Global Department Stores Market By Type (Hardline and Softline, Apparel and Accessories, FMCG), By Size (Large, Small), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 60997

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

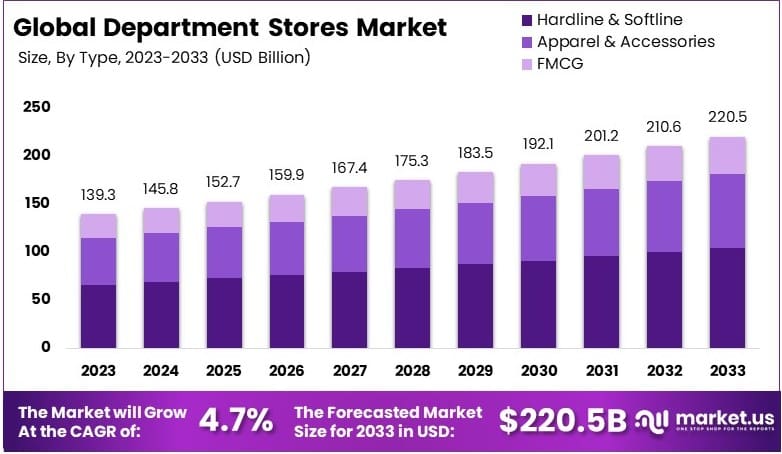

The Global Department Stores Market size is expected to be worth around USD 220.5 Billion by 2033, from USD 139.3 Billion in 2023, growing at a CAGR of 4.7% during the forecast period from 2024 to 2033.

Department stores are large retail establishments offering a wide variety of products under one roof. They typically sell clothing, household items, cosmetics, and more. These stores provide a one-stop shopping experience, attracting consumers looking for convenience and variety. Department stores often feature multiple brands, catering to different customer preferences.

The department stores market consists of retail chains that operate large-scale stores, targeting various consumer needs. This market serves urban and suburban areas, adapting to changes in consumer behavior and economic conditions. As e-commerce grows, traditional department stores innovate to enhance in-store experiences and retain customer loyalty.

Investments and expansions continue to shape this market. For example, Dollar General and Dollar Tree plan to open over 1,300 new stores in 2024, reflecting growth in the discount segment. This strategic expansion addresses increasing demand for affordable products, boosting competition within the department store sector.

Consumer spending significantly influences department store sales. In the U.S., personal consumption expenditures (PCE) rose by 0.5% in September 2024, following a 0.3% gain in August, according to the Bureau of Economic Analysis. This growth surpassed expectations and indicates strong consumer activity, benefiting retail markets, including department stores.

Market saturation and competition impact this sector, pushing stores to offer unique experiences and exclusive products. Many retailers invest in partnerships to differentiate themselves. As consumer preferences shift, department stores focus on value-driven strategies to maintain relevance in an increasingly competitive landscape.

Government policies and economic conditions play a role as well. Changes in consumer income and spending habits directly affect department store performance. By adapting to market trends and exploring new business models, department stores continue to evolve within the dynamic retail industry.

Key Takeaways

- The Department Stores Market was valued at USD 139.3 Billion in 2023 and is projected to reach USD 220.5 Billion by 2033, with a CAGR of 4.7%.

- In 2023, Hardline and Softline dominate the type segment with 47.5%, covering a range of consumer goods.

- In 2023, Apparel and Accessories is the fastest-growing type, reflecting evolving fashion trends.

