Global Fraud Analytics Software Market Size, Share Analysis Report By Deployment (Cloud-Based, On-Premises), By Enterprise Size (Small & Medium Enterprise Size (SME's), Large Enterprises), By Industry (Banking, Financial Services and Insurance (BFSI), Government and Public Sector, Aerospace & defense, Healthcare, IT and Telecom, Automotive, Retail and E-commerce, Others (Gaming and Entertainment, Education, etc.)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: January 2025

- Report ID: 137451

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- U.S. Market Size

- Deployment Analysis

- Enterprise Size Analysis

- Industry Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Regions and Countries

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

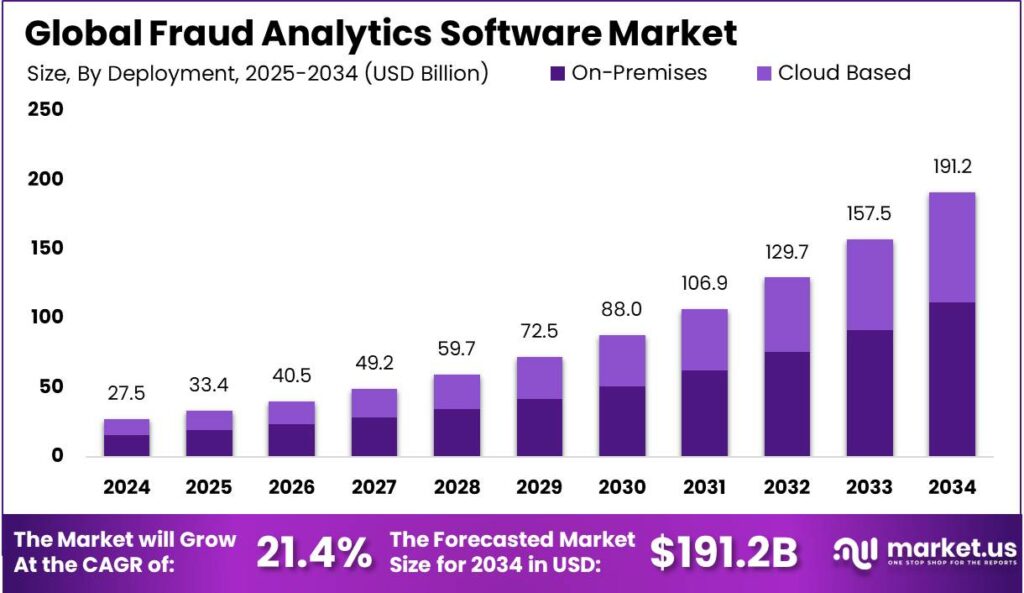

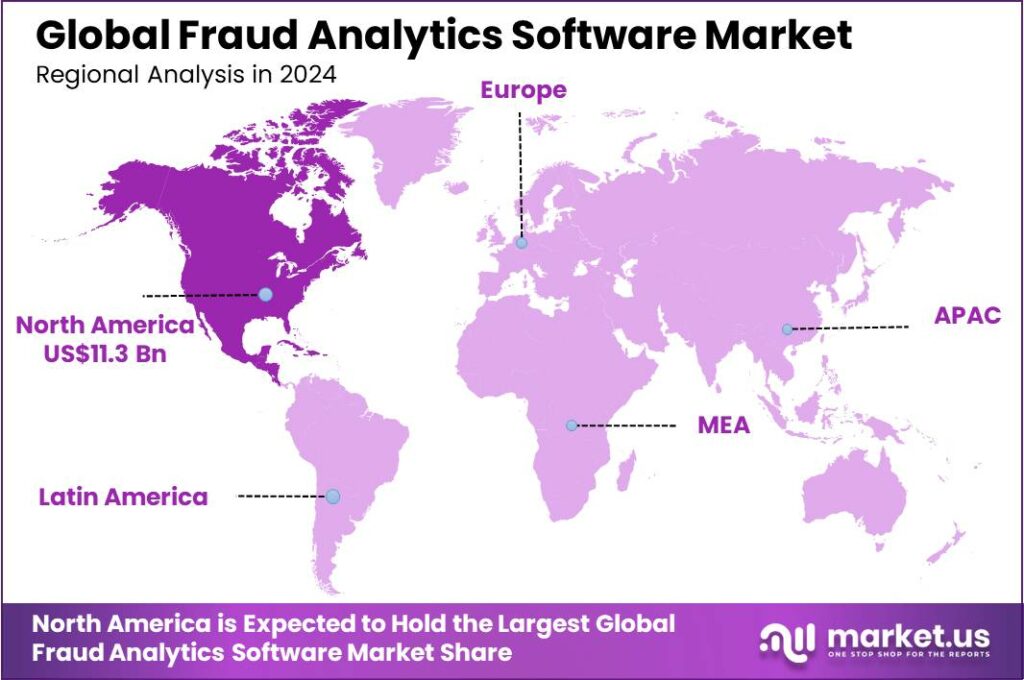

The Global Fraud Analytics Software Market size is expected to be worth around USD 191.2 Billion By 2034, from USD 27.5 Billion in 2024, growing at a CAGR of 21.40% during the forecast period from 2025 to 2034. In 2024, North America captured more than 41.1% of the fraud analytics software market share, generating a revenue of USD 11.3 billion, thereby securing a dominant market position.

Fraud Analytics Software encompasses a range of advanced technological tools designed to detect and prevent fraudulent activities across various industries. These tools leverage machine learning, artificial intelligence (AI), predictive analytics, and anomaly detection to scrutinize massive data sets in real-time. The software identifies irregular patterns that deviate from normal behavior, flagging potential fraudulent activities for further investigation.

The market for Fraud Analytics Software is expanding as businesses increasingly require robust systems to mitigate the growing sophistication of cybercriminals and the shift towards digital transactions. The integration of AI and machine learning enables these systems to adapt and improve over time, making them more effective at identifying and preventing fraud.

Financial institutions, healthcare providers, insurance companies, and retail businesses are among the key users of fraud analytics to safeguard their operations and maintain customer trust. Several factors drive the demand for Fraud Analytics Software. Increasing digital transactions and the proliferation of online platforms have made businesses more vulnerable to cyber fraud.

