Global Ecological Restoration Service Market Size, Share Analysis Report By Туре (Wetland, Stream, Land, Others), By Service (Physical Restoration, Monitoring, Planning, Design and Engineering, Consulting, Site Acquisition, Others), By Application (Biodiversity Conservation, Erosion Control, Climate Change Mitigation, Water Quality Improvement), By End User (Government Agencies, Non-Governmental Organizations, Private Companies, Educational Institutions) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153465

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

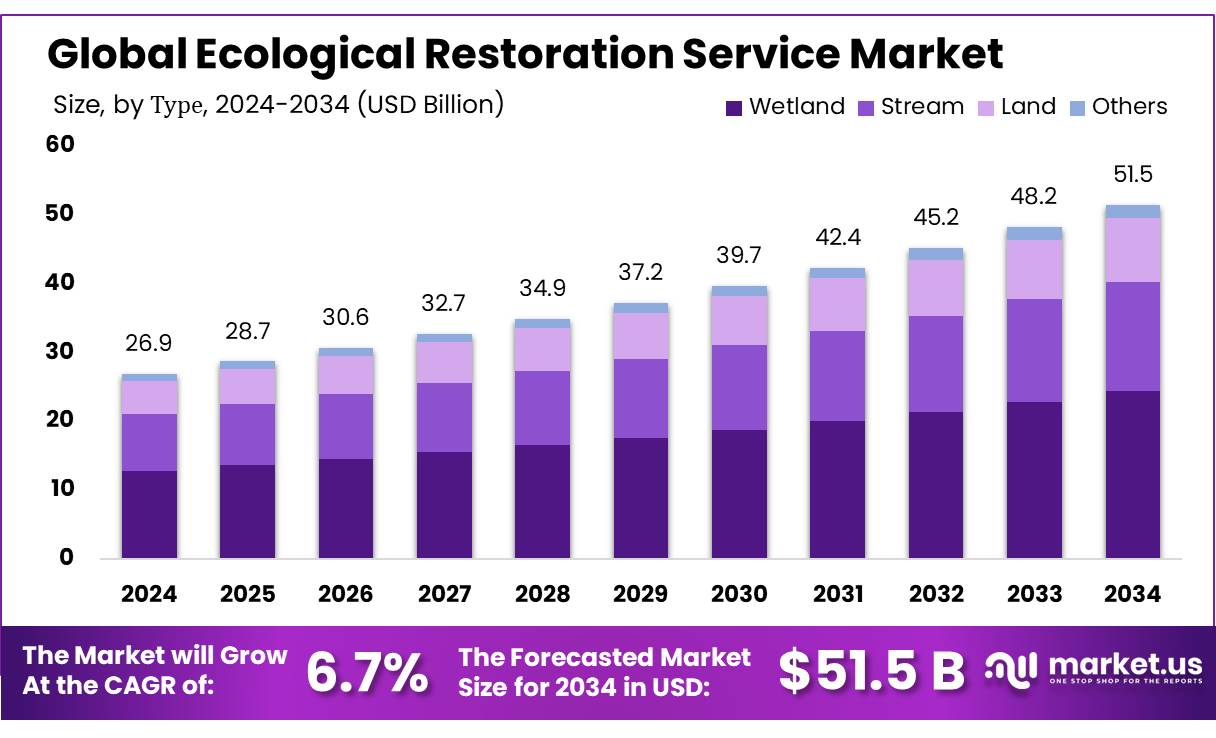

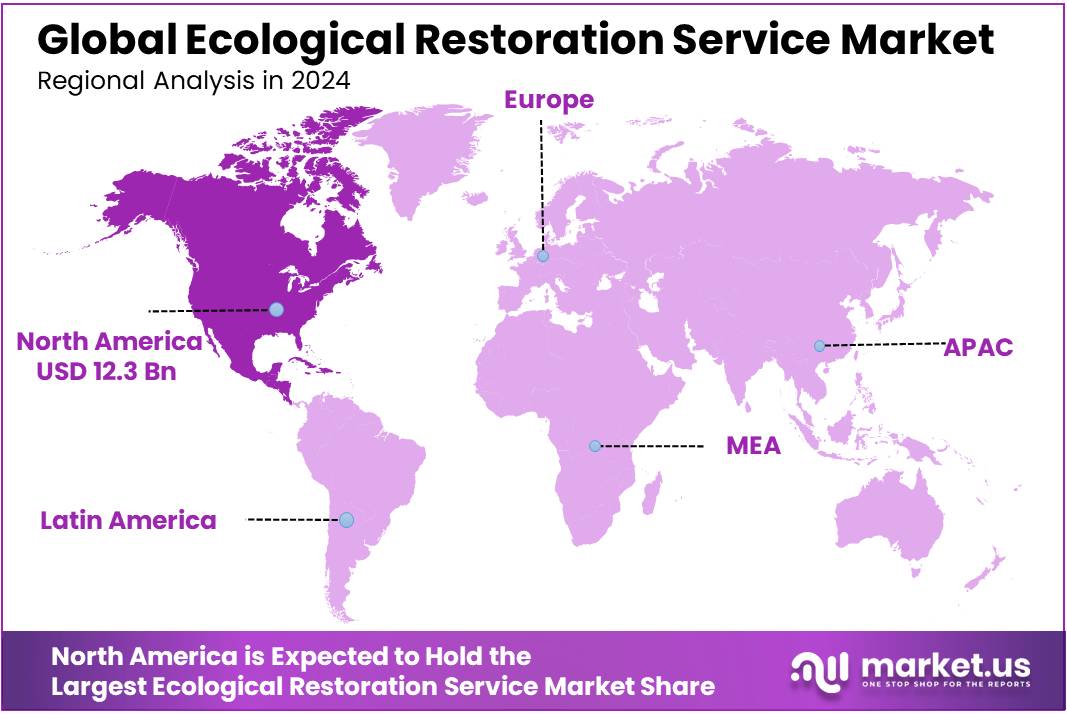

The Global Ecological Restoration Service Market size is expected to be worth around USD 51.5 Billion by 2034, from USD 26.9 Billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 45.9% share, holding USD 12.3 Billion revenue.

Ecological restoration services are pivotal in reversing environmental degradation and enhancing ecosystem resilience. Globally, the sector is experiencing significant growth, driven by increasing environmental awareness, stringent regulations, and a collective push towards sustainability. In the United States, the ecological restoration industry generated $9.6 billion in 2023 and supported over 53,000 jobs, underscoring its economic and employment significance.

The driving forces behind the expansion of ecological restoration services include heightened awareness of biodiversity loss, climate change, and the degradation of natural resources. Government policies, such as the National Afforestation Programme and the National Mission for a Green India, focus on rehabilitating degraded forests and increasing tree cover, thereby promoting ecological balance.

