Global Decentralized Cloud Storage Market Size, Share, Industry Analysis Report By Type of Storage Technology (Blockchain-based Storage, InterPlanetary File System (IPFS), Distributed File Systems, Hybrid Storage Solutions), By End-user Industry (Healthcare, Finance and Banking, Media and Entertainment, Government and Public Sector, Education, Retail, Other), By Deployment Model (Public Cloud Storage, Private Cloud Storage, Hybrid Cloud Storage), By Storage Capacity (Small Scale (up to 1 TB), Medium Scale (1 TB to 10 TB), Large Scale (Above 10 TB), By Security Protocols (End-to-End Encryption, Redundancy and Backup Solutions, Data Integrity Verification, Access Control Mechanisms, Compliance with Data Protection Regulations, Others) , By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 160062

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- Notable Platforms

- U.S. Market Size

- Type of Storage Technology Analysis

- End-user Industry Analysis

- Deployment Model Analysis

- Storage Capacity Analysis

- Security Protocols Analysis

- Emerging trends

- Growth factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

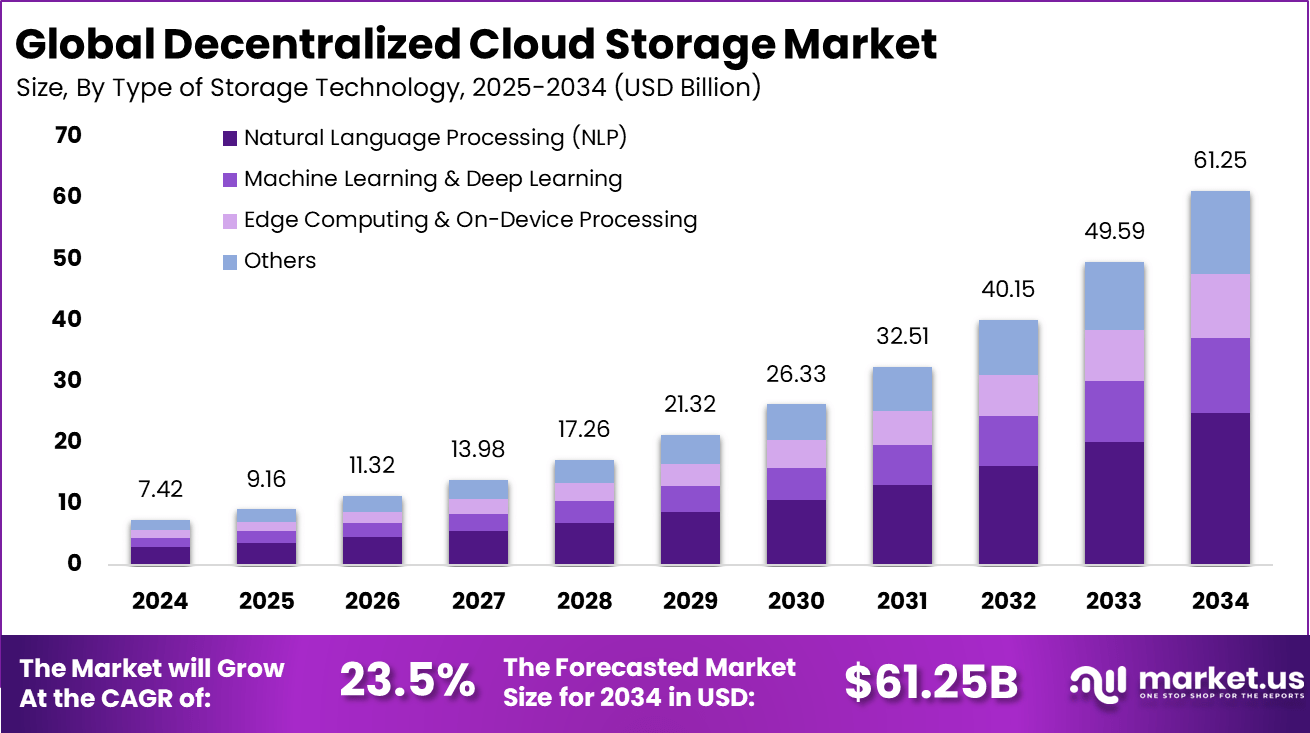

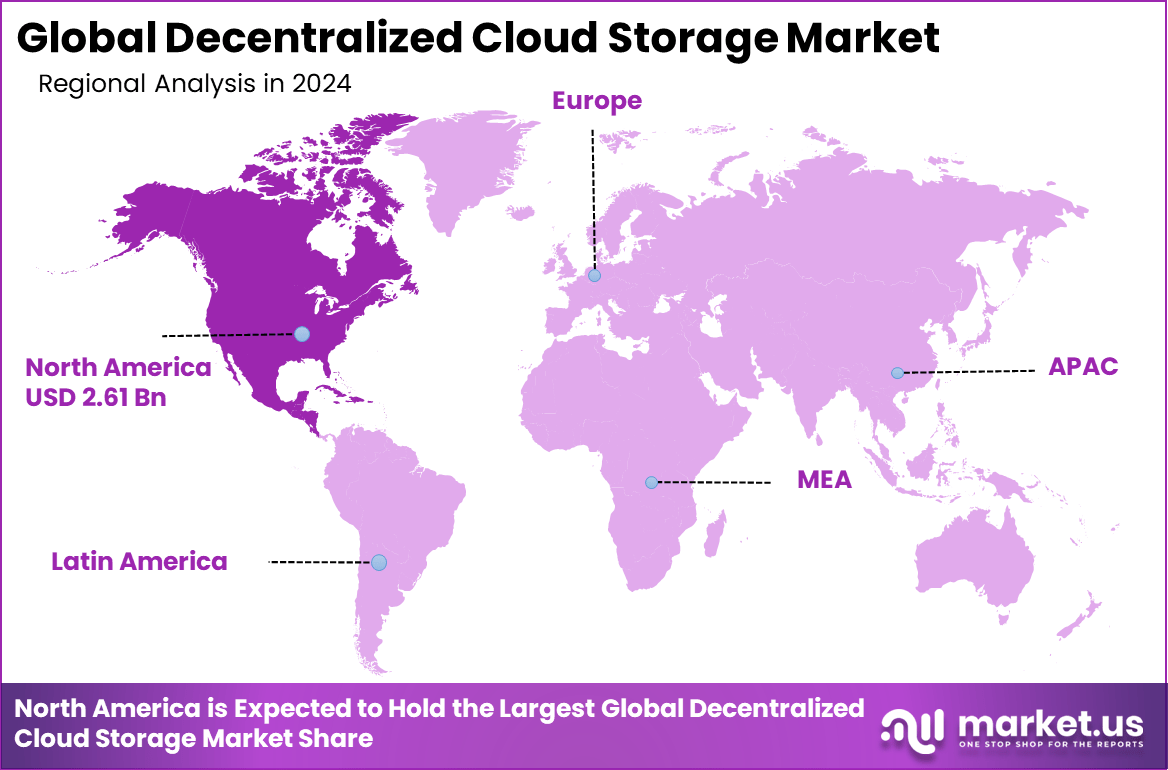

The global Decentralized Cloud Storage market generated USD 7.4 billion in 2024 and is predicted to register growth from USD 9.1 billion in 2025 to about USD 61.2 billion by 2034, recording a CAGR of 23.5% throughout the forecast span. In 2024, North America held a dominant market position, capturing more than a 35.2% share, holding USD 2.61 billion in revenue.

The decentralized cloud storage market involves systems and platforms that distribute data storage across many independent nodes (computers, servers, devices) rather than relying on centralized data centers. Data is typically fragmented, encrypted, and stored redundantly across nodes controlled by different entities. This model is intended to increase fault tolerance, privacy, and trust, because no single party holds full control over user data.

Security and privacy concerns are strong drivers. Many organizations and users worry about data breaches, centralized control, or single point of failure in traditional cloud services. Decentralized storage offers improved resilience, as data is distributed and often encrypted. Rising regulatory pressure, such as data sovereignty and cross-border data regulation, motivates solutions that can provide locality and control.