Additionally, regulatory requirements across industries demand stringent measures to prevent fraud, thereby compelling companies to adopt advanced analytics solutions. The cost savings associated with preventing fraud, rather than addressing its consequences, also significantly contribute to the market’s growth.

For instance, a solution highlighted by Thomson Reuters Legal Solutions helped identify $50 million in overpayments, which led to $18.7 million being successfully recovered by a Medicaid Inspector General. These tools are becoming increasingly vital, especially in healthcare programs. Currently, 40% of the top Medicaid states are leveraging fraud detection software to safeguard their programs against fraudulent activities.

The demand for Fraud Analytics Software is bolstered by the need to protect against increasingly sophisticated fraud schemes, such as identity theft, payment fraud, and account takeovers. The software not only detects fraud but also helps in improving the efficiency of fraud investigation processes, thus saving time and reducing operational costs.

Market opportunities are expanding with the growing integration of AI and machine learning technologies, which enhance the ability of these systems to learn from new data and adapt to evolving fraud tactics without human intervention.

Technological advancements in Fraud Analytics Software include the integration of NLP (Natural Language Processing) to analyze textual data and detect fraud in communication-based transactions. Improvements in machine learning algorithms have also enhanced the software’s ability to learn from transactional data dynamically, thereby increasing accuracy in fraud detection over time.

Key Takeaways

- The Global Fraud Analytics Software Market size is expected to be worth around USD 191.2 Billion by 2034, up from USD 27.5 Billion in 2024, growing at a CAGR of 21.40% during the forecast period from 2025 to 2034.

- In 2024, the On-Premises segment held a dominant position in the fraud analytics software market, capturing more than 58.4% share.

