Global Digital Diabetes Management Market Analysis By Product (Continuous Glucose Monitoring Systems, Smart Glucose Meters, Smart Insulin Pens, Smart Insulin Pumps/Closed Loop Systems, Apps), By Type (Wearable Devices, Handheld Devices), By End-use (Hospitals, Home Settings, Diagnostic Centers) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154372

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

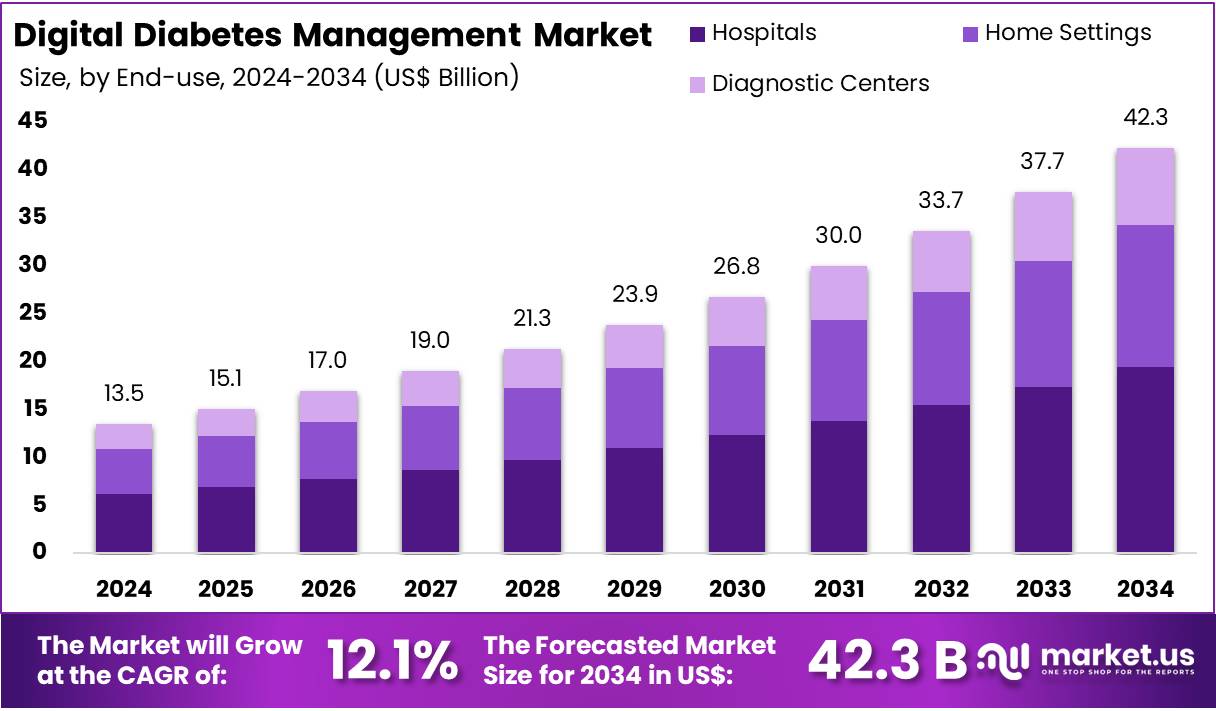

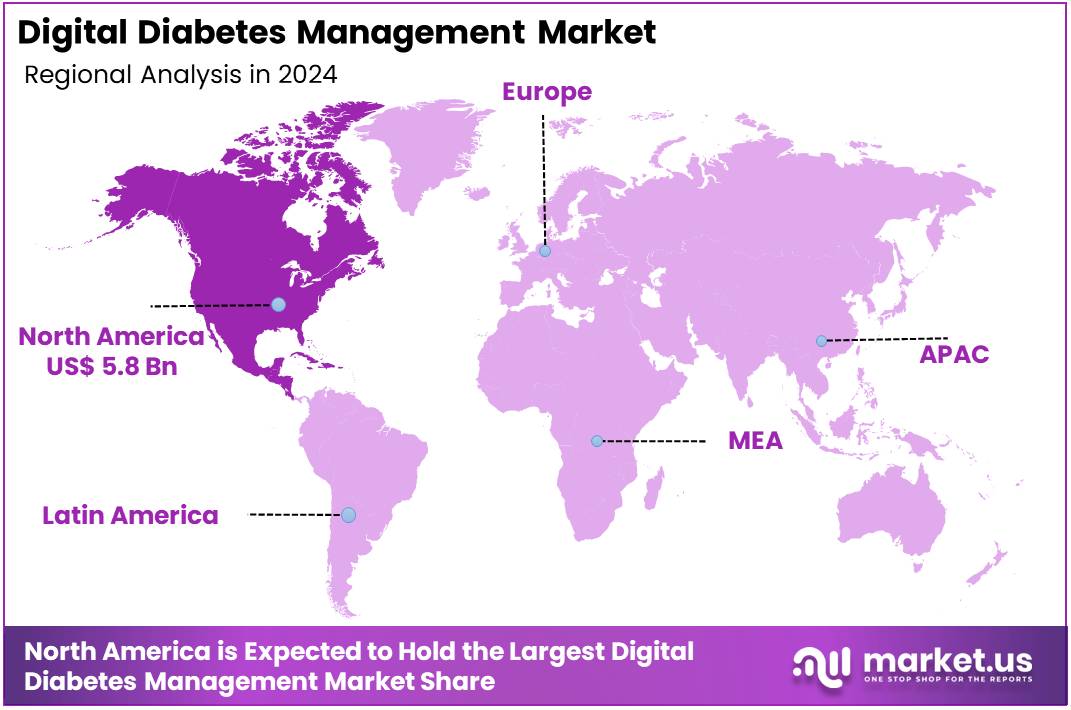

The Global Digital Diabetes Management Market size is expected to be worth around US$ 42.3 Billion by 2034, from US$ 13.5 Billion in 2024, growing at a CAGR of 12.1% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 43.2% share and holds US$ 5.8 Billion market value for the year.

Digital Diabetes Management refers to the use of digital tools to improve diabetes care. It includes continuous glucose monitoring (CGM) systems, smart insulin pens, mobile apps, cloud platforms, and digital insulin pumps. These technologies help patients track their glucose levels, get alerts, and make real-time decisions. Healthcare professionals also benefit from access to remote data, enabling timely interventions and improved outcomes. These tools play a major role in empowering patients and supporting personalized diabetes care.

The growing diabetes burden is a key factor driving this digital transformation. According to the 2025 edition of the International Diabetes Federation (IDF) Diabetes Atlas, about 590 million adults (aged 20–79) are living with diabetes—roughly 1 in 9 adults. This figure is expected to rise to 853 million by 2050, marking a 46% increase. In 2024, diabetes caused 3.4 million deaths globally, or one death every 9 seconds. The financial toll is significant, with global diabetes-related health expenditures exceeding USD 1 trillion in 2024.

