Global Electrophoresis Reagents Market By Product Type (Agarose Gel Electrophoresis, Capillary Electrophoresis, Cellulose Acetate Electrophoresis, Polyacrylamide Gel Electrophoresis) By Technology (Buffers, Chemicals, Dyes, Precast Gels) By Application (DNA Analysis, RNA Analysis, Quality Control, Protein Analysis) By End-User (Academic Research, Pharmaceuticals, Clinical Diagnostics, Biotechnology), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155547

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

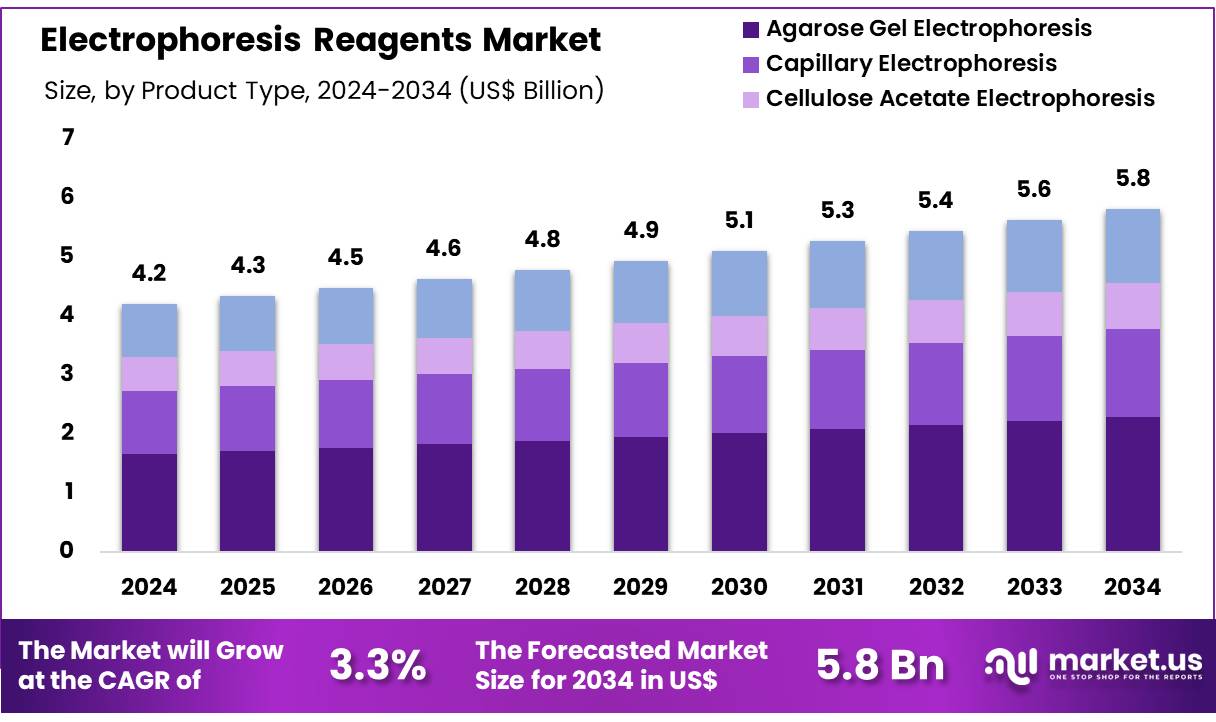

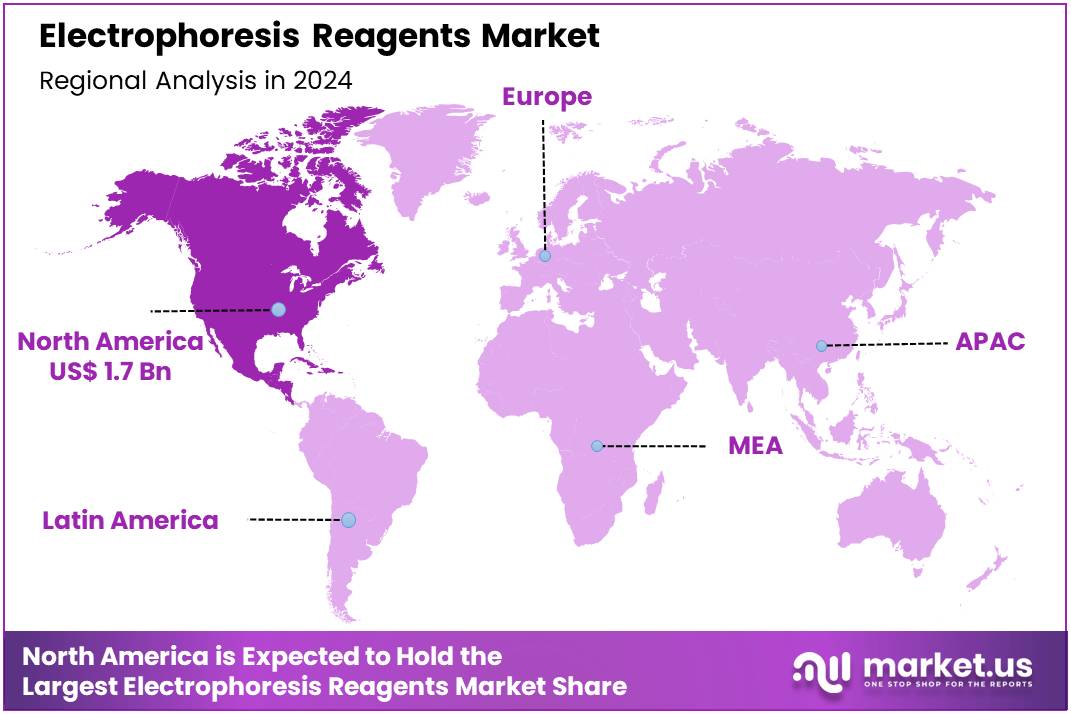

Global Electrophoresis Reagents Market size is expected to be worth around US$ 5.8 Billion by 2034 from US$ 4.2 Billion in 2024, growing at a CAGR of 3.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.7% share with a revenue of US$ 1.7 Billion.

Rising demand for personalized medicine, coupled with sustained federal research funding, fundamentally drives the electrophoresis reagents market. The May 2024 United States Food and Drug Administration’s laboratory-developed-test rule, for example, introduced a substantial compliance burden of US$ 566 million to US$ 3.56 billion over two decades. This regulatory change elevates quality thresholds, creating a clear preference for established reagent suppliers who can meet these stringent standards.

Meanwhile, the Asia-Pacific region is poised to rebalance global growth, as regional research hubs expand and attract investment despite recent softness in venture financing. These long-term shifts in regulation and funding ensure a robust and growing demand for high-quality electrophoresis reagents.

