Global Digital Health for Obesity Market By Component (Services, Hardware, and Software), End-use (Patients, Providers, Payers, and Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151041

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

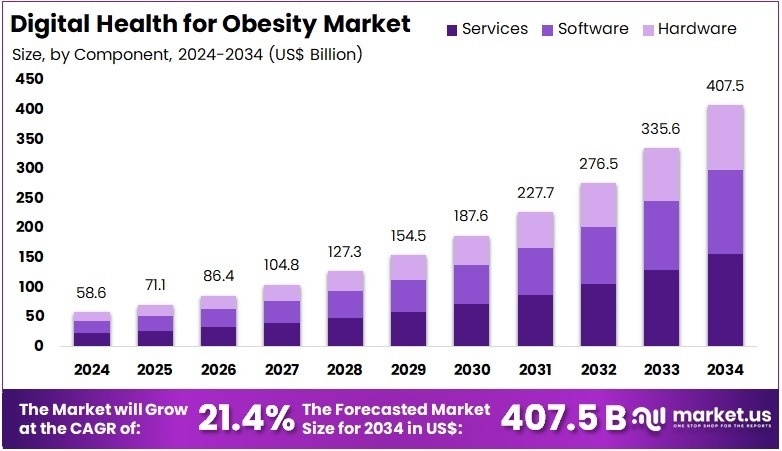

The Global Digital Health for Obesity Market Size is expected to be worth around US$ 407.5 Billion by 2034, from US$ 58.6 Billion in 2024, growing at a CAGR of 21.4% during the forecast period from 2025 to 2034.

The global digital health for obesity market is experiencing significant growth, driven by several key dynamics. The increasing adoption of electronic health records (EHRs) and health information technology (Health IT) has facilitated the collection and analysis of vast amounts of healthcare data, enabling providers to make data-driven decisions that improve patient outcomes and operational efficiency. For instance, the Office of the National Coordinator for Health Information Technology (ONC) has been instrumental in promoting the meaningful use of EHRs, aiming to enhance the quality of care and reduce healthcare costs.

Additionally, the shift towards value-based care models emphasizes the need for healthcare organizations to focus on patient outcomes rather than the volume of services provided, further driving the demand for operational analytics solutions. Moreover, the integration of artificial intelligence (AI) and machine learning into healthcare analytics is revolutionizing the industry by enabling predictive analytics, personalized medicine, and improved diagnostic accuracy.

However, challenges such as data privacy concerns, interoperability issues, and the need for substantial investments in infrastructure and training pose significant barriers to the widespread adoption of operational analytics solutions. Despite these challenges, the continuous advancements in technology and the increasing emphasis on data-driven decision-making are expected to propel the growth of the Digital Health for Obesity market in the coming years.

Key Takeaways

- The global digital health for obesity market was valued at USD 58.6 billion in 2024 and is anticipated to register substantial growth of USD 407.5 billion by 2034, with 21.4% CAGR.

- In 2024, the services segment took the lead in the global market, securing 38.4% of the total revenue share.

- The patients segment took the lead in the global market, securing 34.8% of the total revenue share.

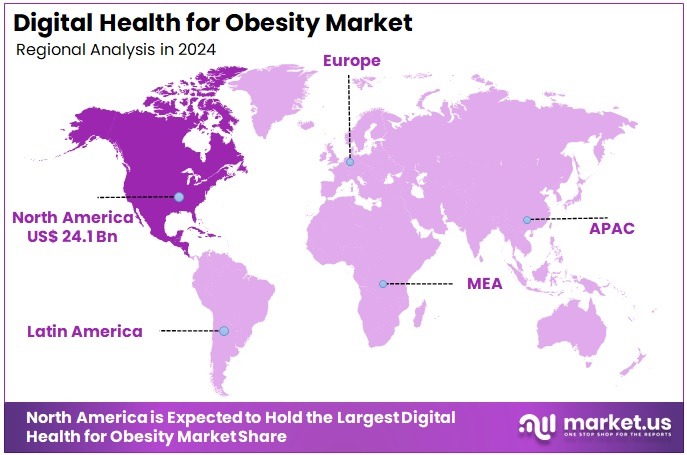

- North America maintained its leading position in the global market with a share of over 41.2% of the total revenue.