India represents one of the most impacted countries, contributing to nearly 26% of global diabetes cases. National data shows that around 212 million people in India are affected. Among adults over 50, the diabetes prevalence reaches 11.8%, while those under 50 show 6.5% diabetes and 5.7% prediabetes rates. In the United States, diabetes-related healthcare costs reached USD 412.9 billion in 2022, reflecting a growing economic challenge across both developed and developing nations.

Government and policy support has accelerated digital diabetes adoption. In May 2021, the World Health Assembly passed a resolution to enhance diabetes control. The WHO’s Global Diabetes Compact and 2022 global coverage targets are supporting digital platform rollouts, especially in low- and middle-income countries. For instance, U.S. health agencies such as the CDC and NIH provide educational tools, driving awareness and encouraging the use of connected health devices and mobile apps for diabetes care.

Clinical studies show clear benefits from digital diabetes tools. A systematic review of 28 studies on Type 2 diabetes found that HbA1c reductions were stronger with coaching intensity. For instance, the ESYSTA app trial in Germany showed an HbA1c reduction of –0.48% over 6 months. Similarly, in India, the mySugr + Accu-Chek program led to a mean HbA1c drop from 8.8% to 7.5% in just 3 months. A study by Teladoc Health showed machine learning models predicted uncontrolled diabetes risks with up to 94% recall accuracy.

Digital solutions are also proving valuable in public health and health economics. A 2021 IDF estimate placed global diabetes spending at USD 966 billion, expected to exceed USD 1 trillion by 2045. Tools like CGMs combined with coaching reduce emergency events and hospital visits. Predictive models, such as the GluMarker framework, are helping forecast daily glucose control. According to ADA guidelines, integrating CGM data into telemedicine improves decision-making and adherence, contributing to improved HbA1c and long-term outcomes.

