Dual Biomarker Assays Market By Product Type (Immunochemistry Assay, In-situ Hybridization (ISH) Assay, Next-Generation Sequencing (NGS) Kits, and Others), By Application (Cancer, Non-Small Cell Lung Cancer (NSCLC), Human Papillomavirus (HPV), Glioma, Gastrointestinal Cancer, Breast Cancer, B-Cell Lymphoma, and Alzheimer’s Disease), By End-user (Hospitals, Specialty Clinics, Diagnostic Laboratories, and Cancer Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164899

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

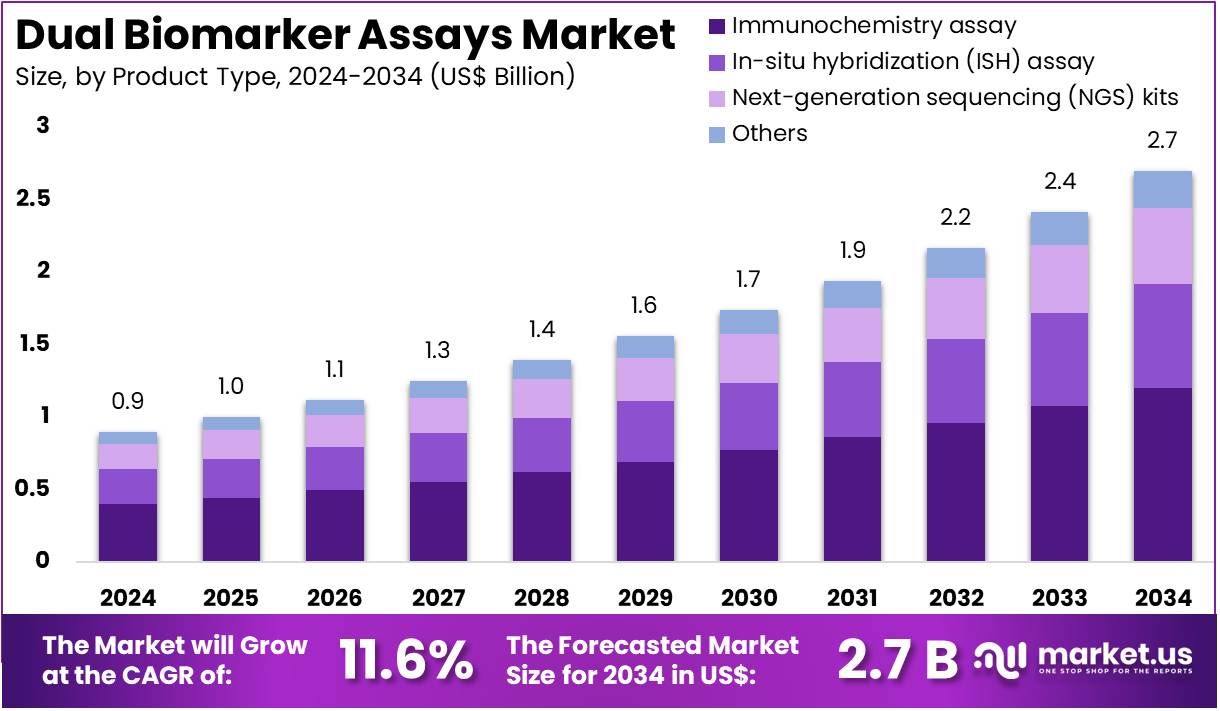

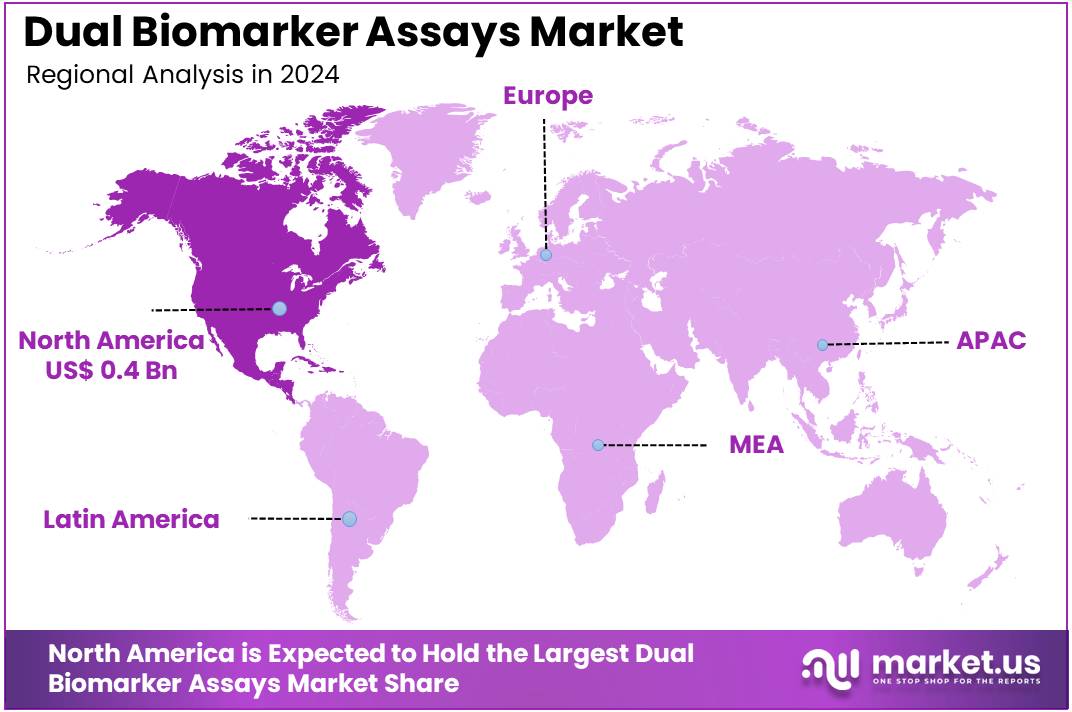

The Dual Biomarker Assays Market Size is expected to be worth around US$ 2.7 billion by 2034 from US$ 0.9 billion in 2024, growing at a CAGR of 11.6% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 39.3% share and holds US$ 0.4 Billion market value for the year.

Increasing demand for precision oncology drives the Dual Biomarker Assays Market, as clinicians integrate multi-marker profiling to optimize therapeutic decisions. Oncologists apply these assays to simultaneously evaluate PD-L1 expression and tumor mutational burden, guiding immunotherapy eligibility in solid tumors. These tests support companion diagnostics by pairing EGFR mutations with ALK rearrangements, streamlining targeted therapy pathways.

