Global Drug Of Abuse Testing Market By Drug Type (Marijuana/Cannabis, Opioids, Methamphetamine & Amphetamine, Cocaine, LSD, Alcohol, and Other Drugs), By Product (Analyzers, Rapid Testing Devices, and Consumables), By Sample(Urine, Oral Fluid, Blood, Hair, and other samples), By End-User(Workplaces, Hospitals, Government Justice Systems, Research Laboratories, and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 28305

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

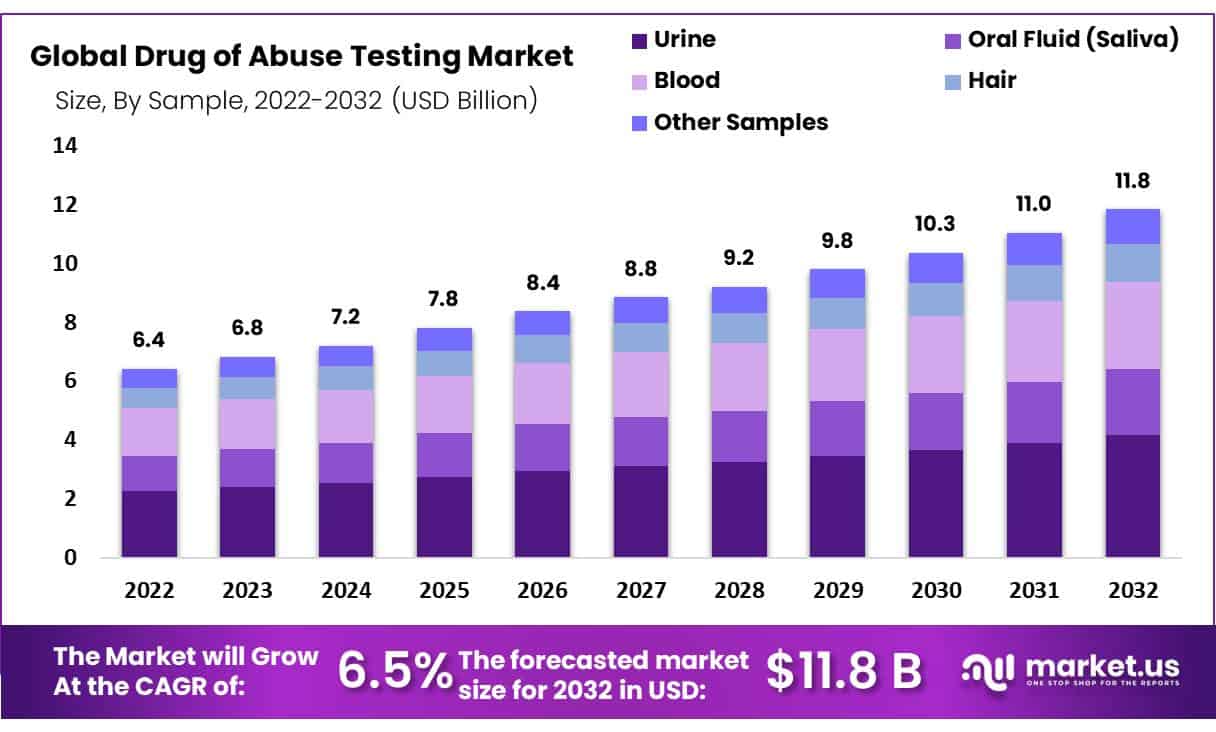

In 2023, the Global Drug Of Abuse Testing Market accounted for USD 6.8 Billion and is expected to reach around USD 11.8 Billion in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 6.5%.

Chemicals that produce specific effects in the user’s brain, primarily in the reward circuitry, are known as drugs of abuse. Within a few seconds to a few minutes of administration, drugs of abuse typically produce positive or alleviate negative emotions. Inhalation, oral absorption, oral ingestion, subcutaneous, intramuscular, or intravenous injection are all methods of drug administration.

Drug tests typically do not reveal drug use. On the other hand, drug tests look for particular drug classes or drugs in biological matrices represented in specific test panels. Any sample can detect drugs; the most common ones used for routine testing are urine, oral fluid, blood, nails, hair, breath, and sweat.

The market for drug of abuse testing is primarily influenced by strict laws that require drug of abuse testing, growing government efforts to combat drug abuse, rising alcohol and drug consumption, and rising drug-related mortality. In addition, there has been a rise in research labs and clinics offering services for drug of abuse testing in recent years. The market has expanded worldwide due to the creation of low-cost testing kits and technological advancements in this field.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Critical for Public Health and Safety: The Drug of Abuse Testing Market is essential in maintaining public health and safety. It identifies individuals using illegal substances, helping create safer workplaces, communities and roadways.