Growing technological sophistication is a key trend shaping the market, with innovations enhancing efficiency and expanding applications. The rising adoption of greener stains, for instance, addresses environmental and safety concerns in laboratories, while the integration of AI-enabled gel analytics is automating data interpretation and improving accuracy.

Furthermore, automation-heavy capillary systems are streamlining workflows, allowing for high-throughput analysis in a fraction of the time. These advancements are critical for a wide range of applications, including DNA sequencing, genotyping, protein analysis for disease detection, and quality control in pharmaceutical production, all of which reinforce the structural demand for specialized electrophoresis reagents.

Increasing strategic consolidation within the industry further defines the market’s trajectory, with leading players strengthening their portfolios to meet evolving customer needs. A prime example of this trend is Thermo Fisher’s February 2025 agreement to acquire Solventum’s Purification & Filtration business for US$4.1 billion.

This acquisition is expected to generate an additional US$ 1 billion in sales and significantly expand Thermo Fisher’s biologics workflow offerings. This strategic move highlights a broader industry focus on building comprehensive, end-to-end solutions for customers, encompassing everything from sample preparation and separation to analysis. Such integrations enhance convenience and operational efficiency for end-users, ensuring that the market for electrophoresis reagents remains dynamic and competitive.

Key Takeaways

- In 2024, the market for electrophoresis reagents generated a revenue of US$ 4.2 Billion, with a CAGR of 3.3%, and is expected to reach US$ 5.8 billion by the year 2034.