Key Takeaways

- By 2034, the global digital diabetes management market is projected to reach US$ 42.3 billion, growing from US$ 13.5 billion in 2024 at a CAGR of 12.1%.

- In 2024, continuous glucose monitoring (CGM) systems accounted for over 39.4% of the product segment, reflecting strong demand for real-time blood glucose tracking.

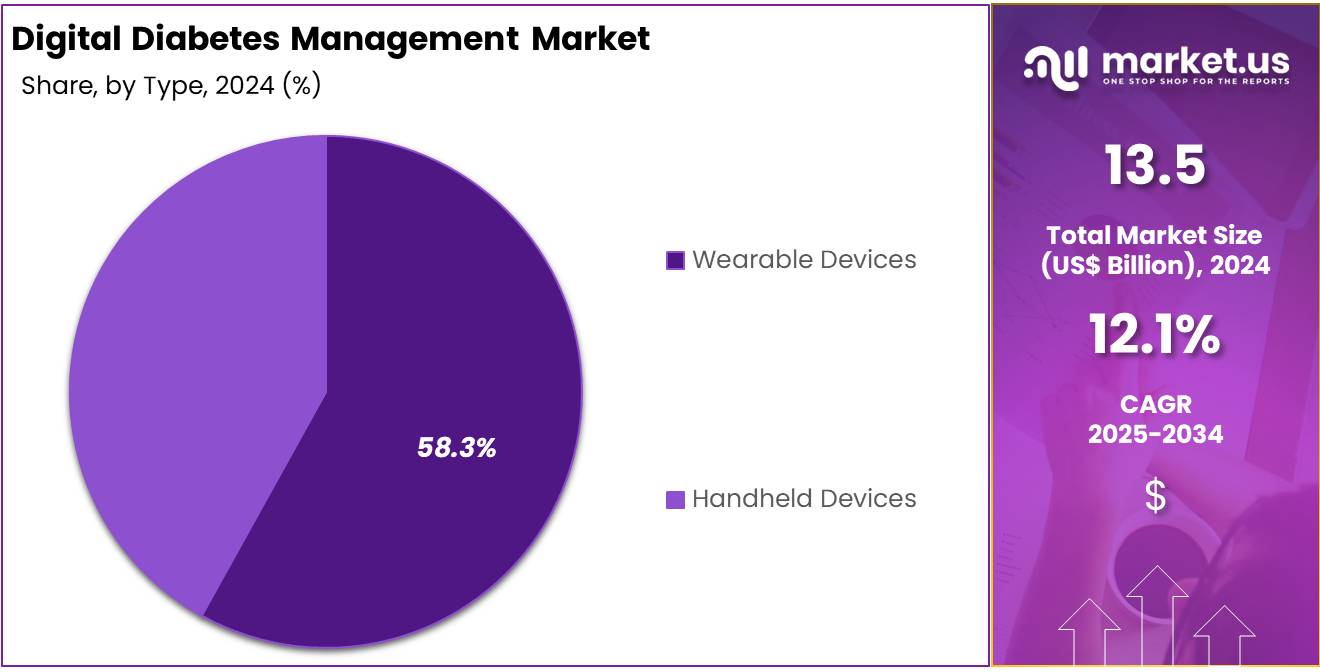

- Wearable devices dominated the type segment in 2024, holding a market share of more than 58.3% due to growing adoption of smart diabetes management tools.

- The hospitals segment led the end-use category in 2024, securing over 45.7% of the market share owing to high patient intake and infrastructure availability.

- North America remained the leading region in 2024, generating US$ 5.8 billion and capturing over 43.2% share, driven by advanced healthcare systems and awareness.

Product Analysis

In 2024, the Continuous Glucose Monitoring (CGM) Systems section held a dominant market position in the product segment of the digital diabetes management market and captured more than a 39.4% share. This was mainly due to the growing need for real-time glucose data. CGM devices help reduce complications linked to poor glucose control. These systems allow better tracking and decision-making. Their benefits include early alerts, improved glycemic outcomes, and reduced dependence on finger-prick tests.

Smart Glucose Meters had the second-largest share in 2024. These gadgets are extensively utilized due to their easy UI and smartphone compatibility. Many patients prefer using them at home. Another significant advantage is the ability to share results immediately with healthcare providers. Their low cost has made them popular among people of all ages. The devices are especially valuable for older patients, who require simple monitoring tools. Their popularity is growing in both urban and rural healthcare settings.

