Global Ear Wax Removal Products Market By Product Type (Ear Drops, Ear Spray, Ear Candles, Cotton Swabs & Buds, and Others), By Price Range (Low, High, and Medium), By Distribution Channel (Offline (Mega Retail Stores, Pharmacies, Specialty Stores, and Others), and Online (Company Websites, and E-Commerce Sites)), By End-User (Individual Consumers, Hospitals and Clinics, Healthcare Professionals (Audiologists, ENT Specialists, and General Practitioners), and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157498

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

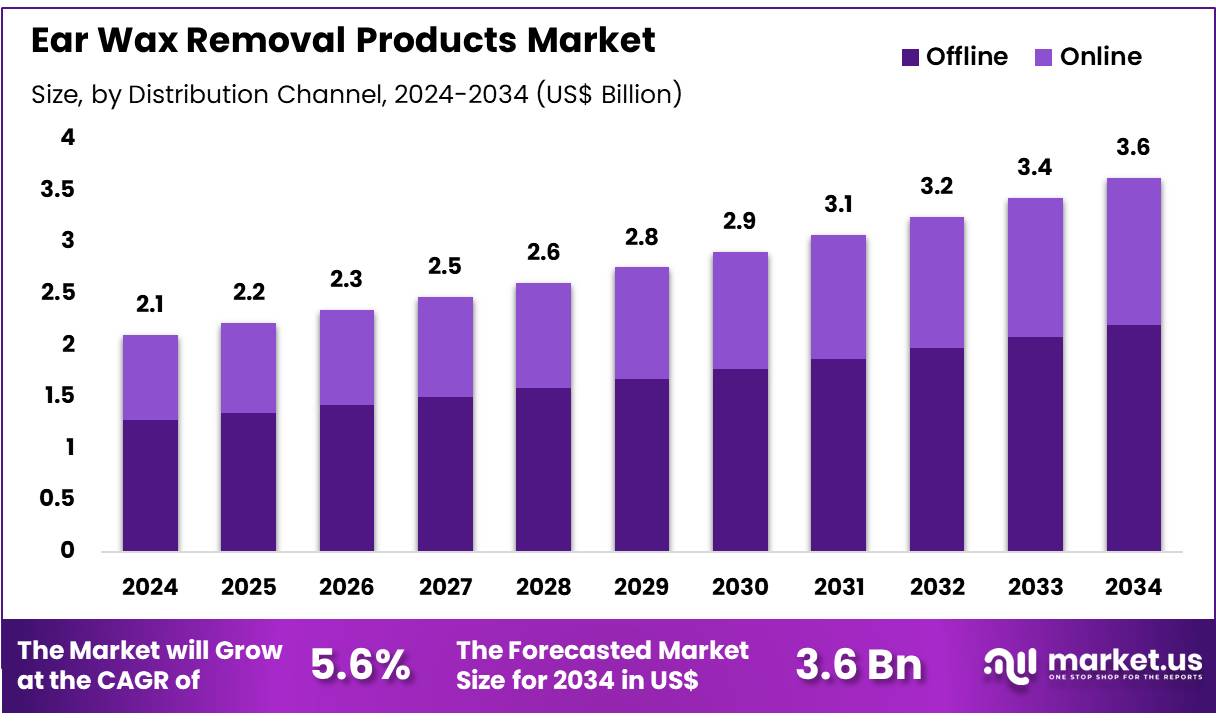

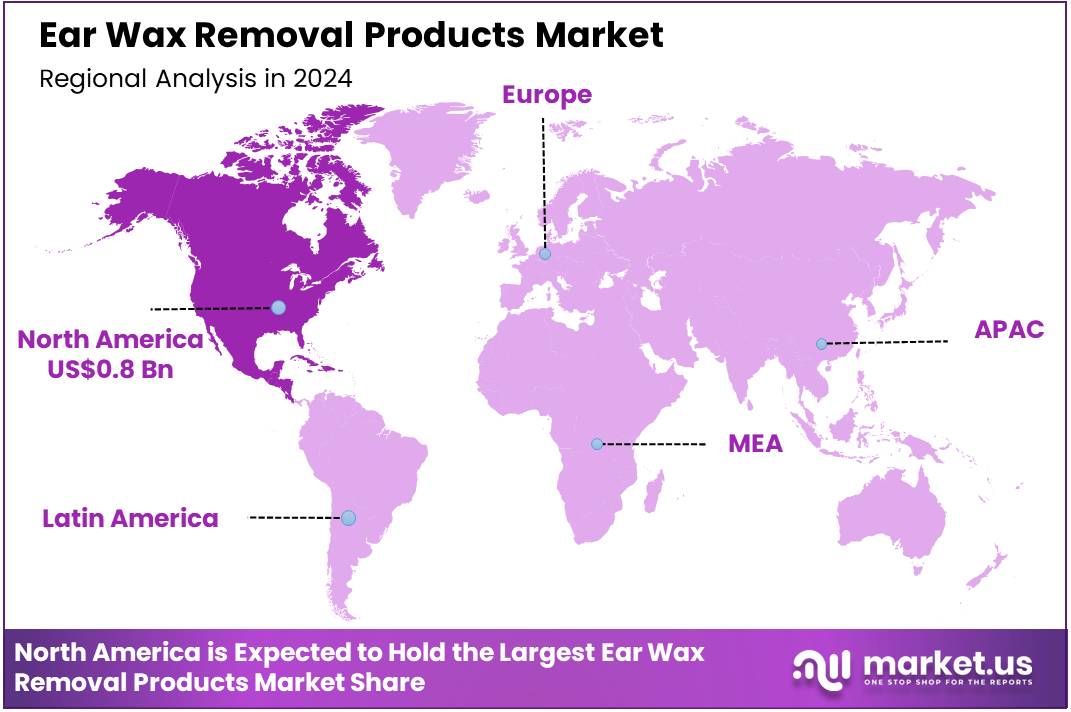

Global Ear Wax Removal Products Market size is expected to be worth around US$ 3.6 Billion by 2034 from US$ 2.1 Billion in 2024, growing at a CAGR of 5.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.9% share with a revenue of US$ 0.8 Billion.

Rising prevalence of cerumen impaction and a growing focus on preventative health are key drivers for the ear wax removal products market. Cerumen impaction, or excessive ear wax buildup, is a common condition that can lead to hearing loss, discomfort, and earaches. The American Academy of Otolaryngology reports that approximately 1 in 10 children and 1 in 20 adults in the general population experience this condition. This widespread issue creates a consistent and strong demand for safe and effective products that consumers can use at home to manage their ear hygiene and avoid more serious medical complications.

Growing technological innovation and a shift toward multi-purpose devices are key trends shaping the market. Manufacturers are developing a new generation of products that go beyond traditional ear drops or cotton swabs, incorporating advanced features for improved safety and efficacy. For exam