- Wide Selection of Testing Methods: This market offers an expansive selection of testing methods, from urine, saliva, blood and hair tests. Each has their own distinct set of advantages that makes them appropriate for various situations ranging from workplace drug screenings to forensic investigations.

- Expanding Legalization and Addressing New Challenges: As legislation concerning drugs evolves – for example with legalizing cannabis in certain regions – so too must testing methods and cutoff levels adapt accordingly in order to differentiate recreational use from impairment.

- Rising Substance Abuse Issues: Substance abuse remains a global threat, necessitating accurate and efficient drug testing solutions to detect opioids, amphetamines and synthetic drugs that continue to pose major challenges.

- Advancements in Point-of-Care Testing: Point-of-care testing (POCT) has seen steady adoption as an on-site drug screening solution, providing rapid drug testing solutions in emergency medical situations, workplace testing environments and law enforcement environments. It has proved particularly valuable during emergency situations as well as for law enforcement purposes.

Drug Type Analysis

The marijuana/cannabis segment accounted for the largest market share in 2022

Based on drug type, the global drug of abuse testing market is segmented into marijuana/cannabis, opioids, methamphetamine & amphetamine, cocaine, LSD, alcohol, and other drugs. In 2022, the marijuana/cannabis segment had the largest revenue share of the overall market. This is because marijuana, also known as cannabis, is the world’s most widely used illegal drug. More than 50 million people in the United States use marijuana, making it the most popular illicit drug, according to the Substance Abuse and Mental Health Services Administration.

In 2022, the opioids segment held the second-largest share. The growing opioid crisis in key regions like North America and Europe is a major factor. Opioid use disorder (including heroin abuse and prescription painkiller abuse) affected between 2 to 2.5 million people in the United States in previous years, according to data released by the National Center for Drug Abuse Statistics. In addition, major market players are expanding their opioids testing portfolio through organic growth strategies.

Amphetamine is a CNS stimulant that makes people feel more confident and energetic while raising blood pressure and tachycardia. Most countries have legalized the use of methamphetamine & amphetamine as it is used in the treatment of post-traumatic stress disorder and depression. This is expected to drive the growth of this segment.

Product Analysis

In 2022, the consumables segment dominated the market with maximum shareholding

Based on product, the drug of abuse testing market is divided into analyzers, rapid testing devices, and consumables. The analyzers are further subdivided into immunoassay analyzers, chromatographic devices, and breath analyzers. On the other hand, rapid testing devices are classified into urine testing devices and oral fluid testing devices.

Consumables account for more than 60% of the total market share because they can be readily available for drug testing on-site. Because of their extremely short shelf lives, the consumables can only be used once, so they must be purchased repeatedly.

Also, immunoassay analyzers are often used because they are quick, cheap, and easy to use for screening many samples in different matrices. The analyzers hold the second-largest share because they also deliver precise results.

The market for rapid testing devices is anticipated to expand significantly in the coming years. On-site screening for the validity of urine specimens, drugs of abuse, and saliva alcohol allows immediate action on the results due to rapid testing devices. In the past, various forensic and clinical settings considered drug of abuse testing in the laboratory the standard procedure.

Sample Analysis

The urine sample is accounted as the most lucrative segment

Based on the sample, the global drug of abuse testing market is classified into urine, oral fluid (saliva), blood, hair, and other samples. Because urine samples secrete metabolites that can be tested easily for the presence of illegal drugs, the urine category dominates the market; No external factor can destroy these molecules.

The non-invasiveness of the collection, the speed of the results, and the fact that the majority of drugs can be identified in urine are additional reasons for the preference for collecting urine samples to analyze intoxicating substances. Utilizing immunoassay analyzers and assay kits has consequently increased the capacity of urinalysis-equipped laboratories.

Additionally, the use of urine has increased due to technological advancements in drug abuse (DOA) testing methods. The rising demand for such procedures and the rising number of overdose-related deaths are the major factors contributing to the market growth.

By trapping biomarkers in the fibers of a growing hair strand, a hair sample provides evidence of drug abuse over time. Additionally, it provides up to a three-month history of drug abuse, ultimately boosting the expansion of the drug of abuse testing market. In addition, the segmental growth will be aided by the hair sample’s numerous advantages, including its ease of collection, suitability for screening, and persistence of drug biomarkers over time.

