Global E-sports Sponsorship Market Size, Share Analysis Report By Sponsorship Type (Team Sponsorships, Event Sponsorships, Streamer/Influencer Sponsorships, Platform Sponsorships, Others), By Industry Verticals of Sponsors (Technology & Consumer Electronics, Beverage & Food Brands, Financial Services & Crypto, Apparel & Lifestyle, Telecommunications & Internet Providers, Others), By Game Genre (MOBA, FPS, Battle Royale, Sports Simulation, Strategy Games, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151322

- Number of Pages: 284

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

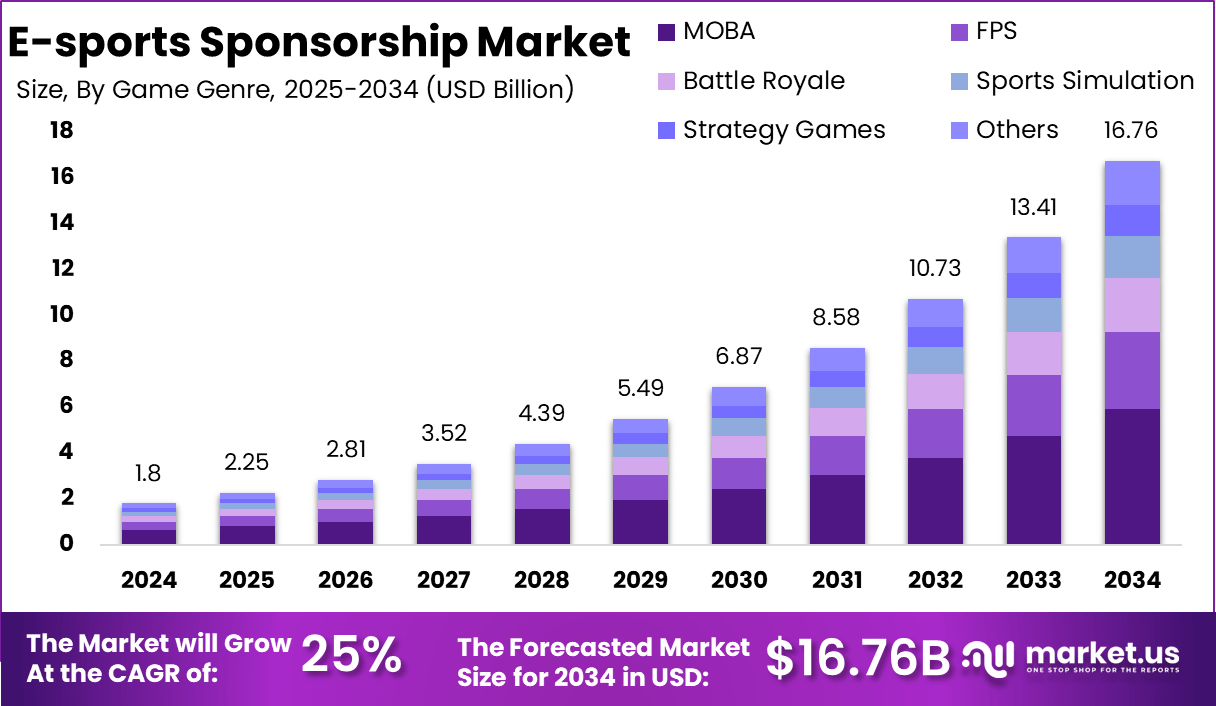

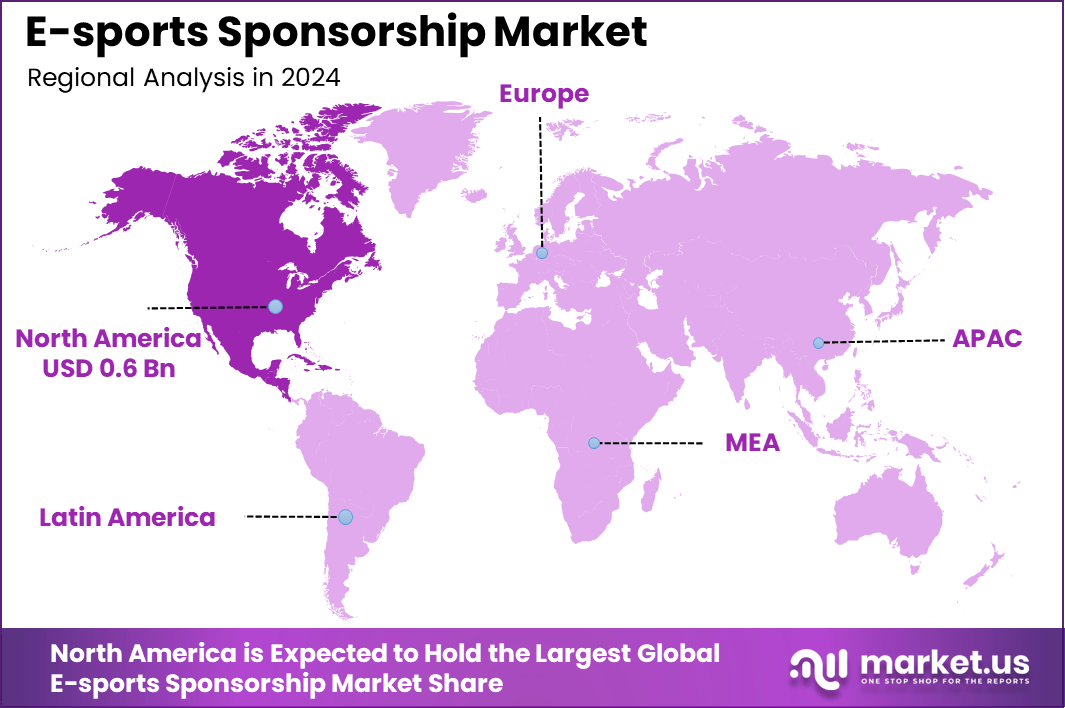

The Global E-sports Sponsorship Market size is expected to be worth around USD 16.76 Billion By 2034, from USD 1.8 billion in 2024, growing at a CAGR of 25% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.4% share, holding USD 0.6 Billion revenue.

The e‑sports sponsorship market has emerged as a pivotal revenue and engagement channel within the broader competitive gaming ecosystem. Brands are increasingly aligning with gaming events, teams, and influencers to reach a growing and highly engaged audience of digitally native consumers. This market leverages the emotional and cultural bonds between players and sponsors, facilitating direct brand integration through event signage, content placement, and innovative digital activations.

A key driving factor is the surge in global esports viewership and fan engagement. The worldwide audience, under a billion strong, has attracted sponsors seeking to build affinity with younger demographics. The visibility offered by high‑exposure tournament branding and live streams enhances sponsor value. This has led to increased activation across tournaments and team partnerships, as brands aim to blend visibility with authenticity in esports contexts.

