Global Ecommerce Shopping Cart Software Market Size, Share, Industry Analysis Report By Type (SaaS Shopping Cart Software, Open-Source Shopping Cart, Others), By Enterprise Size (Small & Medium Enterprises (SMEs), Large Enterprises), By End-User Application (Business-to-Consumer (B2C), Business-to-Business (B2B), Business-to-Business-to-Consumer (B2B2C), Direct-to-Consumer (D2C), By Pricing Model (Subscription-Based (Monthly/Annual Fee), Transaction Fee-Based, License Fee (One-time or Annual), Open-Source (Free Core Software), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165087

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Type Analysis

- Enterprise Size Analysis

- End-User Application Analysis

- Pricing Model Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

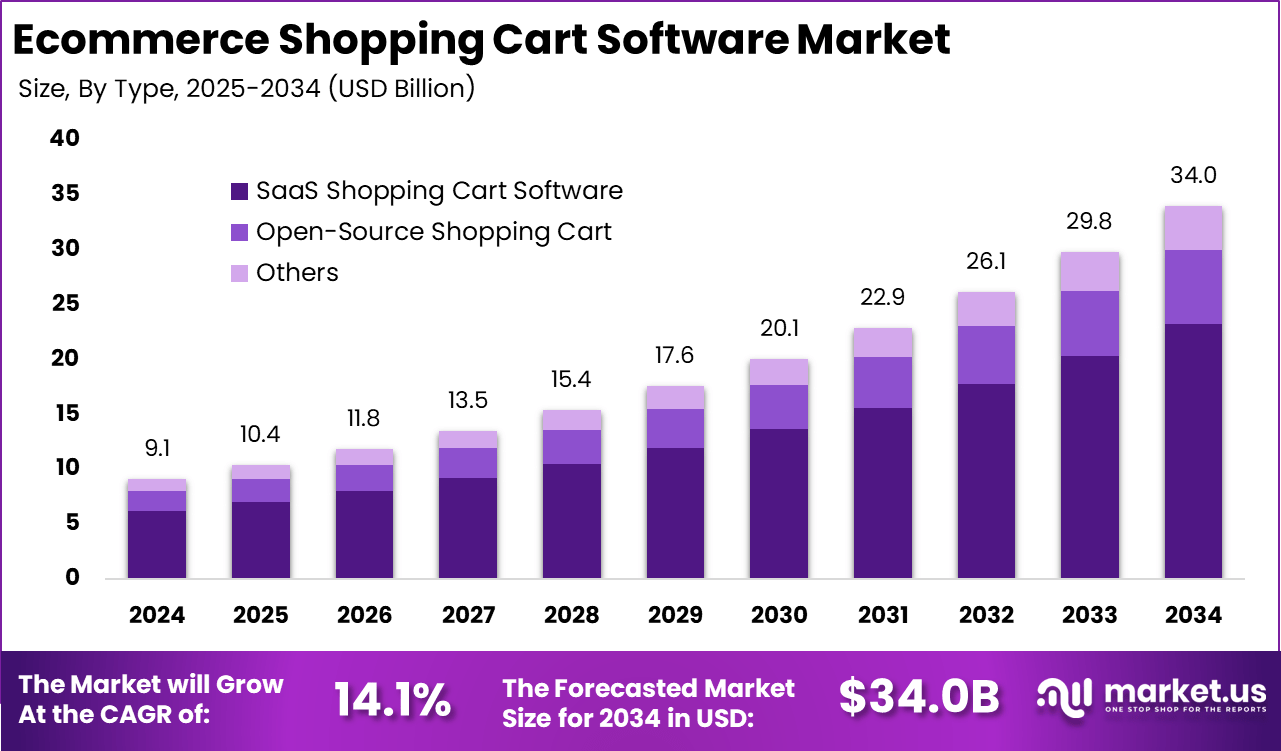

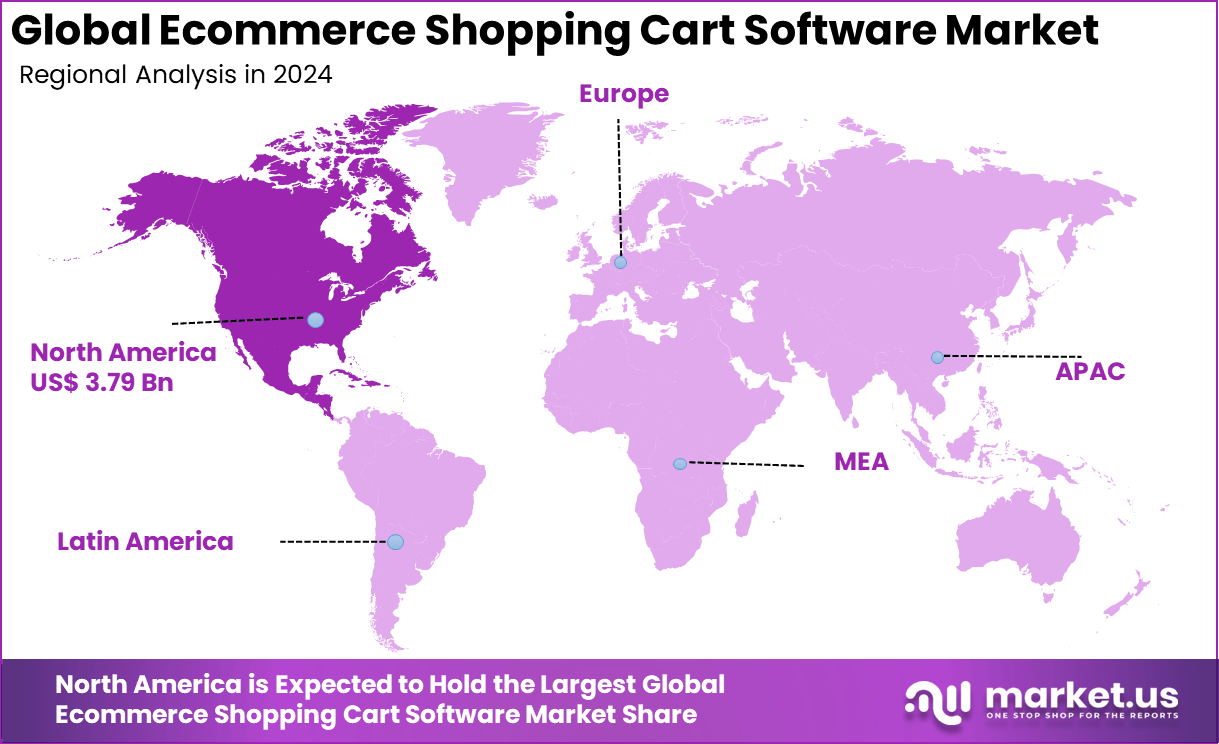

The Global E-commerce Shopping Cart Software Market size is expected to be worth around USD 34.0 billion by 2034, from USD 9.1 billion in 2024, growing at a CAGR of 14.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41.7% share, holding USD 3.79 billion in revenue.

The e-commerce shopping cart software market is a key component of the growing digital retail ecosystem. This software enables online merchants to manage product selection, pricing, inventory, payments, and order tracking, providing a seamless and secure buying experience to customers. Modern shopping cart solutions support mobile and multi-channel commerce, offering features such as AI-driven personalization, real-time analytics, and fraud detection.

The primary driver for the e-commerce shopping cart software market is the rapid growth of online retail and increasing consumer preference for convenient shopping. With over 70% of global e-commerce sales made via mobile devices, mobile commerce advancements force shopping cart software providers to create fluid, mobile-optimized user experiences. Security concerns also push demand for advanced payment integrations including digital wallets, cryptocurrencies, and strong encryption standards.

About 65% of online retailers reported enhancing or adopting new cart software within the last two years, driven by the need for better features to reduce cart abandonment and improve customer satisfaction. The global pandemic pushed many small and medium enterprises online, intensifying the requirement of shopping cart software that supports omnichannel retail and multi-currency transactions.