Demand is growing among organizations dealing with sensitive data (finance, healthcare, government) that require higher assurance of confidentiality, integrity, and availability. Developers building decentralized applications (dApps), NFTs, content platforms, or blockchain systems often require robust decentralized storage backends. Some individuals or small businesses explore decentralized backup solutions to avoid vendor lock-in.

For instance, in July 2025, Akave launched the first decentralized data layer on the Avalanche blockchain with Akave Cloud. This innovative solution aims to offer secure, scalable, and decentralized cloud storage that integrates seamlessly with decentralized applications (dApps).

Key Takeaway

- Blockchain-based storage leads with 40.7%, reflecting its trustless, tamper-proof data management benefits.

- Healthcare industry adoption stands at 32.5%, driven by secure patient data storage and compliance needs.

- Public cloud storage dominates with 42.7%, offering scalability and easy access for enterprises and individuals.

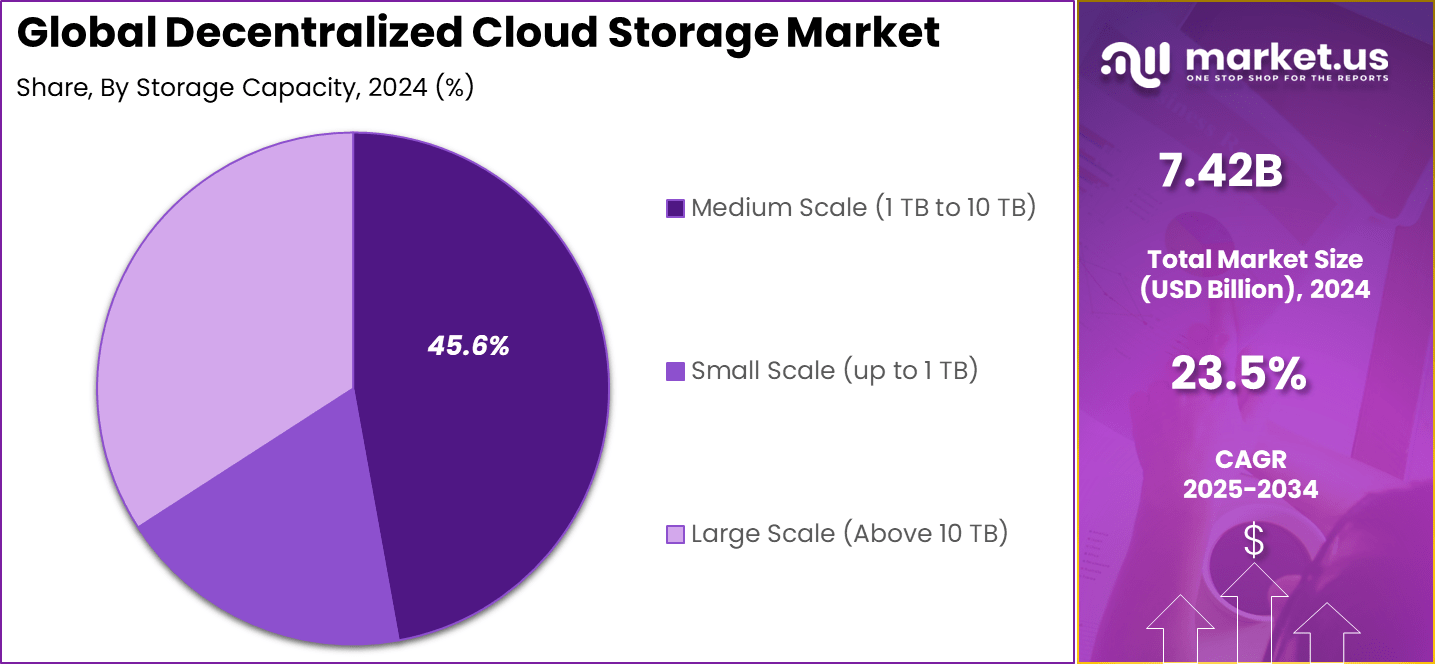

- Medium-scale capacity (1 TB–10 TB) holds 45.6%, showing strong uptake among SMEs and mid-sized deployments.

