Global Digital Twins in Power Market Size, Share Analysis Report By Solution (Component, Process, System), By Deployment (Cloud, On-premise), By Application (Asset Management, Grid Optimization, Predictive Maintenance, Load Forecasting, Others), By End-User (Power Generation, Transmission and Distribution, Utilities), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151054

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

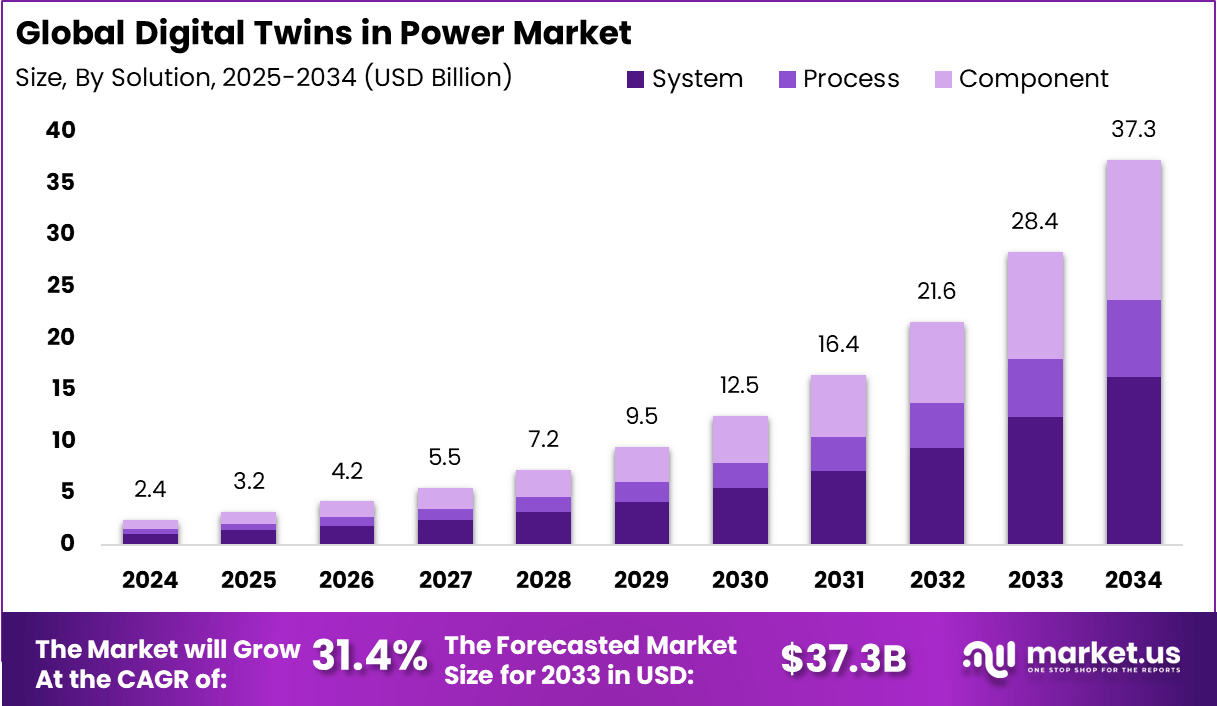

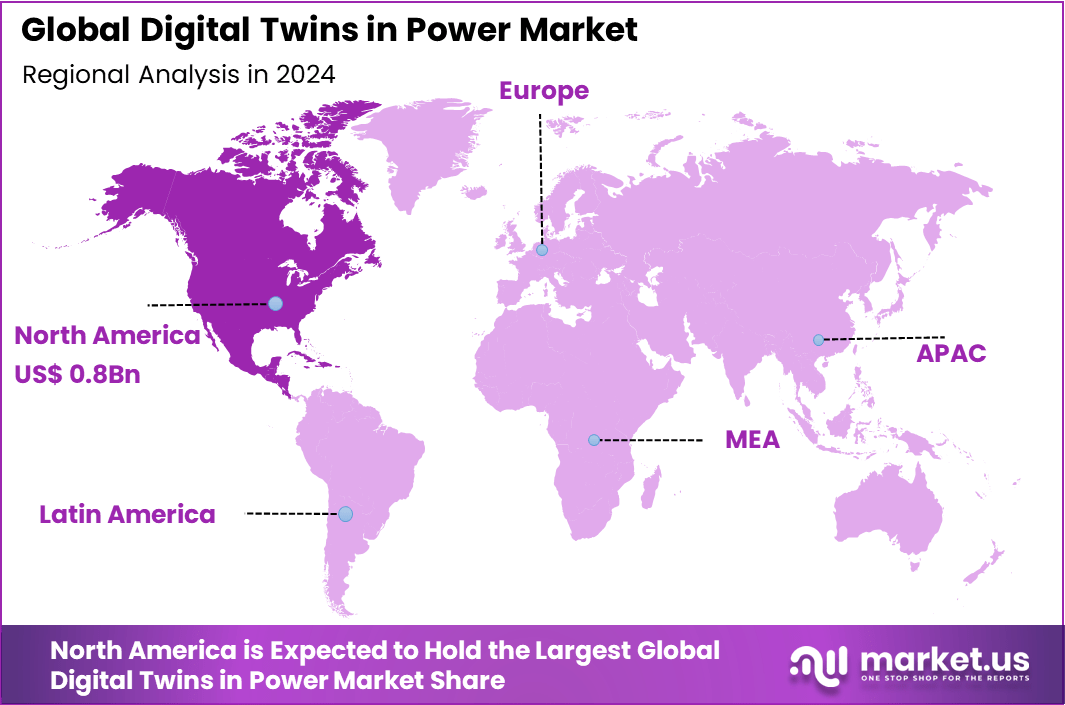

The Global Digital Twins in Power Market size is expected to be worth around USD 37.3 Billion By 2034, from USD 2.4 billion in 2024, growing at a CAGR of 31.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.2% share, holding USD 0.8 Billion revenue.

The Digital Twins in Power market represents the application of virtual replicas to monitor, simulate, and optimize power generation, transmission, and distribution systems. These digital models, built through sensor networks and IoT integration, enable real-time mirroring of physical infrastructure. Utilities leverage these tools for enhanced planning, rapid fault detection, and integration of renewable energy sources, supporting the evolving demands of modern power grids.

Top driving factors for market expansion include the shift toward “Energy 4.0”, characterized by the convergence of IIoT, artificial intelligence, machine learning, and cloud computing. This synergy fuels advanced asset monitoring, demand forecasting, and predictive maintenance across power plants and grid systems.

According to Market.us’s research, The Global Digital Twin Market is witnessing unprecedented growth, driven by accelerated digital transformation across industries. In 2024, the market was valued at approximately USD 17.2 Billion, and it is projected to reach nearly USD 522.9 Billion by 2033, expanding at a striking CAGR of 46.1% during the forecast period.

Investment opportunities can be found in several segments, including software platforms for simulation and analytics, IoT infrastructure deployment, digital twin-as-a-service offerings, and solutions tailored for smart grid, renewable energy integration, and planning tools. Regionally, the Asia-Pacific market is emerging rapidly alongside regulatory backing for grid modernization.

The business benefits of implementing digital twins are clear: improved asset performance, lower operational costs, better integration of renewables, enhanced grid reliability, and strengthened compliance with regulatory standards. Simulation-driven decision-making supports faster responses to demand fluctuations and outage scenarios.

Key Takeaways

- The Global Digital Twins in Power Market is projected to grow from USD 2.4 Billion in 2024 to approximately USD 37.3 Billion by 2034, reflecting a robust CAGR of 31.4% from 2025 to 2034.

- In 2024, North America led the market with a 34.2% share, generating around USD 0.8 Billion in revenue.