- The product type segment is divided into agarose gel electrophoresis, capillary electrophoresis, cellulose acetate electrophoresis, polyacrylamide gel electrophoresis, with agarose gel electrophoresis taking the lead in 2023 with a market share of 49.4%.

- Considering technology, the market is divided into buffers, chemicals, dyes, precast gels. Among these, buffers held a significant share of 40.2%.

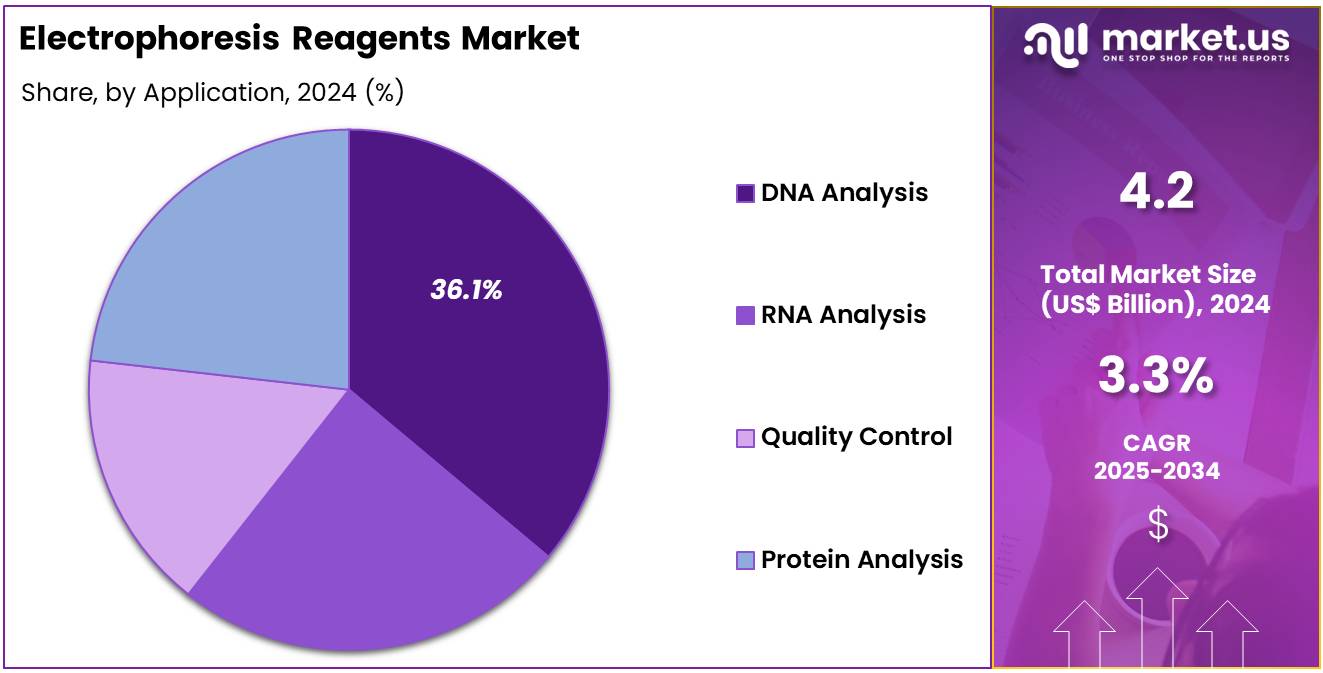

- Furthermore, concerning the application segment, the market is segregated into DNA analysis, RNA analysis, quality control, protein analysis. The DNA analysis sector stands out as the dominant player, holding the largest revenue share of 36.1% in the electrophoresis reagents market.

- The end-user segment is segregated into academic research, pharmaceuticals, clinical diagnostics, biotechnology, with the academic research segment leading the market, holding a revenue share of 43.5%.

- North America led the market by securing a market share of 39.7% in 2023.

Product Type Analysis

Agarose gel electrophoresis dominates the product type segment with 39.4% of the market share. This method remains a critical tool in molecular biology, particularly for the separation of DNA, RNA, and protein samples. The growth of this segment is expected to continue as agarose gel electrophoresis offers a cost-effective, efficient, and versatile solution for analyzing nucleic acids. The increasing demand for genetic research, diagnostics, and biotechnology applications, combined with its ease of use and accessibility, ensures that agarose gel electrophoresis remains the preferred choice in many laboratories.

