Global Digital Freight Brokerage Market Size, Share, Growth Analysis By Transportation Mode (Road Freight, Rail Freight, Air Freight, Ocean Freight), By End-User (Retail & E-commerce, Manufacturing, Automotive, Food & Beverages, Healthcare & Pharmaceuticals, Oil & Gas, Other End-user Industries), By Service Type (Full-truckload (FTL) Brokerage, Less-than-Truckload (LTL) Brokerage, Intermodal Brokerage, Expedited Freight, Refrigerated Freight (Temp-Controlled), Cross-border Freight Brokerage, Other), By Customer Type (Business-to-Business (B2B), Business-to-Consumer (B2C)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151555

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

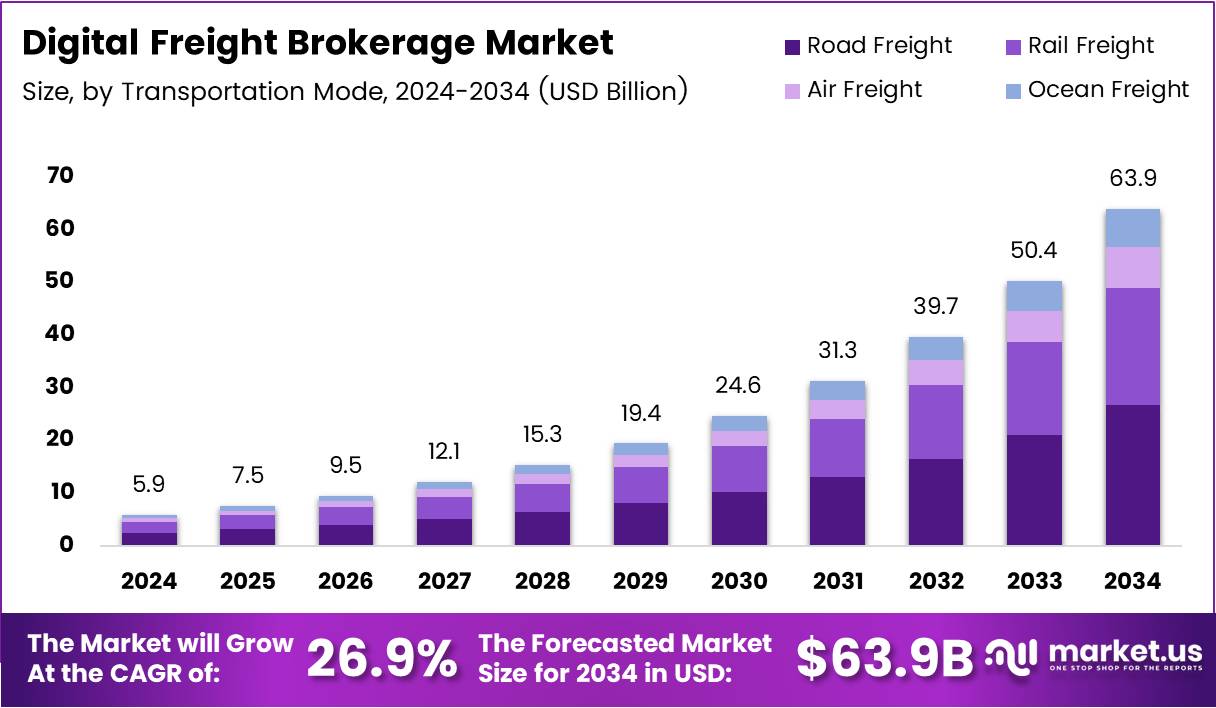

The Global Digital Freight Brokerage Market size is expected to be worth around USD 63.9 Billion by 2034, from USD 5.9 Billion in 2024, growing at a CAGR of 26.9% during the forecast period from 2025 to 2034.

The Digital Freight Brokerage Market is revolutionizing the logistics and transportation sectors by leveraging technology to streamline the booking, pricing, and management of freight shipments. Digital freight brokers facilitate transactions between shippers and carriers, utilizing online platforms and automated systems to match freight loads with available transportation. This process enhances efficiency, reduces costs, and improves transparency within the supply chain.

