Global Digital Marketing Spending Market Size, Share, Industry Analysis Report By Channel/Platform (Search Advertising, Social Media Advertising, Video Advertising, Display Advertising, Email Marketing, Others), By Pricing Model (Cost-Per-Click (CPC), Cost-Per-Thousand-Impressions (CPM), Cost-Per-Acquisition/Action (CPA)),By Organization Size (Large Enterprises, Small & Medium-sized Enterprises (SMEs)),By Industry Vertical (Retail & E-commerce (largest spender), Consumer Packaged Goods (CPG) & FMCG, BFSI, Automotive, Technology & Telecom, Travel & Hospitality, Healthcare & Pharma, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 166223

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

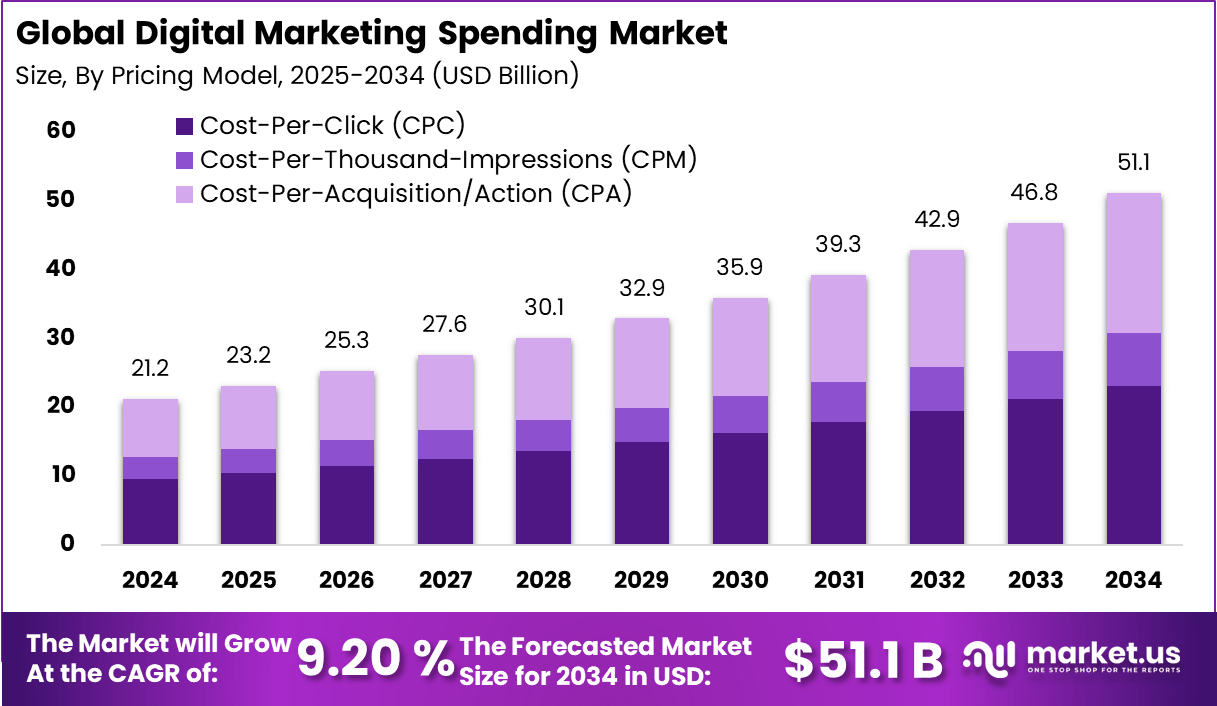

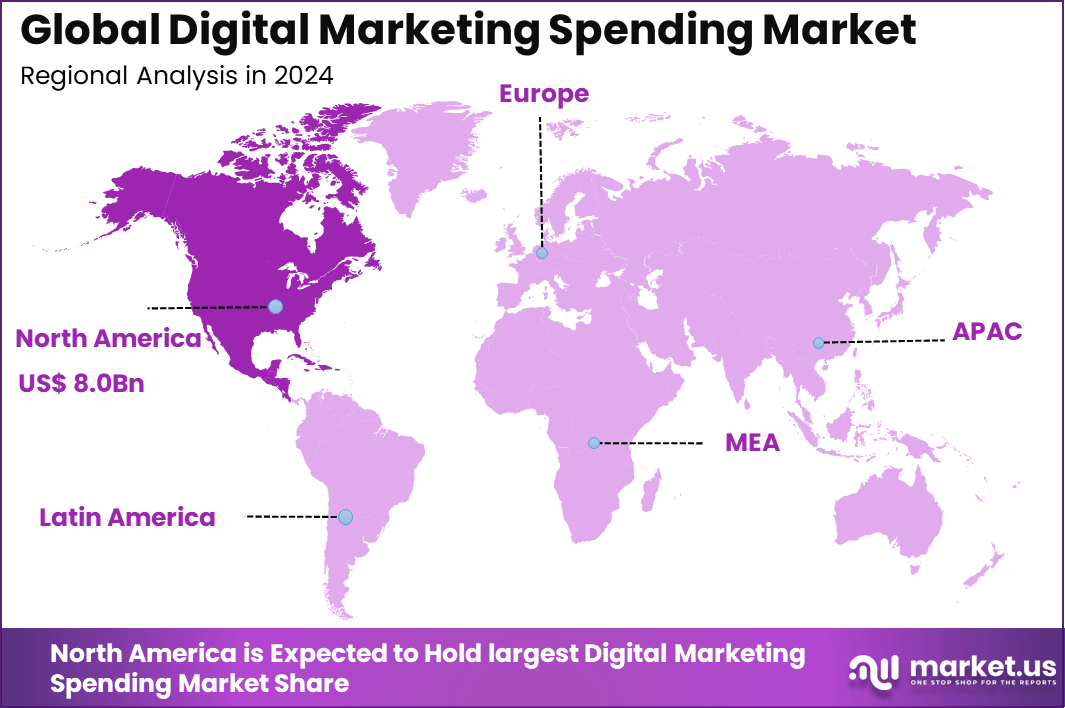

The Global Digital Marketing Spending Market generated USD 21.2 Billion in 2024 and is predicted to register growth to about USD 51.1 Billion by 2034, recording a CAGR of 9.20% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 38.2 share, holding USD 8.0984 Billion revenue.

The digital marketing spending market reflects the total investment made by businesses in online marketing channels such as search advertising, social media, display ads, video marketing, email campaigns, and content marketing. This market has become central to modern business strategy as consumers increasingly spend time on digital platforms. Companies are shifting budgets from traditional media to digital channels to reach targeted audiences, measure performance accurately, and optimize return on investment.

Digital marketing spending is now a core part of growth strategies across retail, finance, healthcare, technology, and consumer services. This market plays a crucial role in helping businesses connect with customers in real time across multiple digital touchpoints. Digital marketing enables personalized communication based on user behavior, location, and preferences. It supports brand visibility, lead generation, and customer retention at scale.

Industry studies indicate that over 70% of consumer purchase journeys now begin online, underlining the importance of digital marketing investment. Growth is driven by rising internet and smartphone penetration worldwide. Increased usage of social media platforms, online video, and ecommerce has expanded digital advertising opportunities.

Businesses are also motivated by the ability to measure performance accurately, unlike traditional advertising. Growth in small and medium businesses using digital channels has further boosted spending. Industry data shows that more than 65% of marketing leaders prioritize digital channels due to better targeting and cost control.

Key Takeaways

- Search advertising leads with 32.6%, as brands prioritize intent-driven customer acquisition and measurable outcomes.

- Cost-per-click (CPC) dominates pricing models at 45.3%, reflecting advertiser focus on performance-based spending.

