Global Dermal Sprays Market By Product Type (Skin Cleansers, Surgical Scrubs, Skin Conditioners, Haircare Sprays and Others), By Distribution Channel (Retail Pharmacies, Specialty Clinics, Online Pharmacies, Hospital Pharmacies and Cosmetic Stores), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170870

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

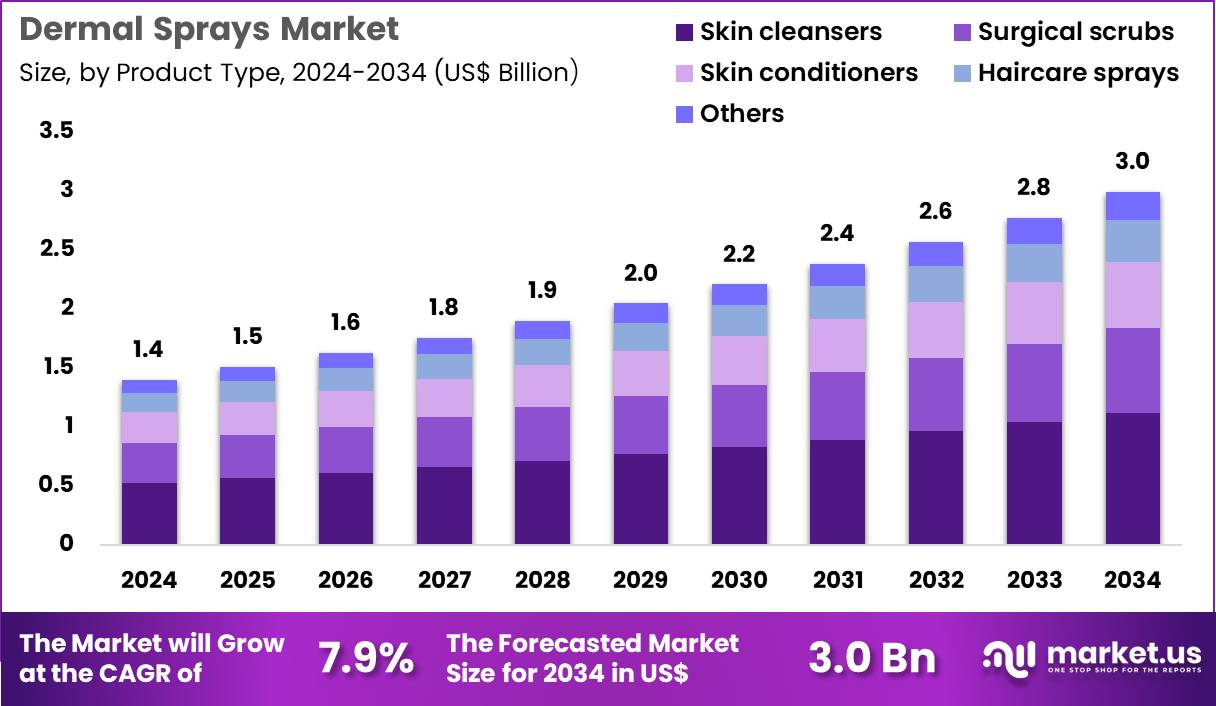

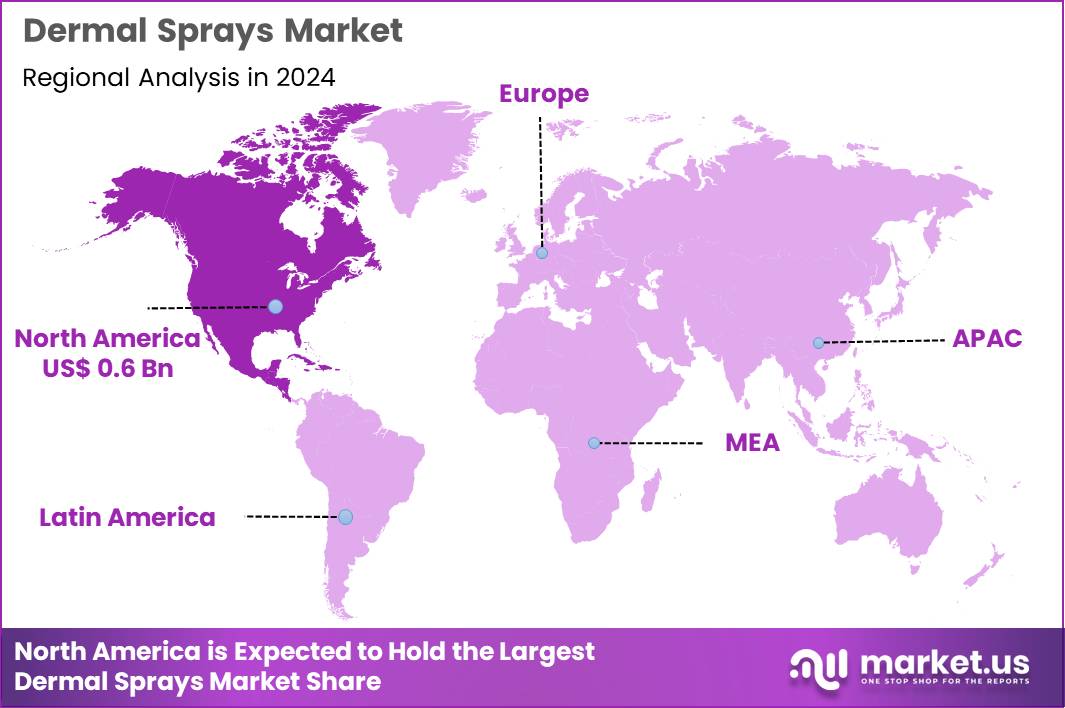

The Global Dermal Sprays Market size is expected to be worth around US$ 3.0 Billion by 2034 from US$ 1.4 Billion in 2024, growing at a CAGR of 7.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.7% share with a revenue of US$ 0.6 Billion.

Increasing consumer preference for non-invasive wound management solutions propels the Dermal Sprays market, as patients and clinicians favor convenient, touch-free delivery systems that minimize infection risk and enhance healing comfort.

Manufacturers formulate hypochlorous acid-based and antimicrobial peptide sprays that create protective barriers while promoting moist wound environments. These products apply in post-surgical incision care to reduce scarring and microbial colonization, minor burn treatment for rapid cooling and pain relief, chronic ulcer management in diabetic foot lesions, and pediatric abrasion coverage to avoid bandage-related distress.

E-commerce expansions create opportunities for direct-to-consumer access that bypass traditional pharmacy channels. In September 2024, Sonoma Pharmaceuticals, Inc. launched several OTC consumer health products online, including MucoClyns™ across European Amazon platforms and Ocucyn® Eyelid & Eyelash Cleanser plus Regenacyn® Advanced Scar Gel on Amazon.com in the United States. These introductions directly broaden patient reach and accelerate adoption of spray-based dermal therapies in everyday wellness routines.

Growing adoption in aesthetic and dermatological procedures accelerates the Dermal Sprays market, as practitioners incorporate post-treatment sprays to soothe inflammation and protect compromised skin barriers after laser resurfacing or chemical peels. Biotechnology firms develop growth factor-enriched and hyaluronic acid formulations that hydrate while delivering regenerative actives through fine mist application.

Applications encompass microneedling aftercare to prevent secondary infections, tattoo healing protocols for vibrant color retention, acne scar revision support with anti-inflammatory botanicals, and rosacea flare management through calming mineral complexes. Professional-grade sprays open avenues for clinic-branded product lines that extend care beyond in-office visits. Cosmetic surgeons increasingly prescribe these solutions as part of comprehensive recovery kits to optimize outcomes. This synergy between medical aesthetics and convenient delivery drives sustained innovation in targeted spray compositions.

Rising focus on infection prevention in athletic and occupational settings invigorates the Dermal Sprays market, as sports medicine professionals and workplace safety officers deploy antimicrobial sprays to address skin breaches in high-contact environments. Companies engineer silver ion and essential oil blends that provide broad-spectrum protection without stinging on open wounds.