In India, the government has launched several initiatives to promote ecological restoration. The ‘Namami Gange’ program aims to rejuvenate the Ganges River, with 1,500 km of the 2,525 km river already restored and 30,000 hectares of forests rehabilitated. These governmental efforts are complemented by community-driven projects. For example, the revival of the Pili Nadi in Jaunpur, Uttar Pradesh, under the “One District, One River” campaign, involved the planting of over 11,000 saplings and the restoration of a culturally significant 25-km river stretch, enhancing irrigation for farmers and improving ecological balance.

This growth is underpinned by various factors, including heightened awareness of climate change, biodiversity loss, and the degradation of natural habitats. Governments worldwide are increasingly recognizing the importance of ecological restoration, leading to the implementation of supportive policies and funding initiatives. For instance, the United Nations Decade on Ecosystem Restoration (2021–2030) aims to restore 350 million hectares of degraded terrestrial and aquatic ecosystems by 2030, with an estimated economic benefit of US$9 trillion in ecosystem services.

Key Takeaways

- The Ecological Restoration Service Market is projected to reach USD 51.5 billion by 2034, up from USD 26.9 billion in 2024, registering a CAGR of 6.7% over the forecast period.

- In terms of type, Wetland restoration led the market in 2024, holding a 47.3% share of the global market.

- By service, Physical Restoration dominated with a 33.2% share in the global ecological restoration service market in 2024.

- Under application, Biodiversity Conservation was the leading segment, capturing more than 39.4% share in 2024.