The market for e-commerce shopping cart software is driven by the rapid growth of online shopping and the increasing use of mobile devices for purchases. Businesses are shifting from traditional stores to digital platforms, pushing demand for user-friendly, flexible carts that offer smooth, secure checkout experiences across devices. Advances in mobile technology and rising consumer expectations for seamless transactions compel companies to adopt advanced shopping cart solutions.

For instance, in October 2025, Squarespace extended its ecommerce features with options for physical, digital, subscription products, and service bookings. It offers tools like abandoned cart recovery, customer accounts, member areas for exclusive content, and integrated marketing/SEO support to help businesses build and grow online.

According to SellersCommerce, there are 2.77 billion online shoppers worldwide. In 2025, about 21% of all retail purchases are expected to occur online, rising to 22.6% by 2027. Global eCommerce sales are projected to exceed USD 6.8 trillion in 2025, supported by over 28 million online stores globally. Around 52% of shoppers browse or buy products from international sellers, and 34% make online purchases at least once a week. Nearly 99% of customers check reviews before completing an online purchase.

Key Takeaway

- The SaaS Shopping Cart Software segment led the market with a 68.2% share, driven by the scalability, low maintenance, and cost efficiency of cloud-hosted e-commerce solutions.

- The Small & Medium Enterprises (SMEs) segment dominated with 81.4%, reflecting increasing adoption of affordable, ready-to-use digital storefronts by emerging online retailers.