AI also enhances integration between traditional sports and e‑sports, enabling cross‑platform sponsorship measurement. Sponsors can apply unified analytics frameworks, originally developed for traditional sports, to e‑sports content. These systems now provide a cohesive approach to marketing investments covering leagues, tournaments, and crossover events.

Technology plays a critical role in enabling sponsorship innovation. Augmented reality overlays, shoppable links, and in-game branded activations have gained traction in recent tournaments. These technologies blend sponsorship content into the viewing experience, creating seamless interaction points that enhance both brand recall and viewer immersion.

According to Market.us, The global esports market is undergoing rapid expansion, driven by growing investments, media rights deals, and the mainstreaming of competitive gaming. The market is projected to reach around USD 16.7 billion by 2033, advancing at a strong CAGR of 21.9% over the forecast period. In 2023, North America emerged as the leading region, generating over USD 0.83 billion and capturing more than 36.3% of the global share.

According to Keevee, global sponsorship spending is projected to reach USD 96.4 billion by 2025, with brands allocating 20% of their marketing budgets to sponsorship activities. The surge in investment is being driven by the proven ability of sponsorships to deliver stronger brand engagement and campaign amplification.

Sports sponsorships dominate with 70% share, fueled by global events like the Olympics, FIFA, and the NFL. Meanwhile, music and entertainment sponsorships are expanding by 15% annually, with festivals, concerts, and streaming platforms offering brands valuable exposure to younger, highly engaged audiences.

As per ExplodingTopics, the esports industry has exceeded USD 1.6 billion in total market value, with the U.S. leading at USD 1.07 billion, overtaking China. The industry’s financial ecosystem continues to evolve, with Dota 2’s 2023 prize pool nearing USD 30 million, and top organizations like TSM valued at USD 540 million.