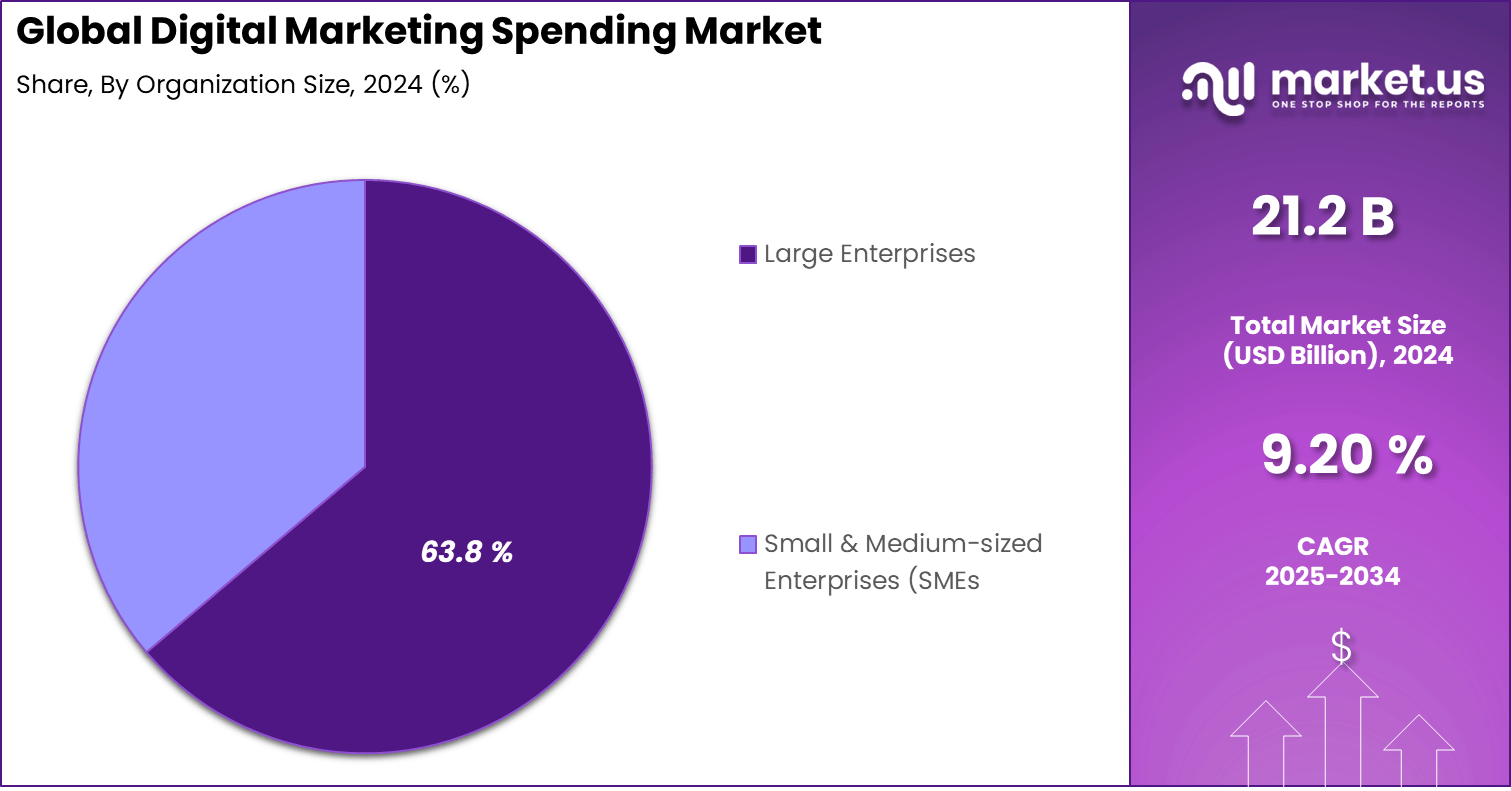

- Large enterprises account for 63.8%, driven by higher marketing budgets and advanced analytics capabilities.

- Retail and e-commerce hold 22.4%, supported by strong reliance on digital channels for customer engagement and sales growth.

- North America captures 38.2% of global spending, backed by mature digital ecosystems and high ad-tech adoption.