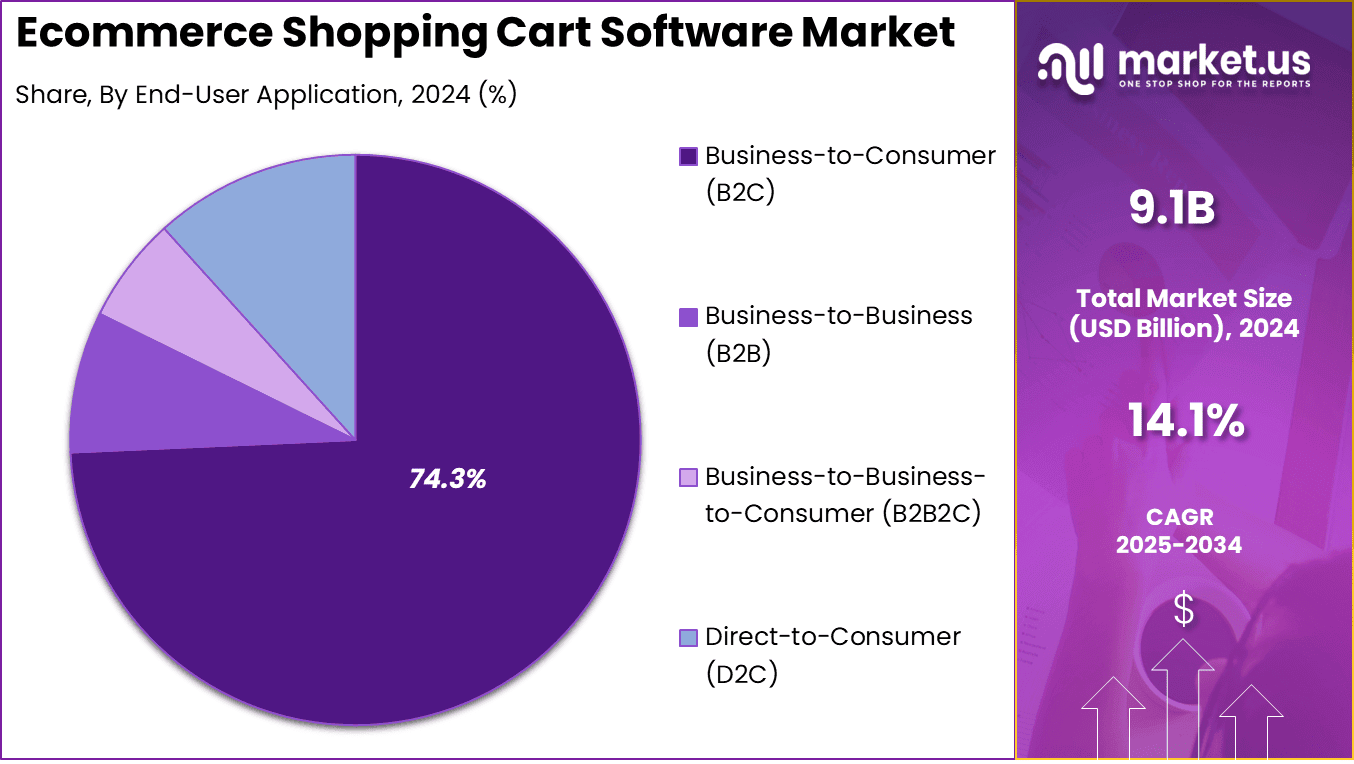

- The Business-to-Consumer (B2C) model accounted for 74.3%, supported by growing online shopping penetration and direct engagement between brands and consumers.

- The Subscription-Based (Monthly/Annual Fee) segment secured 56.4%, as recurring payment structures became the preferred model for continuous feature access and support.

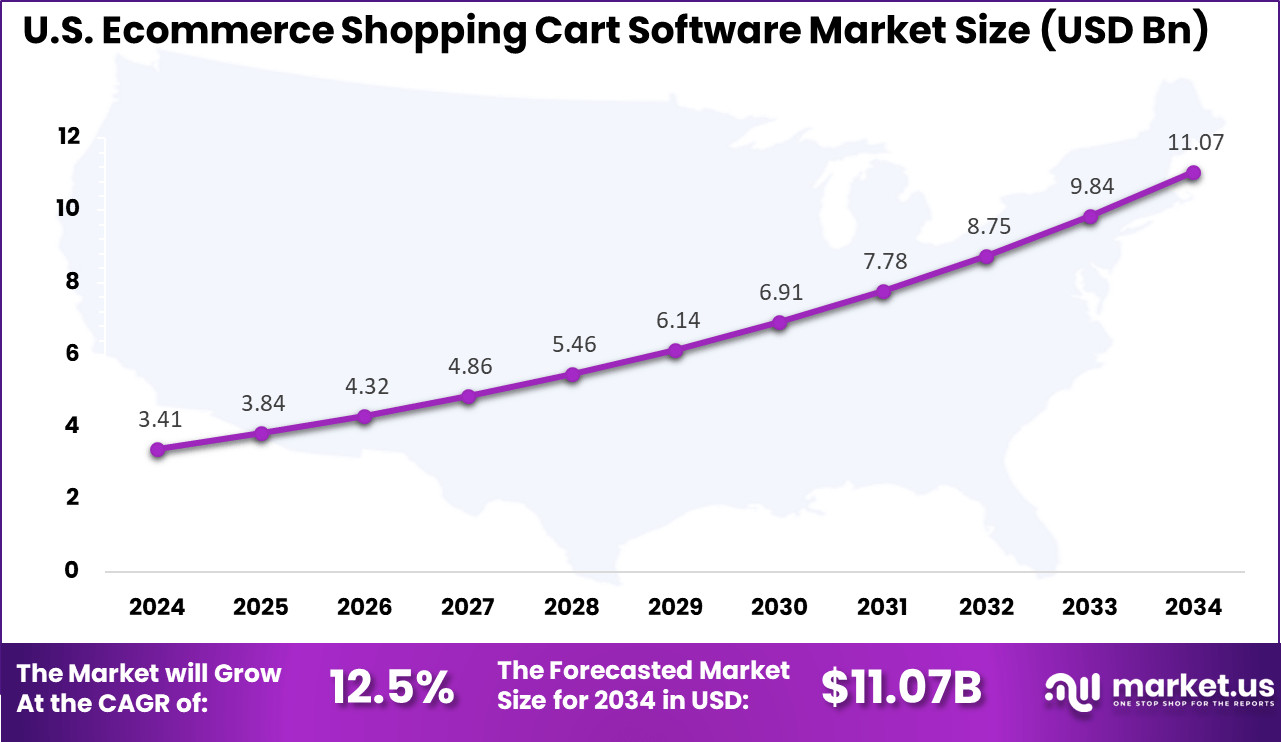

- The U.S. market reached USD 3.41 Billion in 2024, advancing at a healthy 12.5% CAGR, bolstered by strong e-commerce infrastructure and demand for integrated checkout solutions.