The market has seen significant growth, primarily driven by the increasing adoption of digital tools and platforms by logistics companies. According to Freightos, only 20% of forwarders gated their pricing tools in 2021, but this number rose to 65% by 2024, illustrating the rapid digital transformation within the freight brokerage space. This shift is enabling real-time price adjustments, reducing friction in transactions, and offering more dynamic service options for shippers and carriers.

Government investments and regulations are also shaping the future of digital freight brokerage. For instance, the U.S. Bureau of Labor Statistics (BLS) projects that jobs for logisticians, including freight brokers, will increase by 18% through 2032, underscoring the growing demand for logistics professionals as the sector continues to evolve. The rise of e-commerce and global trade volumes further contributes to this demand, making digital freight platforms more vital than ever.

There is also a growing opportunity for freight brokers to earn competitive incomes. According to the NDFCA, freight brokers can earn substantial salaries, with median earnings ranging from $45,000 to $90,000 annually. As more businesses seek to optimize their logistics processes through digital solutions, brokers with the right technology skills will be in high demand.

Key Takeaways

- The global digital freight brokerage market is expected to reach USD 63.9 billion by 2034, growing at a CAGR of 26.9% from 2025 to 2034.

- In 2024, Road Freight dominated the By Transportation Mode Analysis segment with a 75.1% market share, driven by cost-efficiency and network availability.

- Retail & E-commerce held the largest share in the By End-User Analysis segment in 2024, driven by consumer demand for fast and trackable deliveries.

- Full-truckload (FTL) Brokerage led the By Service Type Analysis segment in 2024 due to its direct routes and enhanced cargo security.

- In 2024, Business-to-Business (B2B) held the dominant market position in the By Customer Type Analysis segment, driven by high-volume shipments.

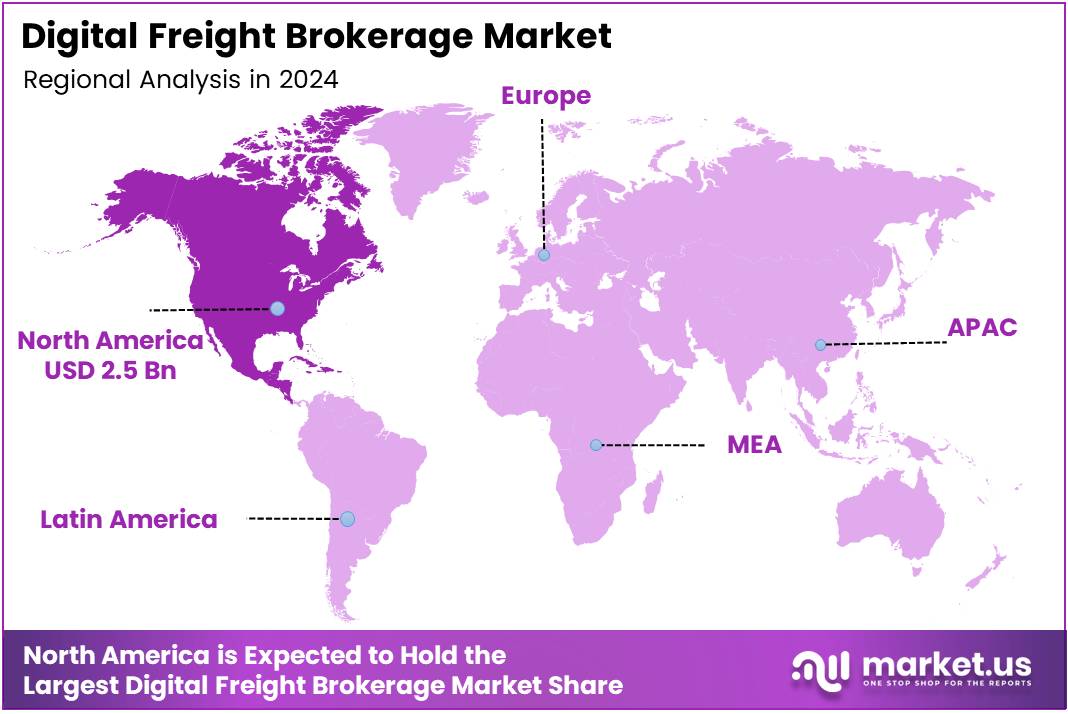

- North America accounted for 42.6% of the global digital freight brokerage market share in 2024, valued at USD 2.5 billion.