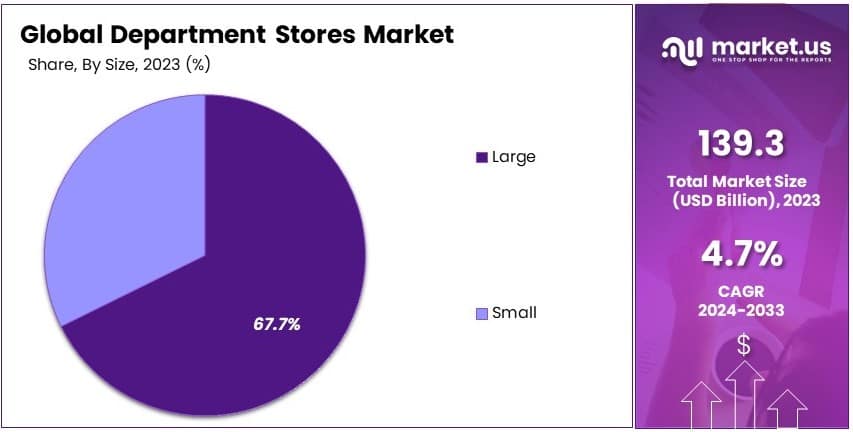

- In 2023, Large stores lead with 67.7%, indicating consumer preference for expansive shopping options.

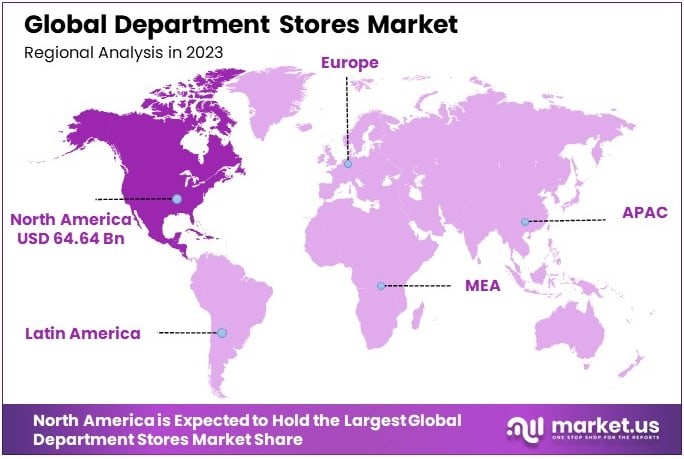

- In 2023, North America leads with 46.4%, driven by established retail infrastructures.

Type Analysis

Hardline and Softline dominate with 47.5% due to diverse product offerings and consumer demand.

The leading sub-segment, hardline and softline, commands a 47.5% market share, driven by a broad range of product offerings that attract a wide consumer base. This segment includes items such as electronics, appliances, furniture, and home decor products, which are essential for everyday use and attract steady consumer spending.

Apparel and accessories, though not the largest segment, are the fastest-growing within the department store market. This growth is fueled by the constant demand for new fashion trends and the personal nature of clothing purchases, which often require physical fitting.

FMCG products, including food, beverages, and other consumables, are crucial for driving foot traffic to stores, thereby supporting sales across other segments. The continuous need for these everyday items ensures their steady contribution to the overall market growth.

Size Analysis

Large department stores lead with 67.7% due to comprehensive service offerings and strategic locations.

Department stores are further segmented by size into large and small establishments. Large department stores hold a dominant market share of 67.7%, benefiting from their ability to offer a wide variety of products under one roof and their strategic location in urban centers or shopping malls. These stores attract a significant volume of customers due to their convenience, variety, and the shopping experience they offer.

On the other hand, small department stores, while smaller in market share, are growing at a compound annual growth rate (CAGR) of 5.3%. These stores often serve niche markets or local communities, offering specialized selections that cater to specific consumer needs.

Their personalized customer service and unique product assortments are crucial for their growth, particularly in areas underserved by larger players. This segment’s growth is essential for maintaining diversity within the department stores market and meeting the localized demands of various demographics.

Key Market Segments

By Type

- Hardline and Softline

- Apparel and Accessories

- FMCG

By Size

- Large

- Small

Drivers

Increased Consumer Spending and Omnichannel Shopping Drives Market Growth

The growth of the Department Stores Market is supported by factors such as increased consumer spending, expansion of product categories, the rise of omnichannel shopping experiences, and enhancements to in-store ambience.

Rising consumer purchasing power, driven by economic growth, has boosted the demand for diverse retail options. Department stores have responded by expanding their product categories, offering everything from clothing to electronics, making them a convenient choice for consumers.

The shift towards omnichannel shopping experiences, integrating online and in-store platforms, has also been instrumental. This seamless approach allows customers to browse online and purchase in-store, creating a versatile shopping journey.