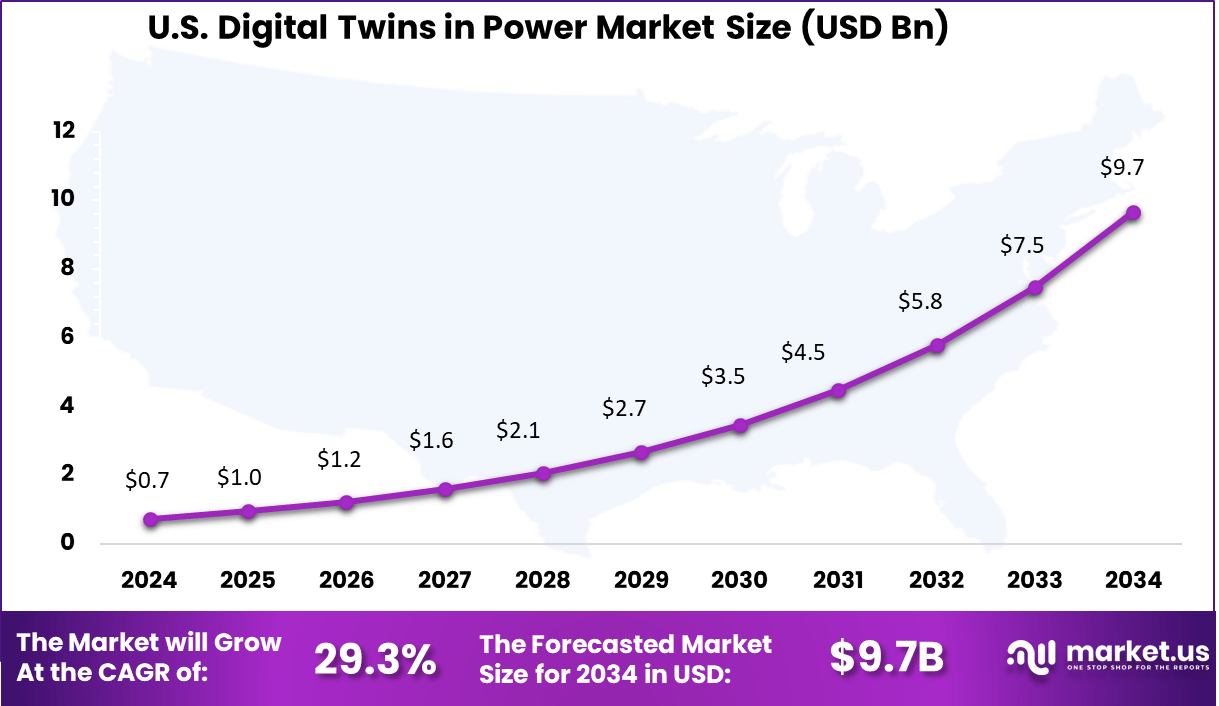

- The U.S. market alone reached USD 0.74 Billion, and is expected to expand at a CAGR of 29.3%, driven by large-scale smart grid deployments and renewable energy monitoring.

- System solutions dominated the market by solution type in 2024, accounting for 43.6%, due to their comprehensive modeling and simulation capabilities.

- By deployment, the On-premise segment held a 65.9% share, reflecting strong preference among utilities for data security and infrastructure control.

- Grid Optimization emerged as the leading application, capturing 29.4% share, as power providers leverage digital twins for real-time grid reliability and efficiency.

- The Power Generation segment dominated end-user adoption, contributing 58.2% share, driven by the need for predictive maintenance, asset performance analytics, and operational efficiency.

US Market Dominance

The US Digital Twins in Power Market is valued at USD 0.87 Billion in 2024 and is predicted to increase from USD 2.7 Billion in 2029 to approximately USD 9.7 Billion by 2034, projected at a CAGR of 29.3% from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 34.2% share, holding USD 0.8 Billion revenue. This leadership is largely driven by the region’s accelerated grid modernization efforts and integration of intelligent energy systems across power utilities.

