Global Electronic Health Records Market By Product (Cloud-based EHR Software, On-premise EHR Software) By Type (Inpatient EHR, Outpatient EHR) By Application (Patient Management, Practice Management, Referral Management, Population Health Management, Other Applications) By End-User (Hospitals, Clinics, Speciality Centers, Other End-Users) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 110470

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

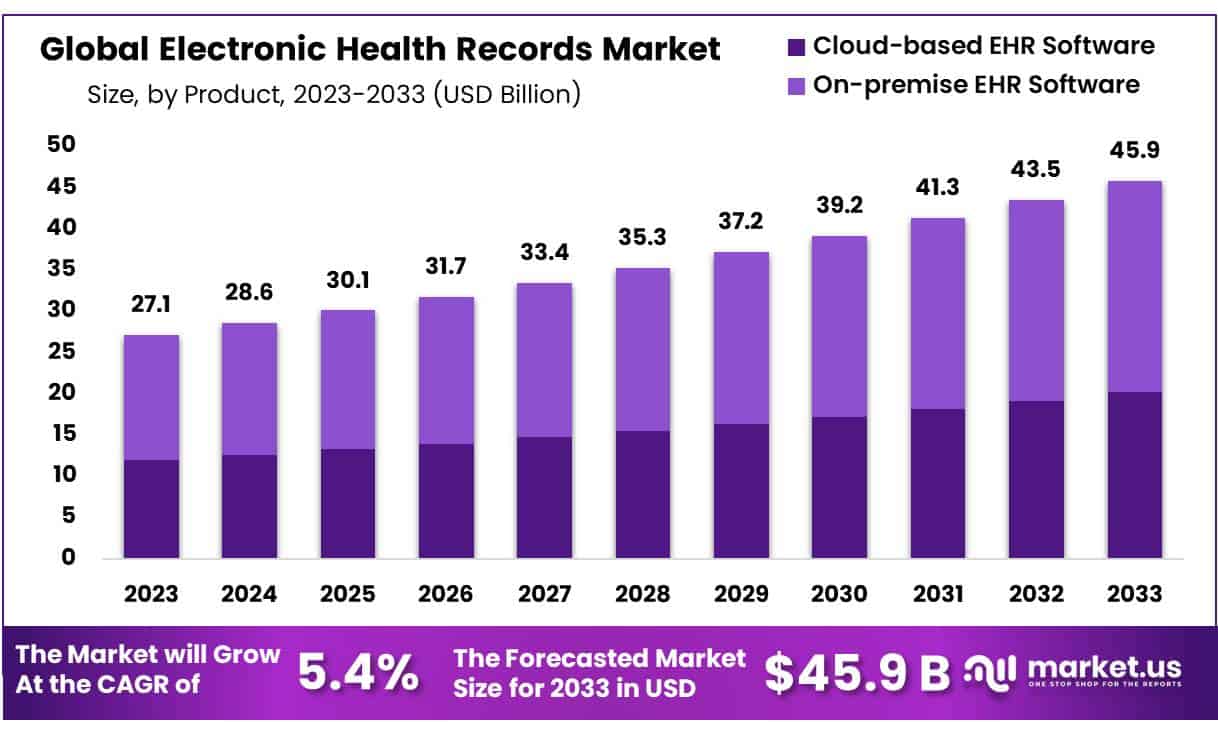

The Global Electronic Health Records Market size is expected to be worth around USD 45.9 Billion by 2033 from USD 27.1 Billion in 2023, growing at a CAGR of 5.4% during the forecast period from 2024 to 2033.

Electronic Health Records (EHRs) are digital versions of patients’ paper charts, facilitating real-time and secure information availability to authorized users. These records are a comprehensive repository of patient interactions, providing detailed documentation of their medical history, diagnoses, medications, treatment plans, immunization dates, allergies, radiology images, and laboratory test results. EHRs are designed to extend beyond standard clinical data collected in a provider’s office, offering a broader view of a patient’s care.