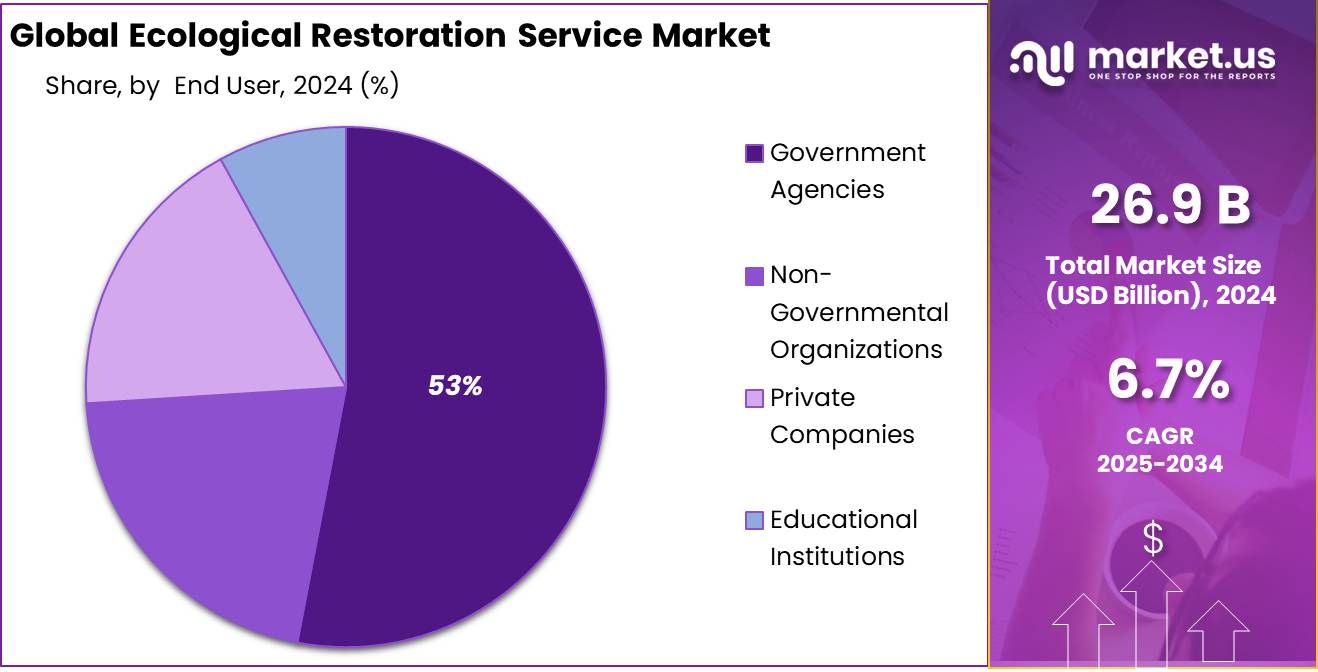

- Among end-users, Government Agencies held a commanding position, accounting for over 53.8% share of the market in 2024.

- Geographically, North America was the top-performing region, representing 45.9% of the global market and reaching a value of around USD 12.3 billion in 2024.

By Type Analysis

Wetland Restoration Leads with 47.3% Share in 2024, Driven by Urgent Ecological Recovery Needs

In 2024, Wetland held a dominant market position, capturing more than a 47.3% share in the global ecological restoration service market. This leadership is largely driven by the urgent global need to restore natural water filtration systems, improve flood resilience, and support biodiversity conservation. Wetlands are among the most productive ecosystems on the planet but have also been among the most heavily degraded due to urban expansion, agricultural encroachment, and industrial development. Their restoration has become a key focus in both climate adaptation strategies and sustainable land-use planning.

Governments and ecological agencies are prioritizing wetland restoration as part of international biodiversity targets, such as the Ramsar Convention and the UN Decade on Ecosystem Restoration. Countries across Asia, North America, and parts of Europe have launched large-scale programs to revive marshes, swamps, and bog ecosystems, supporting their role in carbon sequestration and as wildlife habitats.

By Service Analysis

Physical Restoration leads with 33.2% in 2024 due to its hands-on approach to degraded ecosystem recovery

In 2024, Physical Restoration held a dominant market position, capturing more than a 33.2% share in the global ecological restoration service market. This segment includes direct interventions such as regrading land, replanting native vegetation, removing invasive species, and rebuilding natural hydrological flows. Its widespread adoption is largely due to its immediate and visible impact on degraded landscapes, especially in regions affected by mining, deforestation, and construction-related disturbances.

The demand for physical restoration services has grown steadily as countries implement large-scale recovery programs aligned with biodiversity goals and land degradation neutrality targets. In particular, areas affected by soil erosion, wetland loss, and forest degradation are seeing increased application of physical restoration techniques. These interventions are often part of publicly funded projects or infrastructure offset schemes that require tangible ecological outcomes.