- End-to-end encryption protocols account for 34.7%, highlighting security as a central factor in adoption.

- North America secures 35.2%, backed by advanced digital infrastructure and strong enterprise use cases.

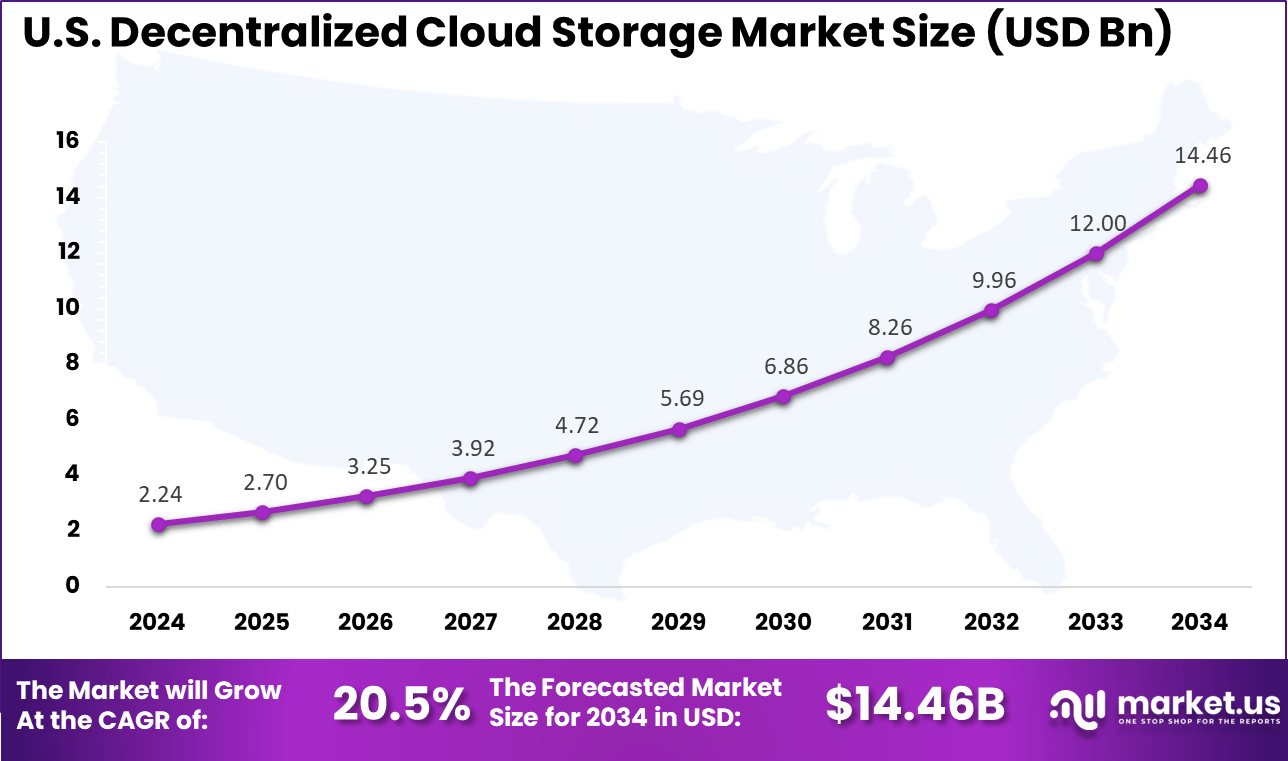

- The US market reached USD 2.24 billion and is expanding at a CAGR of 20.5%, underscoring rapid demand for secure and decentralized data storage solutions.

Role of Generative AI

The role of generative AI in decentralized cloud storage is increasingly prominent as AI models require vast amounts of distributed, reliable, and secure data storage. Decentralized storage offers a scalable solution for storing the large datasets AI models like generative pre-trained transformers need for training.