Investment opportunities are large in sponsorship strategies that fuse gaming, data analytics, and creative content. Opportunities exist in targeted micro‑sponsorship of influencers, event co‑creation, and branded content series. Growth regions notably include Asia‑Pacific and the Middle East, where esports viewership is rapidly expanding and new events are emerging

Key Takeaways

- In 2024, North America held a dominant market position, capturing more than a 34.4% share, generating USD 0.6 Billion in revenue, driven by high audience engagement and structured league ecosystems.

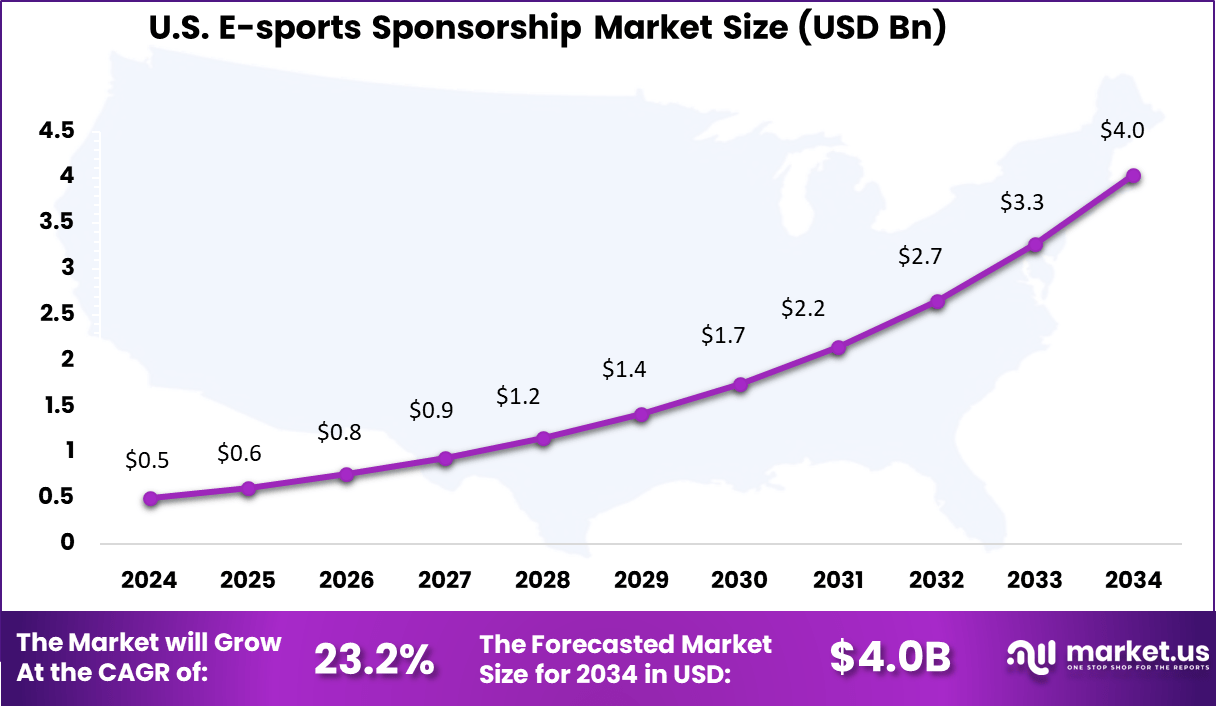

- The US alone contributed USD 0.526 Billion in 2024, with a strong CAGR of 23.2%, backed by increasing brand activations and collegiate-level e-sports expansion.

- By Sponsorship Type, Team Sponsorships accounted for 35.4% of the global share, as brands preferred long-term visibility through team branding, jerseys, and exclusive partnerships.