- North America remained the leading region, capturing over 41.7% of the global share, due to high digital maturity, strong payment gateway integration, and widespread cloud adoption among e-commerce businesses.

Role of Generative AI

Generative AI is reshaping e-commerce shopping cart software by offering smarter and more personalized shopping experiences. It automates tasks like product recommendations, natural language search, and content creation, which helps online stores understand consumer preferences better.

According to a survey, about 80% of shoppers want personalization, and generative AI helps meet this demand by analyzing customer behavior and purchase patterns in real time. This has led to a notable 14% increase in the efficiency of support agents who use AI tools to resolve issues faster, improving the overall shopping journey.

Beyond personalization, generative AI also helps reduce cart abandonment by providing timely reminders and checkout assistance. For example, AI-powered virtual assistants offer helpful cues and seamless navigation through the checkout phase, which significantly smoothens the purchase process. These AI systems can also generate tailored product descriptions and marketing content, increasing click-through and engagement rates by up to 50%.

Investment and Business Benefits

Investment opportunities abound as the e-commerce sector flourishes. Businesses can leverage shopping cart software to scale operations, enter new markets, and integrate emerging payment and marketing technologies. Investments in customization features help companies create unique brand experiences that foster loyalty.

The integration of data analytics capabilities also opens doors for targeted promotions and optimized inventory management, maximizing return on investment. Business benefits of shopping cart software include improved sales through increased conversion rates, enhanced customer retention driven by better shopping experiences, and operational efficiencies gained by automating routine processes.

Secure checkout capabilities build consumer trust, which is vital in e-commerce. Additionally, insightful sales data gathered from carts enables better marketing strategies and product management, contributing to long-term business health.

U.S. Market Size

The market for E-commerce Shopping Cart Software within the U.S. is growing tremendously and is currently valued at USD 3.41 billion, the market has a projected CAGR of 12.5%. This growth is fueled by rapid expansion in online shopping as more consumers prefer digital purchases for convenience and variety. Increasing internet penetration and the widespread use of mobile devices further accelerate demand for efficient and user-friendly e-commerce platforms.

Additionally, the rise of AI-driven personalization, seamless payment integrations, and omnichannel strategies helps merchants enhance user experience and reduce cart abandonment. The increasing need for affordable, scalable solutions among small and medium enterprises also plays a key role, making e-commerce software an essential tool for business growth in the digital age.

For instance, in September 2025, BigCommerce generated $82.4 million in revenue in Q1 2025, with about 67.4% of its stores located in the U.S., representing over 27,500 stores domestically. BigCommerce is focusing on expanding its open, composable commerce system with AI-driven capabilities, reinforcing its North American market presence.

In 2024, North America held a dominant market position in the Global E-commerce Shopping Cart Software Market, capturing more than a 41.7% share, holding USD 3.79 billion in revenue. This strength comes from widespread adoption of online shopping driven by high internet penetration and a digitally savvy population.

Consumers increasingly prefer convenient, mobile-friendly shopping experiences, driving demand for advanced e-commerce platforms. Additionally, North America benefits from well-established logistics and delivery networks that support fast fulfillment. The presence of major e-commerce companies and continuous technological innovations further strengthens the region’s market leadership and growth prospects.

Type Analysis

In 2024, The SaaS Shopping Cart Software segment held a dominant market position, capturing a 68.2% share of the Global E-commerce Shopping Cart Software Market. This dominance is due to the SaaS solutions offering ease of access and scalability by hosting software on the cloud, which eliminates the need for heavy upfront investments in infrastructure. These solutions appeal particularly to businesses seeking fast deployment and regular updates without the burden of maintenance.

Their flexibility and lower cost of entry make SaaS the preferred choice for many merchants aiming for a smooth online shopping experience. SaaS platforms typically come with a strong focus on user-friendly interfaces and built-in integrations that support payment processing, inventory management, and customer engagement. This results in smoother e-commerce operations, helping merchants capture and retain customers effectively.