EHR systems improve patient care by enabling better coordination among healthcare providers. They support diagnostics and outcomes by aggregating patient data, thereby enhancing treatment precision. EHRs also streamline the caregiving process, reducing the likelihood of medical errors and ensuring clearer communication. Furthermore, they assist in administrative duties by automating provider workflows and can contribute significantly to practice efficiencies by lowering costs through decreased paperwork and improved safety, efficiency, and quality of patient care. The adoption of EHR systems is being encouraged globally by various healthcare policies promoting technological integration into healthcare management.

Key Takeaways

- Market Size: Electronic Health Records Market size is expected to be worth around USD 45.9 Billion by 2033 from USD 27.1 Billion in 2023

- Market Growth: The market growing at a CAGR of 5.4% during the forecast period from 2024 to 2033.

- Product Analysis: On-premise EHR Software that is projected to dominate the market share of approximately 54% in the year 2023.

- Type Analysis: Inpatient EHR systems command a substantial 55% market share in 2023.

- Application Analysis: Practice management emerges as the dominant segment, capturing 30% of the market share.

- End-Use Analysis: Hospitals segment holding the dominant share of 40% in 2023.

- Regional Analysis: North America was the dominant market for electronic medical records in 2023, accounting for 39% of the total revenue.

- Rising Adoption of Cloud-based EHRs: Cloud-based EHR solutions are rapidly growing in popularity due to their cost-effectiveness, scalability, and ease of access, making them particularly appealing to small and medium-sized healthcare providers.

- Expansion in Specialty Centers: EHR adoption in specialty centers is significant, driven by the need for systems tailored to specific medical fields, which aids in specialized patient care management and operational efficiency.

Product Analysis

The EHR market has been differently categorized depending on its deployment models, with the on-premise EHR Software that is projected to dominate the market share of approximately 54% in the year 2023. Healthcare providers have reported this prevalence because of formidable data control features, security improvements, and the flexibility of the system, which can be tailored to meet an organization’s individual requirements. On-premise solutions are especially crucial in cases where institutions wish to have strong control over the location of the data environment and do not wish to be tied down by subscription costs.

On the other hand, the segment that encompasses standalone or cloud based EHR software services is growing steadily. The general advancement of this concept is fueled by the growing need for dynamic solutions that grant users access to data through remote methods, at cheaper costs than traditional setup, and little demands for constant upkeep. This is because more and more healthcare entities though especially the small and medium ones are embracing cloud-based EHRs due to the benefits associated with the usage of these systems in that they consume less resources in terms of IT and also support collaboration. While presently EHRs may not be as fluid and user-friendly as desired by most healthcare practices, the continuous move towards more adaptable and easily accessible solutions suggests greater cloud solutions adoption trends in the future that will realign the EHR market in the next few years.

Type Analysis

The Electronic Health Records (EHR) market is characterized by a significant division between inpatient and outpatient solutions. Inpatient EHR systems command a substantial 55% market share, reflecting their critical role in managing the comprehensive needs of patients who require hospital stays. These systems are integral for coordinating complex workflows and continuous patient monitoring, ensuring that detailed patient information is readily available for multifaceted care requirements.

Outpatient EHR solutions, while currently holding a smaller segment of the market, are pivotal in supporting the day-to-day operations of clinics and physician offices. These systems cater to scheduling, billing, and routine patient care management, facilitating a smoother, more efficient patient flow. As healthcare delivery increasingly shifts towards outpatient services and telemedicine, the demand for these systems is expected to rise. This shift is driven by the need for streamlined healthcare processes that enhance patient engagement and improve the efficiency of healthcare delivery outside traditional hospital settings. The evolving landscape suggests a potential growth in market share for outpatient EHR systems as they adapt to changing healthcare practices.

