Global Doxycycline Market Analysis By Formulation Type (Oral (Tablets, Capsules, Oral Suspension), Injectable (Intravenous, Intramuscular), Topical), By Therapeutic Application (Infectious Diseases (Respiratory Tract Infections, Sexually Transmitted Infections, Intestinal Infections, Urinary Tract Infections, Others), Acne Vulgaris), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, E-Pharmacies) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160820

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

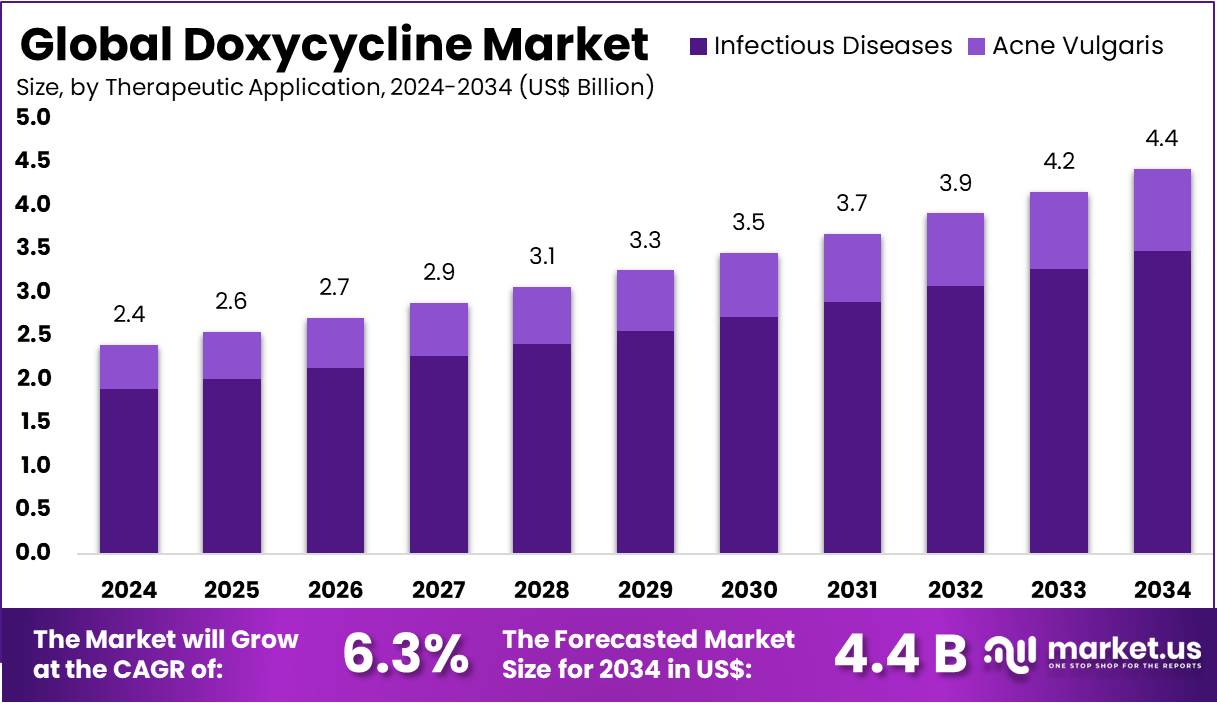

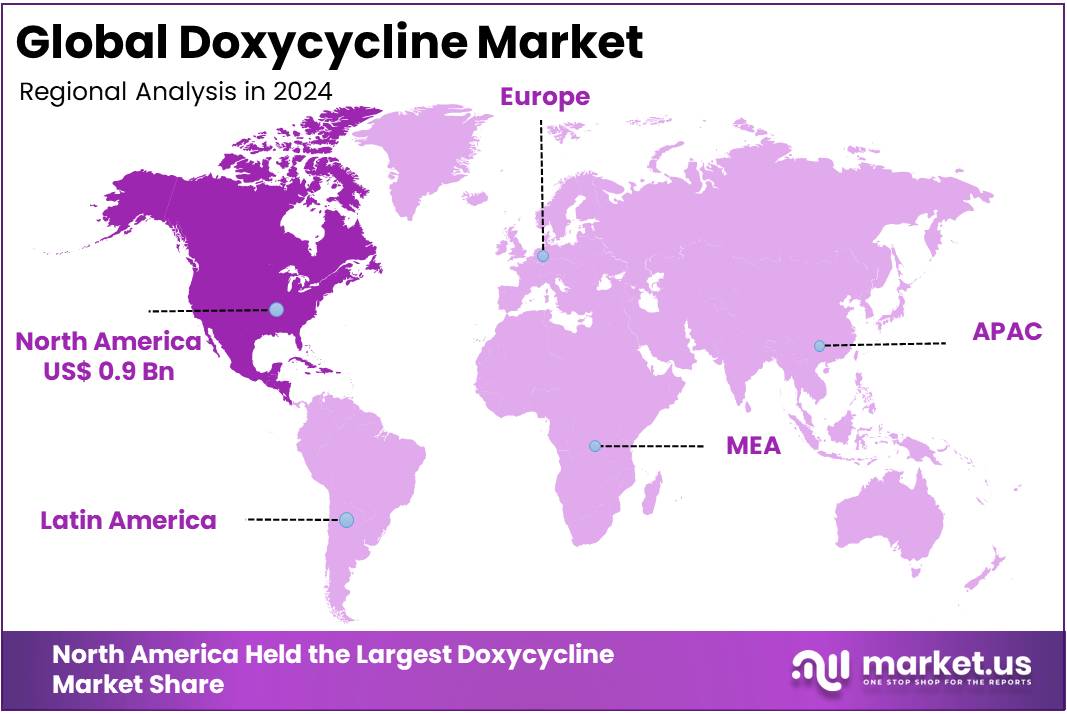

The Global Doxycycline Market size is expected to be worth around US$ 4.4 Billion by 2034, from US$ 2.4 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 36.9% share and holds US$ 2.37 Billion market value for the year.

Doxycycline is a broad-spectrum antibiotic belonging to the tetracycline class. It acts by inhibiting bacterial protein synthesis, thereby preventing bacterial growth. According to the World Health Organization (WHO), doxycycline is listed in the Model List of Essential Medicines, emphasizing its critical role in global healthcare. The medicine is available in 100 mg capsules and 100 mg dispersible tablets, making it accessible and affordable for use in various healthcare settings worldwide.

This antibiotic is widely used to treat respiratory tract, urinary tract, and skin infections, as well as sexually transmitted diseases (STDs) and zoonotic infections. Studies by the U.S. Centers for Disease Control and Prevention (CDC) have highlighted doxycycline’s broad clinical applications. For example, it is the first-line treatment for rickettsial diseases such as Rocky Mountain spotted fever and spotted fever group infections. The CDC recommends its use for both adults and children due to its effectiveness and life-saving potential in severe bacterial infections.

