Global Digital Out-Of-Home (DOOH) Advertising Market By Format (Billboards, Transit Advertising, Street Furniture, Others), By Industry Vertical (Retail, Automotive, Entertainment, Hospitality, Financial Services, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sept. 2024

- Report ID: 120134

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

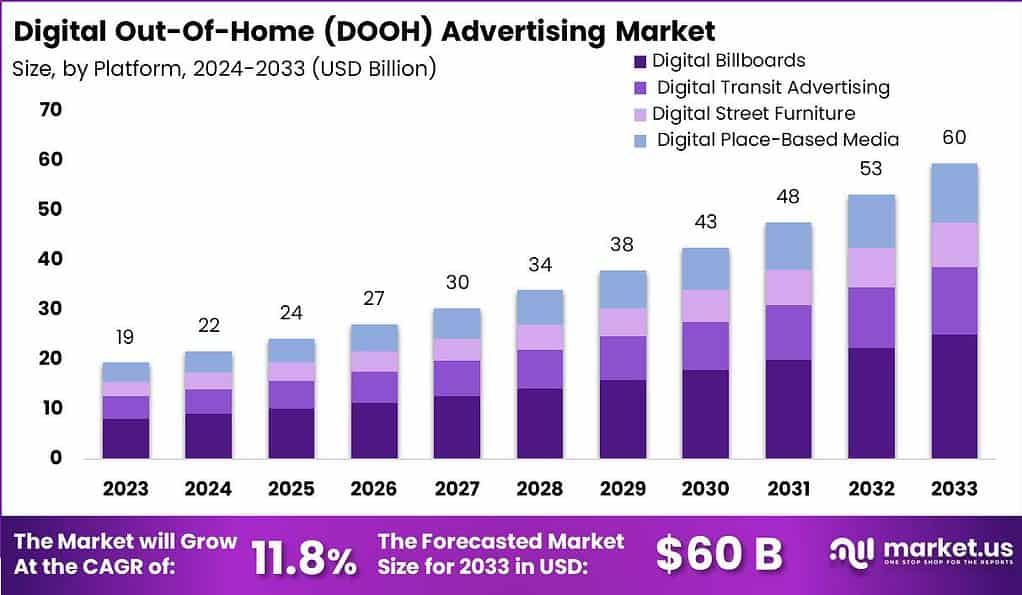

The Global Digital Out-Of-Home Advertising Market size is expected to be worth around USD 60 Billion By 2033, from USD 19 Billion in 2023, growing at a CAGR of 11.8% during the forecast period from 2024 to 2033.

Digital Out-Of-Home (DOOH) advertising refers to the digital transformation of traditional outdoor advertising methods. This form of advertising uses digital screens, billboards, and displays to engage audiences in public spaces such as shopping centers, transit hubs, and city centers. DOOH enables dynamic content delivery, allowing advertisers to tailor messaging based on time, location, and audience demographics. This adaptability offers a more personalized and engaging experience for viewers, making it a popular choice for marketers.

The market for Digital Out-Of-Home (DOOH) advertising has been on a growth trajectory, driven by advancements in technology and increasing demand for real-time and dynamically changing content. Advertisers appreciate the benefits of DOOH, which include higher engagement rates and the ability to reach larger audiences with more targeted messages. The market’s growth is bolstered by innovations such as programmatic advertising platforms that streamline the buying and selling process of DOOH advertising space.

Geographically expansive, this market spans urban centers worldwide where traffic and consumer presence are dense, offering high visibility and impact for promotional efforts. Demand in the Digital Out-Of-Home (DOOH) advertising market is primarily driven by the shifting focus of advertisers from traditional mediums such as print and broadcast to more dynamic, targeted, and engaging digital formats. The growing penetration of digital screens in high-traffic areas and the rise in urban populations contribute to this demand.

Several key factors are propelling growth in the DOOH advertising sector. Technological advancements in display technologies have greatly enhanced the quality and visibility of advertisements, even in adverse conditions. The integration of AI and IoT has allowed for smarter, context-aware advertising capable of adjusting content based on real-time data such as audience demographics and weather conditions.