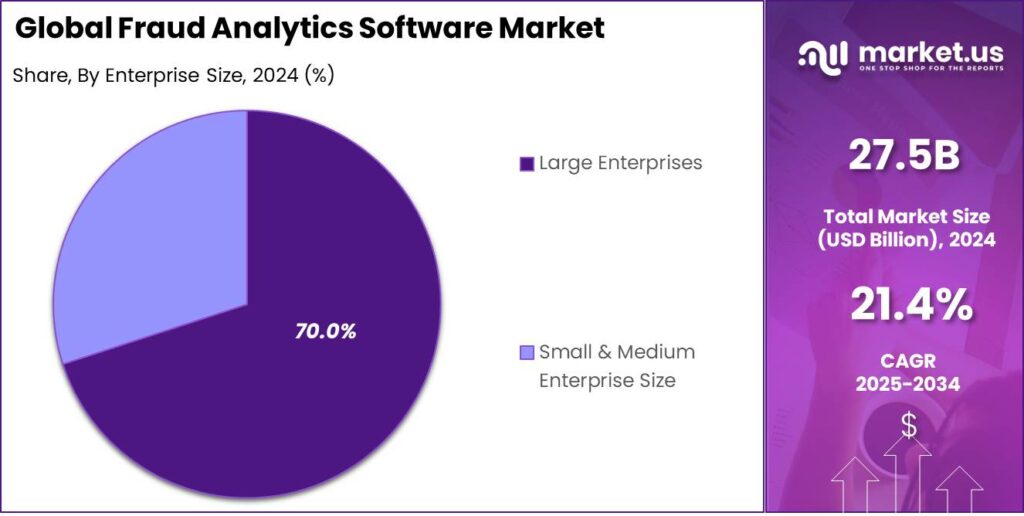

- In 2024, the Large Enterprises segment held a dominant position in the fraud analytics software market, capturing more than 70% share.

- In 2024, the Banking, Financial Services, and Insurance (BFSI) segment held a dominant position in the fraud analytics software market, capturing more than 36.6% share.

- In 2024, North America held a dominant market position in the fraud analytics software market, capturing more than 41.1% share, with revenue amounting to USD 11.3 billion.

U.S. Market Size

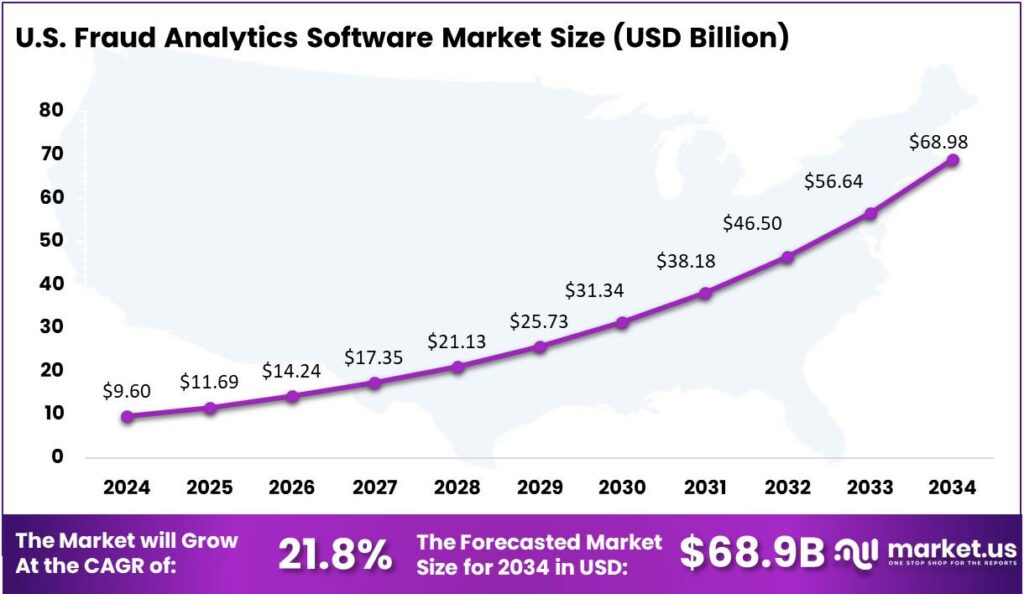

The US Fraud Analytics Software Market size was exhibited at USD 9.6 Bn in 2024 with CAGR of 21.8%. The United States holds a leading position in the Fraud Analytics Software market due to several key factors. Firstly, the robust cybersecurity infrastructure within the region plays a pivotal role. North America, particularly the United States, is known for its advanced cybersecurity measures, which are essential in the combat against fraud.

This advanced infrastructure supports the development and implementation of sophisticated fraud detection technologies that leverage artificial intelligence (AI) and machine learning (ML) to identify and prevent fraudulent activities. Secondly, the regulatory environment in the U.S. strongly supports the growth of the fraud analytics market.