In recent years, doxycycline has gained attention for new preventive uses. According to a June 2024 CDC guideline, doxycycline post-exposure prophylaxis (doxy-PEP) can prevent sexually transmitted infections in higher-risk groups. A single 200 mg dose taken within 72 hours after sexual exposure reduced syphilis and chlamydia by over 70% and gonorrhea by about 50%. This evidence-based addition to public health policy is expected to increase doxycycline prescriptions, especially within sexual health clinics in developed regions.

Vector-borne diseases continue to sustain steady global demand. For instance, U.S. surveillance reported over 89,000 Lyme disease cases in 2023, with broader estimates suggesting 476,000 individuals treated annually. Doxycycline remains a key outpatient therapy for early Lyme disease. According to environmental health studies, climate change has expanded tick habitats, increasing infection risks in both North America and Europe. As a result, the demand for doxycycline in treating tick-borne diseases is expected to remain consistent.

Additionally, doxycycline plays a critical role in malaria prophylaxis. A study by NCBI confirms that 100 mg daily is approved for malaria prevention, beginning 1–2 days before travel and continuing for 28 days after return. As international travel recovers post-pandemic, prophylactic use is rising again, particularly among long-term or budget travelers who favor low-cost, oral options. The affordability and high efficacy of generic doxycycline continue to anchor its use across travel medicine and general infectious disease control.

Economic and Policy Factors Influencing the Doxycycline Market

The global doxycycline market has witnessed steady and moderate growth, supported by essential medicine designation and rising infectious disease burdens. The market expansion is driven by growing healthcare infrastructure in developing economies and the wide availability of generic formulations. In 2023, doxycycline ranked 77th among the most-prescribed drugs in the U.S., accounting for over 8 million prescriptions. This consistent demand demonstrates the drug’s strong presence in both human and veterinary medicine.