Application Analysis

In 2023, the Electronic Health Records (EHR) market is segmented into various applications, among which practice management emerges as the dominant segment, capturing 30% of the market share. This segment leads due to its crucial role in enhancing the operational efficiency of healthcare facilities. Practice management systems integrated within EHRs streamline administrative and billing operations, schedule management, and improve overall financial performance of practices.

Other significant segments include patient management and population health management, which are essential for improving care delivery and patient outcomes. Patient management applications facilitate the comprehensive tracking of patient health records and scheduling, making up 25% of the market share. Meanwhile, population health management, which focuses on analyzing and managing patient data across multiple health information technology resources, accounts for 20% of the market. Referral management and other applications also play critical roles but with a slightly lesser focus, reflecting evolving priorities within the healthcare sector as it continues to leverage technology to meet diverse needs.

End-User Analysis

In 2023, the Electronic Health Records (EHR) market is significantly shaped by its diverse end-use sectors, with hospitals holding the dominant share of 40%. Hospitals are the primary users of EHR systems due to the complex nature of care they provide and the critical need for comprehensive, integrated patient information management systems. These systems enable hospitals to enhance patient care efficiency, reduce errors, and streamline operations across various departments.

Clinics follow closely, making up 30% of the market share. EHR systems in clinics support streamlined patient processing, appointment scheduling, and enhance the quality of care through better health record management. Specialty centers, which require targeted functionalities to cater to specific types of medical care, such as oncology or cardiology, account for 20% of the market. These centers benefit from EHR systems that are customized to their unique needs, improving patient outcomes and operational efficiency. The remaining 10% of the market comprises other end-users like small medical practices and outpatient services, reflecting the broad applicability and essential role of EHR systems across various healthcare settings.

Key Market Segments

Product

- Cloud-based EHR Software

- On-premise EHR Software

Type

- Inpatient EHR

- Outpatient EHR

Application

- Patient Management

- Practice Management

- Referral Management

- Population Health Management

- Other Applications

End-User

- Hospitals

- Clinics

- Speciality Centers

- Other End-Users

Driver

Regulatory Compliance and Government Initiatives

A primary driver for the adoption of EHR systems is the regulatory requirement for standardized record keeping and government incentives. Initiatives like the Medicare and Medicaid EHR Incentive Programs in the United States encourage healthcare providers to adopt and meaningfully use EHR technology. These regulations aim to enhance care quality, safety, and efficiency through digital record-keeping.

Trend

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence (AI), machine learning, and big data analytics into EHR systems is a significant trend. These technologies enhance the functionality of EHRs by improving the accuracy of diagnostics, personalizing patient care plans, and predicting patient outcomes. Moreover, they facilitate better data management and analysis, leading to more informed decision-making in healthcare.

Restraint

High Costs and Complexity of Implementation

A major restraint in the EHR market is the high initial costs and complexity associated with deploying and maintaining these systems. Small to medium-sized healthcare providers, in particular, find it challenging to bear the financial burden and manage the technical aspects of implementation, which can hinder market growth.

Opportunity

Rising Demand for Telehealth and Remote Monitoring

The growing demand for telehealth services and remote patient monitoring presents a significant opportunity for the EHR market. With the ongoing global health challenges, healthcare providers are increasingly relying on telehealth solutions integrated with EHR systems to offer continued care. This adaptation not only extends the reach of healthcare services but also opens new avenues for market expansion by meeting the evolving needs of the healthcare sector.

Regional Analysis

In 2023, North America leads the global Electronic Health Records (EHR) market with a 39% share, underscoring the region’s advanced healthcare infrastructure and strong emphasis on healthcare IT innovations. This dominance is propelled by widespread adoption of EHR systems across hospitals, clinics, and specialty centers, driven by regulatory mandates like the Health Information Technology for Economic and Clinical Health (HITECH) Act which encourages the use of EHRs.

Additionally, the presence of major EHR vendors and ongoing investments in healthcare technology further strengthen North America’s position as a key player in the EHR market, promoting higher standards of patient care and operational efficiencies.