With stringent regulations such as the Bank Secrecy Act (BSA) and anti-money laundering (AML) policies, there is a high demand for compliance in financial services. These regulations drive the adoption of advanced fraud detection and prevention technologies that ensure financial transactions are secure and transparent.

Furthermore, the U.S. market benefits from high levels of investment in AI and ML technologies, which are integral to modern fraud prevention systems. The integration of these technologies allows for real-time processing and analysis of large data sets to detect and prevent fraud quickly and efficiently. This technological advantage is supported by significant private investment and a strong focus on innovation within the country.

In 2024, North America held a dominant market position in the fraud analytics software market, capturing more than a 41.1% share with revenue amounting to USD 11.3 billion. This leading status can be attributed to several pivotal factors that underline the region’s advanced technological adoption and robust financial sector.

The presence of a highly developed IT infrastructure and a strong push towards digital transformation across industries has significantly fueled the adoption of fraud analytics solutions in North America. The region is home to several global financial and tech giants who are continuously enhancing their security measures against an increasing number of cyber threats and fraud incidents.

North America’s strict regulations, like the Sarbanes-Oxley Act and GDPR, require high standards for data protection and fraud prevention, driving companies to adopt efficient systems and fueling the growth of the fraud analytics market.

Additionally, the high incidence of online transactions and the corresponding rise in cybercrimes in the region necessitate robust fraud analytics solutions. With e-commerce and online banking seeing substantial growth, especially in the U.S. and Canada, businesses in these domains are increasingly investing in fraud analytics software to safeguard consumer data and maintain business integrity.

Deployment Analysis

In 2024, the On-Premises segment held a dominant position in the fraud analytics software market, capturing more than a 58.4% share. This segment’s leadership can be attributed to several critical factors that resonate with the needs and preferences of certain businesses, particularly in sectors where data sensitivity is paramount.

Companies in financial services, government, and healthcare, which handle highly sensitive information, prefer on-premises solutions due to their enhanced security measures that mitigate risks associated with data breaches and external attacks.

One significant advantage of on-premises fraud analytics software is the control it offers organizations over their data management and security protocols. Companies opting for on-premises deployment can tailor the security settings, system updates, and compliance measures to their specific requirements without relying on a third-party service provider.

Furthermore, the on-premises deployment allows for better integration with existing internal IT infrastructures. Many organizations with complex systems find that on-premises solutions can be more effectively aligned with their operational workflows.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant position in the fraud analytics software market, capturing more than a 70% share. This substantial market share is primarily due to the high volume of transactions processed by large organizations, which increases the potential for fraud.

Large enterprises typically have more complex operational structures and conduct business on a global scale, necessitating robust fraud detection and prevention systems to safeguard their assets and maintain regulatory compliance.

Large enterprises typically have the financial resources to invest in advanced fraud analytics solutions. By prioritizing security, they adopt top-tier platforms that can detect complex fraud patterns, preventing potential losses through sophisticated technologies.

Fraud analytics solutions are popular among large enterprises due to their focus on customization and scalability. These companies need tailored solutions that integrate with existing systems and can grow with their needs, making customizable platforms highly appealing.

Industry Analysis

In 2024, the Banking, Financial Services, and Insurance (BFSI) segment held a dominant position in the fraud analytics software market, capturing more than a 36.6% share. This sector’s leading stance is largely attributed to the high volume of financial transactions processed daily, including those across digital platforms, which are increasingly susceptible to fraudulent activities.

As financial institutions continue to emphasize security to maintain customer trust and comply with stringent regulatory requirements, the demand for sophisticated fraud detection and prevention tools has surged. Fraud analytics software helps these institutions identify and mitigate risks promptly, thus safeguarding their assets and reputation.

The significant reliance on electronic transactions and the shift towards online banking have further propelled the adoption of fraud analytics solutions in the BFSI sector. These platforms leverage advanced technologies like machine learning, artificial intelligence, and big data analytics to detect anomalies and patterns indicative of fraudulent activity.

Moreover, the global rise in cybercrime rates, especially identity theft and phishing attacks, has compelled the BFSI sector to invest heavily in advanced fraud prevention technologies. Financial institutions are particularly vulnerable to these threats, which can lead to substantial financial losses and erosion of customer trust.

