Global DC Surge Arrester Market Size, Share, Growth Analysis By Type (Metal Oxide Varistor, Silicon Carbide (SiC), Hybrid DC Surge Protection Devices, Gas Discharge Tube (GDT), Others), By Application (Solar PV Power Systems, Electric Vehicle (EV) Charging Stations, Telecom DC Power Systems, Industrial DC Power Infrastructure), By End User (Industrial, Commercial, Residential, Utilities), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175461

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

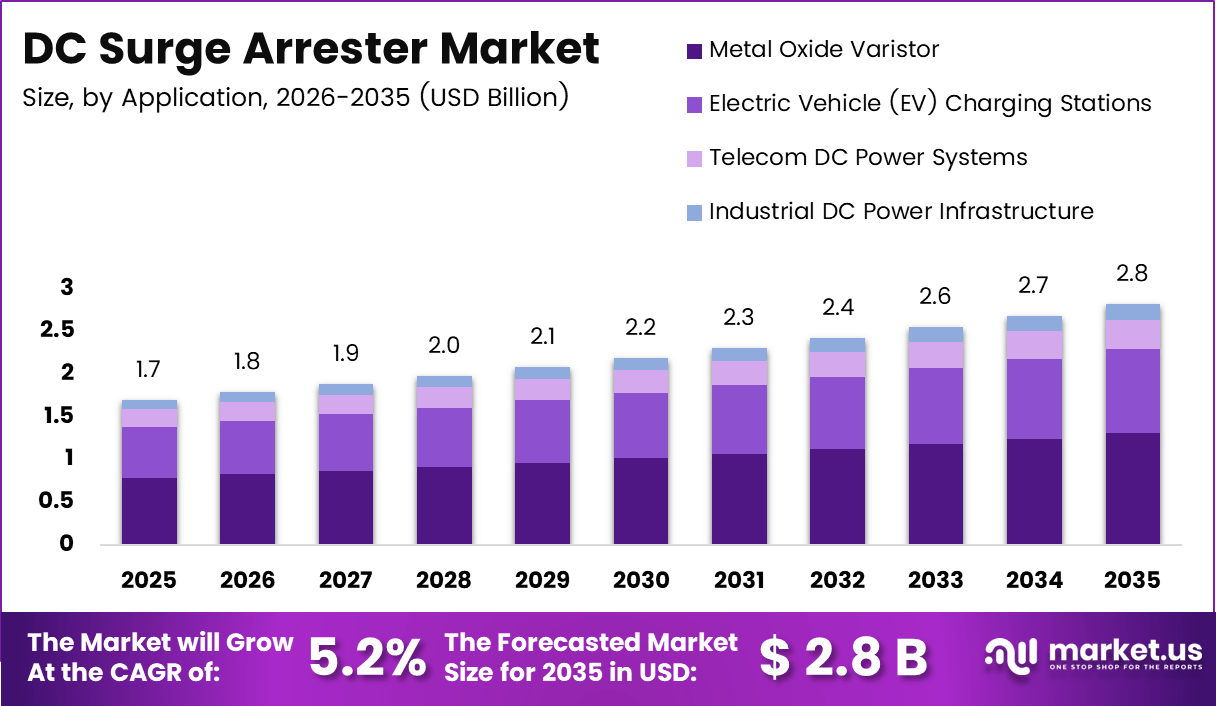

The Global DC Surge Arrester Market size is expected to be worth around USD 2.8 billion by 2035, from USD 1.7 billion in 2025, growing at a CAGR of 5.2% during the forecast period from 2026 to 2035.

The DC Surge Arrester market refers to protective solutions designed to limit transient overvoltages in direct current networks. These devices are increasingly critical as DC power architectures expand across solar photovoltaics, battery energy storage, electric vehicles, and industrial automation systems. Consequently, demand continues rising due to higher asset protection priorities and system reliability expectations.

DC surge arresters play a foundational role in preventing insulation failure, equipment downtime, and fire risks. Moreover, growing deployment of DC microgrids and data-centric infrastructure accelerates adoption across commercial and utility-scale projects. As a result, buyers increasingly prioritize compliance-ready, compact, and application-specific surge protection solutions.

