Global Digital Signature Market By Component (Solution, Services), By Level (Advanced Electronic Signatures (AES), Qualified Electronic Signatures (QES)), By Deployment (Cloud, On-premise), By Vertical (BFSI, Health Care & Life Science, IT & Telecom, Government, Retail, Real estate, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 112235

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Digital Signature Market size is expected to be worth around USD 134.9 Billion By 2033, from USD 7.5 Billion in 2023, growing at a CAGR of 33.5% during the forecast period from 2024 to 2033.

A digital signature is a cryptographic technique used to verify the authenticity and integrity of digital documents or messages. It provides a way to ensure that the sender of a document is who they claim to be and that the document has not been tampered with during transmission. Digital signatures use public key infrastructure (PKI) technology, where a signer uses their private key to create a unique digital signature, which can be verified using the corresponding public key.

The digital signature market has witnessed significant growth in recent years, driven by the increasing adoption of digital transformation initiatives across various industries. Organizations are shifting from traditional paper-based processes to digital workflows, recognizing the benefits of enhanced security, efficiency, and cost savings. The market encompasses a wide range of sectors, including finance, healthcare, government, legal, and more.

Note: Actual Numbers Might Vary In The Final Report

The market for digital signature solutions is experiencing rapid growth as industries shift towards paperless processes and remote work. Key factors driving adoption are evolving regulations that give digital signatures equal legal standing to wet ink signatures, the expanding use of e-commerce and cloud services that require identity assurance, and the COVID-19 pandemic which accelerated remote transactions.

Financial services, healthcare, and government are leading digital signature implementations due to high security and compliance demands. Integration with electronic health record systems and electronic prescribing have made e-signatures vital for healthcare processes like informed consent.

For regulated industries like finance and insurance, digital signatures enable remote customer onboarding and avoid in-person signing. Government agencies similarly need digital signatures for allowing online submission of legal forms and contracts. Other adoption drivers are mobile workforce expansion in fields like real estate, logistics, and field services together with the environmental benefits of paperless processes.

Key Takeaways

- Market Growth: In 2023, the market was estimated to be worth USD 7.5 billion, and it is expected to reach USD 10.0 billion by the end of 2024. By 2033, the market is anticipated to reach a substantial valuation of USD 134.9 billion.

- Market Drivers: The adoption of digital signatures is being driven by several factors, including evolving regulations that give digital signatures legal equivalence to traditional ink signatures, the rise of e-commerce and cloud services, and the acceleration of remote transactions due to the COVID-19 pandemic.

- Component Analysis: In 2023, the Solution segment dominated the Digital Signature Market, capturing over 75% of the market share. This is because digital signature solutions are essential for verifying signatory identity and document integrity, particularly in sectors like banking and government.

- Level Analysis: Advanced Electronic Signatures (AES) held a dominant market position in 2023, accounting for more than 55% of the market share.

- Deployment Analysis: In 2023, the On-premise segment was the leader in the Digital Signature Market, with over 57% market share.

- Vertical Insights: The BFSI sector held a dominant market position in 2023, with over 23% market share. This is driven by the need for secure transactions and regulatory compliance.