Public health preparedness and biosecurity measures form another critical growth pillar. The U.S. Food and Drug Administration (FDA) has approved doxycycline for post-exposure prevention of inhalational anthrax, positioning it as a key component of national emergency stockpiles. According to U.S. biodefense documentation, periodic replenishment of government stockpiles supports recurring bulk procurement, creating periodic surges in demand for pharmaceutical manufacturers.

Affordability remains central to doxycycline’s sustained market penetration. Generic competition has reduced unit prices, making it a cost-effective antibiotic for health systems and global aid programs. For example, many public healthcare providers prefer doxycycline for primary-care infections, selected STIs, and vector-borne diseases, given its balance between efficacy and cost. Moreover, stewardship initiatives encourage rational use without significantly reducing volume, sustaining long-term baseline demand.

Veterinary medicine continues to represent an important secondary market segment. However, regulatory restrictions on antibiotic use in livestock have slightly constrained growth. Despite these limitations, the medication’s dual applicability across human and animal health maintains a broad commercial footprint. In both domains, its inclusion in WHO and CDC guidelines ensures standardized usage and consistent procurement by healthcare authorities worldwide.

From a pharmacological perspective, doxycycline exhibits negligible metabolism and is primarily excreted through the gut and kidneys, contributing to favorable safety and dosing profiles. For children under 8 years, use is restricted to life-threatening cases where no safer alternatives exist. This careful clinical positioning reinforces its trusted status in public health. In conclusion, according to multiple global health agencies, the doxycycline market is expected to remain stable and policy-driven, supported by essential medicine recognition, new STI prevention strategies, and resilience against evolving infectious disease patterns.

Key Takeaways

- The global doxycycline market is anticipated to reach approximately US$ 4.4 billion by 2034, expanding from US$ 2.4 billion in 2024, at a 6.3% CAGR.

- In 2024, the Oral formulation segment dominated the market, accounting for over 65.2% of total revenue due to higher patient compliance and accessibility.

- The Infectious Diseases segment led the therapeutic applications in 2024, capturing around 78.8% share, supported by doxycycline’s wide use against bacterial infections.

