Global Driving Simulator Market By Simulator Type (Full-scale, Compact, Advanced), By Application (Research and Testing, Training, Motor Sports and Gaming), By End Use (Automotive, Marine, Aviation), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 141042

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

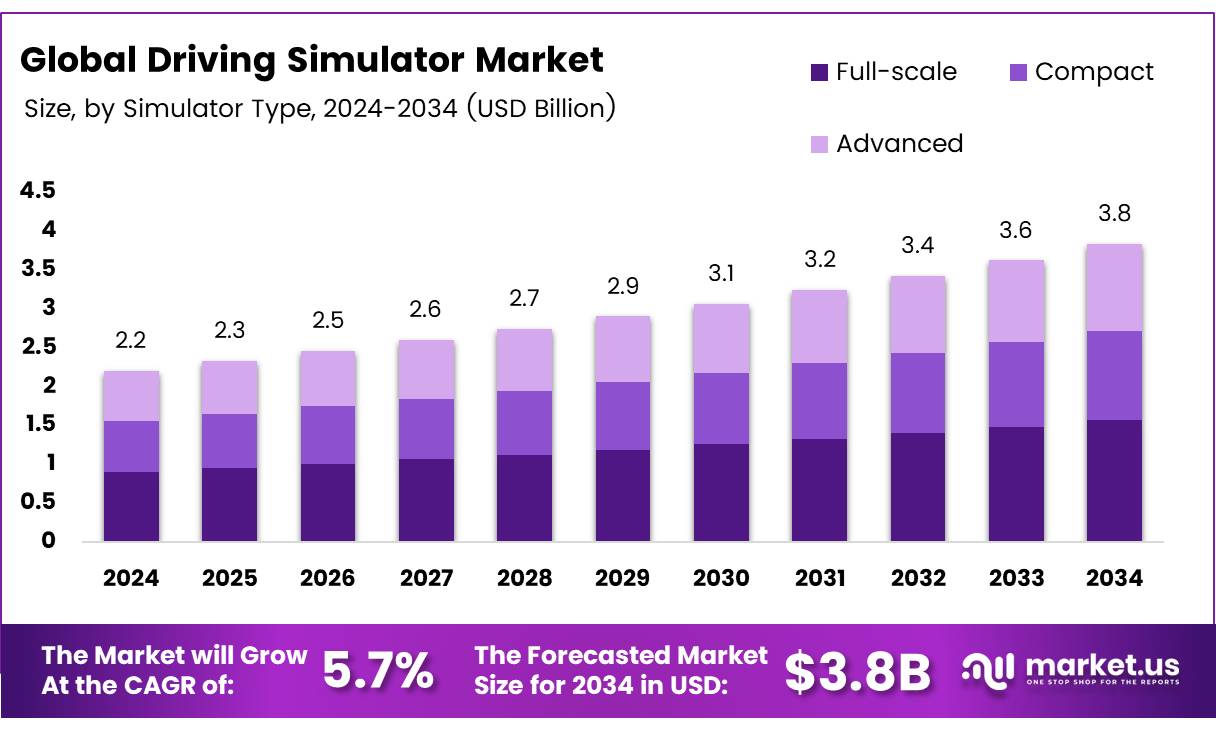

The Global Driving Simulator Market size is expected to be worth around USD 3.8 Billion by 2034, from USD 2.2 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

The driving simulator market is gaining substantial momentum due to the growing need for advanced training tools that provide a safe, controlled environment for both novice and experienced drivers. Driving simulators replicate real-world driving conditions, allowing users to practice under various weather conditions, traffic patterns, and emergency situations.

These simulators are widely used for both commercial driver training and driver safety education. Their ability to offer diverse and dynamic driving scenarios makes them an essential component in the education and transportation sectors. The adoption of simulators is also expanding across various industries, including automotive, defense, and aviation, where high-fidelity training tools are critical.

According to Viragesimulation, driving simulators can reduce training costs by up to 50% compared to traditional on-road training. This cost-effectiveness, coupled with the growing demand for high-quality training programs, positions the driving simulator market for sustained growth.