The United States, in particular, has seen a strong push toward digital transformation in power infrastructure, fueled by regulatory mandates, decarbonization goals, and aging grid challenges. Digital twins are being widely adopted in this landscape to simulate, predict, and optimize power operations, especially for grid resilience, predictive maintenance, and real-time asset monitoring.

Summary – Regional Breakdown (2024)

Region Key Highlights North America Leading due to smart grid upgrades, aging infrastructure, and tech innovation Europe Focused on energy transition, renewables integration, and decarbonization Asia-Pacific Rising demand for electricity and urbanization fueling adoption Latin America Moderate growth due to limited digital infrastructure Middle East & Africa Adoption rising in Gulf nations for energy efficiency and sustainability Moreover, the presence of major technology firms and energy solution providers in North America has facilitated early adoption and faster innovation cycles. These firms are actively collaborating with utility companies to deliver advanced digital twin platforms that combine AI, IoT, and real-time analytics. Cloud-based deployment models, coupled with the region’s mature IT infrastructure, have made implementation more efficient.

By Solution Analysis

In 2024, System segment held a dominant market position, capturing more than a 43.6% share. This leadership stems from the System solution’s capacity to integrate multiple components and processes into a unified digital representation. Such system-level digital twins are widely adopted in power and utility sectors, where complete network monitoring – from generation to distribution – is essential.

By providing real-time simulation and predictive insights, these platforms enable operators to anticipate failures, balance loads, and optimize overall grid performance, which drives their precedence over narrower component or process solutions. Moreover, the System segment benefits from its applicability across large-scale infrastructure projects.

Organisational demand for comprehensive visibility into asset interactions, especially within smart grid modernization and renewable integration projects, has accelerated deployment of system twins. These solutions support real-time data integration, AI-driven analytics, and scenario planning, resulting in operational efficiencies and reliability improvements.

Comparison Segmental Summary

Solution Segment 2024 Market Position Key Drivers & Use Cases System Dominant with > 43.6% share Combines components/processes for full-grid visibility, predictive control, and scenario planning Process Strong growth focus Optimizes workflows in generation, distribution, and supply chain processes Component Essential for detailed asset modeling Simulates individual equipment (e.g., transformers, turbines) for maintenance and performance tuning By Deployment Analysis

In 2024, On-premise segment held a dominant market position, capturing more than a 65.9% share. This preference reflects a tendency within power and utility sectors to retain control over critical infrastructure. On-premise digital twin systems offer direct asset management, enabling utilities to host simulation platforms within their data centers.

This arrangement accommodates strict regulatory requirements and firmly addresses cybersecurity concerns, as organizations maintain full command over sensitive grid data. The substantial investment in existing IT environments and legacy systems also favors on-premise deployment, since integration and co-location with in-house platforms reduce latency and improve real-time responsiveness.

Further, on-premise systems are often perceived as more cost-effective over the long term. While upfront capital expenditure is significant, this approach can deliver greater cost predictability and easier budget planning compared to recurring cloud subscription fees. Performance predictability and minimal latency are essential in grid operations – attributes more reliably achieved within private infrastructure.

Comparison Segmental Summary

Deployment Mode 2024 Market Position Key Drivers & Use Cases On-premise Dominant with > 65.9% share Facilitates control, data sovereignty, integration with legacy assets, low-latency grid operations Cloud Growing adoption Offers scalable compute for AI-driven analytics, disaster recovery, flexible deployment By Application Analysis

In 2024, Grid Optimization segment held a dominant market position, capturing more than a 29.4% share. This segment has led the Digital Twins in Power market by enabling utilities to maintain grid stability amid increasing complexity. With growing integration of intermittent renewables – such as solar and wind – alongside rising electric demand, utilities are deploying digital twins to simulate grid behavior in real time and test scenarios virtually.

These systems provide proactive insights into voltage fluctuations, load imbalances, and grid stress, helping to preempt outages and optimize asset utilization – for example in balancing demand and supply across distributed energy resources.