Pharmaceutical developers utilize dual assays in clinical trials to stratify patients for combination regimens. In August 2024, Illumina’s TruSight Oncology Comprehensive assay received FDA approval with companion diagnostic claims for over 500 genes, establishing multiplex profiling as a standard in treatment selection. This milestone accelerates market growth by validating dual biomarker reliability in personalized cancer care.

Growing evidence for liquid biopsy superiority creates opportunities in the Dual Biomarker Assays Market, as combined analyte detection enhances sensitivity over single markers. Hematologists employ CTC and ctDNA dual assays to monitor minimal residual disease in leukemia, enabling early relapse intervention. These platforms aid breast cancer surveillance by tracking HER2 amplification alongside mutation profiles, informing trastuzumab adjustments.

Automated systems facilitate serial sampling for longitudinal therapy response assessment. In February 2025, a Biosensors study demonstrated that integrating CTCs and ctDNA significantly improves cancer detection and monitoring compared to single-biomarker approaches. This research fuels market expansion by underscoring dual assay advantages in non-invasive precision diagnostics.

Rising adoption of advanced sensing technologies propels the Dual Biomarker Assays Market, as innovative platforms enable simultaneous high-sensitivity detection. Pathologists leverage SERS-based immunosensors to quantify HER2 and CA 15-3 in serum, supporting breast cancer staging and prognosis. These assays find applications in ovarian cancer by pairing CA-125 with HE4, refining diagnostic specificity.

