Global Edge AI Chipsets Market Size, Share, Growth Analysis By Chipset (CPU, GPU, ASIC, Others), By Function (Training, Inference), By Device (Consumer Devices, Enterprise Devices), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165182

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

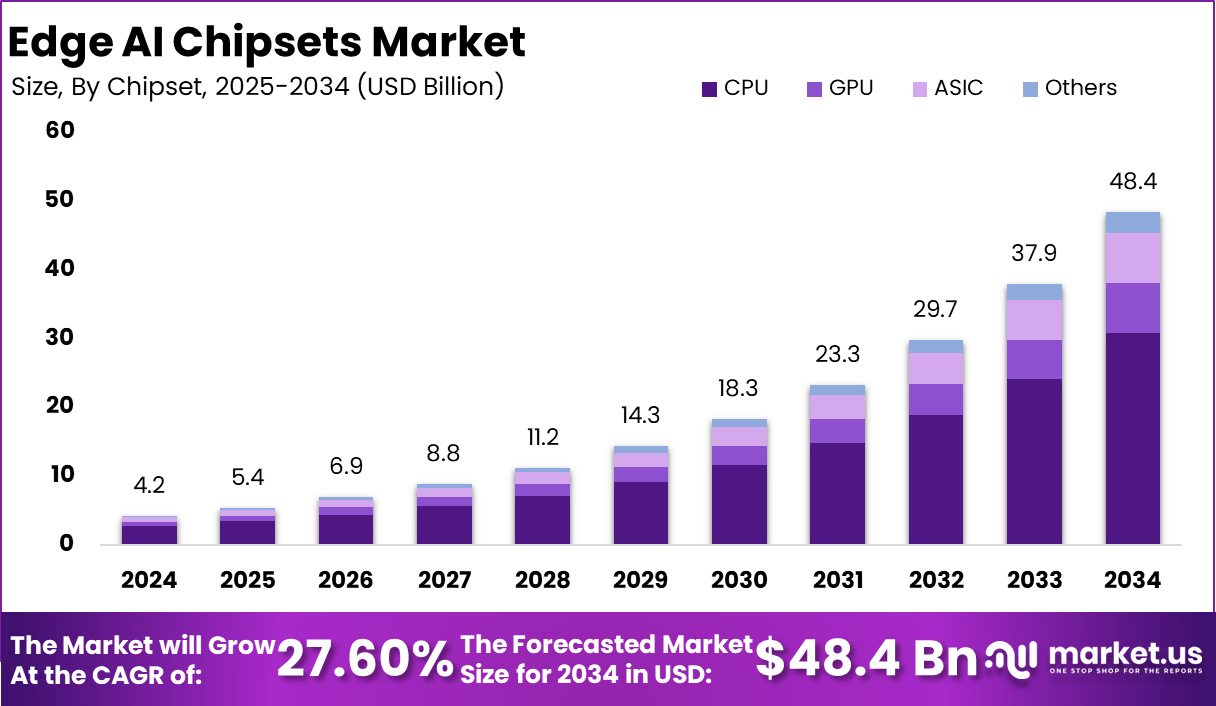

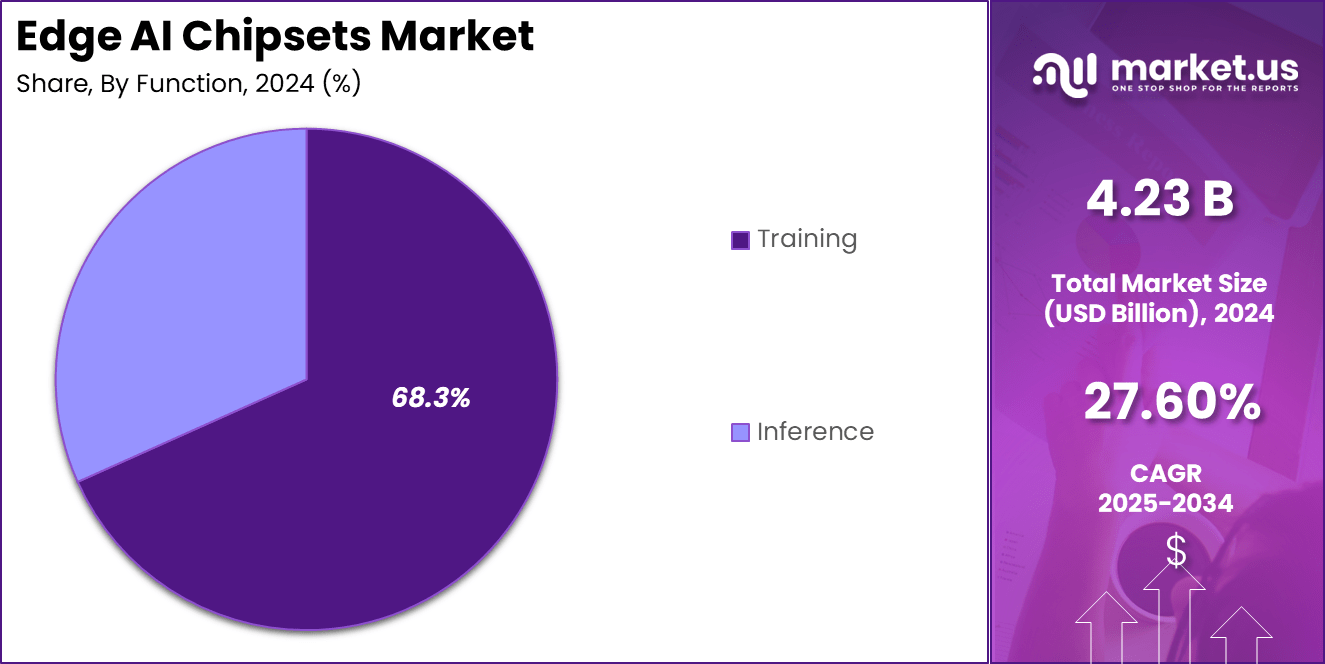

The global Edge AI Chipsets Market was valued at USD 4.23 billion in 2024 and is projected to reach USD 48.4 billion by 2034, growing at a strong CAGR of 27.6%. The expansion is driven by the rising integration of artificial intelligence into IoT devices, autonomous systems, and industrial automation.

Edge AI chipsets enable faster decision-making by processing data locally, minimizing latency, and reducing reliance on cloud computing. This capability is crucial in real-time applications such as autonomous driving, smart cities, and healthcare monitoring, where speed, reliability, and security of data are critical performance factors.