As a result, a wide range of applications, including fleet management, driver safety, and insurance testing, are contributing to the market’s expansion.

The driving simulator market is poised for significant growth due to the ongoing digitalization of training processes across multiple sectors. The increasing need for cost-effective and scalable training solutions, especially in commercial and military sectors, is expected to drive further adoption.

According to D-Box, some simulators have been shown to reduce accidents by up to 50%, while also saving billions of dollars annually on training. The demand for more immersive, realistic training environments is pushing technological advancements in the development of simulators.

Moreover, government investments and regulations are fueling the market’s growth. Many countries are investing in training programs that incorporate driving simulators to enhance road safety and improve overall driving standards. This is in line with regulations that mandate the use of advanced training tools in specific sectors like defense and transportation.

Driving simulators have also been integrated into research projects aimed at reducing traffic accidents, with the added benefit of creating simulated environments for emergency situations. According to Drivewise, simulators can replicate over 1,000 driving scenarios, including tire blowouts and brake failures, which offer realistic training experiences.

Governments worldwide are focusing on improving road safety and reducing accident rates. This has led to an uptick in public and private sector investments aimed at implementing driving simulators as part of comprehensive driver education programs. With both public and private sector growth, the future of the driving simulator market remains robust, offering numerous opportunities for stakeholders across industries.

Key Takeaways

- The global driving simulator market is expected to reach USD 3.8 billion by 2034, growing at a CAGR of 5.7% from 2025 to 2034.

- Full-scale simulators accounted for 40.1% of the market share in 2024, driven by their high-precision applications in professional training and research.

- The Research & Testing segment held a dominant position in 2024 due to rising demand for reliable testing solutions in automotive safety and design.

- The automotive sector led the By End Use Analysis segment in 2024, fueled by the need for ADAS and autonomous vehicle research and training.

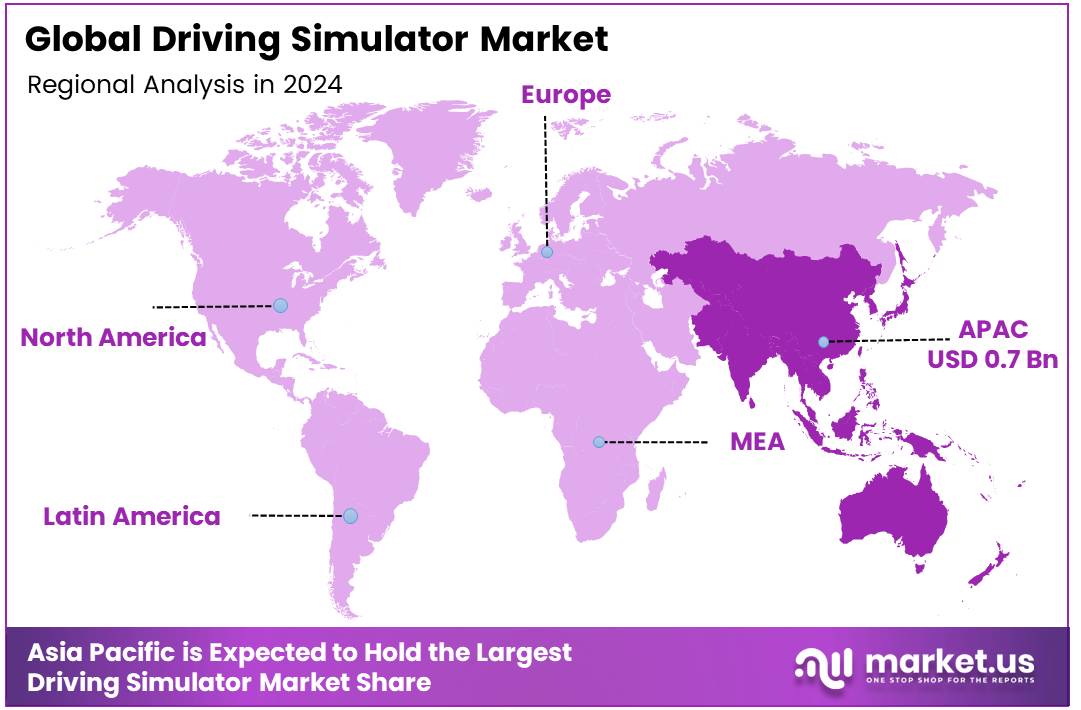

- Asia Pacific is the largest regional market, contributing 34.2% or USD 0.7 billion in 2024, driven by industrialization and investments in automotive and transportation sectors.

