Global Endpoint Security Market By Component (Antivirus/Antimalware, Endpoint Detection and Response (EDR), Mobile Device Management (MDM), Encryption Technologies, Application Control, Other Components), By Deployment (On-Premise, and Cloud), By Organization(Large Enterprise, SME), By Industry Vertical (IT & Telecom, BFSI, Industrial, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 38223

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

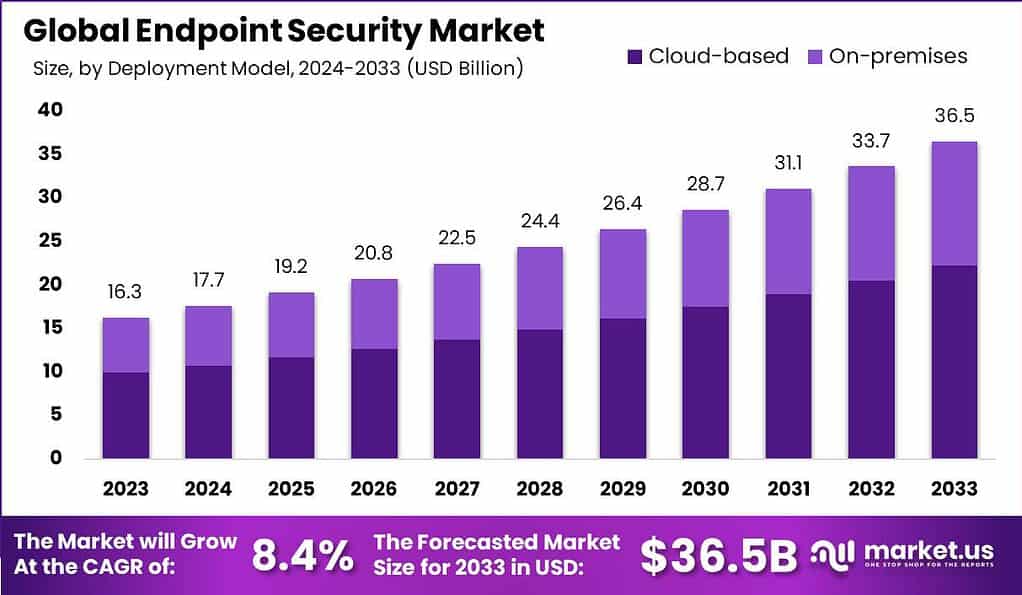

The Global Endpoint Security Market is anticipated to be USD 36.5 billion by 2033. It is estimated to record a steady CAGR of 8.4% in the Forecast period 2024 to 2033. It is likely to total USD 16.3 billion in 2023.

Endpoint security refers to the practice of securing individual devices, such as desktops, laptops, smartphones, and servers, from potential cyber threats and unauthorized access. Endpoints are considered the entry points for cyberattacks, making them a primary target for hackers and malicious actors. Endpoint security aims to protect these devices by implementing security measures, such as antivirus software, firewalls, encryption, intrusion detection/prevention systems, and vulnerability management.

The Endpoint Security Market is a dynamic and rapidly growing sector within the broader cybersecurity industry. It encompasses the products and services offered by vendors to protect endpoints from a wide array of cyber threats. The market has witnessed significant expansion due to the increasing frequency and sophistication of cyberattacks, as well as the proliferation of connected devices. Organizations across various sectors, including healthcare, finance, government, and enterprises of all sizes, are investing heavily in endpoint security solutions to mitigate risks and secure their data.

Analyst Viewpoint

One of the key driving factors is technological advancements. Rapid advancements in technology, such as artificial intelligence, internet of things, and blockchain, are revolutionizing the way businesses operate. These technologies offer opportunities for increased efficiency, improved customer experiences, and the development of innovative products and services. Companies that can effectively leverage these technologies are likely to gain a competitive edge in the market.

Additionally, the ongoing globalization and digitalization of markets present opportunities for companies to expand their reach beyond traditional boundaries. E-commerce and digital platforms have made it easier for businesses to enter new markets and connect with customers worldwide. This opens up new avenues for growth and allows companies to tap into previously untapped markets, leading to increased revenue and market share. For instance, in March 2022, Google revealed its aim to purchase cybersecurity firm Mandiant for USD 5.4 billion.