Transportation Mode Analysis

Road Freight dominates with 75.1% due to its flexibility and expansive infrastructure.

In 2024, Road Freight held a dominant market position in the By Transportation Mode Analysis segment of the Digital Freight Brokerage Market, with a 75.1% share. This leadership is largely attributed to its cost-efficiency, network availability, and ability to provide last-mile connectivity in both urban and remote regions. The flexibility of road freight continues to make it a preferred choice among businesses of all sizes.

Rail Freight remained a reliable option for bulk and long-haul transportation, especially for industrial goods. Though its usage is limited by infrastructure constraints, it contributes significantly to sustainable freight movement.

Air Freight, on the other hand, is often leveraged for time-sensitive and high-value goods. While it represents a smaller market portion, its role in industries like electronics and pharmaceuticals keeps it relevant.

Ocean Freight plays a key role in cross-continental trade, particularly in handling large volumes. Although slower in comparison, it remains crucial for global logistics, particularly for bulk commodities and intermodal connections.

End-User Analysis

Retail & E-commerce dominates due to rising online shopping trends.

In 2024, Retail & E-commerce held a dominant market position in the By End-User Analysis segment of the Digital Freight Brokerage Market. The sector’s rapid expansion, driven by consumer demand for fast and trackable deliveries, has made it the largest adopter of digital freight services.

Manufacturing emerged as a strong contender, relying on freight brokers for efficient movement of raw materials and finished goods, especially in just-in-time production models.

The Automotive sector continues to utilize freight brokerage to handle complex supply chains and global sourcing. Timely delivery of components and vehicles remains a critical demand.

Food & Beverages rely on timely and controlled shipments, using brokerage platforms to ensure freshness and regulatory compliance. Similarly, Healthcare & Pharmaceuticals need consistent temperature-controlled logistics and traceability.

Oil & Gas requires specialized transport solutions, making brokerage platforms ideal for finding vetted carriers for hazardous and heavy-duty materials.

Other End-user Industries, including retail suppliers and construction, also leverage digital brokerage for cost control and network optimization.

Service Type Analysis

Full-truckload (FTL) Brokerage dominates due to consistent demand for high-volume shipments.

In 2024, Full-truckload (FTL) Brokerage held a dominant market position in the By Service Type Analysis segment of the Digital Freight Brokerage Market. FTL’s ability to offer direct routes with fewer stops enhances delivery speed and cargo security, making it ideal for large shipments.

Less-than-Truckload (LTL) Brokerage remains valuable for businesses with smaller, more frequent deliveries. It supports cost savings through shared transport, particularly for SMEs.

Intermodal Brokerage integrates multiple transport modes, such as rail and truck, offering a balance of cost-efficiency and environmental benefits for long-haul routes.

Expedited Freight caters to urgent delivery needs, often used in sectors like healthcare and aerospace where time is critical. Though niche, it’s a high-value service.

Refrigerated Freight (Temp-Controlled) serves industries with perishable or sensitive goods, such as food and pharma, demanding strict temperature monitoring.

Cross-border Freight Brokerage simplifies international logistics by offering vetted carrier networks and compliance support across borders.

Other services cover specialized needs like oversized loads and customized logistics solutions, adding flexibility to the broader brokerage ecosystem.