Moreover, regulatory support for digital signage in cities coupled with decreasing costs of digital screen technology has allowed for broader deployment and adoption. Lastly, the increased capabilities in measuring viewer engagement and effectiveness are making DOOH a more quantifiable and appealing option for advertisers seeking to optimize their advertising spend.

The DOOH advertising market presents several opportunities for growth and innovation. The ongoing expansion of smart city projects around the world presents a substantial opportunity for integrating DOOH systems into public infrastructures, from transit systems to public plazas. There is also potential for greater personalization through deeper integration with mobile technologies, where advertisers can engage directly with consumers through their smartphones in conjunction with DOOH displays.

Another area of opportunity lies in the development of more interactive and engaging content that can transform passive viewers into active participants. Finally, the ability to gather and utilize big data for more effective targeting and ROI analysis can help drive further investment into DOOH advertising strategies, shaping a more data-driven approach in the advertising world.

For instance, In April 2023, Lamar Advertising launched a new programmatic DOOH platform that allows advertisers to purchase ad space in real-time across its network of digital billboards. This platform is designed to integrate with existing programmatic advertising strategies, providing more flexibility and efficiency for advertisers.

According to Eskimi, In 2024, Digital Out-of-Home (DOOH) advertising is anticipated to achieve notable growth, with per capita spending reaching $2.41. The United States is poised to dominate this segment, with expected expenditures totaling approximately $5.277 million. This significant uptick in DOOH investment is largely driven by advancements in artificial intelligence (AI) and data analytics, which enhance the effectiveness of advertising campaigns.

The proportion of DOOH expenditures relative to overall out-of-home (OOH) advertising spend in the U.S. is also set to increase, accounting for 31.4% of the total market. This reflects a robust recovery to pre-pandemic spending levels. Furthermore, global revenue from DOOH advertising is expected to rise by 17% in 2024, reaching over $15.5 billion. Looking ahead to 2028, the sector is projected to grow by an additional 34%, potentially reaching nearly $21 billion in revenue.

According to recent findings by Neuron, about 49% of consumers reported noticing digital street-level OOH ads in the past month, with 62% taking action on their mobile devices after viewing these ads. These actions include searching for more information or visiting a business. This increased interaction, up 45% compared to pre-pandemic levels, underscores the heightened visibility and effectiveness of DOOH advertising in engaging consumers during their outdoor activities.

Key Takeaways

- The Global Digital Out-Of-Home (DOOH) Advertising Market is projected to reach approximately USD 60 billion by 2033, rising from USD 19 billion in 2023. This growth represents a compound annual growth rate (CAGR) of 11.8% over the forecast period from 2024 to 2033.

- In 2023, North America emerged as the leading region in the DOOH Advertising Market, accounting for more than 36% of the market share, with revenues totaling USD 6.98 billion.

- The Billboards segment dominated the market in 2023, capturing over 42% of the overall market share.

- The Retail segment also held a significant market position, accounting for more than 30.6% of the total market share in 2023.

- In 2023, DOOH ad investment is projected to grow 13.2% year on year, reaching $11.5 billion globally, according to WARC Media. By 2029, the sector is expected to reach $24 billion, growing at a 5.18% annual rate over the next five years.

- In 2024, the average DOOH spending per capita is expected to reach $2.41, with the US leading the market with a projected volume of $5.277 million. In the EMEA region, ad spending in DOOH is forecast to reach $3.89 billion by 2024. The increased use of AI and data analytics is enhancing campaign effectiveness, making DOOH a more attractive option for advertisers.

- DOOH ads are expected to make up 31.4% of all US out-of-home ad spend in 2024, demonstrating a strong recovery to pre-pandemic levels. In addition, 33% of US advertisers are reallocating budgets from other digital channels to DOOH.

- DOOH’s premium advertising, featuring large, high-quality screens in high-traffic areas, is shown to increase brand trust by 13% compared to brands without such exposure. Contextually relevant content, triggered by real-time factors like weather or live updates, boosts ad effectiveness by an average of 17%.

- Gen Z, a critical target demographic, shows high engagement with dynamic DOOH content, with 55% drawn to billboards displaying dynamic messaging. Additionally, 52% of consumers take smart device actions such as website visits or purchases after seeing a DOOH ad, while 65% take some form of action, such as visiting a store or posting on social media.