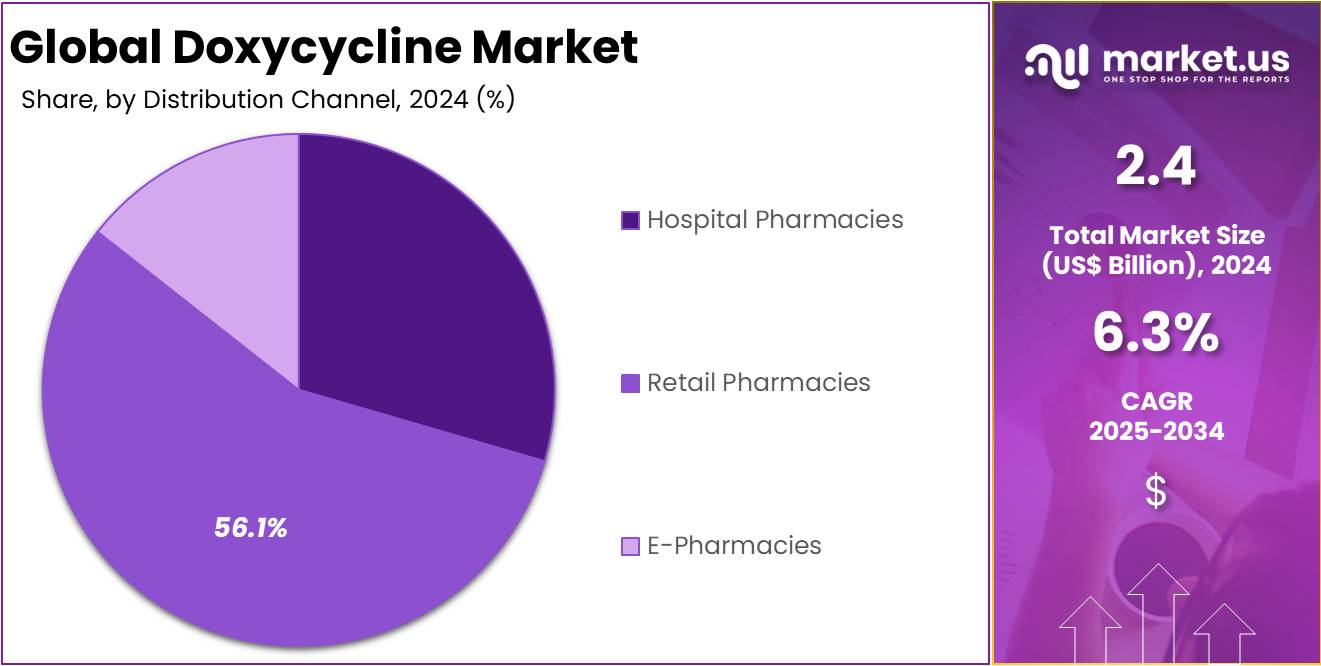

- Among distribution channels, Retail Pharmacies held a leading position in 2024 with a 56.1% market share, reflecting strong consumer availability and prescription rates.

- North America emerged as the dominant regional market in 2024, representing over 37.5% share and a market value of nearly US$ 0.9 billion.

Formulation Type Analysis

In 2024, the Oral Section held a dominant market position in the formulation type segment of the Doxycycline market and captured more than a 65.2% share. This dominance was mainly due to its easy use, wide availability, and strong patient preference. Oral forms such as tablets, capsules, and suspensions were commonly prescribed for infections like acne, respiratory issues, and sexually transmitted diseases. Their lower cost and effective results helped oral formulations maintain a leading position across global markets.

The Injectable Section accounted for a moderate share of the Doxycycline market in 2024. These formulations were used mainly in hospitals and clinics for severe or urgent infections. Intravenous and intramuscular injections offered quick absorption and high effectiveness. However, they required professional administration and were relatively expensive. Such factors limited their use compared to oral forms. Even so, injectable formulations remained vital in treating acute bacterial conditions and in emergency medical care.

The Topical Section represented a smaller share of the overall market. It was widely used in dermatology for acne and rosacea treatment. Topical formulations offered targeted delivery and fewer systemic side effects. Their growth was supported by the increasing number of skin-related infections and ongoing research into combination treatments. Although smaller in volume, this segment showed steady progress. With rising awareness about skin health, topical doxycycline is expected to gain more adoption during the forecast period.

Therapeutic Application Analysis

In 2024, the Infectious Diseases Section held a dominant market position in the Therapeutic Application Segment of the Doxycycline Market, and captured more than a 78.8% share. This dominance was mainly due to the broad clinical use of doxycycline in treating bacterial infections. It was widely prescribed for respiratory, urinary, intestinal, and sexually transmitted infections. Its affordability, high efficacy, and broad-spectrum coverage strengthened its adoption. The growing prevalence of infectious diseases further supported its significant market share.

The Acne Vulgaris segment held a moderate share of the doxycycline market in 2024. Its growth was driven by the increasing incidence of acne among both adolescents and adults. Doxycycline’s anti-inflammatory and antimicrobial effects made it a preferred systemic therapy in dermatology. Rising awareness of skin health and advancements in dermatological formulations enhanced its use. However, the segment’s market share remained limited due to the availability of topical substitutes and shorter treatment durations.

Other therapeutic applications of doxycycline included periodontal diseases, ocular infections, and preventive treatments in at-risk populations. These niche uses continued to expand gradually, supported by ongoing clinical studies exploring its anti-inflammatory and anti-parasitic properties. The overall market outlook remained positive. The infectious diseases category was expected to maintain dominance through 2030. Strong therapeutic demand and public health initiatives continued to support its clinical and commercial importance across global healthcare markets.

Distribution Channel Analysis

In 2024, the Retail Pharmacies section held a dominant market position in the Distribution Channel Segment of the Doxycycline Market and captured more than a 56.1% share. This dominance was linked to the easy accessibility of retail outlets and the strong trust they hold among patients. Retail pharmacies remained the preferred choice for purchasing antibiotic drugs. Their wide presence in urban and semi-urban areas made them the most convenient and reliable option for consumers seeking quick access to doxycycline.

Hospital Pharmacies also held a notable position in the doxycycline market. The demand in this segment was supported by a rise in inpatient treatments and the growing need for effective infection management. Hospitals widely used doxycycline for treating a range of bacterial infections. The segment benefited from antibiotic stewardship programs and increased awareness of infection control. These factors collectively enhanced the importance of hospital pharmacies within the overall distribution network.