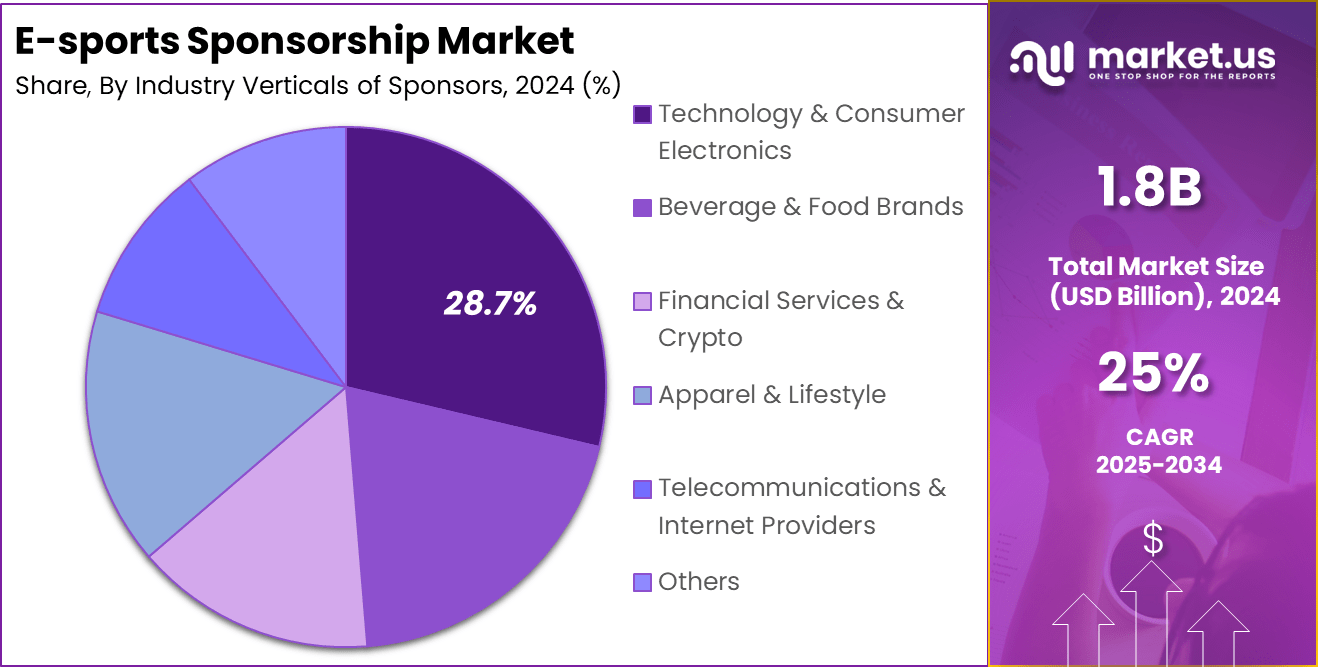

- Technology & Consumer Electronics led the sponsor verticals with 28.7% share, owing to product alignment with gamer demographics and integration opportunities during live events and streams.

- By Game Genre, MOBA games dominated with a 30.6% share, driven by high viewership, structured tournaments, and consistent fan engagement across titles like League of Legends and Dota 2.

US Market Expansion

The US E-sports Sponsorship Market is valued at USD 0.5 Billion in 2024 and is predicted to increase from USD 1.4 Billion in 2029 to approximately USD 4.0 Billion by 2034, projected at a CAGR of 23.2% from 2025 to 2034.

The United States holds a leading position in the E-sports Sponsorship Market due to several interlinked economic, technological, and cultural factors that have fostered a supportive ecosystem for brand engagement in competitive gaming.

One of the primary reasons is the strong digital infrastructure and internet penetration across the country. With high-speed connectivity and widespread access to advanced gaming platforms, the U.S. has created a seamless environment for online gaming tournaments and live streaming, allowing sponsors to reach millions of engaged viewers in real time.

Additionally, the U.S. market benefits from the significant presence of global brands and advertisers with high digital marketing budgets. Major companies are actively investing in e-sports to connect with the younger demographic, especially Gen Z and Millennials, who represent a substantial share of the gaming audience. This audience is considered highly valuable due to its purchasing power and digital nativity.

In 2024, North America held a dominant market position, capturing more than 34.4% share and generating around USD 0.6 billion in revenue within the global E-sports Sponsorship Market. This leadership can be attributed to the region’s early commercialization of e-sports, robust digital infrastructure, and strong investment pipelines from corporate sponsors, media networks, and gaming platforms.

North America, particularly the United States, has witnessed a steady rise in large-scale tournaments, franchise-based e-sports leagues, and celebrity endorsements, all of which have significantly elevated sponsorship appeal. Major brands have increasingly partnered with gaming influencers and streamers, recognizing the region’s deep engagement with online gaming audiences.

By Sponsorship Type Analysis

In 2024, Team Sponsorships segment held a dominant market position, capturing more than a 35.4% share of the total e‑sports sponsorship market. This superior performance is driven by the deep-rooted appeal of team identity among fans.

Supporting well-established teams enhances brand visibility through uniform logos, event overlays, and collaborative merchandise – ensuring sustained exposure throughout a season. Additionally, team sponsorships benefit from long-term multi-year agreements that deliver predictable returns and deeper strategic integration compared to one-off event deals.