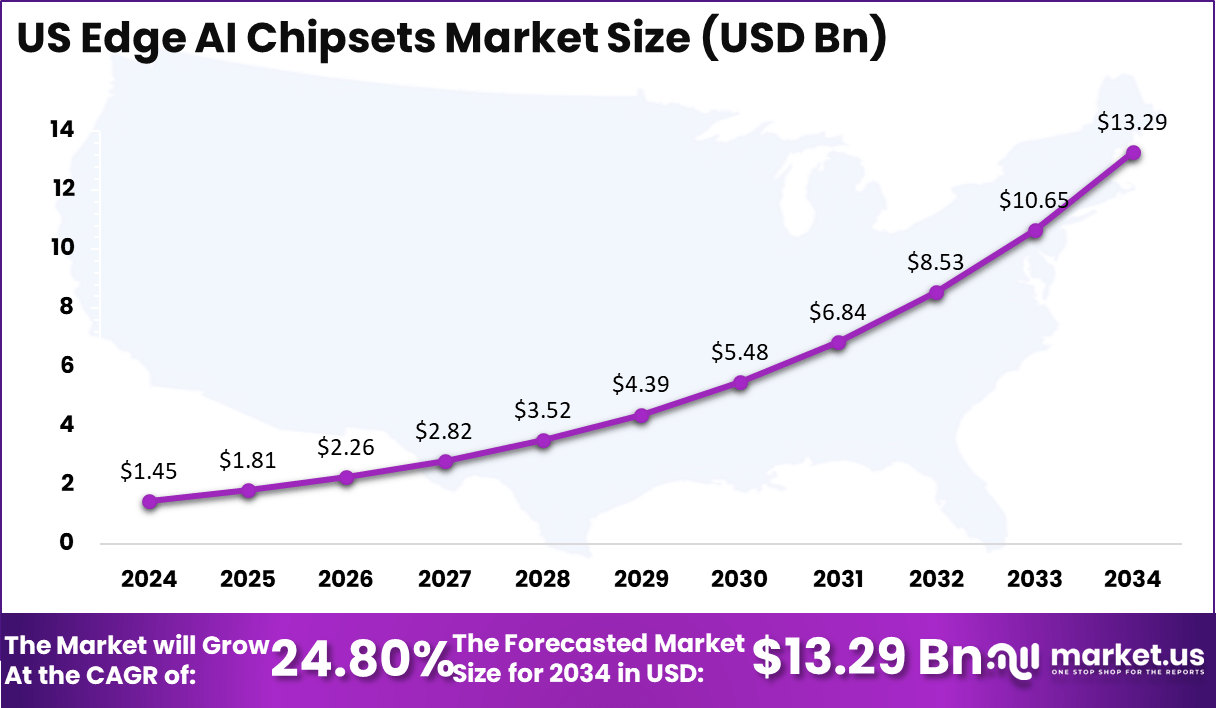

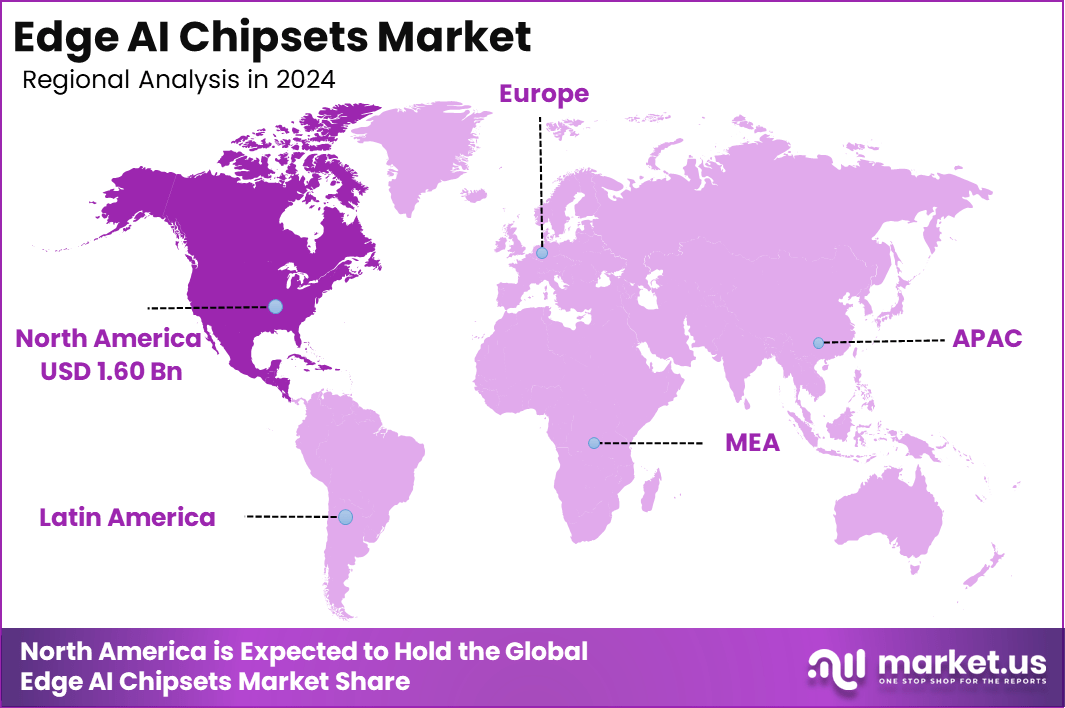

North America accounted for 38% of the market in 2024, valued at USD 1.60 billion, supported by rapid technological advancements and large-scale AI adoption. The US contributed USD 1.45 billion in 2024 and is expected to grow at a CAGR of 24.8% through 2034, which reflects growth to USD 13.29 billion.

Growth is driven by strong semiconductor R&D infrastructure, expanding edge data center networks, and partnerships among AI chipset developers and cloud providers. Increasing investments in 5G, edge computing, and autonomous systems are further anticipated to position the region as a global hub for next-generation AI processing innovation.

Edge AI chipsets are specialized processors designed to perform artificial intelligence computations directly on devices at the network’s edge, rather than relying on centralized cloud servers. These chipsets enable faster data processing, reduced latency, and improved privacy by analyzing information locally on devices such as smartphones, cameras, drones, and industrial sensors.

They combine advanced CPU, GPU, and neural processing unit (NPU) architectures to optimize performance for machine learning workloads like image recognition, speech processing, and predictive analytics. Their efficiency and low power consumption make them ideal for battery-operated and real-time systems requiring continuous intelligence.

The growing adoption of IoT, autonomous vehicles, and smart infrastructure is driving the global demand for edge AI chipsets. They play a critical role in enabling responsive, context-aware systems that can make instant decisions without needing cloud connectivity. The automotive, healthcare, manufacturing, and retail sectors are witnessing increasing use of these chipsets for applications such as real-time object detection, predictive maintenance, and patient monitoring.

Furthermore, the development of 5G networks and AI-optimized hardware architectures is expanding the deployment of edge intelligence. As industries prioritize data security, real-time analytics, and energy efficiency, edge AI chipsets are expected to become fundamental components in the next decade of digital transformation.