Simulator Type Analysis

Full-scale Driving Simulators Lead with 40.1% Share in 2024, Dominating the Simulator Type Market

In 2024, Full-scale simulators maintained a dominant position within the By Simulator Type segment of the driving simulator market, accounting for a significant 40.1% market share. This strong performance can be attributed to their extensive application in high-fidelity training environments, including professional driver training and advanced research purposes. Their ability to replicate real-world driving conditions with high precision makes them a preferred choice for institutions requiring detailed simulations.

Compact simulators, while accounting for a smaller portion of the market, are gaining traction due to their cost-effectiveness and suitability for commercial or lower-budget training environments. These simulators are increasingly popular in driver education programs and for use in automotive marketing or R&D due to their portability and lower operational costs.

Advanced simulators, though representing a niche segment, are also experiencing growth. These systems are designed with cutting-edge technology to offer highly interactive experiences that include virtual reality (VR) and artificial intelligence (AI). As the demand for more immersive and realistic training tools rises, the advanced segment is expected to expand further, particularly in specialized sectors such as military and autonomous vehicle development.

Application Analysis

Research & Testing Dominates the Driving Simulator Market in 2024

In 2024, the Research & Testing segment held a dominant market position in the By Application Analysis segment of the Driving Simulator Market. This is due to the increasing demand for high-precision, reliable testing solutions across a range of industries, including automotive safety, vehicle design, and regulatory compliance.

Driving simulators are widely utilized in these sectors to replicate real-world driving conditions and test vehicle performance in a controlled environment. This ability to gather detailed, actionable data makes simulators an essential tool in research and testing applications, reinforcing their dominance within the market.

The Training segment, which focuses on driver education and professional development, also remains a significant application. However, its growth is comparatively slower as simulators primarily serve as a complementary tool to traditional training methods.

Meanwhile, the Motor Sports & Gaming segment, while growing in prominence due to technological advancements and the increasing popularity of eSports, holds a smaller share of the market. Overall, the Research & Testing segment continues to drive the driving simulator market’s growth, supported by its crucial role in ensuring safety and performance accuracy in vehicle testing.

