Global Due Diligence Investigation Market Size, Share, Statistics Analysis Report By Type (Business Due Diligence (CDD), Financial Due Diligence (FDD), Legal Due Diligence (LDD)), By Application (For Acquisition, For Investment, For Listing), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139530

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Scope

- Key Takeaways

- Analyst Viewpoints

- Due Diligence Investigation Market Key Statistics

- Regional Analysis

- Key Player Analysis

- By Type

- By Application

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenging Factors

- Growth Factors

- Emerging Trends

- Business Benefits

- Recent Developments

- Report Scope

Report Scope

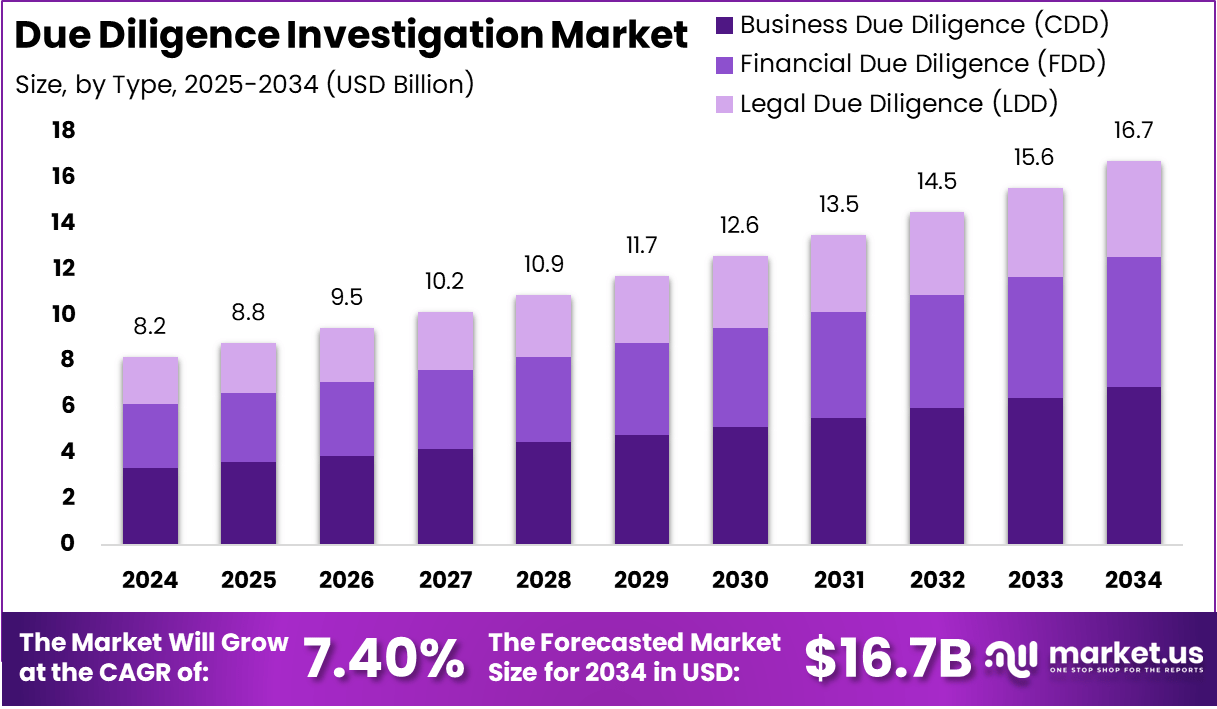

The Global Due Diligence Investigation Market is expected to be worth around USD 16.7 Billion By 2034, up from USD 8.5 billion in 2024. It is expected to grow at a CAGR of 7.40% from 2025 to 2034.