These sprays serve turf burn treatment on playing fields, construction site laceration first-aid, gym equipment-related folliculitis control, and military field medicine for rapid battlefield wound decontamination. Portable formats create opportunities for integration into team medical bags and industrial first-aid stations. Performance brands actively co-develop athlete-specific lines that combine cooling menthol with healing accelerants. This proactive hygiene trend positions dermal sprays as essential components of modern injury prevention and management protocols.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.4 Billion, with a CAGR of 7.9%, and is expected to reach US$ 3.0 Billion by the year 2034.

- The product type segment is divided into skin cleansers, surgical scrubs, skin conditioners, haircare sprays and others, with skin cleansers taking the lead in 2024 with a market share of 37.4%.

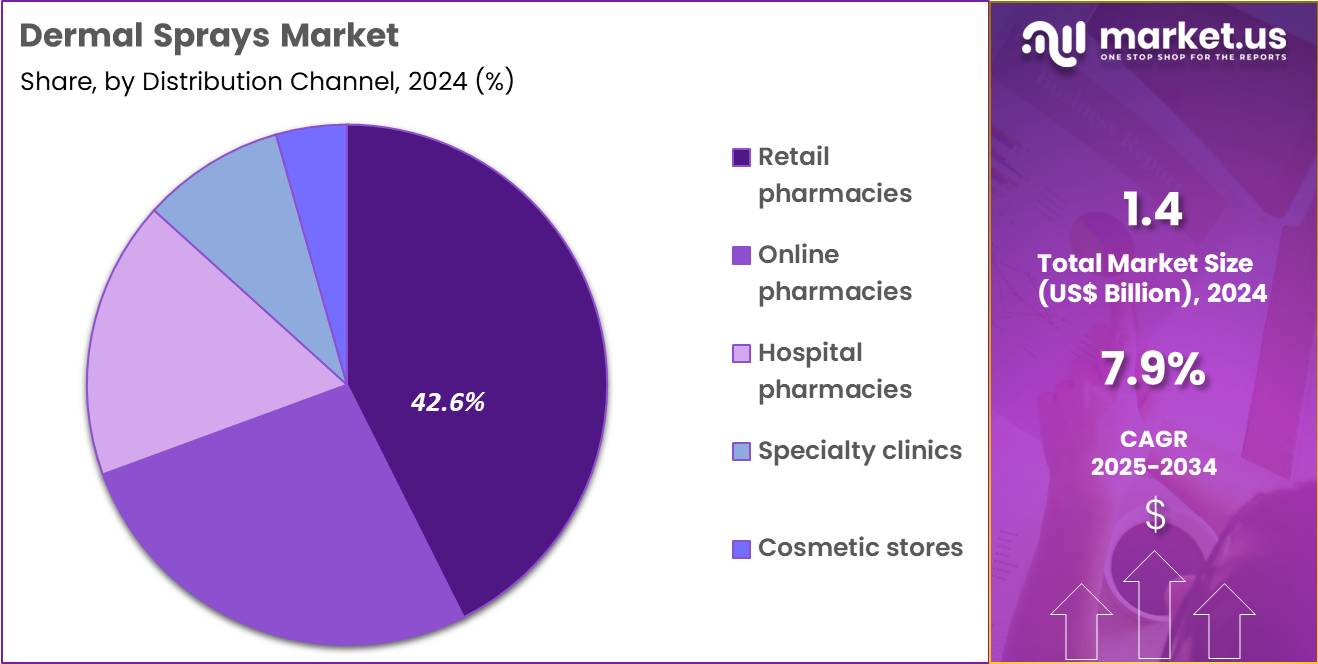

- Considering distribution channel, the market is divided into retail pharmacies, specialty clinics, online pharmacies, hospital pharmacies and cosmetic stores. Among these, retail pharmacies held a significant share of 42.6%.

- North America led the market by securing a market share of 40.7% in 2024.