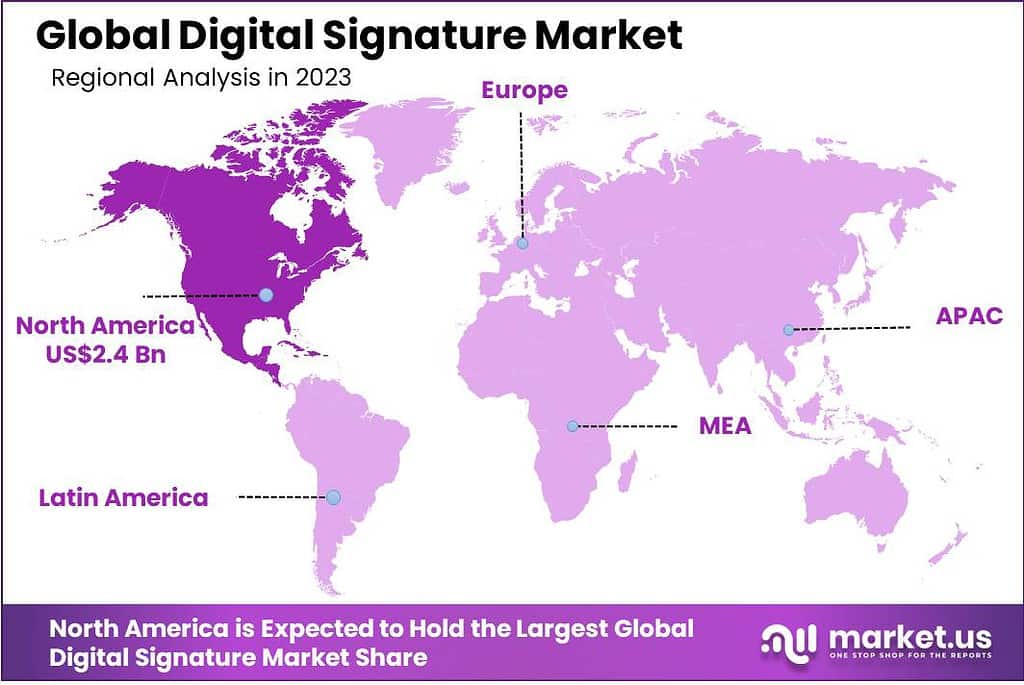

- Market Regions: North America led the market in 2023, capturing over 32% of the market share, followed by Europe. Asia-Pacific is witnessing rapid growth, particularly in countries like Japan, China, and South Korea. Latin America and the Middle East & Africa are also showing promise.

- Key Players: Key players in the Digital Signature Market include DocuSign Inc., SIGNiX Inc., Adobe, OneSpan, GlobalSign, IdenTrust Inc., PrimeKey AB, Visma, Ascertia, Topaz Systems Inc., and Entrust Corporation.

Component Analysis

In 2023, the Solution segment held a dominant position in the Digital Signature Market, capturing more than a 75% share. This substantial portion can be attributed to the widespread adoption of digital signature solutions across various industries seeking secure, efficient, and legally binding ways to sign documents electronically.

These solutions, integral for authenticating the identity of signatories and ensuring the integrity of signed documents, have become essential in an increasingly digital world. Their importance is underscored in sectors like banking, government, and healthcare, where the security and veracity of documents are paramount. Furthermore, the continuous advancements in encryption and cybersecurity have bolstered trust in digital signature solutions, further driving their uptake.

On the other hand, the Services segment, while smaller, is showing promising growth. It encompasses support, maintenance, and integration services vital for implementing digital signature solutions effectively. As businesses seek to navigate the complex regulatory landscapes and technical challenges associated with digital signatures, the demand for these services is expected to rise.

Expert service providers play a crucial role in ensuring that digital signature solutions are deployed securely and comply with the relevant legal standards, thereby enhancing the segment’s value within the market. As of 2023, this segment’s growth is fueled by the increasing need for seamless and secure integration of digital signature solutions into existing business workflows.

Level Analysis

In 2023, the Advanced Electronic Signatures (AES) segment held a dominant market position in the Digital Signature Market, capturing more than a 55% share. The AES segment’s significant market share is largely due to its robust security features and wide acceptance across various industries.

Advanced Electronic Signatures offer a higher level of security than basic electronic signatures by uniquely linking the signatory to the signature and enabling the detection of any subsequent changes in the document. This makes AES particularly appealing in sectors like legal, financial, and government services, where the authenticity and integrity of documents are critical. The growing emphasis on cybersecurity and the increasing incidence of cyber fraud have further propelled the adoption of AES.

