% erucic acid), sourced from vegetable oils and widely used in high-performance plastics, lubricants, and coatings.

In 2024, BASF SE furthered its footprint in the oleochemicals and fatty-acid space by emphasizing development of renewable and bio-based intermediates, aligning with industry trends toward sustainability. The company reported annual group sales of approximately €68.9 billion in 2023 and maintains a presence across six major business segments.

Report Scope

Report Features Description Market Value (2024) USD 339.9 Mn Forecast Revenue (2034) USD 498.3 Mn CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Solid), By Source (Natural, Synthetic), By End Use (Automotive, Consumer Goods, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape PMC Biogenix, Vantage Oleochemicals, BASF, Cargill, Emery Oleochemicals, AkzoNobel, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- PMC Biogenix

- Vantage Oleochemicals

- BASF

- Cargill

- Emery Oleochemicals

- AkzoNobel

- Others