Global DeNOx Catalyst Market by Type (Honeycomb & Flat), By Application (Power Plant, Cement Plant, Steel Plant & Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 17112

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

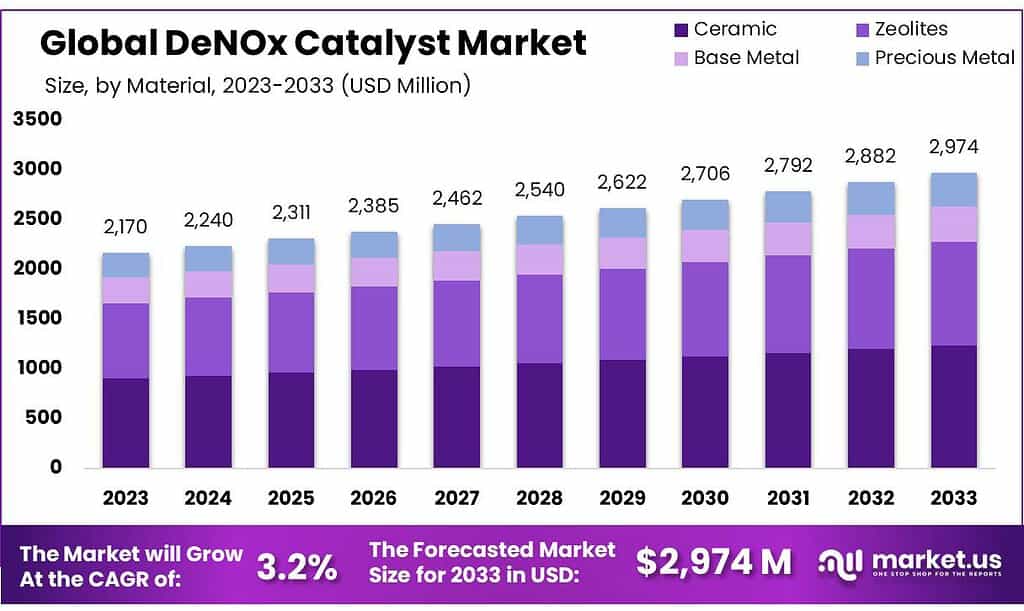

The DeNOx Catalyst Market size is expected to be worth around USD 2974 Million by 2033, from USD 2170 Million in 2023, growing at a CAGR of 3.2% during the forecast period from 2023 to 2033.

The DeNOx Catalyst Market is a specialized segment of the environmental solutions and industrial catalyst industries. It focuses on the development, manufacturing, and distribution of DeNOx (Denitrification) catalysts, which are used to reduce nitrogen oxide (NOx) emissions from various sources, particularly in industrial processes and vehicular exhaust.

DeNOx Catalyst Market is an essential component of the broader effort to reduce environmental pollution from industrial and automotive sources. It encompasses the scientific development, commercial production, and application of catalysts specifically designed to reduce NOx emissions, addressing critical environmental concerns while supporting industrial and vehicular emissions standards.

Key Takeaways

- Market Growth: DeNOx Catalyst Market is expected to grow at a CAGR of 3.2%, reaching USD 2974 million by 2033 from USD 2170 million in 2023.

- Ceramic Dominance: Ceramic materials accounted for 41.2% of the market in 2023, preferred for their NOx reduction capabilities.

- Honeycomb Effectiveness: Honeycomb-type catalysts held 53.1% market share in 2023, known for efficient NOx reduction.

- Power Plant Leadership: Power plants led with a 41.4% market share in 2023, emphasizing NOx emission control.

- Drivers of Growth: Environmental awareness, strict regulations, and technology advancements drive market expansion.

- Cost Constraints: High implementation costs pose challenges for some industries considering DeNOx catalysts.

- Sustainability Opportunities: Environmental concerns create growth opportunities for cleaner air technologies.