Many leading teams maintain highly engaged global audiences, creating fertile ground for sponsors aiming to build affinity and loyalty through consistent representation. Furthermore, the expanding professionalism of e‑sports leagues has boosted the credibility and visibility of team-level sponsorships. As organizations adopt traditional sports frameworks – complete with performance analytics, coaching staff, player academies, and fan engagement platforms – sponsors are increasingly drawn to align with these stable structures.

This alignment supports broader marketing goals, including audience targeting and brand positioning. As a result, team sponsorships have attracted significant investment and have remained the leading segment, reflecting sponsors’ preference for authentic, relationship-based brand associations within the dynamic e‑sports ecosystem.

By Industry Verticals of Sponsors Analysis

In 2024, Technology & Consumer Electronics segment held a dominant market position, capturing more than a 28.7% share of e-sports sponsorship, largely due to its strategic alignment with gaming audiences. Brands in this category have been leveraging hardware showcases, product launches, and co-branded esports events to demonstrate high-performance capabilities in real-world settings.

The integration of cutting-edge peripherals, gaming rigs, and display technologies into competitive tournaments and influencer streams has created immersive experiences that resonate deeply with tech-savvy viewers. This leadership is also driven by the demographic affinity between esports fans and consumer electronics brands.

The millennial and Gen Z cohorts – who account for the majority of esports viewership – are enthusiastic early adopters of the latest gadgets and gear. Sponsorships from chipset manufacturers, PC and console brands, and smartphone providers enable direct engagement through product placements, giveaways, and on-site demo zones. These activations reinforce brand credibility and position sponsors as essential partners in the gaming ecosystem, strengthening consumer perceptions of innovation and performance.

By Game Genre Analysis

In 2024, the MOBA segment held a dominant market position, capturing more than a 30.6% share. This leadership is attributable to its expansive viewer base, well‑established tournament ecosystems, and high sponsorship appeal.

Flagship titles like League of Legends and Dota 2 continue to draw tens of millions of viewers globally, supported by massive prize pools and viewership (e.g., Dota 2’s International consistently ranks among the most‑watched esports events).

These dynamics create a virtuous cycle: strong audience engagement attracts premium sponsorships, which in turn fuel more polished production and further community growth. Furthermore, MOBAs benefit from robust in‑game economies and free‑to‑play models that lower barriers for player participation while monetizing through cosmetic purchases.

This model fosters broad user acquisition and engagement, reinforcing brand exposure opportunities for sponsors. In 2024, sponsorship continued as the leading revenue driver in esports – accounting for over 60% of total revenue – with the MOBA genre contributing disproportionately due to its global reach and deep fan loyalty.

Key Market Segments

By Sponsorship Type

- Team Sponsorships

- Event Sponsorships

- Streamer/Influencer Sponsorships

- Platform Sponsorships

- Others

By Industry Verticals of Sponsors

- Technology & Consumer Electronics

- Beverage & Food Brands

- Financial Services & Crypto

- Apparel & Lifestyle

- Telecommunications & Internet Providers

- Others

By Game Genre

- MOBA

- FPS

- Battle Royale

- Sports Simulation

- Strategy Games

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

AI‑Driven Brand Recognition

AI‑powered systems are being adopted to track sponsor visibility in real time – recognizing logos and audio mentions during live matches, clips, and broadcasting. These tools transform raw media into actionable exposure data, allowing transparent dashboards that quantify exactly how often a brand appears, where, and for how long. This shift to automated analytics is strengthening trust between sponsors and e‑sports teams by grounding sponsorship decisions in measurable outcomes.

Driver

Expansion of Mobile‑First Viewership

Mobile gaming continues to fuel e‑sports viewership, especially in Southeast Asia and Latin America. As 5G connectivity improves, tournaments held on smartphones reach a broader, younger demographic. This mobile-led audience is attractive to brands outside traditional gaming, as campaigns can be tailored to short‑form, mobile-accessible formats. This expanding mobile ecosystem is thus a powerful driver behind e‑sports sponsorship growth.

Restraint

Elevated Entry Costs with Reputation Risks

Engaging in e‑sports sponsorship increasingly requires heavy investment – not only in analytics tools, but also in bespoke content such as AR overlays and in‑game branding. Moreover, linking a brand with influential e‑sports individuals or teams can pose reputational risks if controversies arise. Together, the financial burden and brand‑safety considerations may deter sponsors from committing fully.

