Global Efficacy Testing Market By Service Type (Disinfectant Efficacy Testing and Antimicrobial Efficacy Testing), By Application (Pharmaceutical Products, Personal Care Products & Cosmetics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144726

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

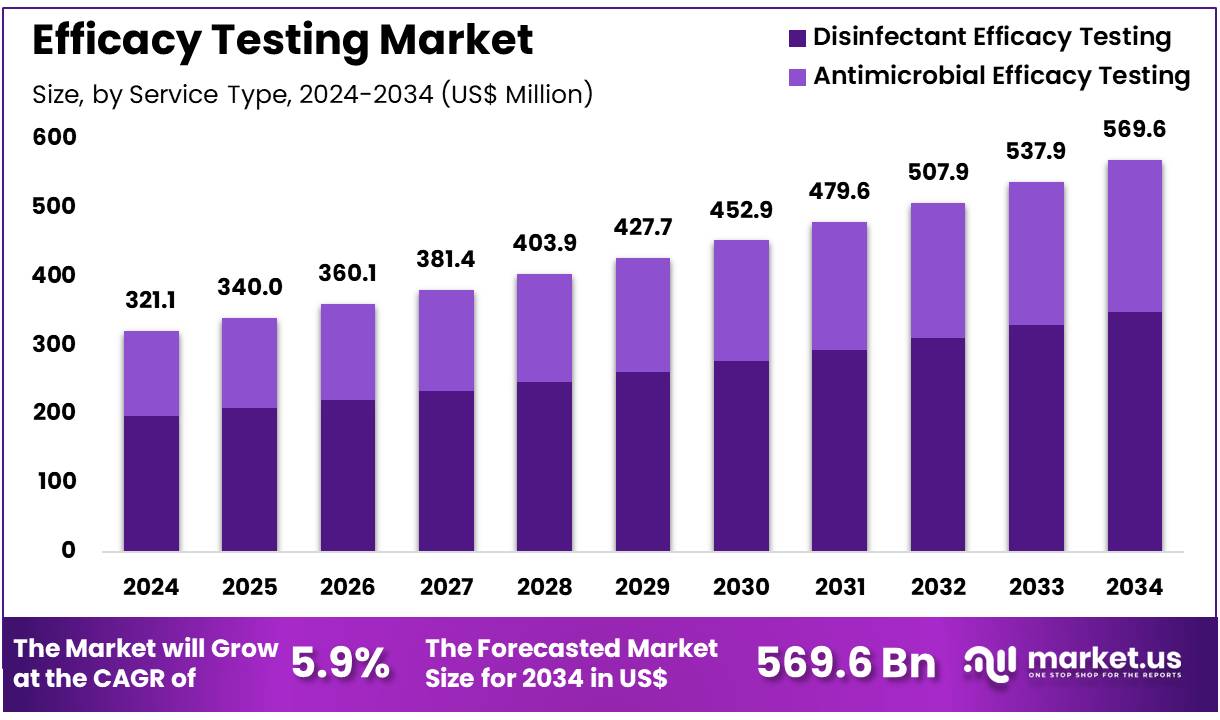

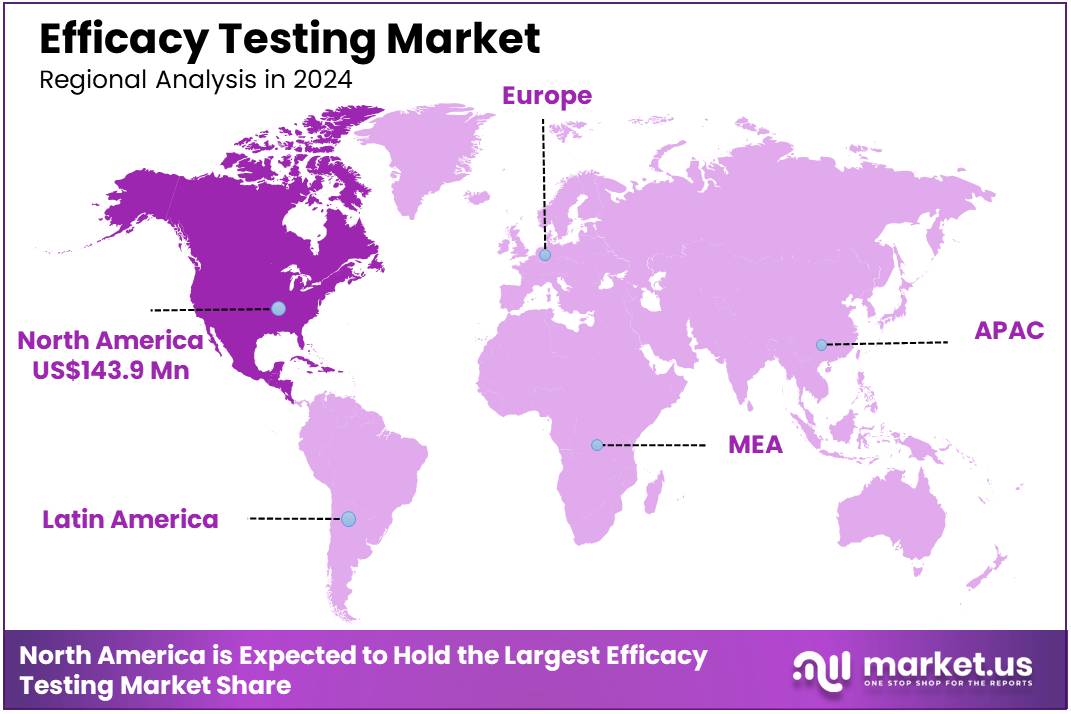

Global Efficacy Testing Market size is expected to be worth around US$ 569.6 million by 2034 from US$ 321.1 million in 2024, growing at a CAGR of 5.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 44.8% share with a revenue of US$ 143.9 Million.

Increasing demand for reliable and transparent product claims is driving the growth of the efficacy testing market. Companies across various industries, including cosmetics, pharmaceuticals, and healthcare, are placing a greater emphasis on providing scientifically validated evidence to support their product claims. This trend arises from consumers’ growing desire for proof of product performance, which influences purchasing decisions.

As a result, efficacy testing has become a critical component of product development, enabling companies to differentiate themselves in competitive markets. Innovations in testing methods and technologies, such as in vitro testing, clinical trials, and randomized controlled studies, have further enhanced the accuracy and reliability of efficacy data. In February 2021, Codex Beauty introduced an efficacy testing label on its products, allowing consumers to better understand the testing process and claims.

This new feature aims to make testing data more transparent, showing quantitative results of product performance directly on product labels. As companies strive for higher transparency, the demand for efficacy testing solutions is expected to continue rising, presenting opportunities for growth in various industries that rely on proving the effectiveness of their products.

Key Takeaways

- In 2024, the market for Efficacy Testing generated a revenue of US$ 321.1 million, with a CAGR of 5.9%, and is expected to reach US$ 569.6 million by the year 2033.

- The service type segment is divided into disinfectant efficacy testing and antimicrobial efficacy testing, with disinfectant efficacy testing taking the lead in 2024 with a market share of 61.3%.