Additionally, department stores have invested in enhancing the in-store experience with improved layouts and customer service, encouraging longer visits and repeat customers.

Restraints

Competition from Online Retailers and Changing Preferences Restrain Market Growth

The Department Stores Market faces restraints from strong online retail competition, high operating costs, shifting consumer preferences toward specialty stores, and declining foot traffic in certain locations.

The rise of e-commerce has posed a significant challenge, offering convenience and competitive pricing that some department stores struggle to match.

High operating costs, including rent and maintenance, further pressure profitability, especially as foot traffic declines in specific areas. Changing consumer preferences have also impacted department stores, with many shoppers favoring specialized stores that offer focused product assortments.

Opportunity

E-Commerce Integration and Analytics Provide Opportunities

Significant growth opportunities in the Department Stores Market come from integrating e-commerce platforms, leveraging advanced analytics, expanding into emerging markets, and forming strategic partnerships. By integrating with e-commerce, department stores can reach a broader audience and offer a convenient online shopping option.

Advanced analytics allows these stores to personalize marketing efforts, enhancing the customer experience through tailored recommendations.

Emerging markets represent untapped potential, as rising income levels create new demand for retail. Strategic partnerships and brand collaborations further enhance market positioning, bringing exclusive products and strengthening brand appeal.

Challenges

Rapid Evolution in Consumer Expectations Challenges Market Growth

Challenges in the Department Stores Market include rapidly changing consumer expectations, the need for digital transformation, supply chain disruptions, and competitive pricing pressures. Consumer expectations evolve quickly, driven by digital advancements and convenience offered by other retail channels.

To meet these demands, department stores must adopt digital solutions, including mobile apps and in-store technology, to improve customer engagement. Supply chain disruptions have also posed logistical challenges, particularly in meeting inventory demands, affecting customer satisfaction.

Additionally, pricing competition from online and specialty retailers forces department stores to balance affordability with quality. Addressing these challenges is crucial to staying competitive and maintaining market relevance.

Growth Factors

Middle-Class Growth and Brand Awareness Are Growth Factors

The Department Stores Market benefits from growth factors such as an expanding middle-class population, increased disposable income, heightened brand awareness, and demand for one-stop shopping destinations. The rise of a middle-class demographic, especially in emerging economies, creates demand for accessible retail.

Increasing disposable incomes allow consumers to spend more on branded goods, further strengthening department store sales. Brand awareness initiatives help in attracting a wider customer base, especially as consumers seek recognized names.

Department stores, known for offering diverse product categories under one roof, cater to consumers’ need for a one-stop shopping experience, which remains a core advantage. These growth factors reinforce the position of department stores as key retail players.

Emerging Trends

Demand for Ethical Products and Experiential Shopping Are Latest Trending Factors

Trending factors impacting the Department Stores Market include demand for sustainable products, experiential shopping, growth in private label offerings, and augmented reality (AR) use in retail. Consumers are increasingly interested in sustainable and ethical options, prompting department stores to offer eco-friendly products.

Experiential shopping, such as in-store events and interactive displays, enhances customer engagement, setting department stores apart from purely online options. Growth in private label products offers competitive pricing and brand loyalty, contributing to profit margins.

AR applications are also trending, allowing customers to visualize products, which enriches the shopping experience. These trends reflect the changing retail landscape, emphasizing unique experiences and ethical shopping practices.

Regional Analysis

North America Dominates with 46.4% Market Share

North America leads the Department Stores Market with a 46.4% share, amounting to USD 64.64 billion. This dominance is driven by well-established retail chains, high consumer spending, and a strong focus on customer experience. The U.S. is the largest contributor, with Canada also showing steady demand.

The region benefits from a mature retail landscape, wide product variety, and strategic digital integration by major department stores. Additionally, frequent promotional events and loyalty programs enhance customer engagement and drive sales. The shift towards omnichannel retailing, combining in-store and online experiences, further supports market performance.