E-Pharmacies displayed strong growth potential during the same period. Their rise was driven by the expanding use of digital health platforms and changing consumer buying behavior. Online pharmacies offered home delivery, transparent pricing, and attractive discounts. These benefits encouraged patients to buy medications online. The segment is expected to grow rapidly in the coming years, transforming how consumers access antibiotics. As a result, e-pharmacies are gradually reshaping the overall doxycycline distribution landscape.

Key Market Segments

By Formulation Type

- Oral

- Tablets

- Capsules

- Oral Suspension

- Injectable

- Intravenous

- Intramuscular

- Topical

By Therapeutic Application

- Infectious Diseases

- Respiratory Tract Infections

- Sexually Transmitted Infections

- Intestinal Infections

- Urinary Tract Infections

- Others

- Acne Vulgaris

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- E-Pharmacies

Drivers

Expanded Use of Doxycycline in Prophylactic and Preventive Healthcare

The growing adoption of doxycycline post-exposure prophylaxis (DoxyPEP) is driving significant demand for the drug. DoxyPEP is increasingly recommended to prevent bacterial sexually transmitted infections (STIs) such as chlamydia and syphilis. This expanding clinical application has led to higher utilization of doxycycline beyond its traditional therapeutic use. Healthcare providers and public health programs are promoting preventive antibiotic strategies, thereby increasing prescription rates and consumption of doxycycline across multiple healthcare settings.

The preventive potential of doxycycline is attracting strong interest from both healthcare professionals and policymakers. Clinical studies have demonstrated its efficacy in reducing the incidence of certain bacterial STIs, especially among high-risk populations. As a result, doxycycline is being positioned as a key preventive tool in sexual health programs. The growing recognition of its effectiveness is expected to enhance its inclusion in treatment guidelines, further stimulating its demand in preventive medicine.

Furthermore, the expansion of DoxyPEP aligns with global efforts to control infectious diseases through early prevention. Governments and non-profit health organizations are endorsing its use to reduce infection transmission rates. This trend is creating sustained market opportunities for doxycycline manufacturers. As awareness of antibiotic-based prophylaxis rises, the demand for doxycycline in both hospital and community settings is projected to increase steadily over the forecast period.

Restraints

Rising Antibiotic Resistance Limiting Doxycycline Effectiveness

The increasing prevalence of antibiotic resistance has emerged as a major restraint to doxycycline use. Bacteria such as Neisseria gonorrhoeae and commensal organisms have shown escalating resistance to tetracycline-class drugs. This resistance reduces doxycycline’s therapeutic effectiveness in bacterial infections. The trend restricts its clinical utility in treating sexually transmitted infections and other bacterial diseases, creating uncertainty in treatment outcomes and posing challenges for healthcare providers relying on doxycycline-based regimens.

Rising tetracycline resistance compromises the reliability of doxycycline as a first-line therapy. The drug’s decreasing susceptibility profile has led to concerns about treatment failures in infections once easily managed. This situation limits doxycycline’s inclusion in standardized treatment protocols and compels clinicians to opt for alternative antibiotics. Consequently, healthcare systems face increased costs due to the need for newer, more expensive drugs and longer treatment durations to achieve comparable clinical outcomes.

The continued spread of resistant bacterial strains threatens doxycycline’s long-term market potential. Resistance trends may hinder its demand and affect growth in therapeutic applications such as respiratory infections, skin diseases, and prophylactic use in travelers. Moreover, regulatory authorities increasingly emphasize antimicrobial stewardship programs, discouraging the excessive use of broad-spectrum antibiotics like doxycycline. These developments collectively act as restraints on the market, restricting its expansion despite the drug’s established clinical benefits.

Opportunities

Repurposing Doxycycline for Non-Infectious Therapeutic Applications

Repurposing doxycycline for non-infectious indications presents a promising opportunity to expand its therapeutic portfolio. Traditionally recognized as a broad-spectrum antibiotic, doxycycline’s anti-inflammatory and neuroprotective properties have attracted attention for use in chronic and degenerative diseases. Exploring its efficacy in conditions such as Alzheimer’s disease can help reposition the drug within high-value therapeutic markets. This repositioning may enhance its commercial life cycle and establish new revenue streams, reducing reliance on antimicrobial indications amid increasing antibiotic resistance concerns.