Key Market Segments

By Deployment

- Cloud-Based

- On-Premises

By Enterprise Size

- Small & Medium Enterprise Size (SME’s)

- Large Enterprises

By Industry

- Banking, Financial Services and Insurance (BFSI)

- Government and Public Sector

- Aerospace & defense

- Healthcare

- IT and Telecom

- Automotive

- Retail and E-commerce

- Others (Gaming and Entertainment, Education, etc.)

Driver

Increasing Complexity and Frequency of Fraudulent Activities

In today’s digital age, businesses face a growing threat from increasingly complex and frequent fraudulent activities. This escalation is largely due to the rapid advancement of technology, which, while beneficial, also provides fraudsters with sophisticated tools to exploit system vulnerabilities.

As a result, organizations are compelled to adopt advanced fraud analytics software to safeguard their financial and operational interests. Such software utilizes cutting-edge technologies like big data analytics, artificial intelligence (AI), and machine learning (ML) to detect and prevent fraud effectively.

Integrating these technologies improves fraud detection accuracy and efficiency, allowing businesses to proactively address threats. Strict regulations like AML and KYC also require strong fraud detection systems.

Restraint

Data Quality and Integration Challenges

Implementing fraud analytics software presents significant challenges, particularly concerning data quality and integration. The effectiveness of these systems heavily relies on the accuracy and comprehensiveness of the data they analyze. However, many organizations grapple with poor data quality, fragmented data sources, and a lack of seamless data integration.

These issues can impede the software’s ability to detect fraudulent activities accurately, leading to false positives or missed threats. Addressing these challenges requires substantial investment in data management infrastructure and processes, which can be resource-intensive. Moreover, the complexity of integrating diverse data sources, especially unstructured data like text notes, adds to the difficulty.

Opportunity

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics presents a significant opportunity for enhancing fraud analytics software. These technologies enable the development of more sophisticated and accurate fraud detection solutions.

Additionally, the rise of digital transactions through e-commerce, online banking, and digital payment platforms has generated large datasets that can be leveraged by these advanced technologies. By investing in AI, ML, and big data analytics, businesses can develop more proactive and efficient fraud detection systems, staying ahead of evolving fraudulent tactics and enhancing their overall security posture.

Challenge

Time-Consuming Deployment and Need for Frequent Upgrades

Deploying fraud analytics software can be a time-consuming process, involving the creation of user interfaces, new databases, and predictive models. This process requires continuous effort from data analysts to run algorithms until the most effective predictive model is achieved. If the desired outcomes are not met, the process may need to be restarted, leading to delays.

Furthermore, the software requires frequent upgrades to keep pace with the constantly changing tactics of fraudsters. These upgrades add to the total cost and require ongoing resource commitment. Organizations must be prepared for the time and resources needed for deployment and maintenance to ensure the effectiveness of their fraud detection systems.

Emerging Trends

A significant trend is the integration of artificial intelligence (AI) and machine learning (ML) into these systems. AI and ML enable the analysis of vast datasets to identify unusual patterns and behaviors that may indicate fraud. This capability allows for real-time detection and response, enhancing the effectiveness of fraud prevention measures.

Another emerging trend is the use of graph technologies. These tools examine relationships between entities such as individuals, organizations, or transactions to uncover complex fraud networks that might be missed by traditional methods. By mapping and analyzing these connections, businesses can detect and prevent fraudulent activities more effectively.

The rise of the Internet of Things (IoT) has also influenced fraud analytics. With more devices connected to the internet, there’s an increased risk of fraud through new channels. Modern fraud analytics software is adapting by monitoring and analyzing data from IoT devices to detect anomalies that could signify fraudulent behavior.

Business Benefits

One of the primary advantages is the significant reduction in financial losses due to fraud. By detecting and preventing fraudulent activities in real-time, companies can avoid the costs associated with chargebacks, legal fees, and reputational damage.

Moreover, modern fraud detection systems enhance operational efficiency. Automating the monitoring and analysis of transactions reduces the need for manual reviews, allowing staff to focus on more strategic tasks. This automation leads to faster processing times and improved customer satisfaction, as legitimate transactions are less likely to be delayed or declined.

Another benefit is the improvement in decision-making processes. With access to detailed analytics and reports generated by fraud detection software, businesses can gain insights into emerging fraud patterns and trends. This information enables companies to adapt their strategies proactively, staying ahead of potential threats and minimizing risks.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the competitive landscape of the fraud analytics software market, several key players stand out due to their innovative solutions and extensive market reach.