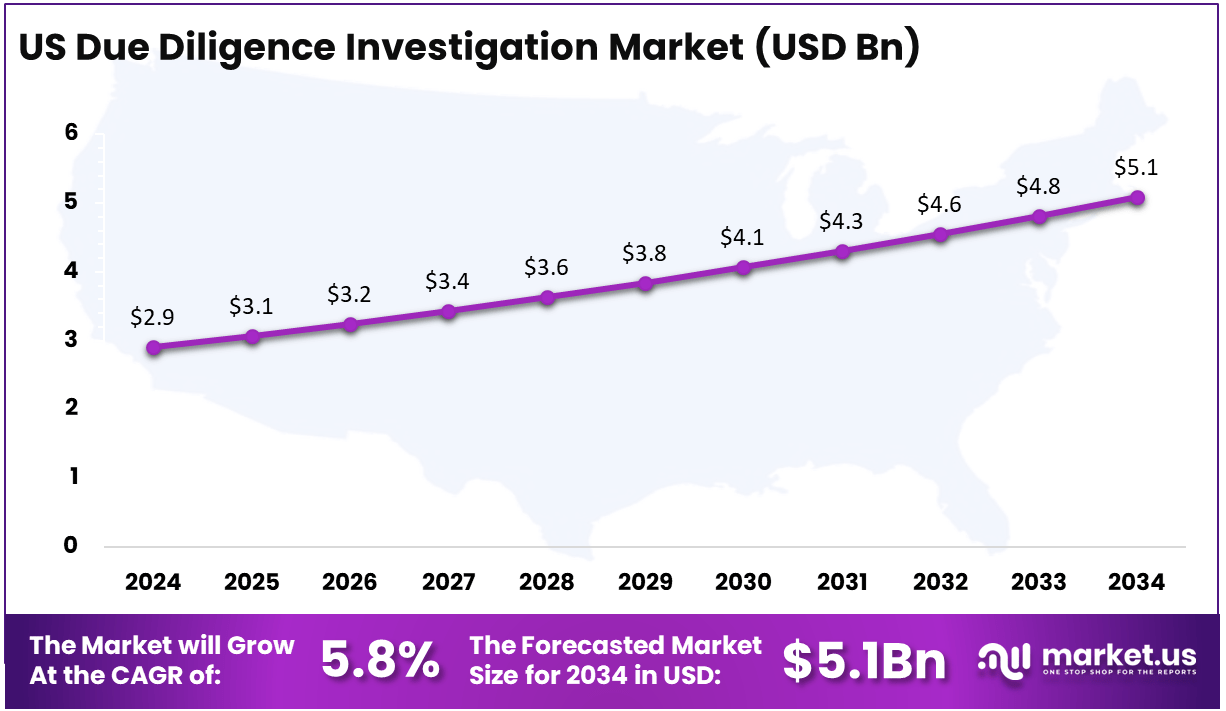

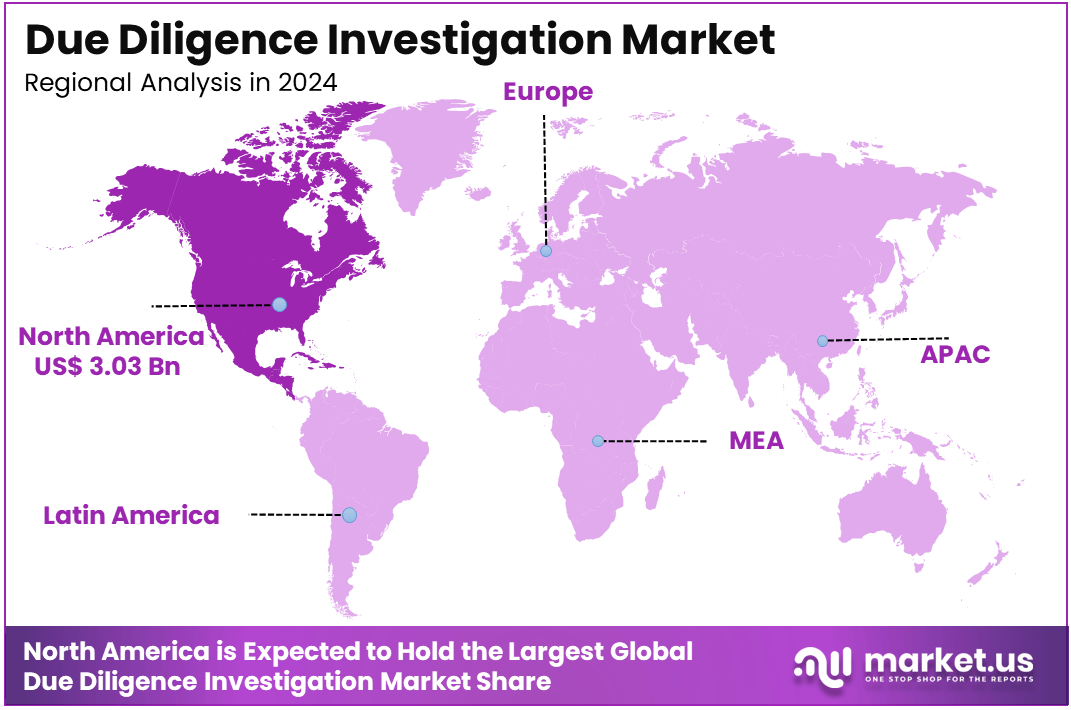

In 2024, North America held a dominant market position, capturing over a 37% share and earning USD 3.03 billion in revenue. Further, the United States dominates the market size by USD 2.9 billion, holding a strong position steadily with a CAGR of 5.8%.

The Due Diligence Investigation Market involves thorough assessments of businesses before significant transactions like mergers, acquisitions, or investments. This process examines a company’s financial health, legal standing, operational efficiency, and market position to identify potential risks and ensure informed decision-making.

Key Takeaways

- Market Growth: The Due Diligence Investigation Market is projected to expand from USD 8.5 billion in 2024 to USD 16.7 billion by 2034, growing at a CAGR of 7.40% over the forecast period.

- Dominant Type: Business Due Diligence (CDD) holds the largest share at 41%, as companies prioritize comprehensive risk assessments before making strategic business decisions.