Conversely, the Qualified Electronic Signatures (QES) segment, while smaller, represents a highly secure and legally binding segment of the market. QES are often used in circumstances where the law requires the highest standard of electronic signature, as they are created using a secure signature creation device and based on a qualified certificate.

As of 2023, the QES segment is witnessing gradual growth, driven by the rising need for secure and verifiable transactions in international and high-stake environments. The stringent regulatory standards and the need for cross-border recognition of electronic signatures contribute to the increasing relevance and potential growth of this segment. As businesses and individuals continue to operate in an increasingly global and digital landscape, the importance of QES in providing a secure, recognized method of signing documents is expected to rise.

Deployment Analysis

In 2023, the On-premise segment held a dominant market position in the Digital Signature Market, capturing more than a 57% share. This considerable portion of the market can be attributed to the robust security and control that on-premise solutions offer.

Organizations often prefer on-premise digital signatures due to their enhanced ability to manage sensitive documents and transactions internally, without relying on third-party providers. This setup is particularly favored in sectors where security is paramount, such as government, healthcare, and finance.

On the other hand, the Cloud-based digital signature segment is experiencing rapid growth, driven by the increasing adoption of cloud services across industries. This segment’s expansion is fueled by the scalability, flexibility, and cost-effectiveness that cloud solutions provide. Businesses, especially small to medium-sized enterprises, are increasingly leveraging cloud digital signatures to streamline their operations and reduce overhead costs.

Moreover, as remote work and digital transactions continue to rise, the demand for accessible and efficient cloud-based solutions is expected to further accelerate, potentially altering the market dynamics significantly in the coming years.

Note: Actual Numbers Might Vary In The Final Report

Vertical Insights

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the digital signature market, capturing more than a 23% share. This prominence is attributed to the growing need for secure transactions and stringent regulatory compliance across the banking and finance sectors.

The heightened focus on preventing fraud and enhancing the customer experience has driven the adoption of digital signatures, ensuring authenticity and integrity in digital communications and transactions. With the increasing digitization of banking services and the surge in online transactions, the demand for digital signatures in the BFSI sector is expected to continue its upward trajectory, underpinned by ongoing innovations in security technologies and a growing awareness of cybersecurity threats.

The Health Care & Life Science sector is also recognizing the value of digital signatures, as they offer a secure and efficient way to manage patient records, consent forms, and other sensitive documents. The drive for better health data management and regulatory compliance, particularly with laws like HIPAA in the United States, is fueling the adoption of digital signatures in this vertical.

In the realm of IT & Telecom, digital signatures are becoming indispensable due to the need for secure communications and transactions. As these industries handle vast amounts of sensitive data, the assurance of authenticity and protection against tampering is crucial. The government sector, too, is a significant adopter, utilizing digital signatures to streamline processes, enhance the security of state documents, and build public trust in digital services.

Retail and Real Estate industries are increasingly turning to digital signatures to expedite transactions and contracts, reducing the time and cost associated with paper-based processes. The convenience and efficiency offered by digital signatures in these customer-centric industries are leading to enhanced customer experiences and operational efficiencies.

Key Market Segments

By Component

- Solution

- Services

By Level

- Advanced Electronic Signatures (AES)

- Qualified Electronic Signatures (QES)

By Deployment

- Cloud

- On-premise

By Vertical

- BFSI

- Health Care & Life Science

- IT & Telecom

- Government

- Retail

- Real estate

- Others

Driving Factors

- Increasing Demand for Secure Transactions: There’s a growing need for secure and legally binding electronic transactions in today’s digital world, driving the demand for robust digital signature solutions.

- Digital Transformation Initiatives: As businesses and governments globally embark on digital transformation journeys, the adoption of digital signatures is increasing to streamline processes and enhance security.

- Regulatory Support: Many countries now recognize digital signatures as valid and enforceable, similar to traditional ink signatures, bolstering their adoption across various sectors.