- Quantexa is a prominent player in the fraud analytics software market, known for leveraging advanced analytics and big data technologies to provide dynamic entity resolution and network analytics solutions. Their software excels in detecting complex fraudulent activities by connecting multiple data points to uncover hidden relationships and patterns.

- Trustpair is another key player that has carved out a niche in the fraud prevention landscape, particularly in the area of wire transfer fraud. Trustpair’s platform focuses on providing real-time validation of B2B payment data, which helps companies mitigate risks associated with payment processes.

- Equifax Inc., a well-established name in the risk management sector, brings a wealth of experience and a broad range of data analytics capabilities to the fraud analytics market. Equifax leverages its vast datasets and analytical expertise to offer tailored solutions that address various aspects of fraud prevention, from identity and credit fraud to internal threats.

Top Key Players in the Market

- Quantexa

- Trustpair

- Equifax Inc.

- Abrigo

- ComplyAdvantage

- IBM Corp.

- Chetu Inc.

- Alessa Inc.

- Sagitec Solutions

- SEON Technologies Ltd.

- Advanced Fraud Solutions

- Others

Top Opportunities Awaiting for Players

In the evolving landscape of the fraud analytics software market, businesses are presented with several key opportunities to enhance their strategies and solutions.

- Advanced Analytics and Machine Learning Integration: With the increasing sophistication of fraud schemes, there is a growing need for fraud detection systems that incorporate advanced analytics, artificial intelligence, and machine learning.These technologies enable real-time transaction analysis, detecting unusual patterns to prevent fraud more effectively.

- Expansion into Emerging Markets: There is significant potential for growth in emerging markets, where digital transformation is accelerating, and regulatory frameworks are evolving. Players in the fraud analytics software market can leverage these changes by providing tailored solutions that meet the specific needs of these regions, particularly in areas such as mobile and online banking.

- Cloud-Based Solutions: As more businesses move their operations online, the demand for cloud-based fraud detection solutions is increasing. These solutions offer scalability, cost-effectiveness, and ease of integration with existing systems, making them an attractive option for small to medium-sized enterprises (SMEs) that are looking for advanced security technologies without substantial upfront investments.

- Regulatory Compliance and Data Protection: With stringent regulations like GDPR in Europe and similar frameworks in other regions, there is a pressing need for compliance-oriented solutions in the fraud detection space. Market players can capitalize on this by developing solutions that not only help businesses combat fraud but also ensure they remain compliant with these evolving regulations.

- Collaborative and Cross-Industry Approaches: The complexity of modern fraud schemes often requires a collaborative approach that involves sharing information across industries and sectors. By facilitating greater collaboration and data sharing, companies can enhance their ability to detect and prevent fraud, creating a more robust defense against fraudsters.

Recent Developments

- In August 2024, Netwrix acquired PingCastle, a French software company known for its Active Directory discovery and assessment tools, aiming to strengthen its cybersecurity capabilities.

- In December 2024, Visa completed its acquisition of Featurespace, a company specializing in financial crime and payment fraud prevention. This move aims to enhance Visa’s fraud prevention and risk-scoring services.

Report Scope

Report Features Description Market Value (2024) USD 27.5 Bn Forecast Revenue (2034) USD 191.2 Bn CAGR (2025-2034) 21.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment (Cloud-Based, On-Premises), By Enterprise Size (Small & Medium Enterprise Size (SME’s), Large Enterprises), By Industry (Banking, Financial Services and Insurance (BFSI), Government and Public Sector, Aerospace & defense, Healthcare, IT and Telecom, Automotive, Retail and E-commerce, Others (Gaming and Entertainment, Education, etc.)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Quantexa, Trustpair, Equifax Inc., Abrigo, ComplyAdvantage, IBM Corp., Chetu Inc., Alessa Inc., Sagitec Solutions, SEON Technologies Ltd., Advanced Fraud Solutions, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fraud Analytics Software MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

Fraud Analytics Software MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Quantexa

- Trustpair

- Equifax Inc.

- Abrigo

- ComplyAdvantage

- IBM Corp.

- Chetu Inc.

- Alessa Inc.

- Sagitec Solutions

- SEON Technologies Ltd.

- Advanced Fraud Solutions

- Others