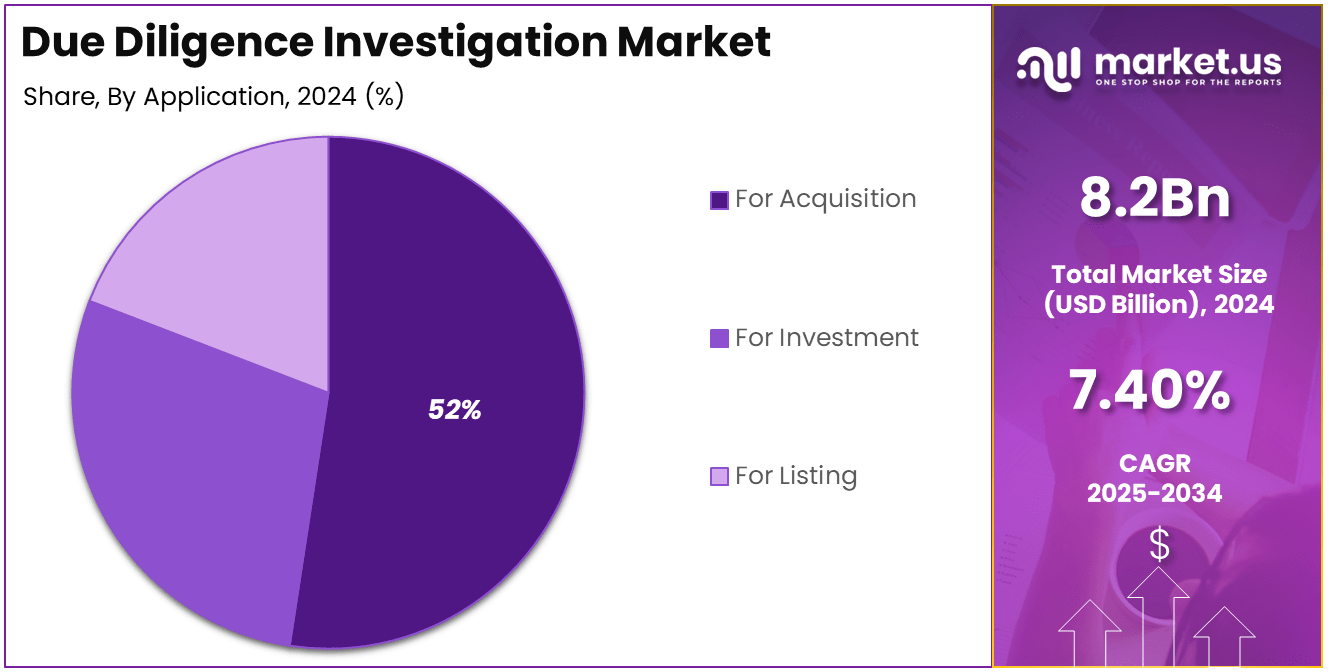

- Leading Application: The For Acquisition segment dominates the market with a 52% share, highlighting the increasing demand for due diligence in mergers and acquisitions.

- Regional Dominance: North America leads the global market, accounting for 37% of the total share, driven by strong regulatory frameworks and frequent corporate transactions.

- The U.S. Market: The United States remains the largest contributor within North America, generating USD 2.9 billion in revenue in 2024, with a CAGR of 5.8%, reflecting steady growth in corporate and legal due diligence activities.

Analyst Viewpoints

The market’s growth is propelled by increasing mergers and acquisitions, globalization of business operations, regulatory complexities, and the need for risk management. Companies are seeking to expand their market presence, diversify their product portfolios, and achieve strategic objectives through acquisitions, prompting the need for comprehensive due diligence to assess target companies’ financial health, operational efficiency, and growth prospects.

As global business transactions become more complex, there’s a rising demand for comprehensive due diligence services. Companies aim to mitigate risks and ensure compliance with international regulations, making thorough investigations essential for informed decision-making.

The market presents significant opportunities, especially in adopting advanced technologies like artificial intelligence (AI) and machine learning. AI-powered due diligence tools enable faster and more accurate analysis of financial documents, contracts, and market data. Firms that invest in AI-driven solutions can capitalize on the growing demand for efficient and cost-effective due diligence services.

The integration of AI and machine learning into due diligence processes is revolutionizing the industry. These technologies enhance the accuracy and efficiency of assessments, allowing for quicker analysis of large datasets and more precise risk evaluations. Firms leveraging these advancements can offer more comprehensive and timely insights to their clients.

In summary, the Due Diligence Investigation Market is expanding due to the increasing complexity of business transactions and the need for thorough risk assessment. Embracing technological innovations and understanding market dynamics are crucial for businesses aiming to make informed decisions and maintain a competitive edge.

Due Diligence Investigation Market Key Statistics

Legal Documents

- Examining contracts and agreements. Reviewing a sample size of at least 20-30 key contracts to identify potential legal risks.

- Compliance with regulations. Verifying that the company has no more than 3-5 minor regulatory infractions in the past 5 years and no major violations.

- Checking for any pending litigation involving amounts greater than 10% of the company’s net worth.

Operational Information

- Reviewing management structure and internal controls. Assessing the experience of key management, with an average tenure of 5+ years in their respective roles.

- Evaluating the operational efficiency through metrics like inventory turnover ratio (target > 6) and order fulfillment time (target < 3 days).

- Analyzing production capacity utilization, aiming for a utilization rate of 80-90%.

Types include

- Financial Due Diligence: Accounts for approximately 30-40% of all due diligence engagements.

- Legal Due Diligence: Represents about 25-35% of engagements.

- Operational Due Diligence: Contributes approximately 15-25%.

- Commercial Due Diligence: Makes up the remaining 10-20%.

Applications include

- Corporate Mergers & Acquisitions: Represents 50-60% of due diligence applications.