End Use Analysis

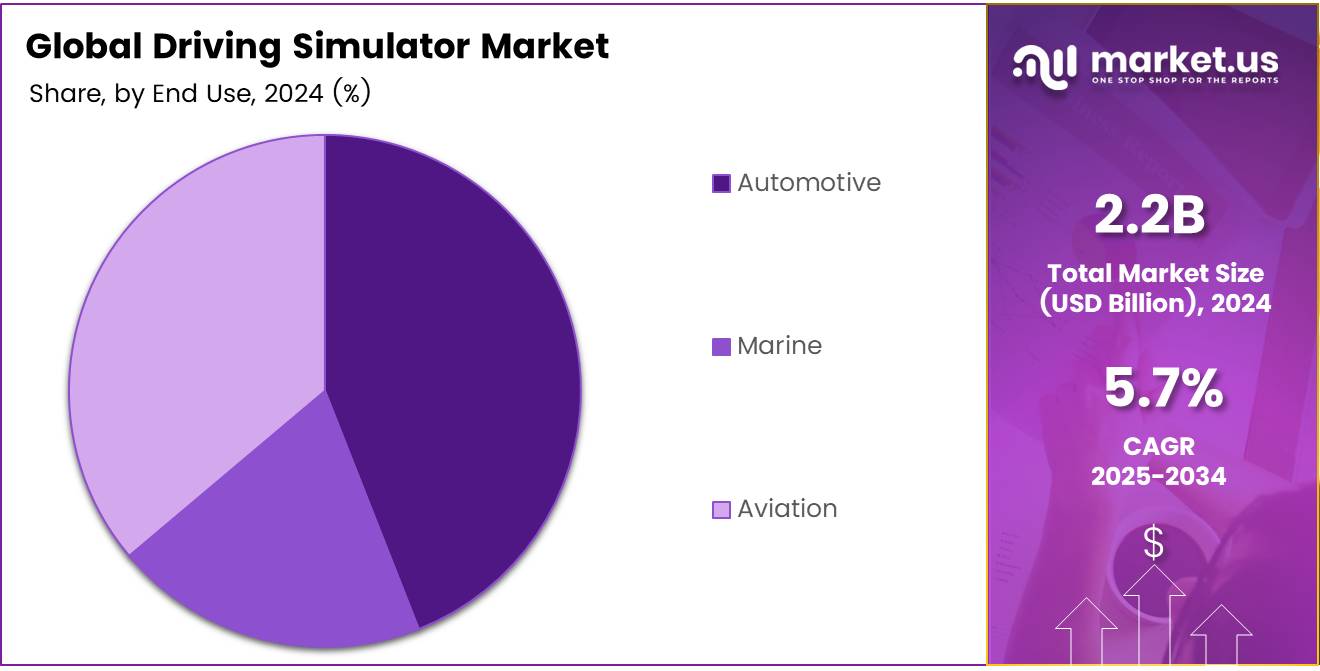

Automotive Leads the Driving Simulator Market’s End Use Segment in 2024

In 2024, the automotive sector held a dominant position in the By End Use Analysis segment of the Driving Simulator Market. This can be attributed to the increasing demand for advanced driver-assistance systems (ADAS) and autonomous vehicle technologies, which necessitate the use of driving simulators for research and development purposes. Additionally, automotive manufacturers are leveraging these simulators for training and safety testing, further driving growth in this segment.

The marine sector followed with a significant share. The use of driving simulators in marine applications, particularly for training purposes and simulation of real-world navigation scenarios, has been steadily increasing. Technological advancements in simulation models have enhanced the effectiveness of training programs, thereby promoting market expansion in this area.

The aviation sector, while smaller in comparison, continues to exhibit growth, driven by global demand for pilot training and advancements in flight simulation technology. Airlines and training organizations are utilizing simulators to train pilots, providing cost-effective and safe environments for skill development.

Key Market Segments

By Simulator Type

- Full-scale

- Compact

- Advanced

By Application

- Research & Testing

- Training

- Motor Sports & Gaming

By End Use

- Automotive

- Marine

- Aviation

Drivers

Increasing Demand for Driver Safety and Training Drives Market Growth

The growing need for road safety and better driver training methods is a key driver in the adoption of driving simulators. As the awareness of road safety risks increases globally, both individuals and organizations are prioritizing improved driver training. Traditional driving methods have limitations, but simulators offer a safer and more controlled environment for learning, allowing for real-time feedback without the risk of accidents.

Moreover, simulators provide an opportunity for drivers to experience various driving scenarios, including extreme weather conditions, hazardous roads, and emergency situations, without putting them in danger.

As a result, both driving schools and commercial organizations are increasingly integrating simulators into their training programs. These systems not only help new drivers but also offer refresher courses for experienced drivers, ensuring that they stay updated on safe driving practices.

Additionally, the cost-effectiveness of simulators, especially when used for repeated practice, makes them an attractive alternative to traditional on-road training. This growing emphasis on improving driver safety and offering more comprehensive training options is expected to continue driving the growth of the driving simulator market in the coming years.

Restraints

Challenges in Simulator Calibration and Maintenance Impact Market Growth

One of the significant challenges facing the driving simulator market is the complexity involved in calibration and maintenance. Driving simulators require regular adjustments and fine-tuning to maintain accurate simulations, which directly impacts the operational costs. Inaccurate simulations due to poor calibration can undermine the effectiveness of the simulator, which could affect its adoption in industries like automotive training, research, and entertainment.