Trends toward label-free multiplex detection reduce assay complexity and costs in research settings. In July 2025, Biosensors published findings on a Dual-Oriented Nanostructured SERS Immunosensor for simultaneous HER2 and CA 15-3 detection. This breakthrough positions the market for sustained innovation through commercializable, high-performance dual biomarker technologies.

Key Takeaways

- In 2024, the market generated a revenue of US$ 0.9 billion, with a CAGR of 11.6%, and is expected to reach US$ 2.7 billion by the year 2034.

- The product type segment is divided into immunochemistry assay, in-situ hybridization (ISH) assay, next-generation sequencing (NGS) kits, and others, with immunochemistry assay taking the lead in 2023 with a market share of 44.5%.

- Considering application, the market is divided into cancer, non-small cell lung cancer (NSCLC), human papillomavirus (HPV), glioma, gastrointestinal cancer, breast cancer, B-cell lymphoma, and Alzheimer’s disease. Among these, cancer held a significant share of 49.6%.

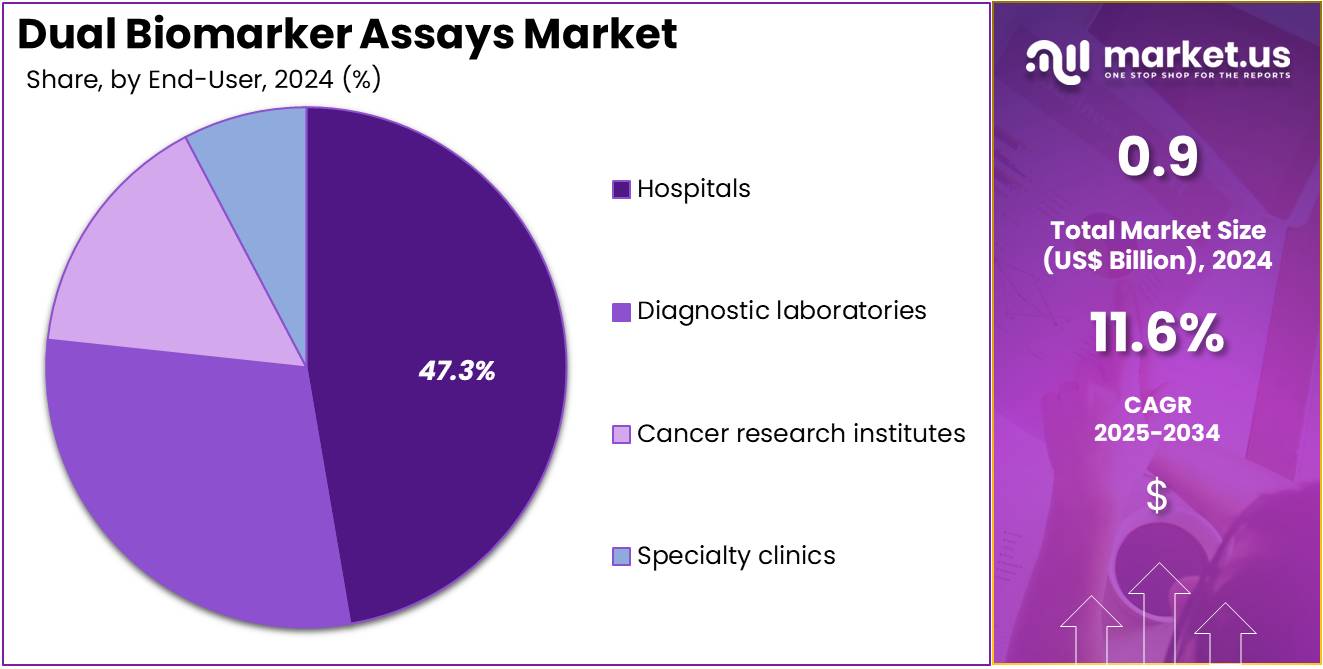

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, specialty clinics, diagnostic laboratories, and cancer research institutes. The hospitals sector stands out as the dominant player, holding the largest revenue share of 47.3% in the market.