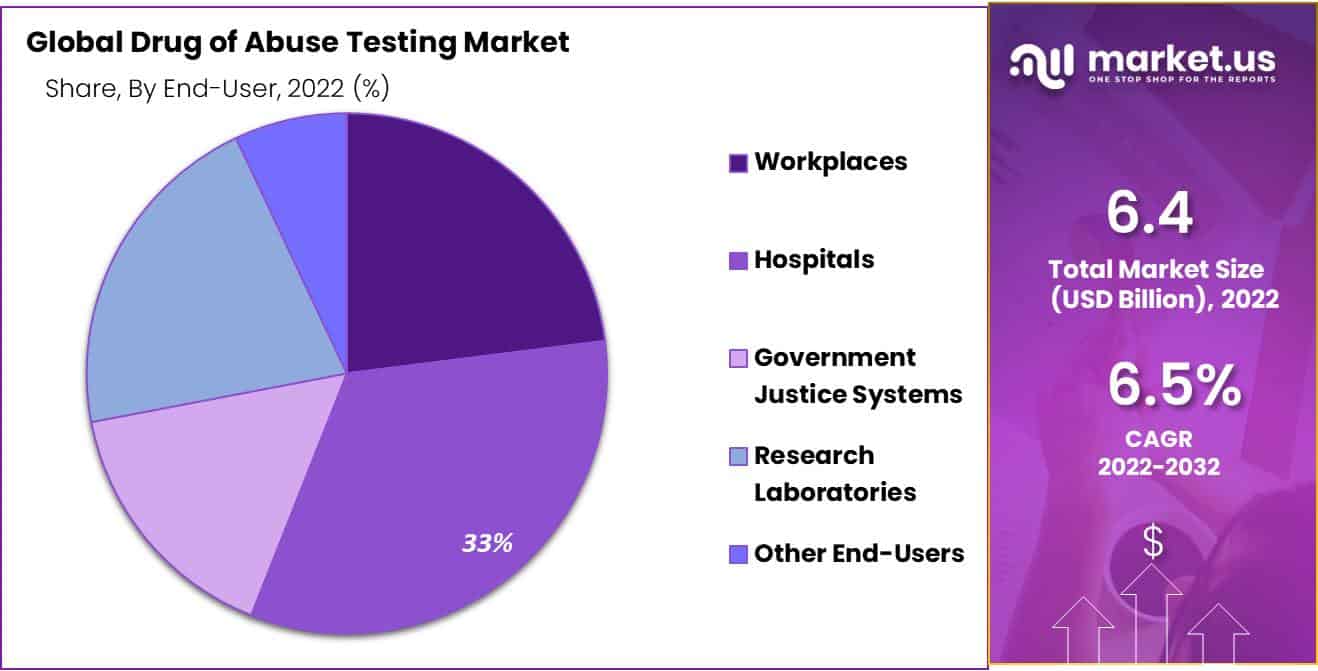

End-User Analysis

In 2022, the hospital segment dominated the global drug of abuse testing market

The global drug of abuse testing market is segmented into workplaces, hospitals, government justice systems, research laboratories, and other end-users based on end-users. Because DOA tests are primarily performed in hospitals, hospitals account for approximately 31% of all end users. In addition, hospitals receive a significant portion of the samples collected at any other location for further analysis. Hospitals’ dominance in this market is attributed to the availability of cutting-edge products that can perform various tests and their straightforward access to prescription drugs and drug screening tools.

The workplace segment is anticipated to expand in the coming years. This is largely because drug of abuse testing is frequently used in workplaces to ensure that employees do not have a drug addiction and can focus on their work. Sobriety (to ensure that individuals are not under the influence of drugs) and accountability are the two main focuses of the government justice system. In particular, the systems are set up to divert drug and alcohol addicts from prisons into forced or organized treatment.

Key Market Segments

Based on Drug Type

- Marijuana/Cannabis

- Opioids

- Amphetamine & Methamphetamine

- Cocaine

- LSD

- Alcohol

- Other Drugs

Based on Product

- Analyzers (Immunoassay Analyzers, Chromatographic Devices, Breath Analyzers)

- Rapid Testing Devices (Urine Testing Devices, Oral Fluid Testing Devices)

- Consumables

Based on Sample

- Urine

- Oral Fluid (Saliva)

- Blood

- Hair

- Other Samples

Based on End-User

Workplaces

Hospitals

Government Justice Systems

Research Laboratories

Other End-Users

Drivers

Rise in the use and sale of illegal drugs

DoA testing will be in high demand as a result of the increased production, consumption, and trade of new and illegal drugs, driving industry expansion. The World Drug Report from the United Nations Office on Drugs and Crime shows that the annual prevalence of all illicit drugs has increased in recent years. This will require DOA testing, which will propel the market forward. The government’s efforts to increase organizational compliance with DOA testing and raise public awareness of DOA will contribute to the expansion of the market as a whole. The industry’s expansion will also be aided by the high demand for goods that are more specific and sensitive to designer drugs.

