Global DNA Sequencing Market Analysis By Product (Instruments, Consumables, and Other Product Types), By End-User (Academics & Research Institutions, Pharmaceutical & Biotechnology Companies, Hospitals & Healthcare Organizations, and Other End Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: July 2024

- Report ID: 101427

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

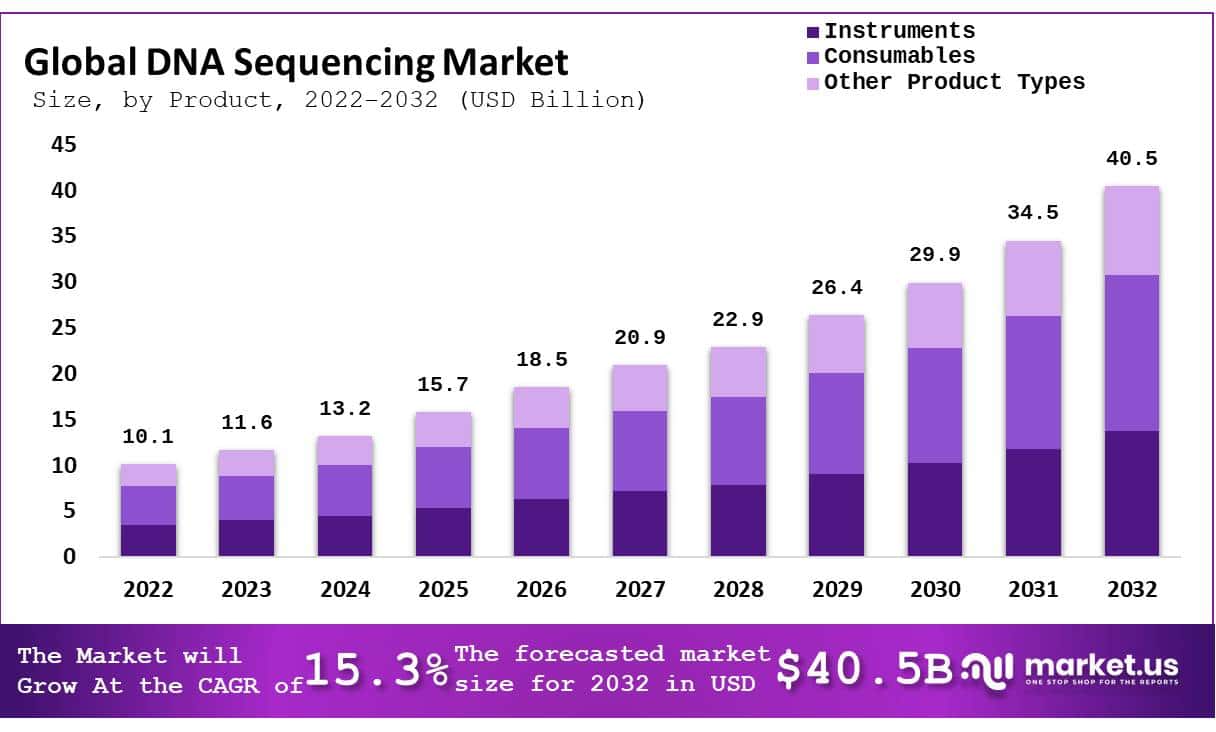

The Global DNA Sequencing Market size is expected to be worth around USD 40.5 Billion by 2033, from USD 10.1 Billion in 2023, growing at a CAGR of 15.3% during the forecast period from 2024 to 2033.

DNA sequencing is a laboratory technique used to determine the exact sequence of nucleotides in a DNA molecule. It involves sample preparation, sequencing, and data analysis. Technologies like Sanger sequencing, next-generation sequencing (NGS), and third-generation sequencing read DNA fragments. This technique is essential in medical diagnostics, genetic research, forensic science, and evolutionary biology, enabling the identification of genetic disorders, development of targeted therapies, study of microbial diversity, and exploration of genetic relationships among species.