By Application Analysis

Biodiversity Conservation leads with 39.4% in 2024 as species protection becomes a global priority

In 2024, Biodiversity Conservation held a dominant market position, capturing more than a 39.4% share in the ecological restoration service market. This strong position reflects the growing urgency to reverse habitat loss, restore natural ecosystems, and protect endangered species across the globe. Conservation-driven restoration efforts have become central to national and international environmental policies, especially as more countries adopt the 30×30 target — aiming to protect 30% of land and marine areas by 2030.

Biodiversity-focused projects are being actively implemented in forests, wetlands, grasslands, and coastal regions, where ecosystem services like pollination, seed dispersal, and food chain balance are at risk. Restoration activities under this application include reintroducing native flora and fauna, removing invasive species, and reconstructing natural habitats to support ecological diversity. These initiatives are not only critical for wildlife but also contribute to long-term climate resilience and food security.

By End User Analysis

Government Agencies dominate with 53.8% in 2024, driven by large-scale ecological and climate commitments

In 2024, Government Agencies held a dominant market position, capturing more than a 53.8% share in the ecological restoration service market. This leading share is primarily due to the active role of national and regional governments in funding, planning, and executing restoration programs aligned with environmental protection laws and international climate agreements. Public institutions continue to be the backbone of large-scale ecosystem recovery efforts, from wetland restoration and afforestation to river and soil rehabilitation.

Governments across the globe have prioritized ecological restoration as a core strategy to meet biodiversity targets, land degradation neutrality goals, and climate adaptation plans. Initiatives such as the UN Decade on Ecosystem Restoration, Green India Mission, and the European Green Deal have allocated significant budgets for restoration activities, often delivered through local forest departments, environmental agencies, and public infrastructure authorities. These projects not only restore ecological balance but also create jobs, enhance water security, and improve rural livelihoods.

Key Market Segments

By Туре

- Wetland

- Stream

- Land

- Others

By Service

- Physical Restoration

- Monitoring

- Planning

- Design & Engineering

- Consulting

- Site Acquisition

- Others

By Application

- Biodiversity Conservation

- Erosion Control

- Climate Change Mitigation

- Water Quality Improvement

By End User

- Government Agencies

- Non-Governmental Organizations

- Private Companies

- Educational Institutions

Emerging Trends

Rise of Nature-Positive Business Models in the Food Industry

A significant trend in ecological restoration services is the increasing adoption of nature-positive business models by food companies. These models go beyond traditional sustainability efforts by actively investing in the restoration and protection of ecosystems, aiming to enhance biodiversity, soil health, and water resources. This shift is driven by a growing recognition of the intrinsic value of nature and its direct impact on food security and supply chain resilience.

- For instance, Nestlé has partnered with reforestation startup re green and chocolatier Barry Callebaut to restore areas in Brazil’s cocoa and coffee regions. The initiative involves planting 11 million trees across 8,000 hectares, with the re.green project focusing on the Atlantic rainforest in Bahia and generating 880,000 carbon credits. Nestlé is fully funding the re.green initiative and covering 60% of the Barry Callebaut project, aligning with its goal to plant 200 million trees globally by 2030 .

Similarly, the U.S. Department of Agriculture (USDA) has announced the availability of $1.5 billion to help farmers, ranchers, and forest landowners adopt and expand conservation strategies. These projects aim to enhance natural resources while tackling the climate crisis, potentially saving farmers money, creating new revenue streams, and increasing productivity .

These examples illustrate a broader movement within the food industry towards integrating ecological restoration into business strategies. Companies are recognizing that investing in nature not only mitigates environmental risks but also offers long-term economic benefits. By adopting nature-positive approaches, businesses can contribute to the restoration of ecosystems, support sustainable agriculture, and build more resilient supply chains, ultimately fostering a harmonious relationship between food production and the natural world.

Drivers

Increasing Focus on Sustainability in Food Production

A major driving factor in the growth of ecological restoration services is the increasing focus on sustainability, especially within the food industry. As global awareness of environmental challenges continues to rise, businesses in the food sector are under growing pressure to implement more sustainable practices. This includes reducing the carbon footprint, conserving water, and restoring ecosystems impacted by agricultural activities. Ecological restoration plays a pivotal role in achieving these goals, with businesses increasingly seeking solutions that align with both environmental and economic sustainability.