Key Takeaways

- The Endpoint Security Market is projected to reach approximately USD 36.5 billion by 2033, with a steady Compound Annual Growth Rate (CAGR) of 8.4%. In 2023, it was estimated to be worth USD 16.3 billion.

- In 2023, the Antivirus/Antimalware segment dominated the market with a market share of over 32%. This segment is crucial for safeguarding endpoints from various cyber threats.

- Cloud-based deployment accounted for over 61% of the total market share in 2023. The flexibility, accessibility, and cost-effectiveness of cloud-based solutions are driving its adoption.

- Large enterprises captured over 57% of the market share in 2023. These organizations prioritize advanced endpoint security solutions due to their complex IT infrastructures and higher risk exposure.

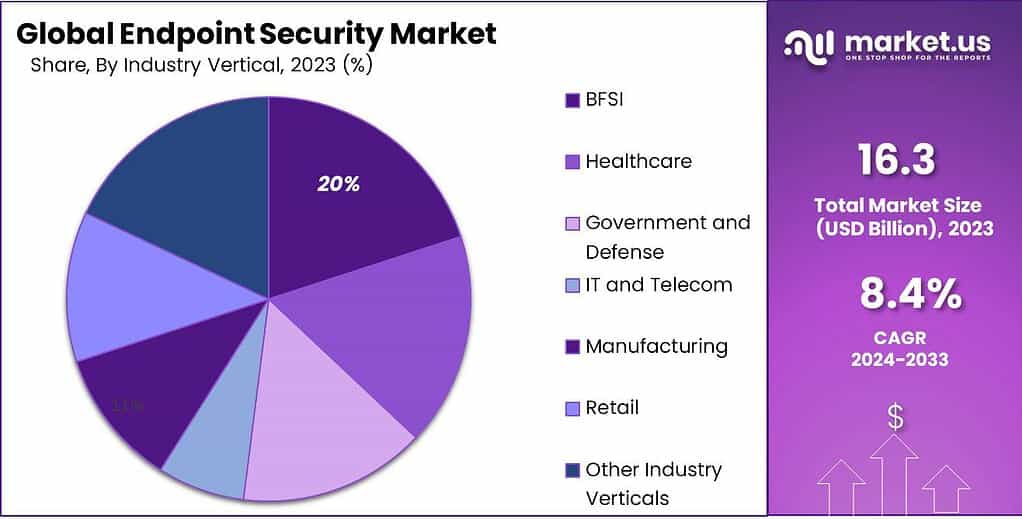

- The Banking, Financial Services, and Insurance (BFSI) sector held a significant share (over 20%) in 2023, emphasizing the importance of data security in this industry.