Moreover, the appeal of Grid Optimization solutions lies in their capacity to fuse AI, IoT, and big‑data analytics. Platforms now ingest live telemetry from transformer stations, smart meters, and energy storage systems. This continuous data stream supports dynamic modeling that can reroute or isolate network sections before disruptions escalate.

Comparison Segmental Summary

Application 2024 Position & Growth Key Drivers & Use Cases Grid Optimization Leading with ~29.4% share Real-time simulation for load balancing, fault avoidance, and renewable integration Asset Management Strong but secondary Tracks equipment health, supports long-term replacement planning Predictive Maintenance Rapidly expanding Models asset failure trends to schedule maintenance preemptively Load Forecasting Emerging use case Enhances demand side management and generation scheduling Others Miscellaneous applications Covers safety, compliance, and strategic planning simulations By End-User Analysis

In 2024, Power Generation segment held a dominant market position, capturing more than a 58.2% share. This dominance is attributed to the extensive use of digital twins across generation assets such as turbines, boilers, solar farms, and wind parks.

Operators rely on these virtual replicas to conduct real-time performance monitoring, test new control strategies, and optimize operational output before actual deployment – especially in renewable and microgrid contexts. By simulating complex interactions within power plants, digital twins assist teams in fine‑tuning production parameters, improving fuel efficiency, and extending equipment lifespan.

Consequently, they enable power generators to meet increasing demand reliably while reducing costs and carbon footprint. Additionally, the Power Generation segment benefits from its early adoption of digital twin technology in response to regulatory pressure and asset modernization goals.

Power plants – especially in mature markets – possess large, capital-intensive assets where unplanned downtime can incur significant losses. Digital twins are now routinely used for predictive maintenance, anomaly detection, and performance forecasting at the turbine and boiler level.

Comparison Segmental Summary

End-User Segment 2024 Status & Drivers Power Generation Leading with ~58.2% share; driven by virtual testing, predictive asset management, and renewables integration Transmission & Distribution Expanding to optimize grid stability and fault management through real-time simulation Utilities Deploying end-to-end twins for full network visibility, customer reliability, and planning Key Market Segments

By Solution

- Component

- Process

- System

By Deployment

- Cloud

- On-premise

By Application

- Asset Management

- Grid Optimization

- Predictive Maintenance

- Load Forecasting

- Others

By End-User

- Power Generation

- Transmission and Distribution

- Utilities

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

AI & IoT Convergence for Real-Time Optimization

Digital twins in the power sector are increasingly combining AI with IoT data to enable real-time monitoring and control. Sensors collect continuous data from substations, transformers, and wind farms. AI processes this data, enabling digital twins to predict equipment failures and proactively optimize asset performance – reducing unplanned downtime and extending asset life. This trend has been noted across multiple industry reports.

This integration also supports sustainability objectives. For instance, digital twins of wind turbines use live environmental sensor data to simulate and adjust power output, minimizing wear and improving renewable integration. The smarter real-time analysis made possible by AI + IoT is reshaping how power operators balance grid stability with green energy adoption.

Driver

Rise of Distributed Energy Resources (DERs)

One of the major forces driving digital twin adoption is the growing complexity of power systems due to the rise in distributed energy resources. Rooftop solar units, battery storage, and electric vehicle charging stations are making the energy flow more dynamic and less predictable. Digital twins provide a much-needed virtual environment to simulate these changing behaviors.

Utilities are now depending on these virtual systems to optimize grid operations, improve asset planning, and reduce energy losses. The ability to model entire distributed networks virtually helps in identifying system risks, testing responses to failures, and planning future expansions without disrupting real-world operations.

Restraint

Data Complexity & Integration Barriers

The effectiveness of digital twins depends on quality and interoperability of data from diverse sources – OT, SCADA, IoT, weather feeds. Many utilities face significant challenges in collecting consistent, clean data and integrating it seamlessly. Inaccurate or fragmented data can compromise simulation accuracy and operational decision-making.