Smart Insulin Pens and Pumps are also gaining popularity. Smart Pens provide dose tracking and reminders. This lowers errors while improving insulin adherence. Meanwhile, Closed-Loop Systems provide automated insulin delivery. These are mostly used for managing Type 1 diabetes. Their popularity has increased in hospitals and among young patients. Furthermore, mobile apps are becoming essential tools. They allow you to track your glucose, meals, and physical activity. App integration with wearable devices improves diabetes care and patient engagement.

Type Analysis

In 2024, the Wearable Devices section held a dominant market position in the Type segment of the Digital Diabetes Management Market and captured more than a 58.3% share. This leadership was largely driven by the growing use of continuous glucose monitoring (CGM) systems and smart insulin pumps. These devices provide real-time data and improve glycemic control. Their ability to sync with mobile applications has also made them a preferred choice among patients and healthcare professionals.

Wearable diabetes devices are gaining traction due to their convenience and accuracy. Features such as Bluetooth connectivity, automated insulin delivery, and real-time alerts support better diabetes care. Many patients are shifting from traditional methods to smart wearables. This shift is encouraged by the rising incidence of type 1 and type 2 diabetes globally. The demand for non-invasive, user-friendly, and compact solutions continues to grow, especially among younger and tech-savvy populations.

Meanwhile, the Handheld Devices segment remains relevant in many regions. It includes tools like blood glucose meters, digital logbooks, and smart insulin pens. These products are cost-effective and widely accessible. However, they often require manual logging and are less connected to digital platforms. Despite this, handheld devices are still widely used, particularly in low- and middle-income countries where affordability is a major factor in diabetes management.

End-use Analysis

In 2024, the Hospitals section held a dominant market position in the End-use segment of the Digital Diabetes Management market, and captured more than a 45.7% share. This strong presence was driven by increasing adoption of digital tools across healthcare institutions. Hospitals are now using continuous glucose monitors, remote insulin pumps, and electronic health records to improve diabetes care. These technologies help doctors monitor patients in real time. As a result, hospitals remain the primary users of digital diabetes solutions.

Home settings followed as the second-largest segment in 2024. This growth was fueled by rising demand for remote care and self-monitoring. Many patients now use connected glucometers, mobile health apps, and wearable trackers at home. These tools help manage blood sugar levels without visiting a clinic. Better awareness about personal health and convenience in tracking daily metrics also support this trend. Home-based diabetes care is expected to expand further in the coming years.

Diagnostic centers also played an important role in the market. These facilities often handle initial diabetes screening and regular blood tests. Many centers have adopted digital systems for faster and more accurate diagnostics. Integration of cloud-based platforms has improved the efficiency of test reporting. Patients now receive timely updates and easier access to results. Although smaller in share, this segment is expected to see stable growth due to rising health check-up rates and better diagnostic infrastructure.

Key Market Segments

By Product

- Continuous Glucose Monitoring Systems

- Smart Glucose Meters

- Smart Insulin Pens

- Smart Insulin Pumps/Closed Loop Systems

- Apps

By Type

- Wearable Devices

- Handheld Devices

By End-use

- Hospitals

- Home Settings

- Diagnostic Centers

Drivers

Integration of AI and Analytics Enhancing Personalized Diabetes Care

The integration of artificial intelligence (AI), machine learning (ML), and advanced analytics is a key driver in the digital diabetes management market. These technologies are enhancing real-time decision-making, risk prediction, and therapy optimization. AI-driven platforms are supporting continuous glucose monitoring (CGM) by generating predictive insights, which help users and providers to anticipate glycemic fluctuations. Reinforcement learning and clustering models are being applied to personalize interventions and automate insulin dosing. As a result, digital platforms are becoming more effective in guiding clinical actions and patient self-care.

Recent evidence reinforces the role of AI in delivering clinically meaningful outcomes. A March 2025 review highlighted the active application of AI for glycemic risk prediction, lifestyle personalization, and remote patient support. A late 2024 AI model trained on 16 million CGM records achieved an rMSE of just 15.6 mg/dL for one-hour glucose forecasts—showing over 50% improvement in prediction accuracy. These advances are transforming conventional diabetes care into data-driven, patient-centric management systems, improving therapy precision and overall control.