In 2025, the edge AI chipset market experienced robust expansion marked by significant acquisitions and product innovations. Notably, Qualcomm announced plans to acquire Arduino, a major platform with over 33 million developers, aiming to enhance its edge AI ecosystem with a combined hardware-software-cloud platform. This move follows Qualcomm’s earlier acquisition of EdgeImpulse, reinforcing its role as a full-stack edge AI provider.

AMD secured key expertise by acquiring Untether AI’s engineering team and also completed the purchase of MK1, which focuses on high-speed AI inference technology. These strategic acquisitions are valued in the hundreds of millions and position these companies to deliver more integrated and efficient edge AI solutions. NXP completed a $307 million acquisition of Kinara, a neural processing unit pioneer, solidifying its footprint in industrial and automotive AI inference

Funding activity was intense, with startups attracting multi-million-dollar rounds. For example, EdgeCortix closed an oversubscribed Series B round backed by a $20 million Japanese government project to develop sustainable AI inference chips. Other investment highlights include Esperanto Technologies raising $115 million to enhance its RISC-V AI chip portfolio and India’s AI chip ecosystem drawing $410 million in venture and strategic funding.

The overall funding landscape for edge AI startups reached over $4.5 billion through mid-2025, accelerating from previous years and fueling rapid innovation in low-power, high-performance chips. New chip launches such as Qualcomm’s Dragonwing QRB2210 and NVIDIA’s Jetson AGX Orin showcase advances with up to 275 TOPS of AI processing and improved power efficiency designed for diverse edge applications, including robotics, IoT, and industrial automation.

Key Takeaways

- The global Edge AI Chipsets Market was valued at USD 4.23 billion in 2024 and is projected to reach USD 48.4 billion by 2034, growing at a CAGR of 27.6%.

- North America accounted for 38% of the total market in 2024, valued at USD 1.60 billion, supported by the strong adoption of AI-enabled IoT and autonomous systems.

- The US market was valued at USD 1.45 billion in 2024 and is anticipated to reach USD 13.29 billion by 2034, registering a CAGR of 24.8%.

- By Chipset, CPU dominated the market with a 63.7% share, driven by its widespread use in AI model execution and data processing at the edge.

- By Function, Training accounted for 68.3% of the market, supported by the growing demand for on-device learning and adaptive AI models.

- By Device, Consumer Devices held the largest share of 84.2%, fueled by increasing integration of edge AI in smartphones, wearables, home automation, and personal assistants.

Role Of Technology

Technology plays a pivotal role in driving the growth and advancement of the Edge AI Chipsets Market by enabling faster, more efficient, and secure data processing at the device level. Innovations in semiconductor design, such as smaller nanometer fabrication processes and the integration of neural processing units (NPUs), have significantly enhanced computational power while reducing energy consumption.

These developments allow AI algorithms to operate directly on devices, eliminating dependency on cloud servers and minimizing latency in decision-making. The convergence of AI, IoT, and 5G technologies has further strengthened the ecosystem for real-time analytics and autonomous operations.

Edge AI technology is transforming various industries, from automotive and healthcare to manufacturing and consumer electronics. In autonomous vehicles, chipsets enable instant image recognition and sensor fusion for safer navigation. In healthcare, wearable devices equipped with edge AI process vital signs locally to provide continuous monitoring.

Smart factories utilize these chipsets for predictive maintenance and operational optimization. Additionally, advancements in AI frameworks, such as TensorFlow Lite and ONNX, are making model deployment on edge devices more seamless. As technology continues to evolve, Edge AI chipsets are expected to play a critical role in building intelligent, decentralized networks that balance speed, efficiency, and data privacy.