Moreover, advancements in agarose gel formulations, which allow for better resolution and faster results, are likely to further drive growth. As academic research and genetic testing continue to expand, the demand for reliable electrophoresis methods like agarose gel electrophoresis is projected to rise, securing its dominant position in the market.

Technology Analysis

Buffers account for 40.2% of the technology segment in the electrophoresis reagents market. This growth is expected to continue as buffers are essential in maintaining the pH and ionic strength required for optimal electrophoresis performance. The role of buffers in stabilizing the electric field and ensuring efficient separation of biomolecules makes them indispensable in electrophoresis applications, especially in DNA and protein analysis.

With the growing need for precise and accurate molecular analysis in research and diagnostics, the demand for high-quality buffers is projected to rise. Moreover, the increasing number of academic and clinical studies, particularly those related to genomics and proteomics, is likely to drive further demand for buffer solutions. As innovations in buffer systems that offer improved stability, consistency, and ease of use emerge, the market for buffers in electrophoresis is expected to continue its growth trajectory.

Application Analysis

DNA analysis holds 36.1% of the application segment in the electrophoresis reagents market. This segment’s growth is expected to continue as DNA-based research and diagnostics become increasingly important in genomics, personalized medicine, and forensic science. Electrophoresis is a key technique for separating DNA fragments by size, making it essential for PCR product analysis, sequencing, and genotyping. The rising prevalence of genetic disorders, along with advancements in gene editing and gene therapy, is likely to drive demand for electrophoresis in DNA analysis.

Additionally, the global expansion of genomic research initiatives, such as those aimed at understanding cancer genetics or rare genetic diseases, will likely accelerate the adoption of electrophoresis techniques for DNA analysis. As the need for more detailed and accurate DNA diagnostics grows, so will the market for reagents and technologies that enable high-quality DNA analysis.

End-User Analysis

Academic research is the largest end-user segment, holding 43.5% of the market share. This growth is expected to continue as electrophoresis reagents remain a cornerstone in molecular biology, genetics, and biochemistry research. Academic research institutions and universities are key drivers of innovation and development in the field of molecular diagnostics and biotechnology, and their demand for electrophoresis reagents is projected to increase as new areas of study, such as CRISPR gene editing and personalized medicine, gain prominence.

The expanding number of research studies in genomics, proteomics, and cell biology is likely to result in higher demand for electrophoresis systems and reagents. Moreover, the increasing funding for scientific research, especially in molecular biology and biotechnology, will contribute to the continued growth of this segment. As academic institutions push the boundaries of scientific knowledge, they will continue to be a major consumer of electrophoresis reagents, ensuring the sustained growth of this segment.

Key Market Segments

By Product Type

- Agarose Gel Electrophoresis

- Capillary Electrophoresis

- Cellulose Acetate Electrophoresis

- Polyacrylamide Gel Electrophoresis

By Technology

- Buffers

- Chemicals

- Dyes

- Precast Gels

By Application

- DNA Analysis

- RNA Analysis

- Quality Control

- Protein Analysis

By End-user

- Academic Research

- Pharmaceuticals

- Clinical Diagnostics

- Biotechnology

Drivers

The rising prevalence of chronic diseases is driving the market.

The electrophoresis reagents market is expanding due to the global increase in chronic diseases, which is creating a persistent need for high-resolution diagnostic and research tools. The global shift toward aging populations elevates diagnostic complexity, favoring high-resolution separation techniques that can detect subtle proteomic and genomic variations in early disease states. This is especially relevant in fields like oncology, where electrophoretic separation of circulating tumor DNA enables minimally invasive liquid-biopsy assays.

According to the Centers for Disease Control and Prevention (CDC), approximately 194 million American adults, or 76.4% of the adult population, reported having one or more chronic conditions in 2023. These conditions necessitate a continuous and reliable supply of reagents for monitoring disease progression and treatment efficacy. Additionally, the increasing focus on personalized medicine requires highly specific and reproducible diagnostic methods.

For instance, the use of liquid biopsies for cancer detection, which rely on electrophoresis for analysis, is becoming more widespread, with an estimated 2,001,140 new cancer cases expected in the United States in 2024. This trend toward recurring diagnostic events and the need for precision medicine directly translates epidemiological trends into a sustained demand for electrophoresis reagents.