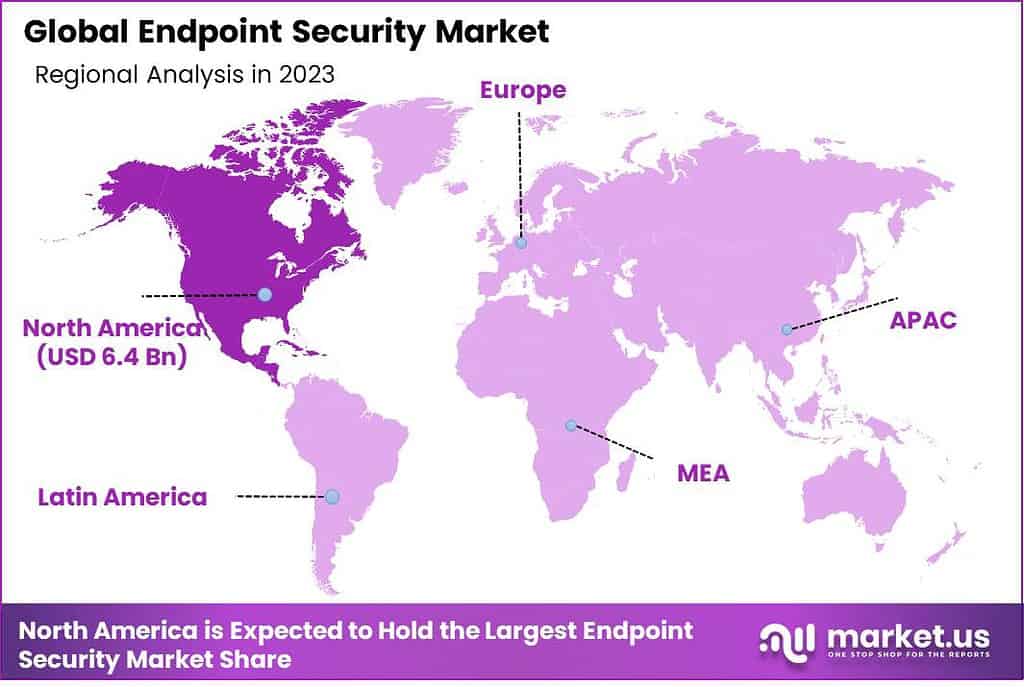

- North America dominated the market in 2023, with over 39.5% of the market share, attributed to strong cybersecurity focus and regulatory frameworks.

Component Analysis

In 2023, the Antivirus/Antimalware segment emerged as the dominant force in the Endpoint Security market, capturing a significant market share of over 32%. This segment’s strong position can be attributed to its vital role in safeguarding endpoints from a wide range of cyber threats, including viruses, malware, and ransomware. Antivirus/Antimalware solutions are designed to detect, prevent, and remove malicious software, ensuring the security and integrity of endpoints such as computers, laptops, and mobile devices.

The growing prevalence of sophisticated cyberattacks and the increasing frequency of data breaches have driven the demand for robust antivirus/antimalware solutions. Organizations across various industries are becoming increasingly aware of the potential risks associated with cyber threats and the need to protect their sensitive data. As a result, they are investing in advanced antivirus/antimalware solutions to fortify their endpoint security measures.

Moreover, the rise in remote and hybrid work models has further intensified the importance of antivirus/antimalware software. With a significant portion of the workforce operating from home or using personal devices for work purposes, endpoints have become more vulnerable to cyber threats. This has prompted organizations to prioritize endpoint security and deploy antivirus/antimalware solutions to mitigate risks and ensure data protection.

The antivirus/antimalware segment is also witnessing continuous innovation and advancements. Vendors are introducing advanced detection techniques, behavior analysis, and machine learning algorithms to enhance threat detection capabilities and provide real-time protection against emerging threats. This continuous evolution of antivirus/antimalware solutions is attracting businesses of all sizes, further propelling the segment’s growth.

Deployment Analysis

In 2023, the Cloud-Based segment emerged as the dominant force in the Endpoint Security market, accounting for over 61% of the total market share. This significant market position can be attributed to several key factors driving the adoption of cloud-based deployment in the industry.

One of the primary drivers behind the popularity of cloud-based endpoint security solutions is the scalability and flexibility they offer. Cloud-based deployments allow organizations to easily scale their security infrastructure up or down to align with their evolving needs, without the need for significant upfront investments in hardware or infrastructure. This flexibility is particularly valuable for businesses experiencing rapid growth or fluctuations in their workforce, as it enables them to adapt their security measures accordingly.

Furthermore, cloud-based endpoint security solutions provide enhanced accessibility and ease of management. With the rise of remote work and the increasing number of mobile devices accessing corporate networks, organizations require security solutions that can be easily deployed and managed across diverse endpoints. Cloud-based solutions offer a centralized platform that can be accessed from anywhere, allowing organizations to efficiently monitor and manage their security posture across their entire network, regardless of the physical location of the endpoints.

Cost-effectiveness is another key advantage of cloud-based deployment. By eliminating the need for on-premise hardware and infrastructure, organizations can significantly reduce their capital and operational expenses associated with maintaining and upgrading traditional security systems. Cloud-based solutions typically operate on a subscription-based model, offering organizations the flexibility to pay for the exact services and resources they require, thereby optimizing their security investments.

Moreover, cloud-based endpoint security solutions often feature robust threat intelligence capabilities. These solutions leverage the power of machine learning and artificial intelligence algorithms to continuously analyze and detect emerging threats in real-time. The cloud-based architecture allows for the rapid dissemination of threat intelligence updates, ensuring that organizations have access to the latest security measures and protection against evolving cyber threats.

Organization Analysis

In 2023, the Large Enterprises segment emerged as the dominant player in the Endpoint Security market, capturing over 57% of the total market share. The significant market position of large enterprises can be attributed to several key factors that drive their adoption of robust endpoint security solutions.