The European Commission’s Digital Single Market Strategy provides consumers and businesses access to goods and services online across Europe. This creates the conditions necessary for the development of the digital network. It is expected that this will maximize the potential growth of the European economy.

The Electronic Health Records market for electronic medical records in the Asia Pacific is expected to experience lucrative growth over the forecast period. This is due to the increasing demand for high-quality services and standards that are driving the digitalization in healthcare.

China’s Ministry of Health has created an action plan to encourage the use of e-health services across China. It covers a wide range of healthcare services and insurance plans. There is a strong focus on electronic records, which will allow data sharing within the national healthcare system.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

In the Electronic Health Records (EHR) market, several prominent players are pivotal in shaping industry trends through innovative and comprehensive solutions tailored for various healthcare settings. These key entities lead with cutting-edge, customizable systems that cater to the intricate needs of large healthcare institutions while also offering scalable options ideal for smaller practices.

Their market dominance is supported by ongoing investments in research and development, which facilitate enhancements in system functionality and integration capabilities. Strategic alliances and a focus on emerging healthcare demands, like telehealth and precision medicine, further solidify their positions, ensuring continued growth and adaptation in a dynamic industry landscape.

Key Market Players

- Cerner Corporation

- Allscripts Healthcare LLC

- GE Healthcare

- Epic Systems Corporation

- NextGen Healthcare Inc.

- eClinicalWorks

- Medical Information Technology, Inc.

- McKesson Corporation

- AdvancedMD, Inc.

- CureMD Healthcare

- CPSI

- Greenway Health, LLC

- Other Key Players

Recent Developments

- Cerner Corporation (April 2024): Cerner Corporation expanded its global reach by acquiring HealthTech Solutions, a European EHR provider, aiming to enhance its integrated healthcare solutions.

- Allscripts Healthcare, LLC (March 2024): Allscripts launched a new AI-enhanced EHR platform in March 2024, designed to optimize clinical workflows and enhance patient outcome predictions.

- GE Healthcare (February 2024): GE Healthcare merged with Quantum Informatics in February 2024, integrating advanced data analytics into its EHR systems to improve patient care efficiency.

- Epic Systems Corporation (January 2024): Epic Systems Corporation introduced a groundbreaking mobile EHR application in January 2024, facilitating better access to patient data for healthcare professionals on the go.

- NextGen Healthcare, Inc. (December 2023): In December 2023, NextGen Healthcare, Inc. launched a cloud-based EHR solution tailored for small to mid-sized practices, emphasizing affordability and ease of use.

- eClinicalWorks (November 2023): eClinicalWorks expanded its product line in November 2023 with the release of an EHR system designed specifically for telehealth services, reflecting the growing demand for virtual care options.

Report Scope

Report Features Description Market Value (2023) USD 27.1 Billion Forecast Revenue (2033) USD 45.9 Billion CAGR (2024-2033) 5.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Cloud-based EHR Software, On-premise EHR Software) By Type (Inpatient EHR, Outpatient EHR) By Application (Patient Management, Practice Management, Referral Management, Population Health Management, Other Applications) By End-User (Hospitals, Clinics, Speciality Centers, Other End-Users) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Cerner Corporation, Allscripts Healthcare, LLC, GE Healthcare, Epic Systems Corporation, NextGen Healthcare, Inc., eClinicalWorks, Medical Information Technology, Inc., McKesson Corporation, AdvancedMD, Inc., CureMD Healthcare, CPSI, Greenway Health, LLC, Other Key Players, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electronic Health Records MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Electronic Health Records MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Cerner Corporation

- Allscripts Healthcare LLC

- GE Healthcare

- Epic Systems Corporation

- NextGen Healthcare Inc.

- eClinicalWorks

- Medical Information Technology, Inc.

- McKesson Corporation

- AdvancedMD, Inc.

- CureMD Healthcare

- CPSI

- Greenway Health, LLC

- Other Key Players