For Instance, in November 2025, Shopify announced that it had achieved impressive growth in its latest quarter. The company reported a remarkable increase in gross merchandise volume and highlighted ongoing investments in artificial intelligence features aimed at simplifying merchant operations. Shopify’s management emphasized its strong performance in both revenue and efficiency, reflecting robust adoption of its SaaS platform during this period.

Enterprise Size Analysis

In 2024, the Small & Medium Enterprises (SMEs) segment held a dominant market position, capturing an 81.4% share of the Global E-commerce Shopping Cart Software Market. SMEs favor shopping cart software solutions for their affordability and ability to professionalize e-commerce operations without large IT teams. These businesses increasingly rely on tailored online tools to compete against larger players and scale operations efficiently.

SMEs’ adoption is stimulated by trends toward multichannel selling and growing online customer segments, demanding flexible and dependable e-commerce platforms. Their significant share signals how critical online sales capabilities are in enabling SME growth in competitive markets.

For instance, in April 2025, Wix emphasized its ecommerce tools targeting small businesses and individual entrepreneurs, offering features like flexible payment processing, integrated tax automation, and easy site building. Wix’s ease of use and built-in business tools cater well to SMEs aiming for streamlined online selling without deep technical expertise.

End-User Application Analysis

In 2024, the Business-to-Consumer (B2C) segment held a dominant market position, capturing a 74.3% share of the Global E-commerce Shopping Cart Software Market. This reflects the strong demand from retailers and brands targeting individual consumers with personalized, convenient online shopping experiences. B2C platforms focus on features such as mobile compatibility, intuitive navigation, and seamless checkout processes that enhance customer satisfaction.

As more consumers shop online for convenience and product variety, platforms serving the B2C segment invest heavily in marketing tools, AI-driven recommendations, and fast payment options. The B2C dominance also highlights the ongoing shift towards direct digital engagement between businesses and end customers.

For Instance, in November 2025, Salesforce Commerce Cloud announced that it is leveraging AI, omnichannel strategies, and social commerce features to support B2C retailers. The platform now offers integrated tools for social media selling, personalized shopping experiences, and seamless cross-channel interactions. These updates enable B2C brands to reach consumers more effectively, with enhanced content personalization and better engagement through social platforms.

Pricing Model Analysis

In 2024, The Subscription-Based (Monthly/Annual Fee) segment held a dominant market position, capturing a 56.4% share of the Global e-commerce shopping Cart Software Market. This model allows businesses to spread costs evenly, aligning with operational budgets and reducing the risk of large upfront payments. Subscription fees usually cover hosting, software updates, and customer support, offering a comprehensive service that adapts as businesses grow.

The predictability of subscription pricing benefits companies by simplifying financial planning and enabling continuous access to the latest features. This payment approach has become popular, especially among SMEs and startups focused on managing cash flow effectively.

For Instance, in June 2025, Adobe Commerce launched its SaaS-based cloud service with subscription pricing, offering businesses predictable costs along with scalable and managed e-commerce infrastructure. This reduces complexity and upfront costs, appealing especially to growing businesses and enterprises transitioning from traditional licenses.

Emerging trends

Emerging trends in e-commerce shopping cart software include widespread adoption of mobile commerce and voice-activated shopping features. Around 85% of consumers now prefer using mobile apps for shopping over mobile websites because these apps offer smoother, faster checkout experiences.

This shift has cut down mobile app cart abandonment rates to just 20%, a major improvement compared to 97% on mobile websites. Features like one-click ordering in mobile apps encourage buyers to complete purchases faster, which drives higher conversion rates. Another growing trend is the integration of augmented reality (AR) and virtual try-ons in shopping carts.

This technology allows buyers to visualize products like clothing or accessories in real time, directly addressing the uncertainty of online shopping. As a result, shoppers are less likely to return products, improving retailer margins. AI-based chatbots and virtual assistants are also becoming ubiquitous to provide around-the-clock customer support, leading to better engagement and loyalty.

Growth Factors

Growth in e-commerce shopping cart software is largely driven by rising consumer demand for personalized, convenient shopping experiences. Retailers who use AI-based recommendation engines see a significant boost in conversion rates because customers get suggestions tailored to their interests.