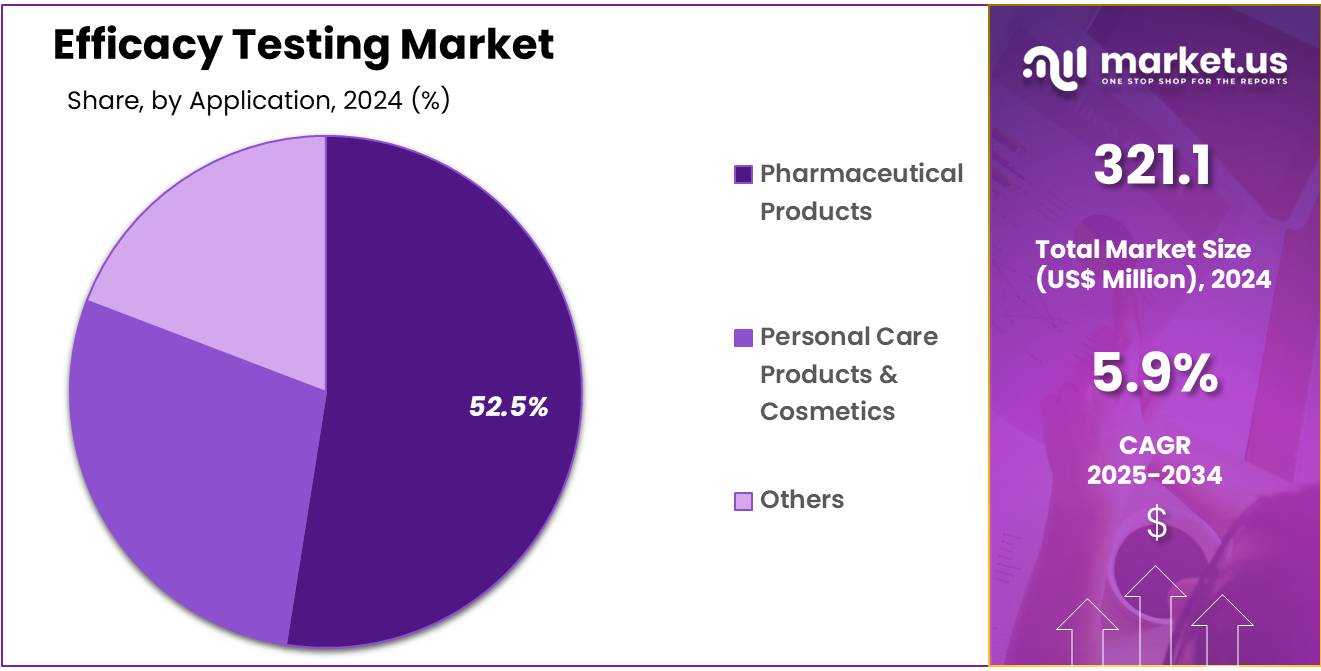

- Considering application, the market is divided into pharmaceutical products, personal care products & cosmetics, and others. Among these, pharmaceutical products held a significant share of 52.5%.

- North America led the market by securing a market share of 44.8% in 2024.

Service Type Analysis

The disinfectant efficacy testing segment led in 2024, claiming a market share of 61.3% owing to the increasing global emphasis on hygiene and sanitation, particularly in healthcare and industrial settings. The rising awareness of infection control, coupled with the growing number of infectious diseases, is likely to drive demand for testing the effectiveness of disinfectants.

Regulatory requirements for disinfection standards in healthcare facilities, food processing, and public spaces are anticipated to further boost this segment. As companies seek to ensure that their disinfectants meet established efficacy standards, the need for reliable and accurate disinfectant efficacy testing is projected to grow, contributing to the expansion of this segment.

Application Analysis

The pharmaceutical products held a significant share of 52.5% as the pharmaceutical industry continues to develop new drugs and treatments. The increasing demand for effective medications, especially with the rise of chronic diseases, cancer, and infectious diseases, is likely to drive the need for rigorous efficacy testing to ensure product safety and effectiveness.

As regulatory agencies worldwide enforce stricter guidelines for pharmaceutical product testing, the importance of efficacy testing is anticipated to grow. Furthermore, the growing focus on personalized medicine and biologics is expected to require more specialized efficacy testing, which could further fuel the growth of the pharmaceutical products segment within the efficacy testing market.

Key Market Segments

Service Type

- Disinfectant Efficacy Testing

- Antimicrobial Efficacy Testing

Application

- Pharmaceutical Products

- Personal Care Products & Cosmetics

- Others

Drivers

Technological Advancements are Driving the Market

Technological advancements in analytical instruments and methodologies are significantly driving the efficacy testing market. Innovations such as high-throughput screening, advanced chromatography, and mass spectrometry have enhanced the accuracy and efficiency of testing processes. These technologies enable faster and more reliable results, which are critical for industries like pharmaceuticals, cosmetics, and food safety.