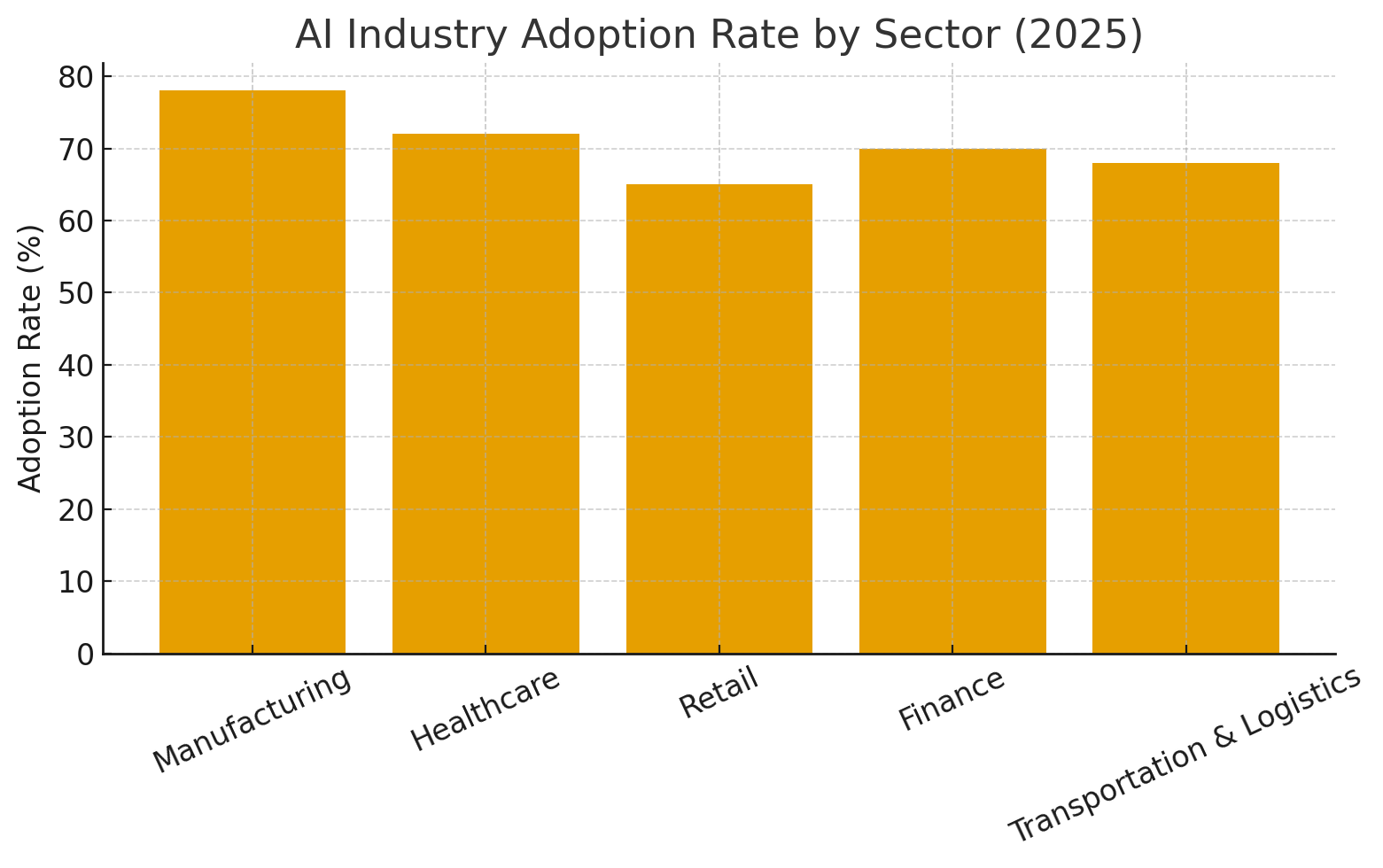

AI Industry Adoption

The adoption of AI across industries is accelerating as organizations recognize its potential to enhance efficiency, decision-making, and innovation. From manufacturing and healthcare to retail and finance, AI is transforming operational models through automation, predictive analytics, and intelligent data processing.

In manufacturing, AI-driven robotics and predictive maintenance systems are reducing downtime and improving production accuracy. In healthcare, AI assists in diagnostics, drug discovery, and patient monitoring, enabling faster and more accurate clinical decisions. Retailers use AI for personalized recommendations, dynamic pricing, and inventory optimization, enhancing both customer experience and profitability.

The financial sector leverages AI for fraud detection, risk management, and algorithmic trading, improving accuracy and reducing human error. Meanwhile, transportation and logistics are adopting AI for route optimization, autonomous driving, and demand forecasting. The expansion of cloud computing, edge AI, and 5G connectivity has further accelerated adoption by making AI applications faster and more accessible.

Governments and enterprises are increasingly investing in AI education, infrastructure, and regulatory frameworks to ensure responsible integration. As AI technologies continue to evolve, industries are transitioning from experimental adoption to large-scale deployment, creating smarter, more adaptive ecosystems that redefine productivity, customer engagement, and competitive advantage.

Emerging Trends

The Edge AI Chipsets Market is witnessing several emerging trends that are reshaping how intelligence is deployed at the device level. One of the key trends is the integration of generative AI capabilities into edge devices, enabling on-device language and image generation without cloud dependency. This development enhances privacy and reduces latency, particularly in smart assistants and automotive systems.