Restraints

The inability to detect special drugs in trace amounts restricts market growth.

The market’s expansion is anticipated to be hampered by these testing products’ inability to detect special drugs in trace amounts. The market for drug abuse (DOA) testing is anticipated to be challenged between 2023 and 2032 as laws to legalize recreational and illicit drug use are changed. Additionally, a lack of skilled technicians, drug legalization, and clear workplace drug of abuse testing regulations are predicted to hinder the market growth.

Opportunity

The rising usage of illegal drugs and implementation of expansion strategies by leading players are expected to create numerous opportunities

According to data released by the Organization for Economic Cooperation and Development (OECD), approximately 98 to 100 million adults in the European Union aged 16 to 64 have used illegal drugs at some point in their lives. Men are more likely than women to report using drugs. Major players are adding new products and updating software with new substances to maintain their competence and share of the drug of abuse testing market. These particular factors are driving the market’s expansion.

Trends

Drug dependence, substance use disorder, benefits associated with special drugs, adherence to strict government regulations, and demand for urine drug testing are subjected to market growth

Cocaine, opiates, cannabinoids, lysergic acid diethylamide (LSD), amphetamines, barbiturates, diazepam, alcohol, and ketamine are among the drugs currently abused for their mind-altering properties, medicinal and non-therapeutic uses, and variety of other purposes, such as assisting individuals in losing weight and enhancing their athletic performance. The potential for this to result in substance use disorder and drug dependence is one of the primary driving forces behind the worldwide demand for drug of abuse testing.

Drug abuse can also negatively affect a person’s productivity and morale and pose significant health and safety risks. As a result, drug of abuse testing is used to screen job applicants and employees, provide a secure working environment, and abide by strict government regulations. Additionally, a significant rise in pain management and opioid dependency clinics contributes to the worldwide demand for urine drug testing. Prominent market players are also offering automated drug of abuse testing and analysis. In addition, these players are selling kits that can be used immediately for drug abuse tests at home.

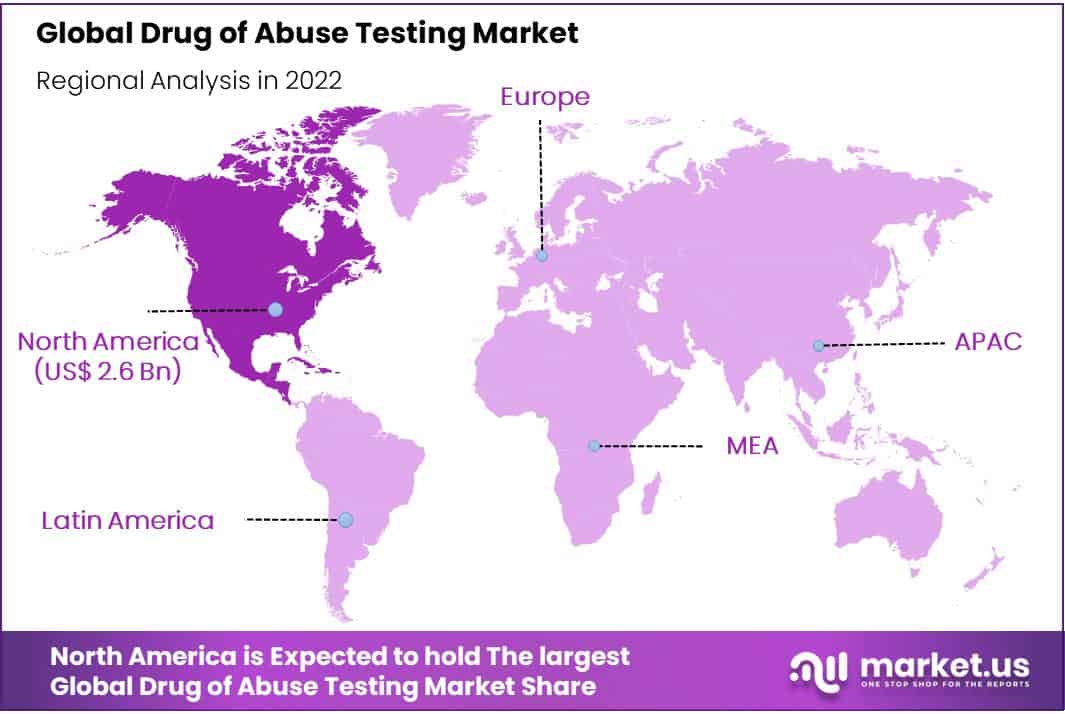

Regional Analysis

North America dominates the market with 42% of the total market share

Due to high R&D investments, the presence of global players, the growing adoption of technologically advanced solutions, and the key companies’ efforts to develop newer patents, North America dominated the drug of abuse testing market in 2022 with a revenue share of around 42%. The United States of America accounts for 89% of the increase in illicit drug use and related health issues in North America. Other factors contributing to the expansion of the market include increased drug trafficking and workplace drug consumption monitoring.