Some reports show that integrating decentralized networks allows secure, censorship-resistant, and more cost-effective storage for AI workflows by distributing data across many independent nodes rather than relying on centralized data centers.

This approach ensures that AI data remains immutable, accessible, and verifiable, helping to mitigate risks of data breaches and enable more flexible AI model development processes. Studies suggest that decentralized storage networks are foundational for the future of decentralized AI, supporting collaborative AI development while enhancing data privacy and system resilience compared to traditional clouds.

Investment and Business Benefits

Investment opportunities abound in building infrastructure for decentralized cloud platforms and supporting services like data migration and maintenance. The market attracts interest from investors due to its rapid growth fueled by technological innovation and regulatory demand. Opportunities also exist in enhancing interoperability standards and integrating AI-driven management tools.

Sustainable technology investments are possible as decentralized models reduce energy consumption. Additionally, developing compliance-focused storage solutions tailored to regulated sectors can yield competitive advantages. Business benefits of decentralized cloud storage include increased data security, reduction in operational costs, scalability to accommodate expanding data, and support for regulatory compliance.

Enterprises benefit from transparent and flexible pricing models without hidden fees typical in centralized cloud services. Enhanced availability minimizes downtime and risks related to cyberattacks or system failures. The immutability of stored data from blockchain usage adds trustworthiness for audit and legal purposes, crucial in industries like finance and healthcare. These solutions enable enterprises to innovate faster by ensuring reliable access to critical data resources.

Notable Platforms

- Filecoin: Built on IPFS, it is the largest decentralized storage network by capacity. Users trade unused storage for lower cost and better control of data.

- Sia: Uses blockchain contracts for secure storage deals. Can cut costs by up to 90% compared to traditional cloud providers.

- Storj: Distributes encrypted data across global nodes. Known for reliability, developer tools, and costs often 50% lower than centralized services.

- Hivenet: Crowdsources storage from everyday devices. Promotes eco-friendly and cost-efficient usage, appealing to sustainability-focused firms.

- Arcana Network: Offers storage plus a developer-focused Privacy Stack. Combines storage, identity, and access control for Web3 applications.

U.S. Market Size

The market for Decentralized Cloud Storage within the U.S. is growing tremendously and is currently valued at USD 2.24 billion, the market has a projected CAGR of 20.5%. The market is growing tremendously due to rising concerns over data privacy, cybersecurity, and control. With increasing data breaches in traditional cloud systems, businesses and consumers are seeking more secure and transparent alternatives.

Additionally, the U.S. market’s strong technological infrastructure and rapid adoption of blockchain, AI, and IoT are driving demand for scalable and resilient storage solutions. The desire for data sovereignty and the need to comply with strict regulations are further accelerating the growth of decentralized storage.

For instance, in September 2025, Storj continued to strengthen its presence in the decentralized cloud storage market, positioning itself as a major player in the U.S. market. The company reported a 7x increase in revenue year-over-year and emphasized its solutions for AI storage, addressing the bottlenecks in GPU-heavy training workflows.

In 2024, North America held a dominant market position in the Global Decentralized Cloud Storage Market, capturing more than a 35.2% share, holding USD 2.61 billion in revenue. This dominance is due to its advanced technological infrastructure, high adoption of blockchain and cloud-based technologies, and strong focus on data security.

The region’s growing concerns over data privacy and cybersecurity have led both businesses and consumers to seek more secure storage alternatives. Additionally, regulatory frameworks in industries like healthcare and finance are encouraging the shift toward decentralized solutions, further boosting market growth in North America.

For instance, in February 2023, Storj introduced Storj Next, a new version designed to make decentralized storage more appealing, especially to businesses in North America. This upgrade enhances data security through encryption, reduces costs, and improves the platform’s compatibility with existing cloud services.

Type of Storage Technology Analysis

In 2024, Blockchain-based storage leads the decentralized cloud storage market with 40.7% share. Its role is vital because it ensures data immutability, secure record-keeping, and a transparent audit trail. This decentralized approach builds trust among users by eliminating intermediaries and reducing the risk of single-point failures.