ple, in May 2022, Allstar Innovations, in collaboration with Black Wolf, launched the WUSH Ear Cleaner, an innovative device that offers a safe and effective solution for earwax removal. With its triple jet stream of water and foldable nozzle, the WUSH cleaner provides a professional-grade experience suitable for both personal and clinical use, highlighting the industry’s focus on user-friendly and feature-rich products.

ple, in May 2022, Allstar Innovations, in collaboration with Black Wolf, launched the WUSH Ear Cleaner, an innovative device that offers a safe and effective solution for earwax removal. With its triple jet stream of water and foldable nozzle, the WUSH cleaner provides a professional-grade experience suitable for both personal and clinical use, highlighting the industry’s focus on user-friendly and feature-rich products.Increasing consumer preference for non-invasive, at-home solutions is creating significant opportunities for market expansion. The high prevalence of earwax buildup, especially among older adults, underscores the need for convenient and accessible care. A 2024 study on cerumen impaction in the US population found a prevalence of 32.4% among adults aged 70 and older, a figure that highlights the immense need for products that can be used at home. This trend, combined with the rising visibility of products through e-commerce platforms and social media, is empowering individuals to take control of their ear health without the need for frequent clinical visits.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.1 Billion, with a CAGR of 5.6%, and is expected to reach US$ 3.6 Billion by the year 2034.