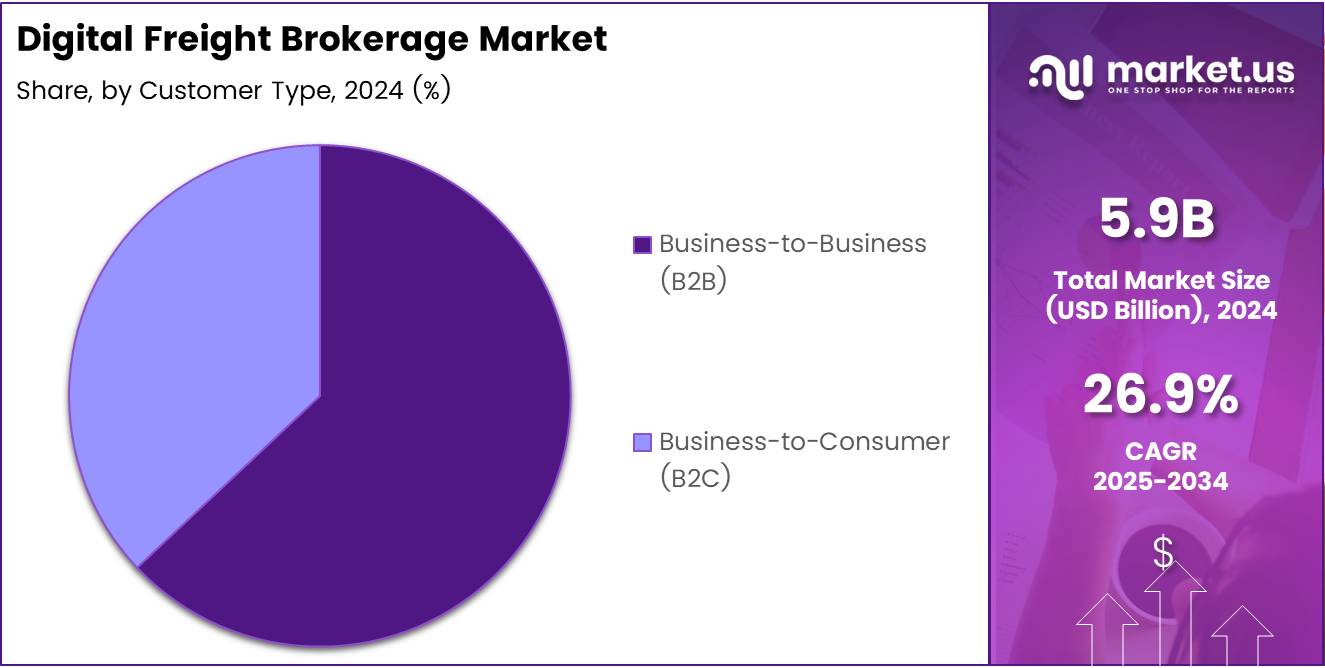

Customer Type Analysis

Business-to-Business (B2B) dominates due to its structured demand and recurring shipments.

In 2024, Business-to-Business (B2B) held a dominant market position in the By Customer Type Analysis segment of the Digital Freight Brokerage Market. B2B clients, including manufacturers, wholesalers, and industrial suppliers, require frequent and high-volume shipments, making them primary users of digital freight services.

Their emphasis on operational efficiency, real-time tracking, and long-term contracts has led to widespread adoption of brokerage platforms that streamline procurement and logistics workflows.

Business-to-Consumer (B2C) services, while growing due to e-commerce expansion, generally involve smaller, parcel-sized shipments. These are typically handled through courier or last-mile networks, although brokerage solutions are increasingly penetrating this space with demand for faster fulfillment.

As digital platforms evolve, both segments are expected to benefit from improved transparency, scalability, and automation in freight management.

Key Market Segments

By Transportation Mode

- Road Freight

- Rail Freight

- Air Freight

- Ocean Freight

By End-User

- Retail & E-commerce

- Manufacturing

- Automotive

- Food & Beverages

- Healthcare & Pharmaceuticals

- Oil & Gas

- Other End-user Industries

By Service Type

- Full-truckload (FTL) Brokerage

- Less-than-Truckload (LTL) Brokerage

- Intermodal Brokerage

- Expedited Freight

- Refrigerated Freight (Temp-Controlled)

- Cross-border Freight Brokerage

- Other

By Customer Type

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

Drivers

Increasing Demand for Real-Time Freight Tracking Solutions Drives Market Growth

The need for real-time freight tracking is growing as shippers and customers want more visibility into shipments. Digital freight brokerage platforms are meeting this demand by offering GPS-enabled and IoT-based tracking solutions, which help reduce delays and improve trust.