Opportunity

Tailored Activation through Community Engagement

The combination of rich audience data and interactive platforms presents ripe opportunity for customized sponsor‑fan experiences. Brands can develop specialized content – community polls, live challenges, branded in-stream overlays, or co-created segments with influencers. As streaming platforms evolve, this activation format lets sponsors engage more personally with niche segments, creating stronger affinity and brand recall compared to traditional ads.

Challenge

Demonstrating Robust ROI and Transparency

Sponsors now demand precise return metrics – not just visibility, but guaranteed impressions, viewer engagement and demographic insights. This has elevated expectations for contractual clarity and performance tracking. E‑sports entities are tasked with integrating data from broadcast, streaming, social platforms, and mobile sources into unified dashboards to meet these standards. The complexity of delivering consistent, verified ROI remains a key challenge.

Key Player Analysis

In 2025, Intel, Nvidia, and AMD continued their strong presence in e-sports sponsorship by integrating high-performance hardware with professional gaming events. These companies focused on exclusive partnerships with tournament organizers and gaming leagues. Their efforts were aimed at promoting next-generation CPUs and GPUs among the global gaming community.

By sponsoring gaming influencers and streaming tournaments, these brands deepened their engagement with competitive players and spectators. Their hardware innovations aligned directly with the performance needs of e-sports professionals, strengthening their visibility across international stages. Peripheral and lifestyle-focused brands such as Logitech G, Razer Inc., and Champion intensified their involvement through custom gear, team branding, and player endorsements.

Logitech and Razer expanded their footprint by releasing limited-edition accessories designed for elite players. Apparel brands like Champion introduced e-sports-specific collections that merged comfort with team identity. At the same time, Nike, Puma, and Adidas utilized athlete-driven campaigns to bring traditional sports sponsorship tactics into the e-sports arena, helping bridge athletic performance culture with virtual gaming.

Top Key Players Covered

- Intel Corporation

- Nvidia Corporation

- AMD

- Logitech G

- Razer Inc.

- Red Bull

- Monster Energy

- Coca-Cola

- PepsiCo (Mountain Dew Game Fuel, Doritos)

- Unilever (AXE, Dove brand activations)

- Nike

- Puma

- Adidas

- Champion

- Mastercard

- Coinbase

- Verizon

- AT&T

- Others

Recent Developments

- In June 2025, AMD extended its partnership with Toronto Ultra (Call of Duty League), ensuring continued hardware support for the franchise. This expansion demonstrates AMD’s escalating role in high visibility franchises. Moreover, AMD’s June 2025 “Advancing AI 2025” event signaled upcoming launches of next‑gen Instinct GPUs, likely bolstering turnkey solutions for esports production environments.

- In May 2025, Intel renewed its multi‑year partnership with ESL FACEIT Group, continuing as the headline partner for flagship Counter‑Strike 2 and Intel Extreme Masters tournaments – marking over 24 years of collaboration. The growth of this long‑standing alliance reaffirms Intel’s strategic commitment to global competitive gaming circuits.

Report Scope

Report Features Description Market Value (2024) USD 1.8 Bn Forecast Revenue (2034) USD 16.76 Bn CAGR (2025-2034) 25% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Sponsorship Type (Team Sponsorships, Event Sponsorships, Streamer/Influencer Sponsorships, Platform Sponsorships, Others), By Industry Verticals of Sponsors (Technology & Consumer Electronics, Beverage & Food Brands, Financial Services & Crypto, Apparel & Lifestyle, Telecommunications & Internet Providers, Others), By Game Genre (MOBA, FPS, Battle Royale, Sports Simulation, Strategy Games, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Intel Corporation, Nvidia Corporation, AMD, Logitech G, Razer Inc., Red Bull, Monster Energy, Coca-Cola, PepsiCo (Mountain Dew Game Fuel, Doritos), Unilever (AXE, Dove brand activations), Nike, Puma, Adidas, Champion, Mastercard, Coinbase, Verizon, AT&T, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  E-sports Sponsorship MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

E-sports Sponsorship MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Intel Corporation

- Nvidia Corporation

- AMD

- Logitech G

- Razer Inc.

- Red Bull

- Monster Energy

- Coca-Cola

- PepsiCo (Mountain Dew Game Fuel, Doritos)

- Unilever (AXE, Dove brand activations)

- Nike

- Puma

- Adidas

- Champion

- Mastercard

- Coinbase

- Verizon

- AT&T

- Others