Restraints

The high cost of reagents and the need for technical expertise are restraining the market.

A significant restraint on the electrophoresis reagents market is the high cost of specialized reagents and the need for a skilled workforce to perform and interpret the complex procedures. High-purity reagents, such as those used for capillary electrophoresis or isoelectric focusing, are expensive to produce and can be a substantial portion of a laboratory’s consumables budget. This financial barrier can limit the adoption of advanced electrophoretic techniques, especially in smaller research institutions or clinical laboratories with constrained funding.

Additionally, the technical complexity of setting up and running these assays requires highly trained personnel. Troubleshooting a faulty gel or an inconsistent capillary run demands specific expertise that is not always readily available. A 2024 survey of biotechnology and pharmaceutical manufacturing organizations highlighted that 76% of companies had their profitability impacted by a shortage of skilled labor, with 35% categorizing the impact as “severe.” This scarcity of qualified professionals poses a significant operational challenge. The combination of high material costs and the necessity for specialized expertise creates a formidable barrier to entry and a persistent challenge for market expansion.

Opportunities

Increasing funding for genomic and proteomic research is creating growth opportunities.

The market is being propelled forward by a sustained increase in public and private funding for genomic and proteomic research, which are heavily reliant on electrophoresis. The National Institutes of Health (NIH) allocated US$660.5 million to the National Human Genome Research Institute (NHGRI) in its fiscal year 2023 enacted budget, with a significant portion of this funding supporting projects that require advanced analytical techniques like electrophoresis. This substantial investment signals a sustained preference for integrated analytical platforms that require electrophoresis reagents for reliable biomarker validation.

Expanded public funding compels suppliers to offer comprehensive, workflow-compatible product suites instead of stand-alone consumables. Private-sector co-investment magnifies these tailwinds, as pharmaceutical sponsors leverage public infrastructure for drug-discovery programs. The increasing focus on data-intensive research further benefits the market, as high-throughput electrophoresis systems are essential for generating the reproducible quantitative outputs needed for algorithmic pipelines. These funding models lengthen demand visibility across the market by anchoring reagent purchases to multiyear research grants.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the operational landscape for manufacturers and suppliers in the electrophoresis reagents market. Global inflationary pressures have increased the cost of essential raw materials, specialized chemicals, and electronic components, which are the building blocks of both the reagents and the instruments used to run them. The US Bureau of Labor Statistics (BLS) reported that the Producer Price Index for “Chemicals and Allied Products Wholesaling” increased by 0.9% in February 2024, reflecting the rising costs faced by distributors and manufacturers.

Concurrently, geopolitical tensions can disrupt intricate global supply chains for these specialized chemicals. A 2024 report on the bio-pharma supply chain highlighted that ongoing conflicts and trade disputes have led to a 2.9% estimated supply chain rate increase for the year, primarily due to rising costs in raw materials and freight. The industry successfully navigates this complex environment by prioritizing operational efficiency and strategic procurement. Companies with resilient supply chains and the ability to absorb or mitigate these cost pressures are better positioned to maintain stability and profitability, demonstrating that an agile and proactive approach can ensure a positive trajectory.

The current United States tariffs are creating a challenging dynamic for the supply chain. The imposition of new duties on various imported diagnostic equipment and reagents from key trading partners has increased the landed cost of these products. A 2025 analysis of US tariffs showed that certain imported diagnostic reagents and lab supplies can face duties as high as 25% or more, depending on their classification and country of origin.

These tariffs are passed down the supply chain, affecting distributors’ margins and ultimately leading to higher prices for laboratories and healthcare providers. This can reduce the profitability of implementing new diagnostic tools and increase the cost to the end consumer, negatively impacting access to care. However, these tariffs are also providing a competitive advantage to US-based manufacturers who are not subject to these import duties.

As a result, some healthcare providers are beginning to shift their purchasing toward domestically produced goods to ensure a more stable supply and predictable pricing. This dynamic is fostering domestic manufacturing and encouraging companies to invest in local production capabilities to bypass the tariff burden and strengthen their market position. The industry is responding with adaptive measures, seeking out new suppliers and optimizing logistics, which demonstrates a resilient path forward.