For instance, in 2022, the FDA reported a 15% increase in the adoption of advanced testing technologies by pharmaceutical companies to meet regulatory standards. Additionally, key players like Thermo Fisher Scientific and Agilent Technologies have invested heavily in R&D, with Thermo Fisher allocating over US$1.5 billion in 2023 to develop next-generation testing solutions. This trend is expected to continue, as the demand for precise and efficient testing methods grows across industries.

Restraints

Stringent Regulatory Requirements are Restraining the Market

Stringent regulatory requirements are a major restraint in the efficacy testing market. Regulatory bodies like the FDA and EMA have implemented rigorous standards to ensure the safety and effectiveness of products, particularly in the pharmaceutical and cosmetics sectors. Compliance with these regulations often requires extensive testing, which can be time-consuming and costly.

In 2023, the FDA issued over 200 warning letters to companies failing to meet efficacy testing standards, highlighting the challenges businesses face. Small and medium-sized enterprises (SMEs) are particularly affected, as they often lack the resources to comply with these stringent requirements. This has led to slower market growth in certain segments, as companies struggle to balance regulatory compliance with operational efficiency.

Opportunities

Increasing Demand for Personalized Medicine is Creating Growth Opportunities

The growing demand for personalized medicine is creating significant growth opportunities in the efficacy testing market. Personalized medicine relies on tailored treatments based on individual genetic profiles, which require highly accurate and specific testing methods. In 2022, the global personalized medicine market was valued at approximately US$500 billion, with a projected annual growth rate of 8–10% through 2023 and beyond.

This growth is driven by the increasing adoption of personalized healthcare solutions that prioritize individualized treatment plans for patients. Companies in the efficacy testing market are expanding their diagnostic and testing capabilities to meet this demand, particularly in genomics, molecular diagnostics, and pharmacogenomics.

The shift towards more personalized treatments is expected to accelerate the growth of the efficacy testing market, as these advanced testing methods are essential for the success of personalized medicine. This trend of individualized care is expected to continue fueling market expansion in the coming years.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors are significantly influencing the efficacy testing market, creating both challenges and opportunities. Rising inflation and supply chain disruptions have increased operational costs, forcing companies to optimize their testing processes. For instance, the US-China trade tensions have impacted the availability of critical testing equipment, leading to delays in product launches.

However, increased government funding for healthcare and life sciences, particularly in the US and Europe, has provided a counterbalance. In 2023, the US government allocated US$10 billion to support advancements in medical testing and diagnostics. Geopolitical instability in regions like Eastern Europe has also driven demand for localized testing facilities, reducing reliance on global supply chains.

Despite these challenges, the market remains resilient, with innovation and strategic investments driving growth. The focus on sustainability and digital transformation is further enhancing market prospects, ensuring long-term stability and expansion.

Latest Trends

Adoption of AI and Machine Learning is a Recent Trend

The adoption of artificial intelligence (AI) and machine learning (ML) in efficacy testing is a prominent recent trend. These technologies are revolutionizing the market by enabling predictive analytics, automating data analysis, and improving the accuracy of test results. In 2023, the FDA approved over 50 AI-driven testing tools, marking a 20% increase from the previous year. Companies like Siemens Healthineers and PerkinElmer are at the forefront of this trend, integrating AI into their testing platforms to enhance efficiency.

For instance, Siemens Healthineers launched an AI-powered diagnostic tool in 2023, which reduced testing time by 30%. This trend is expected to accelerate as AI and ML technologies become more sophisticated, offering new possibilities for innovation in the market.

Regional Analysis

North America is leading the Efficacy Testing Market

North America dominated the market with the highest revenue share of 44.8% owing to increased regulatory scrutiny, advancements in pharmaceutical and biotechnology sectors, and heightened demand for quality assurance in consumer products. According to the US Food and Drug Administration (FDA), the number of product recalls due to inefficacy or safety concerns rose by 15% between 2022 and 2023, prompting companies to invest more in rigorous testing protocols.