DNA sequencing technology has revolutionized healthcare, pharmaceuticals, agriculture, and forensics by providing detailed genetic insights. In healthcare, it aids in the early detection and treatment of genetic disorders, benefiting millions worldwide, according to the World Health Organization (WHO). The U.S. Food and Drug Administration (FDA) underscores its role in precision medicine with numerous approved gene therapies. In agriculture, the Food and Agriculture Organization (FAO) highlights its impact on improving crop resilience and productivity. Additionally, Interpol reports its use in over 70% of criminal investigations involving biological evidence.

Regulatory frameworks are essential for the ethical and safe use of DNA sequencing technologies. The General Data Protection Regulation (GDPR) in the European Union mandates strict controls on genetic data to protect individual privacy. In the United States, the National Institutes of Health (NIH) enforces guidelines for ethical research involving human DNA. The International Organization for Standardization (ISO) has established standards, such as ISO 15189, for laboratories conducting DNA sequencing to ensure accuracy and reliability.

The DNA sequencing market demonstrates dynamic import-export activity across key regions. Major players like Illumina and Thermo Fisher Scientific dominate the market. Europe imports significant volumes driven by healthcare and research demands, particularly in Germany and the UK. Increased R&D investments and research initiatives bolster the European market. In the Asia-Pacific region, China and India are major importers. China has invested over $1.5 billion in genomic research, driven by the expanding application of DNA sequencing in clinical diagnostics and personalized medicine.

Technological advancements and increasing applications in healthcare and research drive significant growth in the DNA sequencing market. The Centers for Disease Control and Prevention (CDC) notes that over 50% of cancer patients benefit from DNA sequencing-based treatments. In 2023, the NIH invested over $2.5 billion in genomic research, underscoring this technology’s importance in advancing scientific knowledge.

Strategic acquisitions also drive market growth. Thermo Fisher Scientific’s acquisition of Mesa Biotech in January 2023 for $450 million enhances point-of-care testing capabilities. In March 2024, Illumina and Bristol-Myers Squibb formed a partnership to accelerate cancer treatment development using next-generation sequencing. Moreover, government initiatives and partnerships, such as the European 1+ Million Genomes Initiative and the UK Biobank’s collaboration with pharmaceutical companies, highlight the role of genomics in advancing disease prevention and treatment strategies.

Key Takeaway

- In 2022, the consumables category emerged as the top revenue generator.