Component Analysis

Based on component the market is fragmented into services, hardware, and software. Amongst these, services segment dominated the global digital health for obesity market capturing a significant market share of 38.4% in 2024. The services segment has emerged as the dominant component in the global digital health for obesity market, attributed to its comprehensive approach in delivering personalized and sustained care.

Unlike standalone software or hardware solutions, services encompass a range of offerings including virtual health coaching, nutritional guidance, behavioral therapy, and telemedicine consultations. These services are often tailored to individual needs, enhancing patient engagement and adherence to weight management programs.

The growing demand for holistic and personalized obesity management solutions has propelled the services segment to the forefront, as patients increasingly seek comprehensive support beyond traditional weight loss methods. This trend reflects a broader shift towards patient-centered care, where continuous support and personalized interventions are key to addressing the multifaceted nature of obesity. Consequently, the services segment is expected to maintain its leadership in the digital health for obesity market, driving innovation and setting new standards in obesity care.

End Use Analysis

Patients dominated the global digital health for obesity market capturing a significant market share of 34.8% in 2024. Patients have emerged as the dominant force in the global digital health for obesity market, accounting for the largest share of end-use applications. This trend is driven by a growing demand for personalized, accessible, and self-managed healthcare solutions.

Individuals are increasingly turning to digital platforms such as mobile health applications, wearable devices, and telemedicine services to monitor and manage their weight. These tools offer real-time feedback, personalized coaching, and behavioral interventions, empowering users to take control of their health outside traditional clinical settings. The shift towards patient-centered care, combined with the convenience of digital solutions, has led to higher engagement and adherence rates among users.

Furthermore, the integration of artificial intelligence and machine learning into these platforms enhances personalization and effectiveness, catering to the unique needs of each patient. The COVID-19 pandemic accelerated the adoption of digital health technologies, highlighting their potential to provide continuous care and support remotely. As patients seek more control over their health journeys, the digital health for obesity market continues to expand, with patients at the forefront of this transformation.

Key Segments Analysis

By Component

- Services

- Services

- Hardware

By End-use

- Patients

- Providers

- Payers

- Others

Drivers

The Rising Global Prevalence of Obesity

The rising global prevalence of obesity is a significant driver for the growth of the digital health market aimed at obesity management. According to the World Health Organization, in 2022, 1 in 8 people worldwide were living with obesity, and the prevalence of obesity has more than doubled since 1990. This escalating trend is further corroborated by the World Obesity Federation, which reported that over 1 billion people globally were living with obesity in 2022, encompassing nearly 880 million adults and 159 million children and adolescents aged 5–19 years. If current trends persist, projections indicate that more than half of the global population will be living with overweight and obesity within 12 years.

This surge in obesity rates has intensified the demand for effective, scalable, and accessible weight management solutions. Digital health platforms have emerged as pivotal tools in addressing this need, offering personalized interventions, real-time monitoring, and behavioral support through mobile applications, wearable devices, and telemedicine services.

These technologies enable individuals to manage their weight proactively, regardless of geographical location, thereby expanding the reach of obesity care. The integration of artificial intelligence and data analytics further enhances the personalization and effectiveness of these digital health solutions. Consequently, the increasing prevalence of obesity is propelling the adoption and innovation of digital health technologies, positioning them as central components in the global strategy to combat obesity.

Restraints

Data Privacy and Security Concerns

A significant restraint in the global digital health for obesity market is the growing concern over data privacy and security. Digital health platforms collect sensitive personal information, including health metrics, behavioral data, and biometric details, which are susceptible to breaches if not adequately protected. Studies have indicated that many health applications lack robust encryption and often share data with third parties, raising alarms about unauthorized access and misuse.