Large enterprises typically possess complex and expansive IT infrastructures, often spanning multiple locations and encompassing a large number of endpoints. These organizations have a higher risk exposure due to their scale, making them attractive targets for cybercriminals. As a result, large enterprises prioritize the implementation of advanced endpoint security solutions to protect their valuable data and mitigate potential risks.

Moreover, large enterprises tend to have greater financial resources and larger budgets allocated for cybersecurity. This enables them to invest in comprehensive endpoint security solutions that offer a wide range of advanced features, such as threat intelligence, behavioral analytics, and real-time monitoring. These organizations can afford to deploy dedicated security teams and employ sophisticated technologies to safeguard their endpoints effectively.

Large enterprises also face unique challenges related to compliance and regulatory requirements. They often operate in highly regulated industries, such as finance, healthcare, and government, where compliance with data protection and privacy regulations is crucial. Endpoint security solutions tailored to meet these specific requirements, such as data encryption, access controls, and audit trails, are essential for large enterprises to ensure regulatory compliance and avoid severe penalties.

Furthermore, large enterprises typically have a diverse workforce, including employees, contractors, and partners, who access their IT systems from various devices and locations. This complexity necessitates the implementation of endpoint security solutions that can effectively manage and secure a wide array of endpoints, including desktops, laptops, mobile devices, and IoT devices. Large enterprises require solutions that offer centralized management capabilities, scalability, and seamless integration with their existing IT infrastructure.

Industry Vertical Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment emerged as the dominant player in the Endpoint Security market, capturing more than a 20% share of the total market. Several key factors contribute to the significant market position of the BFSI industry in terms of endpoint security adoption.

The BFSI sector operates in an environment where data security and privacy are of utmost importance. Financial institutions handle vast amounts of sensitive customer data, including personal and financial information, making them prime targets for cyberattacks. To protect their assets and maintain customer trust, organizations in the BFSI industry prioritize robust endpoint security solutions.

Moreover, the BFSI sector is highly regulated, with stringent compliance requirements imposed by regulatory bodies. These regulations, such as the Payment Card Industry Data Security Standard (PCI DSS) and the General Data Protection Regulation (GDPR), demand the implementation of strong security measures to safeguard customer data. Endpoint security solutions that offer features like encryption, access controls, and advanced threat detection help BFSI organizations meet these regulatory obligations and avoid potential penalties.

Financial institutions also face unique cybersecurity challenges, including sophisticated and evolving cyber threats. The BFSI sector is a primary target for financially motivated cybercriminals who seek to exploit vulnerabilities in systems and gain unauthorized access to sensitive data. Endpoint security solutions tailored specifically for the BFSI industry provide advanced threat intelligence, behavioral analytics, and real-time monitoring capabilities to detect and mitigate these threats effectively.

Furthermore, the BFSI sector often has a complex IT infrastructure, with a variety of endpoints, including desktops, laptops, mobile devices, and ATMs. Endpoint security solutions for the BFSI industry need to be scalable, flexible, and capable of managing these diverse endpoints while ensuring minimal disruption to critical banking and financial operations.

Key Маrkеt Ѕеgmеntѕ

Component Outlook

- Antivirus/Antimalware

- Endpoint Detection and Response (EDR)

- Mobile Device Management (MDM)

- Encryption Technologies

- Application Control

- Other Components

Deployment Outlook

- On-premise

- Cloud

Organization Outlook

- Large Enterprise

- SME

Application Outlook

- IT & telecom

- BFSI

- Industrial

- Education

- Retail

- Healthcare

- Government & Defense

- Others

Driving Factor

Rising Cybersecurity Threats

The endpoint security market is driven by the increasing wave of cybersecurity threats that organizations face today. With the evolving tactics and sophistication of cybercriminals, businesses are recognizing the critical importance of protecting their endpoints from malicious activities. Cyber threats such as malware, ransomware, phishing attacks, and zero-day vulnerabilities pose significant risks to sensitive data, financial stability, and business operations. As a result, organizations are investing in robust endpoint security solutions to detect, prevent, and respond to these threats effectively. The growing awareness of the potential consequences of cyberattacks has led to a surge in demand for advanced endpoint security technologies and solutions.