In recent years, the food industry has seen a significant shift towards regenerative agriculture, which prioritizes soil health, biodiversity, and ecosystem restoration. According to the United Nations Food and Agriculture Organization (FAO), sustainable agriculture is essential for mitigating climate change and ensuring long-term food security. The FAO emphasizes the importance of restoring degraded lands and ecosystems to boost food production while minimizing environmental impact.

- For instance, in the U.S., the food industry has embraced initiatives like the 2030 Food Loss and Waste Reduction Goal, which calls for reducing food waste by 50% by 2030. This goal is directly tied to ecological restoration efforts, as reducing waste often involves reintroducing organic matter back into the soil, helping to restore its health and capacity to produce food sustainably.

In addition, global agricultural companies are making significant investments in ecological restoration to improve land productivity. For example, the World Resources Institute reports that by 2025, more than 2 billion hectares of land are expected to undergo some form of restoration, driven by both public and private sector funding. These efforts are not only beneficial for ecosystems but also help food companies meet sustainability targets, improve yields, and reduce operational costs.

Restraints

High Costs and Limited Funding for Ecological Restoration

A significant restraining factor for ecological restoration services is the high costs associated with large-scale restoration projects and the limited funding available for such initiatives. Restoration efforts, especially in agricultural landscapes, require substantial investments in both time and resources, which can be a significant barrier, particularly for small and medium-sized enterprises (SMEs) in the food industry.

- According to the United Nations Environment Programme (UNEP), it is estimated that global ecological restoration efforts could cost up to US$ 84 trillion by 2050 to restore 350 million hectares of degraded land. However, current investments are far below the required levels. In fact, UNEP estimates that only 10% of the necessary funds have been mobilized so far, leaving a significant gap between the need and available financial resources.

For the food industry, many companies face challenges in securing the necessary funding for such restoration projects. While large corporations in the food sector may be able to allocate funds to support restoration, smaller companies often struggle to do so, especially with competing financial priorities such as production costs, supply chain issues, and fluctuating market demands.

Moreover, government programs aimed at supporting ecological restoration often fall short in terms of coverage and funding. For example, the U.S. Department of Agriculture (USDA) offers financial assistance to farmers through its Conservation Reserve Program, which pays landowners to restore environmentally sensitive land. However, only a small fraction of agricultural land receives support, and the program’s funding is often limited, constraining its reach.

Opportunity

Growing Demand for Regenerative Agriculture Practices

A key growth opportunity for ecological restoration services lies in the increasing adoption of regenerative agriculture. As more food companies and farmers seek sustainable solutions to address soil degradation, biodiversity loss, and water scarcity, the demand for ecological restoration services is expected to rise. Regenerative agriculture goes beyond traditional conservation methods by focusing on restoring the entire ecosystem, from the soil to the surrounding wildlife, and it is gaining traction globally due to its proven benefits for long-term agricultural productivity.

Regenerative agriculture practices, such as cover cropping, crop rotation, agroforestry, and no-till farming, help restore soil health, sequester carbon, and enhance biodiversity. The Food and Agriculture Organization (FAO) has highlighted that regenerative practices can reduce agricultural emissions by up to 30%, while also improving soil fertility and water retention. These practices have become a priority for governments and organizations worldwide as they aim to tackle climate change and enhance food security.

- In the United States, the U.S. Department of Agriculture (USDA) has committed significant funding to support regenerative farming practices. In 2021, the USDA announced the “Climate-Smart Agriculture and Forestry” initiative, which allocated US$ 1 billion in funding to encourage farmers to adopt climate-friendly practices, including ecological restoration. This initiative is expected to benefit thousands of farmers and expand the market for ecological restoration services in the agricultural sector.

Additionally, global food companies are increasingly recognizing the value of restoring ecosystems as part of their sustainability strategies. For example, major brands in the food industry have pledged to restore millions of hectares of land to help meet their climate goals. As more food producers embrace regenerative agriculture, there will be a growing need for ecological restoration services to help implement and maintain these practices across large agricultural landscapes.

Regional Insights

North America Leads Ecological Restoration Service Market with 45.9% Share, Valued at USD 12.3 Billion in 2024

In 2024, North America emerged as the dominant region in the global ecological restoration service market, accounting for 45.9% of the total market share and reaching a valuation of approximately USD 12.3 billion. This leadership is attributed to the region’s strong policy frameworks, significant public investment, and a well-established network of federal and state agencies committed to ecological conservation and land rehabilitation. The United States and Canada have implemented extensive restoration programs focused on wetlands, forests, grasslands, and coastal zones, driven by both regulatory mandates and environmental liability requirements.