Market growth is strongly supported by renewable energy expansion, especially utility-scale solar and hybrid power plants. Governments continue investing heavily in grid modernization, transmission upgrades, and clean energy integration. Simultaneously, stricter electrical safety regulations encourage mandatory surge protection adoption, thereby improving transactional demand for certified DC surge arrester systems across regions.

Opportunities further emerge from industrial digitization and DC-powered control circuits in manufacturing environments. Additionally, telecom network infrastructure, EV charging stations, and smart transportation systems increasingly rely on DC networks. Therefore, the DC Surge Arrester market benefits from long-term replacement cycles, retrofitting demand, and lifecycle-based procurement strategies.

According to IEC/EN 61643–41, Type 2 DC surge protection devices address low-voltage DC systems efficiently. These devices operate with maximum continuous voltages from 15 VDC to 460 VDC, while handling discharge currents from 2 kA to 40 kA. Such standards strengthen buyer confidence and regulatory alignment.

According to DEHNpatch, advanced Ethernet surge protection supports data rates up to 10 GBit and 4 PPoE, reflecting convergence of power and data protection needs. Additionally, the DEHNgate FF5 integrates 5 channels for digital, analog SAT, and terrestrial antenna systems, enabling compact multi-line DC surge protection deployment.

According to BLITZDUCTOR ML4 BPD 24, protection of two-pair 24 V DC systems with an earthed negative pole supports control circuits, offering a 3 kA discharge capacity. Secondary arresters rated from 1 kV to 36 kV protect transformer low sides below 1000 V. Transformer failure rates range between 0.4% and 1%, with 50 to 70% linked to low-side surges. These arresters operate at 50 Hz or 60 Hz, feature rated discharge currents of 5 kA, 10 kA, and 20 kA, support voltage ratings up to 120 kV, and may include discharge counters above 52 kV.

Key Takeaways

- The Global DC Surge Arrester Market is projected to grow from USD 1.7 billion in 2025 to USD 2.8 billion by 2035, registering a 5.2% CAGR.

- Metal Oxide Varistor dominates the type segment with a market share of 48.3%, driven by fast response time and high energy absorption.

- Solar PV Power Systems lead the application segment, accounting for 46.2% of total market demand in 2025.