- Overall, 85% of adults report looking at OOH ads at least some of the time, and 62% engage in mobile actions like scanning QR codes or downloading apps after viewing DOOH ads, reinforcing its effectiveness as a dynamic, interactive advertising medium.

North America Digital Out-Of-Home (DOOH) Advertising Market

In 2023, North America held a dominant market position in the Digital Out-Of-Home (DOOH) Advertising Market, capturing more than a 36% share with revenues amounting to USD 6.98 billion. This region’s leadership is primarily attributed to its advanced infrastructure, high consumer spending, and the significant presence of leading advertising firms and digital display manufacturers, which facilitate widespread adoption and innovative uses of DOOH advertising.

North America benefits from a mature advertising market where digital transformation has been rapidly embraced. The proliferation of digital screens across urban settings, transportation hubs, and commercial areas such as malls and entertainment centers in cities like New York, Los Angeles, and Toronto contributes to the extensive reach and effectiveness of DOOH campaigns. This extensive network of digital displays allows advertisers to implement large-scale campaigns that can change dynamically, reacting to real-time data such as weather, traffic, and audience demographics.

Technological advancements in North America, including the integration of AI and IoT with DOOH systems, have enhanced the capability of advertisers to engage consumers through personalized and contextually relevant advertisements. Such technologies enable the delivery of content that resonates more profoundly with viewers, increasing the impact and recall of advertising messages. For instance, advertisers can alter their messages based on the time of day or current events, making the ads more relevant to the audience’s immediate environment and needs.

By Format Analysis

In 2023, the Billboards segment of the Digital Out-Of-Home (DOOH) Advertising Market held a dominant market position, capturing more than a 42% share. This segment leads primarily due to its high visibility and broad audience reach, which are critical in high-traffic areas such as highways and city centers.

Billboards offer advertisers significant advantages in terms of size and scale, making them highly effective for brand awareness campaigns. Their large format is ideal for delivering impactful messages that capture the attention of passersby, whether they are pedestrians or vehicle occupants.

The effectiveness of billboards in the DOOH advertising market is further amplified by technological advancements such as digital billboards, which allow for dynamic content that can be updated in real-time. This flexibility enables advertisers to tailor their messages based on time of day or specific audience demographics, enhancing the relevance and engagement of the advertisements.

Additionally, digital billboards can rotate multiple advertisements on a single structure, maximizing revenue potential for advertisers and space owners. Moreover, the integration of interactive and augmented reality features with billboard advertising has begun to transform how consumers engage with outdoor advertising, driving higher levels of engagement and recall.

For example, campaigns that utilize QR codes or social media integrations encourage viewers to interact with the billboard beyond mere viewing, creating a memorable consumer experience that boosts the value of billboard advertising.

Lastly, the strategic placement of billboards in high-density areas ensures sustained viewer attention compared to other formats such as transit advertising or street furniture. This strategic advantage is crucial in a fragmented media environment where capturing consumer attention is increasingly challenging. As a result, the billboards segment continues to outperform other segments in the DOOH advertising market, maintaining its lead through innovation and strategic placement.

By Industry Vertical Analysis

In 2023, the Retail segment held a dominant market position within the Digital Out-Of-Home (DOOH) Advertising Market, capturing more than a 30.6% share. This leadership can be attributed to the crucial role that DOOH advertising plays in driving consumer behavior and enhancing the retail experience.

Retailers leverage these platforms to promote products and services directly to consumers at points of high commercial engagement such as shopping malls, high streets, and retail parks. This strategic placement ensures maximum visibility and influence at critical decision-making moments, directly impacting consumer purchase patterns.

DOOH advertising in the retail sector is particularly effective due to its ability to deploy timely and targeted advertising campaigns that align with consumer preferences and seasonal shopping patterns. For example, digital displays can show promotions and discounts in real-time during peak shopping periods like the holiday season or back-to-school weeks, tapping into consumer impulses and boosting sales.

This capability to adjust advertising content swiftly and flexibly allows retailers to respond promptly to market trends and competitor activities. Furthermore, the integration of technology such as touch screens, NFC, and QR codes with DOOH mediums has transformed traditional advertising into interactive customer experiences.