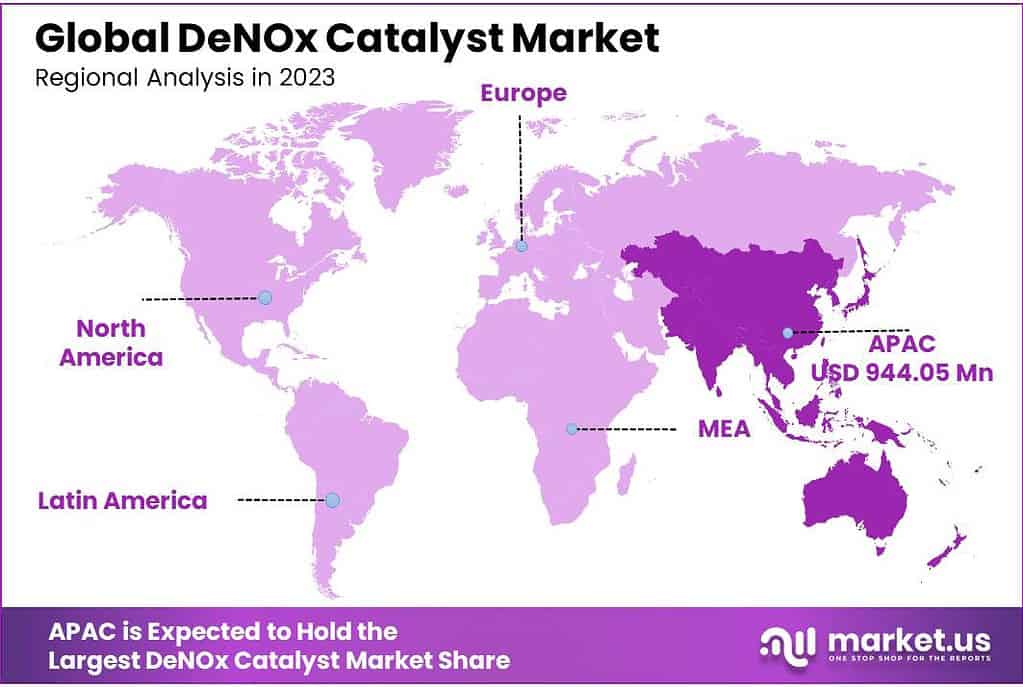

- Regional Dominance: Asia-Pacific dominated with 43.2% of global revenue in 2022; North America grew at 8.2% CAGR.

By Material

In 2023, Ceramic materials took a big share, more than 41.2%, in the DeNOx Catalyst Market. This means a lot of industries prefer DeNOx catalysts made of Ceramic. They like Ceramic catalysts because they work well in reducing harmful nitrogen oxide (NOx) emissions.

These catalysts made of Ceramic are strong and can handle high

h temperatures, making them a good choice for different industries where controlling emissions is very important. Knowing that Ceramic materials are widely used in the DeNOx Catalyst Market is crucial for companies and those using these catalysts.

It helps them choose the right catalysts for reducing emissions and meeting specific operational needs. As industries focus more on being environmentally friendly and following regulations, Ceramic-based DeNOx catalysts play a crucial role in making industrial processes cleaner and more sustainable. As the market changes, industry players need to stay informed about the various catalyst materials.

This knowledge helps them adapt to new trends, technological improvements, and regulatory updates, ensuring they lead in providing effective and environmentally friendly solutions for controlling emissions.

By Type

The market for Honeycomb-type DeNOx catalysts was significant in 2023, capturing more than half of the market share at 53.1%. This dominance highlights the effectiveness of Honeycomb-type catalysts in reducing nitrogen oxide (NOx) emissions. The honeycomb structure of these catalysts provides efficiency and a large surface area, facilitating optimal interaction between exhaust gases and the catalyst material, resulting in efficient NOx reduction.

Understanding the prevalence of Honeycomb-type catalysts is essential for both manufacturers and end-users. This knowledge guides decision-making processes, helping select catalysts that suit specific emission reduction requirements and operational conditions.