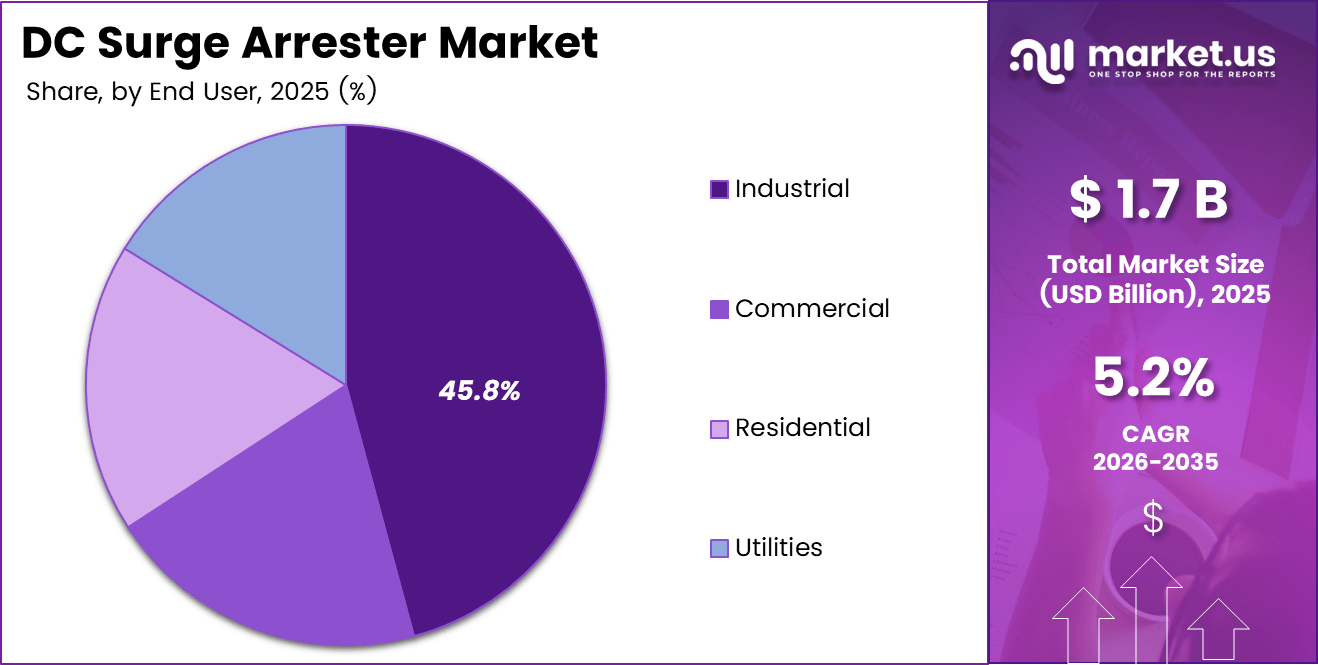

- Industrial end users represent the largest share at 45.8.

Type Analysis

Metal Oxide Varistor dominates with 48.3% due to fast response time and high energy absorption capability.

In 2025, Metal Oxide Varistor held a dominant market position in the By Type Analysis segment of DC Surge Arrester Market, with a 48.3% share. It is widely adopted across renewable and industrial DC systems, as it delivers reliable clamping performance, long service life, and effective protection against transient overvoltage conditions.

Silicon Carbide (SiC) surge arresters continue to be used in legacy DC installations, as they offer proven durability under harsh electrical conditions. However, their comparatively slower response and higher maintenance needs gradually limit adoption, especially when modern DC grids prioritize compact, maintenance-free surge protection solutions.

Hybrid DC Surge Protection Devices are gaining attention as they combine multiple protective elements into a single unit. These solutions improve coordination between components, enabling enhanced surge suppression in complex DC networks such as energy storage and transportation electrification systems.

Gas Discharge Tube (GDT) devices remain relevant for applications requiring high surge current handling. They are often deployed as secondary protection layers, where their ability to manage large transient currents complements faster-response technologies used in sensitive DC equipment.

Others include niche and customized surge protection technologies designed for specialized DC applications. These solutions typically serve project-specific requirements, supporting unique voltage levels or environmental conditions across emerging DC infrastructure deployments.

Application Analysis

Solar PV Power Systems dominates with 46.2% driven by rapid global solar capacity expansion.

In 2025, Solar PV Power Systems held a dominant market position in the By Application Analysis segment of DC Surge Arrester Market, with a 46.2% share. The segment benefits from growing solar installations, where DC surge arresters protect inverters, combiner boxes, and arrays from lightning-induced surges.

Electric Vehicle (EV) Charging Stations increasingly integrate DC surge arresters to ensure equipment safety and charging reliability. As fast-charging infrastructure expands, surge protection becomes critical to prevent downtime, protect power electronics, and support uninterrupted charging operations.

Telecom DC Power Systems rely on DC surge arresters to maintain network uptime and safeguard sensitive communication equipment. These systems require stable DC power protection, especially in outdoor and remote installations exposed to frequent electrical disturbances.

Industrial DC Power Infrastructure adopts surge arresters to protect automation systems, drives, and control panels. As industries shift toward DC-based processes, surge protection ensures operational continuity, equipment longevity, and reduced maintenance risks.

End User Analysis

Industrial dominates with 45.8% due to extensive use of DC-powered equipment.

In 2025, Industrial held a dominant market position in the By End User Analysis segment of DC Surge Arrester Market, with a 45.8% share. Industrial facilities increasingly deploy DC systems for automation and energy efficiency, driving consistent demand for robust surge protection solutions.

Commercial end users adopt DC surge arresters to protect building energy systems, data centers, and EV charging installations. As commercial spaces integrate renewable energy and smart power solutions, surge protection becomes essential for safeguarding investments and ensuring service continuity.