Product Type Analysis

Skin cleansers, holding 37.4%, are expected to dominate because rising skin sensitivity issues and urban pollution drive demand for gentle, quick-application cleansing solutions. Consumers rely increasingly on dermal spray cleansers for convenience, portability, and minimal-touch hygiene benefits. Dermatologists recommend spray-based cleansers for patients with acne, dermatitis, and post-procedure skin care, strengthening clinical adoption.

Growing interest in antimicrobial and hydrating spray formulations expands product acceptance across both medical and cosmetic use cases. The trend toward no-rinse skincare routines encourages higher usage in daily hygiene habits. Manufacturers introduce multi-functional sprays that combine cleansing with soothing or barrier-support features, enhancing market penetration. These factors keep skin cleansers anticipated to remain the dominant product type in the dermal sprays market.

Distribution Channel Analysis

Retail pharmacies, holding 42.6%, are projected to dominate as they remain the most accessible and trusted point of purchase for dermatology-related products. Consumers prefer retail pharmacies for professional guidance, authentic brands, and immediate product availability. Growing footfall in pharmacy chains supports expanded shelf space for premium dermal sprays targeting cleansing, conditioning, and post-procedure care.

Retail pharmacists influence purchasing decisions through personalized recommendations, strengthening customer confidence. Increasing product launches by skincare brands prioritize pharmacy distribution due to better visibility and regulatory compliance. Pharmacies also offer loyalty programs and bundled skincare promotions that boost sales volume. These dynamics keep retail pharmacies expected to remain the leading distribution channel for dermal sprays.

Key Market Segments

By Product Type

- Skin Cleansers

- Surgical Scrubs

- Skin Conditioners

- Haircare Sprays

- Others

By Distribution Channel

- Retail Pharmacies

- Specialty Clinics

- Online Pharmacies

- Hospital Pharmacies

- Cosmetic Stores

Drivers

Increasing prevalence of chronic wounds is driving the market

The growing incidence of chronic wounds worldwide has intensified the demand for effective topical delivery systems, including dermal sprays, to facilitate wound healing and infection prevention. These conditions, encompassing diabetic foot ulcers, venous leg ulcers, and pressure injuries, impose substantial burdens on healthcare infrastructures, prompting innovations in non-invasive treatment modalities.

Dermal sprays offer advantages in uniform application and reduced manipulation of sensitive tissues, aligning with clinical needs for patient comfort during therapy. Public health entities underscore the economic implications, as untreated wounds escalate hospitalization rates and associated costs. This driver is amplified by demographic shifts, including aging populations susceptible to impaired vascularity and neuropathy.

Integration of dermal sprays into multidisciplinary wound care protocols enhances adherence, as they minimize dressing changes and support moist healing environments. Collaborative guidelines from professional societies advocate for such technologies to standardize care in outpatient settings.

The accessibility of over-the-counter variants further broadens utilization among home care providers. As prevalence escalates, regulatory pathways prioritize expedited reviews for spray-based therapeutics. Overall, this momentum sustains investment in formulation enhancements, positioning dermal sprays as indispensable in contemporary wound management paradigms.

Restraints

Stringent regulatory requirements under MoCRA is restraining the market

The enactment of the Modernization of Cosmetics Regulation Act in 2022 has introduced rigorous oversight for cosmetic and topical products, including dermal sprays, thereby complicating market entry and compliance. Facilities manufacturing these products faced a mandatory registration deadline of July 1, 2024, with the U.S. Food and Drug Administration requiring detailed product listings and adverse event reporting. This expanded authority mandates safety substantiation and facility inspections, escalating administrative burdens for smaller developers.

Variability in state-level alignments with federal standards creates jurisdictional inconsistencies, hindering uniform distribution strategies. Post-market surveillance obligations, such as mandatory reporting of serious adverse events within 15 days, strain operational resources. Ingredient transparency demands, including allergen disclosures, necessitate reformulations that delay launches. The absence of pre-market approval pathways for most cosmetics prolongs validation timelines, deterring innovation in spray technologies.

Economic pressures from compliance costs, estimated to rise significantly post-2022, impact pricing and accessibility. Ethical considerations around data privacy in reporting further complicate implementation. Collectively, these constraints moderate expansion, emphasizing the need for streamlined harmonization to alleviate developmental bottlenecks.