- Financial Investments: Accounts for 20-30%.

- Legal Proceedings: Covers about 10-20%.

- Strategic Partnerships: Contributes approximately 5-10%.

Regional Analysis

US Due Diligence Investigation Market Size

The region’s leadership is driven by the high volume of mergers and acquisitions (M&A), regulatory scrutiny, and the increasing complexity of corporate compliance requirements. Companies across industries, including banking, healthcare, real estate, and technology, rely on due diligence services to assess risks, ensure regulatory compliance, and safeguard investments. The region’s well-established legal framework and the presence of leading financial and consulting firms further contribute to the expansion of due diligence services.

Further, in North America, the United States dominates the market size, reaching USD 2.9 billion in 2024 and holding a strong position with a CAGR of 5.8%. The U.S. leads due to frequent corporate transactions, a highly regulated financial environment, and increased private equity and venture capital investments, reinforcing its role as the largest market for due diligence investigations.

The demand for AI-driven due diligence solutions is also growing in North America, with businesses leveraging automation, machine learning, and big data analytics to improve accuracy and efficiency in risk assessment. As companies expand their operations and seek strategic partnerships, thorough due diligence is becoming a critical part of business decision-making.

North America Due Diligence Investigation Market Size

In 2024, North America held a dominant market position, capturing more than a 37% share, holding USD 3.03 billion in revenue. The region’s leadership is driven by the high frequency of mergers, acquisitions, and corporate transactions, requiring in-depth due diligence to assess financial health, operational stability, and legal compliance.

With industries such as banking, real estate, healthcare, and technology witnessing continuous expansions and investments, businesses in North America heavily rely on due diligence services to mitigate risks and ensure compliance with evolving regulations.

This growth is attributed to strict financial regulations, increased private equity and venture capital investments, and a well-developed legal framework that necessitates thorough due diligence. The U.S. also has a strong presence of leading financial institutions, law firms, and risk advisory companies that provide advanced due diligence solutions, including AI-powered analytics and real-time data monitoring.

Canada also plays a crucial role in the region’s growth, with increasing corporate activity and cross-border transactions leading to higher demand for business, financial, and legal due diligence services.

As companies expand internationally, North America continues to lead due diligence advancements, integrating AI, machine learning, and blockchain technology to enhance efficiency and accuracy in risk assessments. The region’s robust legal system, regulatory oversight, and high investment activity will sustain its leadership in the due diligence investigation market over the coming years.

Key Player Analysis

The Due Diligence Investigation Market is highly competitive, with several key players offering specialized services across financial, legal, operational, and compliance risk assessments. Leading companies provide due diligence solutions tailored for mergers and acquisitions, investment evaluations, regulatory compliance, and fraud prevention. These players leverage advanced data analytics, artificial intelligence (AI), and blockchain technology to enhance accuracy, speed, and security in their investigations.

Top firms in the market operate globally, serving industries such as banking, finance, legal, healthcare, real estate, and technology, where due diligence is critical for risk management. Companies are increasingly investing in AI-driven automation, machine learning algorithms, and big data analytics to improve due diligence efficiency and detect hidden risks more effectively.

Additionally, strategic collaborations, mergers, and acquisitions are reshaping the market, with firms expanding their capabilities to provide more comprehensive, real-time due diligence insights. As global regulations tighten and corporate transparency becomes a priority, major players in this market continue to innovate and enhance their offerings to meet the growing demand for fast, reliable, and data-driven due diligence solutions.

Top Key Players in the Market

- Deloitte

- EY (Ernst & Young)

- Alvarez & Marsal

- Boston Consulting Group

- FTI Consulting

- L.E.K. Consulting

- Kreller Group

- PwC (PricewaterhouseCoopers)

- Bain & Company

- KPMG

- Main Goerdeler (KMG))

- McKinsey & Company

- BAE Systems Applied Intelligence

- Control Risks

- Protiviti

- Aon

- Grant Thornton

- Baker Tilly

- LexisNexis Risk Solutions

- Other Key Players

By Type

In 2024, the Business Due Diligence (CDD) segment held a dominant market position, capturing more than a 41% share of the Due Diligence Investigation Market. This segment leads due to the increasing need for comprehensive risk assessments in mergers, acquisitions, and strategic business partnerships. Companies and investors are prioritizing CDD to evaluate an organization’s financial stability, operational efficiency, market position, and management structure before making investment decisions.