The bibliometric analysis of 482 studies reveals growing global interest in AI-powered glucose forecasting and behavioral modeling. The U.S., U.K., and Italy have emerged as research leaders in this domain. These efforts are being translated into real-world applications, such as AI-based decision support systems that recommend adaptive insulin dosing. Improved predictive accuracy and patient adherence are positioning AI technologies as essential components of modern diabetes care strategies, particularly for type 1 and insulin-requiring type 2 diabetes populations.

Consumer adoption is also rising rapidly. A 2025 systematic review showed that combining standard care with remote monitoring and monthly digital interventions achieved a 0.20% reduction in A1c levels. Meanwhile, in 2024, CGM use expanded beyond diabetic patients to athletes and wellness users. Devices like Dexcom’s Stelo and Abbott’s Libre Rio/Lingo received over-the-counter (OTC) approval, allowing non-prescription access. These developments are broadening the use cases for digital diabetes tools, enhancing lifestyle integration, and strengthening the market potential.

Restraints

High Cost and Affordability Barriers in Digital Diabetes Management

The high cost of digital diabetes management devices continues to restrict widespread adoption, especially in low-income regions. Continuous glucose monitors (CGMs) and smart insulin pumps remain expensive to purchase and maintain. CGM systems often require upfront investments exceeding USD 1,000, alongside recurring costs for transmitters and sensors. Most sensors last only 7 to 10 days, demanding 36 to 52 replacements per year. These factors contribute to sustained financial pressure on individuals and healthcare systems, limiting access beyond well-insured or affluent users.

Out-of-pocket expenses remain a key concern for patients, even when partial insurance coverage is available. For instance, in early 2024, a reported case highlighted that a 3-month supply of insulin pump accessories cost approximately USD 1,800. Some users indicated they needed to spend nearly USD 3,000 to meet deductible thresholds. In addition, monthly CGM sensor costs can reach USD 100, adding up to significant annual expenses. These recurring costs discourage continued use among financially vulnerable patients and create treatment discontinuity.

Despite proven clinical benefits, cost remains a major obstacle. A 2024 real-world study of 790 type 2 diabetes patients showed that Dexcom G6 real-time CGM helped reduce ER visits by 30% and inpatient admissions by 41.5%. Cost savings were reported at over USD 300 per patient per month. However, these benefits are often limited to users on intensive insulin therapy. Broader adoption remains low due to unaffordability, especially among those not requiring daily insulin doses.

Access disparities are also becoming more evident. A 2024 survey conducted at an inner-city safety-net hospital revealed that although most patients used smartphones for health monitoring, nearly half of CGM users discontinued their use due to high device and sensor costs. The wider economic burden is notable, with the United States recording over USD 306 billion in direct medical expenses for diabetes in 2022. As total diabetes-related costs surpassed USD 412 billion, the affordability of digital tools remains a key restraint to equitable care.

Opportunities

Expansion in Emerging Economies Through Mobile Health (mHealth) Platforms

The digital diabetes management market holds significant opportunity in emerging economies through the adoption of mobile health (mHealth) platforms. With rising smartphone penetration and increasing internet access in regions such as Asia-Pacific, Latin America, and parts of Africa, mobile-based diabetes management solutions can bridge gaps in healthcare access.

According to the International Telecommunication Union (ITU), mobile internet usage in low- and middle-income countries surpassed 54% in 2023. This growing digital infrastructure supports the delivery of app-based services, including blood glucose tracking, virtual consultations, medication reminders, and educational content, particularly in underserved rural and semi-urban populations.

Moreover, national digital health initiatives—such as India’s Ayushman Bharat Digital Mission (ABDM)—are accelerating the integration of digital tools into primary care systems, creating an environment conducive to mobile-based diabetes care. This presents a scalable, cost-effective opportunity for companies to expand their reach and improve diabetes outcomes in price-sensitive regions.

Trends

Shift Toward Continuous Glucose Monitoring (CGM) and App-Based Diabetes Management

Digital diabetes management is undergoing a significant transformation, led by the widespread adoption of continuous glucose monitoring (CGM) systems. These devices provide real-time, automatic tracking of glucose levels, enabling timely interventions and more effective treatment planning. As of 2024, CGM systems hold nearly half the digital diabetes market share. Their growing use is supported by increased clinical validation, improved patient adherence, and the ability to reduce hypoglycemic episodes through predictive alerts and trend data.