The National Institutes of Health (NIH) reported a 20% increase in funding for clinical trials and efficacy studies in 2023, reflecting the growing emphasis on evidence-based product validation. Additionally, the Environmental Protection Agency (EPA) highlighted a 12% surge in demand for environmental efficacy testing in 2024, driven by stricter regulations on disinfectants and pesticides.

The pharmaceutical industry, in particular, has seen a 25% rise in outsourcing efficacy testing to specialized labs, as reported by the Pharmaceutical Research and Manufacturers of America (PhRMA). This growth is further supported by the increasing adoption of advanced technologies such as AI and machine learning in testing processes, which have improved accuracy and efficiency. These factors collectively highlight the robust expansion of the efficacy testing market in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rapid industrialization, expanding pharmaceutical and cosmetic industries, and increasing regulatory harmonization. The World Health Organization (WHO) reported a 30% rise in clinical trial registrations in the region between 2022 and 2024, reflecting the growing focus on product validation and safety.

The Chinese National Medical Products Administration (NMPA) announced a 22% increase in approvals for new drugs and medical devices in 2023, necessitating extensive testing to meet regulatory standards. India’s Central Drugs Standard Control Organization (CDSCO) highlighted a 18% surge in demand for bioequivalence and efficacy studies in 2024, driven by the country’s booming generic drug industry.

The Japanese Ministry of Health, Labour, and Welfare (MHLW) noted a 15% increase in funding for quality control and testing infrastructure in 2023, aiming to enhance product reliability. These developments, coupled with increasing investments in research and development, are expected to propel the market’s growth in the Asia Pacific region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the efficacy testing market focus on advancing technology, broadening their service offerings, and forming strategic partnerships to drive growth. They invest in developing more accurate and faster testing solutions, incorporating automation and data analytics to enhance the reliability and efficiency of results.

Companies also expand their product portfolios to cater to various industries, including pharmaceuticals, biotechnology, and cosmetics. Strategic collaborations with research institutions and regulatory bodies help accelerate the adoption of their solutions. Additionally, expanding into emerging markets with growing pharmaceutical and healthcare sectors further supports market expansion.

Charles River Laboratories, headquartered in Wilmington, Massachusetts, is a leading provider of preclinical and clinical laboratory services. The company offers comprehensive efficacy testing solutions, including pharmacological, toxicological, and microbiological assessments, to support drug development.

Charles River focuses on innovation by integrating advanced technologies, such as automated testing systems and data analytics, to improve testing efficiency and accuracy. The company’s global presence and strong partnerships with pharmaceutical and biotechnology companies solidify its position as a key player in the efficacy testing market.

Top Key Players

- SGS

- Pfizer

- Merck KGaA

- Lucideon Limited

- Eurofins Scientific

- Charles River

- Biomérieux Sa

- Almac Group

Recent Developments

- In June 2022, Eurofins Cosmetics & Personal Care strengthened its position in the market by acquiring a majority stake in CRA Korea Inc., a leading South Korean clinical testing laboratory. This acquisition will enhance Eurofins’ capabilities in providing safety, efficacy, and sensory evaluations tailored for the cosmetics and personal care industries.

- In May 2022, the Pfizer-BioNTech COVID-19 vaccine exhibited impressive results in children aged 6 months to under 5 years, with a strong immune response and a vaccine efficacy rate of 80.3%. The data, gathered after the third dose, was particularly relevant as the Omicron variant remained the predominant strain during the trials.

Report Scope

Report Features Description Market Value (2024) US$ 321.1 million Forecast Revenue (2034) US$ 569.6 million CAGR (2025-2034) 2024 Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Type (Disinfectant Efficacy Testing and Antimicrobial Efficacy Testing), By Application (Pharmaceutical Products, Personal Care Products & Cosmetics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SGS, Pfizer, Merck KGaA, Lucideon Limited, Eurofins Scientific, Charles River, Biomérieux Sa, and Almac Group. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SGS

- Pfizer

- Merck KGaA

- Lucideon Limited

- Eurofins Scientific

- Charles River

- Biomérieux Sa

- Almac Group