With corporate fraud, regulatory compliance issues, and operational risks on the rise, businesses are increasingly relying on thorough due diligence to mitigate potential pitfalls. The demand for CDD services has surged across industries such as banking, finance, healthcare, and technology, where investments and acquisitions require in-depth evaluations of business models, market trends, and reputational risks.

Additionally, advancements in AI-powered analytics and big data integration have strengthened business due diligence, enabling companies to conduct more accurate and real-time assessments. As businesses continue to expand globally, the need for CDD services is expected to grow, ensuring its position as the leading segment in the due diligence investigation market.

By Application

In 2024, the For Acquisition segment held a dominant market position, capturing more than a 52% share of the Due Diligence Investigation Market. This leadership is driven by the rising number of mergers and acquisitions (M&A) across various industries, where companies and investors conduct in-depth due diligence to assess potential risks, liabilities, and opportunities before finalizing deals.

Businesses acquiring other firms require extensive evaluations of financial records, operational efficiencies, legal compliance, and market positioning to ensure a successful transaction and avoid post-acquisition surprises.

The increasing complexity of global business environments, along with tightening regulatory frameworks, has made acquisition due diligence a critical process. Large corporations, private equity firms, venture capitalists, and multinational enterprises are prioritizing comprehensive investigations to safeguard investments and enhance deal success rates. Additionally, advancements in AI-driven data analytics and risk assessment tools have improved the accuracy and efficiency of acquisition due diligence, making it more reliable and accessible.

As businesses continue to expand through strategic acquisitions, the demand for detailed and technology-enhanced due diligence services is expected to grow. This ensures that the For Acquisition segment remains the dominant force in the market, driving higher investment in due diligence solutions and expertise.

Key Market Segments

By Type

- Business Due Diligence (CDD)

- Financial Due Diligence (FDD)

- Legal Due Diligence (LDD)

By Application

- For Acquisition

- For Investment

- For Listing

Driving Factors

Globalization of Business Operations

The globalization of business operations has significantly increased the demand for due diligence investigations. As companies expand into international markets, they encounter diverse regulatory frameworks, cultural differences, and varying market dynamics. Conducting thorough due diligence becomes essential to navigate these complexities effectively.

By performing comprehensive assessments, businesses can identify potential risks, understand local market conditions, and ensure compliance with international laws and standards. This proactive approach not only mitigates risks but also facilitates successful cross-border mergers, acquisitions, and partnerships, thereby driving the growth of the due diligence investigation market.

Restraining Factors

High Costs Associated with Due Diligence Services

One significant challenge in the due diligence investigation market is the high cost associated with these services. Conducting thorough due diligence requires extensive research, analysis, and expertise, which can be resource-intensive and expensive.

This financial burden can be particularly challenging for small and medium-sized enterprises (SMEs) or startups with limited budgets. The substantial upfront costs may deter these organizations from engaging in comprehensive due diligence, potentially exposing them to unforeseen risks. Therefore, the high cost of due diligence services acts as a restraining factor, limiting market growth, especially among smaller entities.

Growth Opportunities

Integration of Advanced Technologies

The integration of advanced technologies presents a significant growth opportunity in the due diligence investigation market. The adoption of artificial intelligence (AI) and data analytics has expanded the horizons of the commercial due diligence market by making the decision-making process much quicker and more accurate.

AI helps to gather and analyze large amounts of data and provides detailed conclusions concerning market conditions, the company’s or buyer’s financial position, and potential or existing threats. By leveraging these technologies, due diligence providers can offer more efficient and comprehensive services, thereby attracting a broader client base and driving market growth.