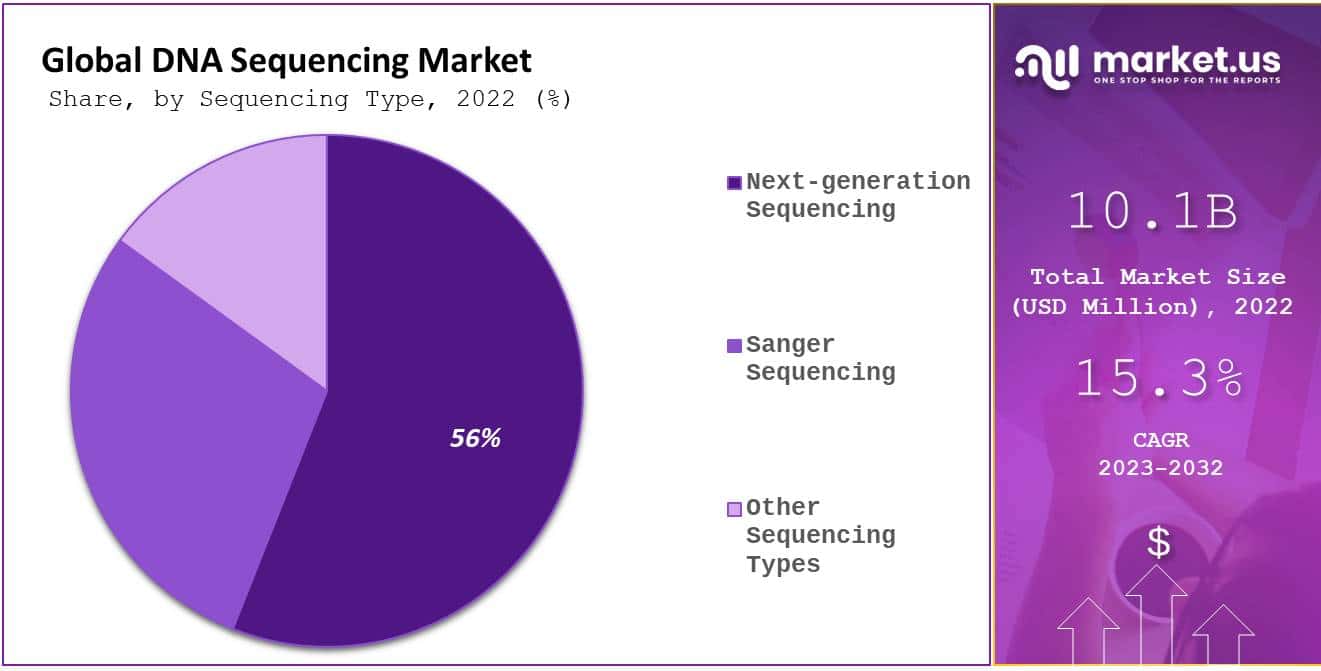

- Next-generation sequencing was the leading contributor in terms of revenue when it comes to sequencing.

- The oncology field led the market, experiencing the highest Compound Annual Growth Rate (CAGR) during the forecast period of 2023 to 2032.

- Academic and research institutes held the largest market share among end-users.

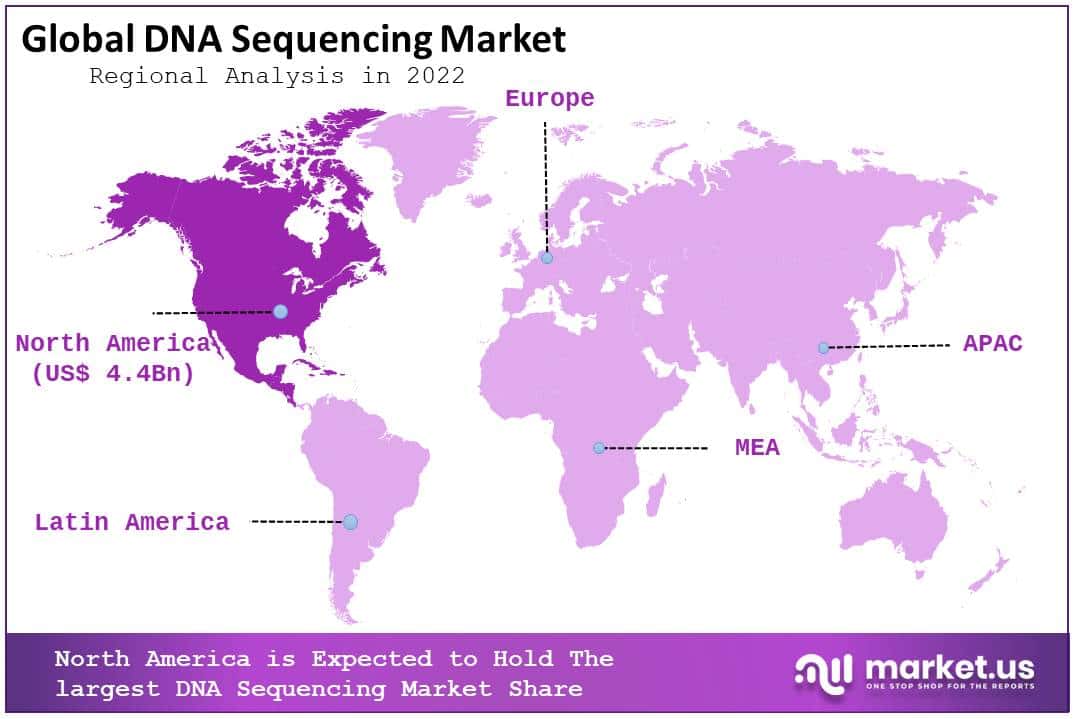

- North America took the lead in 2022, with the highest revenue share at 44.3%.

- Looking ahead, Asia-Pacific is poised for rapid growth between 2023 and 2032.

Product Analysis

In the DNA sequencing market, the consumables segment has acquired the largest revenue share. This segment’s dominance is primarily due to the extensive range of reagents and kits available for various stages of library construction. These stages include adapter ligation, DNA fragmentation, enrichment, quality control, and amplification.

The versatility of these tools significantly contributes to their popularity. They are compatible with low-input and formalin-fixed specimens, which makes them highly adaptable for different research needs. Additionally, these tools come with ready-to-use components, further enhancing their convenience.