Latest Trends

Technological advances in high-throughput electrophoresis are creating growth opportunities.

A significant and transformative trend in 2024 and 2025 is the rapid advancement of high-throughput electrophoresis technologies, which are fundamentally changing lab workflows and driving market demand for compatible reagents. These technological innovations focus on increasing the speed and reproducibility of assays while reducing the manual labor required.

For instance, the SCIEX BioPhase 8800 multi-capillary platform, a prominent example of this trend, processes up to eight samples in parallel, significantly cutting analysis times. This high-throughput capability, which is designed to minimize bottlenecks in drug development pipelines, is directly supported by its validated assay kits and pre-packaged reagents, ensuring a steady demand for consumables. Beyond hardware, AI-driven software tools are becoming more common.

For example, a 2025 review of AI in lab automation highlighted a surge in AI-driven tools that can automatically interpret gel images and other electrophoretic data. These advances raise switching costs, as laboratories adopt integrated instrument-consumable ecosystems that effectively lock in reagent purchases for the long term. This push towards automation and efficiency is making advanced electrophoretic techniques more accessible while securing a consistent revenue stream for reagent suppliers.

Factor Impact on Market Growth Key Regions Affected Relevant Market Segment(s) Increasing Funding for Genomic & Proteomic Research Enhanced research capabilities and demand for electrophoresis reagents in genomics and proteomics studies. This funding supports advancements in molecular diagnostics and personalized medicine. North America, Europe, Asia-Pacific Academic & Research Institutions, Pharmaceutical & Biotechnology Companies Rising Prevalence of Chronic Diseases Higher incidence of diseases such as cancer, diabetes, and cardiovascular disorders increases the need for diagnostic tools, boosting the demand for electrophoresis reagents. North America, Europe, Asia-Pacific Clinical Diagnostics, Hospitals & Diagnostic Laboratories Technological Advances in High-Throughput Electrophoresis Development of automated and high-throughput systems enhances efficiency and throughput, making electrophoresis more accessible and cost-effective. North America, Europe, Asia-Pacific Pharmaceutical & Biotechnology Companies, Academic & Research Institutions Shift Toward Greener, Non-Toxic Dyes & Buffers Adoption of environmentally friendly and safer reagents reduces health risks and disposal costs, aligning with regulatory standards and sustainability goals. North America, Europe Academic & Research Institutions, Pharmaceutical & Biotechnology Companies Growing Adoption of Personalized Medicine Increased focus on individualized treatment plans drives demand for precise diagnostic tools, including electrophoresis, to tailor therapies. North America, Europe, Asia-Pacific Pharmaceutical & Biotechnology Companies, Hospitals & Diagnostic Laboratories Regional Analysis

North America is leading the Electrophoresis Reagents Market

In 2024, the North American electrophoresis reagents market accounted for 39.7% of the total revenue, driven by strong public research funding and a well-established pharmaceutical and biotechnology sector. The National Institutes of Health (NIH) plays a pivotal role in this, allocating billions of dollars annually to biomedical research, directly fueling the demand for electrophoresis reagents in genomics, proteomics, and drug discovery. According to the Endocrine Society, every $1 invested in NIH research generates a $2.46 return, highlighting the economic impact of this research. This steady flow of funding ensures a continuous demand for reagents, insulating the market from broader economic fluctuations.

The region’s growth is further supported by the high burden of diseases requiring advanced diagnostic and research solutions. For example, the CDC’s 2022 report on antimicrobial resistance emphasized the escalating threat of resistant infections, such as a 60% rise in Candida auris cases, reinforcing the need for molecular diagnostics that rely heavily on these reagents. Additionally, the FDA plays a crucial role in advancing diagnostics by approving new lab tests like the Agilent Resolution ctDx FIRST and VENTANA FOLR1 RxDx Assay in 2022. Such regulatory approvals stimulate innovation, further propelling the demand for electrophoresis reagents.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific region is projected to experience the fastest growth in the electrophoresis reagents market, with an estimated compound annual growth rate (CAGR) of 6.45% through 2030. This growth is fueled by increasing government investment in life sciences, expansion of biopharmaceutical manufacturing, and the rising prevalence of infectious and genetic diseases. The region’s large population and increasing healthcare spending are creating substantial demand for diagnostic and research tools. For instance, the World Health Organization’s 2024 Global Report on Neglected Tropical Diseases noted that 1.62 billion people required interventions in 2022, many of them in Asia, underscoring the ongoing need for diagnostic solutions.