Restraint Factor

Complexity of Managing Diverse Endpoints

A key restraint in the endpoint security market is the complexity of managing diverse endpoints within organizations. As businesses increasingly adopt a wide range of devices, including desktops, laptops, mobile devices, and IoT devices, ensuring consistent security and management across all endpoints becomes a significant challenge. Each endpoint may have different operating systems, configurations, and security requirements, making it difficult to implement a unified and seamless security infrastructure. Organizations need to address the complexity of endpoint diversity while ensuring adequate protection against threats. Managing patching, software updates, access controls, and monitoring across diverse endpoints requires specialized knowledge, resources, and tools, adding to the complexity and cost of endpoint security management.

Opportunity

Integration of AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) presents a significant opportunity in the endpoint security market. AI and ML technologies have the potential to revolutionize endpoint security by enhancing threat detection and response capabilities. These technologies can analyze vast amounts of endpoint data, identify patterns, and detect anomalies that indicate potential security breaches.

By leveraging AI and ML algorithms, organizations can proactively detect and respond to emerging threats in real-time, thereby reducing the risk of data breaches and other cyber incidents. AI-powered endpoint security solutions can automate security processes, improve accuracy in threat detection, and reduce the burden on security teams. The integration of AI and ML in endpoint security offers the potential for more efficient and effective protection against advanced and evolving cyber threats.

Challenge

Compliance with Evolving Regulations

One of the significant challenges in the endpoint security market is compliance with evolving regulations. Governments and regulatory bodies worldwide are continuously updating and introducing new cybersecurity regulations to address emerging threats and protect sensitive data. Organizations need to ensure that their endpoint security solutions meet the requirements of these regulations to avoid penalties, legal consequences, and reputational damage.

Compliance with regulations such as the General Data Protection Regulation (GDPR), Payment Card Industry Data Security Standard (PCI DSS), and various industry-specific standards can be complex and resource-intensive. Organizations must stay updated with changing compliance requirements, implement appropriate security measures, conduct regular audits, and demonstrate compliance to regulators. The challenge lies in effectively aligning endpoint security strategies with evolving regulations and maintaining compliance while mitigating security risks effectively.

Regional Analysis

In 2023, North America held a dominant market position in the Endpoint Security market, capturing more than a 39.5% share. This can be attributed to the region’s strong focus on cybersecurity measures, driven by the increasing frequency and sophistication of cyber threats.

The demand for endpoint security in North America reached US$ 6.4 billion in 2023, and there are optimistic projections for significant growth in the foreseeable future. With a robust IT infrastructure and a high level of awareness regarding data security, organizations in North America have been proactive in adopting advanced endpoint security solutions. Moreover, stringent regulatory frameworks, such as GDPR in Europe and various data protection laws in the United States, have further propelled the demand for endpoint security solutions in the region.

Moving on to Europe, it accounted for a significant portion of the market, with a more share in 2023. European countries have been increasingly investing in cybersecurity measures to safeguard sensitive data and maintain compliance with evolving regulations. The European market’s growth is also driven by the expanding adoption of cloud-based services, which require robust endpoint security solutions to protect data stored in the cloud. Additionally, the region has witnessed a rising number of cyberattacks, leading organizations to prioritize endpoint security.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Endpoint Security Market is highly competitive, with several key players driving innovation and offering a range of solutions to protect organizations from cyber threats. To mitigate cyber risk, major companies offer advanced technologies and are involved in mergers & acquisitions as well as strategic alliances. This contributes to market growth. These companies have established themselves as leaders in the industry and play a crucial role in shaping the market’s landscape.

Some of the prominent players in the global endpoint security market include:

- Symantec Corporation (Now part of Broadcom)

- McAfee LLC

- Trend Micro Incorporated

- CrowdStrike Holdings Inc.

- Kaspersky Lab

- Cisco Systems Inc.

- Sophos Group plc

- Palo Alto Networks Inc.

- Carbon Black Inc. (Now part of VMware)

- Bitdefender

- Checkpoint Software Technologies Ltd.

- FireEye Inc.

- Other Key Players

Recent Developments

1. Broadcom (formerly Symantec):

- March 2023: Acquired 6Degrees, a cloud-based security posture management vendor, to enhance their endpoint security portfolio with threat intelligence and attack surface management capabilities.

2. McAfee LLC:

- October 2023: Launched McAfee MVISION XDR 7.0, an extended detection and response (XDR) platform integrating endpoint, network, and cloud security functionalities.