- North America led the market by securing a market share of 39.3% in 2023.

Product Type Analysis

Immunochemistry assays account for 44.5% of the Dual Biomarker Assays market and are expected to remain dominant owing to their precision in detecting protein and antigen interactions critical for disease diagnosis. These assays are integral in evaluating dual biomarkers that indicate both disease presence and treatment response, particularly in oncology and autoimmune diagnostics.

The growing demand for personalized medicine is increasing reliance on immunochemistry-based platforms that deliver fast, accurate, and cost-efficient results. Technological advancements, such as automated analyzers and high-sensitivity chemiluminescence assays, are enhancing assay throughput and reliability. The integration of multiplexing capabilities allows simultaneous detection of multiple biomarkers, optimizing clinical workflows.

Increasing adoption of these assays in companion diagnostics and targeted therapy monitoring strengthens their clinical importance. Pharmaceutical companies are expanding their immunochemistry testing portfolios to support biomarker-driven drug discovery. The rising incidence of chronic and infectious diseases is amplifying test utilization across healthcare facilities. As healthcare shifts toward precision diagnostics, immunochemistry assays are projected to sustain market dominance through continuous innovation and clinical validation.

Application Analysis

Cancer represents 49.6% of the Dual Biomarker Assays market and is anticipated to remain the leading application due to the growing importance of biomarker-guided oncology diagnostics. Dual biomarker assays enhance cancer detection accuracy by simultaneously measuring genetic and protein markers, improving diagnostic specificity and treatment selection.

The rising global cancer burden and increased screening programs are driving high assay adoption rates. These assays play a critical role in identifying predictive and prognostic markers used in immunotherapy and targeted treatment planning. For instance, combined evaluation of PD-L1 expression and tumor mutation burden through dual assays aids in optimizing therapeutic strategies. The integration of advanced technologies, including NGS and immunohistochemistry, enhances assay precision for solid and hematologic malignancies.

The surge in oncology clinical trials focusing on biomarker-based stratification supports demand growth. Pharmaceutical and biotech firms are collaborating with diagnostic developers to validate dual biomarker tests for drug efficacy prediction. As personalized cancer treatment becomes central to modern oncology, dual biomarker assays are projected to remain indispensable in clinical decision-making.

End-User Analysis

Hospitals dominate the Dual Biomarker Assays market with a 47.3% share and are projected to retain this position due to their central role in disease diagnosis, patient management, and therapy monitoring. Hospitals are increasingly adopting dual biomarker assays to provide precise, integrated testing for complex diseases such as cancer and neurological disorders. The presence of advanced diagnostic laboratories and multidisciplinary oncology units within hospitals supports large-scale implementation.

Rising patient inflow for cancer diagnostics and biopsy testing drives in-house assay utilization. Hospitals are expanding collaborations with diagnostic manufacturers to integrate automated biomarker testing platforms, ensuring faster turnaround times and enhanced diagnostic accuracy. The adoption of digital pathology and AI-assisted assay interpretation further strengthens diagnostic workflows. Continuous physician training and government funding for advanced diagnostic infrastructure promote broader test accessibility.

Hospitals also benefit from reimbursement coverage for biomarker-based testing, improving affordability for patients. As clinical pathways increasingly rely on molecular profiling for therapy decisions, hospitals are anticipated to remain the primary setting for dual biomarker assay applications globally.