In the U.S., federal initiatives such as the Wetlands Reserve Program, Conservation Reserve Program (CRP), and large-scale efforts under the Environmental Protection Agency (EPA) and Department of the Interior have supported widespread adoption of restoration services. Additionally, the Bipartisan Infrastructure Law and Inflation Reduction Act have allocated substantial funds toward climate resilience and ecosystem repair, directly fueling market growth. Canada, through agencies such as Environment and Climate Change Canada (ECCC), has intensified its commitment to ecological restoration, with a focus on peatland and boreal forest recovery to meet its carbon neutrality targets.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

EnviroScience is a U.S.-based company specializing in ecological restoration, environmental consulting, and biological monitoring services. The company focuses on restoring aquatic ecosystems, including wetlands, streams, and lakes, using scientifically backed methods. In 2024, EnviroScience continued to support large-scale habitat restoration projects across state and federal levels. Their expertise in ecological assessments, native species planting, and streambank stabilization has positioned them as a key player in delivering regulatory-compliant and sustainable restoration outcomes across various watersheds in North America.

ENCAP, based in Illinois, provides ecological restoration, erosion control, and native landscape services. The company delivers a full range of field-based ecological services, including prairie, wetland, and woodland restoration. In 2024, ENCAP actively supported regional conservation initiatives through controlled burns, invasive species removal, and biodiversity enhancement. Their projects serve both urban and rural landscapes, and the firm is known for its field execution capabilities combined with regulatory compliance expertise. ENCAP continues to expand its footprint across the Midwest.

Jacobszoon Forestry is a California-based ecological services firm offering forest management, reforestation, and wildfire restoration planning. In 2024, the company played an important role in restoring fire-damaged landscapes, especially across Northern California, through thinning, fuel reduction, and native tree planting. They serve both public and private clients, including municipalities, land trusts, and utility companies. Jacobszoon’s integrated forestry and ecological knowledge supports long-term ecosystem health while aligning with climate resilience and carbon sequestration goals.

Top Key Players Outlook

- EnviroScience

- Jacobszoon Forestry

- ENCAP

- Polatin Ecological Services

- Heartland Restoration Services

- SWCA Environmental Consultants

- Kimley-Horn

- Apache Ecological Service

- Ecological Restoration Inc.

- Integrated Environmental Restoration Services

- Envite Environment

- National Audubon Society

- Conservation International

- Restoration Ecology

- Ecology Restoration Group

Recent Industry Developments

In 2024, EnviroScience actively advanced its role in the ecological restoration service market, planting 24,825 live stakes and 14,025 bare-root trees to restore habitats, treating over 500 acres for invasive species removal, and tracking 672 tons of greenhouse gas emissions.

In 2024, Polatin Ecological Services continued to play a meaningful role in the ecological restoration service market, with a compact team of 2–10 employees delivering native habitat restoration, invasive species control, and conservation planning projects across New England.

Report Scope

Report Features Description Market Value (2024) USD 26.9 Bn Forecast Revenue (2034) USD 51.5 Bn CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Туре (Wetland, Stream, Land, Others), By Service (Physical Restoration, Monitoring, Planning, Design and Engineering, Consulting, Site Acquisition, Others), By Application (Biodiversity Conservation, Erosion Control, Climate Change Mitigation, Water Quality Improvement), By End User (Government Agencies, Non-Governmental Organizations, Private Companies, Educational Institutions) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape EnviroScience, Jacobszoon Forestry, ENCAP, Polatin Ecological Services, Heartland Restoration Services, SWCA Environmental Consultants, Kimley-Horn, Apache Ecological Service, Ecological Restoration Inc., Integrated Environmental Restoration Services, Envite Environment, National Audubon Society, Conservation International, Restoration Ecology, Ecology Restoration Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ecological Restoration Service MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Ecological Restoration Service MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- EnviroScience

- Jacobszoon Forestry

- ENCAP

- Polatin Ecological Services

- Heartland Restoration Services

- SWCA Environmental Consultants

- Kimley-Horn

- Apache Ecological Service

- Ecological Restoration Inc.

- Integrated Environmental Restoration Services

- Envite Environment

- National Audubon Society

- Conservation International

- Restoration Ecology

- Ecology Restoration Group