Dynamic pricing powered by AI also helps sellers offer competitive prices that adjust with demand and competitor moves, further fueling growth. Personalized email marketing powered by AI shows a higher open rate and clicks, making it an effective channel for increasing sales and customer retention.

Expanded mobile commerce plays a key role in growth with the proliferation of smartphones and faster internet. Mobile-first shopping experiences are becoming a must-have, as customers increasingly expect fast, seamless, and secure checkout processes from their devices. Investments in AI-driven customer support tools also reduce operational costs while enhancing service quality, helping e-commerce platforms scale efficiently and meet growing demand.

Key Market Segments

By Type

- SaaS Shopping Cart Software

- Open-Source Shopping Cart

- Others

By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By End-User Application

- Business-to-Consumer (B2C)

- Business-to-Business (B2B)

- Business-to-Business-to-Consumer (B2B2C)

- Direct-to-Consumer (D2C)

By Pricing Model

- Subscription-Based (Monthly/Annual Fee)

- Transaction Fee-Based

- License Fee (One-time or Annual)

- Open-Source (Free Core Software)

Drivers

Rising E-Commerce Growth and Mobile Shopping

The e-commerce sector is growing rapidly as more consumers prefer online shopping for convenience and broad product selection. This trend is pushing businesses to adopt flexible shopping cart software that supports seamless transactions across devices, especially mobile. Mobile commerce advances increase demand for carts that offer smooth experiences on smartphones and tablets, making this a key market growth factor.

The shift from physical stores to digital platforms, accelerated by the COVID-19 pandemic, has intensified this demand. Online shopping’s convenience, coupled with fast payment and tracking capabilities, encourages the continuous adoption of advanced cart solutions, driving the market forward.

For instance, in June 2025, Shopify announced new AI tools that enhance mobile checkout experiences, making buying seamless on smartphones. This reflects Shopify’s push to capitalize on mobile shopping’s rise by simplifying purchase steps and improving user engagement, aligning with the growing trend of mobile commerce.

Restraint

Complex Security and Data Privacy Regulations

Tightening security and data privacy rules slow down progress in the e-commerce shopping cart market. Online stores face growing threats from fraud and hacking, which require constant security updates and compliance with intricate regulations. For smaller businesses, the cost and complexity of implementing advanced security measures can be a heavy burden, limiting their ability to adopt newer software.

Integrating these security demands with multiple payment options and customer tools adds more layers of difficulty. This technical challenge is combined with a crowded market where many players compete, creating pricing pressures and slowing adoption for some vendors.

For instance, in August 2025, BigCommerce detailed new efforts to ensure GDPR compliance for merchants using their platform. Their transparency in managing data privacy reflects how evolving regulations demand considerable resources, posing hurdles especially for smaller businesses trying to stay compliant.

Opportunities

Demand for User-Friendly, AI-Enhanced Checkout

There is strong potential in providing shoppers with simple, personalized checkout options powered by AI. Innovations like tailored product suggestions, smart pricing, and automation to reduce abandoned carts help online stores improve sales and engagement. Companies are investing in technology that makes shopping carts more intuitive and efficient, offering a better customer experience and operational gains.

Expanding e-commerce in emerging areas also calls for shopping carts that support many languages and sales channels. Businesses that develop adaptable and smart shopping cart solutions can capture new audiences and grow their market presence.

For instance, in October 2025, Shopify rolled out an AI-driven “Instant Checkout” feature integrated with ChatGPT that lets customers buy products directly within chat conversations. This innovation exemplifies leveraging AI to make checkout smoother and more personal, opening new avenues for e-commerce growth.

Challenges

Rising Cybersecurity Threats and Compliance Complexity

The e-commerce market faces ongoing risks from increasing cybersecurity attacks targeting customer data. These threats damage consumer trust and can be costly for businesses. At the same time, changing laws on data protection force software makers to regularly update their platforms.

Balancing high security standards while keeping the shopping experience smooth is difficult. Smaller providers especially struggle with the resources needed to stay compliant and competitive, making this a key challenge in the market.