- The product type segment is divided into ear drops, ear spray, ear candles, cotton swabs & buds, and others, with ear drops taking the lead in 2023 with a market share of 42.3%.

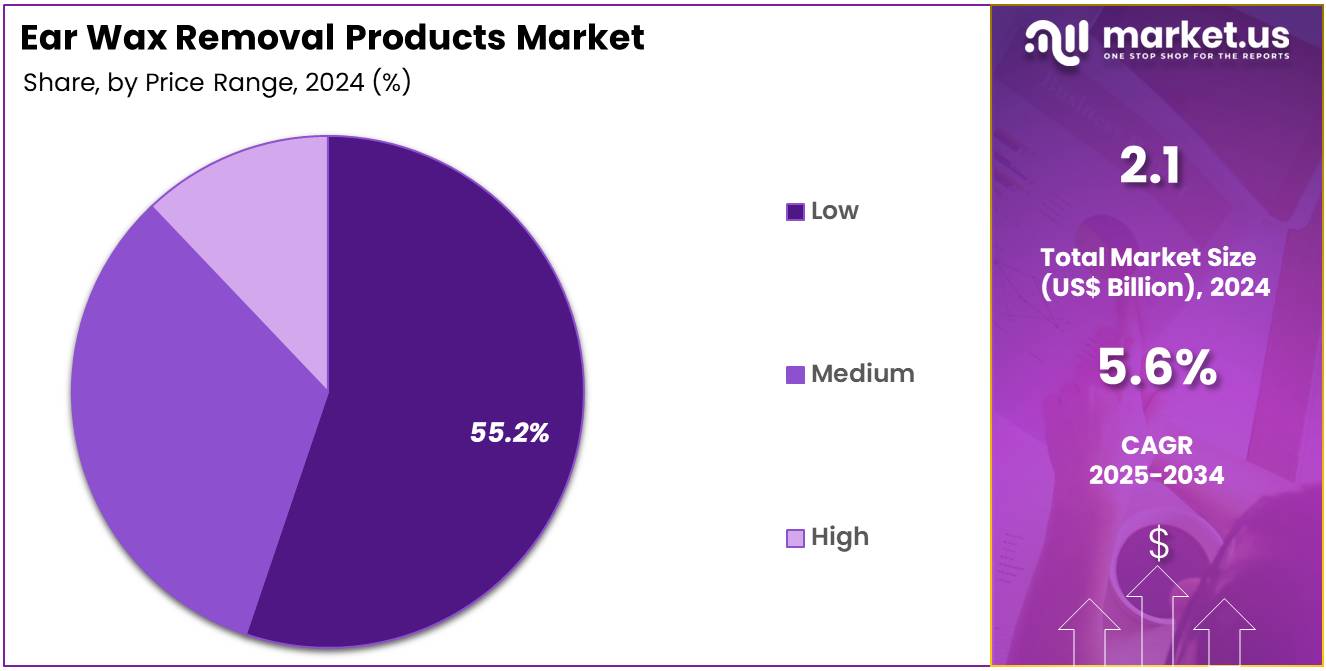

- Considering price range, the market is divided into low, high, and medium. Among these, low held a significant share of 55.2%.

- Furthermore, concerning the distribution channel segment, the market is segregated into offline and online. The offline sector stands out as the dominant player, holding the largest revenue share of 60.8% in the market.

- The end-user segment is segregated into individual consumers, hospitals and clinics, healthcare professionals, and others, with the individual consumers segment leading the market, holding a revenue share of 48.9%.

- North America led the market by securing a market share of 40.9% in 2023.

Product Type Analysis

Ear drops dominate the ear wax removal products market, holding a 42.3% share. This product is expected to maintain its leading position due to its ease of use, affordability, and effectiveness in treating ear wax buildup. The growing awareness of ear hygiene, particularly among individuals prone to ear infections or excessive earwax buildup, is anticipated to further drive demand for ear drops. The convenience of home-based treatment and the availability of over-the-counter (OTC) ear drops are likely to contribute to the segment’s growth.