The adoption of blockchain-based storage is also growing due to its ability to support smart contracts and decentralized applications. These features make it useful across enterprises that handle sensitive data, from finance to healthcare, where secure, verifiable, and tamper-proof storage is essential.

For Instance, In May 2025, MicroCloud Hologram Inc. introduced a blockchain-based edge storage system to improve data security and circulation. The solution combines decentralized blockchain storage with edge computing for faster processing, making it especially useful for high-speed, security-sensitive sectors such as AI and IoT.

End-user Industry Analysis

In 2024, the Healthcare segment held a dominant market position, capturing a 32.5% share of the Global Decentralized Cloud Storage Market. This dominance is due to the need for enhanced data security, privacy, and compliance with stringent regulations such as HIPAA.

Decentralized storage solutions offer healthcare providers a secure and scalable way to store sensitive patient data while ensuring data integrity and accessibility. Additionally, the growing adoption of telemedicine and digital health tools has further fueled the sector’s reliance on decentralized storage.

For instance, in September 2025, the Sui blockchain made significant strides in decentralized cloud storage for healthcare by partnering with CUDIS, a human longevity protocol. This collaboration focuses on improving patient data management and ownership using blockchain and decentralized storage protocols like Walrus and Seal.

Deployment Model Analysis

In 2024, Public cloud storage represented 42.7% of the share, driven by its affordability and accessibility. Many small and mid-sized enterprises prefer public decentralized cloud models because they do not require heavy infrastructure investments yet offer high availability.

The combination of cost-effectiveness and scalability has made public decentralized storage appealing for industries handling frequent but less sensitive data exchanges. Its growing appeal lies in enabling businesses to scale as needed without worrying about infrastructure overhead.

For Instance, in August 2025, Broadcom’s CEO, Hock Tan, announced at VMware Explore that VMware Cloud Foundation (VCF) 9.0 now outperforms public cloud offerings in security, cost management, and control. This private cloud solution integrates compute, networking, and storage, providing businesses with enhanced infrastructure flexibility.

Storage Capacity Analysis

In 2024, The Medium Scale (1 TB to 10 TB) segment held a dominant market position, capturing a 45.6% share of the Global Decentralized Cloud Storage Market. This dominance is due to the growing demand from small to medium-sized enterprises (SMEs) that require cost-effective, scalable storage solutions.

The 1 TB to 10 TB range offers a perfect balance between affordability and capacity, meeting the needs of businesses handling moderate data volumes while ensuring sufficient space for future growth without excessive overhead costs.

For Instance, in September 2025, Ethereum’s decentralized storage initiatives, such as IPFS and Arweave integrations, support various storage capacities, including the 1 TB to 10 TB range. These solutions are designed to offer decentralized storage options for developers and enterprises, focusing on scalability and data availability.

Security Protocols Analysis

In 2024, End-to-end encryption accounted for 34.7% of the market. Its integration ensures that stored and transferred data is only accessible to authorized users, protecting against interception or misuse. This high standard of data protection has become a key driver of adoption among industries that handle sensitive business or personal information.

The focus on encryption has risen due to increasing global awareness around cyber threats and data privacy. Many enterprises see end-to-end encryption as a baseline requirement for implementing decentralized storage solutions across critical applications.

For Instance, in July 2023, Skiff introduced end-to-end encryption across its platform, offering a privacy-focused alternative to traditional cloud storage services. This includes secure email, cloud storage (Skiff Drive), and document creation (Skiff Pages), all protected by encryption. Skiff also integrates decentralized storage via IPFS, allowing users to store files on a decentralized network while maintaining full control over their data.

Emerging trends

Emerging trends in decentralized cloud storage for 2025 highlight the growth of hybrid and multi-cloud strategies where decentralized storage is integrated alongside traditional cloud options. More than 69% of organizations have adopted hybrid cloud strategies, favoring distributed storage approaches to avoid vendor lock-in and improve resilience and data locality.

The rise of edge computing also boosts demand for decentralized architectures by enabling real-time data processing closer to source devices like IoT systems. Innovation surrounding blockchain, peer-to-peer protocols, and distributed file systems continues to advance, making decentralized storage more transparent, autonomous, and secure.