Legacy asset management systems and proprietary protocols further complicate integration. The complexity involved in connecting real-world devices to digital environments often translates into higher implementation costs and prolonged deployment cycles, slowing adoption across regions.

Opportunity

Hybrid Cloud and Edge Deployment Models

A promising opportunity lies in the combination of cloud computing and edge technology to deploy digital twins. Edge devices located close to physical assets can process data locally and enable fast decision-making, while cloud platforms support large-scale analytics and simulations across multiple locations.

This hybrid model improves flexibility and scalability. It also enables new service delivery models where utilities can access digital twin functionality on-demand, reducing the need for heavy upfront investments in IT infrastructure. Such approaches make digital twin technology more accessible to smaller utilities and developing power markets.

Challenge

Cybersecurity & Workforce Skills Gap

As digital twins become integral to grid operations, they introduce new attack surfaces vulnerable to cyber incidents. Research in smart grid cybersecurity emphasizes these threats and calls for rigorous testing using digital twin environments to address resilience gaps.

Meanwhile, industry surveys show that although over 92 % of energy utilities recognize workforce reskilling as essential, only 29 % are investing in training programs. A shortage of professionals skilled in both power systems and advanced analytics impedes adoption and undermines the effectiveness of digital twin initiatives.

Key Player Analysis

GE Vernova Inc. has positioned itself as a pioneer in digital twin technology, deploying AI- and machine learning–powered models for over 7,000 critical grid assets. In 2025, it continued expanding its platform through new inverter software updates and strengthened its energy ecosystem by investing nearly $600 million in U.S. facilities and forging a multi‑year alliance with MIT to accelerate digital infrastructure innovation.

Siemens AG completed its landmark acquisition of simulation software firm Altair Engineering in March 2025. Valued at approximately USD 10 billion, this move integrated high-performance computing, mechanical and electromagnetic simulation tools directly into Siemens’ Xcelerator platform, reinforcing its digital twin leadership across industrial and life sciences domains.

Schneider Electric SE joined forces with ETAP and NVIDIA in early 2025 to launch a cutting-edge digital twin tailored for AI data centers. Built on NVIDIA Omniverse, this model offers integrated simulation of mechanical, electrical, thermal, and networking systems – facilitating energy efficiency and predictive performance in AI factories.

Top Key Players Covered

- GE Vernova Inc.

- Siemens AG

- Microsoft Corporation

- Schneider Electric SE

- IBM Corporation

- Cognite AS

- Akselos SA

- Fluentgrid Limited

- FlexGen Power Systems, Inc.

- Enel X S.r.l.

- Neara Inc.

- Others

Recent Developments

- In February 2024, A comprehensive software suite named GridBeats was launched to modernize grid operations. This suite integrates AI/ML‑driven automation and digital‑twin‑based control across substation and zonal operations. It is intended to enhance grid resilience through software‑defined automation and improved visibility.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Bn Forecast Revenue (2034) USD 37.3 Bn CAGR (2025-2034) 31.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution (Component, Process, System), By Deployment (Cloud, On-premise), By Application (Asset Management, Grid Optimization, Predictive Maintenance, Load Forecasting, Others), By End-User (Power Generation, Transmission and Distribution, Utilities) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape GE Vernova Inc., Siemens AG, Microsoft Corporation, Schneider Electric SE, IBM Corporation, Cognite AS, Akselos SA, Fluentgrid Limited, FlexGen Power Systems, Inc., Enel X S.r.l., Neara Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Twins in Power MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Twins in Power MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- GE Vernova Inc.

- Siemens AG

- Microsoft Corporation

- Schneider Electric SE

- IBM Corporation

- Cognite AS

- Akselos SA

- Fluentgrid Limited

- FlexGen Power Systems, Inc.

- Enel X S.r.l.

- Neara Inc.

- Others