Given the increasing emphasis on environmental sustainability and stringent emission standards in various industries, Honeycomb-type DeNOx catalysts play a crucial role in promoting cleaner and more sustainable industrial processes. As the market dynamics continue to evolve, staying informed about trends, technological advancements, and regulatory changes related to different catalyst types is imperative.

This awareness empowers industry stakeholders to navigate emerging challenges and seize opportunities, ensuring they stay ahead in providing efficient and eco-friendly solutions for emissions control.

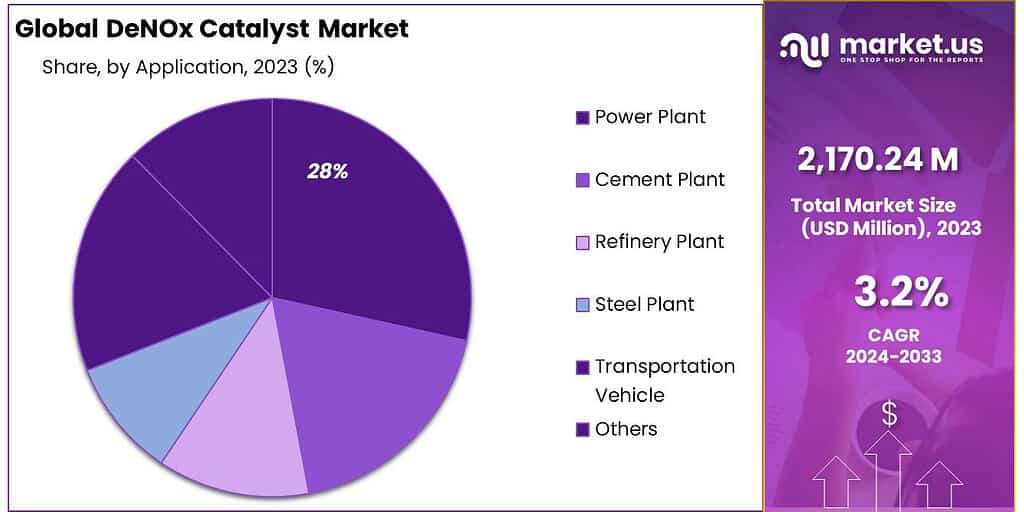

By Application

In 2023, the Power Plant segment dominated the DeNOx Catalyst market, securing a substantial market share of 41.4%. This shows that power plants were the primary users of DeNOx catalysts, highlighting the crucial role these catalysts play in decreasing nitrogen oxide (NOx) emissions from power generation processes. The strict emission standards applied to the power generation sector and the dedication to environmental sustainability led to the extensive use of DeNOx catalysts in power plants.

Cement plants were also an important part of the market, showing that the industry recognized the need for controlling emissions. Making cement is linked to producing significant amounts of nitrogen oxides (NOx), and using DeNOx catalysts in cement plants plays a vital role in addressing environmental concerns and meeting regulatory standards.

The Refinery Plant, Steel Plant, and Transportation Vehicle segments demonstrated the varied uses of DeNOx catalysts in different industries. Refinery plants and steel plants, both known for emitting pollutants, were actively seeking solutions to reduce their environmental impact. Vehicles, such as cars and other mobile sources, also contributed to the demand for DeNOx catalysts as part of efforts to cut down emissions and comply with environmental regulations.

Understanding the dominance of each application segment provides valuable insights for industry stakeholders. It guides investment decisions, influences product development strategies, and reflects the versatile applications of DeNOx catalysts in various industrial settings. As the market evolves, staying informed about these dynamics is crucial for adapting to emerging trends and maintaining competitiveness in the DeNOx Catalyst market.

Key Market Segmentation

By Material

- Ceramic

- Zeolites

- Base Metal

- Precious Metal

By Type

- Honeycomb Type

- Flat Type

By Application

- Power Plant

- Cement Plant

- Refinery Plant

- Steel Plant

- Transportation Vehicle

- Others

Drivers

In recent years, the DeNOx Catalyst Market has seen significant growth due to important reasons. One major reason is the increasing awareness and commitment to protecting the environment. Governments and industries recognize the harmful effects of nitrogen oxides (NOx) emissions on air quality and public health. This recognition has led to a higher demand for effective emissions control technologies, including DeNOx catalysts.