The repurposing approach also offers advantages in terms of reduced development cost and time. Since doxycycline’s safety, pharmacokinetics, and tolerability are already well-established, its transition into non-infectious disease markets becomes more efficient. Clinical development risks are minimized, and regulatory approval timelines may be shortened. Such strategic repositioning aligns with the growing focus on drug repurposing to maximize existing assets, supporting a more sustainable and cost-effective innovation model within the pharmaceutical industry.

Furthermore, the rising prevalence of neurodegenerative disorders globally strengthens the opportunity for doxycycline’s repositioning. Increasing healthcare investments and patient awareness in managing Alzheimer’s and similar conditions create a favorable market environment. Early research indicating doxycycline’s potential in modulating neuroinflammation provides a scientific basis for further exploration. If validated through clinical studies, this shift could position doxycycline as a valuable adjunct or alternative therapy in neurodegenerative care, enhancing its therapeutic relevance beyond infectious diseases.

Trends

Advancements in Doxycycline Formulation and Delivery Systems

The development of advanced doxycycline formulations is becoming a major focus in pharmaceutical research. The trend is driven by the need to enhance the drug’s therapeutic efficacy, bioavailability, and patient compliance. Controlled-release and modified delivery systems are being designed to ensure consistent plasma concentrations and prolonged drug action. Such innovations aim to minimize the dosing frequency, reduce gastrointestinal side effects, and improve the overall treatment outcomes for bacterial infections and inflammatory conditions.

Innovations in parenteral and localized delivery of doxycycline are gaining momentum. Injectable and implantable systems are being explored for targeted drug delivery in severe infections, periodontal diseases, and wound healing. These systems enable direct delivery of doxycycline to affected tissues, improving local concentration and reducing systemic exposure. The parenteral approach is particularly beneficial in cases where oral administration is limited due to poor absorption or patient noncompliance, thus enhancing therapeutic precision and stability.

Research efforts are increasingly directed toward wound-targeted and nano-based doxycycline formulations. Nanocarriers, hydrogels, and liposomal systems are being developed to ensure site-specific drug release with better tissue penetration. These novel platforms provide improved stability and protection from degradation while enhancing antimicrobial and anti-inflammatory effects. The focus on advanced drug delivery technologies highlights a broader shift toward precision therapy, where doxycycline’s pharmacological benefits are optimized through modern formulation science.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than 37.5% share and holding a market value of approximately US$ 0.9 billion. According to recent studies, the region’s leadership is strongly supported by public health guidelines, high clinical need, and diverse usage patterns. In the United States, the Centers for Disease Control and Prevention (CDC) recommends doxycycline as the first-line therapy for common infections such as chlamydia, which reinforces its consistent demand across both primary and specialist healthcare settings.

A study by the CDC in 2024 further expanded doxycycline’s role through post-exposure prophylaxis (Doxy-PEP) guidelines for the prevention of bacterial sexually transmitted infections in high-risk groups. For instance, the implementation of Doxy-PEP in urban health clinics has normalized preventive use and improved procurement predictability. As these national recommendations scale within public health systems, baseline consumption levels have grown, driving a steady increase in regional market demand.

Additionally, the high prevalence of tick-borne diseases sustains substantial outpatient use. The United States records about 476,000 cases of Lyme disease diagnosed and treated annually. Doxycycline is widely prescribed as a first-line treatment for early Lyme disease and as a single-dose prophylaxis following high-risk tick exposure. This consistent epidemiological burden translates into strong and recurring seasonal sales, especially in endemic areas across North America.

Emergency preparedness initiatives have further enhanced market stability. For example, doxycycline serves as a core countermeasure against inhalational anthrax under the U.S. Strategic National Stockpile. The Food and Drug Administration (FDA) also permits shelf-life extensions for stockpiled products, supporting periodic replenishment and government procurement cycles. This policy-driven demand strengthens long-term market consistency.