Challenging Factors

Data Availability and Quality Constraints

Data availability and quality constraints pose significant challenges in the due diligence investigation market. Inadequate or unreliable data can undermine the accuracy of due diligence assessments, leading to potentially misinformed decisions.

For instance, scarce information or inconclusive data can result in incomplete evaluations of investment opportunities, thereby affecting the credibility of the due diligence process. Addressing these challenges requires implementing robust data collection and validation processes to ensure the reliability of due diligence outcomes.

Growth Factors

The Due Diligence Investigation Market is experiencing significant growth, primarily driven by the increasing volume of mergers and acquisitions (M&A) across various industries. In 2023, global M&A activity reached a value of approximately $3.6 trillion, underscoring the heightened demand for comprehensive due diligence services to assess potential risks and opportunities.

Additionally, the rising emphasis on regulatory compliance and corporate governance has compelled organizations to invest in thorough due diligence processes. This ensures adherence to evolving legal frameworks and mitigates potential liabilities, further fueling market expansion.

Emerging Trends

A notable emerging trend in the due diligence sector is the integration of advanced technologies, such as artificial intelligence (AI) and data analytics. These tools enhance the efficiency and accuracy of investigations by automating data collection and analysis.

For instance, AI-driven platforms can swiftly analyze vast datasets to identify anomalies and potential risks, reducing the time required for due diligence by up to 30%. Furthermore, there’s a growing focus on environmental, social, and governance (ESG) factors during evaluations, reflecting the increasing importance of sustainable and ethical business practices in investment decisions.

Business Benefits

Implementing robust due diligence processes offers numerous advantages to businesses. Primarily, it aids in identifying and mitigating risks associated with potential investments or partnerships, thereby safeguarding the company’s assets and reputation. A thorough due diligence investigation can uncover financial discrepancies, legal issues, or operational inefficiencies that might not be evident initially.

Moreover, businesses that conduct comprehensive due diligence are better positioned to negotiate favorable terms, as they possess a deeper understanding of the target entity’s value and potential challenges. This strategic insight can lead to cost savings and more informed decision-making, ultimately contributing to long-term success.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Recent Developments

- In 2024: The European Union enacted the Corporate Sustainability Due Diligence Directive (CSDDD) 2024, mandating companies to implement due diligence processes to identify and address adverse human rights and environmental impacts within their operations and value chains.

- In 2024: In 2024, due diligence processes expanded to include more rigorous assessments of supply chain vulnerabilities and cybersecurity risks.

Report Scope

Report Features Description Market Value (2024) USD 8.5 Billion Forecast Revenue (2034) USD 16.7 Billion CAGR (2025-2034) 7.40% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Business Due Diligence (CDD), Financial Due Diligence (FDD), Legal Due Diligence (LDD)), By Application (For Acquisition, For Investment, For Listing) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Deloitte, EY (Ernst & Young), Alvarez & Marsal, Boston Consulting Group, FTI Consulting, L.E.K. Consulting, Kreller Group, PwC (PricewaterhouseCoopers), Bain & Company, KPMG, Main Goerdeler (KMG)), McKinsey & Company, BAE Systems Applied Intelligence, Control Risks, Protiviti, Aon, Grant Thornton, Baker Tilly, LexisNexis Risk Solutions, Other Key Players/td> Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Due Diligence Investigation MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Due Diligence Investigation MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Deloitte

- EY (Ernst & Young)

- Alvarez & Marsal

- Boston Consulting Group

- FTI Consulting

- L.E.K. Consulting

- Kreller Group

- PwC (PricewaterhouseCoopers)

- Bain & Company

- KPMG

- Main Goerdeler (KMG))

- McKinsey & Company

- BAE Systems Applied Intelligence

- Control Risks

- Protiviti

- Aon

- Grant Thornton

- Baker Tilly

- LexisNexis Risk Solutions

- Other Key Players