These continuous maintenance requirements demand skilled personnel and can lead to high upkeep costs for simulator providers, limiting accessibility for smaller companies or organizations.

Additionally, the lack of standardized protocols across simulator models makes it difficult to ensure consistency in performance, further complicating maintenance processes. This lack of uniformity in simulation quality and calibration procedures across different manufacturers creates additional hurdles for businesses trying to integrate these technologies seamlessly.

Consequently, without a clear set of industry-wide standards, the growth potential of the driving simulator market may be hindered, as companies are hesitant to invest in systems that may not meet their specific needs or operational requirements. As a result, the overall market adoption could be slow, affecting long-term expansion opportunities within the sector.

Growth Factors

Development of Multi-Sensory Simulators Enhances Market Potential

The driving simulator market is witnessing significant growth driven by innovations such as the development of multi-sensory simulators, which enhance the user experience by incorporating additional sensory inputs like touch, smell, and even temperature changes.

This technological advancement is expected to attract a broader customer base, particularly in sectors where immersion is critical, such as entertainment, training, and research. Moreover, the increasing focus on autonomous vehicle development presents another key growth opportunity.

As autonomous vehicle technologies evolve, simulators are becoming an essential tool for testing, refining, and validating self-driving algorithms, which further bolsters the demand for simulation platforms. Additionally, driving simulators are finding applications in driver rehabilitation programs, offering an alternative, safer way for individuals recovering from accidents or managing medical conditions to regain their driving skills.

The market is also expanding through partnerships with educational institutions, where simulators are integrated into driver education programs, ensuring sustained demand. These strategic collaborations with universities and vocational schools help nurture a long-term market for driving simulators, positioning the technology as a central component in both training and rehabilitation efforts. Collectively, these factors create a favorable environment for the growth of the driving simulator market, making it an attractive area for investment and development.

Emerging Trends

Integration of VR and AR Enhances Driving Simulator Experience

The driving simulator market is experiencing significant growth due to several key trends that enhance both training efficiency and user experience. One of the primary trends is the integration of Virtual Reality (VR) and Augmented Reality (AR) technologies, which aim to offer more immersive and realistic driving scenarios.

These technologies not only enhance user engagement but also provide safer, controlled environments for training, reducing the risk of accidents during real-world learning. Additionally, gamification elements are becoming a popular feature, making training more interactive and appealing, especially to younger users who are accustomed to digital gaming environments.

Another critical factor driving the market is the growing use of driver behavioral analysis within simulators. This integration enables the collection of valuable insights regarding driver habits, which can be used for both performance feedback and insurance purposes. Additionally, the emergence of cloud-based simulation solutions is improving accessibility and scalability, with remote access and easy updates, while reducing the need for expensive hardware.

The rising adoption of electric vehicles (EVs) is also shaping the market, as simulators are now being tailored to train drivers in EV-specific handling techniques and technology, supporting the shift towards sustainable transportation. Collectively, these trends point to a more interactive, data-driven, and adaptable driving simulator market, catering to the evolving needs of training and technology adoption.

Regional Analysis

Asia Pacific leads the driving simulator market with a 34.2% share, valued at USD 0.7 billion

The global driving simulator market is experiencing significant growth, with regional dynamics playing a crucial role in shaping its expansion. Asia Pacific holds the largest share of the market, contributing approximately 34.2%, equating to USD 0.7 billion in 2024. This dominance can be attributed to the rapid industrialization and increasing investments in the automotive and transportation sectors, particularly in countries like China, Japan, and India.

The region is witnessing a surge in demand for driving simulators across various applications, including driver training, research and development (R&D), and vehicle design. The growing adoption of advanced technologies and the rising emphasis on road safety further fuel market growth in this region.

Regional Mentions:

North America follows closely as a prominent market, driven by the strong presence of leading automotive manufacturers and research institutions in the United States and Canada. The demand for driving simulators in North America is primarily supported by applications in autonomous vehicle development and advanced driver-assistance systems (ADAS). The region’s robust infrastructure for simulation technologies and government-backed initiatives to enhance road safety contribute to its continued market growth.