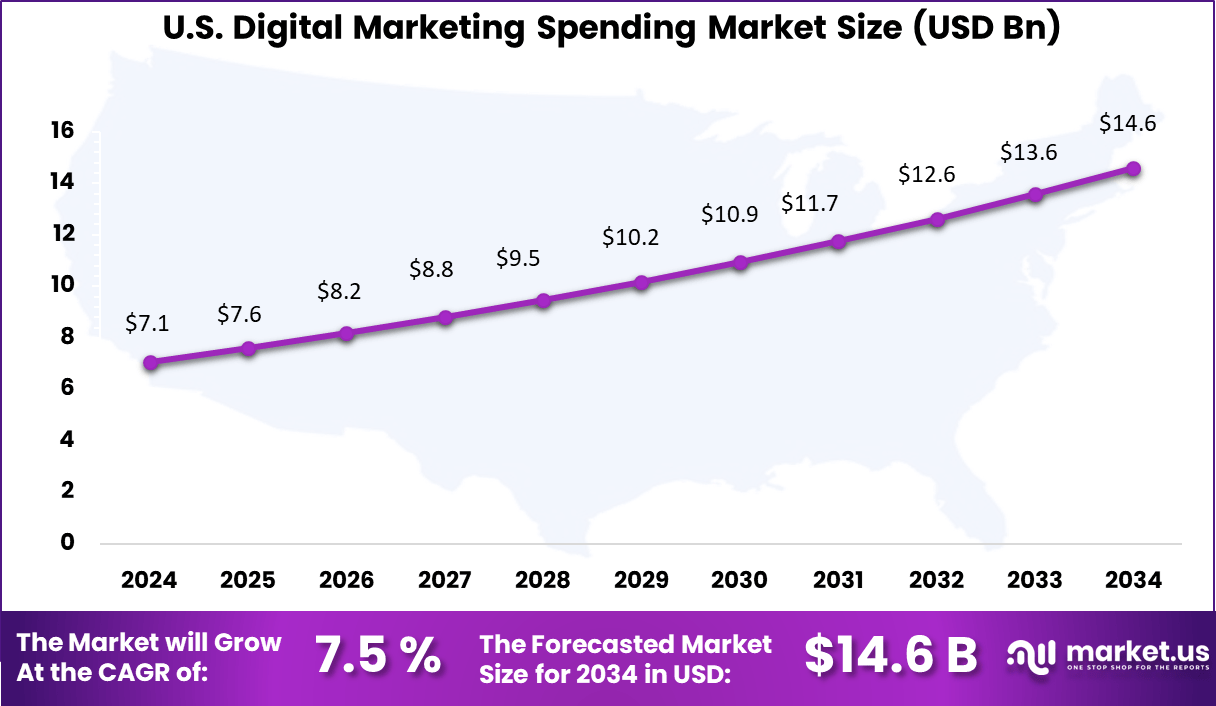

- The U.S. market reached USD 7.08 billion, expanding at a steady 7.5% CAGR, reflecting sustained investment in data-driven marketing strategies.

Key Global Insights

- Global digital ad spend is projected to reach USD 798.7 billion to over USD 1.17 trillion, accounting for 73% of total advertising spend worldwide.

- Search advertising remains the largest channel, contributing around 41% of total digital ad spend.

- Mobile advertising dominates usage, capturing nearly two-thirds of all digital ad budgets as consumer activity shifts to smartphones.

- Programmatic advertising accounts for over 80% of digital media buying, reflecting strong reliance on automation and data-driven targeting.

- Overall digital ad spend is expected to grow by around 8% in 2025, showing steady market expansion.

- Businesses typically allocate 30-40% of their total marketing budgets to digital channels.

- Platforms such as Google and Meta recommend a USD 50-100 daily minimum spend per platform to generate meaningful performance data.

- Content marketing is viewed as cost-efficient over the long term, while programmatic buying continues to absorb a large share of ongoing budgets.

U.S Market Size

The United States stands as the largest single market in North America for digital marketing, with spending reaching around USD 7.08 billion and growing at a healthy CAGR of 7.5%. This growth reflects intense competition among brands and the increasing importance of digital channels in reaching consumers effectively. US marketers prioritize search advertising and cost-per-click models to ensure measurable results and optimized campaign budgets.

In the US, large enterprises lead ad spending, employing data-driven strategies and cross-platform approaches to capture diverse audience segments. Investments in emerging channels like social commerce, influencer marketing, and connected TV further enhance reach and engagement. The US market’s sophistication is also marked by rapid adoption of automation and AI, helping marketers improve campaign efficiency and ROI.

North America holds a substantial share of about 38.2% in the global digital marketing spending market, reinforcing its position as a leading region for digital advertising investments. This dominance stems from the region’s mature digital infrastructure, widespread internet penetration, and advanced e-commerce ecosystems.