- November 2023: Partnered with Tanium to offer endpoint detection and response (EDR) capabilities within the McAfee Endpoint Security platform, leveraging Tanium’s unique visibility and control features.

3. Kaspersky Lab:

- May 2023: Released Kaspersky Endpoint Security Cloud, a cloud-based endpoint security solution designed for small and medium-sized businesses, offering centralized management and protection.

- June 2023: Announced a partnership with Invincea, a leader in endpoint detection and response (EDR) solutions, to integrate Invincea’s EDR capabilities into Kaspersky Endpoint Security for advanced threat detection and response.

4. Cisco Systems Inc.:

- January 2023: Acquired Duo Security, a cloud-based access security provider, for $6.5 billion, aiming to integrate Duo’s zero-trust security approach into Cisco’s endpoint security offerings.

- September 2023: Launched Cisco SecureX XDR, a cloud-native extended detection and response (XDR) platform providing unified visibility and security management across endpoints, networks, and cloud environments.

Report Scope

Report Features Description Market Value (2023) US$ 16.3 Bn Forecast Revenue (2033) US$ 36.5 Bn CAGR (2024-2033) 8.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Antivirus/Antimalware, Endpoint Detection and Response (EDR), Mobile Device Management (MDM), Encryption Technologies, Application Control, Other Components), By Deployment (On-Premise, and Cloud), By Organization(Large Enterprise, SME), By Industry Vertical (IT & Telecom, BFSI, Industrial, and Other Applications) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Symantec Corporation (Now part of Broadcom), McAfee LLC, Trend Micro Incorporated, CrowdStrike Holdings Inc., Kaspersky Lab, Cisco Systems Inc., Sophos Group plc, Palo Alto Networks Inc., Carbon Black Inc. (Now part of VMware), Bitdefender, Checkpoint Software Technologies Ltd., FireEye Inc., Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Endpoint Security?Endpoint Security refers to the practice of protecting computer systems and networks at the endpoints, or individual devices, such as laptops, desktops, mobile devices, and servers. It involves securing these endpoints from cyber threats, malware, and unauthorized access.

How big is Endpoint Security Industry?The Global Endpoint Security Market is anticipated to be USD 36.5 billion by 2033. It is estimated to record a steady CAGR of 8.4% in the Forecast period 2024 to 2033. It is likely to total USD 16.3 billion in 2023.

Why is Endpoint Security Important?Endpoint Security is crucial because endpoints are often the entry points for cyberattacks. Protecting these devices is essential to prevent data breaches, malware infections, and other cybersecurity incidents that can compromise the integrity and confidentiality of sensitive information.

What Challenges does the Endpoint Security Market Face?Challenges in the Endpoint Security Market include the increasing sophistication of cyber threats, the need to protect a growing number of diverse endpoints (including IoT devices), and the demand for solutions that do not impact system performance.

How does Endpoint Security Differ from Antivirus Software?While antivirus software is a component of endpoint security, the latter is a broader term encompassing a range of tools and practices. Endpoint Security involves a more comprehensive approach, including features like firewalls, intrusion prevention, and device control to address a wider array of threats.

Who are the key players in endpoint security market?Some key players operating in the endpoint security market include Symantec Corporation (Now part of Broadcom), McAfee LLC, Trend Micro Incorporated, CrowdStrike Holdings Inc., Kaspersky Lab, Cisco Systems Inc., Sophos Group plc, Palo Alto Networks Inc., Carbon Black Inc. (Now part of VMware), Bitdefender, Checkpoint Software Technologies Ltd., FireEye Inc., Other Key Players

What Trends are Shaping the Future of Endpoint Security?Trends in the Endpoint Security Market include the integration of artificial intelligence and machine learning for threat detection, the emphasis on zero-trust security models, and the growing importance of securing endpoints in cloud environments.

-

-

- Symantec Corporation (Now part of Broadcom)

- McAfee LLC

- Trend Micro Incorporated

- CrowdStrike Holdings Inc.

- Kaspersky Lab

- Cisco Systems Inc.

- Sophos Group plc

- Palo Alto Networks Inc.

- Carbon Black Inc. (Now part of VMware)

- Bitdefender

- Checkpoint Software Technologies Ltd.

- FireEye Inc.

- Other Key Players