The Health Insurance Portability and Accountability Act (HIPAA) in the U.S. and the General Data Protection Regulation (GDPR) in Europe impose stringent requirements on data handling, but enforcement remains inconsistent, and many digital health solutions operate in regulatory gray areas. This uncertainty can deter users from fully engaging with digital health tools, limiting their effectiveness in obesity management.

Moreover, the potential for data misuse, such as targeted advertising or unauthorized sharing with insurers, exacerbates public apprehension. Addressing these concerns is paramount for fostering trust and ensuring the widespread adoption of digital health technologies in obesity care.

Opportunities

Integration of Artificial Intelligence for Personalized Care

An emerging opportunity in the digital health for obesity market lies in the integration of Artificial Intelligence (AI) to provide personalized care. AI can analyze vast amounts of data from various sources, including wearable devices, mobile applications, and electronic health records, to identify patterns and predict individual health trajectories. This capability allows for the development of tailored interventions that address the unique needs of each patient, enhancing the effectiveness of obesity management strategies.

For instance, AI-driven platforms can offer real-time feedback, adjust dietary recommendations, and suggest personalized exercise regimens based on an individual’s progress and preferences. Companies like Omada Health are already leveraging AI to provide personalized nutrition education and meal tracking, aiming to guide patients in making healthier choices . The adoption of AI not only improves patient outcomes but also optimizes healthcare resources by enabling more efficient and targeted interventions. As AI technology continues to evolve, its integration into digital health platforms presents a promising avenue for advancing obesity care and management.

Impact of macroeconomic factors / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the digital health market for obesity, affecting both demand and supply dynamics. Economic downturns can lead to reduced healthcare budgets, limiting the adoption of digital health solutions for obesity management. Conversely, economic growth can increase disposable income, enabling more individuals to invest in digital health tools. For instance, in 2023, the U.S. workforce incurred an economic burden of $425.5 billion due to obesity, encompassing excess medical costs, absenteeism, and presenteeism. This underscores the potential economic benefits of investing in digital health interventions to manage obesity.

Geopolitical factors, including trade policies and international relations, can impact the availability and cost of digital health technologies. For example, trade liberalization has been linked to increased obesity rates in developing countries, potentially due to the influx of inexpensive, calorie-dense foods Additionally, government policies, such as subsidies for digital health initiatives or regulations promoting healthy lifestyles, can either encourage or hinder the development and adoption of digital health technologies for obesity management.

Latest Trends

The digital health market for obesity is witnessing significant trends, driven by advancements in technology and evolving consumer behaviors. One of the key trends is the increased adoption of mobile health applications and wearable devices. These tools offer real-time monitoring and personalized feedback, helping individuals manage their weight more effectively. Wearables, for instance, track vital metrics such as calorie consumption, physical activity, and sleep patterns, providing data that can be used to optimize weight management strategies.

Another emerging trend is the integration of artificial intelligence (AI) and machine learning, which enable more personalized and data-driven approaches to obesity management. These technologies analyze user data to predict potential health risks and suggest tailored interventions. Additionally, the rise of telemedicine platforms has made it easier for patients to consult with healthcare professionals remotely, enhancing accessibility to treatment. The growing focus on prevention, rather than just treatment, has also led to a surge in digital health solutions that empower individuals to proactively manage their weight.

Despite these positive trends, challenges like data privacy concerns, regulatory barriers, and the need for more clinical evidence supporting the effectiveness of digital health interventions remain. However, ongoing investments in digital health technologies are expected to address these challenges, positioning the market for further innovation and growth in combating obesity.

Regional Analysis

North America held a dominant position in the global digital health for obesity market, largely due to the region’s advanced healthcare infrastructure, high adoption of digital health solutions, and a growing prevalence of obesity. The United States, in particular, benefits from a strong healthcare system that supports technological innovation and the widespread implementation of digital health tools. As obesity continues to be a significant public health concern, digital health solutions are becoming essential in addressing this epidemic.