Governments in the region are actively fostering the growth of the life sciences sector. China, for example, is providing domestic-equipment subsidies to strengthen local production capabilities, while India’s production-linked incentives are encouraging regional manufacturing. South Korea is leading the way in genetic research with initiatives like Korea1K, which has sequenced over 10,000 human genomes, providing valuable data for genetic analysis and personalized medicine. These large-scale genomic projects require a steady supply of high-quality electrophoresis reagents, further driving market expansion. These factors together indicate that Asia Pacific is poised to become a key player in the global electrophoresis reagents market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading players in the market for electrophoresis reagents drive growth by prioritizing technological innovation, strategic alliances, and global market expansion. They invest heavily in developing sophisticated formulations that improve the speed and resolution of molecular separation, catering to the growing demands of proteomics and genomics research. These companies forge collaborations with academic institutions, biotechnology firms, and healthcare providers to accelerate product development and broaden their commercial footprint.

They also actively pursue mergers and acquisitions to diversify their portfolios and access new customer bases. Additionally, key players navigate regulatory complexities to ensure their advanced solutions meet evolving global standards, which, combined with offering tailored and user-friendly products, fosters strong customer relationships and long-term growth.

Thermo Fisher Scientific stands as a preeminent global leader in the life sciences and diagnostics sectors. The company’s strategy is built on a comprehensive portfolio that includes instruments, equipment, and consumables for research, analysis, and clinical diagnostics. Through continuous innovation and strategic acquisitions, Thermo Fisher has integrated a wide array of specialized technologies, allowing it to provide end-to-end solutions for researchers and clinicians. This robust approach ensures its position at the forefront of the industry by delivering reliable, high-quality products and services that meet the evolving needs of the global scientific community.

Top Key Players

- Thermo Fisher Scientific

- Takara Bio

- SigmaAldrich

- Sartorius AG

- Qiagen

- Promega Corporation

- PerkinElmer

- Merck KGaA

- Lonza Group

- GE Healthcare

- HoffmannLa Roche

- Cortex Biochem

- Biosciences Corporation

- BioRad Laboratories

- Agilent Technologies

Recent Developments

- In April 2025, Thermo Fisher Scientific announced a significant investment of US$ 2 billion aimed at expanding its life-science manufacturing and research and development capabilities in the US over the next four years.

- In April 2025, QIAGEN revealed plans to launch three new sample-prep instruments, including the QIAsymphony Connect and QIAsprint Connect, which will enable processing of up to 192 samples per run, enhancing laboratory efficiency.

Report Scope

Report Features Description Market Value (2024) US$ 4.2 Billion Forecast Revenue (2034) US$ 5.8 Billion CAGR (2025-2034) Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Agarose Gel Electrophoresis, Capillary Electrophoresis, Cellulose Acetate Electrophoresis, Polyacrylamide Gel Electrophoresis) By Technology (Buffers, Chemicals, Dyes, Precast Gels) By Application (DNA Analysis, RNA Analysis, Quality Control, Protein Analysis) By End-User (Academic Research, Pharmaceuticals, Clinical Diagnostics, Biotechnology) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Takara Bio, SigmaAldrich, Sartorius AG, Qiagen, Promega Corporation, PerkinElmer, Merck KGaA, Lonza Group, GE Healthcare, F. HoffmannLa Roche, Cortex Biochem, Biosciences Corporation, BioRad Laboratories, Agilent Technologies. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electrophoresis Reagents MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Electrophoresis Reagents MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific

- Takara Bio

- SigmaAldrich

- Sartorius AG

- Qiagen

- Promega Corporation

- PerkinElmer

- Merck KGaA

- Lonza Group

- GE Healthcare

- HoffmannLa Roche

- Cortex Biochem

- Biosciences Corporation

- BioRad Laboratories

- Agilent Technologies