Residential adoption is gradually increasing as rooftop solar systems and home energy storage solutions expand. DC surge arresters help protect household equipment from voltage transients, supporting system safety and long-term performance in distributed energy environments.

Utilities utilize DC surge arresters across substations, transmission assets, and grid modernization projects. Their focus remains on maintaining grid stability and protecting critical DC components as utilities integrate renewable energy and advanced power management technologies.

Key Market Segments

By Type

- Metal Oxide Varistor

- Silicon Carbide (SiC)

- Hybrid DC Surge Protection Devices

- Gas Discharge Tube (GDT)

- Others

By Application

- Solar PV Power Systems

- Electric Vehicle (EV) Charging Stations

- Telecom DC Power Systems

- Industrial DC Power Infrastructure

By End User

- Industrial

- Commercial

- Residential

- Utilities

Drivers

Rising Deployment of Utility-Scale Solar PV and Wind Farms Requiring Robust DC Protection Systems

The rapid expansion of HVDC transmission system projects across long-distance power corridors is a key market driver. As power is transferred over hundreds of kilometers, DC systems face higher exposure to voltage surges. Therefore, utilities increasingly depend on DC surge arresters to protect converters, cables, and substations.

Moreover, large-scale solar PV and wind farms operate on DC architectures before grid integration. These renewable assets are capital intensive and highly sensitive to electrical disturbances. As a result, operators invest in reliable DC surge protection to avoid downtime, equipment damage, and revenue loss.

Another strong driver is the rising frequency of lightning-induced overvoltage events. Climate variability has increased storm intensity, directly impacting exposed DC power infrastructure. Consequently, surge arresters are becoming essential rather than optional components in modern DC networks.

Additionally, grid operators now focus strongly on reliability and asset protection. Aging infrastructure upgrades and new installations both emphasize preventive protection strategies. This mindset steadily supports sustained demand for DC surge arresters across transmission and generation projects.

Restraints

High Initial Cost of Advanced DC Surge Arrester Materials and Installation

One major restraint in the DC Surge Arrester market is the high upfront cost of advanced materials. Polymer housings, metal-oxide varistors, and precision insulation increase product pricing. For cost-sensitive utilities, this can delay procurement decisions.

Installation expenses further add to the challenge, especially in high-voltage or remote locations. Skilled labor, safety compliance, and system downtime during installation raise overall project costs. Therefore, some operators postpone upgrades despite known surge risks.

Limited standardization across regional DC grid protection specifications also restricts market growth. Different voltage classes and regulatory requirements complicate product selection. This lack of uniformity increases engineering effort and slows adoption in cross-border or multi-region projects.

As an analyst, these restraints mainly affect short-term buying behavior. However, long-term reliability concerns continue pushing stakeholders toward gradual adoption despite cost barriers.

Growth Factors

Accelerating Investments in Electric Vehicle Charging Infrastructure Using High-Power DC Systems

Electric vehicle charging infrastructure presents a strong growth opportunity for the DC Surge Arrester market. Fast-charging stations rely on high-power DC systems, which are vulnerable to switching and lightning surges. Protection demand grows alongside charging network expansion.

DC microgrids are also gaining popularity in commercial, industrial, and remote applications. These systems require stable and protected DC environments. Surge arresters help maintain continuity and equipment safety, creating steady demand in decentralized power setups.

Energy storage systems represent another opportunity area. Battery installations operate entirely on DC and are sensitive to overvoltage conditions. Therefore, enhanced DC surge protection becomes critical for system longevity and safety.

Furthermore, emerging HVDC interconnections for cross-border power trade drive adoption. These projects require reliable surge protection to ensure uninterrupted energy exchange and renewable integration.

Emerging Trends

Development of Polymer-Housed DC Surge Arresters for Improved Thermal and Mechanical Performance

One key trend is the shift toward polymer-housed DC surge arresters. These designs offer better thermal stability, lighter weight, and improved mechanical strength. As a result, installation becomes easier in compact and elevated DC environments.