The rise in e-commerce and online shopping has also led to more demand for flexible and fast freight services. Digital freight brokers make it easier to match shippers and carriers quickly, supporting the growing volume of online orders.

Technology like artificial intelligence and automation is changing logistics. Smart algorithms now help in route optimization, pricing, and load matching, making freight operations faster and more cost-effective.

Restraints

Lack of Standardization in Digital Freight Platforms Limits Market Expansion

Digital freight brokerage is still a developing field, and many platforms use different systems and standards. This lack of uniformity makes it difficult for shippers and carriers to operate smoothly across different platforms.

Another challenge is the limited integration with traditional freight brokers. Many established players still rely on manual systems, making it harder to fully transition to digital methods.

These factors slow down adoption and reduce the overall efficiency of digital freight solutions. To move forward, the industry needs more common standards and better platform compatibility.

Growth Factors

Emergence of Blockchain Technology for Freight Management Creates New Opportunities

Blockchain is becoming a powerful tool in freight management. It can improve security, traceability, and contract transparency in digital freight brokerage, making transactions more trustworthy.

Emerging markets offer another major growth opportunity. As freight networks expand in developing regions, digital brokers can play a big role in organizing logistics and improving delivery reliability.

Sustainability is also gaining importance in logistics. Digital freight platforms are supporting green freight solutions by optimizing routes and reducing fuel consumption, which meets growing demand for eco-friendly transportation.

Emerging Trends

Growth of Last-Mile Delivery Services in Urban Areas Fuels Market Trends

Last-mile delivery is a fast-growing segment, especially in cities. Digital freight brokerage platforms help handle these short, urgent deliveries more efficiently through quick carrier matching.

Investment in smart logistics infrastructure, like automated warehouses and digital tracking tools, is also increasing. These developments support the scalability and efficiency of digital freight services.

Mobile freight platforms are trending, allowing operators and drivers to manage loads and routes directly from their smartphones. This adds flexibility and real-time control.

Autonomous vehicles are under development and may soon play a role in freight. Digital freight brokers are preparing to integrate these technologies, signaling the next phase of smart logistics.

Regional Analysis

North America Dominates the Digital Freight Brokerage Market with a Market Share of 42.6%, Valued at USD 2.5 Billion

North America holds the leading position in the digital freight brokerage market, accounting for a substantial 42.6% of the global share and valued at USD 2.5 billion. This dominance can be attributed to the region’s early adoption of digital logistics platforms, well-established transportation infrastructure, and strong demand for efficient freight solutions. The presence of a mature logistics ecosystem and increased investment in digital transformation further strengthen North America’s position.

Europe Digital Freight Brokerage Market Trends

Europe follows closely behind, driven by the growing emphasis on sustainability, automation, and efficiency in supply chain operations. Regulatory support for digitalization in freight and logistics, coupled with cross-border trade within the European Union, supports market expansion. Additionally, a rising focus on reducing carbon emissions is pushing enterprises to adopt more technologically advanced freight solutions.

Asia Pacific Digital Freight Brokerage Market Trends

The Asia Pacific region is witnessing rapid growth in the digital freight brokerage market due to increasing industrialization, urbanization, and e-commerce penetration. Countries like China and India are investing heavily in logistics infrastructure, leading to a growing demand for streamlined and cost-effective digital freight solutions. The region’s large population and booming trade activities provide strong opportunities for market players.

Middle East and Africa Digital Freight Brokerage Market Trends

In the Middle East and Africa, the digital freight brokerage market is gradually emerging, fueled by infrastructure development and diversification of economies beyond oil. Adoption of technology in logistics is accelerating, particularly in Gulf countries, where governments are investing in smart transport systems. However, the market remains in a nascent stage compared to more developed regions.