Growth factors

Growth factors driving decentralized cloud storage include rising concerns over data privacy, security, and the increasing volume of data generated globally. Reports estimate that global daily data generation exceeds 400 million terabytes, creating a strong need for cost-efficient, scalable, and secure storage alternatives.

Decentralized storage addresses data breach risks by encrypting and distributing data across multiple nodes, making systems more resilient against attacks. The adoption of blockchain technology underpins these solutions, ensuring transparency and data integrity while reducing dependency on central providers.

Demand from industries such as BFSI, healthcare, IT, government, and retail is accelerating adoption due to stringent data protection requirements and the need for scalable storage architectures supporting digital transformation efforts.

Key Market Segments

By Type of Storage Technology

- Blockchain-based Storage

- InterPlanetary File System (IPFS)

- Distributed File Systems

- Hybrid Storage Solutions

By End-user Industry

- Healthcare

- Finance and Banking

- Media and Entertainment

- Government and Public Sector

- Education

- Retail

- Other

By Deployment Model

- Public Cloud Storage

- Private Cloud Storage

- Hybrid Cloud Storage

By Storage Capacity

- Small Scale (up to 1 TB)

- Medium Scale (1 TB to 10 TB)

- Large Scale (Above 10 TB)

By Security Protocols

- End-to-End Encryption

- Redundancy and Backup Solutions

- Data Integrity Verification

- Access Control Mechanisms

- Compliance with Data Protection Regulations

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Drivers

Data Privacy and Security Concerns

Decentralized cloud storage significantly enhances privacy and security by distributing data across multiple nodes, making it harder for hackers to access. Unlike traditional centralized models, data isn’t stored in a single location, reducing the risks of large-scale breaches.

Encryption further safeguards data, offering individuals and businesses greater control. This feature appeals especially to those who prioritize privacy and want to ensure sensitive information is less vulnerable to unauthorized access or government surveillance.

For instance, in September 2025, Sia activated a significant v2 hard fork and rebranded its platform, enhancing scalability and security. The Sia Foundation also secured high-profile partnerships and launched developer engagement initiatives, positioning the network for broader adoption and long-term growth.

Restraint

Regulatory and Compliance Concerns

One of the key challenges for decentralized cloud storage is adhering to regulatory and compliance standards, especially in sectors like healthcare and finance. These industries often have strict rules about data storage, protection, and access.

With data scattered across multiple nodes and jurisdictions, ensuring compliance with local and international laws becomes complex. This can create hurdles for decentralized solutions, as meeting regulatory requirements may require additional measures like data localization or specific security protocols.

For instance, in September 2025, Iagon expanded its decentralized cloud storage and computing platform on Cardano, focusing on GDPR compliance and targeting enterprise adoption. This move addresses critical regulatory concerns in industries like healthcare and finance by offering a blockchain-based solution that aligns with strict data protection regulations.

Opportunities

Integration with AI and IoT

As AI and IoT technologies generate vast amounts of data, decentralized cloud storage offers a scalable and resilient solution. These systems can efficiently handle the massive data loads generated by IoT devices, providing flexibility and distributed access.

With the growth of connected devices and intelligent systems, decentralized storage could support real-time processing and secure storage, offering businesses and developers more efficient infrastructure to support their data-intensive applications, making it an exciting opportunity for future integration.

For instance, in July 2025, Walrus and Veea announced a strategic partnership to combine Walrus’ decentralized storage with VeeaHub STAX edge solutions. This collaboration aims to power AI and decentralized applications at the edge, offering a secure, low-latency data environment. The hybrid approach integrates NVMe architecture with decentralized storage, enabling fast, cost-effective, and scalable storage.

Challenges

Market Competition

The decentralized cloud storage market faces intense competition, particularly from established players like AWS and Microsoft Azure. These giants have a vast infrastructure, significant brand trust, and loyal customer bases, making it difficult for newer decentralized solutions to gain market traction.

Smaller decentralized projects may struggle with visibility, resources, and scalability, hindering their ability to compete effectively. Overcoming these barriers and carving out a niche in a market dominated by cloud providers will be one of the key challenges for new entrants.