Key Market Segments

By Product Type

- Immunochemistry Assay

- In-situ Hybridization (ISH) Assay

- Next-Generation Sequencing (NGS) Kits

- Others

By Application

- Cancer

- Non-Small Cell Lung Cancer (NSCLC)

- Human Papillomavirus (HPV)

- Glioma

- Gastrointestinal Cancer

- Breast Cancer

- B-Cell Lymphoma

- Alzheimer’s Disease

By End-user

- Hospitals

- Specialty Clinics

- Diagnostic Laboratories

- Cancer Research Institutes

Drivers

Rising Incidence of Cancer is Driving the Market

The continual increase in cancer occurrences has greatly expanded the dual biomarker assays market, since these paired tests deliver superior accuracy in diagnostics by merging several indicators to boost both sensitivity and specificity during tumor characterization. Dual biomarker assays, for example those assessing PD-L1 along with MSI levels, allow medical professionals to pinpoint treatment susceptibilities in varied cancers, directing choices for immune therapies better than individual markers alone. This factor stands out in cancer care, where the intricate nature of genetic changes calls for layered assessments to categorize patients for specific drugs.

Medical teams now include these assays in regular processes, starting from first detection to tracking relapses, in order to achieve better results and limit resistance formation. The requirement grows with population changes, like older age groups, needing expandable options for wide-scale checks. Health programs stress their importance in cutting death rates via prompt action, leading to funding for lab improvements.

The Centers for Disease Control and Prevention documented 1,918,030 fresh cancer instances in the United States during 2022, pointing to the urgent need for sophisticated dual biomarker approaches to manage this load. This number stresses the pressing demand, because dual assays prevent excessive treatment through exact grouping. New simultaneous measurement styles simplify operations, handling different tissue and fluid samples.

From a money angle, using them reduces useless treatments, supporting growth in testing setups. Global groups set common assay limits, allowing steady use everywhere. This cancer load not only lifts assay use but also secures dual biomarker’s key spot in accurate cancer systems. In all, it pushes forward multi-data merges, matching diagnostics to changing treatment ways.

Restraints

Regulatory Validation Challenges is Restraining the Market

The strict regulatory checks needed for dual biomarker assays keep slowing their common use, as full proof of practical value extends approval times and raises creation expenses. These assays, mixing various points like tumor mutation load and PD-L1 levels, have to show strong lab performance on different systems, frequently meeting FDA questions about consistency in varied groups. This issue hits new combined styles hardest, where evidence lacks hold back approval as partner diagnostics. Insurer caution, looking for clear cost savings, splits coverage further, with Medicare’s area choices setting tough result rules.

Makers deal with repeated filings and after-market checks, moving money from betterment to review work. These holdups keep single-marker norms in place, blocking entry for better panels. The Food and Drug Administration handled around 18,800 medical device applications in 2022, with dual biomarker assays facing stronger checks for lab and clinical proof, adding to longer review times. These amounts show process jams, as approval steps need complete files.

Doctor doubts about unproven mixes lead to sticking with known markers over new dual ones. Plans for faster approvals move step by step, held by lab differences. These validation problems not only lower rollout but also weaken the market’s forecast strength. As a result, they need team efforts to balance new ideas with control rules.

Opportunities

Advancements in Multiplex Assay Platforms is Creating Growth Opportunities

The development of multiplex systems has opened big growth paths for the dual biomarker assays market, letting at-once checks of matching markers to sharpen forecast exactness in cancer studies. These systems, using next-gen sequencing, join gene and protein signals like EGFR changes and HER2 boosts, beating step-by-step testing in speed. Chances come up in partner diagnostic builds, where multiplex assays group patients for mixed treatments.

Drug-company links pay for checks in fluid biopsy changes, closing holes in live resistance watches. This combining fixes single-marker weak points, setting assays as helpers for flexible study plans. Money pushes for marker-led studies speed buys, spreading to all-cancer uses. The U.S. Food and Drug Administration cleared 1016 AI/ML medical devices by December 2024, covering multiplex systems for dual biomarker finds in cancer care. This spread proves workable plans, with uses expecting more reagent needs in treatment outlines.

New droplet digital PCR lifts clarity for rare signals, widening use in small samples. As computer tools grow, multiplex results open forecast model income. These system steps not only vary assay choices but also root the market in full disease check structures.