Another trend is the growing adoption of heterogeneous computing architectures that combine CPUs, GPUs, NPUs, and custom ASICs to optimize power efficiency and performance across diverse AI workloads. These architectures are becoming crucial for real-time applications such as robotics and industrial automation.

The advancement of 5G and Wi-Fi 7 connectivity is further propelling the deployment of edge AI solutions, as faster network speeds support seamless data transfer and decentralized decision-making. Energy-efficient chip designs and neuromorphic computing are also emerging, focusing on brain-inspired architectures that enable adaptive and low-power AI processing.

Moreover, collaborations between semiconductor companies and cloud service providers are driving innovation in edge-cloud integration, allowing hybrid AI systems to dynamically balance workloads. With growing emphasis on privacy, speed, and sustainability, these trends are expected to define the next generation of intelligent edge ecosystems across consumer electronics, healthcare, and smart infrastructure.

US Market Size

The US Edge AI Chipsets Market was valued at USD 1.45 billion in 2024 and is projected to reach USD 13.29 billion by 2034, expanding at a CAGR of 24.8%. This rapid growth is driven by the widespread adoption of artificial intelligence across industries such as automotive, healthcare, manufacturing, and consumer electronics.

Increasing investments in edge computing infrastructure and AI-integrated hardware are fueling demand for advanced chipsets capable of processing data locally with minimal latency. The strong presence of leading semiconductor companies, AI startups, and research institutions in the US further supports innovation in edge AI design and deployment.

The market is also benefiting from government initiatives promoting AI adoption and domestic chip manufacturing under policies like the CHIPS and Science Act. The integration of edge AI into autonomous vehicles, smart home devices, and industrial automation systems is creating a robust ecosystem for localized intelligence.

Moreover, the rise of 5G networks and enterprise IoT solutions is accelerating real-time data processing requirements, boosting chipset demand. With growing emphasis on privacy, energy efficiency, and on-device analytics, the US market is expected to maintain its leadership position globally, serving as a critical hub for the development of next-generation edge AI technologies.

By Chipset

CPU accounted for 63.7% of the global Edge AI Chipsets Market in 2024, making it the dominant segment due to its flexibility, widespread adoption, and capability to handle diverse workloads efficiently. CPUs are central to running AI inference, lightweight training, and data pre-processing on edge devices, offering a balance of performance, cost, and energy efficiency.

Their ability to support multitasking and integrate seamlessly with AI accelerators has made them indispensable in devices such as smartphones, industrial sensors, and autonomous systems. Continuous architectural improvements, such as multi-core processing and integrated AI extensions, are further enhancing their suitability for real-time analytics at the edge.

GPUs represent a growing share of the market, primarily driven by their superior parallel processing capabilities essential for high-intensity AI tasks such as image recognition and object detection. With advancements in compact GPU designs, their integration into edge computing devices is increasing, particularly in autonomous vehicles and smart cameras.

ASICs are gaining traction for specific AI applications that require optimized performance and lower power consumption, making them ideal for dedicated tasks in robotics, consumer electronics, and healthcare monitoring. The ‘Others’ category, which includes FPGAs and NPUs, is expected to grow steadily as industries demand greater customization, adaptability, and energy efficiency for real-time AI workloads across evolving edge environments.

By Function

Training accounted for 68.3% of the global Edge AI Chipsets Market in 2024, emerging as the dominant functional segment due to the growing need for on-device learning and model adaptation. Edge-based training enables devices to continuously improve their performance by learning from local data without requiring frequent communication with the cloud.

This approach enhances privacy, reduces latency, and ensures faster response times, particularly in mission-critical applications such as autonomous driving, industrial robotics, and predictive maintenance. The integration of advanced neural processing architectures and distributed learning techniques has further strengthened the role of training at the edge, enabling adaptive and context-aware intelligence across devices.

Inference, while smaller in share, remains an essential function that complements training by executing pre-trained AI models to deliver real-time predictions and analytics. It is extensively used in voice recognition, video surveillance, and smart home devices where quick decision-making is vital. The growing adoption of lightweight AI models optimized for inference on low-power devices is also expanding this segment.

As industries increasingly combine on-device training with real-time inference, hybrid AI systems are emerging, enabling continuous learning and operational intelligence. Together, these functions are transforming edge ecosystems into autonomous, self-improving systems capable of localized decision-making and enhanced data security.

By Device

Consumer devices accounted for 84.2% of the global Edge AI Chipsets Market in 2024, representing the dominant segment driven by the rapid proliferation of AI-enabled electronics in households and personal applications. The integration of edge AI chipsets into smartphones, wearables, smart speakers, home security systems, and AR/VR headsets has significantly increased due to rising consumer demand for real-time processing and personalized experiences.