- Technological Advancements: Innovations such as blockchain and biometrics are continuously enhancing the security and reliability of digital signatures, making them more appealing to users.

- Cost and Efficiency Gains: The shift to paperless documentation through digital signatures offers significant cost savings and operational efficiencies, a compelling factor for businesses.

- Enhanced User Experience: Digital signatures provide a level of convenience and speed that traditional ink signatures can’t match, improving the overall user experience.

Restraints

- Legal and Regulatory Compliance: Keeping up with evolving legal and regulatory frameworks worldwide is a significant challenge, as non-compliance can lead to legal issues and loss of trust.

- Data Privacy and Security Concerns: As digital signatures involve sensitive data, addressing concerns related to data privacy and security is crucial for user trust and widespread adoption.

- Establishing Trust and Credibility: Building trust among users who are unfamiliar with digital signatures or skeptical of their validity remains a key challenge.

- Overcoming Resistance to Change: Cultural barriers and resistance to change in traditional industries can slow down the adoption of digital signatures.

- User-Friendly Platforms: Developing intuitive and easy-to-use digital signature platforms is essential to encourage user adoption.

- Interoperability Issues: Ensuring that digital signature solutions work seamlessly across different systems and platforms is a technical challenge.

Opportunities

- Software and Platform Improvement: There’s significant opportunity in the development and refinement of digital signature software and platforms to meet varying needs.

- Business Process Integration: Integrating digital signature solutions with existing business processes can enhance workflow efficiency and provide a seamless user experience.

- Emerging Market Expansion: Expanding into emerging markets with low digital signature penetration represents a substantial growth opportunity.

- Value-Added Services: Offering services like document management and workflow automation can provide additional value to customers, differentiating providers in the market.

- Collaboration with Tech Providers: Partnering with technology providers can enhance security features and authentication capabilities of digital signature solutions.

- Consulting and Advisory Services: Providing expert services to assist organizations in their digital transformation can be a lucrative opportunity.

Trends

- Rise of Remote and Mobile Signatures: The increasing need to accommodate a distributed workforce is driving the adoption of remote and mobile digital signatures.

- Biometric Authentication: The use of biometrics for user verification is becoming more common, providing enhanced security and convenience.

- AI and Machine Learning Integration: Incorporating artificial intelligence and machine learning can make digital signatures smarter and more secure.

- Emphasis on User Experience: There’s a growing focus on improving the design and usability of digital signature platforms to boost adoption rates.

- Blockchain Adoption: Utilizing blockchain technology ensures that digital signatures are immutable and tamper-proof, enhancing their reliability.

- Hybrid Signature Solutions: There’s a trend towards hybrid solutions that combine the benefits of digital and physical signatures to meet diverse needs.

Regional Analysis

In 2023, North America held a dominant market position in the digital signature sector, capturing more than a 32% share. This is largely due to the region’s quick adoption of advanced technologies, stringent cybersecurity regulations, and the presence of major industry players.

The United States, in particular, has been a significant driver, with businesses and government entities increasingly implementing digital signatures to streamline operations and enhance security. The region’s robust legal framework, supporting the validity and enforceability of digital signatures, further bolsters its leading position.

Europe follows closely, with a well-established market for digital signatures. The region’s strict data protection laws, such as the General Data Protection Regulation (GDPR), and the eIDAS regulation, which provides a clear legal framework for electronic identification and trust services, have been pivotal in driving adoption. Countries like Germany, the UK, and France are at the forefront, utilizing digital signatures to enhance the efficiency and security of both public and private sectors.

The Asia-Pacific (APAC) region is witnessing rapid growth in the digital signature market, driven by digital transformation initiatives and an increasing awareness of cybersecurity. Countries like Japan, China, and South Korea are investing heavily in digital infrastructure, while emerging economies are recognizing the potential of digital signatures to bolster various industries, including banking, healthcare, and government services.