Impact of Macroeconomic / Geopolitical Factors

Rising chronic disease rates and expanded precision medicine programs urge clinicians to adopt dual biomarker assays for simultaneous detection of cancer and cardiac markers, allowing labs to streamline workflows and accelerate patient stratification for targeted therapies. Heightened unemployment from economic slowdowns, however, curbs public health funding, causing facilities to scale back elective assay volumes and favor single-marker tests over comprehensive dual panels during resource constraints.

Geopolitical strains, like ongoing US-EU disputes over tech exports, delay shipments of specialized proteomic reagents from European vendors, compelling suppliers to reroute logistics and face elevated insurance premiums that strain quarterly forecasts. Current US tariffs, enforcing a 10% baseline on imported diagnostic kits and analyzers from more than 180 nations since April 2025, boost overheads for multiplex immunoassay components, challenging regional providers to maintain service levels without hiking fees for underserved communities.

Yet, these trade hurdles spur joint ventures with US innovators, yielding streamlined point-of-care dual assays that integrate AI for faster result interpretation and cut reliance on overseas validation. Bolstered private equity inflows also support assay customization for telemedicine, widening adoption among remote care networks and bolstering data security protocols.

Latest Trends

FDA Approval of Illumina’s TruSight Oncology Comprehensive Assay is a Recent Trend

The official okay of full gene profiling kits has shown a big step forward in dual biomarker assays in 2024, allowing at-once finds of useful changes for exact cancer guidance. Illumina’s TruSight Oncology Comprehensive, checking over 500 genes, spots dual markers like BRAF V600E and MSI-high, helping therapy picks in solid tumors. This okay marks a change to shareable IVD systems, fitting fixed tissues in local labs. Control checks prove its lab truth, speeding partner diagnostic claims for several signs. This width fits treatment needs, linking results to health records for easy talks. The system ends split testing, focusing on setups tough to sample wear.

The U.S. Food and Drug Administration cleared Illumina’s TruSight Oncology Comprehensive as an in vitro diagnostic kit on August 26, 2024, with companion diagnostic indications for non-small cell lung cancer and metastatic breast cancer. These steps speed line growth, as copies move for all-cancer tools. Watchers expect rule adds, raising its place in normal steps. Long checks show fewer mismatches, better money views. The path sees AI adds, foreseeing change links. This sequencing change not only lifts biomarker sharpness but also matches walk-in cancer ideas.

Regional Analysis

North America is leading the Dual Biomarker Assays Market

The market in North America is anticipated to have held a 39.3% share of the global dual biomarker assays landscape in 2024, advanced by FDA’s breakthrough designations for multiplex immunoassays that integrate protein and nucleic acid markers for Alzheimer’s detection, such as Roche’s Elecsys pTau217 plasma test in April 2024, enabling earlier intervention in neurodegenerative cohorts through combined amyloid and tau profiling.

Labs ramped up adoption of bead-based platforms to quantify dual markers like pTau and amyloid-beta, achieving 90% accuracy in distinguishing mild cognitive impairment from normal aging, correlating with NIH-funded validations that reduced diagnostic costs by 30% in clinical workflows. The National Institute on Aging’s Alzheimer’s Disease Research Centers expanded dual assay use for longitudinal tracking, addressing ethnic disparities in biomarker accessibility for Hispanic and African American populations, where prevalence reaches 13%.

Regulatory efficiencies under the FDA’s Emerging Drug Safety Technology Program expedited clearances for oncology panels combining ctDNA and circulating tumor cells, aligning with Medicare expansions for precision oncology in stage IV cancers. Demographic pressures from a 10% rise in early-onset dementia diagnoses amplified demand for integrated assays in primary care. These elements positioned the region as a pioneer in multi-marker diagnostic precision. The FDA awarded Breakthrough Device designation to Roche’s Elecsys pTau217 plasma biomarker test in April 2024 for Alzheimer’s disease diagnosis.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The market in Asia Pacific is projected to expand during the forecast period, as governmental health strategies prioritize multiplex platforms to tackle chronic disease burdens in aging societies. Officials in China and South Korea invest in bead-based kits, outfitting research institutes to profile amyloid and tau markers in cognitive decline studies for elderly urban dwellers.