Europe also represents a significant portion of the global driving simulator market. The region’s demand is largely driven by the automotive sector, with countries like Germany, France, and the United Kingdom focusing on automotive innovation and R&D activities. Europe’s strong regulatory framework around road safety and vehicle emissions, combined with the increasing adoption of simulation technologies by automotive companies, supports its market share.

The Middle East & Africa (MEA) and Latin America, while smaller in comparison, are expected to grow steadily due to the increasing emphasis on road safety, transportation research, and the adoption of simulators for driver training. These regions are gradually integrating advanced simulation systems to meet the rising demand for efficient training solutions and enhance road safety protocols.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global driving simulator market is characterized by the presence of several established players across the automotive, defense, and transportation sectors. As of 2024, companies such as Anthony Best Dynamics Limited, VI-grade GmbH, and CAE Inc. stand out due to their long-standing expertise and technological advancements in simulation systems.

Anthony Best Dynamics Limited, a pioneer in high-fidelity driving simulators, is anticipated to maintain its leadership in providing advanced simulation solutions for driver training, automotive R&D, and performance analysis. Their focus on delivering highly customizable and realistic simulation experiences positions them well for continued growth.

Similarly, VI-grade GmbH has a strong market presence, particularly in the automotive sector, with an emphasis on virtual testing and engineering. Their simulator platforms are integral to various stages of vehicle development, allowing for efficient testing and validation of new designs and technologies.

CAE Inc., a global leader in simulation-based training solutions, has expanded its footprint in the automotive and aviation sectors. The company is well-poised to leverage its established technologies and services to capture a larger share of the growing demand for integrated training simulators.

Other players such as Bosch Rexroth AG, L3Harris Technologies, and ECA Group contribute their expertise in control systems and high-tech simulation equipment, targeting both the automotive and defense markets. Companies like Tecknotrove and Thales are expected to drive innovation through immersive simulation environments and advanced modeling techniques.

Top Key Players in the Market

- Anthony Best Dynamics Limited

- Adacel Technologies Limited

- Bosch Rexroth AG

- VI-grade GmbH

- CAE Inc.

- Cruden BV

- ECA Group

- L3Harris Technologies, Inc.

- Tecknotrove

- Thales

Recent Developments

- In April 2024, Today secured $5 million in funding to develop a Web3 game featuring AI-driven NPCs, aimed at enhancing interactive player experiences with advanced technology. The funding will support the game’s development and its integration of blockchain elements.

- In June 2023, Spektra Games raised $1.25 million to further develop its mobile racing and simulation games, promising immersive gameplay experiences with cutting-edge graphics and physics. This funding is expected to accelerate the studio’s ability to bring its innovative titles to market.

- In September 2024, Treble, an emerging audio tech company, landed €11 million in funding to revolutionize sound simulation across industries like automotive, gaming, and the metaverse. The investment will help scale its cutting-edge spatial audio technologies and applications.

- In October 2024, Outlier Games Ltd completed a €583k funding round to enhance its portfolio of interactive gaming experiences, focusing on unique narratives and innovative gameplay. This funding will support the company’s expansion and game development initiatives.

Report Scope

Report Features Description Market Value (2024) USD 2.2 Billion Forecast Revenue (2034) USD 3.8 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Simulator Type (Full-scale, Compact, Advanced), By Application (Research & Testing, Training, Motor Sports & Gaming), By End Use (Automotive, Marine, Aviation) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Anthony Best Dynamics Limited, Adacel Technologies Limited, Bosch Rexroth AG, VI-grade GmbH, CAE Inc., Cruden BV, ECA Group, L3Harris Technologies, Inc., Tecknotrove, Thales Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Anthony Best Dynamics Limited

- Adacel Technologies Limited

- Bosch Rexroth AG

- VI-grade GmbH

- CAE Inc.

- Cruden BV

- ECA Group

- L3Harris Technologies, Inc.

- Tecknotrove

- Thales