The workflows associated with these consumables are simplified and streamlined. This ease of use is a major factor driving their widespread adoption in the market. Researchers and technicians can perform complex procedures more efficiently, leading to increased productivity and reduced error rates.

Sequencing Type Analysis

In the DNA sequencing market, the Next-generation Sequencing (NGS) segment holds the largest share. This segment is expected to maintain its dominance throughout the forecast period. NGS has revolutionized genome sequencing by making it cheaper, faster, and more accurate. The falling cost of sequencing and significant technological advancements have driven this growth. The COVID-19 pandemic has further accelerated the adoption of NGS technology as a routine clinical diagnostic tool, thereby boosting the segment’s revenue share.

Third-generation sequencing methods, such as Single-Molecule Real-Time (SMRT) and Nanopore sequencing, are projected to grow at a significant CAGR during the forecast period. These methods address the limitations of second-generation techniques by eliminating the need for PCR amplification and speeding up sample preparation. Additionally, they produce long reads that can span several thousand kilobases, which is essential for identifying repetitive regions in complex genomes.

Application Analysis

The oncology segment dominated the DNA sequencing market, holding the largest revenue share. This is due to the technology’s immense potential in cancer treatment development and diagnostics. Next-Generation Sequencing (NGS) technology, in particular, has proven to be a low-cost, high-throughput method. It can rapidly identify and characterize clinically actionable genetic variants across multiple genes in a single test.

Clinicians and businesses recognize the significance of these technologies in precision medicine and companion diagnostics. The FDA recently approved the first liquid biopsy companion diagnostic using NGS technology to guide cancer treatment. This approval underscores the technology’s importance in the market.

The Guardant360 CDx assay, a prime example, allows for simultaneous mapping of multiple biomarkers of tumor genomic alterations. It also supports less invasive testing, enhancing patient comfort and diagnostic efficiency. As a result, the market for DNA sequencing in oncology continues to grow, driven by technological advancements and increasing clinical applications. This trend highlights the ongoing evolution and importance of precision medicine in cancer care.

End-User Analysis

The market for DNA sequencing is primarily driven by the academic and research institutes segment, which holds the highest revenue share. This dominance is attributed to the widespread acceptance of Next-Generation Sequencing (NGS) and Sanger technology in research projects within these institutions. Additionally, increased funding and investment programs have further boosted the revenue share for these organizations.

One notable example is the collaboration between DNA Script and the Broad Institute. They received USD 23.0 million from the Intelligence Advanced Research Projects Activity (IARPA). This funding supports their four-year-long project aimed at integrating NGS and enzymatic DNA synthesis technology into a single instrument. Furthermore, this consortium plans to collaborate with Illumina to leverage its sequencing-by-synthesis technology.

Key Market Segments

Based on Product

- Instruments

- Consumables

- Other Product Types

Based on Sequencing Type

- Next-generation Sequencing

- Sanger Sequencing

- Other Sequencing Types

Based on Application

- HLA Typing

- Oncology

- Clinical Investigation

Based on End-User

- Academics & Research Institutions

- Pharmaceutical & Biotechnology Companies

- Hospitals & Healthcare Organizations

- Other End Users

Drivers

Advancements in DNA Sequencing: Empowering Clinical Diagnostics and Drug Discovery

Technological advancements in next-generation sequencing (NGS) have revolutionized genomics, enabling the sequencing of billions of DNA fragments simultaneously. This high-throughput approach has significantly reduced costs and enhanced the detail and speed of genomic analysis. For instance, recent enhancements allow comprehensive genome mapping, critical for diagnosing rare genetic disorders and advancing personalized medicine.

In clinical applications, NGS helps diagnose rare diseases by identifying specific genetic signatures, crucial for customizing effective treatments with minimal side effects. Furthermore, in drug discovery, it provides detailed insights into disease mechanisms, accelerating the development of targeted therapeutics. Additionally, NGS plays a vital role in infectious disease management by tracking pathogen evolution, crucial for controlling outbreaks.