In 2022, approximately 40 million people in the United States used drugs, rising to over 14% yearly. Men consume more drugs than women, and the country has seen nearly 1 million deaths from drug overdoses since 2001. As a result, governments, businesses, and even concerned friends and family members are intensifying their DOA testing efforts in response to the rising fatalities.

The United States government has implemented the National Drug Control Strategy in this regard. It builds on the significant actions taken in the first year of the Biden administration to reduce overdose deaths, raise public awareness of alcohol’s dangers, and bring supply and demand into balance. By taking various law enforcement actions to undermine the illicit finance networks that make such trade possible and profitable, the strategy aims to build a stronger substance use disorder treatment infrastructure, reduce the supply of illicit substances, and disrupt criminal organizations.

Expanding evidence-based harm reduction strategies to meet people where they are, thereby preventing drug use in its early stages, is another major priority. Constructing a system for rehabilitation and recovery, addressing a variety of drug policy issues in the criminal justice system, and improving the research and data systems that support the development of drug policy.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Numerous drug of abuse testing providers and manufacturers aim to raise awareness among the intended audience. The importance of drug screening and the effects of drug abuse are brought to people’s attention. To gain significant market shares, the major players employ various growth strategies, including creating new products, product differentiation strategies, and expanding geographical reach.

Market Key Players

- Quest Diagnostics

- Abbott Laboratories

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- Laboratory Corporation of America Holdings

- Siemens

- Mayo Clinic Laboratories

- DRUGSCAN

- Legacy Medical Services, LLC.

- LCG Limited

- Precision Diagnostics

- Other Key Players

Recent Developments

- In August 2022, to make Narcan kits available to the general public, the Delaware Division of Public Health began including fentanyl strips. The effort was part of a harm-reduction plan to stop people from accidentally overdosing on fentanyl.

- In June 2022, the Punjab Government of India launched a drug screening campaign to identify drug abuse in jails. Over 8,000 inmates from over 14 jails were screened, and 42% were drug addicts.

Report Scope

Report Features Description Market Value (2022) USD 6.8 Bn Forecast Revenue (2032) USD 11.8 Bn CAGR (2023-2032) 6.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Type – Marijuana/Cannabis, Opioids, Methamphetamine & Amphetamine, Cocaine, LSD, Alcohol, and Other Drugs; By Product Analyzers (Immunoassay Analyzers, Chromatographic Devices, Breath Analyzers), Rapid Testing Devices (Urine Testing Devices, Oral Fluid Testing Devices), and Consumables; By Sample – Urine, Oral Fluid (Saliva), Blood, Hair, and Other Samples; By End-User – Workplaces, Hospitals, Government Justice Systems, Research Laboratories, and Other End-Users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Quest Diagnostics, Abbott Laboratories, Danaher Corporation, Bio-Rad Laboratories, Inc., Laboratory Corporation of America Holdings, Siemens, Mayo Clinic Laboratories, DRUGSCAN, Legacy Medical Services, LLC., LCG Limited, Precision Diagnostics, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the growth rate of drug of abuse testing market?The Drug Abuse Testing Market is growing at a CAGR of 6.5% over the next 10 years.What is the current size of drug of abuse testing market?Drug abuse testing market accounted for USD 6.4 billion in 2022 and is expected to reach around USD 11.8 billion in 2032.

Who are the major players in the drug of abuse testing market?The major players operating in the drug abuse testing market are Quest Diagnostics, Abbott Laboratories, Danaher Corporation, Bio-Rad Laboratories, Inc., Laboratory Corporation of America Holdings, Siemens, Mayo Clinic Laboratories, DRUGSCAN, Legacy Medical Services, LLC., LCG Limited, Precision Diagnostics, Other Key Players.

Drug of Abuse Testing MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Drug of Abuse Testing MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Quest Diagnostics

- Abbott Laboratories

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- Laboratory Corporation of America Holdings

- Siemens

- Mayo Clinic Laboratories

- DRUGSCAN

- Legacy Medical Services, LLC.

- LCG Limited

- Precision Diagnostics

- Other Key Players