These technologies enhance customer engagement by making advertisements more interactive, providing additional product information, or linking directly to online platforms for immediate purchases. Such interactions not only enrich the customer experience but also provide valuable data to retailers, helping them to better understand and serve their target audiences.

Key Market Segments

By Format

- Billboards

- Transit Advertising

- Street Furniture

- Others

By Industry Vertical

- Retail

- Automotive

- Entertainment

- Hospitality

- Financial Services

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Preference for DOOH Advertising

The global Digital Out-of-Home (DOOH) advertising market is driven by the increasing preference for DOOH over traditional outdoor advertising methods. This shift is primarily due to DOOH’s ability to deliver dynamic and real-time content, which significantly enhances audience engagement. Digital displays offer the flexibility to change advertisements quickly and can target specific demographics based on the time of day or location, thus increasing the effectiveness of marketing campaigns.

Moreover, the integration of advanced technologies such as facial recognition and vehicle recognition further enhances the targeting capabilities of DOOH, making it a highly effective platform for advertisers aiming to reach a broader audience with tailored messages.

Restraint

High Initial and Operational Costs

One major challenge facing the DOOH advertising market is the high initial investment and operational costs associated with installing and maintaining digital displays. These costs can be prohibitive, particularly for small businesses, limiting their ability to participate in this advertising medium.

Additionally, the regulatory landscape for DOOH varies by region, which can complicate compliance and increase costs related to ensuring that advertising content meets local standards. This variation can deter advertisers from widely adopting DOOH solutions.

Opportunity

Adoption of Programmatic Advertising

The adoption of programmatic advertising platforms presents a significant opportunity for the DOOH advertising market. Programmatic technology allows for the automated buying and selling of ad space, which can optimize advertising budgets and improve ad targeting efficiency.

This technology enables advertisers to purchase DOOH ad space in real-time, targeting specific audiences at optimal times, which maximizes the impact of their advertising spend. The integration of programmatic advertising is expected to attract more advertisers to DOOH by simplifying the process and making it more accessible and effective.

Challenge

Measurement of Effectiveness

A persistent challenge in the DOOH advertising sector is the difficulty in measuring the effectiveness and return on investment (ROI) of campaigns. Unlike online advertising, where detailed analytics are readily available, measuring audience engagement and direct impact in DOOH is more complex.

The industry lacks standardized metrics and methodologies for accurately assessing the reach and effectiveness of DOOH campaigns. This uncertainty can make it difficult for advertisers to justify investments in DOOH without clear metrics to gauge campaign success.

Latest Trends

One of the major trends in the digital out-of-home (DOOH) advertising market recently is the adoption of programmatic technology that has allowed advertisers to sell and buy digital out-of-home (DOOH)G inventory in real time. This has enabled targeted and effective ad placement with high flexibility in campaign management as well as optimization.

Further, the integration of digital out-of-home (DOOH) advertising within mobile devices has also been a trend that has enabled seamless cross-channel experiences and different engagement opportunities for businesses. In addition to these, the incorporation of technologies such as Augmented Reality and Virtual Reality has helped businesses captivate the attention of audiences and deliver a memorable brand experience. This has also aided in driving the brand engagement and loyalty among the customers.

Key Players Analysis

Numerous firms are operating in the market that have effectively launched different products, innovations, expansions, mergers, and acquisitions, contracts, agreements, partnerships, and collaborations. These companies have used different techniques to enhance market penetration and boost their presence in the market. Businesses across the globe are highly involved in creating new strategies and innovating new products or services in order to sustain this competitive market. The number of new entrants in the market has also further boosted the competition.

The Digital Out-of-Home (DOOH) advertising market is characterized by a dynamic competitive landscape with several key players that dominate the industry. JCDecaux leads with a substantial global presence, leveraging its high-visibility digital billboards in strategic locations worldwide. Clear Channel Outdoor Holdings and Lamar Advertising Company are also significant contributors, offering extensive networks of digital displays across major urban and transit routes in the U.S. and beyond.

Outfront Media Inc. complements these with its innovative use of digital billboards and transit advertising solutions designed to capture commuter attention. On a similar trajectory, Ocean Outdoor and Ströer have made notable strides in Europe, with Ocean Outdoor focusing on digital transformations in high-impact areas and Ströer expanding its digital offerings in Germany and other European markets.