Latin America, though a smaller market, is showing promising growth. As countries like Brazil and Mexico begin to embrace digital solutions and improve their legal frameworks to support electronic signatures, the region is poised for significant expansion. Increasing internet penetration and a push towards reducing bureaucratic red tape are further encouraging the adoption of digital signatures.

The Middle East and Africa are also embracing digital signatures, albeit at a slower pace. The demand in this region is primarily driven by government initiatives aiming to promote digital transformation and enhance the efficiency of public services. The United Arab Emirates, in particular, has been a leader in adopting digital solutions, including digital signatures, to bolster its position as a tech-savvy nation

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Thailand

- Singapore

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the analysis of the Digital Signature Market, key players play a crucial role. These industry leaders significantly influence market dynamics and trends. Understanding their strategies, market share, and innovations is essential for gaining insights into the overall landscape.

Market Leaders

- DocuSign Inc.

- SIGNiX Inc.

- Adobe

- OneSpan

- GlobalSign

- IdenTrust Inc.

- PrimeKey AB

- Visma

- Ascertia

- Topaz Systems Inc.

- Entrust Corporation

- Other key players

Recent Developments

- In June 2023, Adobe elevated its product, Adobe Acrobat Sign, to offer an advanced e-signature solution. This enhancement incorporates the integration of over 50 global Trust Service Providers (TSPs) and Identity Providers (IDPs), ensuring robust identity verification and digital signature capabilities

- In February 2023, Zoho reinforced its Zoho Sign for ISVs and OEMs service, a comprehensive solution empowering software vendors and equipment manufacturers to seamlessly integrate Zoho’s digital signature capabilities into their products. This offering includes robust APIs, mobile SDKs for app integration, Single Sign-On (SSO) authentication, and options for complete white labeling to strengthen brand identity.

Report Scope

Report Features Description Market Value (2023) USD 7.5 Bn Forecast Revenue (2033) USD 134.9 Bn CAGR (2024-2033) 33.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Level (Advanced Electronic Signatures (AES), Qualified Electronic Signatures (QES)), By Deployment (Cloud, On-premise), By Vertical (BFSI, Health Care & Life Science, IT & Telecom, Government, Retail, Real estate, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape DocuSign Inc.; SIGNiX Inc.; Adobe; OneSpan; GlobalSign; IdenTrust Inc.; PrimeKey AB; Visma; Ascertia; Topaz Systems Inc.; Entrust Corporation; Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a Digital Signature?A digital signature is a cryptographic technique that verifies the authenticity and integrity of digital messages, documents, or software using a unique identifier.

How Big is the Digital Signature Market?The digital signature industry is predicted to expand at a rate of 33.5% CAGR over the course of the forecast period, reaching a valuation of USD 134.9 billion by 2033.

Who are the key players in Digital Signatures Market?Major vendors namely include DocuSign Inc.; SIGNiX Inc.; Adobe; OneSpan; GlobalSign; IdenTrust Inc.; PrimeKey AB; Visma; Ascertia; Topaz Systems Inc.; Entrust Corporation; Other key players

Which Countries Dominate the Global Market?The United States, Japan, and China dominate the global market.

What factors are driving the growth of the Digital Signature Market?The market is propelled by increased digitization, a growing need for secure transactions, regulatory compliance requirements, and a rising emphasis on paperless workflows.

What industries are adopting Digital Signatures most prominently?Digital signatures find widespread adoption in sectors such as finance, legal, healthcare, government, and various others where secure and verifiable documentation is crucial.

What are the key trends shaping the Digital Signature Market?Trends include the integration of blockchain for enhanced security, the use of artificial intelligence for signature verification, and the emergence of mobile-based digital signature solutions.

-

-

- DocuSign Inc.

- SIGNiX Inc.

- Adobe

- OneSpan

- GlobalSign

- IdenTrust Inc.

- PrimeKey AB

- Visma

- Ascertia

- Topaz Systems Inc.

- Entrust Corporation

- Other key players