North America’s influence in the department stores market is expected to remain strong. Future growth will be driven by digital transformation, expanding e-commerce platforms, and personalized shopping experiences.

Regional Mentions:

- Europe: Europe maintains steady growth, supported by a focus on luxury goods and established department store brands. Digital innovation and sustainable product offerings boost market performance.

- Asia Pacific: Asia Pacific shows rapid growth, driven by rising urbanization, increasing disposable incomes, and expanding middle-class populations, particularly in China, Japan, and India.

- Middle East & Africa: The region experiences moderate growth, supported by high-end retail developments in major cities and growing interest in luxury brands.

- Latin America: Latin America shows potential, driven by rising consumer spending and expanding retail infrastructure, especially in Brazil and Mexico, where department stores are popular shopping destinations.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The department stores market is competitive, driven by evolving consumer preferences, e-commerce integration, and a wide product range. The top four players in this market are Walmart Inc., Macy’s Inc., Target Corporation, and Nordstrom Inc. These companies maintain strong positions through extensive store networks, diverse product offerings, and digital transformation.

Walmart Inc. is a global leader, offering a wide range of products, including apparel, electronics, and groceries. It has a strong online presence, making shopping convenient for customers. Walmart’s focus on low pricing and extensive distribution supports its dominance.

Macy’s Inc. is known for its wide range of fashion, beauty, and home products. It targets mid-to-high-income consumers, emphasizing brand partnerships and exclusive collections to attract shoppers. Macy’s has enhanced its digital offerings to support in-store and online sales.

Target Corporation offers a mix of affordable fashion, home goods, and groceries. It focuses on a seamless shopping experience, integrating online and in-store services, including curbside pickup and same-day delivery, strengthening its customer base.

Nordstrom Inc. is a premium department store chain known for quality apparel, accessories, and customer service. Its strong e-commerce strategy, combined with in-store services like personal shopping and alterations, enhances its market position.

These companies drive growth by adapting to digital trends, expanding product lines, and improving customer experience, making them leaders in the department stores market.

Top Key Players in the Market

- Marks and Spencer Group Plc.

- Macy’s Inc.

- Sears Holdings Corp.

- Target Corporation

- Nordstrom Inc.

- Walmart Inc.

- Isetan Mitsukoshi Holdings Ltd.

- Kohl’s Corporation

- Chongqing Department Store Co. Ltd

- Lotte Department Store

- Other Key Players

Recent Developments

- Country Road Group: On November 4, 2024, Country Road Group implemented a centralized work management platform via monday.com to streamline store planning for its five retail brands. This system replaces traditional spreadsheet and meeting-based planning, improving coordination for new store openings, refurbishments, and department store concessions.

- Von Maur Department Stores: In May 2024, Von Maur announced a $100 million, five-year renovation plan to update interiors across its 32 stores, emphasizing white and cream tones, warm woods, and modern lighting. This initiative seeks to enhance the in-store experience and includes plans to expand into new markets such as Pittsburgh and Fargo.

- Smith & Caughey’s: On November 1, 2024, Smith & Caughey’s, a historic department store in Auckland, unveiled its final Christmas window display, concluding a longstanding holiday tradition. This shift reflects evolving retail strategies focused on modern customer engagement methods.

Report Scope

Report Features Description Market Value (2023) USD 139.3 Billion Forecast Revenue (2033) USD 220.5 Billion CAGR (2024-2033) 4.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hardline and Softline, Apparel and Accessories, FMCG), By Size (Large, Small) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Marks and Spencer Group Plc., Macy’s Inc., Sears Holdings Corp., Target Corporation, Nordstrom Inc., Walmart Inc., Isetan Mitsukoshi Holdings Ltd., Kohl’s Corporation, Chongqing Department Store Co. Ltd, Lotte Department Store, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Marks and Spencer Group Plc.

- Macy's Inc.

- Sears Holdings Corp.

- Target Corporation

- Nordstrom Inc.

- Walmart Inc.

- Isetan Mitsukoshi Holdings Ltd.

- Kohl's Corporation

- Chongqing Department Store Co. Ltd

- Lotte Department Store

- Other Key Players