For instance, In June 2025, StorX Network achieved a key milestone by getting listed on the MEXC Exchange, a leading global centralized exchange. The move supports its goal of expanding Decentralized Physical Infrastructure Networks (DePIN) and advancing decentralized cloud storage. Built on the XDC blockchain, StorX secures data by encrypting and splitting it across multiple nodes, giving users stronger control and protection.

Key Players Analysis

The decentralized cloud storage market is led by blockchain-based platforms such as Sia, Storj, Protocol Labs (Filecoin/IPFS), and MaidSafe. These companies provide distributed storage networks that eliminate centralized control and enhance data privacy through encryption and peer-to-peer architecture.

Well-known Web3 and distributed computing platforms including BitTorrent, Ethereum, Swarm, Arweave, and Akash Network support storage-driven use cases through decentralized infrastructure. BitTorrent and Arweave specialize in long-term, tamper-resistant file storage, while Swarm and Ethereum provide frameworks for dApp-based storage and data hosting.

Emerging players such as Siacoin, Qitchain, Iagon, Ocean Protocol, MaidSafeCoin, Opacity, Intext, and Others are expanding the market with privacy-focused and application-specific solutions. These platforms emphasize secure file sharing, data monetization, Web3 integration, and decentralized data ownership.

Top Key Players in the Market

- Sia

- Company Overview

- Product Portfolio

- Financial Performance

- Recent Developments/Updates

- Strategic Overview

- SWOT Analysis

- Storj

- MaidSafe

- Protocol Labs

- BitTorrent

- Ethereum

- Swarm

- Intext

- Arweave

- Siacoin

- Akash Network

- Qitchain

- Iagon

- Ocean Protocol

- MaidSafeCoin

- Opacity

- Others

Note (*): Similar analysis will be provided for other companies as well.

Recent Developments

- In March 2025, Storj announced a strategic partnership with NodeShift, integrating decentralized storage with compute VMs and GPU instances. This collaboration offers a cost-effective, secure, and scalable alternative to traditional cloud solutions.

- November 2024, BitTorrent: BitTorrent ($BTTC) continues expanding beyond file sharing into decentralized storage and dApps within multiple blockchain ecosystems including TRON, Ethereum, and Binance Smart Chain. Adoption of $BTTC token for network transactions and staking rewards is expected to rise through 2025.

- In June 2024, EthStorage partnered with Taiko, a fully permissionless Ethereum-equivalent rollup, to offer a long-term data availability solution. This collaboration aims to enhance decentralized storage capabilities on Ethereum.

Report Scope

Report Features Description Market Value (2024) USD 7.4 Bn Forecast Revenue (2034) USD 61.2 Bn CAGR(2025-2034) 23.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type of Storage Technology (Blockchain-based Storage, InterPlanetary File System (IPFS), Distributed File Systems, Hybrid Storage Solutions), By End-user Industry (Healthcare, Finance and Banking, Media and Entertainment, Government and Public Sector, Education, Retail, Other), By Deployment Model (Public Cloud Storage, Private Cloud Storage, Hybrid Cloud Storage), By Storage Capacity (Small Scale (up to 1 TB), Medium Scale (1 TB to 10 TB), Large Scale (Above 10 TB), By Security Protocols (End-to-End Encryption, Redundancy and Backup Solutions, Data Integrity Verification, Access Control Mechanisms, Compliance with Data Protection Regulations, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sia, Storj, MaidSafe, Protocol Labs, BitTorrent, Ethereum, Swarm, Intext, Arweave, Siacoin, Akash Network, Qitchain, Iagon, Ocean Protocol, MaidSafeCoin, Opacity, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Decentralized Cloud Storage MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Decentralized Cloud Storage MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sia

- Storj

- MaidSafe

- Protocol Labs

- BitTorrent

- Ethereum

- Swarm

- Intext

- Arweave

- Siacoin

- Akash Network

- Qitchain

- Iagon

- Ocean Protocol

- MaidSafeCoin

- Opacity

- Others