Restraints

Data Privacy, High Costs, and Lack of Professional Expertise

The DNA sequencing industry faces significant hurdles that could constrain its growth. One major concern is data privacy. A study by the National Center for Biotechnology Information reveals that only 10% of biopharmaceutical companies fully anonymize their genetic data. This shortfall raises substantial risks of data breaches and misuse by competing entities, potentially stifling market development.

Cost is another formidable barrier. The National Human Genome Research Institute reports that the total cost of DNA sequencing procedures could reach $300 million, making it an expensive endeavor. Such high costs may limit market accessibility and slow the rate of technological adoption.

Additionally, there is a notable scarcity of professional expertise in DNA sequencing. This gap hinders the development and adoption of specialized methods and products within the sector, further delaying progress and innovation.

Opportunities

Accelerating Market Growth with Advanced DNA Sequencing Technologies

The adoption of next-generation sequencing (NGS) is significantly enhancing market growth in the field of genomics. NGS technologies allow for the simultaneous sequencing of millions of DNA fragments. This capability has revolutionized genomic research and clinical applications by improving our understanding of genetic variations and gene functions.

These technologies are not only more accessible but also cost-effective, encouraging wider adoption across various scientific and medical disciplines. The improved accuracy and speed of DNA sequencing support personalized medicine, enabling treatments tailored to individual genetic profiles.

Future Prospects in DNA Sequencing Technologies

Continued advancements in long-read sequencing (LRS) are pushing the boundaries of genetic research and diagnostics. LRS is particularly effective in diagnosing rare genetic disorders and complex diseases, offering detailed insights into genomic variations and structural variants.

The integration of sophisticated data analytics with these advanced sequencing technologies promises to enhance our ability to process and interpret vast amounts of genetic data efficiently. This development could lead to breakthroughs in understanding complex diseases and further drive market growth. As sequencing technologies evolve, they are set to play a crucial role in the expansion of genomics and personalized healthcare markets.

Trend

Rise of Direct-to-Consumer Services

The trend of Direct-to-Consumer (DTC) services in the DNA sequencing market is reshaping how consumers engage with genetic testing. As of 2023, approximately 38.5 million to 50 million individuals worldwide have utilized at-home DNA testing kits. This reflects a significant penetration into the consumer health sector, indicating a broad interest in genealogical and health-related information. Moreover, the DTC testing market’s rise is fueled by the ease of access these tests provide, allowing consumers to gain insights into potential health risks and ancestral data without the mediation of healthcare providers.

In North America alone, the revenue share from DTC genetic tests was the highest globally in 2023, showcasing a substantial consumer shift towards personal genomic exploration and the implications it holds for personalized treatment strategies. This trend is supported by the proliferation of online platforms offering these services, making genetic testing more accessible and encouraging more people to explore their genetic makeup for health and ancestry insights.

Regional Analysis

The global DNA sequencing market is segmented into North America, Europe, Asia-Pacific, the Middle East and Africa, and Latin America. North America is projected to dominate the market, holding a 44.3% share. Factors such as the rising need for personalized medicine, growing demand for genome sequencing, and higher adoption rates of new technologies contribute to this dominance.

Europe is expected to increase its market share during the forecast period. The growth in this region is driven by the presence of research institutions and genomics-focused academics. Additionally, significant awareness of genome sequencing applications in healthcare and well-developed healthcare systems fuel the market’s expansion.

Asia-Pacific is anticipated to grow at a faster rate compared to other regions. The large population and government initiatives to create a genomic database drive this growth. For example, the Genomics for Public Health in India, known as the IndiGen project, led by the Institute of Genomics and Integrative Biology (IGIB), aims to enroll thousands of Indians for whole genome sequencing. This project will develop baseline data, indigenous expertise, and capacity in precision medicine.

The Middle East, Africa, and Latin America are also expected to see greater acceptance and growth during the forecast period. These regions show potential for increased adoption of genome sequencing technologies in the coming years.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global DNA sequencing market is highly competitive. Key players include Illumina, Inc., Agilent Technologies, QIAGEN, PerkinElmer, and Thermo Fisher Scientific. These companies dominate the market through significant investments in distribution, production, and total quality management. Their focus is on expanding their portfolios to meet rising customer demand.