Strict regulatory standards and emission norms, especially for industries like power plants, cement plants, and refineries, have also contributed to the widespread use of DeNOx catalysts. Industries find themselves obliged to invest in technologies that reduce emissions to meet these standards and lessen the environmental impact of their operations. This commitment to environmental responsibility is a crucial driver of growth in the DeNOx Catalyst Market.

Progress in catalyst technology and ongoing research and development efforts have resulted in the innovation of more efficient and cost-effective DeNOx catalysts. This continuous improvement in catalyst performance has increased their use across various applications and industries.

The growing emphasis on environmental sustainability, regulatory requirements, and advancements in catalyst technology collectively contribute to the expansion of the DeNOx Catalyst Market. Companies that align their strategies with these driving factors are well-placed to take advantage of the growing market opportunities.

Restraints

In recent years, the DeNOx Catalyst Market has grown significantly due to various factors. One major factor is the increased awareness and commitment to protecting the environment. Governments and industries understand the harmful effects of nitrogen oxides (NOx) emissions on air quality and public health.

This recognition has led to a higher demand for effective technologies to control emissions, and DeNOx catalysts have become essential in addressing this environmental concern. Strict regulatory standards and emission norms imposed on industries, especially power plants, cement plants, and refineries, have driven the adoption of DeNOx catalysts.

Industries feel the need to invest in technologies that reduce emissions to comply with these standards and lessen the environmental impact of their operations. The dedication to meeting these standards has played a crucial role in the widespread use of DeNOx catalysts in various applications.

The continuous progress in catalyst technology and ongoing research and development activities have resulted in the innovation of more efficient and cost-effective DeNOx catalysts. This enhancement in catalyst performance has driven their adoption across various applications and industries. The pursuit of more sustainable and technologically advanced solutions aligns with the market’s growth trajectory, creating new opportunities for innovation and market expansion.

Despite the remarkable growth, the DeNOx Catalyst Market faces certain challenges that can impact its path. One significant restraint is the high cost associated with DeNOx catalysts. Implementing these catalysts requires a substantial investment, especially for industries dealing with economic constraints. The initial capital expenditure and ongoing maintenance costs may pose challenges for some businesses, influencing their decision to adopt DeNOx catalysts.

Another restraint is the complexity of the regulatory landscape. As emission standards evolve and become more stringent, industries must continuously adapt and upgrade their emissions control technologies, including DeNOx catalysts. Navigating through complex and frequently changing regulations demands significant efforts, resources, and compliance management.

In conclusion, while the DeNOx Catalyst Market experiences robust growth, challenges such as high costs and regulatory complexity pose restraints that need to be addressed for sustained market development. Companies that find strategic solutions to these challenges are better positioned for success in this evolving market.

Opportunities

In 2023, the DeNOx Catalyst Market showcased promising growth opportunities, especially with the increasing global focus on environmental sustainability. As awareness about climate change and air quality concerns rises, there is a growing demand for efficient emissions control technologies, including DeNOx catalysts.

Companies that invest in technologies contributing to cleaner air and environmental protection are well-positioned to benefit from this trend. Moreover, the growing trend towards green and sustainable initiatives creates an opportunity for innovation in DeNOx catalyst formulations.

Manufacturers focusing on developing catalysts with improved efficiency, reduced environmental impact, and cost-effectiveness stand to gain a competitive edge. Meeting the evolving needs of industries striving for eco-friendly solutions positions companies for success in a market driven by sustainability goals. Additionally, the expansion of industries such as power generation, cement manufacturing, and refineries in developing regions presents a geographical opportunity.

As these industries seek to comply with environmental regulations, the demand for DeNOx catalysts is likely to increase. Companies strategically targeting these emerging markets can capitalize on the rising demand for emissions control technologies, contributing to the overall growth of the DeNOx Catalyst Market.