Marketers in North America leverage a broad range of digital channels and sophisticated tools, including AI-powered analytics and customer data platforms, to deliver highly targeted campaigns. The region’s strong broadband connectivity and mobile device usage further facilitate the adoption of innovative advertising formats such as video ads, interactive content, and programmatic buying.

By Channel and Platform

Search advertising leads with 32.6%, showing its continued importance in digital marketing budgets. Businesses rely on search platforms to reach customers who are actively looking for products and services, which improves lead quality and conversion potential.

Growth in this segment is supported by strong performance tracking and measurable return on spending. Search advertising allows marketers to adjust campaigns in real time, optimize keywords, and target users based on clear purchase intent.

By Pricing Model

The cost per click model accounts for 45.3%, reflecting its popularity among advertisers seeking controlled and performance-based spending. This model ensures that businesses pay only when users engage with their ads.

Its dominance is driven by transparency and budget efficiency. Advertisers prefer CPC because it provides clear insight into campaign effectiveness and allows better control over marketing costs across multiple digital channels.

By Organization Size

Large enterprises represent 63.8% of total spending, highlighting their strong investment capacity and broad marketing reach. These organizations manage multiple brands, regions, and customer segments, which increases overall digital advertising demand.

Adoption among large enterprises is supported by advanced analytics capabilities and dedicated marketing teams. Digital marketing spending helps these organizations maintain brand visibility, customer engagement, and competitive positioning.

By Industry Vertical

Retail and e-commerce hold 22.4%, making them the leading industry vertical in digital marketing spending. Online retailers depend heavily on digital channels to attract traffic, promote products, and drive sales conversions.

High competition and frequent promotional activity continue to support strong spending in this segment. Digital marketing enables retailers to target customers precisely and respond quickly to changing consumer behavior.

Key Market Segments

-

By Channel/Platform

- Search Advertising

- Social Media Advertising

- Video Advertising

- Display Advertising

- Email Marketing

- Others

-

By Pricing Model

- Cost-Per-Click (CPC)

- Cost-Per-Thousand-Impressions (CPM)

- Cost-Per-Acquisition/Action (CPA)

-

By Organization Size

- Large Enterprises

- Small & Medium-sized Enterprises (SMEs)

-

By Industry Vertical

- Retail & E-commerce

- Consumer Packaged Goods (CPG) & FMCG

- BFSI

- Automotive

- Technology & Telecom

- Travel & Hospitality

- Healthcare & Pharma

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Shift from Traditional to Digital Channels

A major driver of the digital marketing spending market is the ongoing shift in where consumers spend their time. As more individuals use smartphones, online video, social media, and streaming services, advertisers respond by reallocating budgets from traditional channels such as print and broadcast toward digital formats.

Digital channels provide opportunities for more direct engagement with audiences, leading many brands to increase spending on programs that run on search engines, social networks, and online video platforms.Another factor driving spending is the increasing share of commerce and content consumption that occurs online.

Consumers now research products, compare options, and complete purchases through digital pathways more often than before. This change in behavior encourages companies to invest in online campaigns that help them remain visible throughout the customer journey. As a result, marketing investment in digital formats continues to grow year after year.

Restraint Analysis

Economic Uncertainty and Budget Pressures

A key restraint for the digital marketing spending market is economic uncertainty and pressure on corporate budgets. When economic conditions slow or costs rise, companies may delay decisions about marketing commitments or tighten budgets. Reports have indicated that some organizations adjust growth forecasts and reduce planned spend in areas perceived as discretionary, including advertising budgets.

Another restraint is the variability in returns from digital campaigns. While digital channels offer detailed performance metrics, not all campaigns deliver expected results. Measuring effectiveness across different platforms and adjusting for privacy changes and new regulations can be challenging. These complexities may cause some marketers to scale back spending or allocate more cautiously across digital formats.

Opportunity Analysis

Expansion of Digital Formats and Engagement Models

An important opportunity in the digital marketing spending market arises from the growth of new digital formats that attract audience attention. Video advertising on streaming and social platforms continues to gain share, while mobile and in-app spending plays a larger role in engagement. Research suggests that digital formats will continue to consume a substantial share of total advertising expenditure in the coming years.