Top Key Players in the Market

- JCDecaux

- Clear Channel Outdoor Holdings

- Outfront Media Inc.

- Lamar Advertising Company

- Ocean Outdoor

- Ströer

- Adams Outdoor Advertising

- Primedia Outdoor

- Ocean Media Group

- Broadsign

- Daktronics Dr.

- Global Outdoor Media Limited

- Focus Media

- oOh! Media Limited

- Other Key Players

Recent Developments

- Lamar Advertising: Lamar continues to lead the U.S. market with its extensive digital billboard network. In 2023, they developed innovative out-of-home (OOH) technology for automotive campaigns, including personalized messaging for Chevrolet.

- August 2023: Clear Channel Outdoor partnered with Vistar Media to strengthen its programmatic Digital Out-of-Home (DOOH) advertising capabilities. This collaboration aims to provide advertisers with better targeting and measurement tools by leveraging Clear Channel’s vast inventory across multiple markets. The partnership is expected to boost the effectiveness of advertising campaigns and drive higher returns for marketers.

- June 2023: JCDecaux SE secured a six-year exclusive advertising deal for public transportation in the greater Oslo region. The contract covers all trams, buses, metro stations, and trains, with around 345 digital panels included. This agreement is expected to grow JCDecaux’s presence in Norway’s DOOH sector, enhancing its market position.

Report Scope

Report Features Description Market Value (2023) USD 19 Bn Forecast Revenue (2033) USD 60 Bn CAGR (2024-2033) 11.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Format (Billboards, Transit Advertising, Street Furniture, Others), By Industry Vertical (Retail, Automotive, Entertainment, Hospitality, Financial Services, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape JCDecaux, Clear Channel Outdoor Holdings, Outfront Media Inc., Lamar Advertising Company, Ocean Outdoor, Ströer, Adams Outdoor Advertising, Primedia Outdoor, Ocean Media Group, Broadsign, Daktronics Dr., Global Outdoor Media Limited, Focus Media, oOh! Media Limited, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is DOOH advertising?Digital Out-Of-Home (DOOH) advertising refers to digital media used for marketing outside of the home. It encompasses digital billboards, digital display panels, interactive kiosks, and other digital signage located in public spaces like malls, transit stations, airports, and urban centers.

How big is Digital Out-Of-Home (DOOH) Advertising Market?The Global Digital Out-Of-Home (DOOH) Advertising Market size is expected to be worth around USD 60 Billion By 2033, from USD 19 Billion in 2023, growing at a CAGR of 11.8% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the Digital Out-Of-Home (DOOH) Advertising market?Rising urbanization, advancements in digital technology, and increased consumer engagement with interactive and dynamic digital displays.

What are the current trends and advancements in Digital Out-Of-Home (DOOH) Advertising market?Programmatic advertising, real-time data integration, interactive and personalized content, and the use of AI and big data analytics.

What are the major challenges and opportunities in the Digital Out-Of-Home (DOOH) Advertising market?Challenges include high installation and maintenance costs, and regulatory issues. Opportunities lie in enhanced targeting capabilities, increased advertiser ROI, and expanding use in emerging markets.

Who are the leading players in the Digital Out-Of-Home (DOOH) Advertising market?JCDecaux, Clear Channel Outdoor Holdings, Outfront Media Inc., Lamar Advertising Company, Ocean Outdoor, Ströer, Adams Outdoor Advertising, Primedia Outdoor, Ocean Media Group, Broadsign, Daktronics Dr., Global Outdoor Media Limited, Focus Media, oOh! Media Limited, Other Key Players

Digital Out-Of-Home (DOOH) Advertising MarketPublished date: Sept. 2024add_shopping_cartBuy Now get_appDownload Sample

Digital Out-Of-Home (DOOH) Advertising MarketPublished date: Sept. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- JCDecaux

- Clear Channel Outdoor Holdings

- Outfront Media Inc.

- Lamar Advertising Company

- Ocean Outdoor

- Ströer

- Adams Outdoor Advertising

- Primedia Outdoor

- Ocean Media Group

- Broadsign

- Daktronics Dr.

- Global Outdoor Media Limited

- Focus Media

- oOh! Media Limited

- Other Key Players