Opportunities

Advancements in hypochlorous acid-based formulations is creating growth opportunities

Hypochlorous acid (HOCl) sprays represent a paradigm shift in antimicrobial wound care, leveraging endogenous antimicrobial properties for broad-spectrum efficacy without promoting resistance. As of September 2024, at least eight branded aqueous HOCl formulations have been cleared by the U.S. Food and Drug Administration for topical use in wound management. This milestone facilitates integration into hospital formularies, addressing gaps in traditional antiseptics prone to cytotoxicity.

Stability enhancements through pH optimization enable longer shelf lives, supporting decentralized applications in ambulatory settings. Compatibility with bioactive dressings unlocks hybrid therapies, promoting biofilm disruption and tissue regeneration. Global health organizations endorse HOCl for its role in low-resource environments, where spray formats simplify administration.

Scalable production from electrolytic generation reduces manufacturing costs, enhancing affordability for emerging markets. Clinical validations demonstrate accelerated healing rates, informing reimbursement pathways for advanced wound products. Partnerships between device manufacturers and pharmaceutical entities accelerate multiplex formulations incorporating analgesics. In summary, these developments herald expansive therapeutic horizons, fostering equitable access to innovative dermal solutions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic momentum energizes the dermal sprays market as rising healthcare spending and expanding wound-care awareness push hospitals and home-care providers to embrace advanced spray-on films, antiseptics, and regenerative formulas for faster healing. Manufacturers swiftly roll out next-generation silicone-based and bioactive sprays, riding the strong tailwind from aging populations and the global shift toward minimally invasive treatments.

Persistent inflation and softer growth, however, drive up propellant and polymer costs, forcing clinics and distributors to tighten inventories and delay new product rollouts in price-sensitive regions. Geopolitical friction, especially U.S.-China trade disputes and raw-material export curbs, repeatedly disrupts supplies of pharmaceutical-grade aerosols and specialty nozzles, triggering shortages and unpredictable pricing for international formulators.

Current U.S. tariffs impose steep duties on imported dermal spray devices and active ingredients, lifting procurement costs for American healthcare networks and squeezing margins across the supply chain. These duties also invite retaliatory barriers abroad that slow U.S. exports of premium formulations and hinder cross-border clinical studies. Yet the pressure accelerates investment in domestic aerosol production, regional partnerships, and breakthrough local technologies, creating a more secure ecosystem that will fuel innovation and sustained market leadership for years to come.

Latest Trends

FDA approval of RECELL GO mini spray-on skin system is a recent trend

In December 2024, the U.S. Food and Drug Administration approved AVITA Medical’s RECELL GO mini, a compact iteration of the RECELL Spray-On Skin technology designed for smaller wound sites. This authorization expands access to autologous cell therapy, enabling point-of-care preparation and application of sprayable skin suspensions from a patient’s own tissue. The system addresses limitations in traditional grafting by requiring minimal donor skin, reducing procedural invasiveness for burns and chronic ulcers.

Integration of automated processing streamlines workflows, achieving results in under 30 minutes per treatment. This trend aligns with regenerative medicine emphases, prioritizing minimally manipulated biologics for accelerated epithelialization. Early adoptions in surgical suites highlight its versatility for partial-thickness defects up to 80 square centimeters. Regulatory endorsements validate safety profiles from pivotal trials, minimizing immunogenicity risks.

Companion training modules ensure proficiency among diverse clinicians, broadening implementation. The approval catalyzes extensions to pediatric and outpatient indications, reflecting post-pandemic recovery in elective procedures. This 2024 innovation exemplifies a maturation in spray-delivered cellular therapies, redefining standards for dermal restoration.

Regional Analysis

North America is leading the Dermal Sprays Market

North America accounted for 40.7% of the overall market in 2024, and the region recorded strong growth as consumers increasingly adopted dermal sprays for wound healing, skin hydration, pain relief, and dermatological conditions. Rising prevalence of chronic wounds, such as diabetic ulcers and pressure injuries, encouraged hospitals and outpatient centers to expand usage of spray-based antiseptics and barrier-forming formulations.