- For example, in January 2024, Eli Lilly and Company launched LillyDirect, a digital healthcare platform designed to manage obesity, migraine, and diabetes. This platform provides U.S. patients with personalized assistance and facilitates home delivery of medications, enhancing the overall patient experience and supporting obesity management.

The increasing availability of mobile health applications, wearable devices, and telemedicine platforms in North America has further fueled the market, allowing individuals to track their health metrics, receive real-time feedback, and access virtual consultations.

Moreover, the strong regulatory framework and investments in healthcare technology initiatives in North America create an environment conducive to the adoption of digital health solutions for obesity. Despite challenges such as data privacy concerns and the need for more clinical evidence, North America remains at the forefront of digital health innovation for obesity management, with continued investments expected to further enhance the market’s growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global digital health for obesity market is highly competitive, featuring a diverse array of players spanning from established pharmaceutical companies to innovative digital health startups. Major pharmaceutical firms have significantly influenced the market with their GLP-1 receptor agonist drugs. These medications have reshaped obesity treatment paradigms, prompting digital health companies to integrate pharmacological solutions into their platforms.

Digital health startups such as Noom, WW International, and PlateJoy have established strong consumer-facing platforms, leveraging behavioral science and personalized coaching to support weight loss. These companies dominate the direct-to-consumer segment, capitalizing on the increasing demand for accessible and personalized obesity management solutions.

The market’s competitive landscape is further intensified by the entry of emerging players offering innovative solutions, including AI-powered metabolic profiling and remote monitoring technologies. This diverse competition fosters continuous innovation, aiming to meet the evolving needs of individuals seeking effective and personalized obesity care.

Top Key Players in the Digital Health for Obesity Market

- Teladoc Health Inc.

- Fitnesskeeper Inc.

- Healthify

- Fitbit Inc.

- WW International

- MyFitnessPal

- WellDoc

- Sidekick Health

- BioAge Labs

- Noom

- PlateJoy HEALTH

- Tempus

Recent Developments

- In December 2023: Hims & Hers, a digital health company, launched its weight loss program, offering digital monitoring tools, educational content, and access to medication. However, it is important to note that the current program does not include prescriptions for GLP-1 weight loss medications, which have gained significant popularity.

- In December 2023: Knownwell, a healthcare provider that integrates virtual and in-person services, introduced Knownwell Teens. This program is designed to support the 14 million children and adolescents in the U.S. struggling with obesity by providing early intervention strategies tailored to their needs.

- In July 2023: Alfie Health introduced its ObesityRx platform, which uses artificial intelligence to create metabolic profiles of individuals to understand the underlying causes of weight gain. The platform suggests personalized treatment plans and behavioral changes. Early results from a study of 300 patients showed an average weight loss of 10% to 15% over nine months using this approach.

- In March 2023: WW International, Inc. completed the acquisition of Weekend Health, Inc., now operating under the name Sequence. This subscription-based telehealth platform offers users access to healthcare professionals specializing in chronic weight management, integrating patient and clinician experiences for continuous care and medication management, while also helping users navigate the insurance approval process.

Report Scope

Report Features Description Market Value (2024) US$ 58.6 billion Forecast Revenue (2034) US$ 407.5 billion CAGR (2025-2034) 21.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Services, Hardware, and Software), End-use (Patients, Providers, Payers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Teladoc Health, Inc., Fitnesskeeper Inc., Healthify, Fitbit, Inc., WW International, MyFitnessPal, WellDoc, Sidekick Health, BioAge Labs, Noom, PlateJoy HEALTH, and Tempus Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Health for Obesity MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Health for Obesity MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Teladoc Health Inc.

- Fitnesskeeper Inc.

- Healthify

- Fitbit Inc.

- WW International

- MyFitnessPal

- WellDoc

- Sidekick Health

- BioAge Labs

- Noom

- PlateJoy HEALTH

- Tempus