Latin America Digital Freight Brokerage Market Trends

Latin America is experiencing steady progress in the digital freight brokerage sector, supported by growing cross-border trade and digital transformation initiatives in logistics. While infrastructure and regulatory challenges persist, increased smartphone penetration and logistics tech startups are playing a crucial role in market development. The region holds untapped potential, particularly in improving supply chain transparency and efficiency.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Digital Freight Brokerage Company Insights

In 2024, the global Digital Freight Brokerage Market continues to evolve with increased automation and demand for real-time freight solutions.

Uber Freight remains a disruptive force, leveraging its tech-first approach and extensive driver network to streamline operations and enhance transparency for both shippers and carriers. Its integration of AI and data analytics provides a competitive edge in dynamic pricing and routing efficiency.

Mode Global is steadily growing through its strategic acquisitions and multi-modal service capabilities. By investing in end-to-end digital logistics platforms, the company is focusing on improving operational visibility and shipper flexibility across complex supply chains.

J.B. Hunt Transport Services, Inc. leverages its deep industry experience and proprietary platform, J.B. Hunt 360, to digitize the brokerage process. The company’s focus on integrating predictive analytics and real-time tracking ensures a responsive and adaptive logistics offering.

WWEX Group, known for its diverse logistics solutions, is expanding its digital freight capabilities through consolidation and technology partnerships. Its emphasis on customer-centric innovation positions it well in a market leaning toward tailored digital solutions.

Overall, these key players are driving competition by innovating with digital tools, creating a more agile and transparent freight brokerage landscape. As automation, predictive analytics, and real-time communication become the industry standard, these companies are shaping the next phase of growth and transformation within the logistics ecosystem. Their continued investment in digital infrastructure suggests a strong outlook for market maturity and operational resilience.

Top Key Players in the Market

- Uber Freight

- Mode Global

- J.B. Hunt Transport Services, Inc.

- WWEX Group

- Schneider National, Inc.

- Coyote Logistics, LLC

- Echo Global Logistics, Inc.

- Landstar System Holdings, Inc.

- Total Quality Logistics, LLC

- C.H. Robinson Worldwide, Inc.

Recent Developments

- In July 2024, digital freight brokerage platform Lobb raised $2.9 million to innovate and disrupt the massive $100 billion logistics industry, aiming to streamline freight operations with advanced technology.

- In December 2024, Vooma secured $16.6 million in funding as brokers gear up for a significant market shift, positioning itself to capitalize on evolving logistics demands.

- In October 2024, Parade successfully closed a $12.7 million funding round to accelerate its expansion plans, driving growth and increasing its footprint in the logistics sector.

Report Scope

Report Features Description Market Value (2024) USD 5.9 Billion Forecast Revenue (2034) USD 63.9 Billion CAGR (2025-2034) 26.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Transportation Mode (Road Freight, Rail Freight, Air Freight, Ocean Freight), By End-User (Retail & E-commerce, Manufacturing, Automotive, Food & Beverages, Healthcare & Pharmaceuticals, Oil & Gas, Other End-user Industries), By Service Type (Full-truckload (FTL) Brokerage, Less-than-Truckload (LTL) Brokerage, Intermodal Brokerage, Expedited Freight, Refrigerated Freight (Temp-Controlled), Cross-border Freight Brokerage, Other), By Customer Type (Business-to-Business (B2B), Business-to-Consumer (B2C)) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Uber Freight, Mode Global, J.B. Hunt Transport Services, Inc., WWEX Group, Schneider National, Inc., Coyote Logistics, LLC, Echo Global Logistics, Inc., Landstar System Holdings, Inc., Total Quality Logistics, LLC, C.H. Robinson Worldwide, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Freight Brokerage MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Freight Brokerage MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Uber Freight

- Mode Global

- J.B. Hunt Transport Services, Inc.

- WWEX Group

- Schneider National, Inc.

- Coyote Logistics, LLC

- Echo Global Logistics, Inc.

- Landstar System Holdings, Inc.

- Total Quality Logistics, LLC

- C.H. Robinson Worldwide, Inc.