These chipsets enable devices to execute voice commands, recognize faces, analyze surroundings, and optimize energy use locally—without depending on cloud connectivity. Major technology companies are investing heavily in developing AI-optimized chip architectures to enhance device responsiveness, data privacy, and battery performance.

Enterprise devices, while representing a smaller share, are gaining traction as industries move toward intelligent automation and decentralized data processing. Edge AI chipsets are increasingly deployed in industrial robots, surveillance cameras, autonomous vehicles, and connected machinery to improve decision-making efficiency and reduce network latency.

Enterprises across manufacturing, logistics, and healthcare are leveraging these systems to support predictive maintenance, anomaly detection, and real-time analytics. The convergence of AI with industrial IoT and 5G connectivity is expected to expand this segment further. As both consumer and enterprise environments demand faster, more secure, and energy-efficient solutions, edge AI chipsets are becoming central to next-generation smart device ecosystems.

Key Market Segments

By Chipset

- CPU

- GPU

- ASIC

- Others

By Function

- Training

- Inference

By Device

- Consumer Devices

- Enterprise Devices

Regional Analysis

North America accounted for 38% of the global Edge AI Chipsets Market in 2024, valued at USD 1.60 billion, making it the leading regional market. The region’s dominance is driven by early adoption of advanced technologies, robust semiconductor infrastructure, and high investment in AI-driven applications across industries.

The United States plays a pivotal role, supported by strong R&D spending, the presence of leading chipset manufacturers, and collaborations between technology firms and research institutions. The growing implementation of edge computing in autonomous vehicles, smart cities, and industrial automation is further accelerating market expansion across the region.

Government initiatives supporting AI innovation and domestic semiconductor manufacturing—such as the CHIPS and Science Act—are strengthening the region’s supply chain resilience and fostering technological self-sufficiency. Canada and Mexico are also contributing to market growth, with increasing AI integration in healthcare, logistics, and smart energy management. The rise of 5G networks across the continent is facilitating low-latency data processing and real-time analytics, key enablers for edge AI deployment.

Moreover, the demand for secure, privacy-preserving data solutions in sectors like defense, finance, and healthcare is boosting the adoption of localized AI processing. North America’s mature ecosystem of AI startups, established hardware suppliers, and cloud service providers positions it as a critical hub for advancing edge AI chipset development globally.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The growth of the Edge AI Chipsets Market is primarily driven by the rising demand for real-time data processing and low-latency decision-making across connected ecosystems. Edge AI chipsets enable faster computing by processing information locally, reducing dependence on cloud servers and enhancing data privacy.

The increasing adoption of smart devices, autonomous systems, and industrial IoT solutions is fueling demand for high-performance, energy-efficient AI processors. Advancements in semiconductor technology, including smaller fabrication nodes and integrated NPUs, have made edge AI more affordable and scalable.

The expansion of 5G networks is further supporting this growth by improving bandwidth and enabling instantaneous communication between devices. Additionally, strong government support for AI research, combined with strategic collaborations between semiconductor companies and cloud providers, is accelerating innovation and commercialization of edge AI chipsets across automotive, healthcare, and consumer electronics sectors.

Restraint Factors

Despite strong growth prospects, the Edge AI Chipsets Market faces challenges related to high development costs, limited standardization, and hardware complexity. Designing chipsets capable of handling intensive AI workloads while maintaining energy efficiency and compact size remains technologically demanding.

Smaller manufacturers often struggle to meet the capital requirements for R&D and fabrication, creating barriers to market entry. Additionally, the lack of standardized AI frameworks and interoperability between devices hinders seamless integration across platforms. Security concerns also pose a restraint, as on-device data processing can increase vulnerability to cyberattacks if not adequately protected.

Furthermore, the dependence on advanced semiconductor materials and the global chip shortage have disrupted supply chains, delaying production and increasing costs. These limitations could slow adoption, particularly among small and mid-sized enterprises that lack the financial and technical resources to deploy edge AI solutions at scale.

Growth Opportunities

Significant growth opportunities lie in the expanding use of edge AI chipsets across automotive, healthcare, and industrial sectors. The rising deployment of autonomous vehicles and driver-assistance systems is creating substantial demand for chipsets capable of real-time sensor fusion and decision-making. In healthcare, AI-powered wearables and diagnostic devices are increasingly integrating edge processors for instant data analysis and patient monitoring.

Industrial automation and predictive maintenance also present strong potential as factories move toward intelligent, connected systems. The increasing convergence of AI, IoT, and 5G networks is enabling more responsive and decentralized operations, opening new avenues for edge AI deployment.