In parallel, mobile applications have become central tools for diabetes management. These apps enable users to log glucose readings, monitor dietary intake, track physical activity, and share data with healthcare providers. Seamless integration with CGM systems offers patients and clinicians a unified platform for continuous monitoring and personalized care. The convenience of mobile access has improved patient engagement, especially among younger, tech-savvy users, and those managing their diabetes remotely or in home care settings.

The integration of CGM with mobile apps is reshaping conventional care models. Real-time data sharing between patients and providers enhances clinical decision-making, facilitates early interventions, and supports value-based care. Additionally, data analytics embedded in many platforms can generate predictive insights, allowing for proactive disease management. This approach supports better glycemic control and long-term health outcomes for patients with both type 1 and type 2 diabetes.

Innovation in sensor technology and digital interfaces continues to drive this trend. Manufacturers are focusing on smaller, longer-lasting sensors, reduced calibration needs, and app interfaces with AI-based recommendations. These advancements are making digital diabetes tools more accessible and user-friendly. As healthcare systems increasingly prioritize chronic disease management and remote monitoring, the convergence of CGM and mobile apps is expected to remain a key pillar of growth in the digital diabetes management market.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 43.2% share and holds US$ 5.8 billion market value for the year. The region’s leadership is supported by a mature healthcare infrastructure and strong technological adoption. Increased public awareness about diabetes care and rising demand for advanced monitoring solutions have further driven the market. The availability of early screening programs and digital intervention tools continues to enhance disease management outcomes across the region.

The United States remains the primary contributor to North America’s market share. This can be attributed to a large diabetic population and favorable reimbursement policies. The Centers for Medicare & Medicaid Services (CMS) have expanded insurance coverage for digital solutions, promoting their widespread adoption. Additionally, the country has seen strong integration of wearable devices such as insulin pumps and continuous glucose monitors into patient care routines, enabling real-time data access and improved glycemic control.

The surge in healthcare spending and high smartphone usage has supported the use of mobile-based diabetes applications. These digital platforms assist users in managing glucose levels, tracking medications, and consulting remotely with healthcare providers. The integration of artificial intelligence has added predictive capabilities, enhancing care efficiency. The growing ecosystem of connected devices has helped in improving treatment adherence and personalized patient support.

Canada has also shown noteworthy advancement in the digital diabetes management space. National programs focused on digital health literacy and remote monitoring have expanded access to care. Government investments and private-sector collaboration have played an important role in strengthening patient engagement. These combined efforts are driving the adoption of integrated diabetes care solutions, especially in underserved or remote communities across Canada.

Overall, North America continues to be a central hub for technological innovation in diabetes care. The region’s commitment to digital transformation, coupled with favorable regulatory support, positions it as a long-term leader in the global digital diabetes management market. The presence of strong clinical networks and innovation-driven health policies further underlines the region’s growth potential.

The Asia Pacific region emerged as a high-growth area in the Digital Diabetes Management market. The region’s rising diabetes burden, particularly in India and China, has intensified the demand for digital care solutions. Rapid urbanization and shifting dietary habits have increased the incidence of type 2 diabetes. As a result, healthcare systems are focusing on scalable solutions to improve disease detection and monitoring.

Governments in the region are launching initiatives to expand access to digital tools. Programs encouraging early diagnosis, teleconsultation, and mobile app use are becoming widespread. These efforts have improved chronic disease management in both urban and rural areas. Public health campaigns are also emphasizing digital literacy, helping patients become more comfortable with smart healthcare devices and mobile-based platforms.

The growing penetration of smartphones and internet access has supported the shift toward remote patient monitoring. Digital startups and technology companies are partnering with hospitals and clinics to deploy AI-powered apps and real-time glucose tracking systems. This collaboration is enhancing diabetes care delivery, especially in regions with limited physical access to healthcare services.

Countries such as Japan, South Korea, and Australia are investing in personalized healthcare systems. Cloud-based data platforms and predictive analytics tools are gaining momentum in managing blood sugar levels and preventing complications. These technologies are making diabetes care more efficient and patient-centered, especially for aging populations and those with chronic conditions.

As digital health spending rises and healthcare ecosystems continue to evolve, the Asia Pacific region is expected to be a major contributor to global market growth. Ongoing infrastructure development and the focus on preventive healthcare are likely to sustain momentum. The region’s commitment to expanding digital healthcare access will play a vital role in shaping the future of diabetes management.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global digital diabetes management market is influenced by several key players who focus on innovation, strategic alliances, and regulatory compliance. Abbott stands out with its FreeStyle Libre CGM systems, offering real-time glucose monitoring and data sharing. The company’s solutions support both clinical and consumer needs, promoting remote monitoring. Medtronic follows closely with its MiniMed series, combining insulin pumps and CGM into one platform. The firm leverages AI tools and mobile apps to personalize diabetes care, enhancing engagement for patients and providers in digital healthcare settings.