Additionally, the growing popularity of natural and non-invasive treatments is expected to boost demand for ear drops made with organic ingredients, further supporting this segment’s market dominance. As healthcare professionals increasingly recommend ear drops for their simplicity and safety, ear drops will continue to be a preferred choice for consumers seeking ear wax removal solutions.

Price Range Analysis

The low price range holds the largest share in the ear wax removal products market with 55.2%. This segment’s growth is primarily driven by the high demand for affordable solutions in both developed and emerging markets. Consumers continue to seek cost-effective treatments, especially for routine needs like ear wax removal. The increasing availability of low-priced ear wax removal products, coupled with rising disposable incomes in emerging markets, will likely continue to drive the segment’s growth.

The widespread distribution of low-cost products in supermarkets, pharmacies, and online platforms makes them accessible to a larger audience. With the growing trend of self-care, consumers are expected to increasingly opt for budget-friendly options, ensuring sustained demand for low-priced ear wax removal solutions.

Distribution Channel Analysis

The offline distribution channel dominates the market, accounting for 60.8% of the share. This growth is expected to persist as brick-and-mortar stores remain a primary shopping method for many consumers, especially in rural areas and among older generations. The availability of ear wax removal products in pharmacies, supermarkets, and retail stores allows consumers to easily access and purchase these products on-site.

The advantage of physical stores lies in immediate product availability and the opportunity for in-person consultation with store staff. Additionally, the increase in the number of pharmacies and retail stores offering ear care products will likely drive the growth of this segment. As consumers continue to trust physical retail for health and personal care products, offline distribution is expected to remain a dominant force in the market.

End-User Analysis

Individual consumers make up 48.9% of the ear wax removal products market. This segment is anticipated to grow as self-care becomes increasingly important, with more individuals taking a proactive approach to their health and hygiene. The increasing availability of ear wax removal products over the counter and through online platforms has made it easier for consumers to manage ear health independently.

The rising awareness of the importance of ear hygiene, coupled with growing concerns about ear infections and related complications, is expected to contribute to increased sales in this segment. As people prioritize convenience and affordability in their healthcare solutions, individual consumers will continue to be the dominant market driver in the ear wax removal products industry.

Key Market Segments

Product Type

- Ear Drops

- Ear Spray

- Ear Candles

- Cotton Swabs & Buds

- Others

Price Range

- Low

- High

- Medium

End-Use

- Individual Consumers

- Hospitals and Clinics

- Healthcare Professionals

- Audiologists

- ENT Specialists

- General Practitioners

- Others

Distribution Channel

- Offline

- Mega Retail Stores

- Pharmacies

- Specialty Stores

- Others

- Online

- Company Websites

- E-Commerce Sites

Drivers

The rising prevalence of cerumen impaction is driving the market.

The market for ear wax removal products is experiencing significant growth, primarily driven by the high and increasing prevalence of cerumen impaction, or excessive ear wax buildup. This condition is a common reason for medical visits and is particularly prevalent among older adults, a demographic that is growing globally. Poor ear cleaning habits, such as the use of cotton swabs, can also exacerbate the issue by pushing wax deeper into the ear canal.

The widespread nature of this problem creates a substantial and consistent demand for effective and convenient at-home solutions. According to a study titled “Cerumen impaction: Prevalence and associated factors in the United States population,” published in the journal Otolaryngology–Head and Neck Surgery in March 2024, the prevalence of cerumen impaction was estimated at 18.6% among individuals 12 years and older in the United States.

For adults aged 70 years and above, this figure rose to 32.4%. This high prevalence, especially within an aging population, highlights a clear need for accessible and easy-to-use products that allow consumers to manage their condition without a doctor’s visit, making the at-home product market a key growth area.

Restraints

The risk of improper use and resulting adverse events is restraining the market.

A significant restraint on the market is the risk of consumer misuse and the subsequent potential for serious adverse events. Ear wax removal products, particularly electronic tools and curettes, can cause serious injury if not used correctly. Pushing too far into the ear canal can lead to eardrum perforation, while improper cleaning techniques can cause infection or push wax deeper, worsening the impaction.