PerkinElmer, Inc., along with FDNA, introduced Face2Gene LABS to provide genomic services using Next-Generation Phenotyping (NGP) technologies. This initiative aims to deliver quicker and more accurate diagnoses. This partnership reflects PerkinElmer’s commitment to diagnosing rare genetic disorders through efficient and high-quality genomic testing.

Face2Gene LABS is a notable example of these efforts. PerkinElmer and FDNA, an artificial intelligence company, launched this service to combine genomic services with NGP technologies. The goal is to enhance diagnostic speed and accuracy. This launch underscores PerkinElmer’s dedication to improving patient outcomes for those with rare genetic disorders.

Market Key Players

- Agilent Technologies Inc.

- PerkinElmer Inc.

- Bio-Rad Laboratories, Inc.

- Hoffmann-La Roche Ltd.

- Siemens AG

- Macrogen, Inc.

- Thermo Fisher Scientific, Inc.

- Roche Holdings AG

- Other Key Players

Recent Developments

- In January 2024: Bio-Rad Laboratories introduced the StarBright Violet 515 Dye, designed for flow cytometry applications. This product enables highly sensitive detection of cellular markers, complementing DNA sequencing technologies by allowing precise cell sorting and analysis.

- In October 2023: Roche launched the AVENIO Edge System, a next-generation sequencing (NGS) platform that simplifies laboratory workflows and reduces turnaround times. This system integrates seamlessly with existing diagnostic processes, enhancing the efficiency of DNA sequencing.

- In March 2023: Thermo Fisher Scientific announced a significant expansion of its genetic testing solutions by launching the Ion Torrent Genexus System. This next-generation sequencing system is fully integrated and automates the specimen-to-report workflow, promising results within a single day.

- In February 2023: Agilent Technologies acquired Avida Biomed, a company specializing in precision molecular diagnostics based on next-generation sequencing (NGS). This acquisition aims to enhance Agilent’s capabilities in the genomics and molecular diagnostics markets.

Report Scope

Report Features Description Market Value (2022) USD 10.1 Billion Forecast Revenue (2032) USD 40.5 Billion CAGR (2023-2032) 15.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product- Instruments, Consumables, and Other Product Types; By Sequencing Type- Next-generation Sequencing, Sanger Sequencing, and Other Sequencing Types; By Application- HLA Typing, Oncology, and Clinical Investigation; and By End-User- Academics & Research Institutions, Pharmaceutical & Biotechnology Companies, Hospitals & Healthcare Organizations, and Other End Users. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Agilent Technologies Inc., PerkinElmer Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., Siemens AG, Macrogen, Inc., Thermo Fisher Scientific, Inc., Roche Holdings AG, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the DNA Sequencing market in 2022?The DNA Sequencing market size is USD 10.1 Billion in 2022.

What is the projected CAGR at which the DNA Sequencing market is expected to grow at?The DNA Sequencing market is expected to grow at a CAGR of 15.3% (2022-2032).

List the segments encompassed in this report on the DNA Sequencing market?Market.US has segmented the DNA Sequencing market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product the market has been segmented into Instruments, Consumables, and Other Product Types. By Sequencing Type the market has been segmented into Next-generation Sequencing, Sanger Sequencing, and Other Sequencing Types. By Application the market has been segmented into HLA Typing, Oncology, and Clinical Investigation. By End-User the market has been segmented into Academics & Research Institutions, Pharmaceutical & Biotechnology Companies, Hospitals & Healthcare Organizations, and Other End Users.

List the key industry players of the DNA Sequencing market?Agilent Technologies Inc., PerkinElmer Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., Siemens AG, Macrogen, Inc., Thermo Fisher Scientific, Inc., Roche Holdings AG, Other Key Players.

Which region is more appealing for vendors employed in the DNA Sequencing market?North America is expected to account for the highest revenue share with 44.3%, and boasting an impressive market value of USD 4.4 Billion. Therefore, the DNA Sequencing industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for DNA Sequencing?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the DNA Sequencing Market.

-

-

- Agilent Technologies Inc.

- PerkinElmer Inc.

- Bio-Rad Laboratories, Inc.

- Hoffmann-La Roche Ltd.

- Siemens AG

- Macrogen, Inc.

- Thermo Fisher Scientific, Inc.

- Roche Holdings AG

- Other Key Players