Regional Analysis

In 2022, the Asia-Pacific region established itself as the preeminent market for DeNOx catalysts, accounting for a remarkable 43.2% share of global revenue. This dominance is attributed to the region’s expansive and varied industrial landscape, particularly in nations like China and India, which constitute significant markets for DeNOx catalysts.

The increasing emphasis on sustainable industrial practices, driven by the need to mitigate environmental impact while accommodating industrial growth, has spurred the adoption of DeNOx catalysts in Asia-Pacific. Meanwhile, North America has emerged as the most rapidly expanding market for DeNOx catalysts, showcasing a Compound Annual Growth Rate (CAGR) of 8.2% during the forecast period.

This impressive growth can be linked to the region’s sophisticated industrial infrastructure and the availability of cutting-edge technologies, which have together enabled the widespread adoption of these advanced emission control solutions.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- India

- Japan

- South Korea

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Key Players Analysis

The DeNOx Catalyst Market, crucial for its role in environmental protection and industrial emissions control, is marked by the presence of several key players. These companies are instrumental in shaping the market through their innovations, production capacities, and strategic initiatives. Here’s an analysis of some of the prominent players in this market

Market Key Players

- Envirotherm GmbH

- Tianhe Environmental Engineering

- Shangdong Gemsky Environmental Technology

- Jiangsu Fengye Tech & Environmental Group

- BASF SE

- Cormetech

- IBIDEN Porzellanfabrick Frauenthal GmbH

- Johnson Matthey Plc

- Haldor Topsoe

- Hitachi Zosen Corp

- Seshin Electronics Co Ltd

- JGC C&C

- CRI Catalyst Company

Recent Developments

2023 Johnson Matthey: Launched a new DeNOx catalyst for stationary engines with improved performance and lifespan.

2023 BASF: Partnered with a Chinese company to develop and manufacture DeNOx catalysts for the automotive industry.

2023 Cormetech: Introduced a novel zeolite-based DeNOx catalyst for power plants with high ammonia conversion efficiency.

Report Scope

Report Features Description Market Value (2023) US$ 2170 Mn Forecast Revenue (2033) US$ 2974 Mn CAGR (2024-2033) 3.2% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material(Ceramic, Zeolites, Base Metal, Precious Metal), By Type(Honeycomb Type, Flat Type), By Application(Power Plant, Cement Plant, Refinery Plant, Steel Plant, Transportation Vehicle, Others) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape Envirotherm GmbH, Tianhe Environmental Engineering, Shangdong Gemsky Environmental Technology, Jiangsu Fengye Tech & Environmental Group, BASF SE, Cormetech, IBIDEN Porzellanfabrick Frauenthal GmbH, Johnson Matthey Plc, Haldor Topsoe, Hitachi Zosen Corp, Seshin Electronics Co Ltd, JGC C&C, CRI Catalyst Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of DeNOx Catalyst Market?DeNOx Catalyst Market size is expected to be worth around USD 2974 Million by 2033, from USD 2170 Million in 2023

What is the CAGR for the DeNOx Catalyst Market?The DeNOx Catalyst Market is registered to grow at a CAGR of 3.2% during 2023-2032.Who are the major players operating in the DeNOx Catalyst Market?Envirotherm GmbH, Tianhe Environmental Engineering, Shangdong Gemsky Environmental Technology, Jiangsu Fengye Tech & Environmental Group, BASF SE, Cormetech, IBIDEN Porzellanfabrick Frauenthal GmbH, Johnson Matthey Plc, Haldor Topsoe, Hitachi Zosen Corp, Seshin Electronics Co Ltd, JGC C&C, CRI Catalyst Company

-

-

- Envirotherm GmbH

- Tianhe Environmental Engineering

- Shangdong Gemsky Environmental Technology

- Jiangsu Fengye Tech & Environmental Group

- BASF SE

- Cormetech

- IBIDEN Porzellanfabrick Frauenthal GmbH

- Johnson Matthey Plc

- Haldor Topsoe

- Hitachi Zosen Corp

- Seshin Electronics Co Ltd

- JGC C&C

- CRI Catalyst Company