Another growing trend is the integration of condition monitoring and digital diagnostics. Smart surge arresters help operators track performance and predict failures. This supports preventive maintenance and reduces unexpected downtime.

Manufacturers are also focusing on compact and lightweight designs. Space constraints in DC substations, EV chargers, and renewable plants encourage smaller yet efficient protection devices.

Finally, eco-friendly and long-life materials are gaining attention. Sustainability goals push power equipment manufacturers to reduce environmental impact while extending product service life.

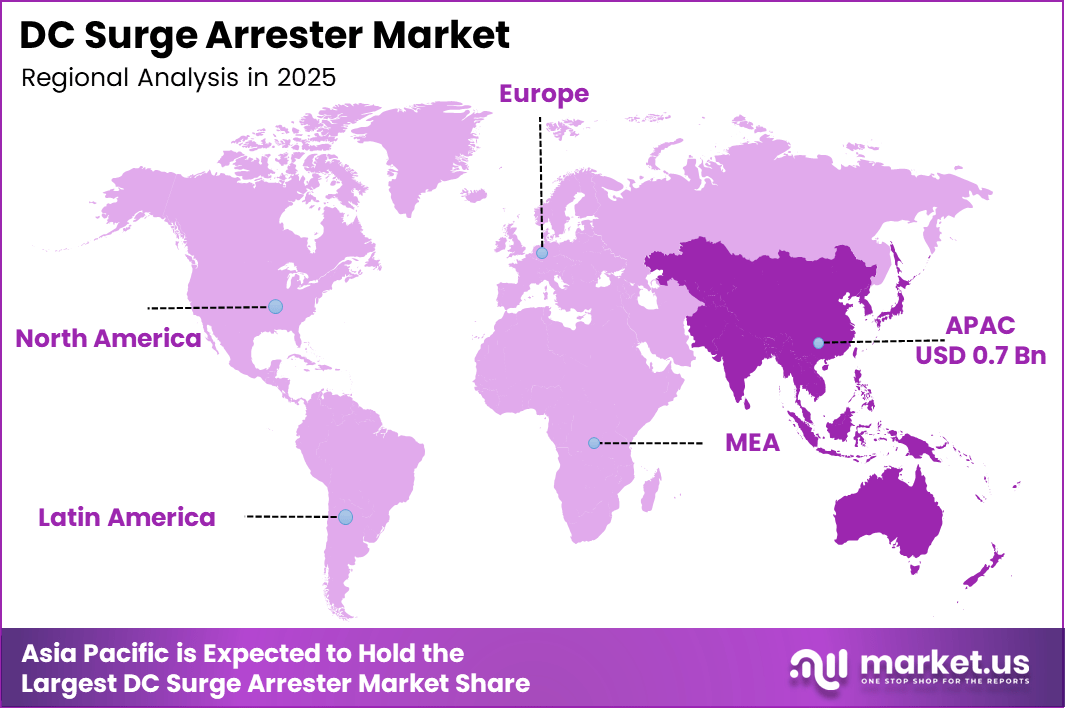

Regional Analysis

Asia Pacific Dominates the DC Surge Arrester Market with a Market Share of 41.3%, Valued at USD 0.7 Bn

Asia Pacific leads the DC Surge Arrester market due to rapid expansion of renewable energy, HVDC transmission, and grid modernization programs. Strong investments in solar, wind, and energy storage infrastructure drive consistent demand for DC surge protection. The region accounts for 41.3% of global market share, valued at USD 0.7 Bn, supported by large-scale electrification and urbanization initiatives.

North America DC Surge Arrester Market Trends

North America shows steady growth driven by grid reliability mandates, rising deployment of utility-scale solar projects, and modernization of aging power infrastructure. Increasing adoption of DC-based EV charging networks further supports demand. Regulatory emphasis on asset protection strengthens long-term market stability across the region.

Europe DC Surge Arrester Market Trends

Europe benefits from strong renewable integration policies and cross-border HVDC interconnections. The region focuses on energy security, decarbonization, and resilient power networks. Strict safety standards and preventive maintenance practices continue to encourage adoption of DC surge arresters across transmission and distribution systems.