The high incidence of atopic dermatitis and contact allergies also supported demand for gentle, non-touch therapeutic delivery systems. Convenience-focused skin-care trends further accelerated retail adoption of moisturizing and medicated sprays. The Centers for Disease Control and Prevention reported 37.3 million Americans living with diabetes in 2022, a population at heightened risk for chronic wounds, thereby increasing clinical reliance on spray-based wound-care solutions. Product innovation in aerosol and pump technologies strengthened the regional market throughout 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to experience strong growth during the forecast period as expanding healthcare access and rising consumer awareness drive demand for convenient, hygienic skin-treatment formats. Hospitals and clinics increasingly utilize spray-based products for wound management due to reduced contamination risk and faster application in high-volume care settings.

Growth in cosmetic dermatology and personal-care spending across China, Japan, India, and Southeast Asia fuels adoption of hydration, soothing, and antiseptic sprays. The World Health Organization reported that over 90 million people in China were living with diabetes in 2023, underscoring the growing need for advanced wound-care and skin-protection solutions.

E-commerce penetration enhances product availability, while manufacturers expand local production to meet rising regional demand. These factors collectively position Asia Pacific for accelerated market expansion over the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading companies in dermal spray therapeutics advance growth by developing formulations that enhance wound healing, manage inflammation, and deliver precise topical dosing across chronic wounds, burns, and dermatologic conditions. They broaden market access by building strong distribution channels with hospitals, outpatient wound-care centers, and dermatology clinics while tailoring product lines for both professional and over-the-counter use.

R&D teams focus on bioactive ingredients, barrier-forming polymers, and antimicrobial additives that improve clinical outcomes and reduce dressing frequency. Commercial groups strengthen customer retention by offering education programs, clinical evidence packages, and reimbursement support that help providers integrate sprays into established treatment pathways.

Strategy teams expand presence in emerging markets through localized manufacturing and regulatory alignment to respond to rising dermatologic-care demand. Mölnlycke Health Care illustrates this approach through its global wound-management portfolio, advanced product-development capabilities, and strong clinical partnerships, positioning the company as a trusted provider of innovative dermal spray solutions.

Top Key Players

- 3M Health Care

- Smith & Nephew

- ConvaTec Group

- Mölnlycke Health Care

- Medline Industries

- Johnson & Johnson (Ethicon)

- Laboratoires Urgo

- Paul Hartmann AG

Recent Developments

- In September 2024, Mankind Pharma entered the topical pain relief category with the release of Nimulid Strong, a formulation containing twice the concentration of diclofenac. Available in both gel and spray forms, the launch reflects growing interest in spray-based delivery systems that offer cleaner, easier application for high-strength topical medications.

- On November 24, 2025, ConvaTec introduced an updated version of its Sensi-Care Sting-Free Skin Barrier Spray. Designed for fast and gentle application around ostomy sites and peri-wound areas, the product emphasizes non-stinging ingredients to improve user comfort and encourage regular use.

- In May 2025, Cardinal Health announced that its Outcomes™ division would merge with Transaction Data Systems. The goal of the merger is to strengthen patient engagement and expand clinical pharmacy services by creating deeper connections between pharmacies, payers, and pharmaceutical partners across its nationwide network.

Report Scope

Report Features Description Market Value (2024) US$ 1.4 Billion Forecast Revenue (2034) US$ 3.0 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Skin Cleansers, Surgical Scrubs, Skin Conditioners, Haircare Sprays and Others), By Distribution Channel (Retail Pharmacies, Specialty Clinics, Online Pharmacies, Hospital Pharmacies and Cosmetic Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3M Health Care, Smith & Nephew, ConvaTec Group, Mölnlycke Health Care, Medline Industries, Johnson & Johnson (Ethicon), Laboratoires Urgo, Paul Hartmann AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M Health Care

- Smith & Nephew

- ConvaTec Group

- Mölnlycke Health Care

- Medline Industries

- Johnson & Johnson (Ethicon)

- Laboratoires Urgo

- Paul Hartmann AG