Moreover, broad FDA-approved labeling—covering respiratory infections, acne, rickettsial diseases, plague, and malaria prophylaxis—allows extensive use across primary care, dermatology, and travel medicine. The combination of preventive policy adoption, infectious disease prevalence, and strong regulatory support has positioned North America as the leading regional market for doxycycline with sustained, diversified, and predictable demand growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The doxycycline market is dominated by several established pharmaceutical manufacturers that ensure wide product availability and price stability. The market structure is shaped by generic competition, integrated supply chains, and regulatory compliance standards. Major companies maintain strong product portfolios, including oral solids and injectable formulations, catering to both hospital and retail channels. Global demand is driven by high antibiotic consumption and dermatological use. The competitive landscape is defined by backward integration, efficient manufacturing, and diversified distribution networks across major therapeutic markets.

Large-scale producers such as Teva Pharmaceuticals, Alembic Pharmaceuticals, and Zydus Lifesciences maintain leadership through operational efficiency and consistent regulatory performance. Their vertically integrated manufacturing ensures a steady API supply and mitigates cost volatility. Pfizer continues to participate selectively, focusing on branded and institutional sales supported by product reliability. These companies leverage strong distribution systems and quality assurance to retain dominance in developed markets, where stringent regulatory standards reward suppliers with proven compliance records and long-term partnerships.

Mid-tier players including Mayne Pharma, Hikma Pharmaceuticals, and Aurobindo Pharma contribute significantly to market balance. Mayne’s expertise in modified-release formulations and Hikma’s strength in injectables position them favorably in specialty and hospital segments. Aurobindo and Strides Pharma Science utilize backward integration and global regulatory approvals to enhance export competitiveness. Their cost efficiency and product diversity enable consistent supply even in highly price-sensitive markets, strengthening their presence across North America, Europe, and emerging economies where antibiotic demand remains strong.

Smaller generics manufacturers such as Solco Healthcare, Amneal Pharmaceuticals, and Epic Pharma compete primarily on price and supply reliability within the U.S. market. Their agility and ability to respond quickly to procurement contracts ensure continued participation in retail and institutional tenders. McGuff Pharmaceuticals focuses on niche clinical supply chains, while Amgen holds limited involvement in this category. Overall, market growth is sustained by consistent demand, API integration, and strategic collaborations among global players aiming to balance affordability with high-quality antibiotic manufacturing.

Market Key Players

- Teva Pharmaceuticals

- Mayne Pharma

- Solco Healthcare

- Alembic Pharmaceuticals

- Pfizer

- McGuff Pharmaceuticals

- Epic Pharma

- Hikma Pharmaceuticals

- Zydus Lifesciences

- Amneal Pharmaceuticals

- Amgen

- Aurobindo Pharma

- Strides Pharma Science

Recent Developments

- In June 2024: Alembic obtained USFDA final approval for its ANDA for Doxycycline Capsules, 40 mg, therapeutically equivalent to Oracea (Galderma). The market for this formulation was estimated at ~ USD 123 million for the 12 months ending March 2024 (per IQVIA). With this approval, Alembic’s cumulative ANDA approvals from the USFDA reached 205 (179 final + 26 tentative).

- In July 2020: Zydus Cadila received USFDA approval for its supplemental ANDA for Doxycycline Injection USP, 100 mg / vial to be manufactured at its Vadodara (Jarod) facility. Zydus has earlier received USFDA approvals for doxycycline formulations (e.g. delayed-release tablets) and capsules.

Report Scope

Report Features Description Market Value (2024) US$ 2.4 Billion Forecast Revenue (2034) US$ 4.4 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Formulation Type (Oral (Tablets, Capsules, Oral Suspension), Injectable (Intravenous, Intramuscular), Topical), By Therapeutic Application (Infectious Diseases (Respiratory Tract Infections, Sexually Transmitted Infections, Intestinal Infections, Urinary Tract Infections, Others), Acne Vulgaris), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, E-Pharmacies) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Teva Pharmaceuticals, Mayne Pharma, Solco Healthcare, Alembic Pharmaceuticals, Pfizer, McGuff Pharmaceuticals, Epic Pharma, Hikma Pharmaceuticals, Zydus Lifesciences, Amneal Pharmaceuticals, Amgen, Aurobindo Pharma, Strides Pharma Science Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Teva Pharmaceuticals

- Mayne Pharma

- Solco Healthcare

- Alembic Pharmaceuticals

- Pfizer

- McGuff Pharmaceuticals

- Epic Pharma

- Hikma Pharmaceuticals

- Zydus Lifesciences

- Amneal Pharmaceuticals

- Amgen

- Aurobindo Pharma

- Strides Pharma Science