Another opportunity comes from emerging strategies such as creator content and influencer engagement. Spending on creator-led campaigns is growing rapidly as brands seek authentic ways to reach younger audiences. Reports indicate significant increases in creator content spend, reflecting interest in channels that may complement traditional digital ad formats.

Challenges

Measurement and Attribution Complexity

One challenge facing the market is the complexity of measuring the impact of various digital spending initiatives. With many channels, devices, and platforms involved, establishing clear attribution for conversions and outcomes can be difficult. This makes it harder for companies to evaluate the performance of campaigns and justify increased spending in specific areas.

Another challenge lies in changes to privacy and data tracking practices. As regulations evolve and platforms restrict third-party data access, marketers face limitations in targeting and measurement. Adjusting strategies to maintain effectiveness while respecting privacy requirements increases operational effort and can influence where and how spending is allocated.

Key Players Analysis

Alphabet, Meta Platforms, Amazon, Microsoft, ByteDance, Google, Baidu, and Alibaba dominate digital marketing spending through large scale advertising ecosystems across search, social media, video, and e commerce platforms. Their platforms attract strong advertiser budgets due to massive user reach, advanced targeting, and data driven ad optimization. These companies focus on performance measurement, AI based personalization, and multi format ad delivery.

IBM, Verizon Communications, Twitter, and Hulu strengthen the market by offering enterprise marketing platforms, programmatic advertising, and premium digital media inventory. Their solutions support brand awareness, audience engagement, and cross channel campaign execution. These players emphasize data analytics, brand safety, and addressable advertising.

Other participants contribute to market growth by supporting niche platforms, regional networks, and specialized advertising services. Their offerings help advertisers reach specific demographics and emerging digital channels. These players focus on flexibility, cost efficiency, and targeted reach. Increasing competition, evolving consumer behavior, and wider adoption of digital commerce continue to drive steady growth in global digital marketing spending.

Top Key Players in the Market

- Alphabet Inc.

- Meta Platforms Inc.

- Amazon.com Inc.

- Microsoft Corporation

- ByteDance

- Google LLC

- Baidu Inc.

- Alibaba Group Holdings Ltd.

- IBM Corporation

- Verizon Communications Inc.

- Twitter Inc.

- Hulu LLC

- Others

Recent Developments

- October, 2025 – Alphabet reported Q3 2025 advertising revenue of $74.18 billion, up 12.6% year on year, helping total quarterly revenue pass the $100 billion mark for the first time and reinforcing Google’s central role in global digital ad spending.

- October, 2025 – Meta’s Q3 2025 ad revenue rose 26% to $51.24 billion, driven by a 14% increase in ad impressions and a 10% rise in average price per ad, showing strong advertiser demand across Facebook, Instagram and WhatsApp despite higher capital spending on AI infrastructure.

Report Scope

Report Features Description Market Value (2024) USD 21.2 Bn Forecast Revenue (2034) USD 51.1 Bn CAGR(2025-2034) 9.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Channel/Platform (Search Advertising, Social Media Advertising, Video Advertising, Display Advertising, Email Marketing, Others), By Pricing Model (Cost-Per-Click (CPC), Cost-Per-Thousand-Impressions (CPM), Cost-Per-Acquisition/Action (CPA)), By Organization Size (Large Enterprises, Small & Medium-sized Enterprises (SMEs)), By Industry Vertical (Retail & E-commerce (largest spender), Consumer Packaged Goods (CPG) & FMCG, BFSI, Automotive, Technology & Telecom, Travel & Hospitality, Healthcare & Pharma, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Alphabet Inc., Meta Platforms Inc., Amazon.com Inc., Microsoft Corporation, ByteDance, Google LLC, Baidu Inc., Alibaba Group Holdings Ltd., IBM Corporation, Verizon Communications Inc., Twitter Inc., Hulu LLC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Marketing Spending MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Marketing Spending MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Alphabet Inc.

- Meta Platforms Inc.

- Amazon.com Inc.

- Microsoft Corporation

- ByteDance

- Google LLC

- Baidu Inc.

- Alibaba Group Holdings Ltd.

- IBM Corporation

- Verizon Communications Inc.

- Twitter Inc.

- Hulu LLC

- Others