For instance, in February 2025, WooCommerce published a detailed security checklist addressing threats like brute-force attacks and plugin vulnerabilities. The need for constant vigilance against these risks reflects a growing challenge for e-commerce software providers in maintaining security without sacrificing ease of use.

Key Players Analysis

The Ecommerce Shopping Cart Software market is shaped by leading platforms such as Shopify, WooCommerce, and Wix, which cater to small and mid-sized merchants. Shopify’s user-friendly design and strong app ecosystem have made it a top choice for startups and independent retailers. WooCommerce dominates among WordPress users with open-source flexibility, while Wix attracts beginners with simple drag-and-drop tools.

Mid-sized and enterprise players such as Adobe Commerce (Magento), BigCommerce, and Salesforce Commerce Cloud focus on scalability and deep integration. Adobe Commerce offers extensive customization and analytics for brand-driven businesses. BigCommerce provides secure, multi-channel solutions suitable for growing enterprises. Salesforce Commerce Cloud combines AI and CRM tools to deliver personalized shopping experiences.

In the advanced enterprise and niche category, SAP Commerce Cloud, HCL Commerce, Oracle Commerce, Commercetools, Elastic Path, and PrestaShop play vital roles. SAP and Oracle enable seamless ERP integration for global retailers, while HCL supports B2B commerce. Commercetools and Elastic Path lead in headless and composable commerce innovation, promoting flexibility in digital storefronts.

Top Key Players in the Market

- Shopify

- WooCommerce

- Wix

- Squarespace

- Adobe Commerce (Formerly Magento)

- BigCommerce

- Salesforce Commerce Cloud (Demandware)

- SAP Commerce Cloud

- HCL Commerce (Formerly IBM WebSphere)

- PrestaShop

- Oracle Commerce

- Commercetools Inc.

- Elastic Path

- Shift4Shop

- Volusion

- Ecwid

- Snipcart

- Others

Recent Developments

- In August 2025, Shopify launched the Summer ’25 update featuring over 50 new client-focused functionalities. This includes Shopify Magic, an AI-powered tool that can build an entire online store from a simple prompt, streamlining store setup. Shopify also integrated native subscriptions without needing third-party apps, revamped checkout with extensibility options, and added smarter discount combinations and fraud protection.

- In April 2025, Adobe Commerce (Magento) released version 2.4.8 with nearly 500 bug fixes, PHP 8.4 support, and smart selling tools. Adobe is doubling down on enhancing Magento 2 with headless commerce and composable commerce capabilities, helping merchants deliver flexible, omnichannel experiences with strong cloud integration.

Report Scope

Report Features Description Market Value (2024) USD 9.1 Bn Forecast Revenue (2034) USD 34 Bn CAGR(2025-2034) 14.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (SaaS Shopping Cart Software, Open-Source Shopping Cart, Others), By Enterprise Size (Small & Medium Enterprises (SMEs), Large Enterprises), By End-User Application (Business-to-Consumer (B2C), Business-to-Business (B2B), Business-to-Business-to-Consumer (B2B2C), Direct-to-Consumer (D2C), By Pricing Model (Subscription-Based (Monthly/Annual Fee), Transaction Fee-Based, License Fee (One-time or Annual), Open-Source (Free Core Software) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Shopify, WooCommerce, Wix, Squarespace, Adobe Commerce (Formerly Magento), BigCommerce, Salesforce Commerce Cloud (Demandware), SAP Commerce Cloud, HCL Commerce (Formerly IBM WebSphere), PrestaShop, Oracle Commerce, Commercetools Inc., Elastic Path, Shift4Shop, Volusion, Ecwid, Snipcart, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ecommerce Shopping Cart Software MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Ecommerce Shopping Cart Software MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Shopify

- WooCommerce

- Wix

- Squarespace

- Adobe Commerce (Formerly Magento)

- BigCommerce

- Salesforce Commerce Cloud (Demandware)

- SAP Commerce Cloud

- HCL Commerce (Formerly IBM WebSphere)

- PrestaShop

- Oracle Commerce

- Commercetools Inc.

- Elastic Path

- Shift4Shop

- Volusion

- Ecwid

- Snipcart

- Others