Middle East and Africa DC Surge Arrester Market Trends

The Middle East and Africa region is witnessing gradual growth supported by investments in solar power plants and transmission infrastructure. Harsh climatic conditions increase exposure to surge events, creating demand for protective equipment. Grid expansion and electrification projects further support market development.

Latin America DC Surge Arrester Market Trends

Latin America shows emerging opportunities driven by renewable energy expansion and grid upgrades. Countries investing in solar, wind, and energy storage increasingly require DC surge protection. While adoption remains moderate, improving infrastructure reliability continues to support steady market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key DC Surge Arrester Company Insights

In the dynamic and rapidly evolving global DC Surge Arrester Market for 2025, several established players are poised to influence growth trajectories and technological innovation. From reliable product portfolios to strategic market penetration, the competitive landscape reflects the continued importance of surge protection in DC systems across renewables, data centers, and transportation sectors.

Eaton Corporation continues to leverage its deep expertise in electrical system protection to advance DC surge arrester solutions that balance performance with operational safety, targeting key verticals such as energy infrastructure and industrial automation. Its strong focus on R&D and integration with power quality ecosystems helps differentiate its offerings in a crowded field.

ABB remains a cornerstone in power protection technologies, with surge protection devices tailored for high-reliability applications. ABB’s global footprint and cross-sector experience in electrical grids and renewable integrations provide robust support for customers navigating increasingly complex DC environments.Schneider Electric brings a holistic approach to surge protection, embedding DC surge arrester technologies within broader energy management systems. By aligning product development with digital monitoring and preventive maintenance strategies, Schneider Electric enhances asset resilience while supporting sustainability targets across distributed energy resources.

Siemens drives innovation with a focus on modular, scalable surge arrester solutions that cater to both utility-scale and commercial DC applications. Siemens’ emphasis on engineering excellence and system compatibility underscores its commitment to delivering reliable protection in high-demand power networks.

Collectively, these key players exemplify how diversification, technological integration, and global service infrastructures will define competitive advantages in the DC Surge Arrester Market in 2025. Their differentiated strategies not only address core protection needs but also anticipate broader shifts toward electrification and intelligent power systems.

Top Key Players in the Market

- Eaton Corporation

- ABB

- Schneider Electric

- Siemens

- Phoenix Contact

- Hubbell Incorporated

- Megger Group Limited

- Ingeteam

- CIRCUTOR

Recent Developments

- In August 2024, CSW Industrials (CSWI) completed the acquisition of PSP Products, Inc. for USD 40 million, strengthening its Contractor Solutions segment by adding advanced surge protection devices and load management systems. The deal, valued at approximately 5.0x EBITDA, is expected to be earnings-accretive within the first full year and was funded through cash on hand and CSWI’s USD 500 million revolving credit facility.

- In September 2025, Weidmann Electrical Technology Inc. introduced the Surge Advance Arrester, a next-generation surge protection solution for medium-voltage distribution systems. Engineered by Prolec Celeco®, the product leverages advanced materials and design innovation to deliver reliable performance in harsh and demanding operating environments.

Report Scope

Report Features Description Market Value (2025) USD 1.7 billion Forecast Revenue (2035) USD 2.8 billion CAGR (2026-2035) 5.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Metal Oxide Varistor, Silicon Carbide (SiC), Hybrid DC Surge Protection Devices, Gas Discharge Tube (GDT), Others),

By Application (Solar PV Power Systems, Electric Vehicle (EV) Charging Stations, Telecom DC Power Systems, Industrial DC Power Infrastructure),

By End User (Industrial, Commercial, Residential, Utilities)Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Eaton Corporation, ABB, Schneider Electric, Siemens, Phoenix Contact, Hubbell Incorporated, Megger Group Limited, Ingeteam, CIRCUTOR Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Eaton Corporation

- ABB

- Schneider Electric

- Siemens

- Phoenix Contact

- Hubbell Incorporated

- Megger Group Limited

- Ingeteam

- CIRCUTOR