F. Hoffmann-La Roche Ltd. contributes to the market through its Accu-Chek line, integrating traditional glucose monitoring with digital health platforms. The company emphasizes cloud-based connectivity, supporting better visualization of patient data and clinical insights. Roche’s strategic collaborations with startups further enhance its digital capabilities. Bayer, while less active in glucose monitoring devices, supports the market through digital innovation in chronic disease care. It focuses on AI-based diagnostics and telehealth platforms to support patients with diabetes and related metabolic conditions.

Sanofi is gradually strengthening its position in the digital diabetes space. The company combines its pharmaceutical leadership with smart technologies like connected insulin pens and mobile health apps. Through partnerships, Sanofi is building integrated platforms for remote monitoring and patient education. These efforts aim to improve treatment adherence and overall glycemic control. Its solutions are aligned with the growing emphasis on preventive care and data-driven chronic disease management.

Other key participants include Dexcom, Ascensia Diabetes Care, and Insulet Corporation. These companies offer advanced digital tools such as wireless glucose monitors and wearable insulin delivery systems. Their focus is on improving usability, patient convenience, and access to real-time analytics. Collaborations with healthcare providers, payers, and technology firms are driving global adoption. Collectively, these stakeholders are advancing a connected diabetes care ecosystem aimed at improving outcomes and reducing long-term treatment costs.

Market Key Players

- Abbott

- Medtronic

- F. Hoffmann-La Roche Ltd.

- Bayer AG

- Sanofi

- Dexcom Inc.

- LifeScan Inc.

- Insulet Corporation

- Ascensia Diabetes Care Holdings AG

- B. Braun Melsungen AG

Recent Developments

- In January 2024: Abbott introduced the FreeStyle Libre 2 Plus sensor in the United States, cleared by the FDA in 2023 for use with automated insulin delivery (AID) systems. The new sensor integrates with Tandem Diabetes Care’s t:slim X2 insulin pump, offering automated predictions and adjustments to insulin dosing every five minutes. Notably, it is the first U.S. CGM with a 15‑day wear time for both adults and children, enhancing convenience and cost‑efficiency. This development marks a significant expansion of Abbott’s digital diabetes ecosystem.

- In August 2024: Medtronic received FDA clearance for its Simplera™ continuous glucose monitoring system, and simultaneously announced the forthcoming launch of its Smart MDI (multiple daily injection) system, which includes the InPen™ app. This system provides real-time, personalized dosing guidance—including on missed or inaccurate mealtime doses—representing a significant step forward in digital insulin dose management.

- In April 2024: Roche unveiled positive topline data at the 17th ATTD International Conference concerning its new Accu‑Chek SmartGuide continuous glucose monitoring (CGM) solution. The platform comprises a CGM sensor and two companion apps that deliver real‑time glucose readings, 30‑minute and two‑hour trend forecasts, and predictive alerts for nocturnal hypoglycaemia risk. Roche indicated that CE mark clearance was underway, with a planned phased launch in selected European markets following regulatory approval.

Report Scope

Report Features Description Market Value (2024) US$ 13.5 Billion Forecast Revenue (2034) US$ 42.3 Billion CAGR (2025-2034) 12.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Continuous Glucose Monitoring Systems, Smart Glucose Meters, Smart Insulin Pens, Smart Insulin Pumps/Closed Loop Systems, Apps), By Type (Wearable Devices, Handheld Devices), By End-use (Hospitals, Home Settings, Diagnostic Centers) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Abbott, Medtronic, F. Hoffmann-La Roche Ltd., Bayer AG, Sanofi, Dexcom Inc., LifeScan Inc., Insulet Corporation, Ascensia Diabetes Care Holdings AG, B. Braun Melsungen AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Diabetes Management MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Diabetes Management MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott

- Medtronic

- F. Hoffmann-La Roche Ltd.

- Bayer AG

- Sanofi

- Dexcom Inc.

- LifeScan Inc.

- Insulet Corporation

- Ascensia Diabetes Care Holdings AG

- B. Braun Melsungen AG