Concerns about safety and effectiveness can deter consumers from purchasing products and can also lead to product recalls or regulatory scrutiny. For example, a search of the US Food and Drug Administration (FDA)’s MAUDE (Manufacturer and User Facility Device Experience) database reveals multiple adverse event reports for ear wax removal devices in 2023 and 2024.

A specific report from December 2023 details a patient experiencing a perforated eardrum after using an at-home ear blaster device. The voluntary nature of this reporting means the true number of injuries is likely higher, but such incidents underscore the critical safety risks that act as a headwind for market growth.

Opportunities

The development of advanced electronic devices is creating growth opportunities.

A key growth opportunity in the ear wax removal market lies in the development of technologically advanced and user-friendly electronic devices. These new products offer a significant improvement over traditional ear drops or manual tools by providing enhanced safety and greater efficacy through innovative features.

Many of these devices now incorporate a camera and a light source, allowing the user to visualize the inside of their ear canal in real-time on a connected smartphone or tablet. This visual guidance minimizes the risk of injury and gives the user a better sense of control over the process. A review of the US Patent and Trademark Office (USPTO)’s database shows a surge in patent activity for these devices.

For example, in 2024, multiple design patents were granted for electronic ear cleaning tools with integrated cameras, highlighting a strong focus on this trend. This innovation is attracting new consumers and is creating a premium segment within the market for products that provide a safer and more effective at-home solution.

Impact of Macroeconomic / Geopolitical Factors

The ear wax removal products market is being shaped by shifts in consumer spending and broader economic trends. With rising inflation and the potential for economic downturns, consumers are increasingly prioritizing self-care and more affordable over-the-counter health solutions to avoid expensive clinical visits. This is reflected in the market’s forecast, with the low-price segment expected to command a significant portion of revenue share, as consumers opt for products like ear drops and sprays over professional procedures.

Geopolitical tensions have also impacted the global supply chain, which, like many health product industries, is reliant on components and raw materials from countries such as China. The United States has enacted tariffs on a range of imported goods, including certain medical devices and their components.

Tariffs from China and the EU can be as high as 54% and 20% respectively, driving up manufacturing and import costs for companies. This forces businesses to either absorb these costs, pass them on to consumers through higher prices, or re-evaluate their supply chains to seek domestic alternatives, potentially disrupting distribution and availability.

Latest Trends

The integration of smart technology with visual guidance is a recent trend.

A defining trend in 2024 is the accelerated integration of smart technology and visual guidance into at-home ear wax removal devices. This innovation goes beyond basic electronic tools by using sophisticated mobile applications that connect directly to the device’s camera. The app provides a live, high-definition feed of the ear canal, giving the user unprecedented visual control and precision. This technology is particularly valuable because it helps to mitigate the safety risks associated with blindly inserting a tool into the ear.

In 2024, prominent manufacturers have launched upgraded versions of their ear care devices that feature these enhanced capabilities. A review of a leading brand’s product lineup from February 2024 shows an updated model boasting a 10-megapixel HD ear camera with an ergonomic, fine-motor tweezer. This level of technological sophistication sets a new standard for at-home ear care, attracting consumers who prioritize safety and professional-grade results.

Regional Analysis

North America is leading the Ear Wax Removal Products Market

The North American market for ear wax removal products held a significant 38.5% share of the global market in 2024. This leadership is directly attributable to the high prevalence of cerumen impaction, an aging population, and a strong consumer preference for convenient, at-home self-care solutions. The widespread nature of the condition places a significant burden on the healthcare system, creating a substantial demand for at-home alternatives.

According to a 2023 study published in the journal Otolaryngology–Head and Neck Surgery, cerumen impaction accounts for approximately 12 million medical office visits annually in the United States, and its removal is the third most billed procedure by otolaryngologists. This heavy reliance on clinical intervention highlights a key driver for the market, as consumers seek to manage the issue more cost-effectively at home. Furthermore, the increasing use of personal audio devices like earbuds and headphones contributes to the problem by pushing earwax deeper into the ear canal, driving a consistent demand for effective over-the-counter products.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific ear wax removal products market is anticipated to experience robust growth during the forecast period. This is largely a result of rapidly increasing health consciousness, a vast and aging population, and a growing adoption of modern hygiene practices. The World Health Organization (WHO) highlights that the number of people aged 65 and over in Asia and the Pacific nearly tripled from 168 million in 1990 to 503 million in 2024, creating a substantial and growing demographic with age-related ear issues.