Additionally, the emergence of energy-efficient and customizable chip architectures—such as neuromorphic and quantum-inspired processors—offers manufacturers the ability to tailor performance for specific applications. These innovations, supported by government funding and private investment, are expected to unlock new markets and strengthen the global edge AI ecosystem.

Trending Factors

Emerging trends in the Edge AI Chipsets Market are reshaping the landscape of intelligent computing. One major trend is the integration of generative AI capabilities at the edge, allowing devices to generate content, detect anomalies, and adapt autonomously without cloud dependency. Heterogeneous computing architectures that combine CPUs, GPUs, and NPUs are gaining traction for balancing performance with energy efficiency.

Another key trend is the growing emphasis on sustainability, prompting manufacturers to design low-power chipsets that support green data processing initiatives. The expansion of 5G and upcoming 6G networks is further enhancing data transmission speeds, enabling real-time edge analytics.

Additionally, federated learning and on-device model optimization are transforming privacy management by ensuring sensitive data remains localized. Strategic collaborations between semiconductor developers and AI software firms are fostering innovation in chip design. These trends collectively indicate a shift toward decentralized, intelligent, and energy-efficient AI ecosystems.

Competitive Analysis

The global Edge AI Chipsets Market is highly competitive, characterized by technological innovation, strategic partnerships, and integration across multiple industries. Advanced Micro Devices, Inc. (AMD) continues to strengthen its presence through embedded processors and adaptive SoCs that support real-time AI workloads across industrial and automotive applications.

Intel Corporation remains a key leader, leveraging its CPUs, GPUs, and accelerators to provide scalable edge AI solutions focused on low-latency computing and efficient power management. Qualcomm Technologies, Inc. dominates the mobile and IoT space with its Snapdragon platforms optimized for AI inference and on-device learning, positioning itself strongly in power-efficient edge environments.

Apple Inc. maintains a competitive advantage through vertical integration, utilizing proprietary neural engines in its A-series and M-series chipsets to enhance on-device intelligence across its ecosystem. Arm Limited plays a foundational role by providing IP architectures that power numerous edge AI designs, while Samsung focuses on advancing NPUs within its Exynos line to deliver enhanced AI performance for consumer electronics.

NVIDIA Corporation continues to lead in high-performance edge computing through its Jetson and EGX platforms, which support advanced AI and robotics applications. Huawei Technologies Co., Ltd. contributes significantly through AI-optimized chipsets tailored for telecom and smart infrastructure deployments.

Emerging players such as Mythic are innovating with analog AI chip architectures that reduce power consumption for edge devices. Overall, competition is intensifying as companies focus on energy efficiency, real-time analytics, and integration of AI across consumer, industrial, and enterprise edge ecosystems.

Top Key Players in the Market

- Advanced Micro Devices, Inc.

- Alphabet Inc.

- Intel Corporation

- Qualcomm Technologies, Inc.

- Apple Inc.

- Mythic

- Arm Limited

- Samsung

- NVIDIA Corporation

- Huawei Technologies Co., Ltd.

- Others

Recent Developments

- August 19, 2025: NVIDIA Corporation announced that it is developing a new artificial-intelligence chip based on its latest Blackwell architecture for China, expected to outperform its current H20 model.

- August 12, 2025: Synopsys entered into a collaboration with the Thai Embedded Systems Association (TESA) to advance prototyping of 32-bit RISC-V edge-AI designs featuring NPU integration, aimed at enhancing local chip-design skills and IoT edge-AI adoption in Thailand.

- August 23, 2025: Edgehax secured INR ₹1.39 crore in seed funding led by Inflection Point Ventures to expand manufacturing of modular edge-AI hardware platforms, supporting global reach in Singapore, the US, and Europe.

Report Scope

Report Features Description Market Value (2024) USD 4.23 Billion Forecast Revenue (2034) USD 48.4 Billion CAGR(2025-2034) 27.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Chipset (CPU, GPU, ASIC, Others), By Function (Training, Inference), By Device (Consumer Devices, Enterprise Devices) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Advanced Micro Devices, Inc., Alphabet Inc., Intel Corporation, Qualcomm Technologies, Inc., Apple Inc., Mythic, Arm Limited, Samsung, NVIDIA Corporation, Huawei Technologies Co., Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Advanced Micro Devices, Inc.

- Alphabet Inc.

- Intel Corporation

- Qualcomm Technologies, Inc.

- Apple Inc.

- Mythic

- Arm Limited

- Samsung

- NVIDIA Corporation

- Huawei Technologies Co., Ltd.

- Others