Diagnostic developers collaborate with national labs to validate dual ctDNA assays, anticipating improved oncology staging for lung cancers in high-pollution zones. Regulatory bodies in India and Japan subsidize nucleic-protein panels, enabling community centers to detect cardiovascular risks without advanced infrastructure.

Countrywide initiatives estimate merging assay data into digital registries, expediting Alzheimer’s referrals in migrant cohorts. Regional neurologists pioneer hybrid immunoassays, coordinating with WHO networks to monitor dual biomarker trends in metabolic syndromes. These actions create a versatile conduit for multi-analyte diagnostics. China’s Ministry of Science and Technology allocated over US$3 billion to precision medicine initiatives in 2022, focusing on biomarker development for cancer and cardiovascular diseases.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Dual Biomarker Assays Market drive growth by launching NGS panels for simultaneous PD-L1 and MSI evaluation, aiding immunotherapy decisions in oncology. They co-develop with pharma for companion diagnostics, speeding FDA approvals. Companies invest in AI software for automated dual-signal analysis, improving lab efficiency. Leaders acquire biotech firms for liquid biopsy options in cardiovascular assessments. They expand in North America and Europe via screening initiatives and reimbursement.

Additionally, they offer performance-linked services with consortia for predictive modeling and revenue. Roche Diagnostics, a Basel-based division of Roche Group since 1896, pioneers in vitro solutions like VENTANA PD-L1 assays for dual biomarker testing in cancers. CEO Thomas Schinecker leads global operations in over 100 countries, focusing on R&D, automation, and collaborations. The firm refines guidelines with authorities, maintaining leadership through innovative, integrated diagnostics.

Top Key Players in the Dual Biomarker Assays Market

- Hoffmann‑La Roche Ltd

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Fujirebio

- QIAGEN N.V.

- Bio‑Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- Abbott Laboratories

- Siemens Healthineers AG

- Myriad Genetics, Inc.

Recent Developments

- In January 2025: Roche gained FDA 510(k) clearance for its VENTANA Kappa & Lambda Dual ISH mRNA Probe Cocktail. This diagnostic advance enables simultaneous detection of two key mRNA markers in B-cell lymphomas, improving analytical efficiency and accuracy. The innovation directly supports the dual biomarker assays market by demonstrating the clinical value of dual-target molecular diagnostics.

- In October 2025: Thermo Fisher Scientific announced plans to acquire Clario Holdings, Inc., a firm specializing in clinical trial data analytics. By integrating Clario’s digital data infrastructure, Thermo Fisher aims to enhance management and interpretation of complex multi-biomarker datasets, a critical enabler for large-scale validation and deployment of dual biomarker assays in modern clinical trials.

Report Scope

Report Features Description Market Value (2024) US$ 0.9 billion Forecast Revenue (2034) US$ 2.7 billion CAGR (2025-2034) 11.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Immunochemistry Assay, In-situ Hybridization (ISH) Assay, Next-Generation Sequencing (NGS) Kits, and Others), By Application (Cancer, Non-Small Cell Lung Cancer (NSCLC), Human Papillomavirus (HPV), Glioma, Gastrointestinal Cancer, Breast Cancer, B-Cell Lymphoma, and Alzheimer’s Disease), By End-user (Hospitals, Specialty Clinics, Diagnostic Laboratories, and Cancer Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape F. Hoffmann‑La Roche Ltd, Illumina, Inc., Thermo Fisher Scientific, Inc., Fujirebio, QIAGEN N.V., Bio‑Rad Laboratories, Inc., Agilent Technologies, Inc., Abbott Laboratories, Siemens Healthineers AG, Myriad Genetics, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dual Biomarker Assays MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Dual Biomarker Assays MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Hoffmann‑La Roche Ltd

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Fujirebio

- QIAGEN N.V.

- Bio‑Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- Abbott Laboratories

- Siemens Healthineers AG

- Myriad Genetics, Inc.