The market’s expansion is further supported by a shift in consumer behavior toward professional and at-home ear care, moving away from traditional methods that are often unsafe. For instance, in India, a 2022 report from the National Programme for Prevention and Control of Deafness found that approximately 63 million people in the country suffer from significant hearing impairment, and a portion of this is attributable to preventable causes like cerumen impaction.

Governments throughout the region are also actively promoting ear and hearing care through public health initiatives, which is likely to increase product accessibility for a broader consumer base and fuel the market’s growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the ear wax removal products market are driving growth through several key strategies. They are heavily investing in product innovation, particularly by developing more convenient and effective home-use devices like automated irrigation systems and portable micro-suction tools. Companies are also pursuing aggressive digital marketing and e-commerce expansion to reach a broader, more tech-savvy audience and leverage the convenience of online shopping.

Furthermore, they are broadening their product portfolios to offer solutions that cater to specific types of wax and consumer preferences. This combination of advanced product development and sophisticated marketing is essential for maintaining a competitive edge.

GlaxoSmithKline plc (GSK), a global pharmaceutical leader, has a significant presence in the market through its consumer healthcare brands, including Debrox. The company’s business model is centered on a deep commitment to consumer-focused wellness, offering a wide range of over-the-counter products that promote health and comfort.

GSK’s strategy involves leveraging its portfolio of well-known and trusted brands, while also investing in new product development and targeted marketing initiatives to drive brand loyalty and customer acquisition. The company’s focus on brand recognition and continuous innovation makes it a key player in the global health and wellness market.

Top Key Players

- Murine Ear

- Johnson & Johnson

- Hydro Clean

- Hear Right Technologies LLC

- Eosera Inc

- Earways Medical

- Doctor Easy Medical Products

- Cerumol (Reckitt Benckiser)

- Black Wolf Nation

- Bausch + Lomb

Recent Developments

- In July 2024, Eosera introduced a convenient, single-use delivery system for its doctor-recommended, over-the-counter ear care products. Designed for one-handed operation, the new system emphasizes ease of use, making it more practical for consumers seeking a hassle-free ear care experience.

- In May 2024, Earways Medical launched its Ear Way and Ear Way Pro devices, catering to both medical professionals and individual users. These intuitive devices mark a significant development in making high-quality ear care solutions more accessible and easy to use for a wide range of people.

- In March 2024, Johnson & Johnson (NYSE: JNJ) completed its acquisition of Ambrx Biopharma, Inc., a move that enhances its capabilities in the biopharmaceutical sector, expanding its portfolio of cutting-edge healthcare solutions.

Report Scope

Report Features Description Market Value (2024) US$ 2.1 Billion Forecast Revenue (2034) US$ 3.6 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ear Drops, Ear Spray, Ear Candles, Cotton Swabs & Buds, and Others), By Price Range (Low, High, and Medium), By Distribution Channel (Offline (Mega Retail Stores, Pharmacies, Specialty Stores, and Others), and Online (Company Websites, and E-Commerce Sites)), By End-User (Individual Consumers, Hospitals and Clinics, Healthcare Professionals (Audiologists, ENT Specialists, and General Practitioners), and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Murine Ear, Johnson & Johnson, Hydro Clean, Hear Right Technologies LLC, Eosera Inc, Earways Medical, Doctor Easy Medical Products, Cerumol (Reckitt Benckiser), Black Wolf Nation, Bausch + Lomb. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ear Wax Removal Products MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Ear Wax Removal Products MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Murine Ear

- Johnson & Johnson

- Hydro Clean

- Hear Right Technologies LLC

- Eosera Inc

- Earways Medical

- Doctor Easy Medical Products

- Cerumol (Reckitt Benckiser)

- Black Wolf Nation

- Bausch + Lomb